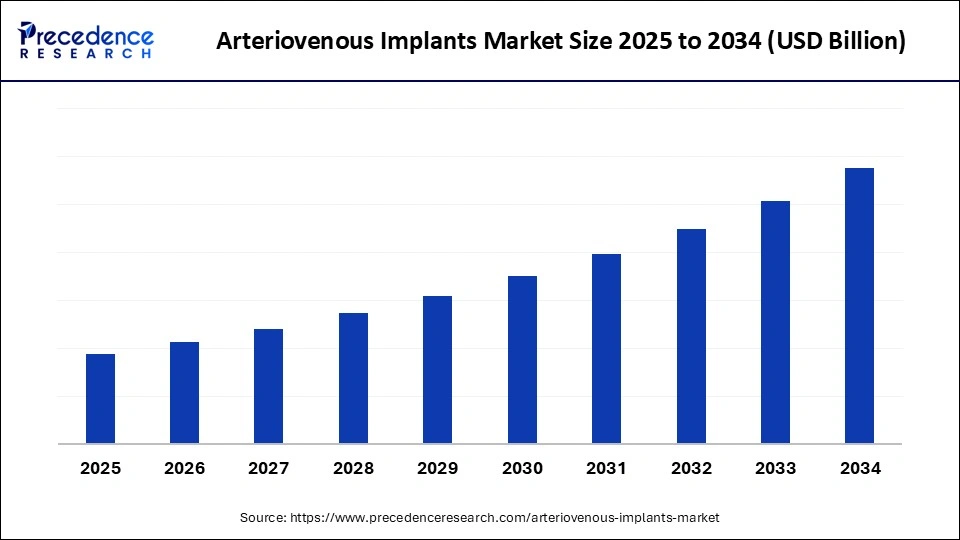

Arteriovenous Implants Market Size and Forecast 2025 to 2034

The arteriovenous implants market continues to grow with supportive reimbursement policies, aging populations, and rising global prevalence of renal disorders. It's reshaping the future of vascular access management. The market growth is attributed to rising ESRD prevalence, expanding hemodialysis populations, and continuous advancements in biomaterial-based vascular access technologies.

Arteriovenous Implants Market Key Takeaways

- North America dominated the global arteriovenous implants market with the largest share in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By device / product type, the prosthetic AV grafts and surgical AVF-related implants segment held the major market share in 2024.

- By device / product type, the percutaneous / endovascular AVF creation systems and covered-stent solutions segment is projected to grow at a CAGR between 2025 and 2034.

- By material / technology, the ePTFE and proven synthetic graft materials segment contributed the biggest market share in 2024.

- By material /technology, the tissue-engineered grafts and drug-eluting / antimicrobial coatings segment is expanding at a significant CAGR for the arteriovenous implants market between 2025 and 2034.

- By indication/clinical use, the initial access creation and replacement for the hemodialysis segment led the market in 2024.

- By indication/clinical use, the access revision/salvage implants segment is expected to grow at a significant CAGR over the projected period.

- By procedure type/approach, open surgical implantation segment contributed the highest market share in 2024.

- By procedure type/approach, the percutaneous and hybrid approaches segment is expected to grow at a notable CAGR from 2025 to 2034.

- By revascularization/salvage device type, balloon angioplasty and standard bare devices segment contributed the maximum market share in 2024.

- By revascularization/salvage device type, covered stents and thrombectomy-integrated systems are expected to grow at a notable CAGR from 2024 to 2034.

- By product ownership/commercial type, the branded originator grafts and established stent platforms segment held the major market share in 2024.

- By product ownership/commercial type, the OEM / CDMO specialty manufacturing segment is projected to grow at a CAGR between 2025 and 2034.

- By end-user/treatment setting, the hospital vascular surgery & interventional suites segment generated the highest market share in 2024.

- By end-user/treatment setting, the ambulatory & outpatient centers segment is projected to grow at a CAGR between 2025 and 2034.

- By patient type/demographics, the Prevalent adult dialysis population segment contributed the biggest market share in 2024.

- By patient type/demographics, the incident patients addressed via percutaneous AVF to reduce catheter dependence segment is expanding at a significant CAGR between 2025 and 2034.

- By distribution channel, the direct OEM and distributor channels segment led the market in 2024.

- By distribution channel, the Direct-to-clinic rapid fulfillment and bundled service contracts with dialysis networks segment is expected to grow at a significant CAGR over the projected period.

Market Overview

The rising trends of end-stage renal disease (ESRD) likely increase the urgency toward stable vascular access and spur next-generation implant technology development and growth in the arteriovenous implants market. According to the NIH 2024 report, diabetes accounted for about 44 per cent of new ESRD cases in the United States in 2024, which adds clinical pressure to find durable access solutions. In the United States, over 808,000 individuals live with ESRD in 2023, with a significant proportion under regular dialysis care.

Clinicians use better heparin-bonded ePTFE and acellular tissue-engineered vessels to enhance early patency, decrease risk of infection, and limit thrombosis. Manufacturers optimize graft architecture to resemble small or calcified vessels found in elderly and diabetic populations. Hospitals increase preemptive vascular access planning and invest in imaging and surveillance devices to identify stenosis earlier, thereby decreasing catheter dependency. That is directly correlated to lower hospitalization and improved long-term outcomes. Furthermore, the growing rates of ESRD are projected to continue as the key driver of demand, keeping the vascular access ecosystem innovating and adopting technology.(Source: https://pmc.ncbi.nlm.nih.gov)

Impact of Artificial Intelligence on the Arteriovenous Implants Market

Artificial intelligence (AI) transforms the arteriovenous implants market, boosting the level of precision, efficiency, and patient outcomes at all levels of the care pathway. Clinicians are implementing the use of AI-powered imaging to estimate vascular structures more accurately. This further ensures that surgeons select the best sites to place a graft or a fistula. Moreover, device manufacturers utilize machine learning models to enhance next-generation grafts, which are engineered to withstand over time and reduce the incidence of thrombosis cases.

Arteriovenous Implants MarketGrowth Factors

- Growing Emphasis on Early Vascular Access Creation: Clinical guidelines prioritizing timely graft or fistula placement are boosting implant utilization in dialysis planning.

- Rising Adoption of Outpatient Dialysis Models: Expansion of home and community-based dialysis programs is fuelling demand for reliable vascular implants.

- Advancing Imaging and Monitoring Integration: Incorporation of ultrasound and surveillance technologies is propelling the use of precision-designed grafts.

- Boosting Research in Tissue-Engineered Vessels: Increased funding for regenerative medicine is driving the development of next-generation bioengineered conduits.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device / Product Type, Material / Technology, Indication / Clinical Use, Procedure Type / Approach, Revascularization / Salvage Device Type, Product Ownership / Commercial Type, End-User / Treatment Setting, Patient Type / Demographics, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Does the Increasing Prevalence of End-Stage Renal Disease (ESRD) Drive Growth in the Arteriovenous Implants Market?

The increasing prevalence of end-stage renal disease (ESRD) is expected to drive the market for vascular access implants across global dialysis populations. According to the National Institute of Diabetes and Digestive and Kidney Diseases, over 808,000 Americans were living with ESRD in 2023, of whom close to 68% utilized dialysis. So the dependability of a reliable vascular access solution is a life-saving requirement. Rapidly aging countries, such as Japan and European countries, encounter increasing dialysis pressures, and emerging markets, such as China, India, where ESRD cases are rising as a result of lifestyle diseases, provide greater urgency to reliable access devices.

Healthcare systems respond to this process by investing in dialysis infrastructure and expanding reimbursement systems. This helps to promote the use of advanced grafts that are meant to reduce the risk of infections and enhance patency. Manufacturers of devices are in line with these clinical needs by coming up with bioengineered grafts, heparin-bounded materials that enhance durability, blood flow, reduction in thrombosis, complementing market expansion. Furthermore, the growing adoption of hemodialysis over peritoneal dialysis is anticipated to strengthen implant utilization rates, particularly in regions with robust dialysis infrastructure.(Source: https://www.niddk.nih.gov)

Restraint

High Risk of Infection and Thrombosis in Vascular Access

Clinical implementation in the form of high risk of infection and thrombosis, likely to continue to be a formidable limitation in the management of vascular access, further hindering the market. Patients undergoing hemodialysis are at great risk of bloodstream infections, and implantable grafts are likely to provide extra routes of bacterial proliferation. Infection-related hospitalizations have consistently been noted as one of the most frequent causes among ESRD patients that had vascular implants. Additionally, the restraint patient acceptance through procedural complications and limited awareness, estimated to reduce uptake in specific populations.

Opportunity

How Are Surging Innovations in Biomaterials and Graft Technologies Expanding Applications in the Arteriovenous Implants Market?

Surging innovations in biomaterials and graft technologies are projected to create immense opportunities for the arteriovenous implant market. The increased use of hemodialysis as compared to peritoneal dialysis is expected to enhance the rates of implant usage, especially in the dialysis infrastructure-strong areas. National statistics and foreign surveys in 2024 revealed that the huge majority of incident kidney failure patients commenced hemodialysis, approximately 82.4% of new cases, based on USRDS reports verified in 2024-and generated a direct demand for consistent vascular access.

Arteriovenous grafts are the preferred choice by clinicians in patients with poor native vessels, due to the shorter time to viable access and the elimination of the need to use transitory central venous catheters. The manufacturers are focusing on elderly and comorbid cohorts, where they develop grafts that fit small or calcified vessels and incorporate infection-resistant properties. Heparin-bonded to enhance early patency, such that surgeons can create access early to prevent catheter emergencies. Furthermore, the high healthcare expenditure and supportive reimbursement policies are estimated to create favorable conditions for implant adoption across developed and developing nations.(Source: https://www.niddk.nih.gov)

Device / Product Type Insights

How Did Prosthetic AV Grafts Strengthen Their Dominance in the Arteriovenous Implants Market?

The prosthetic AV grafts and surgical AVF-related implants segment dominated the arteriovenous implants market in 2024, due to the use of prosthetic grafts by clinicians occurring in cases of patients with hollowed-out superficial veins.

Extreme pathologic vasculature and graft and surgical fistulas are routinely performed by high-volume dialysis centers, which maintain consistent procedural throughput. Furthermore, diabetes and vascular calcification promote reliance on grafts, as such devices offer a faster time to continuous cannulation compared to many autogenous fistulas, thus further fueling the segment.The percutaneous/endovascular AV fistula creation systems (endoAVF devices) segment is expected to grow at the fastest CAGR in the coming years, owing to their adoption in minimally invasive fistula creation in patients with an appropriate selection.

Covered-stent grafts exhibit better target-lesion patency with graft-vein anastomoses and are an effective salvage option in failing access circuits. Therefore, centers use them regularly in maintenance pathways to restrict recurrent open revisions. Additionally, the Percutaneous approaches were encouraged by regulatory and clinical guidelines, including NICE and KDIGO, further facilitating the market in the coming years.

Material / Technology Insights

Why Did ePTFE Grafts Remain the Leading Material Choice in the Arteriovenous Implants Market?

The ePTFE and expanded PTFE grafts segment held the largest revenue share in the arteriovenous implants market in 2024, as manufacturers provide widely standardized products that are familiar to surgical teams and can be sourced through hospital procurement. Moreover, device manufacturers employed incremental advances, such as heparin-bonded surfaces and surface-modified ePTFE to enhance early patency and reduce thrombosis, further propelling the segment.

Tissue-engineered grafts and drug-eluting / antimicrobial coatings segment is expected to grow at the fastest CAGR in the coming years, owing to the clinical advancements around regenerative conduits. In 2024, the U.S. FDA approved and prioritized acellular tissue-engineered vessels, and multiple companies have reported Phase 3.

Registry data demonstrating that these conduits function better and are less infected than some synthetic options at 6 and 12 months, driving clinician interest in off-the-shelf biologic alternatives. Incorporation of biologic grafts and drug-release coatings is expected to lower reintervention rates and downstream hospitalizations in select high-risk cohorts, which drives procurement pilots and payer deliberations. Furthermore, the continued randomized trials and FDA Breakthrough designations granted to new AV graft candidates further boost the market.(Source: https://www.fda.gov)

Indication / Clinical Use Insights

What Made the Creation of Initial Vascular Access the Most Critical Indication Driving the Arteriovenous Implants Market?

Initial access creation and replacement for the hemodialysis segment dominated the arteriovenous implants market in 2024. Surgeons and interventionalists were focused on creating a stable vascular access for the swelling population of dialysis. They were assisted by the guideline-based preference to place early AVF or AVG. Moreover, the reinforced clinical dependence on this category was the increasingly modified graft coating and minimally invasive creation systems, supported by device makers, that maximized maturation and short-term durability.

The access revision/salvage implants segment is expected to grow at the fastest rate in the coming years. There is a growing trend of clinicians resorting to covered stent grafts, thrombectomy systems, and new biologic conduits to salvage failing accesses, as they understand the cost burden and morbidity to the patient associated with repeated catheter placements. Furthermore, the Hospitals and payers estimate that focused efforts on salvage and revision rather than repeated surgical reconstruction further fuel the demand for access revision/salvage implants.

Procedure Type / Approach Insights

Why did open surgical implantation dominate procedural adoption in the Arteriovenous Implants Market?

The open surgical implantation segment held the largest revenue share in the market in 2024, due to the standardization of fistula and graft placement protocols that guarantee predictable intraoperative control and early cannulation schedules.

Surgical capacity and inventory of prosthetic grafts and autogenous fistula procedures were maintained in hospitals and contributed to the overall stable procedural throughput in high-volume dialysis centers. Additionally, the manufacturers of devices assisted surgical practice by optimizing graft-handling, anastomotic designs, and surface treatments, which continued to give clinicians confidence in open approaches.

The percutaneous and hybrid approaches segment is expected to grow at the fastest CAGR in the coming years, as these modalities help minimise procedure duration, decrease complications related to incisions, and create access to previously surgically inaccessible patients. Furthermore, the manufacturers increased the pace of development of integrated toolsets, including the creation of catheters, covered stents, and adjunctive thrombectomy devices, which set the stage for rapid clinical growth of percutaneous and hybrid methods.

Revascularization / Salvage Device Type Insights

How did balloon angioplasty consumables emerge as the cornerstone for salvage interventions in the Arteriovenous Implants Market?

Balloon angioplasty + standard bare devices segment dominated the arteriovenous implants market in 2024, due to the immediate dilatation of lesions and the wide accessibility across centers. Access to program dialysis facilities and hospitals had high stocks of angioplasty consumables, which sustained procedural throughput and facilitated regular surveillance-based interventions.

Published clinical data in 2023-2024 showed good uptake of specialty balloons to address resistant stenotic lesions and complex anatomies that support the maintenance of fistula and graft functions. Moreover, the surfaces, pressure ratings, and balloon durability were also developed by device manufacturers in 2024, which prompted interventionalists to persist with balloon-based salvage plans.(Source: https://pmc.ncbi.nlm.nih.gov)

The covered stents and thrombectomy-integrated systems segment is expected to grow at the fastest rate in the coming years, as they are expected to transform access salvage practices. Clinical teams were increasingly using covered stents to treat recurrent graft-vein anastomotic stenosis, as the studies published in 2024 showed better target lesion patency than plain angioplasty. Furthermore, the integrated platforms with reduced profiles and improved deliverability were refined by manufacturers and emerged as core instruments in future access salvage algorithms.

Product Ownership / Commercial Type Insights

Why Did Branded Originator Grafts and Stent Platforms Dominate Commercial Uptake in the Arteriovenous Implants Market?

The branded originator grafts and established stent platforms segment held the largest revenue share in the arteriovenous implants market in 2024. Clinical teams continued to utilize branded grafts and stent systems that were supported by numerous years of regulatory approvals, long-term outcomes, and extensive global distribution networks. Additionally, the presence of established stent platforms helped them to be included in revised practice guidelines and reimbursement models by payers, which maintained high acceptance in key dialysis markets.

The OEM/CDMO segment is expected to grow at the fastest CAGR in the coming years. Healthcare systems were demanding patient-specific grafts, smaller lot sizes, and rapid regional supply chains to meet patient needs and reduce dependence on international logistics.

OEM and CDMO collaborators were found to be agile in manufacturing bioengineered and specialty-coated grafts according to the hospital's specific design requirements for vascular access devices. Moreover, the development placed OEM and CDMO-based supply chains as the most rapidly expanding product owner group, further facilitating the segment in the coming years.

End-User/Treatment Setting Insights

What Drove Hospital Vascular Surgery Departments and Interventional Suites to Lead Utilization in the Arteriovenous Implants Market?

The hospital vascular surgery & interventional suites segment dominated the arteriovenous implants market in 2024, due to the majority of the complex access creations, revisions, and salvage procedures being done in hospitals. They provided advanced imaging, operating room backup, and multidisciplinary teams to handle high-risk patients and failed access procedures. Furthermore, the complexity of procedures, infected explantations, and combined surgery-endovascular procedures led to referring patients to hospitals and confirmed their status as the leading location of challenging cases.

The ambulatory and outpatient facilities segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing share of the procedural demand. To reduce cost, shorten patient stay, and enhance throughput, providers moved lower-complexity, percutaneous access creation, and routine surveillance management into the outpatient setting. Moreover, the ASC accreditation that enhanced safety metrics and allowed a wider range of patients to access minimally invasive procedures further propels the segment growth.(Source: https://pubmed.ncbi.nlm.nih.gov)

Patient Type / Demographics Insights

Why Did the Prevalent Adult Dialysis Population Remain the Largest Patient Group Influencing the Arteriovenous Implants Market?

The prevalent adult dialysis population segment held the largest revenue share in the arteriovenous implants market in 2024, due to the high demand for replacement implants and interventions. Cohorts of long-term dialysis patients are consistent demanders of graft maintenance, revisions, and replacement of devices. That contribute to the consistent volumes of procedures in hospitals and interventional programs.

- According to U.S. statistics, over 808,000 individuals with end-stage kidney disease existed in 2023, and approximately 68% undergo dialysis, which supports the sustained need to access devices and salvage procedures. Additionally, the growing prevalence of kidney disease is expected to fuel the demand for arteriovenous implants in the adult population.(Source: https://www.niddk.nih.gov)

Incident patients via percutaneous AVF to reduce catheter dependence is expected to grow at the fastest rate in the coming years, owing to the incident patients treated with percutaneous AVF to lessen catheter reliance. Furthermore, the nephrology societies prioritized early referral and access planning to decrease urgent catheter initiation, which had become common practice in hospitals that converted pipelines to rapid-access, which focus more on percutaneous options.

Distribution Channel Insights

How Did Direct OEM and Distributor Channels Secure Dominance in the Arteriovenous Implants Market's Distribution Structure?

The direct OEM and distributor channels segment dominated the arteriovenous implants market in 2024. The supply chains of hospitals and the large dialysis providers had been dependent on direct contacts with the manufacturers and distributors of their products.

That they receive regular grafts, stents, and consumables of the brand name, which made them traceable, compliant with the regulations, and their stocks predictable. Moreover, group purchasing organizations and hospital systems negotiated framework contracts that combined the supply of devices, training, and maintenance, thereby strengthening the use of established channels.

The direct-to-clinic rapid fulfillment and bundled service contracts with dialysis networks segment is expected to grow at the fastest rate in the coming years, as big dialysis chains and outpatient access centers require on-site inventory. Additionally, the observers in the industry projected that implementation of direct-to-clinic models and bundled service contracts could increase access to novel devices in the outpatient care and drive adoption among dialysis networks in the region.

Regional Insights

Which Regions Led the Market and are Projected to Experience the Fastest Growth?

North America led the arteriovenous implants market, capturing the largest revenue share in 2024, due to the high levels of dialysis and developed clinical infrastructure. According to CDC and USRDS summaries, the United States recorded more than 808,000 patients with end-stage kidney disease in 2023, about 68% of whom were on dialysis, posing a long-term demand for the need to create and maintain vascular access. The high reimbursement policies by CMS that facilitated inpatient and outpatient graft placement, percutaneous fistula creation, and salvage procedures enhanced the adoption of devices by large hospital systems and dialysis networks.

FDA-approved regulatory routes and post-market intensive surveillance of devices enhanced clinician confidence in newer devices and faster adoption across integrated delivery networks. Established companies like Fresenius Medical Care, DaVita Inc., Medtronic, and Becton Dickson had invested in R&D partnerships in the U.S and Canada in the process, which further consolidated the leadership of North America. Furthermore, the 2023-2024 clinical activity and multicenter registries strengthened the evidence creation and contributed to the expansion of the guidelines' incorporation across North American centers.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the increasing number of chronic kidney disease and the weak progress in early diagnoses, which encouraged procedural demand in populated countries. The population of dialysis-dependent patients worldwide was more than half of the patient population in Asia, reflecting both the load and the increasing access to treatment. Additionally, the growing regional manufacturing capacity and regulatory visibility in the Asia-Pacific region are well-positioned to adopt next-generation implants on a large scale and facilitate region-specific clinical registries.

Arteriovenous Implants Market Companies

- Access Vascula / Vascular Access Solutions

- Transverse Medical

- Terumo Corporation

- Olympus / Pentax

- NxThera / Lombard Medical

- Nipro Corporation

- Merit Medical Systems

- Medtronic

- LeMaitre Vascular

- InnAVasc Medical

- Gore & Associates (W. L. Gore)

- Cook Medical

- Boston Scientific

- BD (Becton, Dickinson & Company) / BD Interventional

- B. Braun Melsungen AG

Recent Developments

- In August 2025, Researchers at Visvesvaraya National Institute of Technology (VNIT), Nagpur, developed an advanced arteriovenous (AV) implant aimed at significantly improving dialysis outcomes. The AV fistula (AVF), a surgical connection between an artery and a vein, serves as a critical lifeline for patients with end-stage renal disease. Nearly half of AVFs fail early due to vessel blockages and turbulent blood flow. The VNIT team, led by former director PM Padole and nephrologist Dr. Dhananjay Ookalkar, collaborated with mechanical engineering and medical science experts to address these longstanding challenges, offering new hope for safer and more reliable vascular access. (Source: https://timesofindia.indiatimes.com)

- In March 2025, Houston Methodist Hospital initiated the SAVE Fistulas trial, a first-of-its-kind randomized controlled study designed to enhance outcomes for hemodialysis patients requiring AVFs. The trial evaluates VenoStent's SelfWrap, a bioabsorbable device engineered to improve fistula success rates in patients with chronic kidney disease. This study represents a significant step forward in translating innovative vascular access technologies into clinical practice. (Source:https://www.houstonmethodist.org)

- In July 2025, Inari Medical, now part of Stryker, announced the launch of its second-generation InThrill Thrombectomy System, the first purpose-built solution for small vessel and arteriovenous access thrombectomy. The 8 French over-the-wire system includes the InThrill thrombectomy catheter and sheath, offering rapid, full-lumen clot removal. Optimized on a familiar platform, the system is positioned to become the standard for AV access thrombectomy, improving procedural efficiency and patient outcomes. (Source: https://www.surgicalroboticstechnology.com)

- In November 2024, Healionics Corporation received Breakthrough Device designation from the U.S. FDA for its STARgraft AV graft, designed to provide safer and more reliable vascular access for dialysis patients. The designation reflects regulatory recognition of the device's potential to improve patient safety, reduce complications, and address unmet clinical needs in hemodialysis care. (Source: https://interventionalnews.com)

- In April 2025, Dutch medtech firm AMT Medical raised $25 million in Series B funding to advance its ELANA Heart Bypass System. This sutureless technology eliminates the need for open-heart surgery, enabling minimally invasive and robot-assisted coronary bypass procedures. The investment is set to accelerate the development and clinical deployment of this innovative cardiovascular solution. (Source: https://www.icthealth.org)

- In May 2025,BiVacor obtained FDA Breakthrough Device designation for its titanium Total Artificial Heart (TAH), intended as a bridge to transplant for end-stage heart failure patients. The device uses rotary blood pump technology with a magnetically suspended centrifugal impeller as its sole moving component, eliminating valves and flexing chambers. The FDA designation prioritizes regulatory review, underscoring the agency's recognition of the technology's transformative potential. (Source: https://cardiovascularbusiness.com)

- In September 2025, Foldax Inc., a leader in polymer heart valve innovation, partnered with Dolphin Life Science LLP to launch the TRIA Mitral Valve in India. This milestone marks the first commercial availability of a polymer heart valve anywhere in the world, offering patients a durable and biocompatible alternative to traditional prosthetic valves.(Source: https://finance.yahoo.com)

Segments Covered in the Report

By Device / Product Type

- Surgical autogenous AV fistula (surgical creation tools & consumables)

- Prosthetic AV grafts (ePTFE, novel biomaterial grafts, hybrid grafts)

- Percutaneous/endovascular AV fistula creation systems (endoAVF devices)

- Covered stents / stent-grafts for AV anastomosis/venous lesions

- Implantable connectors, anastomotic couplers and connector systems

- Flow-modulating implants (valves, flow restrictors)

- Hemodialysis catheter adapters & graft-to-catheter connectors

By Material / Technology

- ePTFE and expanded PTFE grafts

- Biological / tissue-engineered grafts (decellularized, bioresorbable scaffolds)

- Nitinol / nitinol-hybrid stent frames with ePTFE liners

- Polymer composite & hybrid connector materials

- Antimicrobial / heparin-bonded coatings and drug-eluting surfaces

By Indication / Clinical Use

- Initial vascular access creation for hemodialysis (first-line access)

- Access revision/salvage (treatment of stenosis, thrombosis)

- Secondary access (graft after failed fistula, tunneled connectors)

- Acute AV shunts for circulatory support or interventional procedures

By Procedure Type / Approach

- Open surgical implantation (operative AV grafts, anastomosis kits)

- Percutaneous endovascular creation (endoAVF systems)

- Hybrid approaches (surgical + endovascular adjuncts)

- Minimally invasive salvage procedures (stent graft placement, angioplasty + stent)

By Revascularization / Salvage Device Type

- Balloon angioplasty consumables and specialty balloons

- Covered stents / stent-grafts for venous anastomosis and cephalic arch lesions

- Thrombectomy / thrombectomy-compatible grafts and aspiration devices

- Drug-coated devices and bioactive adjuncts

By Product Ownership / Commercial Type

- Branded originator grafts & stent platforms

- Licensed platform technologies / OEM-relabelled implants

- CDMO-manufactured grafts and custom molded connector assemblies

- Disposable consumable kits & procedure packs

By End-User / Treatment Setting

- Hospital vascular surgery departments (inpatient & OR)

- Outpatient vascular centers & interventional radiology suites

- Dialysis centers & integrated renal clinics (implant follow-up, minor interventions)

- Ambulatory surgery centers (ASC) for percutaneous creations

By Patient Type / Demographics

- Incident ESRD patients initiating hemodialysis (incident access demand)

- Prevalent chronic dialysis patients (graft replacement, salvage)

- Pediatric vs adult cohorts (device sizing & regulatory considerations)

- High-risk/comorbid cohorts (diabetes, vascular disease)

By Distribution Channel

- Direct OEM hospital contracts & tender supplies

- Distributors & medical wholesalers

- Specialty vascular distributors & dialysis equipment suppliers

- E-commerce / direct clinic procurement for consumables

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting