Baby Oral Care Market Size and Forecast 2025 to 2034

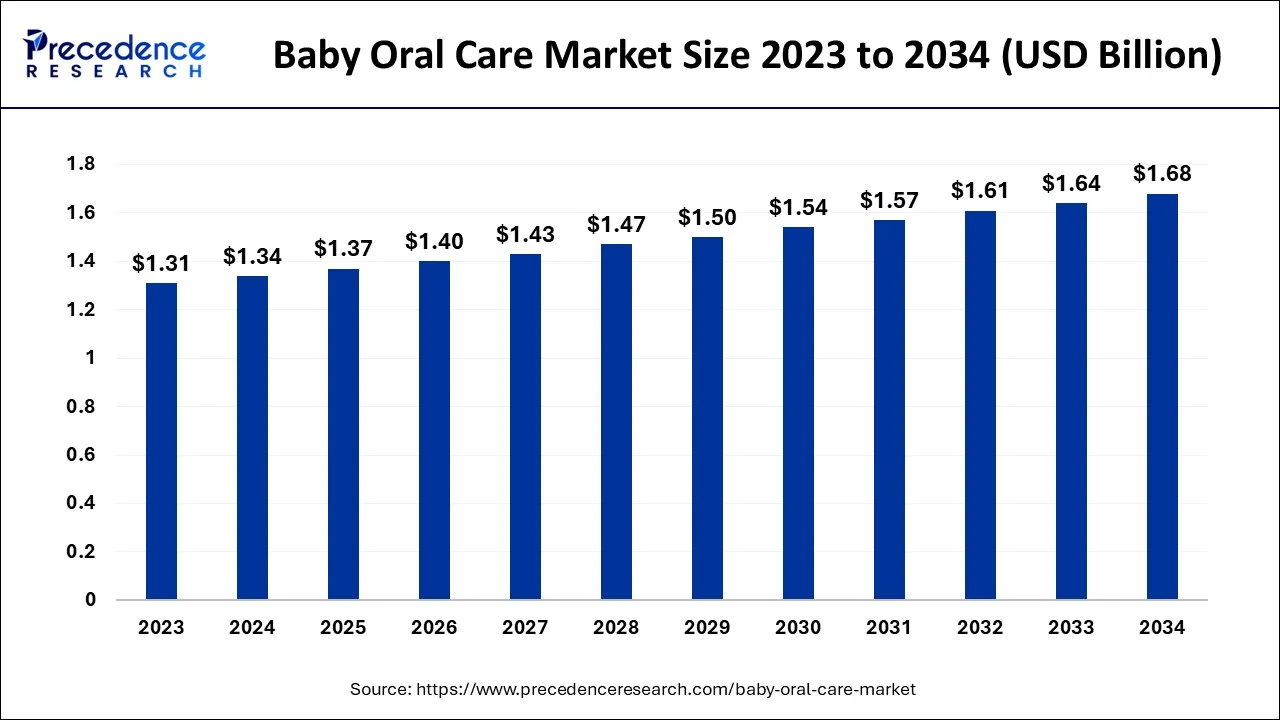

The global baby oral care market size is estimated at USD 1.34 billion in 2024, and is projected to hit USD 1.37 billoin by 2025 and is anticipated to reach around USD 1.68 billion by 2034, expanding at a CAGR of 2.29% from 2025 to 2034.

Baby Oral Care Market Key Takeaways

- In terms of revenue, the market is valued at $1.37 billion in 2025.

- It is projected to reach $1.68 billion by 2034.

- The market is expected to grow at a CAGR of 2.29% from 2025 to 2034.

- On the basis of product, the toothpaste segment dominated the market with highest revenue in 2024.

- On the basis of application, the home segment predicted maximum sales of oral care products.

- On the basis of distribution channels, the supermarkets & hypermarkets segment will have the largest market share from 2025 to 2034.

- The Asia Pacific region will generate the highest revenues in the long run.

- The North America region will also see steady growth from 2025 to 2034.

Market Overview

Oral care plays a significant role in infant health, due to which several companies have launched numerous products over the past few years. Moreover, these companies have invested heavily in research & development to launch innovative products. For instance, commercially available hand brushes are made of soft and gentle silicon, causing no abrasion or injuries on a baby's gum. Mild toothpaste and massagers are also available, made using herbal and natural ingredients. Baby oral care products can avoid most oral disorders that begin from a young age and help prevent gum diseases, cavities, decay, foul breathing, and tongue thirsting.

Europe Market Trends

Europe is observed to grow at a considerable growth rate in the upcoming period, fueled by heightened awareness among parents regarding early dental hygiene and preventive healthcare measures. Various governments are promoting educational initiatives that underscore the significance of oral health from a young age. Furthermore, the market is supported by the introduction of innovative products tailored for infants, including fluoride-free toothpaste and toothbrushes with soft bristles. The surge in e-commerce platforms has also enhanced product accessibility for consumers, aiding market growth. In summary, Europe's dedication to child health and wellness is cultivating a thriving environment for the baby oral care sector.

Germany

Germany distinguishes itself in Europe's baby oral care market because of its strong focus on preventive healthcare and heightened consumer awareness. The nation's robust healthcare system and proactive dental care initiatives have led to increased uptake of specialized oral hygiene products for infants. Parents in Germany are progressively seeking safe and natural oral care alternatives for their babies, thus boosting demand for items such as organic toothpaste and environmentally-friendly toothbrushes.

Baby Oral Care Market Growth Factors

Oral diseases are widespread in babies, and the chances of caries in childhood have also increased significantly in recent times. This is one of the key factors driving the market growth for baby oral care products.

Rising awareness among parents regarding their baby's oral care and increasing disposable income will lead to market growth. An increase in the consumption of sugar and bottled feed plays a significant role in increasing cases of oral diseases, due to which the demand for various premium products has grown. Consumers are inclined towards various products of premium quality to have the best for their children, which positively impacts market growth.

Market players have been diversifying their product portfolios by launching innovative products for babies in the oral care segment yearly. Toothpaste and toothbrushes are made using chemical-free natural products, which have zero side effects on babies' oral care. Toothpaste is made using fruits that are natural and free of chemicals. All of these factors will increase market profitability in the long run.

Distribution channels via convenience stores, grocery stores, hypermarkets, and departmental outlets, offer maximum opportunities for manufacturers. NGOs also play a significant role in educating individuals through offline and online campaigns to create awareness about the importance of oral hygiene in children.

Major Key Trends in Baby Oral Care Market

- Emphasis on Preventive Healthcare: There is an increasing trend toward preventive oral care for young children, with parents actively looking for products that can help establish healthy dental habits from an early age. This shift is raising the demand for fluoride-free toothpaste, toothbrushes with soft bristles, and teething gels specifically formulated for babies.

- Rise of Smart Oral Care Products: Technological advancements have led to the creation of smart toothbrushes for infants, which come equipped with Bluetooth connectivity and mobile applications that assist parents in ensuring proper brushing techniques and tracking their child's oral hygiene practices.

- Sustainable and Eco-Friendly Products: Consumers are becoming more inclined to prefer eco-conscious baby oral care items, including biodegradable toothbrushes and recyclable packaging, which reflects an overarching commitment to environmental sustainability.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1.68 Billion |

| Market Size in 2025 | USD 1.37 Billion |

| Market Size in 2024 | USD 1.34 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 2.30% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers

Organic oral care products for babies have a greater demand

The significant increase in parents' disposable income and awareness regarding the commercial availability of various organic products is driving the market growth. Furthermore, numerous offline and online campaigns conducted by multiple non-government organizations (NGOs) further provide an impetus to market growth. Although organic products are more expensive than conventional ones, most parents prefer the former due to natural ingredients with zero side effects, even with prolonged use.

Focus on research and development

Market players focus on investments in research & development to introduce innovative products to increase their foothold in the market. Manufacturers have successfully launched new products, such as silicon-based toothbrushes and toothpaste with a wide variety of flavors, encouraging oral hygiene habits in babies.

Restraints

COVID-19 impacting baby oral care production

The COVID-19 pandemic resulted in shutting down operations of non-emergency industries across the world in 2020 and 2021. Furthermore, there was a significant drop in spending on non-essential products and services. These factors resulted in a decline in sales of baby oral care products. Moreover, fluctuations in raw material availability and prices during the lockdown severely affected the production of these products, further plummeting market growth.

Opportunities

Lifestyle changes

Recently, chronic diseases have increased as children's eating habits become unhealthy due to the easy availability of processed and packaged foods. Furthermore, their lifestyle has significantly changed, with more babies relying on formulas rather than breast milk.

Poverty also increases the chances of oral diseases among children, especially in underdeveloped and developing economies. Most of the products are unaffordable for the parents, thus, adversely affecting the babies' oral hygiene. These factors can provide opportunities for manufacturers as they can focus on providing affordable products to the lower strata of the economy.

Product Insights

Based on the product landscape, the toothpaste segment dominated the market with maximum revenue in 2022. Growing cases of tooth decay, gum problems, and cavities will drive the demand for toothpaste in the coming years. Different organic toothpaste flavors are being launched to appeal to the diverse preference of babies.

Toothbrushes are an essential part of oral care. The use of organic products in manufacturing toothbrushes, such as bamboo, will play a significant role in the market's growth. Silicon-based toothbrushes are also gaining popularity, which is biocompatible and have no abrasive effect on baby's gums. Electric toothbrushes are also available in the market, and consumers find these tools extremely attractive.

Application Insights

Based on application, the maximum sales of oral care products are in the home segment. Increased disposable income and spending on oral hygiene products will lead to the market's growth in the long run. The home segment utilizes maximum oral care products. The maximum use of these products at home is to reduce the money spent on visiting the dentist for various reasons. The dentist segment will also show significant growth as oral diseases have increased, and healthcare awareness will also increase routine checkups at the dentist's clinic.

Distribution Channel Insights

The supermarkets & hypermarkets segment will have the maximum share during the forecast period. The easy availability of different products and brands will drive the market growth of this segment.

The sales of oral care products through online retailers, specialty stores, and other outlets will also grow significantly. The online segment will register a higher growth rate as the number of online shoppers has increased post the pandemic. These platforms offer a wide range of products, and the orders are processed quickly. The option of getting the products delivered on the same day will also play a significant role in the growth of this segment.

Regional Insights

Asia Pacific will generate maximum revenues in the long run due to the large population and increasing awareness among parents regarding oral health, especially in China and India. A high disposable income and ease of availability of oral hygiene products catering specifically to babies are expected to drive market growth over the next few years. The increasing number of cavities and other dental issues in the younger population is driving the need for oral hygiene products.

North America will also see steady growth during the forecast period due to introduction of innovative products in the market and constant research and development in the field. Manufacturers are constantly engaged in conducting awareness drives to increase the sales of oral care products and to create awareness regarding the importance of the usage of such products.

Baby Oral Care Market Companies

- Colgate-Palmolive Company

- Johnson & Johnson

- Church & Dwight Co. Inc.

- Unilever

- Proctor & Gamble

- Pigeon Corporation

- Anchor Group

- Oriflame

- Amway

- Dr. Fresh

- Chattem

- Dabur

- Splat Baby

Key Market Developments

- In September 2023, Edgewell Personal Care has announced that it has acquired Mamamoo Baby, a brand focused on natural baby care products, including oral hygiene solutions. This acquisition broadens Edgewell's range of baby products while catering to consumer demand for safe and chemical-free hygiene options for infants.

- In August 2023, Colgate-Palmolive has acquired Hello Products, a prominent brand in the natural and vegan oral care market. This purchase enhances Colgate's position in the natural oral care sector, targeting health-conscious parents who are looking for gentle, plant-based oral hygiene options for their babies.

- In June 2023, Philips Avent has joined forces with The Natural Dentist to promote baby oral care products collaboratively. Their partnership has launched a range that includes finger toothbrushes in addition to electric baby toothbrushes, emphasizing comprehensive oral care solutions for various developmental stages.

- Companies are using non-traditional methods for marketing their products, such as social media. For instance, to encourage children to maintain a proper brushing routine, Colgate entered into a partnership with Ryan, a YouTube star, in 2019. New oral care products were launched, which were promoted by Ryan.

Segments Covered in the Report

By Product

- Toothpaste

- Toothbrush

- Denture Products

- Mouthwash

- Others

By Application

- Home

- Dentistry

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Retailers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting