Biliary Stents Market Size and Forecast 2025 to 2034

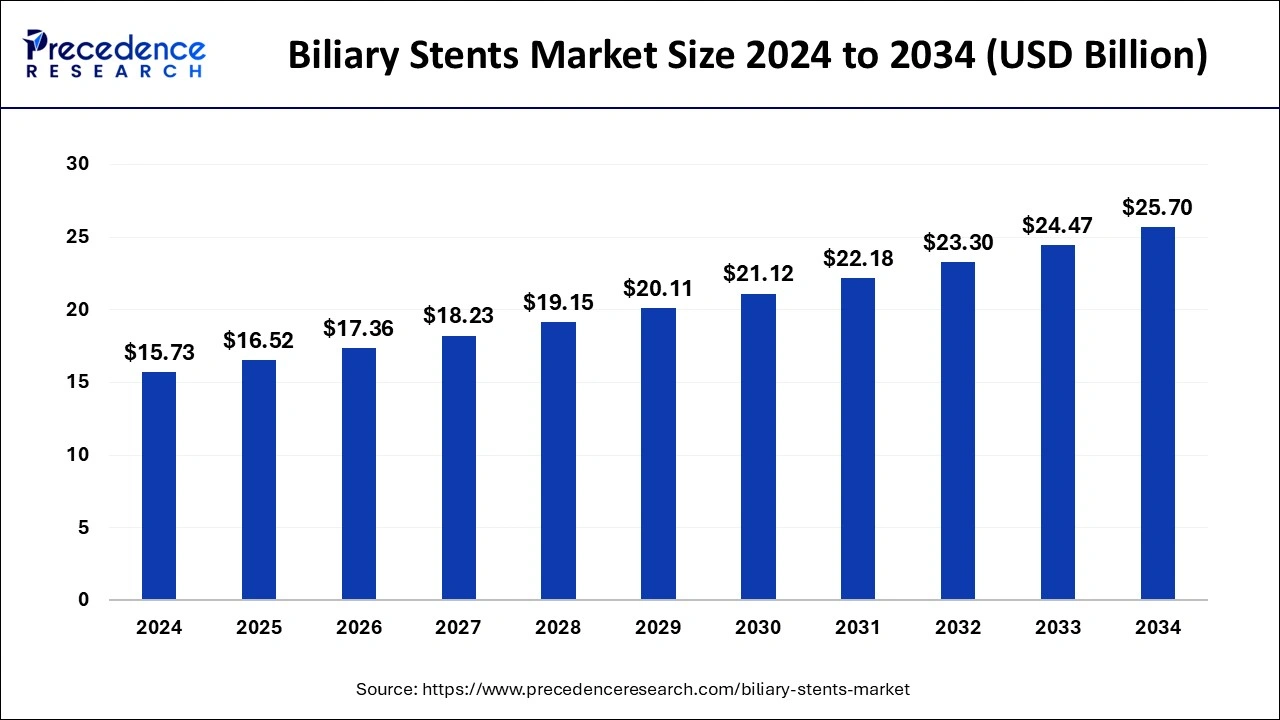

The global biliary stents market size was estimated at USD 15.73 billion in 2024 and is predicted to increase from USD 16.52 billion in 2025 to approximately USD 25.70 billion by 2034, expanding at a CAGR of 5.03% from 2025 to 2034.

Biliary Stents MarketKey Takeaways

- The global biliary stents market was valued at USD 15.73 billion in 2024.

- It is projected to reach USD 25.70 billion by 2034.

- The biliary stents market is expected to grow at a CAGR of 5.03% from 2025 to 2034.

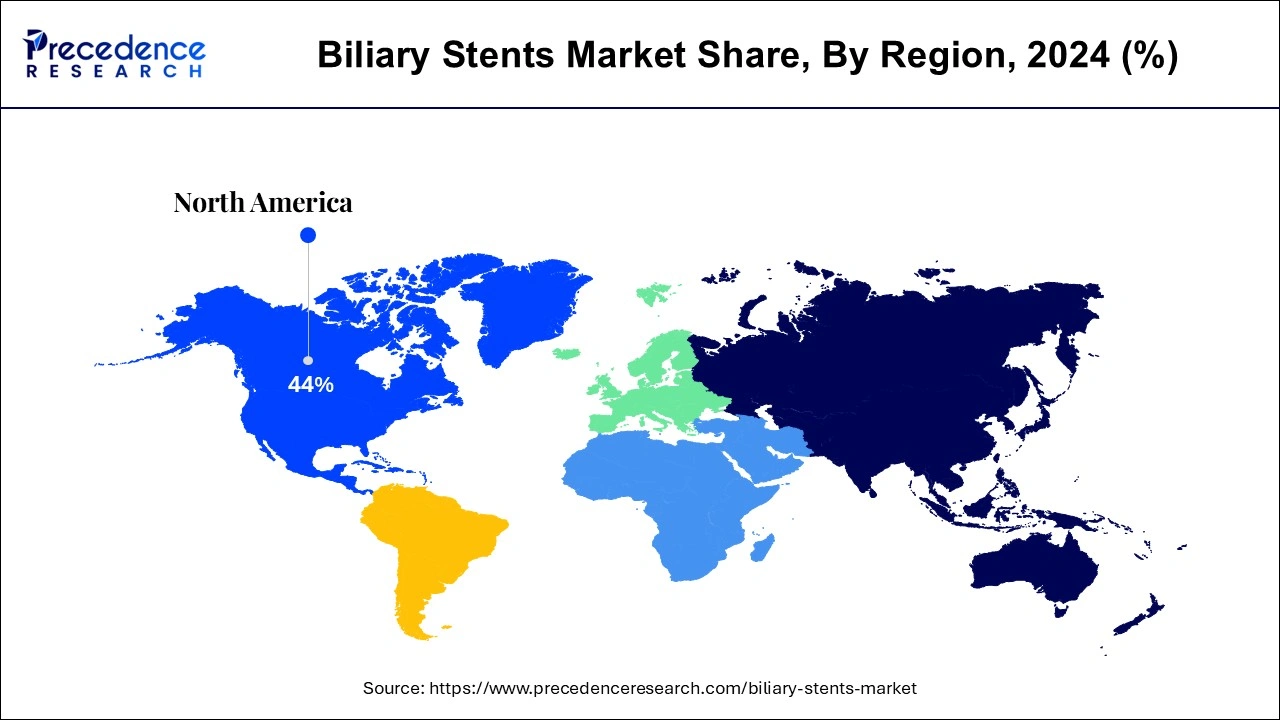

- North America dominated the biliary stents market with revenue share of 44% in 2024.

- By product type, the metal segment has held the largest market share in 2024.

- By application, the gallstone segment has held the largest segment of the biliary stents market.

- By end use, the hospital segment held the dominating position in the market in 2024.

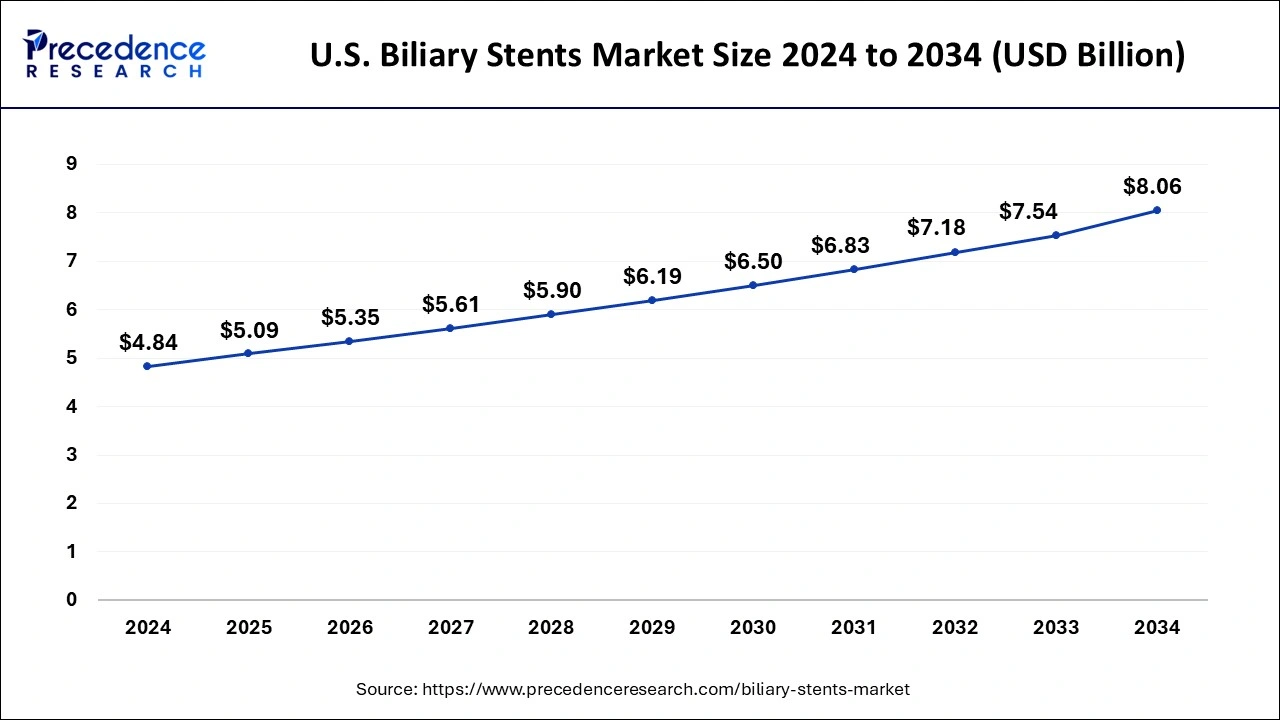

U.S. Biliary Stents Market Size and Growth 2025 to 2034

The global biliary stents market size was valued at USD 4.84 billion in 2024 and is predicted to worth around USD 8.06 billion by 2034, expanding at a CAGR of 5.23% from 2025 to 2034.

North America emerged as the strongest player in the biliary stents market in 2024. Pancreatic cancer ranks as the second most common digestive cancer and the fourth leading cause of cancer-related deaths in the United States among both men and women. Approximately 4,500 new cases of cholangiocarcinoma are reported annually in the United States, with proximal cholangiocarcinomas constituting 30% to 60% of these tumors.

Pancreatic ductal adenocarcinoma (PDAC) presents a significant challenge, with an average five-year survival rate of 9% across all stages. Despite curative-intent surgery and adjuvant chemotherapy, fewer than 20% of patients with PDAC present with resectable tumors, and disease recurrence is common.

- WallFlex Biliary RX Fully Covered Stent, manufactured by Boston Scientific in the United States, stands as the sole fully covered self-expandable metal stent (FCSEMS) approved by the United States Food and Drug Administration for the treatment of benign biliary stricture (BBS) due to chronic pancreatitis, with an indwell time of up to 12 months.

Market Overview

Biliary stenting involves the insertion of tubes, typically made of plastic or metal, to alleviate obstructions within the biliary tree or to address biliary leaks. This procedure is utilized across both benign and malignant conditions affecting the biliary tract, serving as a crucial intervention, particularly in cases of advanced malignancies where palliative care is necessary. The types of stents commonly employed include plastic stents and self-expanding metal stents (SEMS), each serving distinct purposes in treatment.

Plastic and metal stents are utilized based on the specific needs of the patient, with plastic stents often preferred for short-term relief and metal stents for longer-term management. While the insertion of a single plastic stent or SEMS typically does not necessitate biliary sphincterotomy, certain cases may require this procedure, wherein blended electrosurgical current is utilized.

Indications for biliary stenting encompass a spectrum of conditions, ranging from benign biliary strictures to malignant obstructions. It serves as a vital intervention in alleviating blockages and managing complications arising from biliary diseases. However, certain contraindications exist, and patient suitability must be carefully evaluated before proceeding with the procedure.

Biliary Stents MarketGrowth Factors

The collaborative effort of the interprofessional team ensures timely and effective treatment of patients with biliary obstructions or leaks. By utilizing biliary stenting, the team can swiftly address emergent situations, thereby enhancing patient outcomes and satisfaction. This positive patient experience leads to increased referrals and the growth of the biliary stents market as healthcare providers recognize the efficacy of biliary stenting in managing complex biliary conditions.

The collaborative effort of an interprofessional team is paramount in ensuring the success of biliary stenting procedures and minimizing associated risks. This team typically includes gastroenterologists, interventional radiologists, surgeons, nurses, and other healthcare professionals, each contributing their expertise to deliver comprehensive care to affected patients. By leveraging the collective knowledge and skills of the team, morbidity and mortality rates associated with biliary diseases can be effectively reduced, thereby enhancing patient outcomes and quality of life.

The use of plastic or metal biliary stents has evolved significantly over the years, with continuous technological advancements improving the efficacy and safety of these devices. The development of stents with anti-migratory, antireflux, drug-eluting, and bioabsorbable properties addresses the limitations of traditional stents, thereby expanding the biliary stents market as healthcare providers seek innovative solutions to optimize patient care.

SEMS, with their larger lumen and longer patency compared to plastic stents, have become the preferred choice for managing malignant biliary strictures. This shift towards SEMS adoption is driving market growth as healthcare facilities invest in these advanced devices to improve patient outcomes and prolong stent durability, leading to higher patient volumes and revenue generation.

Biliary stenting offers a minimally invasive alternative for patients with inoperable malignant biliary obstructions. The deployment of endoscopic bilateral metallic stents, particularly in cases of hilar malignant biliary strictures with high-grade obstruction, has demonstrated improved patient survival rates. As healthcare providers recognize the efficacy of biliary stenting in prolonging patients' lifespans and improving their quality of life, market demand for these procedures continues to grow.

Manufacturers are responding to market demand by offering a wide range of biliary stents manufactured using various polymers and available in different sizes and shapes. Compatibility with standard duodenoscopes further facilitates the adoption of biliary stenting procedures, leading to increased market penetration and revenue generation for both device manufacturers and healthcare facilities.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.03% |

| Market Size in 2025 | USD 16.52 Billion |

| Market Size by 2034 | USD 25.70 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Evolving market landscape

The biliary stents market is driven by the widespread adoption of biliary stenting as a crucial treatment for obstructive jaundice, with gastroenterologists and interventional radiologists leading the procedure's implementation. Enhanced awareness among healthcare professionals underscores its life-saving potential, while the recurring need for stent replacement fuels market demand.

Preference for covered stents, supported by studies showing higher patency rates, amplifies market growth despite concerns regarding elevated pancreatitis rates associated with metal-covered stents. Balancing efficacy and complication rates remains paramount, stimulating ongoing innovation and research efforts and ultimately propelling the expansion of the biliary stents market.

Biliary tube stent migration

Plastic biliary stents serve as long-term solutions for elderly patients or those ineligible for surgery, driving market expansion. Endoscopic biliary stenting, a well-established therapy for biliary obstruction, faces challenges such as stent migration in 5%-10% of patients, stimulating demand for solutions to mitigate migration risks. Investigating the factors influencing stent migration becomes pivotal, fostering innovation and driving growth in the biliary stents market.

Restraints

Complications in biliary stenting

Early complications such as infection, bleeding, and pancreatitis, alongside occlusion due to sludge or tissue overgrowth, pose significant challenges in biliary stent placement, hindering market growth. Dislodgment rates vary across stent types, with fully covered SEMSs experiencing a higher incidence at 20%, followed by plastic stents and partially covered SEMSs at approximately 5%. Benign biliary strictures exhibit a higher dislodgment risk compared to malignant strictures, further restraining the expansion of the biliary stents market. Efforts to mitigate these complications are essential to unlock the full potential of biliary stenting procedures.

Risks in biliary stenting

Complication rates ranging from 8% to 10% in biliary stent procedures present significant challenges, including cholangitis, cholecystitis, duodenal perforation, bleeding, pancreatitis, stent fracture, migration, and occlusion. Of particular concern is stent migration, which occurs in 5%-10% of cases and can lead to recurrent biliary obstruction. This late-stage complication acts as a restraint on market growth, emphasizing the urgent need for innovative solutions to mitigate risks associated with biliary stenting procedures and unlock the full potential of this essential medical intervention.

Opportunities

Functional coatings

The biliary stents market is exposed to several new opportunities as material science continues to advance. The structural design of biliary stents undergoes significant improvement, amplifying stent performance and expanding their utility. Despite being a vital intervention in managing biliary tract diseases, complications such as postoperative biliary infection and restenosis remain common due to the complex nature of the biliary system. The integration of coating technology with biliary stents presents a promising avenue for addressing these challenges.

The cutting-edge development of functional coatings on biliary stents heralds a new era of innovation, offering solutions to mitigate complications and enhance patient outcomes. This innovative approach not only opens doors for overcoming existing limitations but also creates exciting opportunities for future growth and development within the biliary stents market.

Revolutionizing technologies

The widespread use of biliary stents has brought about notable advancements, albeit accompanied by increased complications like post-implantation infection and restenosis. To enhance biliary stent performance, surface modification techniques, including coating with radioactive particles and other methods, have gained traction. Among these techniques, coating has emerged as the primary focus of research for expanding the biliary stents market.

Coatings, comprising thin layers of materials, augment surface properties and create a protective shield against external threats. Leveraging coating technology holds immense potential for the development of drug-eluting stents, offering targeted enhancements tailored to specific structural designs and compatible substrates. This innovative approach not only addresses existing challenges but also fosters opportunities for growth and advancement within the biliary stents market.

Type Insights

The metallic segment has emerged as the dominant force in the biliary stents market, offering distinct advantages over plastic stents. Their mesh design prevents the occlusion of side branches and reduces the occurrence of tumor growth, which is particularly beneficial for treating firm and scirrhous hilar tumors. With longer patency durations ranging from 4 to 6 months compared to 2 to 4 months for plastic stents, metallic stents have become the preferred choice for palliative treatment of malignant biliary obstructions.

Utilizing smaller catheters for delivery minimizes patient discomfort and liver complications while expanding to larger internal diameters of up to 12 mm or more ensures improved drainage and extended patency rates. Self-expandable metal stents (SEMS) further enhance stent performance by addressing occlusion complications faced by plastic stents, boasting a core structure comprising metal alloys such as stainless steel, Nitinol, Elgiloy, and Platinol, offering prolonged patency and improved patient outcomes.

Application Insights

The gallstones segment emerged as the leading contributor in the biliary stents market in 2024. However, the efficacy of prophylactic biliary stenting for patients with gallstones (GS) and common bile duct stones (CBDS) remains a subject of debate. The impact of the common bile duct (CBD) stenting on mitigating gallstone migration and reducing symptom recurrence in patients with pancreatitis and delayed cholecystectomy candidates is under scrutiny. These considerations highlight the ongoing discourse surrounding the application of biliary stenting in managing bile duct stones and its potential implications for patient care and treatment outcomes.

End-use Insights

The hospital segment commanded the largest share in the biliary stents market in 2024. Biliary stents, essential for unblocking bile ducts obstructed by tumors or scar tissue, are inserted through minimally invasive procedures post-surgery to ensure optimal duct function. These stents, composed of inert materials like metal or plastic, minimize immune reactions. During the surgical process, a catheter is initially inserted into the blocked bile duct to facilitate drainage, followed by the placement of a small tube, or biliary stent, to allow for consistent bile flow and alleviate symptoms.

Some hospitals utilize endoscopic ultrasound (EUS) for stent insertion, leveraging detailed images of the bile duct obtained through an endoscope equipped with a small ultrasound probe inserted through the mouth and down the throat to position the stent accurately. This strategic approach ensures efficient and precise biliary stent placement, optimizing patient outcomes and enhancing hospital capabilities in providing comprehensive biliary care services.

Biliary Stents Market Companies

- Boston Scientific

- Cook Group

- ENDO-FLEX GmbH

- Olympus Corporation

- B Braun Melsungen

- CONMED Corporation

- M.I Tech

- Becton, Dickinson & Company

- Medtronic plc

- Cardinal Health

- Merit Medical System

Recent Developments

- In January 2024, Olympus concluded the acquisition of Taewoong Medical Co. Ltd., a leading Korean gastrointestinal stent company.

- In October 2022, Cordis, a global frontrunner in the innovation and production of interventional cardiovascular and endovascular technologies, revealed its acquisition of MedAlliance, a Switzerland-based firm renowned for pioneering drug-eluting balloons.

- In June 2022, Boston Scientific announced its agreement to acquire a majority stake in M.I.Tech Co. Ltd. from Synergy Innovation Co. Ltd.

Segments Covered in the Report

By Type

- Metal

- Polymer

- Plastic

By Application

- Biliopancreatic Leakages

- Pancreatic Cancer

- Benign Biliary Structures

- Gallstones

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting