What is the Automotive Lubricants Market Size?

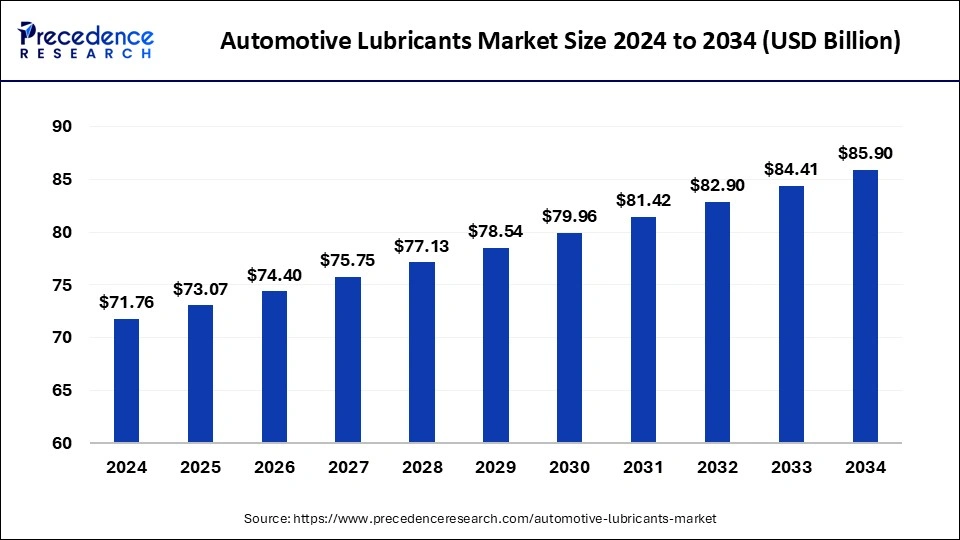

The global automotive lubricants market size is calculated at USD 73.07 billion in 2025 and is predicted to increase from USD 74.4 billion in 2026 to approximately USD 87.40 billion by 2035, expanding at a CAGR of 1.81% from 2026 to 2035. Increasing adoption of high-quality and environment-friendly automotive lubricants, which are further compatible with the technically advanced engines in the automotive market, are the major driving factors of the global automotive lubricants market.

Automotive Lubricants Market Key Takeaways

- The global automotive lubricants market was valued at USD 73.07 billion in 2025.

- It is projected to reach USD 87.40 billion by 2035.

- The market is expected to grow at a CAGR of 1.81% from 2026 to 2035.

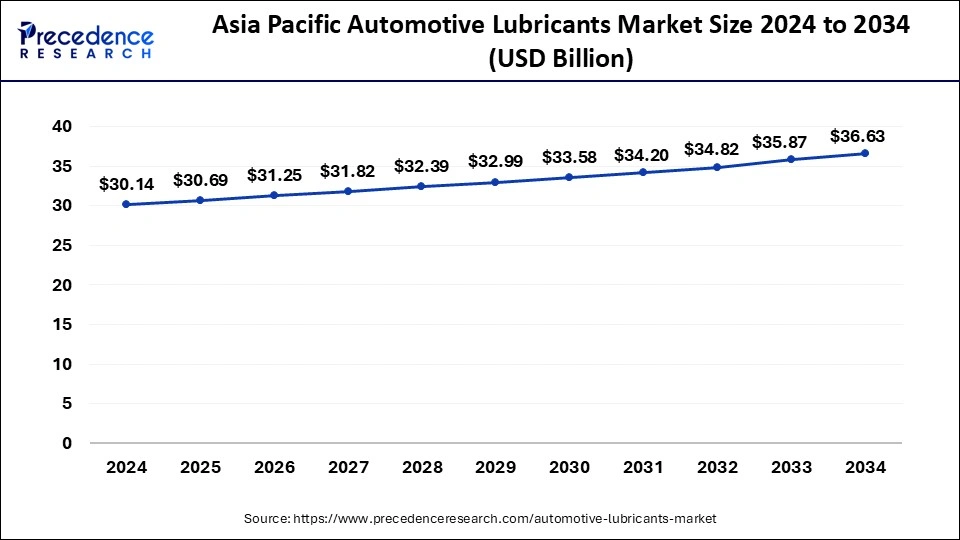

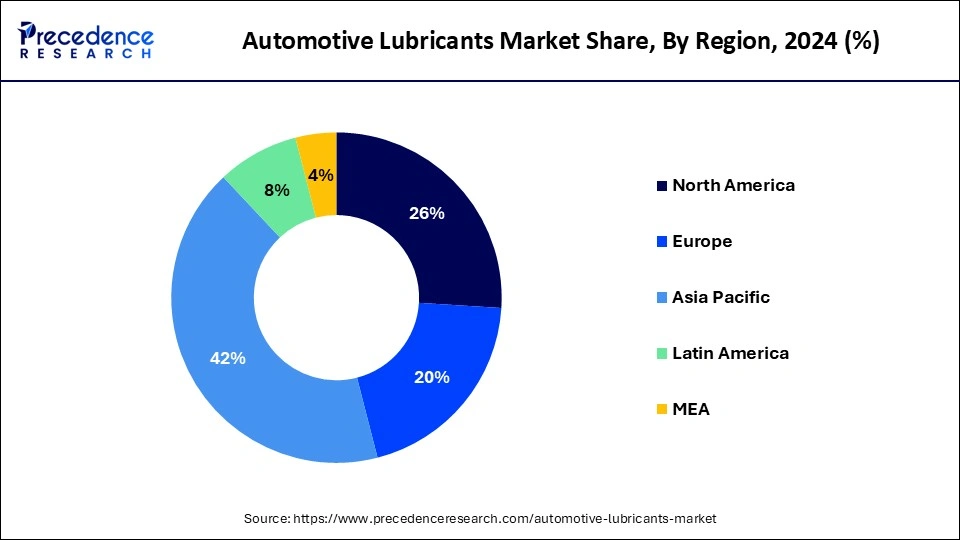

- Asia Pacific dominated the automotive lubricants market with the largest revenue share of 42% in 2025.

- By product type, the engine oil segment dominated the global market in 2025.

- By product type, the gear oil segment is projected to gain a notable share of the market over the forecast period.

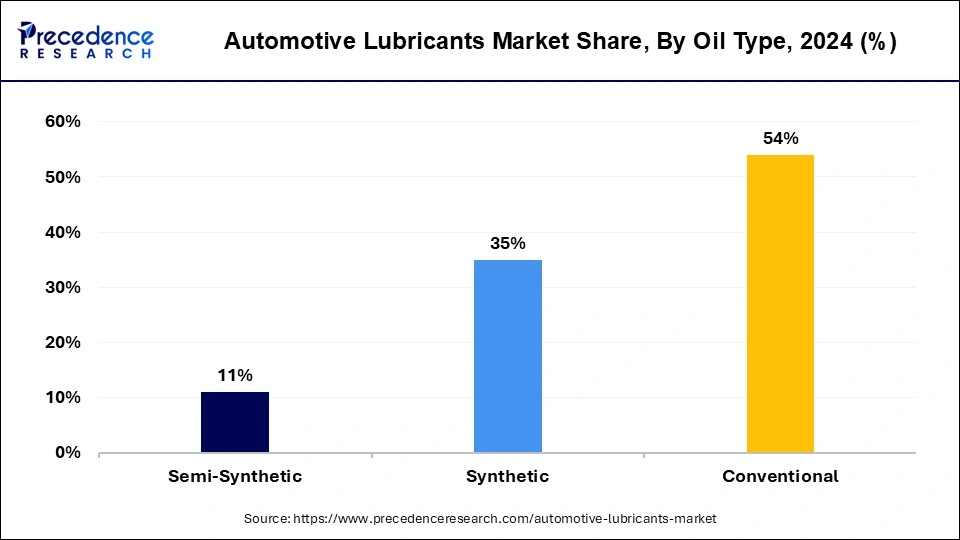

- By oil type, the conventional segment accounted for the largest revenue share of 54% in 2025.

- By oil type, the synthetic segment is expected to witness considerable growth in the global market over the studied period.

What are Automotive Lubricants?

The global automotive lubricants market is experiencing steady growth, driven by increasing vehicle production and ownership, especially in emerging economies. The market is segmented into engine oils, transmission fluids, and other lubricants, with engine oils dominating due to their critical role in vehicle maintenance. Advancements in lubricant technology, focusing on enhancing fuel efficiency and reducing emissions, are propelling market expansion.

Major players in the automotive lubricants market include Shell, ExxonMobil, and BP, who are investing in R&D to develop high-performance lubricants. Environmental regulations and the shift towards electric vehicles pose challenges but also open opportunities for specialized lubricants. Asia-Pacific leads the market, followed by North America and Europe, owing to high vehicle demand and manufacturing bases.

Automotive Lubricants Market Growth Factors

- Increasing vehicle production and ownership, particularly in emerging economies.

- Advancements in lubricant technology enhance fuel efficiency and reduce emissions.

- Strong investments in research and development by major industry players.

- Rising demand for high-performance and specialized lubricants.

- Stringent environmental regulations driving the need for more efficient and eco-friendly lubricants.

- Expansion of automotive manufacturing bases, especially in Asia Pacific and North America.

- Growing aftermarket for vehicle maintenance and repair services.

- Development of electric and hybrid vehicles requiring specific lubricant solutions.

Automotive Lubricants Market Outlook

Between 2025 and 2030, this market is expected to rise significantly due to the rising sales of automotive products in developed nations, coupled with rapid investment by market players for opening new production centres.

Numerous market players are actively entering this market, drawn by collaborations, R&D and business expansions. Numerous lubricant manufacturers such as Exxon Mobil, Castrol, Shell, Repsol and some others have started investing rapidly for developing high-quality lubricants for the automotive sector.

Various startup brands are engaged in manufacturing automotive lubricants. The prominent startup companies dealing in automotive lubricants consist of Eannol Automotive India, Axabull, Ziel Lubricants and some others.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 87.40 Billion |

| Market Size in 2025 | USD 73.07 Billion |

| Market Size in 2026 | USD 74.4 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 1.81% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Oil Type, Product Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Need to minimize energy loss due to friction in metal components of automotive

The major driver for the automotive lubricants market lies in the need to reduce the energy loss that happens during transportation due to the friction in a metal component of the vehicle, which will later develop more corrosion or rust in the equipment that plays a key role in running vehicles effortlessly. Lubricants are basically made up of specific additives and base oils, which reduce the friction between the two surfaces of components that come in contact.

Lubricants can be used in a wide range of industrial and automotive engine applications as they keep engines cool by lowering the temperature and preventing a sludge buildup in the machinery otherwise. The automotive lubricants market is fuelled by a spectrum of lubricants available in the market, like automotive engine oil, anti-rust engine oil, gear oil, automotive transmission oil, sludge prevention oil, and special fluids designed for automotive equipment. All these oils provide specific benefits that they are designed to target, such as engine oil generally used in car servicing, which boosts the performance of engines and offers superior protection for both diesel- and petrol-based engines by maintaining their longevity.

Additionally, these specialized lubricants aid in neutralizing the acidic fluids generated during the combustion of engines, which prevents corrosion and makes sure to keep the engine block thermally at a low temperature and free from residual buildup that may damage the engine further to ensure a smooth run. Under extreme pressure, machinery functioning may be affected if not prevented properly. Here, lubricants optimize functioning even under heavy loads, as they are designed to withstand extreme loads or pressure.

- In February 2022, ExxonMobil announced the expansion of its Mobil 1 and Mobil Super engine oil portfolio with new formulations designed for hybrid and electric vehicles. The new formulations will help enhance vehicle performance, extend engine life, and reduce maintenance costs.

Restraint

Works under a specific thermal range

A major challenge that can hinder the growth of the automotive lubricants market is that conventional lubricants work efficiently only under particular temperature ranges, and they do not perform optimally when the temperature gets out of range as it affects the viscosity of lubricants. The viscosity of any fluid means the ability of fluid to move easily with less resistance and provide optimal performance for which the fluid is set.

Hence, the same logic applies to conventional fluids like lubricants in automotive, which would not perform well in extreme temperatures, either high or cold temperatures, hindering startup lubrication. These lubricants tend to break down easily in hot climatic conditions or due to exposure to contaminations; hence, it is required to change oil after a regular interval of time, which increases the maintenance burden on the vehicle.

Moreover, lubrication oil is extracted from non-renewable sources that are basically mineral-based oils. After disposal, these mineral oils can have serious side effects on environmental health as they are not able to degrade easily in the soil or by any of the natural methods without leaving a hazardous footprint behind. Also, many lubricants are made one size fits all, which creates compatibility issues for newly developed automotive engines such as EVs and hybrid vehicles.

Opportunity

Innovations like biodegradable lubricants and nanotechnology

The major opportunity that the automotive lubricants market holds is an innovation in lubrication, such as the development of biodegradable lubricants instead of conventional ones. Growing climatic concerns due to the automotive market are not a new subject to work on. Hence, biodegradable lubricants could solve the issue by providing degradable components in the oils, which are mainly derived from renewable energy sources.

It reduces the ecological impacts since they can break down easily in nature, protecting the soil and water from pollution. Such a health approach from the automotive market will not only help reduce the harmful effect of conventional lubricants on the environment but also compel stringent environmental regulations set by authorities to protect an overall healthy climate for better survival.

On the other hand, nanotechnology is set to play a huge role in the development of innovative lubricants in the automotive market by manipulating minute particles on a nanoscale so as to utilize it effectively to revolutionize the performance of lubricants made up of nanoparticles. Nanoparticles are basically particles less than 100 nanometres as per measurement. These tiny particles can intellectually work as an additive in the lubricants by forming a thin protective layer between the working parts within the engine block to reduce friction to a nearly microscopic level, boosting its performance at the highest. Hence, nanotechnology presents an excellent opportunity to propel the automotive lubricant market globally by offering demanding tailored needs of advanced automotive engines and other equipment.

Segment Insights

Oil Type Insights

The conventional segment accounted for the largest automotive lubricants market share in 2025. Conventional oils, derived from crude oil, are preferred for their affordability and availability. They provide reliable performance for a wide range of vehicles, making them a popular choice among consumers and automotive manufacturers. Despite the rising interest in synthetic and semi-synthetic oils, conventional oils continue to hold a significant market share due to their adequate protection and lubrication in standard driving conditions. Key players are enhancing the quality of conventional oils to meet evolving performance standards and environmental regulations, ensuring their continued dominance in the market.

The synthetic segment is expected to witness considerable growth in the global automotive lubricants market over the studied period. Synthetic oils offer enhanced protection, improved fuel efficiency, and better performance in extreme temperatures. Increasing consumer awareness about these benefits, coupled with advancements in automotive technology, is driving demand. This segment is attracting significant investments from key players aiming to develop high-performance, eco-friendly lubricant solutions.

Product Type Insights

The engine oil segment dominated the global automotive lubricants market in 2025 and is expected to maintain its position in the upcoming period. Engine oils are essential for lubricating engine components, reducing friction, and preventing wear and tear. They also help cool the engine and keep it clean by suspending contaminants. Given the high frequency of oil changes required to maintain optimal engine performance, this segment sees consistent demand. Additionally, the proliferation of internal combustion engines across various vehicle types further reinforces the dominance of the engine oil segment.

The gear oil segment is projected to gain a notable share of the automotive lubricants market over the forecast period. Gear oils are essential for reducing friction and wear in gear systems, ensuring smooth and efficient operation. The rise in automatic and high-performance vehicles, which require specialized lubricants, is also driving growth. Additionally, advancements in gear oil formulations that enhance fuel efficiency and meet stringent environmental standards are contributing to the segment's expansion.

Regional Insights

The Asia Pacific automotive lubricants market size is exhibited at USD 30.69 billion in 2025 and is projected to be worth around USD 37.58 billion by 2035, growing at a CAGR of 2.05% from 2026 to 2035.

Asia Pacific accounted for a substantial share of the automotive lubricants market in 2025. The growth of this region is attributed to many factors, such as the rising automotive industry with technically advanced vehicles like EVs, which have a major contribution to the market growth. The production of automobiles is registered higher in Asian countries due to key players in the manufacturing domains established here for decades. Owing to these factors, the rising frequency of automobile servicing, including lubrication for various parts of the vehicles, has also shown a surge in the past years, helping fuel the automotive lubricants market.

Moreover, countries like China and India are the major contributors to the expansion of the automotive lubricants market due to their developing national strategy, including the establishment of robust infrastructure to support the automotive sector. Also, the automotive sector in Japan is the third largest automotive manufacturing market in the world. Again, China is considered the country with the highest revenue generator in the automotive lubricant market in the region since China has substantial lubricant consumption owing to its largest vehicle fleet in the country, which serves major organizations.

- In March 2023, ExxonMobil announced that it is investing nearly USD 110 million to build a lubricant manufacturing plant that will produce 159,000 kiloliters of lubricants in Maharashtra, India.

- In January 2022, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions, and ExxonMobil Low Carbon Solutions.

Europe is witnessing a rapid growth rate due to the increasing adoption of high-quality and sustainable automotive lubricants in the region, fuelling the market's growth. The growth of this region is attributed to the stringent government regulations on the emission of greenhouse gases, which led marketers to come up with innovative solutions in automotive lubricants. The shift towards biodegradable and less toxic lubricants has seen a surge in the region. Moreover, the integration of digital technologies with predictive maintenance presents a lucrative opportunity in the European automotive lubricants market.

Europe has a spectrum of expanding industrial landscapes, such as manufacturing facilities, chemical plants, and several industrial processes that further fuel the European market. A number of major key players in the automotive market, like Mercedes-Benz, BMW, Volkswagen, and Audi, are established and based in Germany; Europe again presents a greater opportunity to proliferate the automotive lubricants market exponentially in Europe.

In Europe, Germany dominated the market by holding the largest market share due to innovations in automotive technology, a surge in consumer demand for high-performance synthetic lubricants, and the growing demand for sustainable products. Furthermore, as a major automotive production hub, Germany's car ownership and vehicle production rates contribute to a consistent demand for lubricants for transmissions, engines, and other vehicle components.

What made Latin America hold a Considerable Share of the Automotive Lubricants Market?

Latin America held a considerable share of the industry. The increasing demand for synthetic engine oils from the automotive users in numerous countries such as Brazil, Argentina, Venezuela and some others has boosted the market expansion. Additionally, rapid investment by market players for opening new production units is expected to propel the growth of the automotive lubricants market in this region.

The Middle East and Africa held a notable share of the market. The rising sales of luxury cars in various nations, including the UAE, Saudi Arabia, South Africa and some others, has driven the market growth. Also, the rapid expansion of the oil and gas industry, coupled with the surging demand for gear oils from the automotive sector, is expected to drive the growth of the automotive lubricants market in this region.

Automotive Lubricants Market-Value Chain Analysis

The raw materials for manufacturing automotive lubricants includes base oils and additives.

Key Companies: Lubrizol Corp, Italmatch Chemicals, Afton Chemical Corp and others.

Automotive lubricants are manufactured by blending base oils (derived from crude oil or synthetically) with performance-enhancing additives. The process involves purifying the base oil, mixing it with specific additives in large kettles, and then performing quality control tests before packaging and distribution.

Key Companies: Castrol, Shell, Repsol and others.

Automotive lubricant distribution channels include traditional routes such as fuel stations and independent workshops as well as other channels such as large retailers, auto parts stores, and original equipment manufacturer (OEM) dealer networks.

Key Companies: Sasol, Indian Oil Corporation Ltd, HP Lubricants, Philipps 66, and others.

Automotive Lubricants Market Companies

ExxonMobil is a multinational American corporation and one of the world's largest publicly traded oil and gas and petrochemical companies. It is vertically integrated across the energy and chemical industries, involved in exploration, production, refining, marketing, and the production of chemical products like polyethene and synthetic rubber.

Castrol is a global lubricant company, part of the BP group, that was founded in 1899 by Charles Wakefield. Its products are used in automotive, industrial, marine, and energy sectors, and it is known for its innovation and performance.

Shell plc is an integrated oil and gas company that also focuses on providing more and cleaner energy solutions, with operations in exploration, refining, and chemicals, and a global presence. It explores for and produces oil and gas, operates refining and petrochemical complexes, and produces products including lubricants, bitumen, and chemicals for plastics and detergents.

Repsol is a Spanish multinational energy and petrochemical company headquartered in Madrid, Spain. It is an integrated company involved in the entire energy value chain, from oil and gas exploration and production to refining, marketing, and electricity generation. This company has a significant focus on lower-carbon energy solutions, including renewables, biofuels, and hydrogen.

LUKOIL is a Russian multinational energy company headquartered in Moscow, specializing in oil and gas extraction, refining, and marketing. It is the second-largest private oil company globally by proven reserves and produces about 2% of the world's oil.

Sasol is a global integrated chemicals and energy company, founded in South Africa in 1950, that uses sophisticated technologies to produce a wide range of fuels and chemicals from sources like coal and gas. Its products include liquid fuels, lubricants, and chemicals, and it operates in the Middle East and Africa, the Americas, Asia, and Europe.

Indian Oil Corporation Ltd (IOCL) is India's largest state-owned oil and gas company, involved in refining, pipeline transportation, marketing, and exploration. The company's business spans the entire hydrocarbon value chain, and it has expanded its operations globally to include alternative energy and petrochemicals.

Other Major Key Players

- HP Lubricants

- Philipps 66

- Fuchs

- Cepsa

Recent Developments

- In October 2025, Shell Lubricants launched a new range of high-performance lubricants. These lubricants find applications in passenger cars and scooters.

(Source: indiatoday.in) - In June 2025, FUCHS Lubricants launched RENOLIT CX SWG 0-1 grease. RENOLIT CX SWG 0-1 is an advanced grease that is used for lubricating electric power steering systems.

(Source:chargedevs.com) - In April 2025, Daewoo partnered with Mangali Industry Ltd. This partnership is for launching a wide range of automotive lubricants in India.

(Source: v3cars.com) - In April 2025, Daewoo entered the Indian automotive lubricant market through a licensing collaboration with Mangali Industries Limited, announced at a launch event in New Delhi. The partnership will introduce Daewoo's range of lubricants for two-wheelers, passenger cars, commercial and agricultural vehicles across the country.(Source: https://www.autocarpro.in)

- In April 2025, MSB Global Group Bhd is boosting its diversification efforts, with plans to launch an in-house electric vehicle (EV) charger brand by the second quarter of 2025, while also preparing to transition from a trading-based business to a lubricant manufacturer.(Source: https://thesun.my)

- In November 2024, EnerG Lubricants, in partnership with Germany's GAT GmbH, launched its GAT X EnerG product line. The new range of high-performance automotive consumables includes fuel system cleaners, engine care, car care, body care, and car detailing products.(Source: https://www.autocarpro.in)

- In May 2023, Lumax Auto Technologies launched a new range of lubricants and coolants for all vehicle segments in the domestic aftermarket. The company says, owing to the automotive industry's significant growth, there is a rapid potential and demand for high-performance and energy-efficient lubricants and coolants in India.

(Source: https://www.financialexpress.com) - In October 2022, Total Energies signed an agreement with MG Motor to develop a new range of lubricants in Chile. The new product is expected to be MG Oil, the first MG Motor oil specially formulated for automobiles. This new product is expected to be manufactured entirely in Chile, which will likely help Total Energies strengthen its geographical presence there.

- In January 2023, McLaren Automotive, a luxury supercar company, announced the renewal of its partnership with Gulf Oil International as its official lubricant and fuel partner for 2023.

- In June 2022, Shell introduced a used oil management service as part of a new attempt to organize India's waste oil disposal infrastructure and enhance re-refining rates. To start collecting and re-refining used oil across India, Shell partnered with used oil refiners. These partners share the objective of advancing the lubricants industry's circular economy.

Segments Covered in the Report

By Oil Type

- Synthetic

- Semi-synthetic

- Conventional

By Product Type

- Engine Oil

- Gear Oil

- Transmission Fluids

- Coolant

- Brake Fluid & Greases

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting