What is the Baby Skincare Market Size?

The global baby skincare market size is calculated at USD 17.87 billion in 2025 and is predicted to increase from USD 18.97 billion in 2026 to approximately USD 31.14 billion by 2034, growing at a CAGR of 6.34% from 2025 to 2034. The global baby skincare market growth is attributed to the increasing disposable income in emerging countries, the rising demand for organic and natural baby skincare products and increasing awareness of baby skin health among parents.

Baby Skincare Market Key Takeaways

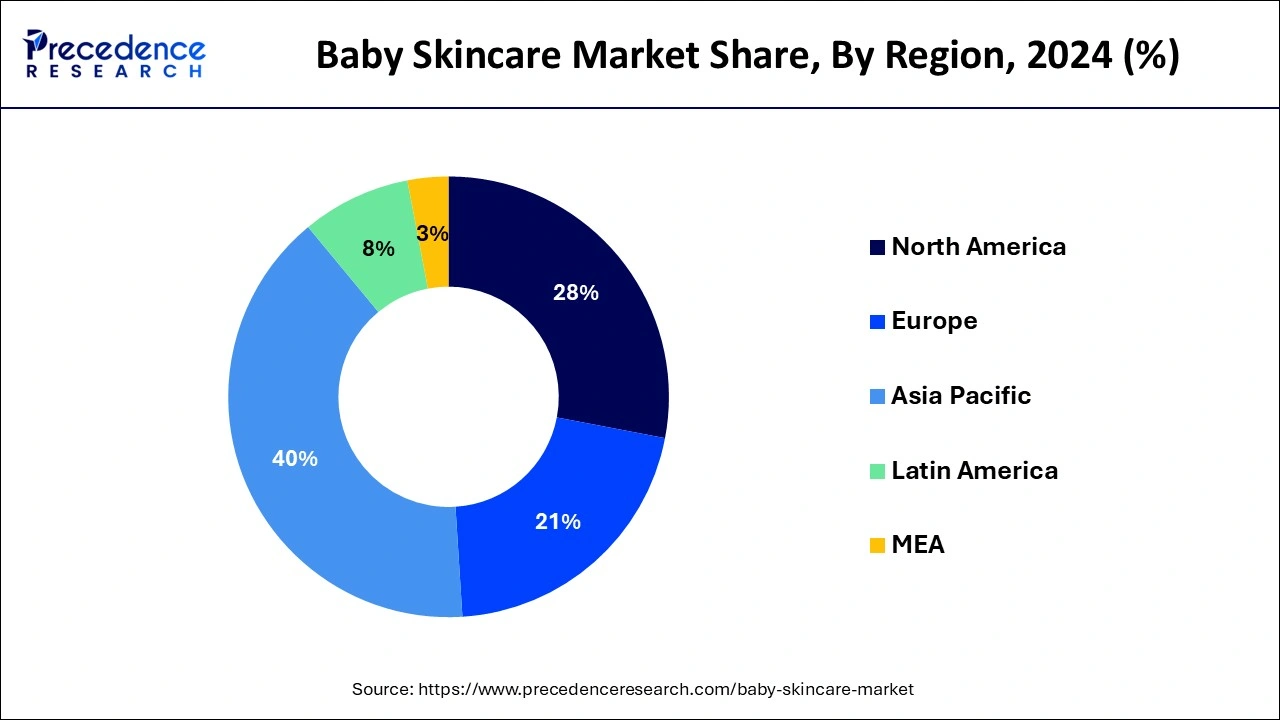

- Asia Pacific dominated the global market with the largest market share of 40% in 2024.

- North America is projected to expand at the notable CAGR during the forecast period.

- By products, the creams segment has held the largest market share in 2024.

- By products, the oil segments is estimated to be the fastest-growing segment during the forecast period.

- By distribution channel, the supermarkets and hypermarkets segment captured the biggest market share in 2024.

- By distribution channel, the online segments is predicted to be the fastest-growing segment during the forecast period.

- By Age Group, the 0-6 Months segment captured the biggest market share in 2024.

- By Age Group, the 7-12 Months segments is predicted to be the fastest-growing segment during the forecast period.

How AI is Changing the Baby Skincare Market?

Artificial intelligence is revolutionizing various industries, and the baby skincare industry is one of them. AI-generated technologies provide innovative solutions that ensure convenient, healthier, and safer parenting. AI-personalized skincare recommendations and used to analyze a baby's skin to address their needs. AI helps in the early detection of skin-related problems such as psoriasis and eczema. In addition, the development of new skincare products with the help of artificial intelligence is the major trend in infant skincare which is expected to transform the growth of the baby skincare market. Furthermore, AI can be utilized to establish new skincare products that are gentle on a baby's skin and are more effective.

Baby Skincare Market Trends

- The skin of newborns is the most susceptible and delicate to infection. As a result, additional attention is essential to safeguard and nurture the baby's delicate skin and further drive the market growth.

- Consumers are also turning toward organic and natural baby products, which are safer with no chemical additives, in order to protect the delicate infant skin. Since more females enter the workforce, the income level rises, resulting in the acceptance of high-quality healthcare products. As a result, the baby skincare market is growing at a rapid pace.

- Natural and organic baby skincare products are becoming increasingly popular since they are free of negative effects on baby skin and most of the skincare products that come into close contact with the infant's skin are expected to enhance the growth of the baby skincare market.

- More individuals are becoming aware of and concerned about baby skincare, with the rise in the working population, educational levels, and disposable income, and parents are also becoming more conscious as a result of sophisticated promotions and commercials, which are expected to drive the growth of the baby skincare market.

- Due to climate change and diaper use, infant skin is prone to various rashes and allergies. As a result, the demand for creams, moisturizers, and lotions to treat diaper rashes, eczema, and sunburns increases. The reproductive decisions, rising population, and fertility rates all seem to be influenced by significant cultural transitions or changes. This factor is influencing the growth of the baby skincare market.

- The Growing Preference for Natural and Organic Ingredients: The growing demand for organic and natural ingredient baby skincare products helps in the market growth. The growing utilization of ingredients like calendula, shea butter, and coconut oil in baby skincare helps the market growth. Parents are giving preference to chemical-free baby skincare products. Parents are giving preference to plant-based components to avoid long-term health effects, allergies, and skin sensitivity.

- Increasing Demand for Multifunctional Products: The busy schedules of parents increase demand for multifunctional products like all-in-one moisturizer, cleanser, and washes. The products provide efficiency and convenience to parents and lower the number of products required for the daily skincare of the baby.

- Growing E-commerce Sector: The rise of e-commerce in various regions increases the availability of various baby skincare products. The availability of 24/7 shopping and doorstep delivery increases demand for various baby skincare products.

Baby Skincare Market Growth Factors

- Growing parents' awareness about safe and high-quality products for delicate infant skin has significantly increased demand for trusted skincare solutions.

- Increased incidences of sensitive skin conditions in infants promote the use of specialized products that take care of rashes, eczema, and irritation.

- Demand for natural, organic, and chemical-free formulations has been increasing as parents become concerned about offering better and toxin-free alternatives to their kids.

- Improving e-commerce platforms have allowed the easy availability of baby skincare products, hence providing the necessary convenience for comparing product reviews over which Mrs. should base her decision.

- An increase in disposable income and a change in parenting style initiate the purchase of high-end, certified, and novel skincare formulations for infants.

Baby Skincare Market Outlook

- Industry Growth Overview: From 2025 to 2030, the baby skincare category is forecasted to experience rapid growth as more parents are aware of infant hygiene and skin health. Sales are being driven by premiumization trends and the popularity of hypoallergenic, natural, organic, and dermatologist-approved products. Asia-Pacific and North America are seeing the most product sales growth.

- Sustainability Trends: Eco-friendly baby skincare products are becoming popular as parents show a preference for natural, cruelty-free, and non-toxic formulations. Major brands, as well as small niche companies, are reformulating products with certain combinations of plant-based ingredients and/or biodegradable packaging. Brands such as Johnson & Johnson and Babyganics are actively increasing R&D in sustainably sourced and clean-label formulations to meet consumer preferences for eco-friendly products.

- Global Expansion: Major companies are targeting high-birth-rate regions for expansion, particularly India, Indonesia, and Africa. Companies such as Pigeon and Chicco are developing locally sourced production and e-commerce networks to increase the availability and affordability of baby skincare products in emerging markets.

- Key Investors: Investors are attracted by stable demand, brand loyalty, and long-term growth in the premium baby care segment. Private equity firms and conglomerates are acquiring niche organic brands to enhance their product portfolio. Recent deals indicate an increased focus on clean beauty start-ups that target infants.

- Startup Ecosystem: The baby skincare startup ecosystem is rapidly evolving towards being more organic-focused, chemical-free, vegan, and dermatologist-tested. Startups such as Mamaearth (India) and Evereden (USA) are innovating through digital-first strategies and sustainable packaging, and are attracting very large venture capital investments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.87 Billion |

| Market Size in 2026 | USD 18.97 Billion |

| Market Size by 2034 | USD 31.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.34% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Distribution Channel,Age Group, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Drivers

The increasing demand for organic and natural baby skincare products

As millennial parents are more educated and informed, they prefer natural and organic baby skincare products to avoid the adverse effects of chemical components on their child's skin. As more women enter the workforce, disposable income rises, allowing for the purchase of high-quality healthcare supplies. As a result, the baby skincare market expansion is accelerated.

Age Group Insights

By age group, the 0-6 months segment led the global market. At this age, babies need constant care, including skin care to tend to their sensitive and fragile skin. Rising disposable incomes have led to more families being able to afford premium products for their babies. The increasing focus on wellness, as well as safe, clean, and baby-safe skincare, is the reason this segment leads.

By age group, the 7-12 months segment is predicted to witness significant growth in the market over the forecast period. New parents today are more informed about child and baby care with increased access to information about child development. This growing emphasis on active parenting is leading to parents being more responsive to a baby's needs and potential concerns. This is leading to higher demand for baby skincare in this segment.

Products Insights

In 2024, the creams segment dominated the baby skincare market. The primary purpose of baby lotions and creams is to hydrate and protect the skin from drying out. The diaper rash creams, on the other hand, are used to provide a barrier between the skin of the infant and the wet diapers, preventing irritation.

The oil segment, on the other hand, is predicted to develop at the quickest rate in the future years. The traditional infant massage oils are used to calm and soothe a baby's sensitive skin. The olive oil, coconut oil, and aloe oil are used as baby skin care products on a large scale.

The moisturizing products segment held the largest share of 32.60% in the 2024 baby skincare market. The moisturizing products come along with multiple care products for every hygiene purpose area for baby's advanced care. The lotions, creams, face creams, and lip balms are significantly growing with the concern and demand for skin protection. Following this, Johnson's Baby Products expanded its production and commercial range to introduce moisturizer in baby skincare. Alongside, Cetaphil Baby Daily Lotion and CeraVe Baby moisturizing lotion are popular in the global baby skincare sector.

The protective products segment is expected to grow at a CAGR of 8.90% during the forecast period. The segment is emerging with the current rising concern and surroundings, especially after the pandemic. Following this, protective products gained traction in the global baby skincare market. The gentle clean hygiene to protect babies from diaper rash or any elastic patch, the segment plays a crucial role with its soft shampoos, sunscreens, and wash-based products.

Distribution Channel Insights

The supermarkets & hypermarkets segment dominated the baby skincare market in 2024. The supermarkets and hypermarkets provide wide range of baby skin care products. These products are available on discounts in these stores, which is boosting the expansion of the supermarkets and hypermarkets segment over the projection period. The Amazon and Walmart are implementing various strategies for the increased sales of baby skin care products.

The online segment is fastest growing segment of the baby skincare market in 2024. The factors such as high rate of internet penetration, growing usage of smartphones and tablets, and easy availability of wide variety of products are driving the growth of the online segment during the forecast period.

Physical form Insights

The liquid segment held the largest share of 39.80% in the 2024 baby skincare market. With many physical forms, liquid is a convenient and reliable source of calming relaxation for babies within the home setting. The big brands like Aveeno Baby, Mustela, Cetaphil, and Johnson's have largely covered this key area with their baby wash, lotion, and other oil products. The demand for liquid baby skincare products has accelerated with the rising infant population, and thus, the brand's responsibility has also increased.

The sheet/nonwoven segment is expected to grow at a CAGR of 9.40% during the forecast period. The nonwoven materials are a comfort, providing softness, efficient fluid management, and breathability, preventing diaper itchiness and rashes. It's most convenient during traveling with the sheer relaxation for babies. Its quick-absorbing quality and customized non-woven baby wet wipes option are elevating the segment in the global baby skincare sector.

Ingredient Origin Insights

The plant-based (botanical) segment held the largest share of 44.20% in the 2024 baby skincare market. The segment plays a crucial role in the global baby skincare by offering a nutritional and natural option, and softness to the synthetic chemicals. As half of the population is health-conscious, sticking to the legacy parents, seeks plant-based integration into the baby skincare products. This is fueling the market trend for organic (natural) formulations.

The biotechnology-derived actives segment is expected to grow at a CAGR of 10.30% during the forecast period. The segment is a transformation to the global baby skincare with its excellence in providing modernized demand for effective, sustainable, and purified compounds. The actives are designed to act softly on the delicate infant skin, identifying parental demand for protective and ingredient visible concern.

Distribution channel Insights

The offline segment held the largest share of 64.90% in the 2024 baby skincare market. The safest traditional, reliable source has always remained crucial for baby care. The segment emerges with the population and parental demands for advanced care. The pharmacies/drugstores, customization available and alternatives, baby and maternity specialty stores, supermarkets, hypermarkets, and departmental stores are gaining traction with their partnership or necessity of brand integration, respectively.

The online segment is expected to grow at a CAGR of 10.10% during the forecast period. The online segment is evolving with the demand for easy access to the products at the doorstep. With this, the e-commerce marketplaces like Amazon, JD.com, Flipkart, etc, are earning profit with the mass orders for online baby skincare products. The direct-to-consumer brand websites are leading with trusted branding, ensuring quality products. This website and marketplaces have elevated their presence and business by introducing subscription/membership platforms (monthly/yearly) as preferred.

Regional Insights

Asia Pacific Baby Skincare Market Size and Growth 2025 to 2034

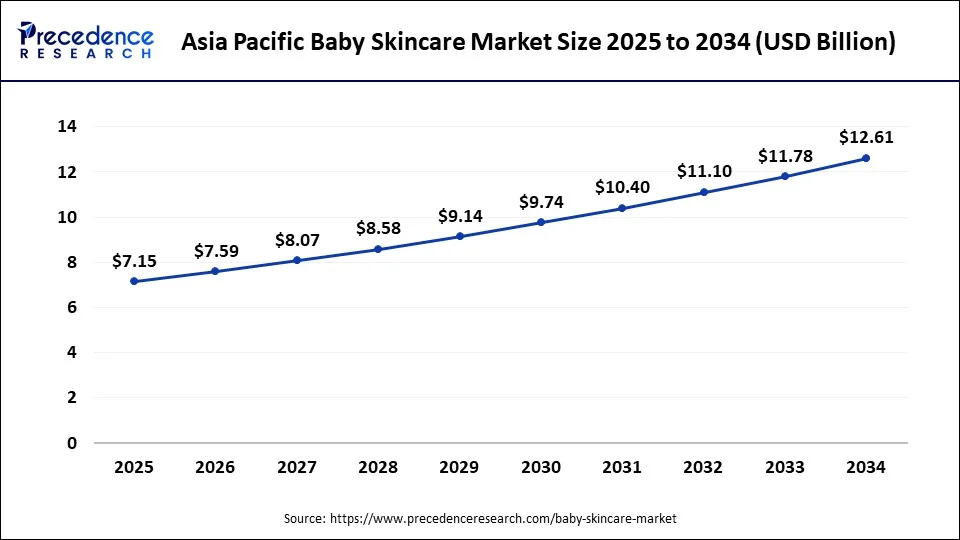

The U.S. baby skincare market size is exhibited at USD 7.15 billion in 2025 and is projected to be worth around USD 12.61 billion by 2034, growing at a CAGR of 6.33% from 2025 to 2034.

Asia-Pacific dominated the baby skincare market in 2024 with a revenue share of 30%. The baby skincare market in the region is being driven by a rise in brand penetration and a broad distribution network. The growth of the market is being aided by the e-commerce sector.

The growing population in countries like India and China increases demand for baby skincare products. The growing disposable income premium increases spending on premium skincare products. The growing awareness of the importance of specialized skincare for infants helps in the market growth. The strong government support for the local manufacturing of baby skincare products drives the overall growth of the market.

China Baby Skincare Market Trends

China is a major contributor to the baby skincare market. The presence of a large population and growing disposable incomes increases spending on baby skincare products. The growing focus on the health & well-being of children helps in the growth of the market. The growing e-commerce platforms increase demand for baby skincare. The shift towards three-child and two-child policies is fueling demand for baby skincare. The growing innovation in baby skincare,like the use of organic & natural ingredients, drives the overall growth of the market.

India Baby Skincare Market Trends

India is growing in the baby skincare market. The shift towards nuclear families and growing disposable incomes increases spending on baby skincare. The growing demand for the utilization of safe and gentle products for babies helps in the market growth. The rise of e-commerce and the availability of a wide range of skincare products are leading to higher adoption of baby skincare products. The growing number of births each year in the country drives the overall growth of the market.

North America, on the other hand, is expected to develop at the fastest rate during the forecast period. The increased research and development expenditures by businesses would boost the baby skincare market growth in North America region.

What made North America the fastest-growing region in the global baby skincare market?

North America experienced the fastest growth due to a significant surge in demand for premium, organic, and dermatologist-tested baby skin care products. Health-conscious parents and their willingness to spend, combined with the power of social media and news media, drove demand. Additionally, manufacturers themselves opened avenues with clean-label and vegan formulations.

The U.S. was the largest country in North America, with key players such as Johnson & Johnson and Aveeno Baby. Consumers increasingly wanted organic options, while fragrance-free products were increasingly important. Companies invested in R&D and increased distribution presence to take advantage of the growing demand for baby skin care products that were safe and science-based.

Europe: Where Safety Meets Softness

Europe benefited from a robust position in the baby skin care market because of strict safety protocols, higher awareness, and preference for organic baby skin care products. Parents valued dermatologically treated and eco-friendly baby skin care products, giving brands that prioritized sustainability and purity strong market positioning.

Germany was the leading country in Europe because of the significant demand for natural baby skin care products. Parents trusted certified organic baby skin care brands like Weleda and Bübchen. With strict product safety laws in place and a robust distribution network, Germany continued to show consistent growth in premium and clean-label baby skin care products.

Latin America: Gentle Growth in Every Crib

Latin America grew at a rapid pace in the baby skincare market with increased income of the middle class, better access to healthcare, and increased awareness of hygiene for babies. Parents were more inclined to choose gentle and affordable options for skincare. At the same time, globally recognized brands attempted to enter this new market to fulfill the demand for baby products that are safe and effective.

Brazil was the leading country in Latin America for both brand awareness and growing e-commerce sales. Parents were generally looking for gently formulated and moisturizing baby creams and soaps. Whether local or international brands, there was an overall effort to target urban parents through advertising and engagement of natural ingredients within the final products.

Middle East & Africa: New Horizons of Baby Care

The Middle East & Africa have developed as a new baby skincare market due to increases in birth rates, urban locations, and increased disposable income for parents. Parents were now preferring premium imported brands, which presented regional opportunities for international brands to grow within the baby safe and natural skincare categories.

Luxury from the First Touch in UAE for Baby Care

The United Arab Emirates held the leading country position in this region with both brand awareness and retail networks. Parents looked for baby skincare products that were luxurious or featured organic ingredients. The increased growth of the expatriate population, growth in e-commerce for international baby care brands, and increased focus on urban parents helped increase overall awareness and sales of brands.

Baby Skincare Market Companies

- Unilever

- Johnson & Johnson Services Inc.

- Beiersdorfs Inc.

- Sudocream

- GALDERMA LABORATORIES L.P.

- Palmers'

- Sebamed

- Cherub Rubs

- Sanosan

- Gaia Natural Baby

Key Developments

- In February 2025, Skincare brand Fixderma expanded into the baby care market with the launch of its new product line, Hoopoe, now available on its direct-to-customer e-commerce store. The line features products designed to address common baby skin concerns. Fixderma's co-founder and CEO, Shaily Mehrotra, stated, "With Hoopoe, we have extended our expertise into a completely new category, with products specifically created to care for and protect the skin of our littlest customers. We understand the importance of using gentle yet effective products for babies, and Hoopoe delivers just that – safe, soothing formulations backed by science.” (Source: https://in.fashionnetwork.com)

- In February 2025, Aveeno Baby expanded its product portfolio with the launch of its new Daily Moisture Hydrating Facial Gel Cream. Aveeno Baby Facial Gel Cream is designed with a unique light texture that absorbs effortlessly, providing 24-hour moisturization without any sticky residue. With the power of oats, Aveeno Baby Daily Moisture Hydrating Facial Gel Cream provides proper hydration and the use of clinically tested, gentle formulations, which can help manage and prevent skin irritations in infants. (Source: https://www.passionateinmarketing.com)

- In July 2024, DKSH and Kimberly-Clark partnered to launch Huggies Baby and skin health products under the brand Huggies across Cambodia. Through this strategic partnership, DKSH Cambodia will collaborate with Kimberly-Clark to develop and execute a long-term sustainable business by providing full agency services, including distribution and logistics management, brand and trade marketing, and sales for the Huggies brand of baby and child products throughout Cambodia.(Source: https://www.indianpharmapost.com)

- In October 2023, Baby Dove launched two new product collections for new parents seeking to improve their baby's daily and nightly skincare routine with gentle formulas and safe ingredients to ensure the baby's skin is moisturized and healthy. Infused with Vitamin E and 100% natural moringa oil, it soothes and nourishes baby's dry skin and helps baby's skin build natural immunity from dryness. (Source: https://www.happi.com)

- In June 2023, the founder Abhishek Pandey launched a baby skincare product, Adorica Care. Adorica Care offers a range of products essential for a complete parenting journey. The aim behind this launch was to protect the baby's delicate skin and prioritize mildness, which led to the inception of the brand Adorica Care.

- In July 2024, a baby skincare manufacturer, Johnson's Baby launched the latest television campaign related to baby skin care. The aim behind this launch was to help protect a baby's delicate skin from day one with products formulated using baby-safe ingredients.

Value Chain Analysis

- Product Conceptualization and Design: Deals with defining what requires skincare, designing a fitting product for the purpose, and selecting safe ingredients for the infants.

Key Players: Johnson & Johnson, Procter & Gamble (P&G), and Unilever - Procurement of Raw Materials: Sourcing of dermatologically safe, certified, and best-quality ingredients from trusted suppliers.

Key Players: Aadhunik Ayurveda - Manufacturing and Assembly: Mixing raw materials under strict safety standards to assemble baby lotions, creams, washes, and specialities.

Key Players: Johnson & Johnson, The Himalaya Drug Company - Branding and Packaging: Have child-safe and eco-friendly packaging designed carefully keeping appeal and clarity of its safety certifications.

Key Players: Mamaearth, Sebamed, and The Honest Company - Distribution-Retail (Online and Off-Line): Make the product available to be bought through e-commerce and multi-store platforms, supermarkets, pharmacies, and specialty baby care stores.

Key players: Amazon, FirstCry, Nykaa - Advertising Promotion: Stresses safety, natural ingredients, and certificates through digital campaigns, influencer commercials, and pediatrician endorsements.

Key Players: Johnson & Johnson (Aveeno Baby), Procter & Gamble (Pampers), Mamaearth - Customer Support & Feedback Loop: Post-sales service, responds to customers, and takes feedback for the continuous improvement of products.

Key players: The Honest Company, Mamaearth

Segments Covered in the Report

By Product Type

- Cleansing Products

- Body Wash

- Shampoo & Scalp Wash

- Soaps & Cleansing Bars

- Moisturizing Products

- Lotions

- Creams

- Face Creams & Lip Balms

- Protective Products

- Diaper Rash Creams

- Sunscreens

- Barrier Balms

- Healing/Therapeutic Products

- Eczema & Psoriasis Creams

- Anti-allergy Skin Ointments

- Specialty Serums (e.g., anti-fungal, anti-bacterial)

- Wipe-Based Products

- Skin Wipes (fragrance-free, textured, or medicated)

- Eye & Face Wipes

- Diaper Wipes

By Physical Form

- Liquid

- Oils

- Washes

- Semi-Solid

- Creams

- Lotions

- Gels

- Balms

- Solid

- Bars

- Sticks

- Sheet/Nonwoven

- Wipes

- Pads

- Aerosol

- Mists

- Sprays

- Foams

By Ingredient Origin

- Plant-Based (Botanical)

- Mineral-Based

- Synthetic/Chemically Synthesized

- Biotechnology-Derived Actives

By Distribution Channel

- Offline

- Pharmacies/Drugstores

- Supermarkets & Hypermarkets

- Baby & Maternity Specialty Stores

- Departmental Stores

- Online

- E-commerce Marketplaces (Amazon, Flipkart, JD.com, etc.)

- Direct-to-Consumer Brand Websites

- Subscription/Membership Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting