What is the Automatic Identification and Data Capture Market Size?

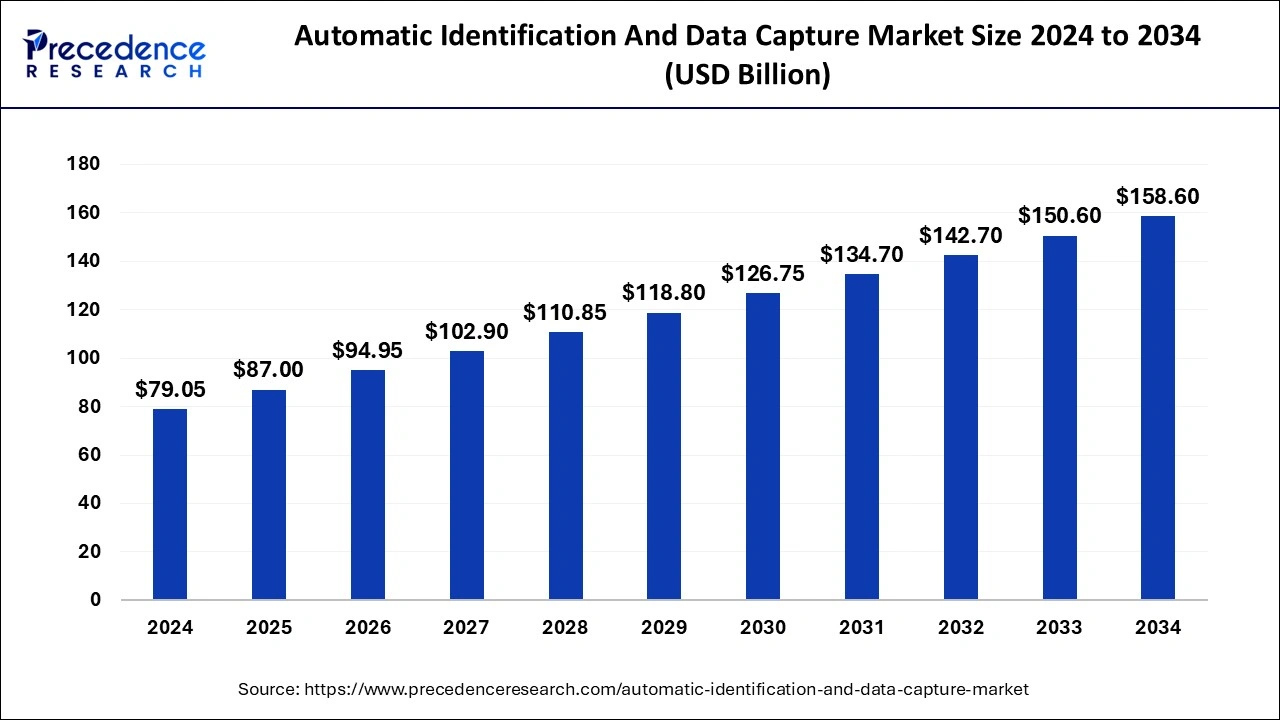

The global automatic identification and data capture market size accounted for USD 87 billion in 2025 and is predicted to increase from USD 94.95 billion in 2026 to approximately USD 166.53 billion by 2035, growing at a CAGR of 6.71% from 2026 to 2035.

Automatic Identification and Data Capture Market Key Takeaways

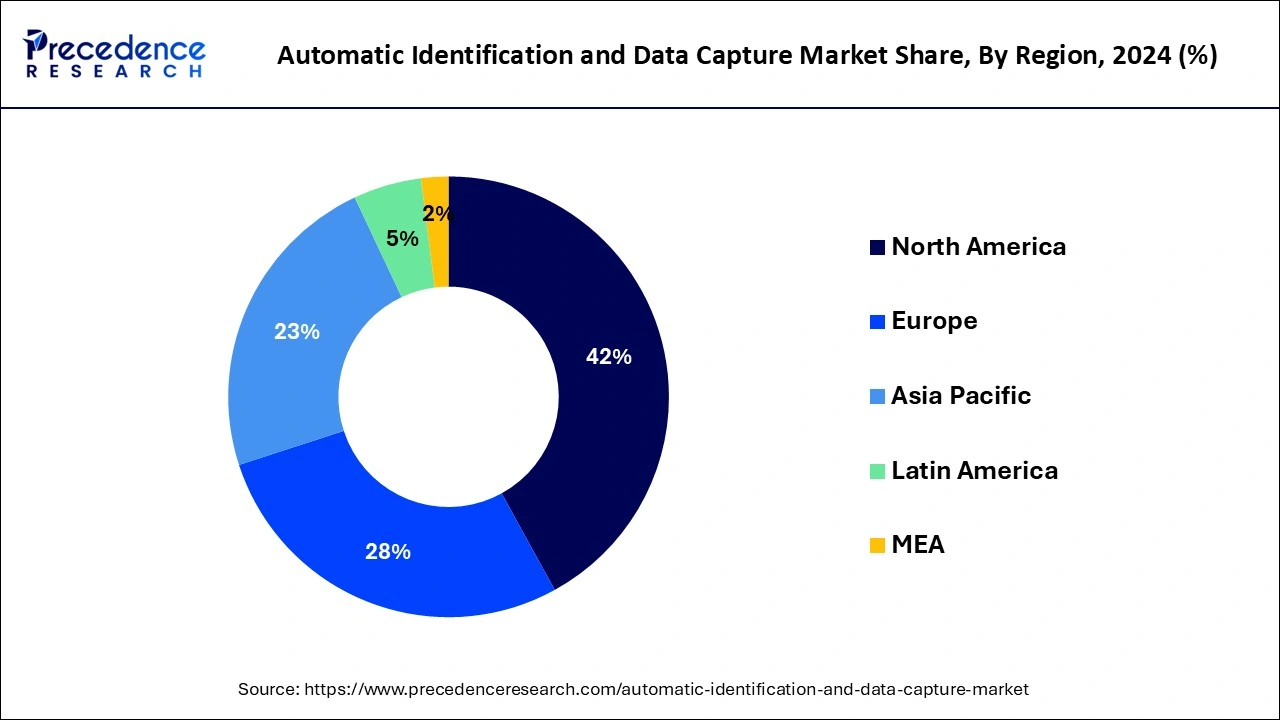

- North America led the global market with the highest market share of 41.20% in 2025.

- Asia Pacific region is estimated to expand the fastest CAGR of 14.7% between 2026 to 2035.

- By Component, the hardware segment has held the largest market share in 2025.

- By End User, the BFSI segment captured the biggest revenue share in 2025.

Market Overview

The process of gathering, capturing, and transforming data into a digital file is known as automatic identity and data capture (AIDC). Images, music, and other digital data are included in this file that can be given to a computer without human interaction. Magnetic strips, optical character recognition (OCR), radio frequency identity (RFID) systems, smart cards, and others are some of the frequently used AIDC instruments.

How is AI Influencing the Automatic Identification and Data Capture Industry?

AI-based solutions go beyond standard OCR to understand unstructured data from documents and invoices, along with labels, minimizing manual data entry. Machine learning algorithms determine captured data to forecast need, optimize inventory management, and monitor product movement in real time.

By learning from data patterns, AI decreases errors in data capture, which lowers expenses associated with manual validation and enhances overall operational efficiency.

Technological Advancement

Technological advancements in the automatic identification and data capture market feature biometrics, RFID, barcoding, IoT, data security, and AI and machine learning. Biometrics consists of iris scanning and facial recognition. This technology is popularly applicable for security purposes. RFID and barcoding provide tracking details of assets and support inventory management. It is also considered for security applications in manufacturing, healthcare, and the retail sector.

IoT integration is popular for devices that allow access to real-time data collection. AI and ML provide appropriate analysis of data with speed and advanced functionality of the AIDC system. These technologies further contribute to the present and future of the automatic identification and data capture market. The advancement has eased most of the manual work.

Automatic Identification And Data Capture Market Growth Factors

A person, a video, a photograph, or some audio data can be scanned, identified, captured, examined, recorded, and stored using the automatic identity and data capture (AIDC) technique without the need for human entry. To handle assets, inventory, deliveries, document scanning, and security, AIDC solutions are frequently used. Transportation and logistics, chemical, pharmaceutical, food and beverage, automobile, consumer goods, retail and warehousing, and distribution are just a few of the commercial uses offered by AIDC. For instance, AIM, the industry alliance for automated data capture technologies including RFID, barcode, NFC, IoT, and RTLS, declared its strategy objective to increase its impact among AIDC market participants in February 2022.

Giving a new set of AIDC standards to members and the general public via a recently created "AIM Standards Marketplace" is one of the main objectives of AIM's strategy plan. Examples of AIDC systems include radiofrequency identity (RFID), barcodes, biometrics, labels, smart cards, and speech and vocal recognition. Due to the solutions' improved accuracy, precision, and seamless operation, they have become widely accepted across a variety of sectors. Improvements in AIDC technology, greater usage of sophisticated AIDC systems, and factors like the increasing need to reduce human data input and capture mistakes are all expected to contribute to market development.

For instance, RMS Omega Technologies and Cybra Corporation, providers of barcoding, RFID devices, data collection, wireless, and mobility technologies, declared a partnership in July 2022. The businesses hope to create RFID-based inventory tracking and asset management systems through this partnership. Users will be able to implement powerful tracking solutions thanks to the collaboration, including real-time equipment position tracking, work-in-process operations, inbound and outgoing cargo accounting, inventory benchmark monitoring, and safety procedure enforcement.

Innovative low-cost solutions and rising smartphone QR reading are anticipated to drive market expansion. Additionally, the quickly expanding retail, consumer goods, and e-commerce industries are likely to fuel demand for AIDC products. Growth is also anticipated to be fueled by increased government efforts to market AIDC goods as a result of a rise in the frequency of human errors and incorrect data input. The need to decrease manual data input and record errors, advances in AIDC technology, and rising usage of sophisticated AIDC systems are all factors that are likely to increase the market growth.

- The rise in government efforts to use AIDC technology, the expanding use of AIDC systems in the e-commerce industry, and the rising need to reduce human data capture and input mistakes are the main factors driving the development of automated identity and data capture.

- A rise in the use of AIDC solutions as a result of their reduced transaction and queue times and increased customer comfort when processing small-value payments.

- The increasing adoption of AIDC solutions by banking and financial organizations to guarantee client safety and security as well as data privacy is one of the key factors fueling the development of this market.

Automatic Identification and Data Capture Market Trends

- Industry Growth Overview: The market is driven by increased automation, e-commerce growth, and the acceptance of RFID or barcode technologies in manufacturing, retail, and healthcare. Thus, retail and manufacturing sectors are main drivers, aiming on enhancing inventory management, supply chain efficiency, and reducing human error.

- Global Expansion: The demand for real-time visibility, faster order fulfillment, and accurate inventory tracking fuels the need for barcode and RFID systems. Strict, government-mandated traceability standards in food, beverages, and pharmaceuticals are driving the acceptance of advanced tracking technologies.

- Major Investor: It includes Zebra Technologies, Honeywell International, Cognex Corporation, Datalogic S.p.A., and NXP Semiconductors. These firms are at the forefront of expanding barcode and RFID, along with machine vision technologies.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.71% |

| Market Size in 2025 | USD 87 Billion |

| Market Size in 2026 | USD 94.95 Billion |

| Market Size by 2035 | USD 166.53Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Product, Technology, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Government regulation of the use of AIDC technology is increasing

Government organizations all over the world have put into place a number of laws in the last ten years to encourage the use of AIDC technologies in a variety of sectors and address the problem of rising data entry mistakes and associated running costs. These guidelines and rules are meant to assist organizations in ensuring improved information visibility, increasing operational effectiveness, lowering running costs through accurate data capture and fewer data input mistakes, and raising customer happiness.

- In May 2025, Tactile Technologies, which positions itself as a leading South African provider of touch, auto-ID, and payment solutions, launched events in Cape Town and Johannesburg to showcase its strategic partnerships with Unitech Europe and Seiko Instruments. These events aim to introduce South African businesses to innovative technologies in automatic identification.

Key Market Challenges:

AIDC systems' high implementation costs

One of the main barriers preventing small and medium businesses from adopting automated identifying and data capturing products is the high cost of implementation. Installing one or two contactless point of sale devices is required when automated authentication and data recording products, such as smart cards, are installed. This is very costly for small and medium-sized businesses with limited money to spend. Similar to this, a lot of tiny retailers still prioritize accepting cash purchases over debit or credit cards. This significantly slows the spread of card-based recognition options for conventional bank acquirers and contactless payment service providers.

Key Market Opportunities:

Increasing the use of fingerprint identification tools

Forensic sciences for criminal identity, automotive keyless entry and ignition, and customer authentication for mobile purchases are just a few industries that have made extensive use of biometric systems. The demand for AIDC devices is also anticipated to rise during the forecast period due to the growing use of biometric authentication devices, particularly for international border crossings to increase national security.

- In August 2024, Bartronics India surged 4.07% to INR 16.89 after announcing plans to acquire a stake in Ventugrow Consultants, an AI and Machine Learning-based investment advisory firm. Ventugrow Consultants, known for its 'Jarvis' brand, offers advanced financial technology solutions to B2B and B2C clients.

Segment Insights

Component Insights

Over 64% of worldwide income in 2025 came from the hardware sector. Increased demand for AIDC hardware devices like scanners, RFID bands, magnetic stripe cards, barcoding solutions, optical character recognition (OCR) systems, smart cards, and fingerprint systems can be credited for the segment's largest market share.

The industry for AIDC technology is also growing as a result of these products' increasing sales. For instance, the Matrix 320 5MP industrial scanner was unveiled in May 2022 by Datalogic S.p.A., a manufacturer of bar code scanners and portable data collecting devices. The new scanner has an excellent field of vision for scanning numerous tags or codes in a single capture with a single reader because it is designed on a multicore framework with HDR capacity and hardware acceleration.

Due to software companies' emphasis on offering distinctive features in data capture software, the software sector is anticipated to expand considerably over the course of the projection period. Vendors of AIDC solutions are increasing their marketing powers to promote their data capture software for handling large volumes of incoming communication from various sectors.

The banking sector is increasingly adopting data capture software to facilitate paperless transactions and improve the efficiency of digitally connected bankers. One recent example of this trend is the partnership between Melissa Inc. and ID-Pal in August 2022. The partnership resulted in the creation of Melissa ID, a flexible software-as-a-service solution that provides a range of automated identity verification tools. These tools utilize advanced technologies, including facial matching, biometrics, address verification, liveness testing, and document checks, to provide a comprehensive and reliable approach to identity verification. By leveraging such innovative solutions, the banking sector can improve operational efficiency, reduce costs, and enhance customer experiences.

End User Insights

In 2025, the BFSI sector had the highest income percentage of over 19%. The largest section share can be ascribed to the financial industry's rising demand for smart cards. It is expected that one possible end-user of the AIDC products will be the transportation and logistics industry. The industry has stretched the envelope and redefined the character of business by implementing AIDC technology for appropriate workflow and supply chain management. The growing demand for smart cards in the finance sector is responsible for the biggest section share. It is anticipated that the shipping and logistics sector will be one potential end-user of the AIDC goods.

Retail distribution centers can work with retail distribution centers to solve these new identification problems and reach the necessary process improvement objectives by utilizing the new, complementary technologies that manufacturers of AIDC systems are developing alongside continuously improving classic laser scanning capabilities.

Regional Insights

What is the U.S. Automatic Identification and Data Capture Market Size?

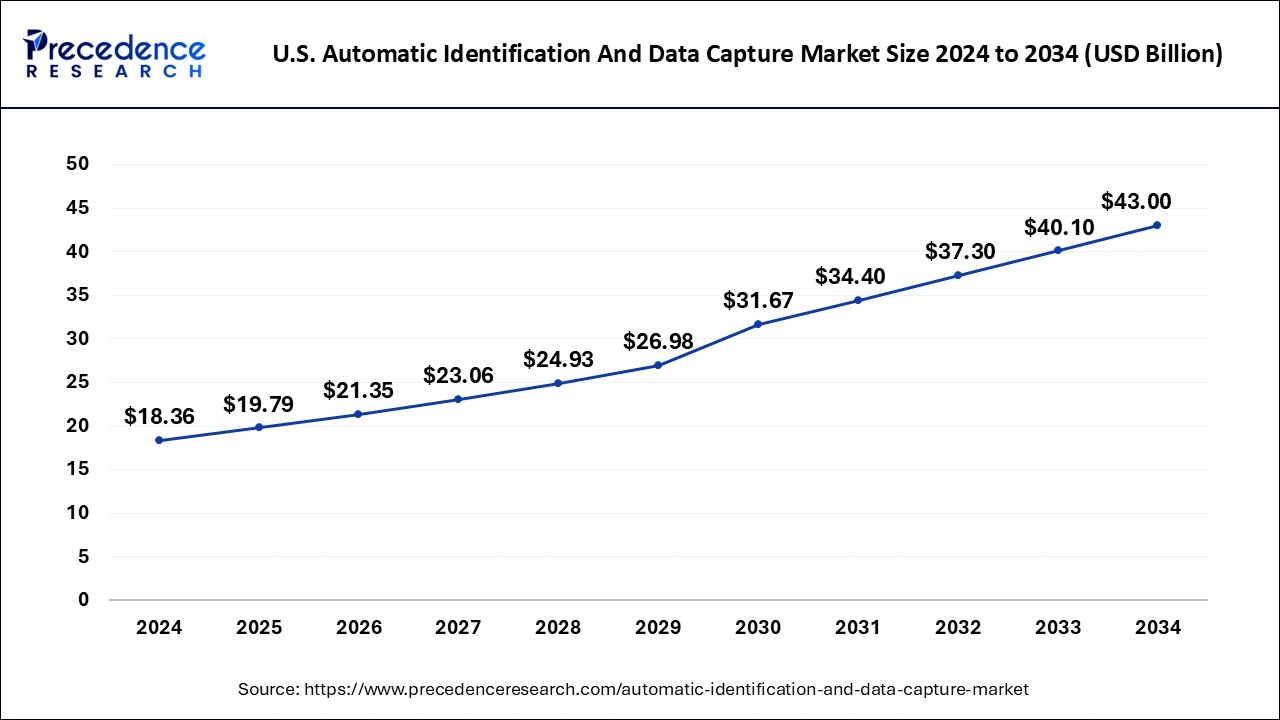

The U.S. automatic identification and data capture market size was exhibited at USD 19.79 billion in 2025 and is projected to be worth around USD 45.83 billion by 2035, growing at a CAGR of 8.76% from 2026 to 2035.

With a roughly 41.20% share of worldwide sales in 2025, North America dominated the industry. This high share can be ascribed to rising government legislation and funding, especially in the manufacturing, healthcare, and retail sectors, as well as rising knowledge of and high adoption of AIDC devices. The expansion of the regional market is also being fueled by the widespread adoption of cutting-edge technology and the technical advancement of numerous sectors.

A project for a supply chain of Fortune 100 stores with more than 2300 sites in North America, for instance, granted OmniQ Inc., an IT company that provides AI-based computer vision solutions, an additional USD 1 in August 2022. The buy order is for complete technological support for the new technology installed in the enormous logistical facilities in the area. By guaranteeing accurate configuration, comprehensive reporting, and a concierge business support staff devoted to the client, will hasten the implementation process.

- In November 2024, Memphis Auto-ID Lab launched the RFID-Shipment Tracking System. Companies and students are sharing learning opportunities based on RFID deployments at the point of shipping to improve logistics as goods leave a factory destined for customers. The solution offers an application for RFID tracking when goods go to customers rather than the more traditional retail solutions used to track goods to stores.

From 2026 to 2035, Asia Pacific is predicted to have the highest growth, at 14.7%. In order to benefit from the growing middle class's increasing buying power, retail, and logistics companies are expanding their presence in the Asia Pacific area. The automated identification and data capture industry in the area has grown as a consequence. Additionally, the existence of numerous significant companies in the region, including Toshiba, SATO, Panasonic, Godex, and Optoelectronics, is anticipated to fuel the industry's growth.

Asia Pacific is dominating the automatic identification and data capture market. The growth of the e-commerce sector is rising and smoothing the inventory management by approaching AIDC solutions. The region secures its position with the rising capitalization of logistics and multinational retail companies. Governments' initiatives and the imposition of favorable regulations supporting AIDC solutions help the region to leverage this market.

European Advancements in the Automatic Identification and Data Capture Industry

Europe is expected to witness significant growth in the market, driven by its strong regulatory frameworks, a high demand for operational efficiency, and an emphasis on supply chain management across various key industries like automotive, retail, logistics, and healthcare. Countries like Germany, the United Kingdom, and France are leading players in the region due to rapid AIDC adoption and an increasing shift towards cloud-based AIDC solutions as well as real-time data management systems.

Germany Automatic Identification and Data Capture Market Trends

This country's growth is due to the increased integration of technology, particularly in the manufacturing sector. Additionally, there is also a growing awareness regarding the advantages of combining AIDC with the Industrial Internet of Things (IIoT), which is anticipated to propel the market further.

Latin America Automatic Identification and Data Capture Industry Analysis

Latin America is expected to experience substantial growth in the market, with significant investments in automation, smart logistics, and digital transformation. Countries such as Brazil, Mexico, and Argentina are leading players in the region due to their rapid adoption of RFID, barcode scanning, and biometric systems. The logistics sector in the region is increasingly using RFID technology for real-time tracking of goods, while retailers are integrating barcode scanning and RFID for better inventory management and supply chain optimization.

Brazil Automatic Identification and Data Capture Market Trends

The rise of e-commerce in the country is contributing quite a lot to the growth of AIDC technologies, as retailers and logistics companies adopt advanced data capture systems to meet the demand for faster and more efficient delivery services.

MEA Region Growing in the Automatic Identification and Data Capture Industry

The Middle East and Africa are expected to witness steady growth throughout the forecast period. This growth is driven by technological advancements and government initiatives that are aimed at enhancing patient care and operational efficiency. The region also has a growing emphasis on digital health records and streamlined supply chain management. The region also benefits from a proactive regulatory environment, which encourages the adoption of innovative healthcare IT solutions through supportive policies and incentives.

UAE Automatic Identification and Data Capture Market Trends

Key companies and stakeholders in the country are increasingly prioritizing interoperability, data security, and scalability to meet rising demands. Additionally, the increasing focus on data security and privacy compliance is pushing companies to integrate robust cybersecurity features into their offerings.

Automatic Identification and Data Capture Market Companies

- Avery Dennison Corporation: Avery Dennison Corporation is a leading manufacturer in the automatic identification and data capture market, customizing in RFID inlays, tags, and even digital ID technologies which connect physical products to the digital world. Their offerings improve inventory accuracy, supply chain efficiency, and traceability for industries such as retail, apparel, food, and logistics.

- Cognex Corporation: Cognex Corporation provides advanced machine vision, barcode scanning, and AI-driven inspection tools to automate, identify, and even track products for the AIDC market.

- Zebra Technologies: Zebra Technologies provides a comprehensive portfolio for the automatic identification and data capture market, specializing in rugged mobile computers, RFID readers, barcode scanners, and thermal printers. Their solutions allow real-time tracking, data analysis, and workflow automation for industries including healthcare, retail, manufacturing, and logistics to enhance accuracy and efficiency.

- Honeywell International: Honeywell International offers a comprehensive suite of Automatic Identification and Data Capture solutions, which includes rugged mobile computers, industrial printers, high-speed barcode scanners, RFID systems, and even voice-automated technology. These products improve workflows in warehousing, retail, healthcare, and logistics by improving data accuracy, inventory tracking, and also operational efficiency.

Other Major Key Players

- Code Corporation

- IMPINJ Inc.

- Allien Technology Corporation

- Epson America Inc.

- Urovo Technology

- Shandong New Beiyang

- Toshiba Tec Corporation

- Denso Wave

- Keyence

- Panasonic

- NEC Corporation

- SATO Worldwide

- Vitronic

- cab Produkttechnik GmbH

- SICK AG

- Opticon Sensors Europe B.V.

- Newland Europe BV

- NXP Semiconductors

- Godex International

- TSC Auto ID Technology Co., Ltd.

- Unitech Electronics Co. Ltd

- Datalogic S.p.A

- Bluebird Inc.

- Better Online Solutions Ltd.

- Axicon Auto ID Ltd.

Recent Developments

- In February 2025, Datalogic, a provider of automatic data capture and industrial automation, introduced the Matrix 220 XAI. This innovative barcode reader, designed specifically for Direct Part Marking (DPM) applications, redefines the benchmarks in factory automation and artificial intelligence (AI)-driven barcode reading. Its unmatched performance is poised to make waves in the Electronics, Automotive, and Packaging sectors.

- In January 2024, UCC launched new barcode, QR code, and RFID services in Egypt, aiming to enhance operational efficiency and accuracy for businesses across various sectors. This initiative is part of UCC's commitment to providing advanced identification solutions tailored to the needs of the local market.

- In February 2024, Tactile Technologies announced a partnership with Unitech Europe, a recognized leader in automatic identification and data capture solutions. This collaboration aims to enhance the product offerings of both companies, focusing on innovative technologies that streamline operations across various industries.

- In November 2024, AIM, the leading global industry association for the automatic identification and data capture (AIDC) community, announced the publication of a new whitepaper titled “How AI, IoT, Robotics and AIDC Technologies are coming together in industrial environments.”

- In February 2025, AIM announced the 2025 industry group chairs for RFID experts and visibility technologies industry groups. The company appointed Jerry Peyton as chair of the RFID expert group (REG) and Chris Cassidy as chair of the visibility technologies industry group (VTIG).

- In July 2024, Newland AIDC, a Chinese developer of automatic identification technology, established a Japanese subsidiary. Newland AIDC offers over 100 types of products, such as mobile terminals, barcode scanners, and RFID reader devices.

- Peak Technologies and Supply Chain Services LLC. reached a comprehensive merger deal in August 2022 that calls for the integration of their respective companies. The new company will operate under the name Peak Technologies. The new business aims to position itself as a full-service solution supplier in the enormous, fragmented, and competing AIDC industry. The newly combined company is in a great situation to offer a wide range of goods to both current and potential clients in North America and Europe.

- On August 26, 2021, Handheld Group released the RS60 Ring Scanner, a convenient hands-free scanning option for use in delivery centers, retail stores, and other environments that call for mobile scanning. In addition to the previously launched SP500X ScanPrinter, this is the second new wearable series from Handheld.

Segments Covered in the Report

By Component

- Hardware

- RFID Reader

- Barcode Scanner

- Smart Cards

- Optical Character Recognition Devices

- Biometric Systems

- Others

- Software

- Services

- Integration & Installation Services

- Support & Maintenance Services

By Product

- Scanner & Reader

- Barcode Scanners

- RFID Scanner

- Smart Card Reader

- Magnetic Stripe Reader

- Optical Character Recognition (OCR)

- Biometric Scanners

- Printer & Recorder

- Others

By Technology

- Biometrics

- Radio Frequency Identification (RFID)

- Smart Cards

- Optical Character Recognition (OCR)

- Others

By End User

- Manufacturing

- Retail

- Transportation & Logistics

- Hospitality

- FSI

- Healthcare

- Government

- Energy & power

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting