What is the Biocomposites Market Size?

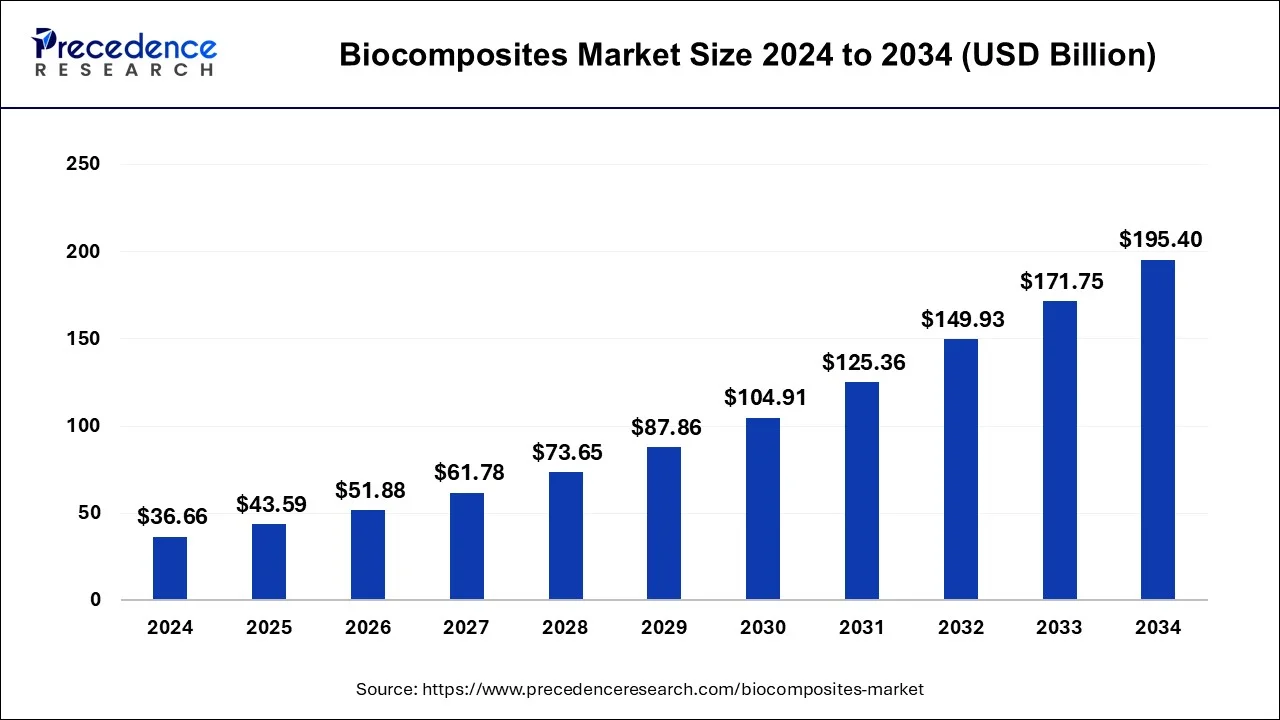

The global biocomposites market size is valued at USD 43.59 billion in 2025 and is predicted to increase from USD 51.88 billion in 2026 to approximately USD 195.40 billion by 2034, expanding at a CAGR of 18.22% from 2025 to 2034.

Biocomposites Market Key Takeaways

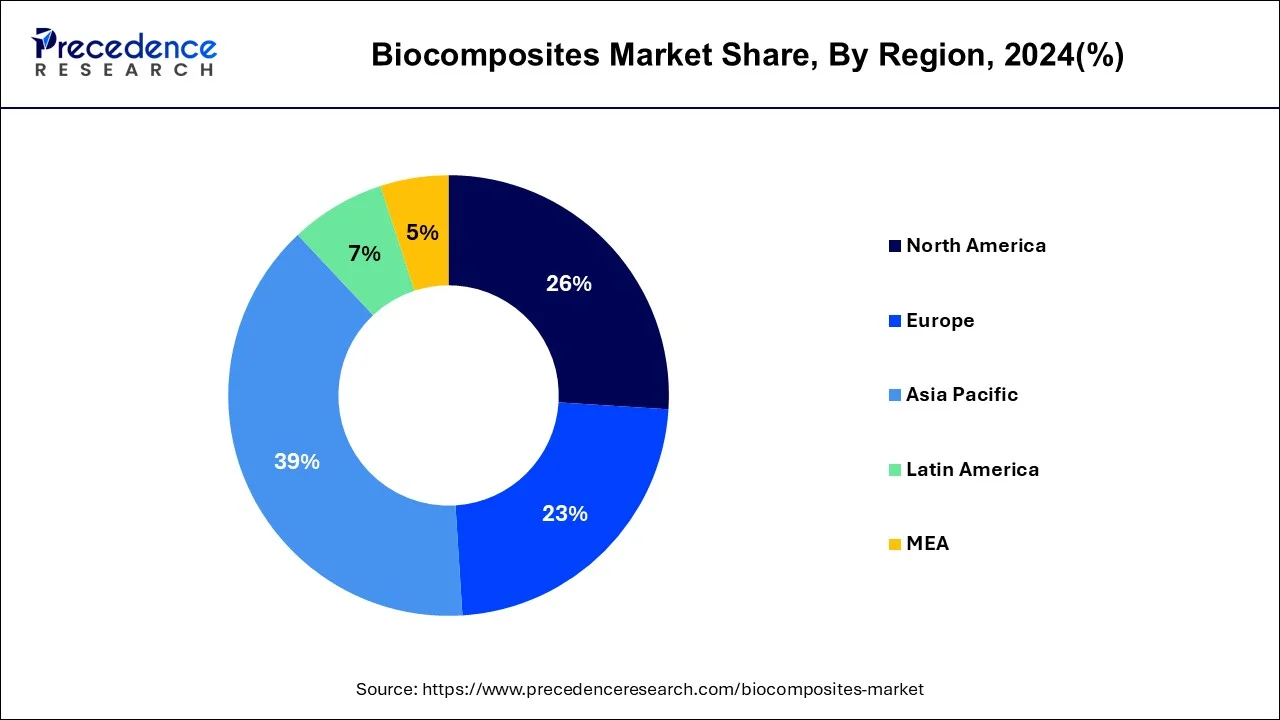

- Asia Pacific dominated the global biocomposites market with the largest market share of 39% in 2024.

- By end use, the transportation segment exhibited a revenue share of about 29% in 2024.

- By product, the green biocomposites segment hit the highest revenue share of 61% in 2024.

- By polymer type, the natural polymer segment has reached a revenue share of 59% in 2024.

- By fiber type, the wood fiber composites segment exhibited the largest revenue share in 2024.

Market Overview

With the help of the natural fibers like hemp flax, jute, industrial waste and wood and paper into polymer matrix are called biocomposites. Biocomposites are used in a large number of industries which range from automobiles to construction. As the bio composites are environment friendly the demand for biocomposites is expected to grow in the coming years. They offer a large range of benefits as they have better mechanical as well as physical properties due to which the market is expected to grow well in the coming years.

Although the use of bio composites in various industries like automotive packaging as well as construction had reduced due to the outbreak of COVID-19 pandemic recently the market is seen to grow as the restrictions across the world are relaxed. As the environmental laws adopted by various nations across the globe are becoming strict the bio composites market is expected to grow during the forecast period. Biocomposites are used as building materials as they are eco-friendly and they are preferred in the construction industry.

How is AI Influencing the Biocomposites Market?

AI is transforming the biocomposites market by accelerating material design and optimizing production processes. Machine learning algorithms help predict the mechanical properties and durability of new biocomposite formulations, reducing the need for extensive physical testing. AI-driven process automation improves manufacturing efficiency, lowers waste, and ensures consistent quality. Additionally, predictive analytics help companies forecast market trends and tailor products for applications in the automotive, construction, and packaging sectors.

Biocomposites Market Outlook

- Industry Growth Overview: The biocomposites market is projected to grow exponentially between 2025 and 2034. This is driven by stringent environmental regulations, growing consumer demand for sustainable materials, and the need for lightweight alternatives in industries such as building & construction, transportation, and consumer goods.

- Major Trends: Key trends include a strong shift toward bio-based, renewable materials derived from agricultural waste. There is increasing demand for low-VOC products, certified compostable materials, and cost-effective, energy-efficient production processes to reduce the overall carbon footprint.

- Major Investors:Investment is flowing into the sector from major chemical companies, private equity firms, and strategic investors drawn by strong growth potential and alignment with ESG goals. Key players driving innovation through R&D, acquisitions, and capacity expansion include Stora Enso, UPM, Universal Forest Products, Inc., and Trex Company, Inc.

- Startup Ecosystem:The startup ecosystem is maturing, with innovators focusing on cost-effective production, novel feedstock use, and advanced manufacturing techniques such as 3D printing with biocomposite filaments. Noteworthy examples include Bcomp, Ecovative, and Lingrove, which are securing VC funding to scale operations and develop new applications.

Biocomposites Market Growth Factors

As the demand for the durable materials and the materials that are eco-friendly has grown in the recent years in the manufacturing industry the bio composites market is expected to grow well during the forecast period. Biocomposites are gaining popularity as compared to the glass fiber as they have many health issues associated with the use of the product. And there are many other issues associated with the use of the plastic composites due to which the demand for biocomposites has grown in the recent years. awareness regarding the ill effects of using harmful composites has grown in the recent years and the environmental laws have also become strict due to which the demand for the sustainable materials have grown and they will drive the market growth in the coming years.

- The demand for the biocomposites is expected to grow in the coming years due to the various properties like the high tensile strength and less weight as compared to the other materials.

- Biodegradable nature of biocomposites is one of the major driving forces that will help in the growth of the market

- Lightweight strong materials are in great demand for the defense industry and the aerospace industry.

- The raw materials used in the manufacturing of bio composites are widely available do to which the market is expected to grow well

- Increased use of biocomposites in different types of industries will provide opportunities for the growth of the market.

- Demand for sustainable materials in the construction industry have grown in the recent years and it will help in boosting the market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 18.22% |

| Market Size in 2025 | USD 43.59 Billion |

| Market Size in 2026 | USD 51.88 Billion |

| Market Size by 2034 | USD 195.40 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Fiber Type, By Polymer Type, By Product, By Process Type, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

What are the drivers of the biocomposites market?

- Environment friendly government regulations - In many countries like Japan, Germany and the United States the governments are enacting laws in order to increase the use of environment friendly products in the construction industry or in any other industries. The demand for the biobased materials has increased in the recent years and the government is also engaged in increasing the usage of different materials that can be recycled. The demand for sustainable materials having increased in the manufacturing of the vehicles. The vehicle manufacturers are also seeking sustainable options.

- Increased application of Biocomposites - The demand for biocomposites have increased in various end user applications as these materials are eco-friendly. In the recent years biocomposites have replaced plastic composites and glass fiber as these two materials pose serious issues.

- Easily available raw materials - As the raw material used in the manufacturing of bio composites are widely available across the world the large-scale manufacturing of biocomposites is possible which will help in the growth of the market in the coming years.

What are the market challenges of the biocomposites market?

- Less tensile strength - When it comes to the tensile strength of carbon fiber or glass fiber, biocomposites do not possess that kind of a strength and this is one of the major reasons that will hinder the growth of the market in the coming years.

- Varying cost of the raw materials - As the cost of the raw materials keeps changing it affects the profit margin of the manufacturers as constant changes or fluctuations in the price will hamper the growth of the market. manufacturing process is one of the major reasons that will have a negative effect on the market.

- Thermal unstability- Thermal instability is one of the characteristics of the natural fibers and these fibers start degrading when the temperature reaches 392° F, due to which these fibers are not preferred in some of the manufacturing processes and this happens to be another challenge in the growth of the market.

Key Market Opportunities

- Economies of scale- the amount of energy that goes in the manufacturing of the carbon fibers or glass fibers is extremely high as compared to that of the biocomposites. Biocomposites are offered in the market at higher prices as compared to glass fibers or the carbon fibers. The prices of the biocomposites could be reduced in the coming years due to economies of scale and the increased use of biocomposites in common applications.

Fiber Type Insights

By fiber type, the wood fiber segment is expected to have a larger market share in the coming years period the demand for this type of fiber has grown due to its increased use in the outdoor construction activities. They are largely used in the construction of railings and decking. Apart from the use of the wood fibers the non-wood fiber segment is also expected to grow with a significant growth rate in the coming year. This type of a fiber is an alternative to the plastic fibers and the demand for the non-wood fibers is expected to grow in the packaging industry in the coming years.

Polymer Type Insights

Natural polymers segment is expected to grow well in the coming years. As that has been a growth in the use of the biodegradable products many consumers in various industries or demanding natural polymers. Rubber, wool cellulose and silk are the natural polymers that are used in the consumer products as well as the automotive industry.

Polyethylene polyester and nylon are the synthetic polymers available in the market synthetic polymers are being replaced by the organic or the natural substitutes and the natural polymers is expected to have greater demand in the coming years.

Product Insights

Based on product, the green biocomposite segment is expected to dominate the market in the coming years. this segment has dominated the market in the past with the largest market share in terms of revenue and it will continue to grow during the forecast period. The demand for this type of product is expected to grow in the coming years as it does not cause any harm to the environment. In most of the developed regions across the world like Europe and North America there has been a growth in the demand of these materials.

Green biocomposites have 100% biodegradability and this is one of the factors that will drive the market growth in the coming years. When it comes to the hybrid variants the demand for these products is expected to grow as they are lightweight and they also have higher strength but when it comes to biodegradability, they are not completely degradable

End User Insights

When it comes to the end user of biocomposites the transportation segment is expected to have the largest market share in the coming years. As bio composites are used in the manufacturing of the trucks and cars of various types the use of biocomposites is expected to grow in the coming years. Biocomposites are also used in the making of the interior panels. The use of these materials is expected to grow in the coming years as they help in reducing the weight of the vehicle and improves the efficiency. The manufacturing cost of the vehicle can also be reduced to a great extent due to the use of the biocomposites.

Regional Insights

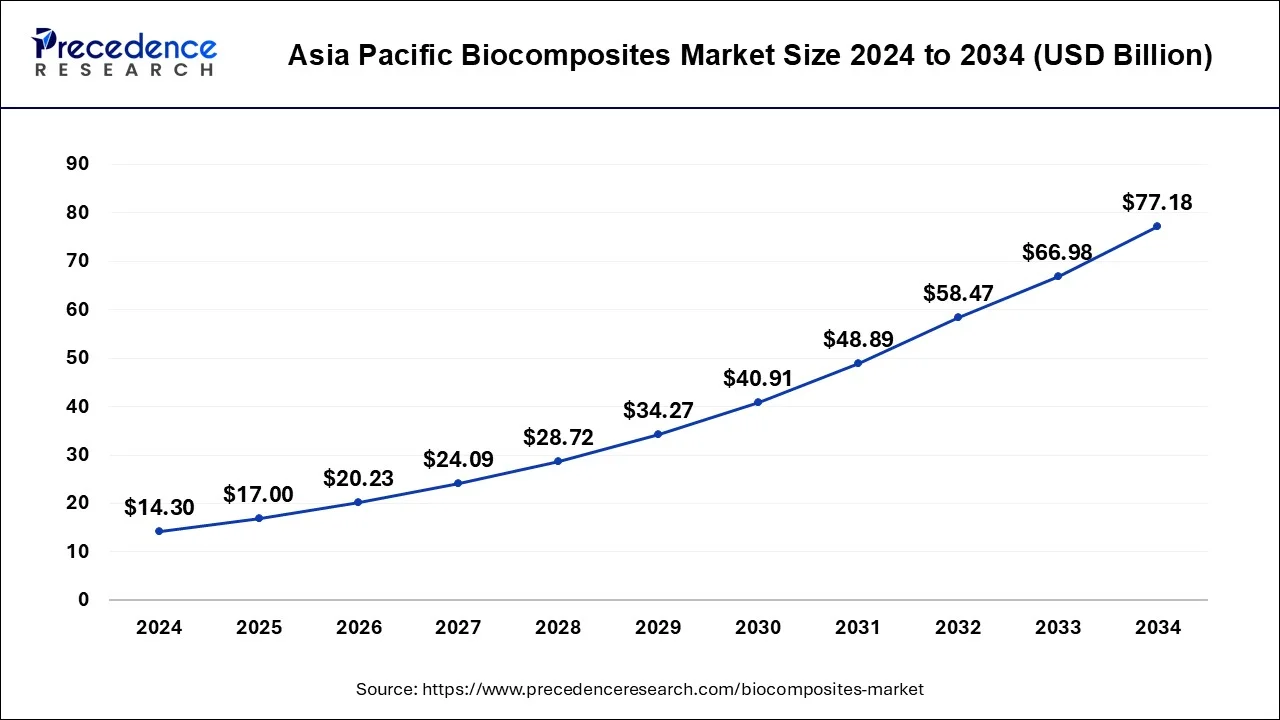

Asia Pacific Biocomposites Market Size and Forecast 2025 To 2034

The Asia Pacific biocomposites market size is evaluated at USD 17 billion in 2025 and is anticipated to be worth around USD 77.18 billion by 2034, poised to grow at a CAGR of 18.36% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Biocomposites Market?

Asia Pacific has emerged as the dominant region in the biocomposites market due to rapid industrialization, a growing automotive and construction sector, and increasing environmental regulations favoring sustainable materials. The availability of raw materials such as natural fibers and biopolymers at competitive costs further supports market growth. Additionally, strong government initiatives promoting green manufacturing and R&D investments in eco-friendly materials have accelerated adoption across key countries like China and India. The presence of major manufacturers and a large consumer base also reinforces the region's leadership in the market.

India Biocomposites Market Trends

India plays a distinctive role in the market, driven by abundant natural fiber resources and cost-effective manufacturing capabilities. As the world's fastest-growing composites market, India is seeing increased adoption across the building, construction, and transportation industries. Government policies promoting a bioeconomy and self-sufficiency encourage domestic production, with major conglomerates investing in large-scale composite facilities. India is positioning itself as a key exporter of natural fibers and an emerging hub for manufacturing cost-efficient composite products that meet global standards.

What Potentiates the Growth of the Biocomposites Market in North America?

The growth of the biocomposites market in North America is driven by increasing demand for lightweight and sustainable materials in the automotive, aerospace, and construction sectors. Strict environmental regulations and government incentives promoting the use of eco-friendly and biodegradable materials are encouraging manufacturers to adopt biocomposites. Advances in R&D and the presence of established key players also support innovation and commercialization of high-performance biocomposite products. Additionally, growing consumer awareness of sustainability is further boosting market adoption across various end-use industries.

U.S. Biocomposites Market Trends

The U.S. is a leading and mature player in the North America biocomposites market, acting as a major consumer, technology innovator, and R&D hub. Fueled by strict environmental laws and the demand for sustainable, lightweight materials in the automotive and construction industries, the market benefits from programs like the U.S. BioPreferred Program. U.S. companies such as Trex and Fiberon are prominent innovators in wood-plastic composites used in decking and construction.

How is the Opportunistic Rise of Europe in the Biocomposites Market?

Europe's rise in the biocomposites market is being fueled by stringent environmental regulations, growing emphasis on circular economy practices, and strong government support for sustainable materials. The region is witnessing increased adoption of biocomposites in automotive, packaging, and construction industries to reduce carbon footprints and comply with EU sustainability targets. Investment in R&D and innovation hubs, particularly in Germany, France, and the Nordic countries, is accelerating the development of high-performance, eco-friendly biocomposite solutions. Additionally, collaborations between manufacturers, research institutes, and startups are enhancing technology transfer and market penetration.

Germany Biocomposites Market Trends

Germany holds a significant position in the European biocomposites market, driven by its strong engineering sector, a mature automotive industry, and a deep commitment to sustainability. The country is at the forefront of technological innovation in biocomposites, focusing on high-performance materials for demanding applications like automotive interior components and advanced building materials. The presence of key chemical and materials science companies, along with government funding for bio-based research, fosters a strong ecosystem for market growth.

A Deep Dive into the Latin American Biocomposites Landscape

The biocomposites market in Latin America is an emerging yet rapidly growing sector, fueled by sustainability requirements, plentiful natural fiber resources, and an increasing focus on lightweight, eco-friendly materials across multiple industries. The region benefits from rich agricultural biodiversity, offering accessible natural fibers like bagasse, sisal, and bamboo that serve as cost-effective reinforcements for polymers. Countries such as Brazil and Colombia are at the forefront, investing in R&D to convert agricultural waste into valuable industrial inputs and attracting foreign investment in sustainable manufacturing.

Brazil Biocomposites Market Trends

Brazil is a key player in the Latin American biocomposites market, mainly because of its large agricultural sector and focus on bio-based production. The country has a substantial supply of sugarcane bagasse, an important raw material for biocomposite products. Brazilian companies and research institutions are actively developing these materials for use in automotive interiors, packaging, and building materials, aligning with the country's strong biofuels and bioplastics industries. This drives market growth and attracts investments in production facilities and technological innovation.

What Factors Support the Growth of the MEA Biocomposites Market?

The MEA biocomposites market is in its early stages but has significant growth potential, mainly driven by efforts to diversify economies, achieve sustainable development goals, and manage agricultural waste. Although traditional materials still dominate, countries like South Africa, the UAE, and Morocco are exploring the use of natural fibers such as date palm and jute in composite materials for construction and non-structural uses. This expansion is fueled by increasing awareness of the environmental benefits of biocomposites and government policies aimed at reducing carbon footprints in industrial sectors.

Saudi Arabia Biocomposites Market Trends

Saudi Arabia's biocomposites market is an emerging sector within its broader economic diversification strategy. The country is leveraging locally available resources, such as date palm waste, to produce value-added composite materials. The primary focus is on applications in construction, furniture, and packaging to satisfy domestic demand for sustainable products. Although the market remains small now, government initiatives promoting research into sustainable materials and emphasizing circular economy principles are expected to foster future investment and technological progress.

Value Chain Analysis

- Biomass Feedstock Supply & Processing

This stage involves sourcing and processing renewable materials, such as wood and natural fibers, into usable forms.

Key Players: flax processors and wood pulp mills. - Matrix Material Supply (Polymers/Resins) & Processing

This provides the polymers that bind the fibers, including both fossil-based and bio-based options.

Key Players: BASF, Dow, and NatureWorks. - Research and Development (R&D) & Material Formulation

Focuses on innovating new biocomposite formulations to enhance mechanical properties and cost-effectiveness.

Key Players: Fiberon and Trex Company.Compounding, Manufacturing, and Production - stage involves compounding the fibers and matrix, then manufacturing final or intermediate products using techniques like extrusion and injection molding.

Key Players: Trex Company, Fiberon, UFP Industries, Majestic Forest Products. - Distribution and Supply Chain Management

This stage manages the delivery of both raw materials and finished products to end-user industries.

Key Players: Builders, FirstSource. - Application and End-User Assembly

Biocomposite products are used in various final applications, including construction, automotive interiors, and consumer goods.

Key Players: Ford, Toyota, IKEA. - End-of-Life Management

The final stage focuses on sustainable disposal through recycling, energy recovery, or composting.

Key Players: Republic Services, Veolia, Suez.

Top Companies in the Biocomposites Market and Their Offerings

- Trex Company: Wood-plastic composite decking, railing, and outdoor living products using reclaimed wood and recycled plastic.

- UPM: UPM ProFi (decking/fencing) and UPM Formi (granulates for injection molding) using post-consumer plastics and wood fibers.

- Universal Forest Products: Composite decking and outdoor products, and automotive natural fiber composites (door panels, seat backs).

- Fiberon LLC:Wood-plastic composite (WPC) decking, railing, and cladding products for residential and commercial buildings.

- FlexForm Technologies:Natural fiber composite mats and panels for automotive interior components like door panels and headliners.

Recent Developments

- Advanced Environmental Recycling Technologies had focused on investing more into research and development activities which will help them in maintaining their market position and to enter other untapped markets.

- In the year 2021, Retrac Group Its plans to offer wide range of biocomposites of the natural type. This new strange of products exhibit the qualities of carbon fiber and natural fiber which can be used in the making of lightweight structures

Segments covered in the report

By Fiber Type

- Wood Fiber Composites

- Non-Wood Fiber Composites

- Jute fiber

- Flax fiber

- Kenaf fiber

- Hemp fiber

- Others

By Polymer Type

- Synthetic Polymers

- Natural Polymers

By Product

- Hybrid

- Green

By Process Type

- Compression Molding

- Injection Molding

- Resin Transfer Molding

- Extrusion molding process

- Others

By End User

- Transportation

- Consumer Goods

- Construction and Building

- Electrical and Electronics

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting