What is the Baby Drinking Water Market Size?

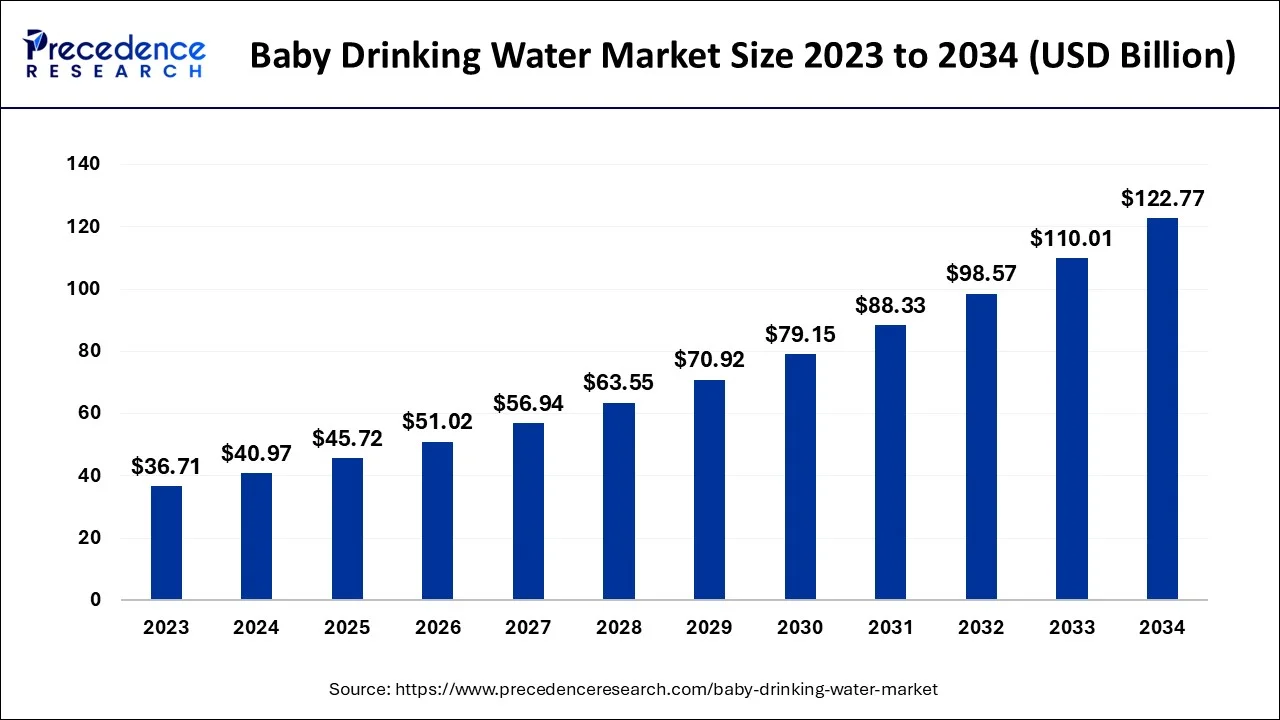

The global baby drinking water market size was calculated at USD 45.72 billion in 2025 and is predicted to increase from USD 51.02 billion in 2026 to approximately USD 134.65billion by 2035, expanding at a CAGR of 11.41% from 2026 to 2035.

Baby Drinking Water Market Key Takeaways

- North Americadominated baby drinking water market in 2025.

- By type, the pure water segment dominated the market in 2025.

- By type, the mineral water segment type is expected to witness a significant increase in its market revenue during the predicted timeframe.

- By age, the 12-24 months segment led the market in 2025.

- By age, the 7-12 months segment is expected to increase its market share during the forecast period.

What is the Baby Drinking Water Market?

The baby drinking water market mainly focuses on specifically purified, safe, and mineral-balanced water that is meant to meet the hydration requirements, as well as the formula preparation requirements of infants. The baby drinking water market is growing in the infant nutrition segment, under parental safety issues, increasing incomes, e-commerce availability, and purification innovation. The demand is in pure and mineral enhanced, and Asia Pacific is the country where the demand is growing, and the world brands are enhancing the packaging differentiation.

How is AI contributing to the Baby Drinking Water Market?

Technology Artificial Intelligence enables safer drinking by the infant through real-time water safety, predictive filter maintenance, smart feeding analytics, accurate dispensing, parental guidance apps, behavioral prompts, and water management on the infrastructure level, thus making the infant drinking process safer, reliable in quality, and informed as to the decisions made by the caregiver.

Baby Drinking Water Market Growth Factors

The baby drinking water market is primarily driven by the lack of drinkable and suitable water for babies. The immune system of babies is weaker. The presence of fluoride and sodium at higher levels in some regions may negatively impact the health of the babies and can harm the body growth and development of the baby. The rising disposable income, the rise of the middle class, and increasing awareness regarding the availability of baby drinking water are propelling the growth of the global baby drinking water market. The rising birth rate is another factor fostering the growth of this market. According to the World Bank, the fertility rate of women was recorded at 2.403 births per woman in 2019. Further, the global population is growing at a rate of 1.036%, as per the World Bank data. The rising global population along with the rising birth rate across the globe is expected to boost the growth of the global baby drinking water during the forecast period.

The lack of suitable drinking water for infants is driving the market growth. The growing need for drinkable water for babies is compelling parents to opt for specially produced water for babies that have the correct amount of minerals and are produced by the purification process. The baby's drinking water has no negative health impacts on the baby. Hence, parents are now adopting the use of baby drinking water for their babies. Further, rising women's participation in the labor force is significantly contributing to the rising disposable income of the household which positively impacts the growth of the global baby drinking water market. The increased risks of getting ill by the consumption of contaminated water had made the parents more conscious about their baby's health and increased their expenditure on the health and wellness products of the babies. Therefore the rising awareness regarding the ill effects of drinking contaminated water and the shortage of suitable drinking water is propelling the demand for baby drinking water across the globe.

Market Outlook

- Industry Growth Overview: The future is bright in the demand for baby drinking water because the issue of the health and safety of babies is becoming more and more important to parents.

- Sustainability Trends:The companies are exploring new ways of packaging their products to be recyclable, glass and plant-based, to attract environmentally conscious parents.

- Global Expansion: Asia-Pacific is the most dynamic market with baby water, though North America and Europe remain the largest markets.

- Major Investors:The key players in the investment in water for babies include Waiwera, Eva Water, Nursery.

- Startup Ecosystem: The startups focus on purification innovation, as well as organic positioning and convenient packaging of the hydration needs of infants.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 45.72 Billion |

| Market Size in 2026 | USD 51.02 Billion |

| Market Size by 2035 | USD 134.65Billion |

| Growth Rate From 2026 to 2035 | CAGR of 11.41% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Age |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

The pure water segment dominated the global baby drinking water market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. Pure water has low sodium, low sulfate, and low fluoride that does not impact the immune system of the babies adversely. Due to the weaker immune systems, the consumption of regular water may impact the nutrition-absorbing capabilities of the infants and may hamper the development of the infants. Therefore, rising awareness regarding the negative health impact of regular water on infants has fostered the growth of this segment significantly and is expected to sustain its significance during the forecast period.

The mineral water segment is expected to grow at a significant rate during the forecast period. The major consumer of this water is the infants between 12-24 months of age. This is attributable to the increased awareness among the population regarding mineral water for babies and the need for clean and drinkable water for babies.

Age Insights

The 12-24 months segment dominated the global baby drinking water market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. According to the World Health Organization, infants must be fed only their mother's milk for the first 6 months after birth. Therefore, parents generally feed water to their babies as later as possible. Therefore, the development of immunity after 12 months enhances the baby's ability to digest the water. Further the low sodium and fluoride content of the baby drinking water is best suitable for the babies of age 12 to 24 months or older.

The 7-12 months segment is expected to register a significant growth rate during the forecast period. This can be simply attributed to the rising birth rate, rising awareness regarding baby health, and rising disposable income.

Region Insights

How Is North America Leading in The Baby Drinking Water Market?

North America dominated the baby drinking water market in 2025 due to high dependence on ultra-purified infant water solutions. The issues about the safety of the tap water among parents, the preference for the fortified formulations, and the availability of the well-established brands in the packaged water market are the factors that contribute to the accelerated demand at the interpersonal, health care provider, and infant nutrition ecosystem levels.

North America dominated the global baby drinking water market in 2025, in terms of revenue, and is estimated to sustain its dominance during the forecast period. The increased preferences for baby specialty products, increased expenditure on baby health, increased disposable income, and increased awareness regarding the availability of baby drinking water across the region are the major drivers of the baby drinking water market in North America. Europe is the second largest market for baby drinking water, just after North America owing to the similar macroeconomic factors as North America.

U.S. Baby Drinking Water Market Trends

The demand for baby drinking water is increasing due to safety concerns regarding the quality of household drinking water. Bottled water formulated for infant formula preparation is becoming the choice of parents more and more, which consequently leads to the creation of brands that offer purified, mineral-controlled products in accordance with pediatric feeding practices.

How Is Asia-Pacific Performing in The Baby Drinking Water Market?

Asia-Pacific is expected to be the most opportunistic primarily because of high birth rates, rising household incomes, and a preference for high-quality health-based infant products. The factors that influence the demand for water in the region within the emerging and developed markets are the population density in urban areas, water quality issues, and the use of packaged baby water solutions and their subsequent acceptance and trust.

Asia Pacific is estimated to be the most opportunistic market during the forecast period. This can be attributed to the presence of huge population, rising birth rates, rising disposable income, and rising awareness regarding the availability of baby drinking water. The rising expenditure on baby care products is a major factor that is expected to foster the growth of the market in Asia Pacific during the forecast period.

India Baby Drinking Water Market Trends

The market exhibiting the most momentum is India, since the parents are seeking safe alternatives to the untrustworthy groundwater. The rising demand in the principle of consuming packaged water, the infant-focused branding, and government initiatives are the motivators of the growing demand for baby drinking water in urban and semi-urban households.

What Are the Driving Factors of The Baby Drinking Water Market in Europe?

Europe is expected to grow at a significant rate owing to premium products developed by the stringent safety standards and sustainability issues. The demand is the mineral-balanced, low-sodium formulations, which meet the requirements of baby food. The recyclable and glass packaging influences the buying behavior of environmentally conscious parents.

Germany Baby Drinking Water Market Trends

Germany plays the role of an innovative mineral balance and regulatory compliance hub. The demand is for low-sodium baby water that is treated carefully and has passed strict standards, and this is supported by the strong consumer trust in the products that are certified and focused on the health of infants' nutrition.

Value Chain Analysis

Product Conceptualization and Design: It involves generating conceptualization of product thoughts, making the correct specification, and designing in line with the needs of infant safety.

- Key players: Nongfu Spring

Raw Material Procurement: Water procurement, input material, and equipment to support quality-controlled production processes.

- Key Players: Ultracare Group

Manufacturing and Assembly: Production of Baby water entails purification, balancing of the minerals, and bottling of water.

- Key Players: Nongfu Spring

Branding and Packaging: The packaging and branding of manufactured baby drinking water that build trust and visibility are being developed.

- Key Players: Tetra Pak, Woyawater

Retail Distribution of Baby Drinking Water: The finished products are sold to the end consumers of the products using the retail channels.

- Key Players: Amazon, Flipkart, Firstcry

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

The various developmental strategies adopted by the key market players include acquisition and mergers, partnerships, joint ventures, and product launches that paves the way for the development of growth avenues in the upcoming future.

Baby Drinking Water Market Companies

- NongfuSpring

- Sant' Anna

- Eva Water

- MAHAC

- Nursery

- Waiwera

Segments Covered in the Report

By Type

- Pure Water

- Mineral Water

- Others

By Age

- 3-6 Months

- 7-12 Months

- 12-24 Months

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Get a Sample

Get a Sample

Table Of Content

Table Of Content