What is the Biodegradable Agrochemicals Market Size?

The global biodegradable agrochemicals market is witnessing rapid growth as farmers adopt eco-friendly pesticides, herbicides, and fertilizers to protect crops and soil.The market is witnessing substantial growth due to increasing environmental concerns over traditional synthetic pesticides. Demand for organic food and sustainable agricultural practices is pushing consumers and regulators toward safer crop protection alternatives. Government initiatives and incentives that promote the use of biopesticides and organic farming further contribute to market growth.

Biodegradable Agrochemicals Market Key Takeaways

- Europe held the largest share of the biodegradable agrochemicals market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By product type, the biodegradable herbicides segment held the largest market share in 2024.

- By product type, the biodegradable fertilizers / plant growth regulators segment is expected to witness the fastest growth during the foreseeable period.

- By source, the bio-based segment dominated the market with a major share in 2024.

- By source, the synthetic biodegradable segment is expected to grow at the fastets CAGR from 2025 to 2034.

- By crop type, the cereals and grains segment held the largest market share in 2024.

- By crop type, the fruits and vegetables segment is expected to expand the fastest CAGR during the foreseeable period.

- By packaging type, the biodegradable films and sachets segment held the largest market share in 2024.

- By packaging type, the biodegradable coatings / capsules segment is expected to witness the fastest growth during the foreseeable period.

- By end-user, the large-scale farms segment held the largest market share in 2024.

- By end-user, the smallholder farmers segment is expected to grow at the fastest CAGR during the forecast period.

- By distribution channel, the agrochemical retailers / distributors segment dominated the market in 2024.

What are Biodegradable Agrochemicals?

As consumers and regulators become more aware of environmental and health issues, the demand for sustainable alternatives to synthetic agrochemicals has grown significantly. Biodegradable agrochemicals are agricultural chemical products that naturally break down in the environment, reducing harmful chemical residues and long-term ecological damage. This category encompasses pesticides, herbicides, fungicides, fertilizers, and other crop protection or plant growth products formulated with biodegradable active ingredients, carriers, or packaging that decompose into non-toxic residues. This process lessens environmental persistence, soil and water contamination, and ecological risks while maintaining agricultural effectiveness.

Key Technological Shift in the Biodegradable Agrochemicals Market Driven by AI

Artificial intelligence (AI) is significantly transforming the biodegradable agrochemicals market by accelerating the discovery and development of new bio-based products, optimizing their application through precision agriculture, and enhancing environmental monitoring for sustainable farming. AI models can simulate the degradation of agrochemicals under various environmental conditions, including soil, water, and air, thereby helping to create more sustainable and eco-friendly products. AI-driven systems can forecast pest outbreaks, detect early signs of disease, and monitor plant health, enabling targeted application of biopesticides and reducing overall usage.

Biodegradable Agrochemicals Market Outlook

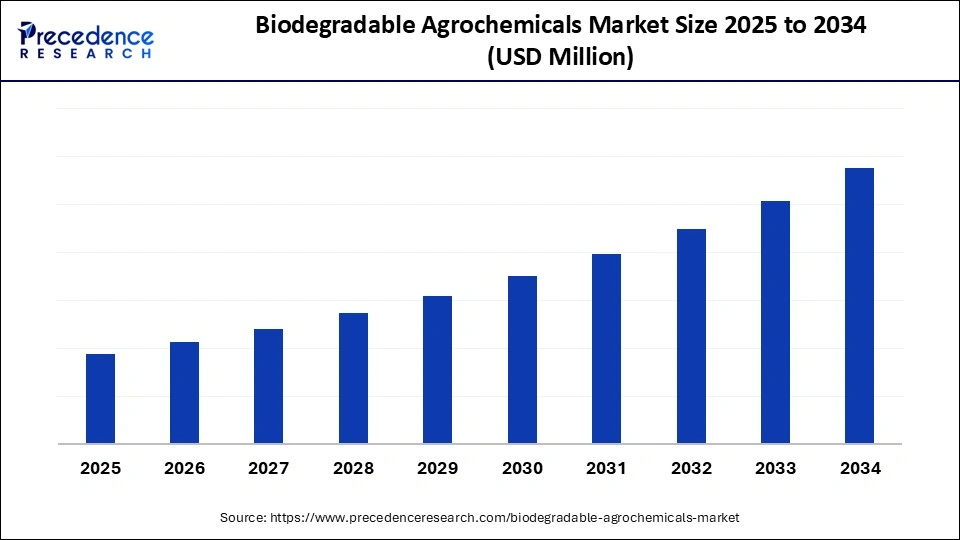

- Industry Growth Overview: From 2025 to 2034, the market is expected to experience rapid growth, driven by increasing demand for value-added and functional products. Increasing regulatory restrictions on chemical residues (e.g., in the EU and Japan), stricter export requirements, pesticide tax regimes, and consumer demand for zero-residue or low-residue products are driving growers toward biodegradable options.

- Sustainability Trends: The shift toward more sustainable agricultural practices is fueling the demand for bio-based polymers, green solvents, and low-VOC (Volatile Organic Compound) coatings within the agrochemical sector.

- Global Expansion: Leading agrochemical players are expanding into emerging markets, such as Southeast Asia, Eastern Europe, and Latin America, to be closer to customers and leverage favorable regulatory environments.

- Major Investors: Private equity and strategic investors are actively entering the specialty agrochemicals space, attracted by high profit margins, technical barriers to entry, and strong Environmental, Social, and Governance (ESG) alignment.

- Startup Ecosystem: The agrochemical startup landscape is maturing, with a particular focus on green chemistry and enzyme-based synthesis. Startups like Solugen (U.S.) and EnzymoCore (India) are attracting venture capital by developing and scaling sustainable, bio-based alternatives to traditional petrochemical-based agrochemical processes.

Market Scope

| Report Coverage | Details |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Source, Crop Type, Packaging Type, End-User, Distrubution channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Global Demand for Food

A major factor driving the growth of the biodegradable agrochemicals market is the rising global demand for food to support a growing population, along with increasing regulatory pressure for sustainable farming practices. Consumers are increasingly shifting toward organic foods. As understanding of the negative effects of synthetic agrochemicals on the environment and human health grows, there is a shift toward safer, biodegradable alternatives. The rising demand for organic foods, which ban the use of synthetic chemicals, directly fuels the need for biopesticides and other natural agrochemical solutions.

Restraint

Lack of Clear and Harmonized Regulatory Frameworks

The primary challenge facing the biodegradable agrochemicals market is the lack of clear and harmonized regulatory frameworks worldwide, which results in slow registration processes and limits market growth. A significant obstacle is the absence of standardized regulations for biodegradable and biological agrochemicals across different countries and regions. This lack of clear and consistent guidelines results in lengthy and complex registration procedures for new biological products, hindering their market entry and widespread adoption.

Opportunity

Development and Adoption of Bio-Based Solutions

A key future opportunity in the biodegradable agrochemicals market lies in developing and adopting bio-based solutions, such as biopesticides and biofertilizers, driven by the increasing demand for organic farming and sustainable practices. Advanced technologies such as GPS, sensors, and AI, combined with biodegradable agrochemicals designed for more precise and targeted application, can reduce overall environmental impact and enhance efficiency. Additionally, consumers and regulatory agencies are advocating for more environmentally friendly agricultural practices, encouraging broader adoption of sustainable, biodegradable agrochemicals.

Segment Insights

Product Type Insights

What Made Biodegradable Herbicides the Dominant Segment in the Market in 2024?

The biodegradable herbicides segment dominated the biodegradable agrochemicals market in 2024. This is mainly due to environmental concerns about synthetic herbicides, which drives the demand for eco-friendly alternatives. Increased consumer focus on organic farming and stricter regulations also supported the segment's dominance. Advances in developing bio-based compounds, such as plant extracts and microbial bioherbicides like Devine, Collego, and Biomal, make herbicides a viable option for weed management. Government policies and regulations promoting sustainable agricultural practices boost the adoption of biodegradable herbicides.

The biodegradable fertilizers / plant growth regulators segment is expected to grow at the fastest rate in the upcoming period. The segment growth is driven by increasing consumer interest in organic food and stricter environmental regulations. There is a strong need to improve crop yields and quality, and rising awareness among farmers about the long-term benefits of bio-based products further fosters this segment's growth. Biodegradable fertilizers and plant growth regulators improve soil health, enhance nutrient availability, and promote plant development, resulting in improved crop quality and higher yields.

Source Insights

How Does the Bio-Based Segment Dominate the Biodegradable Agrochemicals Market in 2024?

The bio-based segment dominated the market with the largest share in 2024. The segment's dominance stems from environmental benefits, alignment with consumer demand for sustainable products, and technological improvements that enhance performance and reduce costs. This shift away from traditional synthetic agrochemicals toward bio-based alternatives, such as biofertilizers, biopesticides, and biostimulants, sourced from plants, microorganisms, and other renewable resources, is supported by innovations like nanoencapsulation for the sustained release of active ingredients. This makes them competitive with or superior to synthetic options.

The synthetic biodegradable segment is expected to experience the fastest growth during the forecast period. This is primarily due to stringent environmental regulations and increasing consumer demand for sustainable products, which favors cost-effective, high-performance biodegradable synthetics like polylactic acid over other options. These materials offer properties similar to those of conventional plastics, can be customized for specific uses, and have a lower environmental impact than traditional plastics. Innovations such as blending with nanomaterials are improving the performance of synthetic biodegradable polymers.

Crop Type Insights

Why Did the Cereals & Grains Segment Dominate the Biodegradable Agrochemicals Market in 2024?

The cereals & grains segment dominated the market in 2024. This is due to the high consumption and large-scale cultivation of staples such as wheat, rice, and corn, driven by their critical role in global food security. These crops are essential for feeding the growing population and for animal feed, resulting in high demand for crop protection solutions, including biodegradable agrochemicals, to ensure high yields and quality while meeting regulatory and consumer standards for residue-free food products.

The fruits & vegetables segment is expected to grow at the fastest CAGR in the coming years. The growth of this segment is driven by high demand for nutrient-rich and disease-resistant produce, increased consumer preference for safe and organic options, and the specific needs of fruits and vegetables cultivation for gentle, specialized agrochemicals. Growing emphasis on sustainability and stricter regulations on chemical use promote the adoption of biodegradable solutions, ensuring quality and compliance without chemical residues.

Packaging Type Insights

How Does the Biodegradable Films & Sachets Segment Dominate the Market in 2024?

The biodegradable films & sachets segment dominated the biodegradable agrochemicals market in 2024. This is primarily due to their flexibility, cost-effectiveness, and superior barrier properties, which make them ideal for various agrochemical products and agricultural applications, aligning with the rising demand for sustainable packaging. These materials offer excellent protection against moisture, oxygen, and environmental factors, thereby extending product shelf life and efficacy. They also provide a sustainable alternative to conventional plastics by reducing waste and facilitating better durability and targeted delivery.

The biodegradable coatings & capsules segment is expected to grow at the fastest rate over the forecast period due to improved product efficacy, environmental benefits, and advancements in materials science that enable the controlled release of active ingredients. This gradual release of agrochemicals improves their effectiveness and reduces the frequency of application. Innovative encapsulation techniques, such as responsive microcapsules and nanocapsules, offer improved durability and targeted delivery, thereby minimizing waste and pollution compared to traditional plastics.

End-User Insights

Why Did the Large-Scale Commercial Farms Hold the Largest Market Share in 2024?

The large-scale commercial farms segment held the largest share of the biodegradable agrochemicals market in 2024 due to their capacity to invest in new technologies, higher demand for sustainable large-scale crop solutions, and potential for cost savings through early adoption. To maintain high yields and profitability, these large operations are seeking sustainable solutions that can protect large crop areas from pests and diseases without causing environmental harm, thereby driving demand for effective biodegradable products that aim for operational efficiency.

The smallholder farmers segment is expected to grow at the fastest rate in the upcoming period as they increasingly seek cost effective, low-residue solutions to manage pests and boost yields under tight resource constraints. They are more sensitive to regulatory pressures and consumer demand for safer, more sustainable food, which is pushing the adoption of biofertilisers, biopesticides, and other biodegradable options.

Distribution Channel Insights

Why Did the Agrochemical Retailers / Distributors Segment Lead the Market in 2024?

The agrochemical retailers / distributors segment led the market in 2024, as retailers/distributors are the most accessible link between manufacturers and farmers, especially in regions where trust and local relationships matter. Supported by strong regional distribution networks, these intermediaries ensure product availability even in remote areas where online and e-commerce penetration is low. They also offer value-added services, product demonstrations, agronomic guidance, credit, and small packaging options that help overcome adoption barriers for biodegradable agrochemicals.

Regional Insights

What Made Europe the Dominant Region in the Biodegradable Agrochemicals Market?

Europe dominated the biodegradable agrochemicals market in 2024, primarily due to stringent EU regulations promoting sustainability, strong consumer demand for eco-friendly products, and government initiatives such as the EU's Sustainable Food System Strategy. Countries like Germany are at the forefront, leveraging advanced research and adopting bio-based solutions to meet environmental targets. Initiatives like Horizon Europe's focus on farming innovation and the increased use of biopesticides and biofertilizers indicate a regional shift towards more sustainable practices.

Germany Biodegradable Agrochemicals Market Trends

Germany plays a key role in the market, driven by stringent regulations, such as the EU Green Deal, and rising consumer demand for organic produce. This has accelerated R&D efforts by major German companies, such as BASF and Bayer AG, which are heavily investing in bio-based and biodegradable solutions, including biopesticides and innovative seed coatings, thereby supporting sustainable and precision agriculture, aided by government initiatives.

Why is Asia Pacific Considered the Fastest-Growing Market for Biodegradable Agrochemicals?

Asia Pacific is expected to experience the fastest growth during the forecast period. This is primarily due to a large agricultural base, a high population, growing demand for food security, and increased awareness among farmers of sustainable solutions. Rapid urbanization and industrialization contribute to increased food demand, driving intensive farming practices that further necessitate yield-enhancing, environmentally friendly agrochemicals. Nations like China and India are experiencing rapid population increases, which drives up food demand and the need for sustainable methods to enhance crop yields and ensure food security.Government initiatives, including subsidies and policies that promote modern agriculture and green technologies, are also driving the market's growth.

Country-level Investments & Funding Trends for the Biodegradable Agrochemicals Market

- India: Government initiatives like PKVY and Agri Seed Funding offer substantial support for organic farming and agritech startups (e.g., funding up to ₹25 lakh for startups). Companies like UPL are expanding R&D, potentially including IPOs for subsidiaries like Advanta. Notable startup investments include GROWiT and Ukhi.Strong interest is evident from investment commitments worth over ₹1.02 lakh crore at World Food India 2025, underscoring the importance of sustainable practices.

- U.S.: USDA provides grants (e.g., $11 million to Innovafeed) and programs to boost domestic organic fertilizer production and sustainable agriculture.

Strong venture capital flows support biotech startups, such as Vestaron, that develop biopesticides, as well as plant-based and precision agriculture solutions.

Major players, such as Corteva Agriscience, are investing in sustainable technologies and partnerships, including collaborations on eco-friendly fertilizer programs. - Europe: The EU funds programs like Horizon Europe, with significant investments in projects such as CROPSAFE (€4.9M), which focuses on bio-based pest control.

Corporations such as BASF and Bayer are heavily investing in biopesticide research and development, as well as production facilities, including new plants in - Germany: he European Investment Bank (EIB) provides venture debt and funding, exemplified by the €20 million investment in Dutch startup Solynta.

Biodegradable Agrochemicals Regulatory Landscape: Global Regulations

| Country | Regulatory Body | Key Regulations | Initiatives |

| U.S. | EPA (BPPD) |

FIFRA: Governs pesticide registration. FFDCA: Determines safe residue levels. |

Offers a streamlined, faster biopesticide registration process with fewer data requirements. |

| EU | EFSA and EC | Regulation (EC) No 1107/2009: Governs authorization of plant protection products. | Farm to Fork Strategy: Promotes sustainable farming. Streamlined approval for microorganisms. |

| India | CIBRC | Insecticides Act, 1968: Updated guidelines for biopesticides. | Uses a simpler provisional registration system (Sec 9(3b)) to encourage market entry for new biopesticides |

| China | MARA & ICAMA | Regulations (2017): Modernized pesticide management, including biopesticides. | Green Agriculture Plan: Promotes eco-friendly products via incentives and subsidies. |

| Brazil | MAPA, ANVISA, IBAMA | Decree No. 10,833 (2021): Updates rules to facilitate biopesticide innovation. |

Coordinates approval across three agencies; offers Special Temporary Registration (RET). |

Top Companies in the Biodegradable Agrochemicals Market

Tier I – Major Players (~40 50% of Market Share)

- Bayer AG

- Syngenta AG

- BASF SE

- Corteva Agriscience

- UPL Limited

These are large agrochemical / crop protection companies with strong biopesticide / biological product portfolios, global reach, strong R&D, and regulatory capability.

Tier II – Mid Level Contributors (≈ 25 35% of Market Share)

- Certis USA

- Koppert Biological Systems

- Marrone Bio Innovations

- Valent BioSciences

- Novozymes

These are moderately large or bio focused companies that are specialized in biopesticides / biodegradable inputs, often with strong regional presence or in certain product niches.

Tier III – Niche / Regional / Emerging Players (≈ 10 20% of Market Share)

- Andermatt Biocontrol

- BioWorks Inc.

- Isagro

- Gowan Company

- Other local biopesticide or biodegradable agrochemical manufacturers

These are smaller companies, regional players, or emerging firms with more limited scale, or focused on specific geographies or niche applications.

Recent Developments

- In January 2025, Super Crop Safe Ltd. launched its groundbreaking product, Super Gold WP+, a unique combination of inoculant mycorrhiza and other essential nutrients. This innovative solution is designed to revolutionize farming practices by significantly reducing the consumption of chemical fertilizers like urea and DAP while enhancing crop productivity.(Source: https://www.global-agriculture.com)

- In April 2025, BASF is set to launch Sokalan CP 301, its first readily biodegradable dispersant for the agrochemical market, in response to global regulations like the EU Green Deal. BASF claims this new dispersant meets biodegradability criteria while maintaining high performance and storage stability, as remarked by Laszlo Szarvas, VP of Research & Development.(Source: https://www.basf.com)

- In January 2024, Bionema Group unveiled Soil-Jet BSP100, a biodegradable surfactant designed to boost the efficacy of biologicals and agrochemicals, promote plant health, and optimize irrigation practices. CEO Dr. Minshad Ansari praised it as a significant advancement for sustainable agriculture.

(Source: https://agrospectrumindia.com)

Segments Covered in the Report

By Product Type

- Biodegradable Herbicides

- Biodegradable Insecticides

- Biodegradable Fungicides

- Biodegradable Fertilizers / Plant Growth Regulators

- Other Biodegradable Crop Protection Products

By Source

- Bio-based

- Synthetic biodegradable

By Crop Type

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Plantation Crops

- Turf & Ornamentals

By Packaging Type

- Biodegradable Films & Sachets

- Biodegradable Bottles & Containers

- Biodegradable Coatings / Capsules

By End-User

- Large-scale Commercial Farms

- Smallholder / Individual Farmers

- Research Institutes & Agro R&D

- Public Sector / Government Programs

By Distribution Channel

- Direct Sales (to large farms, agro-industrials)

- Agrochemical Retailers / Distributors

- Online / E-commerce Platforms

- Cooperatives & Government Procurement Programs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting