Baby Care Products Market Size and Forecast

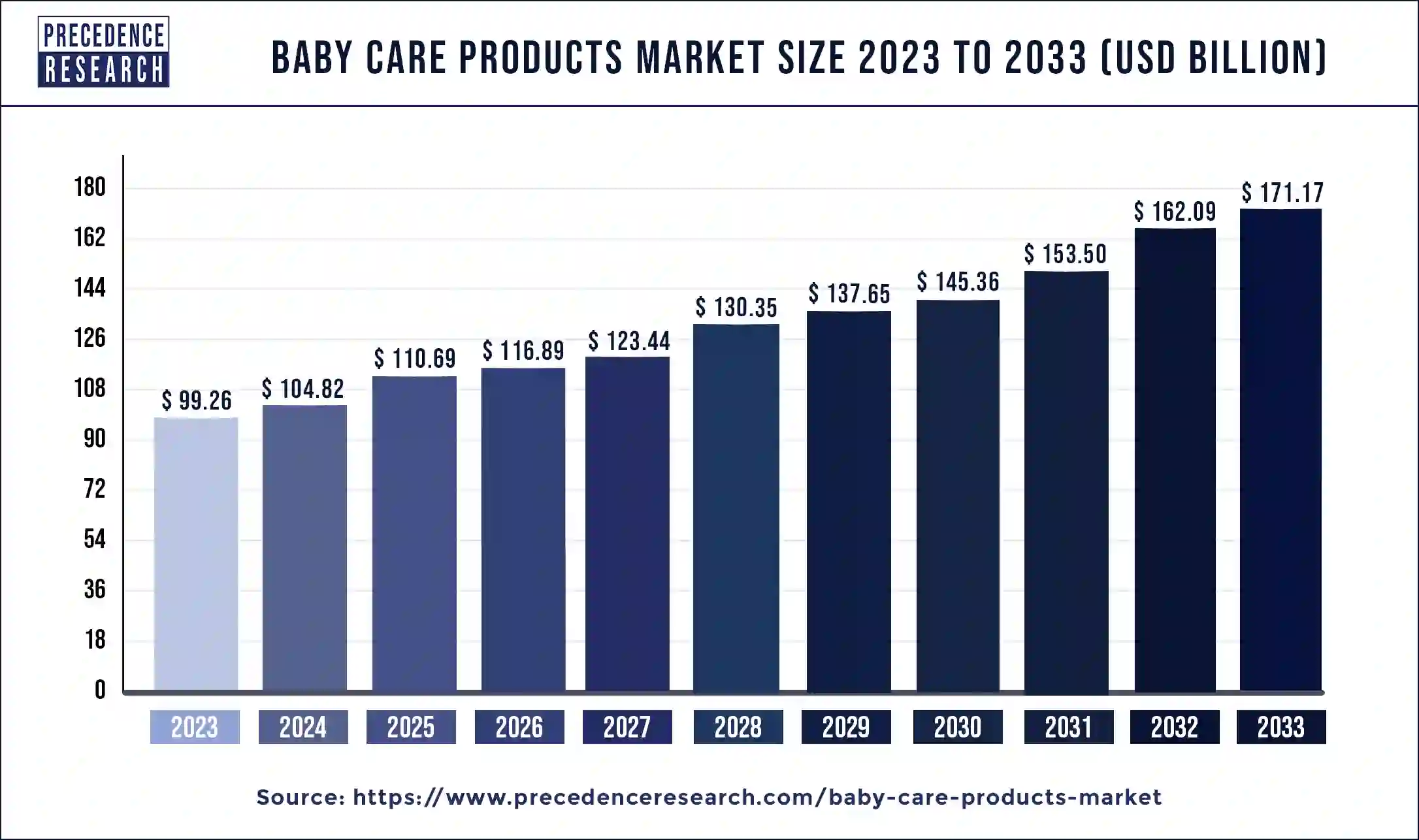

The global baby care products market size was USD 99.26 billion in 2023, accounted for USD 104.82 billion in 2024, and is expected to reach around USD 171.17 billion by 2033, expanding at a CAGR of 5.6% from 2024 to 2033.

Baby Care Products Market Key Takeaways

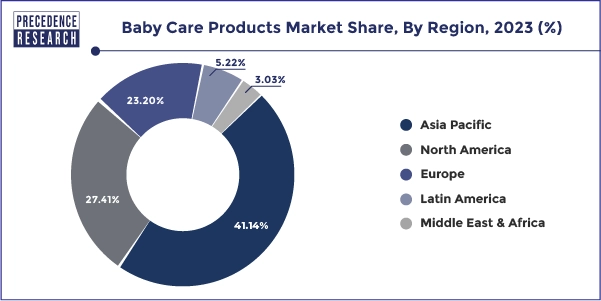

- Asia Pacific region has reached 41.14% market share in 2023.

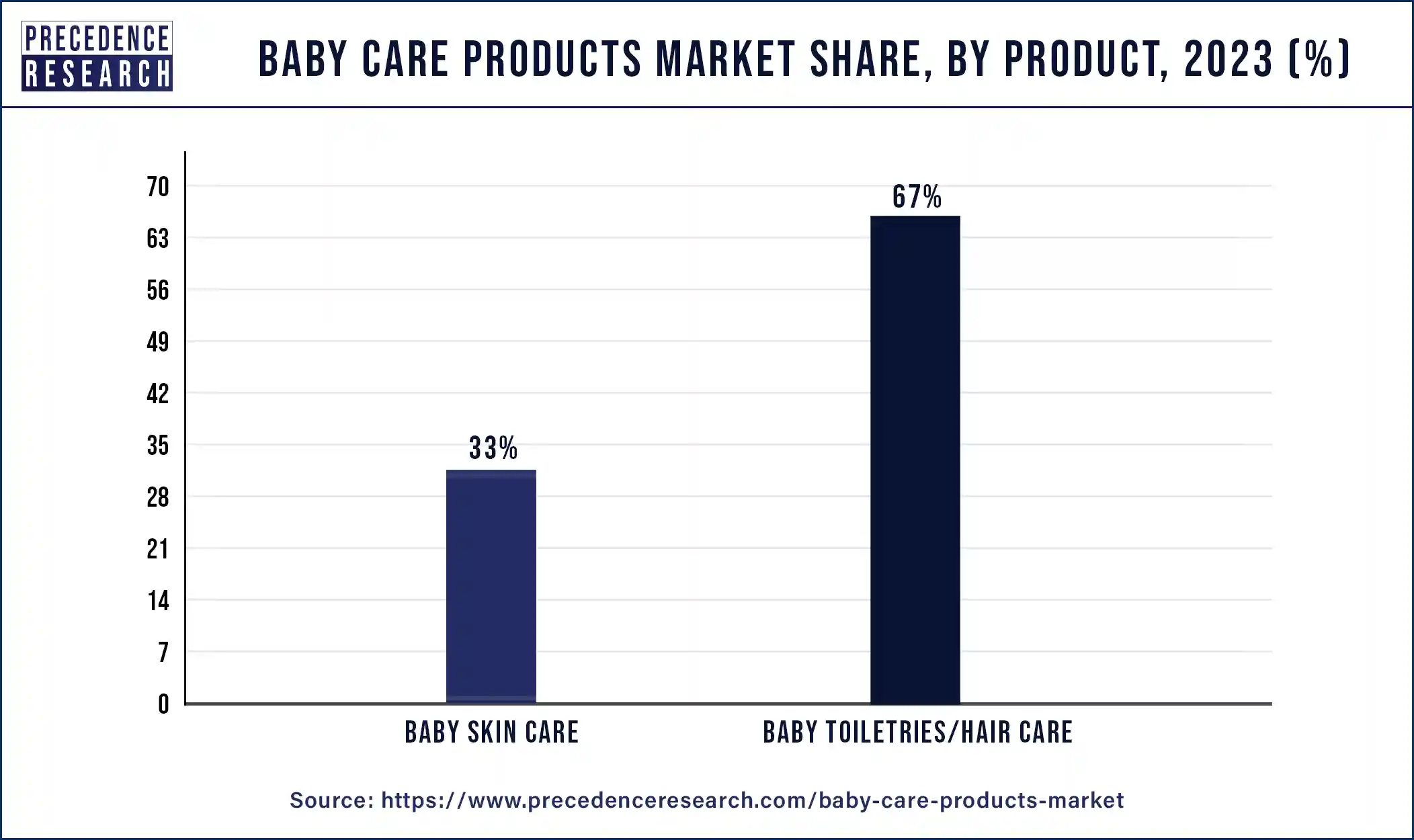

- By product, the baby toiletries/hair care segment accounted market share of around 66% in 2023.

- The skin care segment is expanding at a CAGR of 5.4% from 2024 to 2033.

- By distribution channel, the hypermarket and supermarket segment captured 46% market share in 2023.

- The specialty store segment is anticipated to reach a CAGR of 4.9% from 2024 to 2033.

AI in the Market

AI is transforming baby care by elevating safety, customization, and ease. Smart baby monitors and wearables track vital signs, sleep phases, and activity patterns, offering predictive alerts to minimize dangers and reassure parents. Feeding and comfort are managed by precision-based AI equipment, including automated bottle warmers, smart cribs, and formula dispensers. Parenting advice is rendered on the fly by virtual assistants, while developmentally oriented activities are presented by interactive AI toys and apps. Parents can now monitor their infants from anywhere, which minimizes worry and false alarms. The whole idea of AI implanted within baby care transforms it into a data-driven, supportive ecosystem where harmony between enlightened parenting solutions and peace of mind coexist.

Asia Pacific Baby Care Products Market Size and Growth 2024 to 2033

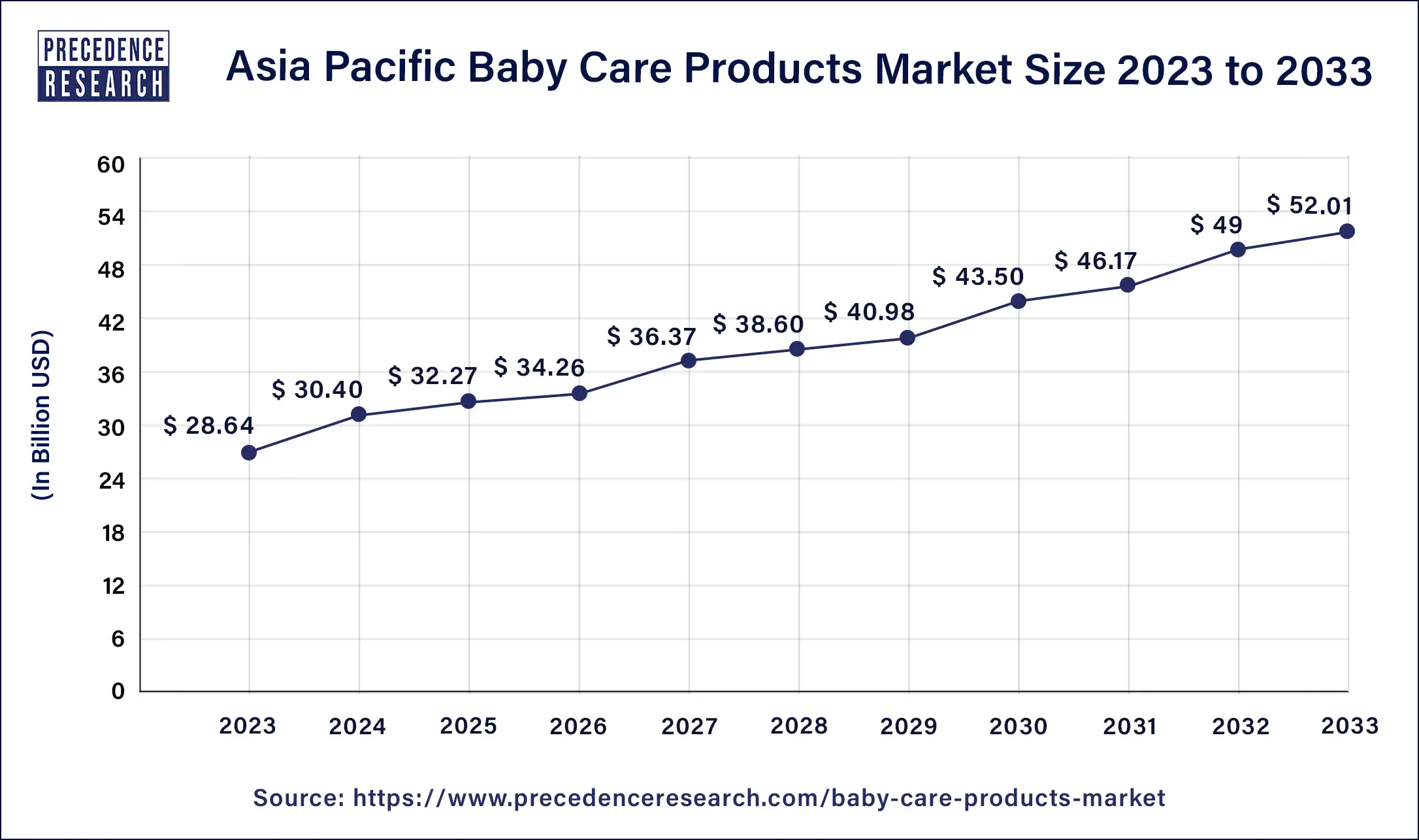

The Asia Pacific baby care products market size was estimated at USD 28.64 billion in 2023 and is predicted to be worth around USD 52.01 billion by 2033, at a CAGR of 6.1% from 2024 to 2033.

A share of about 41.14% was held by the Asia Pacific regionin the past and it will continue to grow well in the coming years. Growing population in most of the regions like India as well as China will play a significant role in the growth of this market. In the coming years it is estimated that the population in these nations of the Asia Pacific region will grow to 270 million and this is one of the major factors driving the growth of the baby care products. Considerable growth will also be registered in the North American region due to the presence of various market players like Unilever, Johnson and Johnson.

Market Overview

The need for baby care products has increased drastically in the recent years as many patients across the world find these products extremely easy and simple for use. Apart from the benefits are associated with the usage of such products the functionalities are also great. The need for these products has increased drastically due to the increasing population of working women.

The health care professionals and doctors are also recommending such products to the parents and this has been instrumental factor which has helped in creating more demand for such products. As the parents are busy the need for these products will increase as they help in maintaining and monitoring the health of the baby. All of these factors will provide good opportunities for the growth of the market in the coming years. There are many types of health issues that are experienced by the children which are sometimes associated with the complications that arise during the process of birth. Skin rashes, respiratory illnesses and many other issues have increased the need for such products.

Baby Care Products Market Growth Factors

- Consciousness about baby hygiene and health is driving a constant demand for specialized care products.

- Having an increasing preference for organic and natural formulations further boosts the product's adoption across global markets.

- More rigorous R&D initiatives from manufacturers channel into innovation and relatively more premium offerings.

- An increase in dual incomes and higher disposable incomes raises the consumer's ability to shop.

- With their interests aligned in integrated health for babies, these parents have finally found nutritional and skin-protecting products.

Baby Care Products Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 99.26 Billion |

| Market Size in 2024 | USD 104.82 Billion |

| Market Size by 2033 | USD 171.17 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Buyer Type, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Baby Care Products MarketDynamics

Key Market Drivers

Busy lifestyles and increase in the disposable income

- As most of the couples across the world lead a busy lifestyle as the number of women employees have also increased. Dual income households and an increase in the disposable income will play a significant role in the growth of the baby care products market in the coming years. Good amount of health benefits which are associated with the use of these products and their efficiency which is proven over the years will play a significant role in the growth of the market.

- These products are all tried and tested products and the reliability of these products has increased over the years. Presence of the organic products in the market will also play an instrumental role in the growth of the market. In order to maintain the health and hygiene of the babies the need for these products will continue to grow and the purchases will also increase as the purchasing power of the consumers has grown to a great extent.

Variety of baby care products

- There are many different types of baby care products available in the market ranging from baby food diapers, lotions, moisturizer, baby oil, baby creams and other consumables. Constant research and development in the field will play an important role in creating more demand for these products as innovative products are being launched in the market. The demand for the organic and natural products has also increased in the recent years in order to reduce the use of artificial fragrances which could harm the skin of the baby or cause some allergies.

- Manufacturers are also concentrating on providing good quality products for the babies in order to prevent any harmful effects. The use of natural components in the production of these products will drive the market growth as this has become a popular choice across various nations in the world. This market is expected to show a rapid expansion as many promotional campaigns are organized in order to create more demand for these efficient and natural products. The need for the products in the hair care range and the skin care product range will also have a significant growth.

Key Market Challenges

- Strict legislations - when it comes to the entry of new market players in the baby care products market these entrants face a major barrier of the stringent rules and regulations that are guiding this industry. The development cost of these products is high and the marketing of these products also happens to be expensive. As the need for investments in order to come up with innovative products is also high the market will face a major challenge when it comes to the growth of such new entrants. Another challenge that this new entrance face is that of adhering to these rules and regulations when it comes to the clinical trials. The cost of production of these products is high and it hampers the profit earned by these new entrants.

Key Market Opportunities

Introduction of natural products

- In the recently years the demand for natural and organic products has grown to a great extent. Increased awareness which is associated with the use of chemical-based products or other products that have proven to be harmful for the skin and the hair of the babies will play a major role in the growth of the organic products market. Many market players are investing huge amounts in order to come up with innovative products that will make use of natural materials for production and they are also concentrating on providing these products at affordable rates.

- The cost-effective nature of these products will be instrumental in the growth of the market. The use of natural ingredients in the manufacturing of the organic products is expected to gain maximum popularity during the forecast period and shall provide good number of opportunities for the growth of this market during the forecast period.

Value Chain Analysis

- Product Conceptualization and Design

Product conceptualization and design for baby care products is a specialized process that places importance on safety, gentleness, functionality, and emotional appeal for the infant and his/her parents.

Key players: The Honest Company, Johnson & Johnson (J&J)

- Raw Material Procurement

The process of raw material procurement for baby care products seeks to source high-quality, safe, and sometimes specialized materials suitable for sensitive infant use.

Key players: Johnson & Johnson, Procter & Gamble

- Manufacturing and Assembly

Manufacturing and assembly for baby care products are anxiously developing, producing, and assembling a diverse array of items, ensuring the safety, quality, and gentleness needed for infants and toddlers.

Key players: Unilever, Himalaya Wellness Company

- Branding and Packaging

Branding and packaging for baby care products is the process of creating a unique identity for a brand using logos, colors, and messaging, while packaging concerns itself with how the product container is to be functionally designed, the materials to be used in construction, and the visual aesthetics of said container.

Key players: Amcor plc, Sonoco Products Company

- Retail Distribution (Online/Offline)

Retail distribution for baby care products involves the selling of these articles through online channels (such as e-commerce sites and brand websites) and offline channels (including supermarkets, drugstores, and specialty stores, among others).

Key players: Amazon, Flipkart

Product Insights

On the basis of the type of products, the hair care and toiletry segment hit maximum share in terms of revenue which was about 67%. This trend shall continue in the coming years. The demand for baby wipes, baby washes and baby shampoos and conditioners or some of the products that are used on a large scale across the world. As most of these products are extremely skin friendly the need for these products will increase in the coming years. They provide benefits like maintaining the moisture in the skin and provide instant hydration due to which the need for these products will increase in the coming years. As these products are extremely easy for use and they provide quick solutions for treating diaper rashes, dryness as well as infection in babies the need for these products will continue to grow in the coming years.

The skin care segment is expected to grow with the highest compound annual growth rate which shall be about 5.4% in the coming years. Various products that come under this segment are the powders, massage oils, face creams and moisturizers and the need for these products has increased in the recent years in order to maintain the health of the scale. The demand for these products that provide antibacterial and antioxidant properties will drive the market growth period the lead for antifungal products will also increase in order to treat various conditions of sensitive skin in the babies.

Distribution Channels Insights

On the basis of the distribution channel, the supermarket and hypermarket segment dominated the market in the past with a share of about 46% and it shall continue to dominate the market in the coming years. There are many advantages which are associated with the purchases made through the stores as they provide lower prices and better options for selection. Better visibility is provided by these stores as dedicated shelves are provided for these products with better arrangements. The presence of the international brands at the supermarkets and hypermarkets will also help in meeting the needs of varied customers. As the stores help in meeting the needs of different types of customer groups the purchases through these stores will grow significantly even in the coming years.

The segment of the specialty store will also show a significant growth and it will expand at a compound annual growth rate of 5.2% in the coming years. Consumers that make purchases of a particular product repeatedly are the consumers that buy from the specialty stores. The availability of natural organic as well as herbal products in the specialty stores is an advantage which helps in the growth of this segment.

Baby Care Products Market Companies

- The Himalaya Drug Company

- California baby

- Unilever

- Procter & Gamble

- Johnson & Johnson

Recent Developments

- In September 2025, CuteStory launches Baby Face Cream, a gentle baby care product combining nature and science to protect infants' delicate skin from dryness and irritation.

https://www.indianretailer.com/brandlicense/archives/news/cutestory-expands-baby-care-range-launch-baby-face-cream.n4345 - In February 2025, Fixderma introduces Hoopoe, a baby care line designed to address common skin concerns, available on its e-commerce store.

https://in.fashionnetwork.com/news/Fixderma-expands-into-baby-care-with-new-line-hoopoe-,1699166.html

Segments Covered in the Report

By Product

- Baby Skin Care

- Baby Moisturizer

- Baby Face Cream

- Baby Massage Oil

- Baby Powder

- Diaper Rash Cream

- Baby Toiletries/Hair Care

- Shampoo

- Conditioner

- Hair Oil

- Baby Body Wash

- Baby Wipes

By Buyer Type

- Institutional Buyers

- Residential Buyers

By Distribution Channel

- Online

- E-commerce Websites

- Company Owned Websites

- Offline

- Hypermarkets & Supermarkets

- Specialty Stores

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content