What is the Application Development and Integration Market Size?

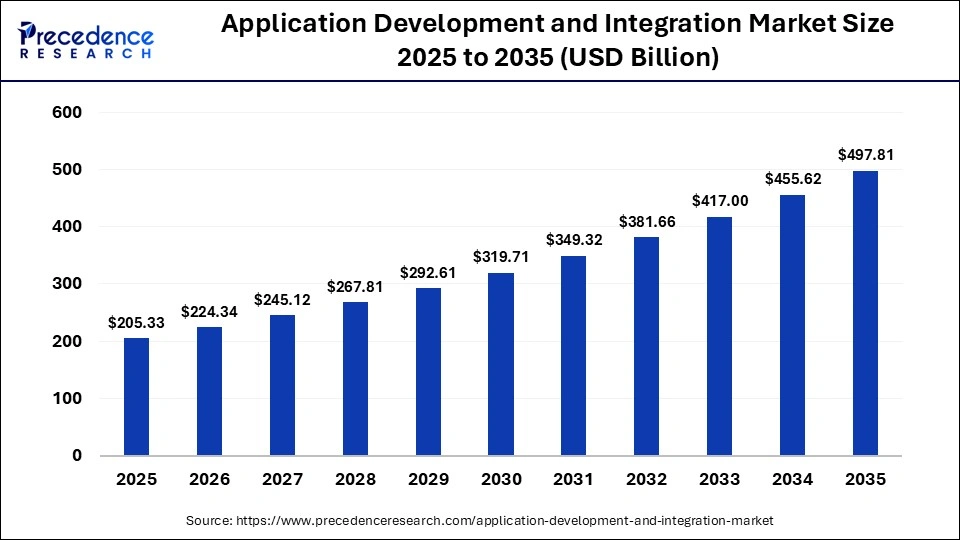

The global application development and integration market size was calculated at USD 205.33 billion in 2025 and is predicted to increase from USD 224.34 billion in 2026 to approximately USD 497.81 billion by 2035, expanding at a CAGR of 9.26% from 2026 to 2035.The rapidly expanding digital transformation is encouraging businesses to upgrade their old systems to remain competitive. Increased need of smooth flow of data between cloud, on-premise, and third-party platforms is also boosting market adoption.

Market Highlights

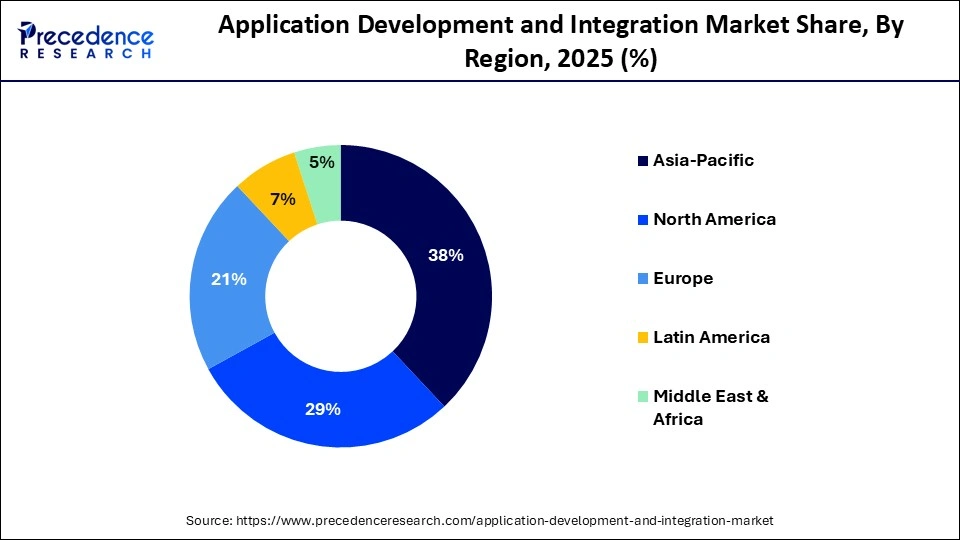

- North America dominated the application development and integration market in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By component, the software segment held a dominant position in the market in 2025.

- By component, the service segment is expected to grow at a significant CAGR in the market between 2026 and 2035.

- By deployment type, the on-premise segment led the global market in 2025.

- By deployment type, the cloud segment is expected to grow at a notable CAGR in the market during the studied years.

- By organization size, the small and medium enterprises segment dominated the global market in 2025.

- By organization size, the large enterprises segment is expected to expand rapidly in the market in the coming years.

- By industry vertical, the BFSI segment held a major revenue share of the market in 2025.

- By industry vertical, the IT and telecommunications segment is expected to gain the highest market share between 2026 and 2035.

What is Application Development and Integration?

The application development and integration market is becoming a key facilitator of enterprise agility and industrial innovations. Organizations are heavily investing in custom applications and integration platforms to achieve efficiency in operations and customer experiences. The move to hybrid IT infrastructures has fueled the pressure on powerful middleware and API-based infrastructures. As businesses go digital, integration solutions are becoming the key to interoperability and digital resilience in the long term.

Financial Data Comparison of the Companies

Formula: EBITA = Net Income + Interest Expense + Taxes + Amortization Expense

| Companies | Market Cap (M) | EV-to-EBITDA |

| Microsoft Corp | $ 3,071,240.19 | 15.89 |

| Oracle Corp | $ 450,053.91 | 19.59 |

| Palantir Technologies Inc | $ 340,616.89 | 231.80 |

| Palo Alto Networks Inc | $ 115,702.00 | 56.24 |

| CrowdStrike Holdings Inc | $ 102,866.25 | 1,728.72 |

| Synopsys Inc | $ 83,969.56 | 38.12 |

| Fortinet Inc | $ 63,901.68 | 24.98 |

| Cloudflare Inc | $ 60,861.35 | 687.91 |

| CoreWeave Inc | $ 50,452.11 | 30.44 |

| Block Inc | $ 34,503.22 | 12.00 |

Analysis of the above table

- Microsoft Corp: Microsoft EBITDA is expected to remain strong due to continued high margins, cloud growth, and expanding AI services demand. Continued subscription revenue growth and enterprise adoption of AI tools should support rising margins.

- Oracle Corp: The overall EBITA is expected to rise soon due to the rise of AI practices, more going on in the current world, but on the other hand, it might also depend upon capital spending due to short-term margins and changing market prospects.

- Palantir Technologies Inc: The transition towards cloud-centric subscriptions and AI-enabled enterprise tools should gradually improve margins and EBITDA. Continued backlog growth indicated stable long-term demand.

- Block Inc: The strength in digital transformation and AI consulting predicts moderate EBITDA growth in the future, supported by enterprise demand for integration.

How is AI Transforming the Application Development and Integration Market?

Artificial intelligence (AI) is transforming the application development and integration industry by automating system monitoring, coding, and testing. AI-based integration engines improve data mapping, error detection, and workflow optimization that require a minimum of human involvement. Predictive analytics assists organizations in forecasting integration failures and bottlenecks that might affect operations. As AI capabilities mature, development cycles are becoming shorter as application reliability and scalability continue to improve.

Application Development and Integration Market Trends

- Low Code and No-code Development: The use of low-code and no-code development platforms with a consequent increase in speed of application delivery is one of the key market trends. API-first and microservice architectures are becoming popular to enable scalable, nimble integrations.

- Cloud-native development and DevOps: These are now the norm that encourages continuous improvement and deployment. There is also a greater emphasis on security and compliance, thus defining the pattern of integration frameworks, designs, and implementations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 205.33Billion |

| Market Size in 2026 | USD 224.34 Billion |

| Market Size by 2035 | USD 497.81Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.26% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment Mode, Organization Size, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Insights

Why Did the Software Segment Dominate the Application Development and Integration Market?

The software segment dominated the market in 2025, due to its ability to build applications quickly, integrate APIs, and coordinate workflows. Solutions facilitate the smooth integration of existing systems with new digital applications, minimizing operational silos. Software platforms are more appealing than standalone tools because they are continuously updated, scalable, and enhanced with security. Software adoption in industries has also been enhanced by the emergence of low-code and no-code platforms. Organizations also prefer software solutions as they allow them to customize and implement long-term digital transformation.

The services segment is expected to show the fastest growth with a CAGR over the forecast period, since organizations are being supported by experts to do complex integration and modernization projects. Application platforms can be fully utilized through consulting, system integration, migration, and managed services that are usually needed by businesses. The increasing problem of a lack of skilled in-house developers is creating the need for third-party service providers. Ongoing optimization, maintenance, and post-deployment services also contribute to the uptake of services.

Deployment Mode Insights

How the On-Premise Segment Dominated the Market?

The on-premise segment held the largest revenue share of the application development and integration market in 2025, driven by data security, compliance, and latency, which are highly considered. Sensitive information industries, in most cases, would desire complete authority over the infrastructure and application, enabling customization. A great number of legacy businesses still use this model because of the long-term investment in infrastructure. The ability to be stable and have predictable performance makes on-premise deployment relevant even in the face of cloud growth.

The cloud segment is expected to witness the fastest growth in the market with a CAGR over the forecast period, because it is flexible, scalable, and has reduced startup costs. Organizations enjoy reduced time on deployment and scaling resources according to demand. With the use of cloud platforms, there is easy teamwork across teams and geographical locations. Their popularity is also improved with constant updates and AI features. Cloud-based deployment is emerging as a solution for future-ready applications in favor of agility and innovation as priorities for enterprises.

Organization Size Insights

Which Organization Size Segment Dominated the Market?

The small and medium enterprises segment contributed the biggest revenue share of the application development and integration market in 2025, due to the development and integration tools to compete with bigger companies. Small business organizations can digitize without major infrastructure investment by using cost-effective platforms. Easy-to-use development environments minimize the need for large IT teams. Integration tools assist SMEs in optimizing work processes and enhancing customer interactions. These solutions are of interest to expanding businesses, especially because of the emphasis on rapid scalability.

The large enterprises segment is expected to expand rapidly in the market in the coming years, because of large-scale digital transformation efforts by big companies. These companies handle sophisticated IT infrastructures that need sophisticated integration abilities. The adoption is necessitated by the desire to modernize old systems and embrace new technologies. Large enterprises also invest heavily in automation, analytics, and AI-powered applications. Their interest in the efficiency of the entire enterprise augments the segment's growth.

Industry Vertical Insights

Which Industry Vertical Segment Led the Market?

The BFSI segment led the application development and integration market in 2025 because it is largely reliant on secure, reliable, and scalable applications. Financial institutions need seamless banking, payment, risk management, and customer platforms. Data protection and regulatory compliance lead to an ongoing application upgrade. The cooperation of digital banking and fintech also adds to the complexity of integration. Because of this, BFSI continues to be a key source of revenue in the market.

The IT and telecommunication segment is expected to grow with the highest CAGR in the market during the studied years, which is witnessing a high rate of network modernization and an increase in digital services. Operators use integration platforms to control cloud services, customer systems, and network operations. The complexity of applications is enhanced by the deployment of sophisticated connectivity technologies. The use of real-time analytics and automation is in demand, promoting adoption.

Regional Insights

Why North America Dominated the Application Development and Integration Market?

North America held a major revenue share of the market in 2025, due to the presence of an established ecosystem of software vendors, integrators, and cloud service providers. The sustained growth can be supported by high demand in the environment of automation and AI-powered applications. Businesses are focusing on application modernization to increase productivity and customer experience. Good regulatory frameworks also facilitate secure and compliant integration solutions.

Country Level Analysis

The U.S is at the center of the activities, which are fueled by enterprise digital transformation programs on a grand scale. Companies focus on implementing AI, analytics, and cloud systems into existing systems. Canada records consistent growth as SMEs and public sector organizations are increasingly adopting it. Mature startup ecosystems promote application platform innovation.

How is Asia-Pacific Growing in the Application Development and Integration Market?

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period, driven by integration platforms to embrace the support of mobile-first and cloud-native applications. Market growth is driven by internet penetration and digital services. Enterprises and governments spend a lot of money on digital infrastructure. The region has a huge supply of technology-conscious users. The increasing need to use scalable and cost-effective solutions drives market growth.

Country Level Analysis

China is a growth engine that promotes the mass enterprise modernization and industrial digitalization programs. India has significant momentum, due to the growing number of SMEs and their digital adoption, as well as a flourishing IT services industry. Japan is concerned with incorporating old systems into the new cloud systems.

Countries of Southeast Asia are rapidly embracing the use of cloud-based development tools. The existence of regional collaboration and outsourcing also promotes market growth. Asia-Pacific is one of the future growth centers due to the diverse range of usage.

Will Europe Grow in the Application Development and Integration Market?

Europe is expected to grow at a considerable CAGR in the upcoming period since businesses accelerate digitalization within industries. Organizations are progressively modernizing ancient systems to enhance operational agility, compliance, and efficiency. The focus on data protection and regulatory compliance is strong, thereby defining the use of a secure application development and integration platform.

The region demonstrates increasing demand for hybrid deployment models, which would strike the balance between control and scalability. Market expansion is being supported by innovation in the cloud, automation, and AI-enabled applications. The cooperation between enterprises, technology providers, and system integrators continues to reinforce the local ecosystem.

Country Level Analysis

Germany is doing the best with manufacturing, automotive, and industrial digitalization efforts. The UK is showing a consistent rise as a result of financial services restructuring and assimilation of cloud-based applications. France witnesses an increasing adoption of advanced technologies among large enterprises and masses of services oriented towards digital governance.

The Nordic countries focus on cloud-native development and secure integration frameworks. Adoption among SMEs in Southern European economies is gradually increasing with an aim of achieving operational efficiency. Digital programs across borders and other regional integrations also contribute to the expansion of the European market.

Who are the Major Players in the Global Application Development and Integration Market?

The major players in the application development and integration market include Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Salesforce.com, Inc., Amazon Web Services, Inc., Google LLC, Adobe Inc., ServiceNow, Inc., Red Hat, Inc., TIBCO Software Inc., MuleSoft, LLC, Dell Technologies Inc., Infosys Limited, Wipro Limited, Capgemini SE, Hewlett Packard Enterprise Development LP, Fujitsu Limited, Cognizant Technology Solutions Corporation, Accenture plc

Recent Developments

- In February 2026, Apple announced the launch of agentic coding capabilities within its Xcode platform, Xcode 26.3 RC, facilitating developers to access agent-coding tools directly in its development environment. Agentic coding instruments empower AI models to harness a broader range of Xcode's functionalities, augmenting task automation and process efficiency. (Source: https://www.rswebsols.com)

- In June 2025, Launch unveiled its AI and no-code development application, enabling users to build and deploy real, full-stack applications within 15 minutes without writing any code. The company delivers production-ready applications with live databases, payment integrations, user authentication, API connections, and seamless GitHub connectivity from day one. (Source: https://www.crnasia.com)

Segments Covered in the Report

By Component

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Industry Vertical

- BFSI

- Healthcare

- IT and Telecommunications

- Retail

- Manufacturing

- Government

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting