Application Modernization Services Market Size and Forecast 2025 to 2034

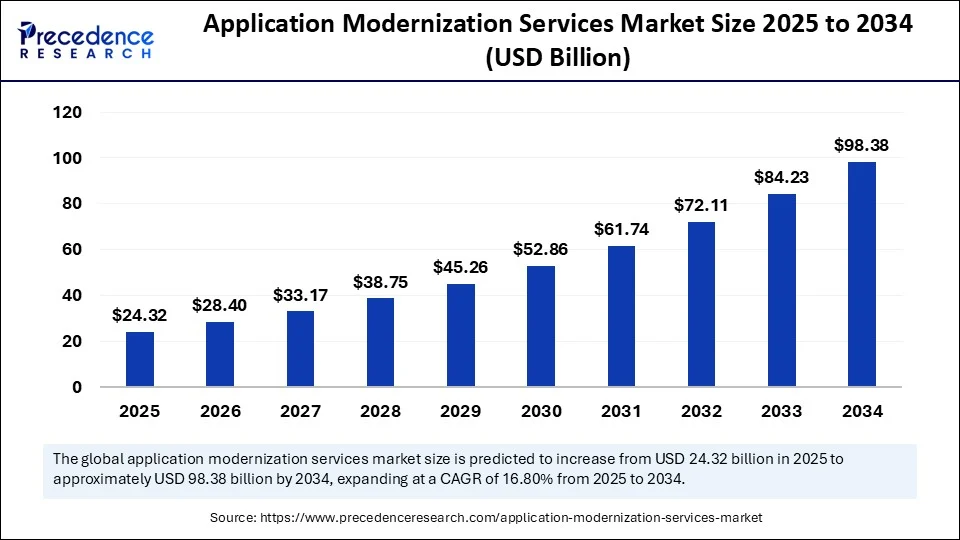

The global application modernization services market size accounted for USD 20.82 billion in 2024 and is predicted to increase from USD 24.32 billion in 2025 to approximately USD 98.38 billion by 2034, expanding at a CAGR of 16.80% from 2025 to 2034.The market growth is attributed to the rising need for scalable, secure, and cloud-ready solutions that replace aging legacy infrastructure across regulated and data-intensive industries.

Application Modernization Services MarketKey Takeaways

- In terms of revenue, the application modernization services market was valued at USD 20.82 billion in 2024.

- It is projected to reach USD 98.38 billion by 2034.

- The market is expected to grow at a CAGR of 16.80% from 2025 to 2034.

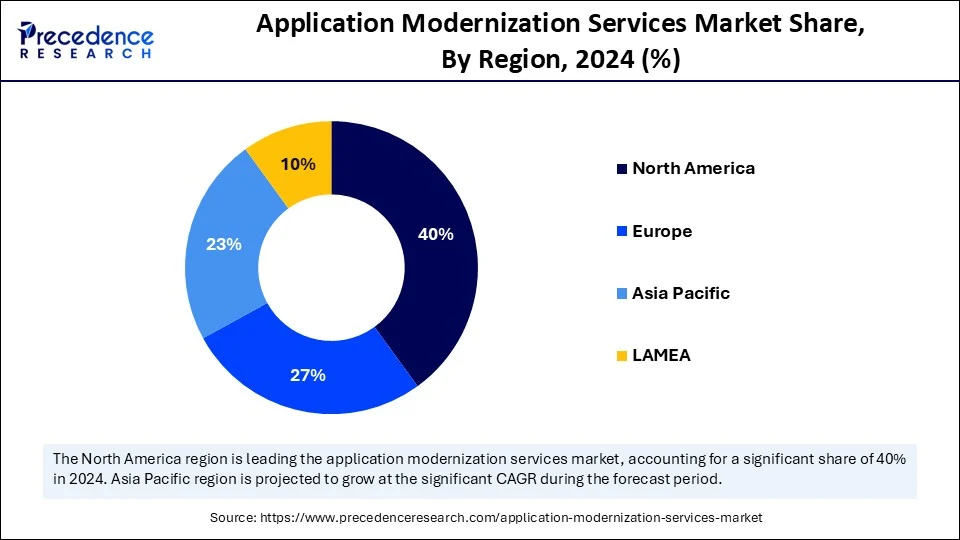

- North America accounted for the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By service type, the application re-platforming segment held the major market share of 24% in 2024.

- By service type, the cloud application migration segment is projected to grow at the highest CAGR between 2025 and 2034.

- By deployment, the hybrid cloud segment contributed the biggest market share in 2024.

- By deployment, the private cloud segment is expanding at a significant CAGR between 2025 and 2034.

- By enterprise size, the SMEs segment dominated the market in 2024.

- By enterprise size, the large enterprise segment is expected to grow at a significant CAGR over the projected period.

- By industry vertical, the BFSI segment dominated the global market with the largest share in 2024.

- By industry vertical, the IT & telecommunication segment is expected to grow at the fastest CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Application Modernization Services Market

Artificial intelligence is advancing application modernization services, as it is used to improve the modernization of systems faster, smarter, and more scalable. The use of AI-powered tools provides an improvement in code refactoring, a significant increase in testing, and a simplification of the migration process. This further helps companies update their IT infrastructure and experience very little downtime and a decreased risk of complications. Furthermore, the enterprise migration to hybrid and multi-cloud deployment brings benefits in terms of interoperability, resource utilization, security and compliance, which AI promotes.

North America Application Modernization Services Market Size and Growth 2025 to 2034

North Americaapplication modernization services market size was exhibited at USD 8.33 billion in 2024 and is projected to be worth around USD 39.84 billion by 2034, growing at a CAGR of 16.94% from 2025 to 2034.

Why Is North America Leading the Application Modernization Services Market in 2024?

North America dominated the application modernization services market, capturing the largest market share of 40% in 2024. This is mainly due to the increased digital transformation strategies by enterprises, the rapid expansion of cloud infrastructure, and the presence of well-established technology service providers. Modernization on a large scale across the banking, healthcare, government, and telecom industries sparked a need for services like re-platforming, containerization, and cloud-native integration.

Large organizations based in the U.S. started re-architecting legacy systems toward AI, cybersecurity, and multi-cloud implementations. The U.S. General Services Administration (GSA) further promoted the Technology Modernization Fund, a program increasing the pace with which legacy systems are replaced in various federal agencies. The most popular cloud operators, such as Microsoft, AWS, and Google Cloud, have been expanding enterprise-oriented migration initiatives to help organizations in North America. They enhance the scalability of their businesses and the flexibility of the operations of their applications, thus further fueling the market in this region.

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, owing to the rapid digitization of enterprises and increasing demand for secure and scalable infrastructure in emerging economies. Japan, India, South Korea and China are among the countries that have undertaken modernization of legacy IT systems in order to improve service delivery and minimize operating costs on infrastructure.

The influx of application migration initiatives in the telecom and government sectors in Southeast Asia supports the shift toward cloud data centers, supporting regional market growth. Cloud-native transformation in the public sector, with the Digital India initiative, the Indian Ministry of Electronics and IT offered additional support, focusing on health, agriculture, and banking legacy systems. Furthermore, Google Cloud and Microsoft Azure added additional regional cloud availability zones to match localized compliance and performance needs of application modernization in enterprises in Asia Pacific.

Europe is expected to grow at a notable rate in the upcoming period due to regulatory pressure, the growing demand for digital public services, and strategic investments in a sovereign cloud infrastructure. The long-term digital transformation roadmap of the European Union, with its schemes within the Digital Europe Program and the NextGenerationEU, further supports regional market growth. Businesses in the region are modernizing their legacy systems and implementing cloud-native, secure applications.

In 2024, The European Union Agency for Cybersecurity (ENISA) published revised cloud security guidelines that stress application security, secure software development, and multi-cloud resilience, creating the need for modernization services. Europe to lead in embracing open-source and interoperable application framework in support of regional IT autonomy and transparency was identified. Moreover, breaking modernization solutions based on storage, security, and standards compliance remains of utmost concern to enterprises all around Europe, further contributing to market expansion.

Market Overview

The rising need to modernize legacy systems is boosting the demand for application modernization services as companies are moving toward cloud environments. Application modernization services include updating, re-platforming, or reengineering legacy applications to integrate with modern application development, including microservices, containers, and serverless computing security. As outlined by the U.S. General Services Administration (GSA), in 2023, a greater portion than 65% of federal IT spending was focused on replacing or modernizing past IT systems to advance service delivery and cybersecurity readiness. Major cloud vendors, including AWS, Microsoft Azure, and Google Cloud, have increased the number of low-code modernization platforms and safe cloud migration services. This further strengthens enterprise demand in the regulated industry. Furthermore, the implementation of rules to facilitate the adoption of application modernization is expected to fuel market growth.

Application Modernization Services MarketGrowth Factors

- Surging Adoption of DevOps and Agile Practices: Modern software development workflows are fueling the demand for application modernization to support faster deployment and continuous integration.

- Expanding Digital Government Initiatives: Public sector digitalization efforts, especially across Europe and Asia, are boosting legacy system transformation across essential government services.

- Rising Demand for Cross-Platform Compatibility: Organizations aiming to deliver seamless multi-device experiences are propelling the modernization of outdated, platform-specific applications.

- Growing Cloud-Native Application Development: Enterprise shifts toward containerized, microservices-based architectures are driving the need to modernize legacy systems for compatibility.

- Accelerating Shift Toward Remote and Hybrid Work: Distributed work models are fuelling investment in modern applications that support secure, scalable, and accessible digital environments.

- Boosting Demand for Real-Time Data Analytics: Businesses seeking actionable intelligence from legacy data are modernizing applications to integrate AI and real-time analytics tools.

- Increasing Emphasis on Digital Customer Experience: Rising expectations for responsive, personalized digital interfaces are propelling modernization strategies focused on user-centric application design.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 98.38 Billion |

| Market Size in 2025 | USD 24.32 Billion |

| Market Size in 2024 | USD 20.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Deployment, Enterprise Size, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Adoption of Cloud-Native Technologies

The growing adoption of cloud-native technologies is anticipated to drive the growth of the application modernization services market. Businesses are transferring their loads to cross-cloud and multi-cloud environments to enhance the scale, performance, and affordability. The shift simplifies operations and improves system robustness, which fuels enterprises to adopt cloud-first strategies. Tools provided by major cloud providers such as AWS, Microsoft Azure, and Google Cloud reduce infrastructure dependence, make the modernization workflow seamless in terms of time, and allow real-time monitoring.

Businesses that have adopted such tools are able to enjoy quick time to market, enhanced agility, and a closer blend between IT operations and business goals. In 2024, NIST updated its DevSecOps framework to highlight the role of containers and orchestration systems such as Kubernetes to support secure, piecemeal modernization. Furthermore, the growing cloud-native frameworks that aid in the quick development, deployment, and maintenance of the current applications are expected to fuel the demand for application modernization services.

Restraint

High Initial Investment

High initial investments required to adopt these services are likely to hinder the market. Modernization projects are expensive, requiring significant investments in infrastructure upgrades, platform reengineering, and improvements in security and software. Smaller businesses may find it difficult to invest in long-term digital conversions. The unpredictability of ROI cycles and apprehension of achieving business continuity during the period of transition also reduce investment in modernized applications. Such economic factors deter a wide range of businesses from modernizing their legacy system. Legacy systems are complex, requiring careful planning and execution. This further creates challenges for small businesses and limits the growth of the market.

Opportunity

How is High Investment in Cybersecurity Compliance Influencing the Growth of the Application Modernization Services Market?

High investment in cybersecurity compliance and regulatory alignment is likely to create immense opportunities for the players competing in the market. Significant investments in the area of cybersecurity compliance and alignment are likely to impact modernization efforts. Statutory requirements, such as GDPR, HIPAA, and ISO/IEC regulations, move companies toward the level of being audit-ready, with the path of data traceability, along with the ability to safely exchange data. Such a regulatory framework has a direct effect of shoring up the need for modernization services that have built-in compliance and security provisions. In 2024, the European Union Agency for Cybersecurity (ENISA) noted a 30% upsurge in modernization projects concerning compliance with EU-based financial institutions as a result of greater enforcement of the NIS2 Directive. Additionally, meeting the global compliance requirements and lowering the exposure to breaches is expected to drive the demand for the modernization services market.

Service Type Insights

Why Did the Application Re-platforming Segment Dominate the Market in 2024?

The application re-platforming segment dominated the application modernization services market with a major market share of 24% in 2024. This is mainly due to the increased need of enterprises to modernize legacy applications without changing their basic structure. Companies in the banking, retail, and manufacturing industries have resorted to re-platforming to optimize their systems' functionality. Their scalability and compatibility with contemporary cloud solutions with minimal impact on business systems. Furthermore, the dependency of businesses on re-platforming has been increasing to ensure seamless modernization, bolstering segmental growth.

The cloud application migration segment is projected to grow at the highest CAGR in the future years as businesses are rapidly transforming toward hybrid- and multi-cloud environments. Organizations are adopting migrating applications to the cloud in an effort to optimize IT infrastructure, increase dependence on physical data centers, and accommodate AI-based workloads. The category of service allows the migration of legacy workloads in full and allows real-time scaling and integration with more powerful DevOps pipelines. Companies recognized that cloud application migration offers risks of time-based agility, compliance automation, and enhanced disaster recovery. Moreover, businesses are prioritizing cloud application migration to ensure resilience, agility, and intelligent automation, further boosting segmental growth.

Deployment Insights

How Does the Hybrid Cloud Segment Dominate the Market in 2024?

The hybrid cloud segment dominated the application modernization services market with the largest share in 2024 due to its flexibility, scalability, and capability to integrate on-premise systems with public cloud deployments. Companies operating or dealing with external customers in areas such as finance, healthcare, and retail depend heavily on hybrid options to manage the delicate balance between sensitive data management and the cost-benefit of public cloud services. This deployment provides a way through which organizations can modernize their legacy applications at their own pace and stay compliant with regulatory requirements. The hybrid model gave the IT departments the flexibility to use what they invested in the private infrastructure but moved to the cloud-native services to run analytics, AI workloads, and DevOps automation. In 2023, Microsoft Azure Arc and AWS Outposts gained popularity as enterprises moved to distributed environment application modernization.

The private cloud segment is expanding at a significant CAGR in the coming years owing to the growing concerns over data security. Cloud deployment is paramount in ensuring data security, access control, and advanced cybersecurity strategies, among others, especially in highly regulated sectors. Defense, critical infrastructure, and government organizations are increasingly updating the applications in a privately owned cloud environment so as to retain complete control of their operation and meet this changing compliance requirement. Furthermore, the growing acceptance of private clouds within the pharmaceutical and aerospace sectors further propels the segment.

Enterprise Type Insights

What Made SMEs the Dominant Segment in the Market in 2024?

The SMEs segment dominated the application modernization services market in 2024. Modernization has become even more feasible for SMEs due to cost-efficient modernization frameworks, access to low-code platforms, AI-based automation tools, and SaaS platforms. SMEs had already started migrating legacy applications to the cloud with a view to enhancing business continuity and responsiveness to their customers. Additionally, the cloud service providers, such as Google Cloud and AWS increased their offerings that help SMEs modernize their applications, further boosting the segment growth.

The large enterprise segment is expected to grow at a significant CAGR over the projected period due to their extensive legacy IT environments, intensive infrastructure, and better financial ability to invest in modernization projects. These organizations are also engaged in the active modernization of major platforms, including enterprise resource planning (ERP), customer relationship management (CRM), and supply chains. This enhances operational efficiency, facilitates AI incorporation, and delivers greater potential in digital service. Large enterprises focused on re-platforming and re-hosting to boost their performance, improve intensive downtimes, and meet the changing cybersecurity requirements, creating the need for application modernization services.

Industry Vertical Insights

Why Did the BFSI Segment Dominate the Market in 2024?

The BFSI segment dominated the application modernization services market with a major revenue share in 2024. This is mainly due to its vast legacy banking systems, which require replacement to ensure compliance with cybersecurity frameworks. The modernization of applications that facilitate payment processing, identify fraud, manage risks, and onboard customer transactions has become the priority of financial institutions. Several re-platforming and cloud migration projects are underway in the sector. BFSI organizations need to address data sovereignty issues by initiating hybrid and closed cloud platforms. Additionally, the new recommendations are dedicated to securing financial digital transformation to decrease threats that influence the market.

The IT & telecommunication segment is expected to grow at the fastest CAGR in the coming years owing to the soaring agile networks and high adoption of cloud-native platforms and edge computing. With the faster implementation of 5G infrastructure, telecommunications operators need these services to handle the load of increasing data, real-time analytics, and latency-intensive workloads. With the rising demand for high-speed networks, telecommunication operators are modernizing their legacy systems, creating the need for application modernizing services.

Application Modernization Services Market Companies

- Accenture

- Capgemini

- Cognizant

- DXC Technology

- HCL Technologies

- IBM

- Infosys

- NTT DATA Corporation

- Tata Consultancy Services

- Wipro

Recent Developments

- In November 2024, Kyndryl, the world's largest IT infrastructure services provider, introduced a set of new end-to-end services designed to help enterprises modernize their mainframe applications using the Microsoft Cloud. These services aim to accelerate mainframe migration and enable AI insights and generative AI features through Microsoft tools like Azure OpenAI, Microsoft Copilot, and Azure DevOps. Kyndryl brings in-depth knowledge of mission-critical mainframe operations, alongside an understanding of the security and compliance needs surrounding them. Kyndryl Consult will work with customers to build custom modernization strategies that align with business goals and regulatory expectations.

- In March 2024, NTT DATA, a global digital business and IT services leader, announced that it has been recognized as a Leader in two IDC MarketScape assessments that evaluated application modernization service providers for AWS and Microsoft Azure platforms. NTT DATA ranked among the top three companies in the Leaders Category, out of nine total providers assessed. As digital transformation becomes a greater priority, enterprises increasingly depend on expert partners to support application modernization in rapidly evolving IT landscapes. These modernization efforts now hold greater strategic value, prompting competition for services such as application migration and instance consolidation across cloud environments.

(Source: https://www.kyndryl.com)

(Source: https://www.nttdata.com)

Latest Announcement by Industry Leader

- In May 2025, Capgemini is spearheading a transformative shift in mainframe modernization with the launch of a next-generation offering designed to deliver faster, more accurate modernization outcomes from legacy systems. This innovative solution harnesses the power of generative and agentic AI to help organizations tied to complex mainframe environments realize substantial cost reductions, enhanced agility, and improved data quality. The offering converts traditional mainframe applications into agile, cloud-optimized formats that operate efficiently both on and off mainframe platforms. “Many organizations have already explored various mainframe migration approaches like rehosting, but none of these lead to a mainframe exit option,” said Franck Greverie, Chief Portfolio & Technology Officer and Head of the Global Business Lines at Capgemini. “Our new automated approach, built on a combination of gen AI assistants and AI agents, provides a comprehensive understanding of an enterprise's existing legacy landscape. This approach enables the automation capabilities needed to completely refactor mainframe applications, driving greater efficiency in migrating and converting core mainframe-based systems. Designed to give enterprises opportunities to achieve greater cost efficiencies, quality and agility, it will open new business perspectives for those that have been relying on their mainframes for years.”

(Source: https://www.capgemini.com)

Segments Covered in the Report

By Service Type

- Application Integration

- Application Portfolio Assessment

- Application Re-Platforming

- Cloud Application Migration

- Post-Modernization

- UI Modernization

By Deployment

- Hybrid Cloud

- Private Cloud

- Public Cloud

By Enterprise Size

- Large Enterprise

- SMEs

By Industry Vertical

- BFSI

- Energy and Utilities

- Healthcare & Life Sciences

- IT & Telecommunication

- Manufacturing

- Retail & E-commerce

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting