What is the Biological Indicators Market Size?

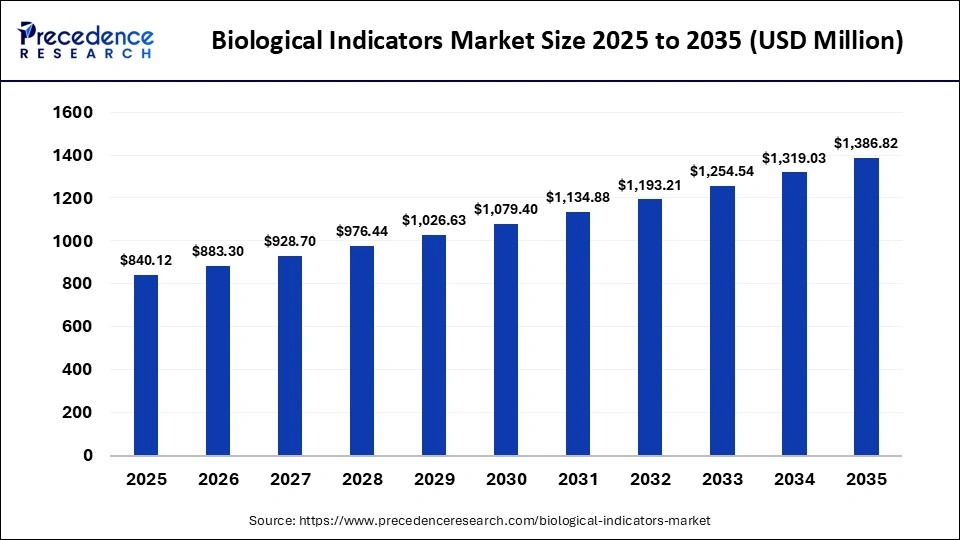

The global biological indicators market size was calculated at USD 840.12 million in 2025 and is predicted to increase from USD 883.30 million in 2026 to approximately USD 1386.82 million by 2035, expanding at a CAGR of 5.14% from 2026 to 2035.The market is witnessing substantial growth due to the increasing prevalence of healthcare-associated infections (HAI), mandatory sterilization standards, and technological advancements in rapid-readout sterilization monitoring.

Market Highlights

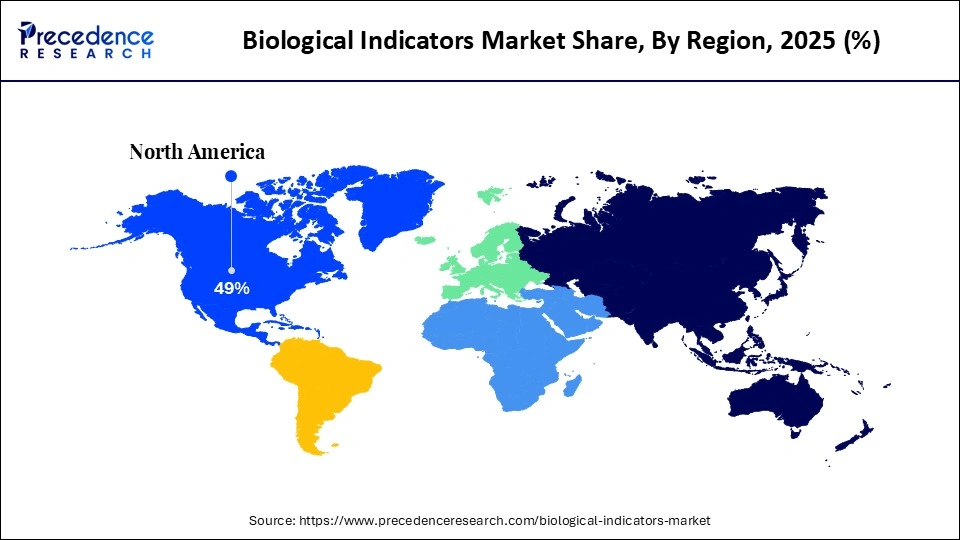

- North America dominated the market with a major share of around 42% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 8.5% between 2026 and 2035.

- By product/type, the self-contained biological indicators segment held the biggest market share of around 64% in 2025 and is expected to grow at a 7.3% CAGR in the coming years.

- By sterilization method, the steam sterilization segment accounted for the largest market share of about 55% in 2025.

- By sterilization method, the hydrogen peroxide sterilization segment is expected to grow at a solid CAGR of 7.2% between 2026 and 2035.

- By end use/application, the hospitals & clinics segment held a major market share of around 50% in 2025.

- By end use/application, the pharmaceutical companies/biopharma segment is expected to expand at a notable CAGR from 2026 to 2035.

What are Biological Indicators?

Biological indicators are sterilization monitoring tools that contain highly resistant microorganisms to validate sterilization efficacy in healthcare, pharmaceutical, and related environments. They confirm that sterilization processes have successfully inactivated targeted microbes, ensuring safety and compliance with regulatory standards. Widely used in hospitals, clinics, pharma manufacturing, and laboratories, biological indicators support infection control, quality assurance, and process validation, driving demand amid rising surgical procedures, stringent sterilization requirements, and expanding global healthcare infrastructure.

How is AI Transforming the Biological Indicators Market?

Artificial intelligence (AI) is transforming the biological indicators market by enabling real-time monitoring, automating data interpretation, and improving sterilization accuracy in healthcare and pharmaceuticals. AI-powered incubators continuously monitor environmental conditions, automatically adjusting parameters to maintain optimal sterilization conditions and reduce human error. AI improves the speed and accuracy of interpreting biological test results, reducing the risk of false positives or negatives. AI optimizes supply chain and inventory management for BIs, predicting demand and improving efficiency.

What are the Major Trends Influencing the Biological Indicators Market?

- Rapid Readout and Molecular Diagnostics: The industry is moving away from traditional 24-48-hour spore tests toward rapid-readout biological indicators, which provide results in 1-4 hours using fluorescence technology.

- Demand for Self-Contained Biological Indicators: There is a strong preference for SCBIs, which contain both the spore carrier and growth media in one vial, significantly reducing the risk of cross-contamination and user-handling errors compared to traditional strips.

- Expanding Digitization and Data Connectivity: Modern biological indicator systems are increasingly integrated with digital incubators and smart software, enabling automatic recording, real-time tracking of sterilization loads, and automated, audit-ready documentation.

- Advanced Sterilization Monitoring in Pharma and Healthcare: Due to increased regulatory pressure and higher surgical volumes, there is a greater focus on comprehensive sterilization validation, particularly in pharmaceutical, manufacturing, and hospital central sterile supply departments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 840.12 Million |

| Market Size in 2026 | USD 883.30 Million |

| Market Size by 2035 | USD 1386.82 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.14% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product/Type , Sterilization Method , End Use/Application , and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product/Type Insights

How is the Self-Contained Biological Indicators Segment Dominating the Biological Indicators Market?

The self-contained biological indicators segment dominated the market with a major share of approximately 64% in 2025 and is expected to maintain its growth trajectory throughout the forecast period. This is mainly due to their superior safety, quick readout times, and high reliability in steam and hydrogen peroxide sterilization processes. The increasing adoption of these indicators is driven by stringent FDA and CDC guidelines that emphasize the need for validated sterilization monitoring during steam and hydrogen peroxide processes. Their closed, user-friendly design minimizes contamination risks and meets strict regulatory requirements, leading to high adoption rates in hospitals and the pharmaceutical industry.

The cards / rapid readout BIs segment is expected to grow at a notable rate in the upcoming period because they provide faster results compared to traditional indicators, allowing healthcare and pharmaceutical facilities to verify sterilization processes in real time. This rapid feedback helps reduce downtime, improve workflow efficiency, and enhance patient safety by ensuring that sterilization is effective before equipment or instruments are used. Additionally, the growing emphasis on operational efficiency, regulatory compliance, and infection control is encouraging facilities to adopt these quick-read solutions over slower, conventional methods.

Sterilization Method Insights

What Made Steam Sterilization the Leading Segment in the Biological Indicators Market?

The steam sterilization segment led the market with a major share of around 55% in 2025. This is because steam sterilization is regarded as the gold standard for sterilizing reusable medical instruments in hospitals and central sterile supply departments. The widespread and routine use of steam autoclaves ensures a continuous high demand for compatible biological indicators. The rise in strict regulatory guidelines to prevent healthcare-associated infections further fuels the need for reliable sterilization monitoring, with increasing focus on self-contained biological indicator ampoules, which provide rapid and accurate results in steam cycles.

The hydrogen peroxide sterilization segment is expected to grow at the fastest CAGR of 7.2% during the projection period. The growth of this segment is largely driven by its rapid, low-temperature, and residue-free process, making it ideal for heat-sensitive instruments. The growing utilization of delicate, high-end medical devices in hospitals and clinics necessitates gentler sterilization methods, making hydrogen peroxide a preferred choice. Additionally, greater adoption in healthcare, rising demand for efficient sterilization solutions, and stringent regulatory compliance for monitoring further contribute to this growth, as quick results confirm sterilization efficiency.

End Use/Application Insights

Why Did the Hospitals & Clinics Segment Dominate the Biological Indicators Market?

The hospitals & clinics segment dominated the market by holding about 50% share in 2025, primarily due to the high volume of surgical instrument sterilization, an increase in surgical procedures, and strict infection control protocols that require reliable, direct measurement of sterility. The growing prevalence of chronic diseases has led to more hospital admissions and surgeries, thus heightening the demand for sterilized equipment. The rise in hospital-acquired infections also necessitates strict adherence to sterilization protocols, leading to greater reliance on biological indicators for verifying effective sterilization.

The pharmaceutical companies/biopharma segment is expected to grow at the fastest rate during the forecast period. This is mainly due to the increasing demand for stringent sterilization validation of injectables, biologics, and vaccines to ensure patient safety and comply with evolving FDA and EMA regulations. The rise in the production of complex drugs, sterile products, and personalized medicines drives the need for rigorous microbial contamination control, propelling the adoption of highly accurate and reliable biological indicators necessary for validating advanced, high-risk sterilization methods.

Regional Insights

How Big is the North America Biological Indicators Market Size?

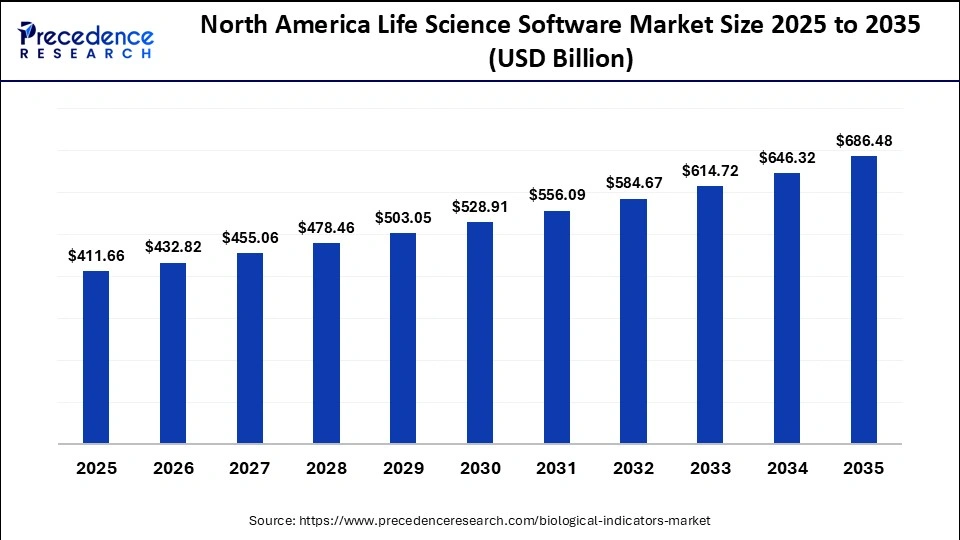

The North America biological indicator smarket size is estimated at USD 41.66 million in 2025 and is projected to reach approximately USD 686.48 million by 2035, with a 5.25% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Biological Indicators Market?

North America dominated the market by capturing around 42% share in 2025. This is largely due to stringent regulatory frameworks, high adoption rates of advanced technologies, and a mature healthcare infrastructure. The U.S. FDA and the Centers for Disease Control and Prevention enforce rigorous standards for sterilization validation. Major manufacturers such as 3M, STERIS, Mesa Labs, and ASP are based in the U.S. and contribute to continuous innovation and high product adoption. Numerous hospitals, ambulatory surgical centers, and dental clinics in the U.S. and Canada require constant, high-volume sterilization of instruments.

What is the Size of the U.S. Biological IndicatorsMarket?

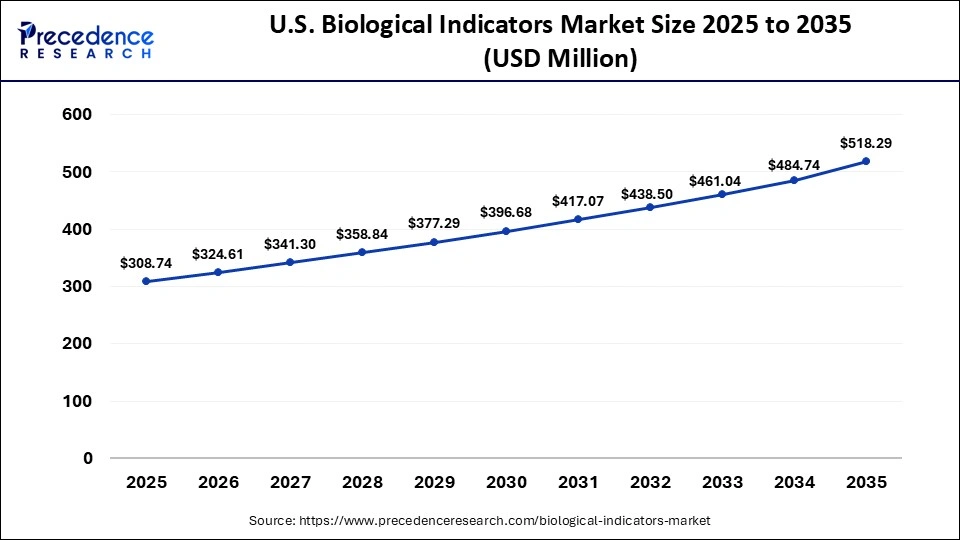

The U.S. biological indicators market size is calculated at USD 308.74 million in 2025 and is expected to reach nearly USD 518.29 million in 2035, accelerating at a strong CAGR of 5.32% between 2026 and 2035.

U.S. Biological Indicators Market Trends

The U.S. is a major contributor to the North American market, primarily due to the high demand from hospitals and dental clinics to prevent surgical site infections. Additionally, the market is shaped by stringent U.S. FDA and ISO 11138 regulations, which ensure high-quality standards for sterilization validation. Key players like 3M, Steris Corporation, and Cantel Medical focus on rapid-readout technology and smart, IoT-enabled incubators, which also contribute to market growth.

Why is Asia Pacific Considered the Fastest-Growing Region in the Biological Indicators Market?

Asia Pacific is expected to expand at the fastest CAGR of 8.5% throughout the forecast period. This growth is primarily driven by rapid industrialization, strengthening regulatory frameworks, and expanding healthcare infrastructure. The increasing adoption of international quality standards in hospitals, particularly within the pharmaceutical industry, is pushing for compliance and strengthening the need for reliable, scientifically validated sterilization methods. There is a rapid shift toward rapid-readout biological indicators and self-contained vials to enhance infection control in hospitals and pharmaceutical manufacturing, especially in countries like China, India, and Japan, to meet safety standards, which is likely to contribute to the market.

India Biological Indicators Market Trends

India represents a mature market within the region, as it is considered a critical hub for pharmaceutical and medical device manufacturing, significantly driving regional demand for sterilization monitoring. Indian Contract Development and Manufacturing Organization companies like Syngene, Laur, and Dishman Carbogen Amcis are becoming major partners, with increased investment in healthcare infrastructure and a growing diagnostics market.

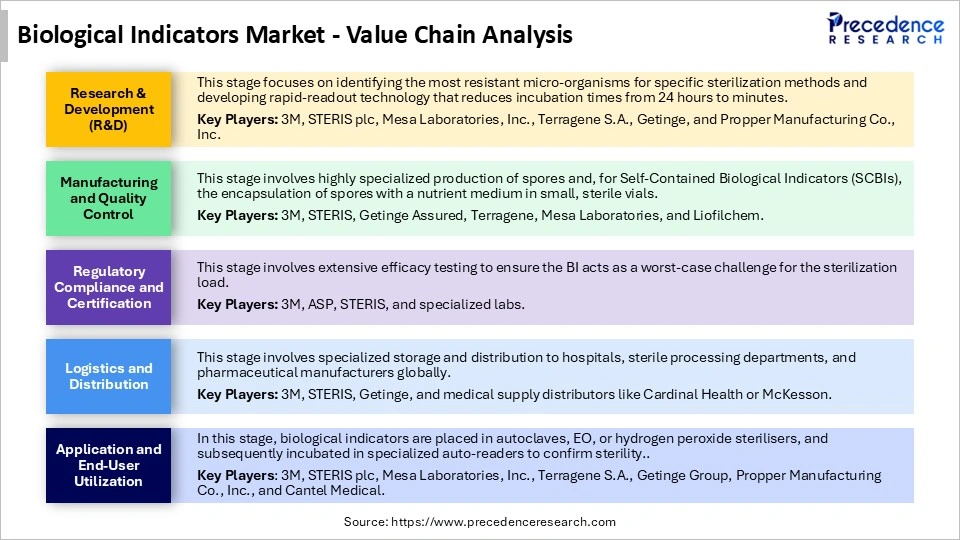

Biological Indicators Market Value Chain Analysis

Who are the Major Players in the Global Biological Indicators Market?

The major players in the biological indicators market include 3M, STERIS plc,. Getinge Group, Mesa Laboratories, Inc., Cantel Medical (Sotera Health), Terragene S.A,. Tuttnauer, Ecolab Inc. / Bioquell, Fuze Medical / Fuze Medicine Equipmen,t Hu-Friedy, Advanced Sterilization Products (ASP), Bag Health Care, H.W. Andersen Products Ltd,. GKE, Shanghai Kuanjian / Other regional specialists

Recent Developments

- In August 2025, Advanced Sterilization Products (ASP) launched the BIOTRACE Instant Read Steam System, which provides sterility readouts in just seven seconds, compared to the standard 20-minute wait. This system is designed for sterile processing departments, enhancing decision-making and clinical workflows while reducing delay in hospital settings. This launch addresses a long-standing bottleneck that impacts productivity and peace of mind, remarked Dr. Ivan Salgo, VP of ASP.(Source: https://discover-pharma.com)

- In September 2025, Nelson Laboratories, LLC introduced RapidCert, a rapid biological indicator sterility testing service that utilizes traditional and modern methods. This service can confirm sterility for lot release and sterilization validations in as little as three days, significantly reducing the traditional incubation time of seven days to just 48 hours. According to Scott Dimond, Principal Scientist at Nelson Labs, this innovation advances testing methodologies for safer healthcare solutions.(Source:https://www.nelsonlabs.com)

- In March 2025, an Australian startup unveiled the world's first commercial biological computer, powered by living human cells. The CL1, developed by Melbourne-based Cortical Labs, merges human stem cell-derived neurons with silicon, introducing a new category of AI called Synthetic Biological Intelligence (SBI) with claims that this hybrid system can learn and adapt faster than traditional silicon-based AI while consuming significantly less energy. (Source: https://www.businesstoday.in)

- In June 2025, Solventum launched the Attest Super Rapid Vaporized Hydrogen Peroxide (VH2O2) Clear Challenge Pack. This FDA-cleared test combines a biological indicator and a chemical indicator in a single-use pack for monitoring medical instrument sterility. It is designed for every load monitoring, integrating dual indicators to ensure the efficacy of sterilization cycles, thereby minimizing patient safety risks.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Product/Type

- Self-Contained Biological Indicators

- Biological Indicator Strips

- Cards / Rapid Readout BIs

By Sterilization Method

- Steam Sterilization

- Ethylene Oxide Sterilization

- Hydrogen Peroxide Sterilization

- Other Methods (plasma, dry heat)

By End Use / Application

- Breakdown reflects common reported application groups.

- Hospitals & Clinics

- Pharmaceutical Companies / Biopharma

- Research Laboratories / Other Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting