Automotive Communication Technology Market Size and Forecast 2025 to 2034

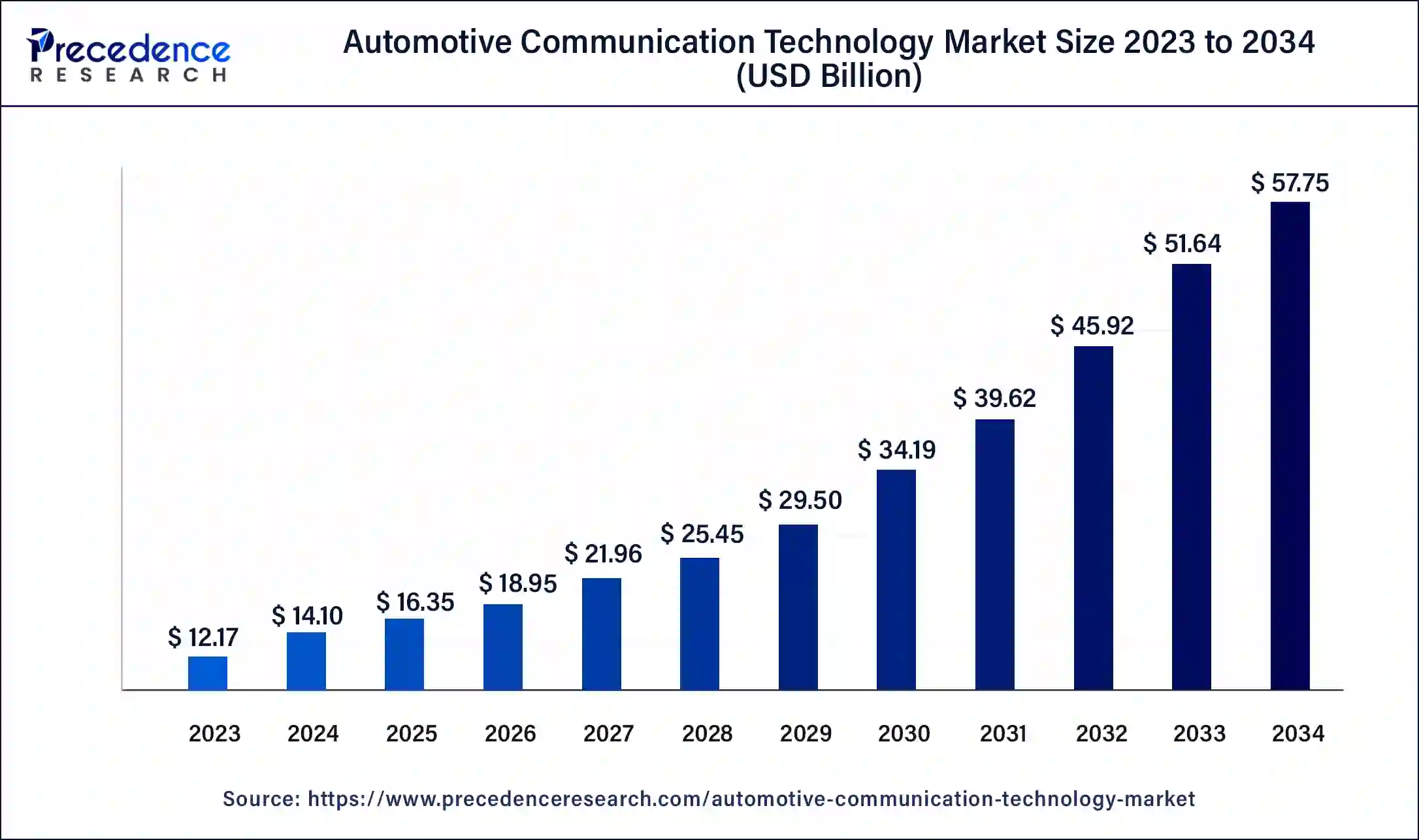

The global automotive communication technology market size accounted for USD 14.10 billion in 2024 and is predicted to reach around USD 57.75 billion by 2034, growing at a CAGR of 15.14% from 2025 to 2034.

Automotive Communication Technology Market Key Takeaways

- In terms of revenue, the market is valued at $16.35 billion in 2025.

- It is projected to reach $57.75 billion by 2034.

- The market is expected to grow at a CAGR of 15.14% from 2025 to 2034.

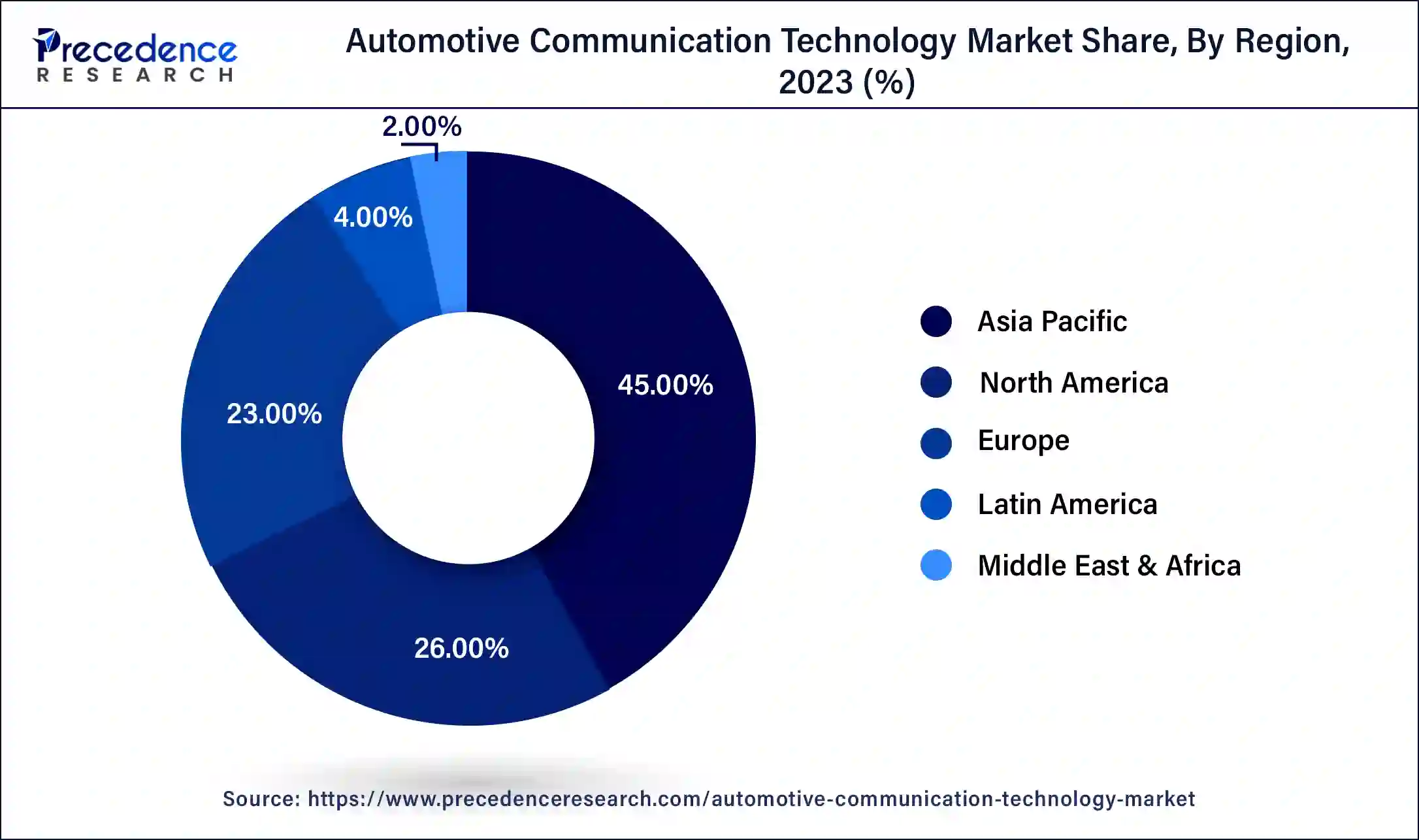

- Asia Pacific dominated the market with the highest market share of 44.7% in 2024.

- By Bus Module, the CAN module segment has held the largest market share 38.7% in 2024.

- By vehicle class, the mid-size vehicle class segment is anticipated to grow at the fastest rate over the projected period

AI in the Market

Artificial intelligence is transforming the automotive communication technologies to scale vehicle-to-everything communication so vehicles may exchange information about traffic, hazards, and road conditions. This is beneficial to road safety and driver assistance systems. In traffic management, AI optimizes signals and maximizes congestion flow to minimize delay and maximize the area. AI is also core to autonomous driving, enabling complex perception data to be translated into reliable decisions. AI enhances connectivity to smart infrastructure, generating seamless interaction among vehicles, traffic lights, and road systems. The integration of intelligent decision-making with strong communication networks creates an interconnected and greener transportation scenario.

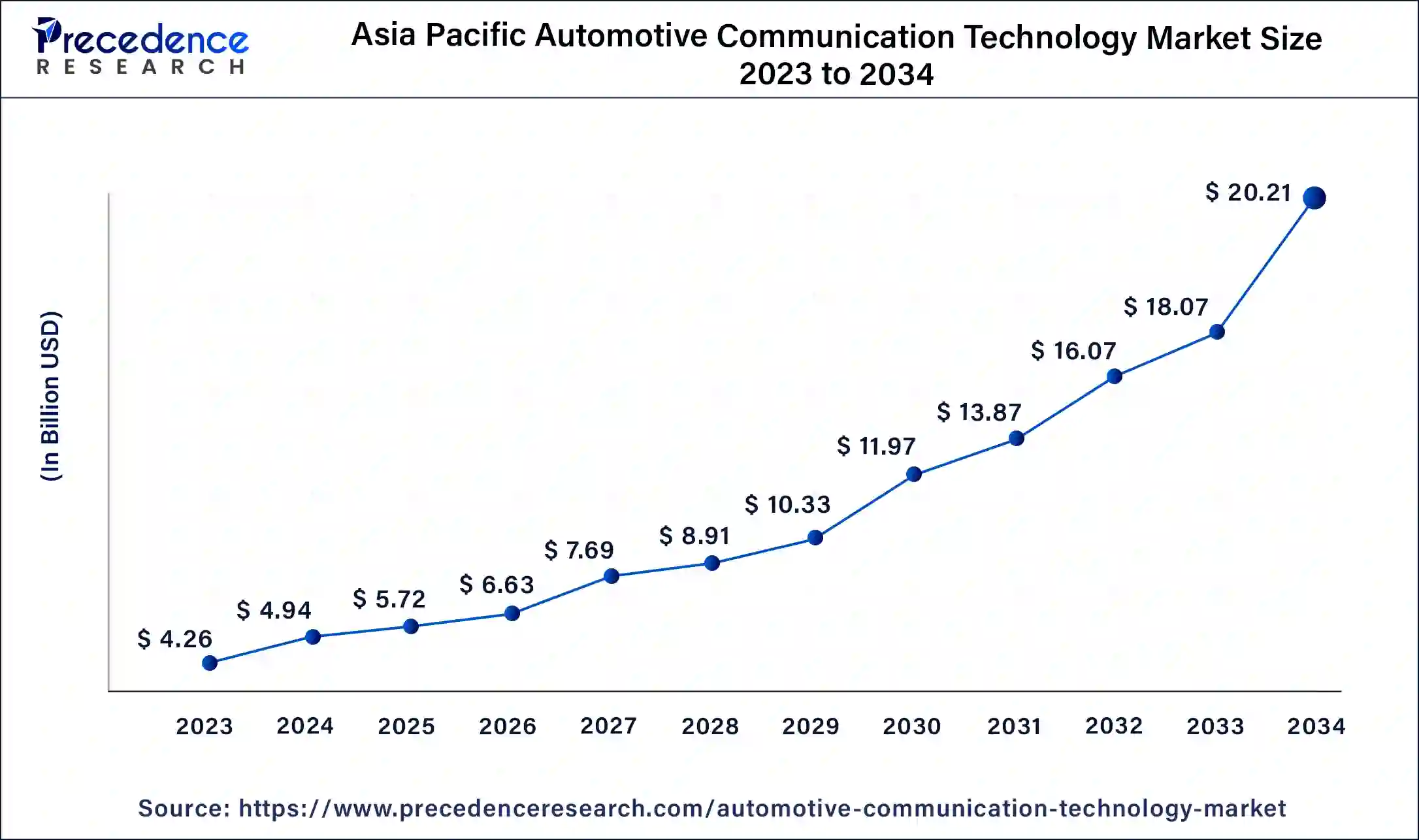

Asia Pacific Automotive Communication Technology Market Size and Growth 2025 to 2034

The Asia Pacific automotive communication technology market size accounted for USD 5.72 billion in 2025 and is projected to grow around USD 20.21billion by 2034, at a CAGR of 16% between 2025 and 2034.

The global automotive communication technology market was analyzed for North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The Asia Pacific is the front-runner with holding 44.7% of market share in 2024 and anticipated to forecast its dominance during the analyzed timeframe. This is mainly attributed to the region being hub for automobile manufacturers as well as the fastest growing region in automotive market.

Rise of automotive communication technology in North America

North America experiences the fastest growth in the automotive communication technology. The growing demand for autonomous and connected vehicles increases the demand for advanced automotive communication technology. The rise of 5G technology and the growing integration of advanced driver assistance systems help in the market growth. The strong government regulations for vehicle safety and automakers' investment in communication technologies drive market growth.

The growing demand for smart transportation infrastructure and the growing adoption of electric vehicles increases demand for automotive communication technology. Furthermore, growing demand for luxury vehicles and increasing use of telematics-based insurance support the overall growth of the market.

United States automotive communication technology market trends

The United States is a key contributor to the automotive communication technology. The strong production of automotive technology and the presence of major manufacturers help in the market growth. The strong focus on implementing advanced safety features increases demand for automotive communication technology. The well-established infrastructure for data networks and telecommunications develops a reliable automotive communication system. The high demand for connected cars and a strong focus on improving road systems drive the overall growth of the market.

Moreover, increasing investments from international manufacturers in the Asian automotive market owing to its high vulnerability for the advanced and upcoming technologies makes the region more lucrative. For instance, in October 2022, Autohome Inc. announced to invest in TTP Car Inc., one of the leading auction platforms in China. This investment helps in the robust development of used cars market in China. Similarly, other auto manufacturing companies mainly among the top automotive giants found Asia as the most opportunistic region because of low labour cost and increasing sales value.

However, developing regions such as Middle East & Africa and Latin America shows accelerating growth in the global automotive communication technology market as these regions have the largest consumer base across the globe and are less explored areas for advanced technologies. Further, the developing nations invest significantly in the adoption of upcoming technologies in order to increase their Gross Domestic Product (GDP).

China is a major contributor to the automotive communication technology. The growing domestic production and adoption of electric vehicles increases demand for effective automotive communication technology. The growing production of vehicles and strong government support for advanced driving systems & electric vehicles help in the market growth. The growing demand for autonomous vehicles increases demand for communication technologies like vehicle-to-everything. The growing consumer demand for connected vehicles, strong investment in research & development of communication systems, drive the market growth.

Automotive Communication Technology Market Growth Factors

- Taking advantage of the integration of IoT with big data and other digital technologies enhances vehicle communication capabilities and performance.

- Increasingly, vehicle makers focus on installing advanced electronic systems and control units to improve safety, comfort, and efficiency.

- Demand for innovative communication technologies is higher because of consumer preferences for connected, intelligent, and feature-rich vehicles.

- The miniaturization and downsizing of electronic components make advanced technologies more affordable to be adopted by a wider variety of vehicles.

- The increasing interest in safety regulations and comfort-based features is ushering in an accelerated deployment of next-generation communication systems within the automotive domain.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 57.75 Billion |

| Market Size in 2025 | USD 16.35 Billion |

| Market Size in 2024 | USD 14.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.14% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Bus Module, Application, Vehicle Class, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Value Chain Analysis

- Raw Material Sourcing: Procurement of specialized raw materials such as steel, plastics, and electronic components that conform to rigid specifications required for the manufacture of automotive communication technology.

Key Players: ArcelorMittal and Nippon Steel

- Component Manufacturing: Production of hardware, sensors, and electronic control units (ECUs) in vehicle communication systems by primary, secondary, and tertiary suppliers.

Key Players: Denso Corporation, Bosch

- Vehicle Assembly and Integration: The integration by OEMs of complex communication technologies and components into the final vehicle design during final vehicle assembly.

Key Players: NXP Semiconductors, Texas Instruments

- Retail Sales and Financing: The stage at which the vehicle with communication features is marketed to and sold by, and often financed for, an end-customer.

Key Players: Volkswagen Group, Hyundai Motor Company

- Aftermarket Services and Spare Parts: After-sales customer services, software updates, and maintenance and replacement of parts to maintain and upgrade the vehicle communication technology throughout its life.

Key Players: Bosch, Denso, and Continental AG

Bus Module Insights

The global automotive communication technology market was bifurcated into Controller Area Network (CAN), Local Interconnect Network (LIN), Media-Oriented Systems Transport (MOST), FlexRay, and Ethernet. CAN module captured major revenue share of 38.7% in the year 2022 and expected to continue its dominance during the forthcoming years. With its increasing applications, CAN bus has become a standard choice for automobiles (cars, buses, trucks, tractors, and others), as well as for other applications too such as EV batteries, planes, ships, machineries, and many more. Looking in to the future perspective, CAN bus expected to stay relevant as it impacted major trends in automotive for instance rise in cloud computing, growth in demand for connected vehicles & IoT integration in cars, rise in autonomous vehicles, and increasing necessity for advanced vehicle functionality.

On the contrary, ethernet technology anticipated to grow at the fastest rate during the projected years registering a CAGR of 20.87% owing to its advantages in high data transfer. An average data transmission speed of ethernet port is 100 Mbps that comparatively higher compared to other communication ports. High data transmission is need of present automotive technologies such as adaptive cruise control, advanced driver assistance system, smart parking system, advanced engine control system, and many others. Presently, there are 400 million ethernet ports in a vehicle and the number anticipated to rise at an exponential rate.

Application Insights

On the basis of application, body control & comfort acquired the maximum market revenue of USD 2.62 billion in 2023 because of rising adoption of higher level of safety and comfort features in modern cars & vehicles. This is mainly because of rising number of deaths related to road accidents. Further, increasing demand for luxury cars and premium vehicles is significantly responsible for the notable revenue share of body control & comfort segment.

On the other hand, powertrain segment witnessed exponential growth over the forthcoming years due to increasing demand for smooth driving as well as high power engines. Rapid growth in the need for more secure and smooth driving has accelerated the powertrain segment. In addition, new government policies for reducing the pollution rate from passenger cars have triggered the need to improve the engine efficiency of vehicles this again impacts the growth of powertrain segment to a greater extent.

Vehicle Class Insights

By vehicle class, mid-size vehicle class captured majority of revenue share in the year 2023 and anticipated to lead the market during the forthcoming years as well. This is mainly attributed to the average price range of vehicles that is suitable for the major share of population across the world. In addition, all necessary features are incorporated in the mid-sizes vehicles that make them more comfortable as well as affordable. However, Luxury cars segment seek exponential growth over the upcoming timeframe because of increase in purchasing power of consumers.

Key Companies & Market Share Insights

The major players in the global automotive communication technology market are majorly focused towards entering into a strategic alliance with the semiconductor manufacturing companies in order to develop more advanced automotive solutions. Further, they are concentrated towards product development and advancement. For instance, in January 2019, Toshiba America Electronic Components Inc., a subsidiary of Toshiba Corporation, introduced announced TC9562 series that provides advanced ethernet capability for infotainment & telematics system for the automotive sector.

Automotive Communication Technology Market Companies

- Toshiba Corporation

- Robert Bosch

- Texas Instruments

- Broadcom Inc.

- NXP Semiconductors

- Infineon Technologies AG

- STMicroelectronics

- Renesas Electronics Corporation

- Microchip Technology Inc.

- ON Semiconductor

- Rohm Semiconductor

- Maxim Integrated

- Melexis NV

- Xilinx Inc.

- Elmos Semiconductor SE

- Analog Devices

- Vector Informatik GmbH

- Intel Corporation

Recent Developments

- In June 2025, Verizon Business launched Edge Transportation Exchange, a V2X communication platform for connected vehicles, with multiple customers, including the Arizona Commerce Authority, Delaware Department of Transportation, Rutgers University, and Volkswagen Group of America.

https://telematicswire.net - In April 2025, DAS Technology launches Dealership Tariff Toolkit, providing auto dealers with communication guidance and strategies to engage consumers during uncertainty surrounding proposed automotive tariffs.

https://www.businesswire.com

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2032. For the purpose of this study, Precedence Research has segmented the global Automotive Communication Technology Market report on the basis of bus module, application, vehicle class, and region:

By Bus Module Outlook

- Controller Area Network (CAN)

- Local Interconnect Network (LIN)

- Media-Oriented Systems Transport (MOST)

- FlexRay

- Ethernet

By Application Outlook

- Powertrain

- Infotainment & Communication

- Body Control & Comfort

- Safety & ADAS

By Vehicle Class Outlook

- Luxury

- Mid-Size

- Economy

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting