What is the Functional Coatings Market Size?

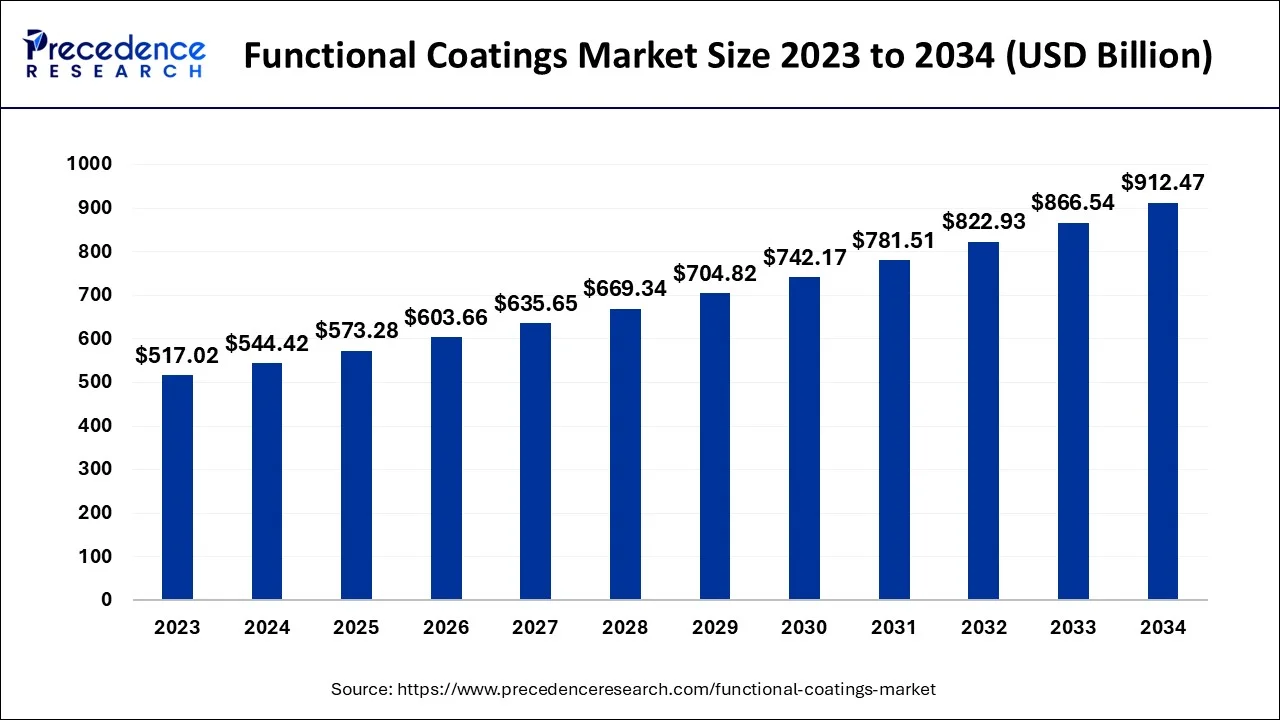

The global functional coatings market size is accounted at USD 573.28 billion in 2025 and predicted to increase from USD 603.66 billion in 2026 to approximately USD 954.98 billion by 2035, representing a CAGR of 5.24% from 2026 to 2035.

Functional Coatings Market Key Takeaways

- Asia Pacific is expected to expand at the fastest CAGR between 2026 and 2035.

- By Product Type, the corrosion-resistant coatings segment held the largest share in 2025.

- By End-User, the automotive segment held the maximum market share in 2025.

What are Functional Coatings?

Functional coatings are a sort of specialised coating created to improve a surface's performance and functioning. They have a number of uses, including corrosion resistance, wear resistance, antifouling, anti-icing, and thermal management, and they may be applied to a wide range of substrates, including metals, plastics, glass, and ceramics. Polymers, nanoparticles, and other materials are used in the formulation of functional coatings. They may be customized to match specific performance needs and can be applied using a variety of techniques, such as spraying, dipping, or electroplating. Numerous sectors, including automotive, aircraft, building, electronics, and marine, among others, use them.

Functional Coatings Market Growth Factors

Strong demand from end-use sectors including automotive, aerospace, construction, electronics, and marine, among others, is driving the global market. Functional coatings are being used more often in various sectors as a result of the need to increase product functionality, performance, and durability while lowering maintenance costs and raising energy efficiency. The market for functional coatings is characterized by considerable technological breakthroughs.

The expansion is being fueled by rising R&D investments. To provide improved functionality and performance, new technologies including nanocoatings, smart coatings, and self-healing coatings are being developed. The need for functional coatings that provide improved protection and durability for these materials is being driven by the growing usage of lightweight materials including composites, plastics, and metals in a variety of sectors. Regulators are putting more pressure on the worldwide functional coatings industry to employ fewer dangerous chemicals and to promote environmental sustainability. New coatings that are safer and more ecologically friendly are being developed as a result.

Market Outlook

- Industry Growth Overview:

The functional coatings market is experiencing significant growth, driven by huge industrial growth, rapid urbanization, and massive populations in countries such as China and India, increasing demand in water treatment, paints and coatings, personal care, and agriculture. - Global Expansion:

The market expanded globally as rising demand for high-performance surface services in automotive, aerospace, construction, electronics, and packaging, providing advantages such as thermal management, corrosion resistance, and self-cleaning. North America is dominant in the market due to the presence of a highly advanced medical care system. - Major investors:

Major investors in the functional coatings industry are usually large, multinational chemical and coatings organizations, as well as private equity organizations that invest in the chemicals sector.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 573.28 Billion |

| Market Size by 2035 | USD 954.98 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.24% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type, By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing use of lightweight materials

The worldwide market for functional coatings is mostly driven by the rising usage of lightweight materials like aluminium, composites, and plastics in a variety of sectors. Because they provide advantages including increased fuel economy, decreased emissions, and greater performance, lightweight materials are in demand across a variety of sectors, including automotive, aerospace, construction, and electronics. However, lightweight materials are frequently more prone to deterioration and damage than more sturdy materials like steel, aluminium is robust and lightweight, yet it is susceptible to corrosion in some situations. Composites can be vulnerable to damage from collisions or abrasion yet are nonetheless lightweight and sturdy. Although they might be lightweight and useful, UV radiation and chemicals can cause plastics to deteriorate over time. Lightweight materials can benefit from the damage prevention offered by functional coatings.

Restraints

Fluctuating raw material prices

Functional coatings must include raw ingredients since they influence the final product's quality. For various reasons, fluctuating raw material costs can be a major restraint for the worldwide market for functional coatings. For functional coatings, the cost of raw ingredients might make up a sizeable amount of the overall production cost. Price fluctuations can have an effect on a manufacturer's profitability and make it difficult to maintain stable pricing for consumers. Supply chain disruptions can result from changes in raw material pricing because manufacturers may find it difficult to get the commodities with the quantities and at the prices they need. Due to the potential for manufacturing and delivery delays, businesses may need to cut their pricing in order to remain competitive in a highly competitive market. But it can be challenging to maintain constant pricing due to volatility in raw material costs, which can result in price wars and lower company profitability.

Fluctuations in raw material costs may have an influence on the availability of certain materials since producers may be forced to use substitutes or find alternative suppliers. This may affect the finished product's quality and qualities, resulting in decreased demand and dissatisfied customers. The creation of novel materials may also affect the market for conventional raw resources, causing price changes. For instance, the development of biodegradable materials may affect the market for functional coatings' raw material prices by reducing the need for conventional plastic-based coatings.

Opportunity

Increasing demand from the automotive industry

The growing need for high-performance coatings in the automotive sector, one of the primary end users of functional coatings, offers a considerable potential opportunity for the functional coatings market. Automotive makers are seeking for coatings that give better functionality such improved corrosion resistance, thermal insulation, and friction reduction in response to the rising demand for fuel-efficient and environmentally friendly automobiles.

Functional coatings are also being employed in the creation of driverless cars and advanced driver assistance systems (ADAS), where they are essential to improving the efficiency and dependability of these systems. For instance, coatings with anti-glare and anti-fog qualities can enhance the visibility of sensors and cameras used in ADAS and driverless cars, while coatings with thermal management qualities can assist in controlling the temperature of vital parts like batteries and electronics.

Additionally, the popularity of electric cars is boosting the market for functional coatings since these cars need specialised coatings that can resist the demanding circumstances of their electric powertrains. The need for specialised coatings with increased capabilities like higher electrical conductivity and corrosion resistance is anticipated to increase dramatically along with the demand for electric cars.

Product Type Insights

Corrosion-resistant coatings held the maximum share in 2023 and are anticipated to account for the majority of the market because of the high demand from end-use sectors including the automotive, aerospace, and marine. The purpose of corrosion-resistant coatings is to shield metallic surfaces from the corrosive effects of exposure to external elements such moisture, salt, and chemicals. The automotive, maritime, and oil & gas sectors, among others, all often utilise these coatings. The need for long-lasting, high-performance coatings that can endure challenging environmental conditions is predicted to increase significantly in the coming years, which will propel the market for corrosion-resistant coatings.

Surfaces that are prone to wear and tear from friction, abrasion, and impact are engineered to perform better and last longer with wear-resistant coatings. Numerous sectors, such as the production of industrial equipment, aircraft, and automobiles, employ these coatings. The need for high-performance coatings that can increase the tenacity and lifetime of goods is projected to push the market for wear-resistant coatings to expand at a faster rate in the next years.

End-User Insights

The application of functional coatings to enhance the performance, longevity, and functionality of automotive parts and components has driven the growth of the automotive sector to represent the largest market segment in 2023. The growing need for coatings that can improve the functionality, performance, and longevity of automotive parts and components has made the automobile sector a significant end-user of functional coatings. Automotive applications for functional coatings include brake systems, engine parts, and external and interior surfaces. Due to the increasing need for lightweight materials and cutting-edge technologies that may increase fuel economy and lower emissions, the automotive sector is also anticipated to represent the largest market segment in the future.

Another significant end-user of functional coatings is the aerospace sector, which is motivated by the demand for high-performance coatings that may improve the robustness, effectiveness, and safety of aircraft components. Aerospace applications include the use of functional coatings on structural materials, turbine blades, and engine parts. Increasing expenditures in the research and development of innovative coatings that can enhance aircraft performance and lower maintenance costs are predicted to make up a sizable portion of the market in the aerospace sector.

Regional Insights

The fastest-growing market at the moment is in the Asia Pacific area, and this trend is anticipated to continue in the years to come. This may be due to various factors including the existence of rapidly expanding economies like China and India, rising infrastructure development spending, and rising demand from end-use sectors like the automobile, building, and electronics industries. Due to the country's substantial industrial base, rising end-use industry demand, and rising R&D expenditures, China is the Asia Pacific region's largest market for functional coatings. In addition, the region is home to the biggest automobile market in the world, a crucial end-use sector for functional coatings. With rising investments in infrastructure development, rising demand from the construction sector, and the existence of significant market competitors, India is another important market for functional coatings in the Asia Pacific area.

The automotive and electronics sectors, which are important end-use markets for functional coatings, are also expanding in the nation. Due to comparable factors including rising end-use industry demand and rising R&D expenditures, other countries in the Asia Pacific region, including Japan, South Korea, and Southeast Asian nations, are also seeing considerable expansion in the functional coatings market.

One of the main geographical markets for functional coatings is North America, and in the years to come, it is anticipated that this market would expand at a greater rate. Strong demand from end-use industries including the automotive, aerospace, and construction sectors drives the North American market. Due to its robust industrial base and technical breakthroughs, the United States has the largest market in the area. Due to increased governmental pressure and customer demand, there is a growing trend in North America towards the usage of sustainable and ecologically friendly coatings. New functional coatings have been created as a result, and they perform better and are more environmentally friendly.

The development of novel coatings that provide superior performance and durability is characterized by strong investment in R&D efforts in the North American market. As a result, cutting-edge technologies with enhanced functionality, such as nanocoatings, and smart coatings, have been created. Due to strict restrictions governing the use of dangerous chemicals in the functional coatings sector in North America, new coatings that are safer and more environmentally friendly have been developed. Additionally, this has prompted the introduction of more sustainable production techniques and technology.

U.S. Functional Coatings Market Trends

In the U.S. presence of strong growth in sectors such as aerospace, automotive, construction, electronics, and packaging make a massive demand for coatings providing corrosion resistance, moisture barriers, UV protection, and antimicrobial characteristics. Well-developed manufacturing ecosystem, specifically, supports large-scale manufacturing and adoption.

India Functional Coatings Market Trends

China's massive chemical industry and extensive manufacturing infrastructure enable to high-volume manufacturing, giving it a noteworthy cost edge. Significant spending is shifting focus towards eco-friendly, customized, and high-performance coatings, with breakthroughs in bio-driven and smart coatings.

Europe: Increasing Government Initiative

Europe is significantly increasing in the market as EU laws shift manufacturers towards sustainable, low-VOC, bio-based coatings and waterborne, leading to novelty in eco-friendly services such as self-healing and smart coatings. Strong presence of infrastructure and stable government frameworks creates a competitive environment that drives continuous innovation.

The UK Functional Coatings Market Trends

The UK is a home for luxury and performance vehicle productions, including brands such as Jaguar Land Rover, Aston Martin, and Bentley, which require specialized functional coatings for durability and aesthetic appeal. UK regulatory guidelines pushing for lowered plastic, circular economy, and net-zero emissions increase demand for biodegradable, water-driven, and solvent-free coatings, which drives the growth of the market.

Value Chain Analysis – Functional Coatings Market

- Raw Material:

Raw materials for functional coatings are varied, significantly comprising resins/binders (epoxy, acrylic, polyurethane, silicone), pigments or fillers (TiO2, silica, talc, nanoparticles), solvents, and additives.

Key Players: Sherwin-Williams and PPG Industries - Manufacturing technology:

Manufacturing technologies for functional coatings include deposition processes such as Spray, PVD/CVD, Dip Coating, Inkjet Printing, Additive Manufacturing, and formulation processes, focusing on precision and adhesion.

Key Players: AkzoNobel and BASF - Waste Management:

Applications of waste products as raw materials to create maintainable coatings and managing the by-products and disposal of the coverings themselves

Key Players: Axalta and Nippon Paint

Top Companies in the Functional Coatings Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Akzo Nobel N.V. |

Netherlands |

Extensive global presence and strong brand equity cultivate customer |

In December 2025, AkzoNobel expanded a strategic agreement with Winning Shipping in China to supply its biocide-free Intersleek 1100SR fouling control coating |

|

Axalta Coating Systems LLC |

United States |

Extensive experience and heritage |

In April 2025, Axalta announced the launch of its next-generation patented Fast Cure Low Energy System (FCLE) clearcoat and surfacer products. |

|

BASF SE |

Germany |

resilient financial performance |

BASF Coatings has successfully commissioned a state-of-the-art production plant for automotive OEM coatings at its Muenster site in Germany. |

|

PPG Industries Inc. |

United States |

Strong focus on innovation and R&D |

In September 2025, PPG highlights its comprehensive industrial finishing technologies at the FABTECH 2025 sheet metal manufacturing trade show, held Sept. 8-11 in Chicago. Featured |

|

Sherwin-Williams Company |

United States |

Strong portfolio of trusted brands |

Sherwin-Williams' advanced coating systems are designed to ensure safety, sterility, and efficiency in pharma manufacturing environments. |

Functional Coatings Market Companies:

- Akzo Nobel N.V. (Netherlands)

- Axalta Coating Systems LLC (US)

- BASF SE (Germany)

- PPG Industries Inc. (US)

- Sherwin-Williams Company (US)

- Kansai Paint Co. Ltd. (Japan)

- Nippon Paint Holdings Co. Ltd. (Japan)

- Jotun (Norway)

- RPM International Inc. (US)

- The Dow Chemical Company (US)

- Wacker Chemie AG (Germany)

Recent Developments

- In November 2021, PPG Industries launched a new line of functional coatings for the automotive industry.

- In October 2021, stahl's performance coatings and polymers business was acquired by AkzoNobel.

Segments Covered in the Report:

By Product Type

- Corrosion-Resistant Coatings

- Wear-Resistant Coatings

By End-User

- Automotive

- Aerospace

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting