Aspiration Tubing Market Size and Forecast 2025 to 2034

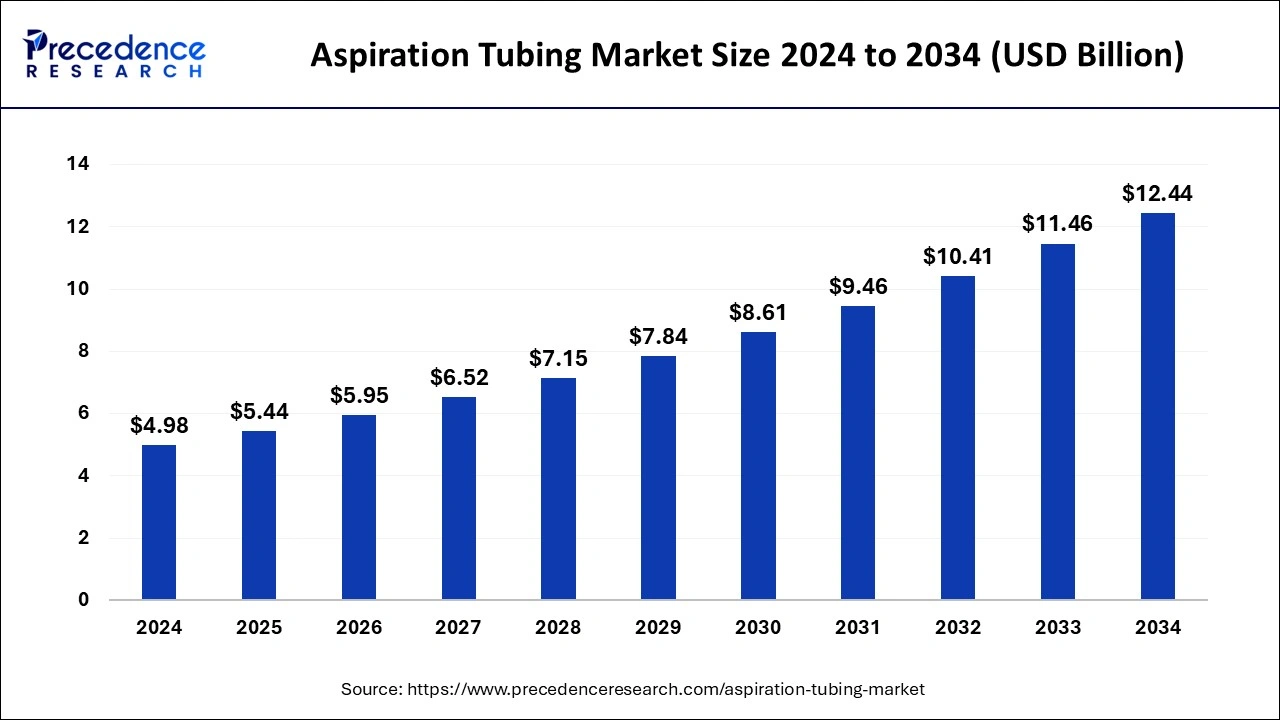

The global aspiration tubing market size was calculated at USD 4.98 billion in 2024 and is predicted to increase from USD 5.44 billion in 2025 to approximately USD 12.44 billion by 2034, expanding at a CAGR of 9.59% from 2025 to 2034.

Aspiration Tubing MarketKey Takeaways

- The global aspiration tubing market was valued at USD 4.98 billion in 2024.

- It is projected to reach USD 12.44 billion by 2034.

- The aspiration tubing market is expected to grow at a CAGR of 9.59% from 2025 to 2034.

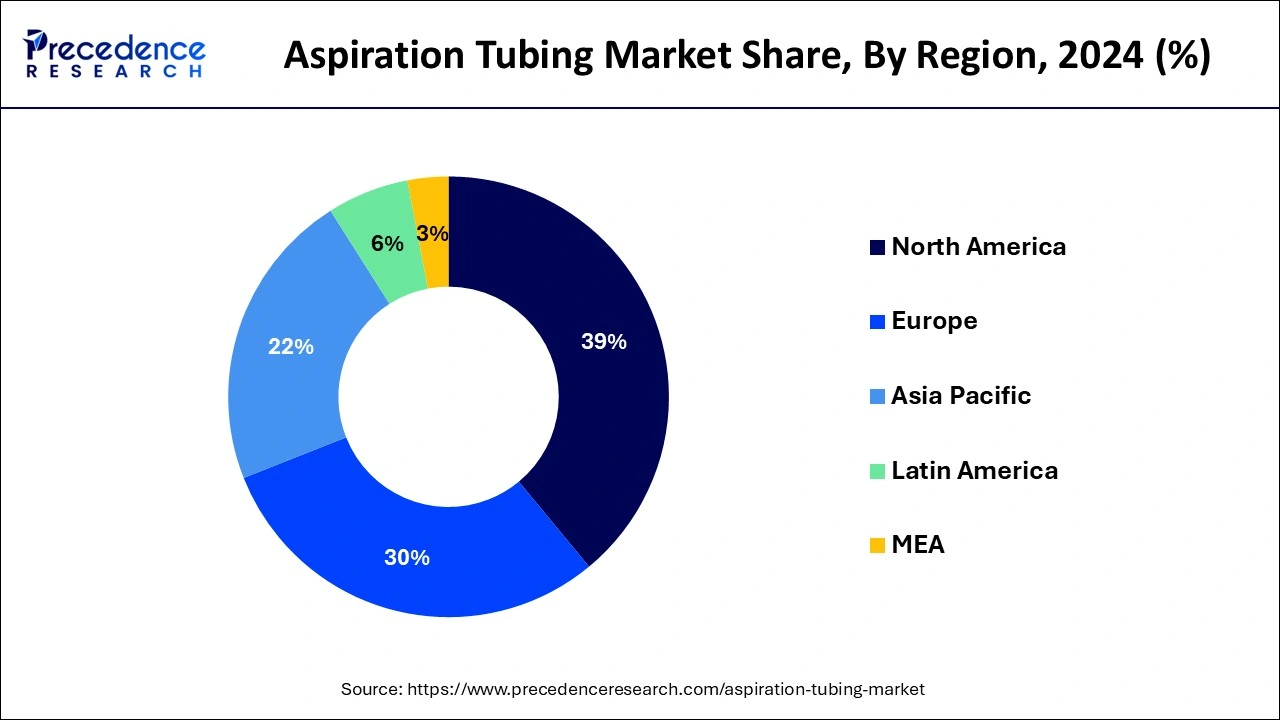

- North America contributed more than 39% of market share in 2024.

- Asia-Pacific is estimated to expand at the fastest CAGR between 2025 and 2034.

- By product, the polyvinyl chloride segment held the largest market share of 25% in 2024.

- By product, the polycarbonates segment is anticipated to grow at a remarkable CAGR of 11.18% between 2025 and 2034.

- By application, the bulk disposable devices segment generated over 29% of market share in 2024.

- By application, the catheters segment is expected to expand at the fastest CAGR over the projected period.

U.S.Aspiration Tubing Market Size and Growth 2025 to 2034

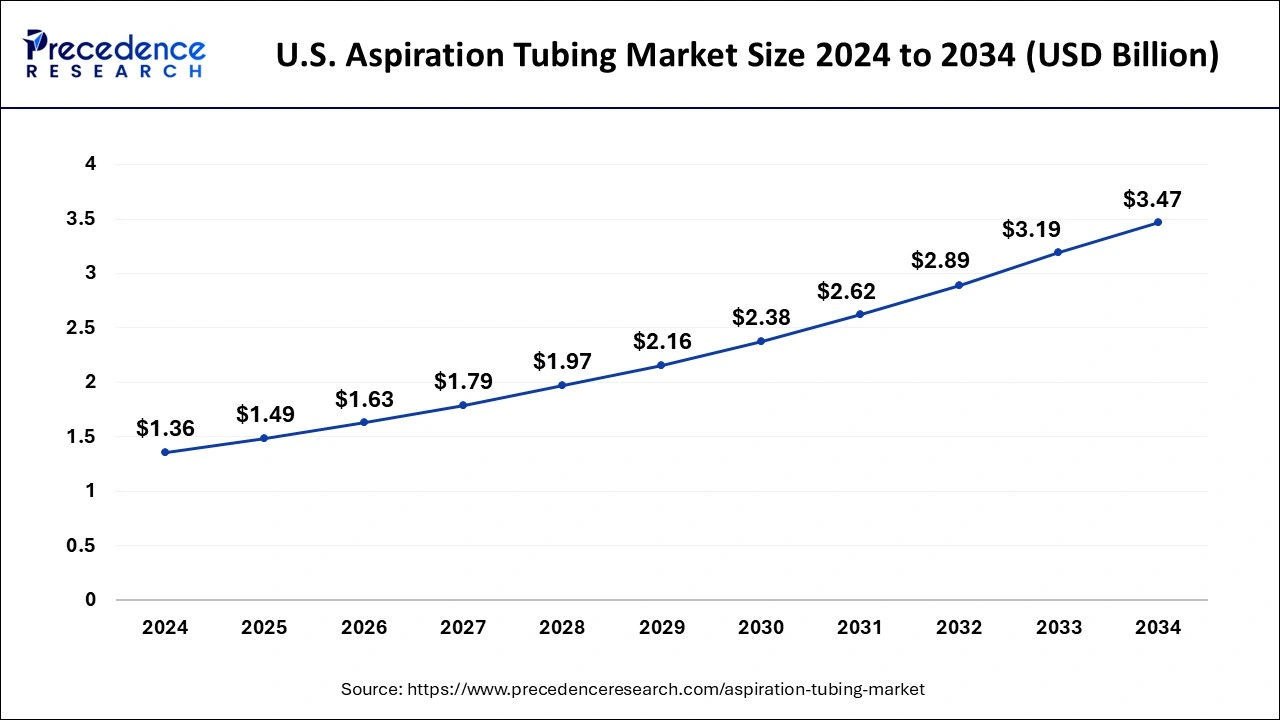

The U.S. aspiration tubing market size was exhibited at USD 1.36 billion in 2024 and is projected to be worth around USD 3.47 billion by 2034, growing at a CAGR of 9.82% from 2025 to 2034.

In 2024, North America holds a share of 39% in the aspiration tubing market due to a well-established healthcare infrastructure, high healthcare spending, and a growing aging population. The region's robust research and development activities drive technological innovations in aspiration tubing, fostering market growth. Additionally, the prevalence of respiratory disorders and the inclination towards advanced medical treatments contribute to the strong demand for aspiration tubing products. The region's stringent regulatory framework also ensures product quality and safety, further solidifying North America's significant role in the aspiration tubing market.

Asia-Pacific is projected to witness rapid growth in the aspiration tubing market due to increasing healthcare awareness, a rising aging population, and advancements in medical infrastructure. With a growing focus on respiratory health, there's a heightened demand for aspiration tubing in various medical procedures. Additionally, the region's expanding economies and healthcare investments contribute to the market's acceleration. As healthcare systems in Asia-Pacific evolve, the aspiration tubing market is positioned for significant expansion, driven by the region's dynamic demographic and healthcare landscape.

Meanwhile, Europe is experiencing notable growth in the aspiration tubing market due to an aging population, increasing prevalence of respiratory disorders, and advancements in healthcare technologies. The region's robust healthcare infrastructure and emphasis on patient-centric care drive the demand for high-quality respiratory devices, including aspiration tubing. Additionally, favorable reimbursement policies and a proactive approach to healthcare contribute to the market's expansion. As Europe continues to prioritize respiratory health, the aspiration tubing market is witnessing significant growth with opportunities for innovation and market penetration.

Market Overview

Aspiration tubing is a specialized type of medical tubing designed for procedures that involve suction or the removal of fluids. This tubing plays a crucial role in healthcare settings, facilitating the safe and efficient extraction of substances from a patient's body or a specific area. It is commonly used in procedures such as aspiration biopsies or when draining unwanted fluids from the body, helping healthcare professionals carry out these tasks with precision and care. The tubing is typically made from materials compatible with medical standards to ensure patient safety. Its design allows for the effective application of suction, making it a valuable tool in various medical contexts where controlled fluid removal is essential for diagnostic or therapeutic purposes.

Aspiration Tubing Market Data and Statistics

- In a June 2021 research article on the "Epidemiology of Peripheral Artery Disease and Polyvascular Disease," it was found that about 7% of adults in the United States, approximately 8.5 million individuals, are affected by peripheral artery disease. This condition involves narrowed arteries, particularly in the legs, impacting blood flow.

- Medtronic plc introduced the Prevail drug-coated balloon (DCB) Catheter in Europe in July 2021, following CE mark approval. This innovative catheter is employed during percutaneous coronary intervention (PCI) procedures to address narrowed or blocked coronary arteries in patients dealing with coronary artery disease (CAD).

- According to the updated Kidney Disease Statistics from July 2022 in the United States, chronic kidney disease (CKD) affects over 1 in 7 adults, totaling an estimated 37 million Americans. As the prevalence of CKD rises, there is an anticipated increase in demand for urinary catheters.

- March 2022 saw the launch of Shockwave Medical, Inc.'s Shockwave M5+ peripheral IVL catheter after obtaining FDA clearance. This catheter is specifically designed to reduce Intravascular Lithotripsy (IVL) treatment time, offer alternative access options, and extend IVL therapy to patients with larger vessel sizes.

Aspiration Tubing Market Growth Factors

- The global demographic shift towards an aging population is a significant driver for the aspiration tubing market. Elderly individuals are more prone to respiratory issues and may require medical interventions, contributing to the demand for aspiration tubing.

- The growing incidence of respiratory diseases, such as chronic obstructive pulmonary disease (COPD), asthma, and pneumonia, is fueling the need for respiratory care devices, including aspiration tubing. According to the World Health Organization (WHO), as of 2021, 235 million people suffer from asthma globally.

- Advances in medical technology, including improvements in aspiration tubing design, materials, and manufacturing processes, enhance the efficiency and safety of respiratory care procedures. Technological innovations attract healthcare providers to adopt updated equipment, stimulating market growth.

- The rise in surgical procedures, both in traditional healthcare settings and minimally invasive surgeries, contributes to the demand for aspiration tubing. Surgeries often involve airway management and suctioning, necessitating the use of high-quality aspiration tubing.

- The trend towards home-based healthcare services is growing, and aspiration tubing plays a crucial role in providing respiratory support to patients in a home setting. The convenience and cost-effectiveness of home healthcare contribute to the market's expansion.

- Increasing awareness about respiratory disorders and advancements in diagnostic capabilities lead to higher rates of diagnosis. As more individuals are diagnosed with conditions requiring respiratory care, there is a parallel increase in the demand for aspiration tubing.

Market Scope

| Report Coverage | Details |

|

Growth Rate from 2025 to 2034 |

CAGR of 9.59% |

| Market Size in 2025 | USD 5.44 Billion |

| Market Size by 2034 | USD 12.44 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Aging population and swallowing disorders

- The U.S. Census Bureau reported that by 2030, all baby boomers will be over the age of 65, contributing to an increased demand for healthcare services.

As the population ages, there is a natural increase in health challenges. Elderly individuals often face swallowing disorders, making it difficult for them to eat and breathe comfortably. This creates a demand for specialized medical tools like aspiration tubing, crucial for procedures assisting those with trouble swallowing or managing respiratory issues. The rise in seniors dealing with such conditions fuels the market for aspiration tubing, as it has become an essential tool for healthcare professionals providing care to the aging population. Moreover, the prevalence of these swallowing difficulties among the elderly is significant. As more people enter their golden years, the need for effective and safe tools like aspiration tubing grows, supporting healthcare providers in addressing the specific challenges faced by older individuals with respiratory and swallowing issues.

Restraint

Concerns regarding infections and contamination

Worries about infections and contamination pose significant challenges to the aspiration tubing market. In healthcare settings, maintaining a sterile environment is crucial to prevent the spread of infections. Concerns arise regarding the cleanliness and safety of medical devices, including aspiration tubing, as any lapse in hygiene can jeopardize patient health. Healthcare professionals and institutions must invest considerable efforts and resources in ensuring the sterility of aspiration tubing, adding complexities and costs to their operations.

Patients and healthcare providers alike may hesitate to embrace aspiration tubing if there are doubts about infection control. This restraint not only impacts the adoption of such essential respiratory care tools but also requires continuous vigilance and adherence to stringent protocols to address and mitigate infection-related concerns. Clear communication and education about the stringent measures in place to guarantee the safety of aspiration tubing can play a vital role in overcoming these reservations and fostering trust among both healthcare providers and patients.

Opportunity

Rising demand for home healthcare

The increasing demand for home healthcare services is creating substantial opportunities for the aspiration tubing market. As more individuals opt for medical care in the comfort of their homes, there is a growing need for portable and user-friendly respiratory care devices, including aspiration tubing. Manufacturers have the chance to design and offer products that cater specifically to home use, ensuring ease of use for patients and caregivers alike. This shift toward home healthcare aligns with the broader trend of personalized and patient-centric medical solutions.

Home healthcare not only provides a more familiar and comfortable environment for patients but also allows for more cost-effective and efficient healthcare delivery. Aspiration tubing tailored for home settings can enhance patient compliance with prescribed respiratory therapies, promoting better overall health outcomes. Manufacturers who tap into this opportunity by developing reliable, easy-to-use aspiration tubing solutions stand to benefit from the expanding home healthcare market and contribute to improved respiratory care outside traditional medical facilities.

Product Insights

The polyvinyl chloride segment held the highest market share of 25% in 2024.The polyvinyl chloride (PVC) segment in the aspiration tubing market refers to tubing made from this synthetic plastic material. PVC aspiration tubing is known for its flexibility, durability, and cost-effectiveness. A trend in this segment involves increasing efforts to enhance the biocompatibility and safety features of PVC materials used in aspiration tubing, addressing concerns about potential health risks associated with certain additives. As manufacturers focus on improving the overall quality and performance of PVC aspiration tubing, this segment continues to be a widely adopted and economical choice in the market.

The polycarbonates segment is anticipated to witness rapid growth at a significant CAGR of 11.18% during the projected period. In the aspiration tubing market, the polycarbonates segment refers to tubing made from polycarbonate material. Polycarbonate tubing is known for its durability, transparency, and resistance to breakage, making it suitable for various medical applications. A notable trend in this segment includes the increasing preference for polycarbonate aspiration tubing due to its robust properties, ensuring longevity and reliability in respiratory care procedures. As healthcare providers prioritize materials that offer strength and clarity, the polycarbonates segment is witnessing sustained growth as a favored choice in the aspiration tubing market.

Application Insights

The bulk disposable devices segment has held a 29% market share in 2024. The bulk disposable devices segment in the aspiration tubing market refers to the large-scale production and distribution of disposable tubing units designed for single-use medical applications. This segment caters to the demand for cost-effective and hygienic solutions in healthcare settings. A notable trend in this segment involves the integration of environmentally friendly materials in disposable devices, aligning with the increasing focus on sustainability in the medical industry. This approach ensures convenience for healthcare professionals while addressing environmental concerns associated with disposable medical products.

The catheters segment is anticipated to witness rapid growth over the projected period. In the aspiration tubing market, the catheters segment refers to specialized tubes designed for various medical applications. These catheters are commonly used in procedures such as bronchoscopy, tracheostomy, and urinary catheterization. A notable trend in this segment is the continuous innovation to enhance catheter design, materials, and functionality. Manufacturers are focusing on creating catheters that are not only efficient but also reduce the risk of infections and improve patient comfort, driving advancements in aspiration tubing technology and expanding its applications in different medical fields.

Recent Developments

- In February 2022, Zeus Industrial Products introduced the PTFE Sub-Lite-Wall multi-lumen tubing to its product lineup, specifically designed for steerable catheters.

- In February 2022, Imperative Care Inc. unveiled its latest advancement in stroke care, the Zoom POD Aspiration Tubing. This innovative product includes the Zoom 88 Large Distal Platform for neurovascular access, four Zoom Aspiration Catheters in different sizes, and the Zoom Pump with accessories. Notably, the Zoom POD is seamlessly integrated into the aspiration tubing, reducing the distance from aspiration to filtration while maintaining optimal aspiration power. These developments showcase ongoing efforts to enhance medical devices for improved patient care and procedural efficiency.

Aspiration Tubing Market Companies

- Medtronic plc

- Boston Scientific Corporation

- Olympus Corporation

- Teleflex Incorporated

- C. R. Bard, Inc. (acquired by Becton, Dickinson and Company)

- Cook Medical Inc.

- CONMED Corporation

- Smiths Group plc

- B. Braun Melsungen AG

- Cardinal Health, Inc.

- Vygon SA

- Amsino International, Inc.

- McKesson Corporation

- Hollister Incorporated

- Argon Medical Devices, Inc.

Segments Covered in the Report

By Product

- Silicone

- Polyolefins

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Others

By Application

- Bulk Disposable Devices

- Drug Delivery Systems

- Catheters

- Bio Pharmaceutical Laboratory Equipment's

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting