What is the Bioplastic Packaging Market Size?

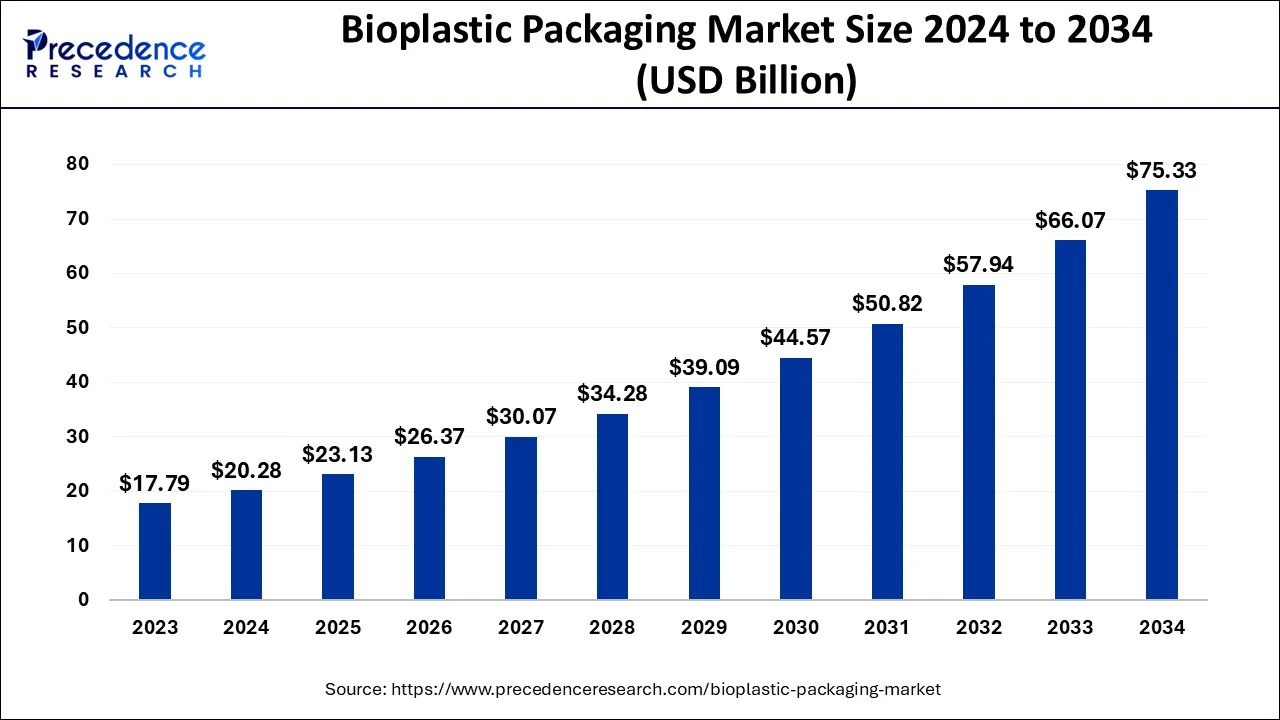

The global bioplastic packaging market size is calculated at USD 23.13 billion in 2025 and is predicted to increase from USD 26.37 billion in 2026 to approximately USD 83.84 billion by 2035, expanding at a CAGR of 13.74% from 2026 to 2035.

Bioplastic Packaging Market Key Takeaways

- In terms of revenue, the market is valued at $23.13 billion in 2025.

- It is projected to reach $83.84 billion by 2035.

- The market is expected to grow at a CAGR of 13.74% from 2026 to 2035.

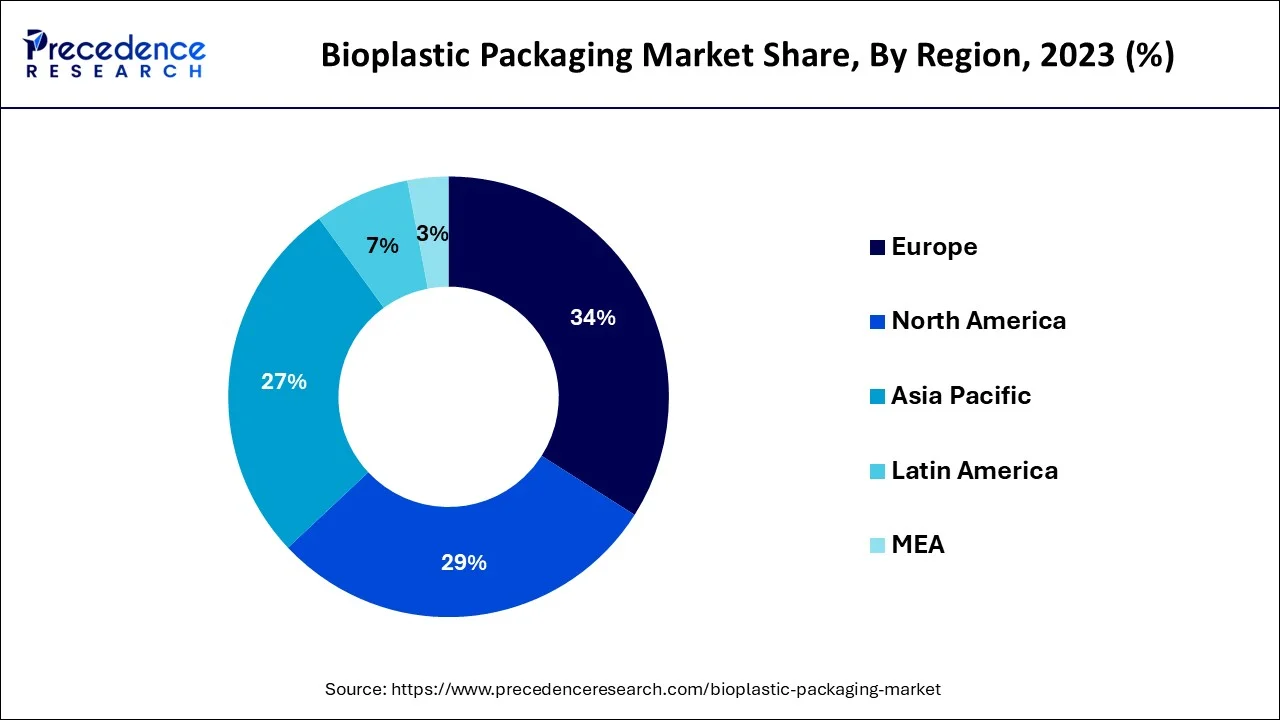

- Europe held the largest market share of around 34% in 2025.

- By material, the biodegradable segments generated more than 53% of the share of revenue in 2024.

- By type, the flexible packaging segments held a significant market share of around 57% in 2025.

- By application, the food and beverage segments held a significant market share of around 59% in 2025.

Market Overview

The expanding trend of sustainability in many packaging elements is driving the bioplastic packaging market. Due to the widespread use of packaging products and the rising aversion to plastic packaging with a high risk of contamination, the food and beverage sectors are recognized as the top consumers of bioplastic packaging.

The adoption rate of these sustainable packaging options in the food and beverage industry is also being positively impacted by consumers' increased preference for natural and organic polymers in food packaging. Along with increased consumer awareness, the industry is growing due to expanded government programs that support the use of eco-friendly packaging in many nations.

Europe follows North America and the Asia Pacific region in terms of projected market expansion. The bioplastics packaging material market will likely grow significantly in Japan, the U.S., China, and Germany.

The main participants in the market are concentrating on improving the physical characteristics of these packaging materials to make them more highly appealing and practical. They are looking for prospects in emerging economies to increase their market footprint.

The Dow Chemical Company (Dow), Innovia Films, Koninklijke DSM N.V., Metabolix, Inc., and NovamontS.p.A. are notable market participants. For a wide variety of products, there is a demand for sustainable and economical packaging solutions across many industry verticals, particularly in the food and beverage industry (F&B).

F&B enterprises worldwide have increased the importance of bioplastics by incorporating the most significant industrial & manufacturing technology available.

Since customers carefully pay attention to the materials used to wrap their preferred food commodities, bioplastics packaging will likely gain traction and achieve a privileged status in the worldwide F&B packaging sector.

Due to the increased preference for packaging materials created from natural or organic polymers obtained from biomass sources such as lipids, starch, oils, and microbiota, among others.

Technological Advancement

Technological advancements in the bioplastic packaging market feature new materials such as PHA, Bio PBS, and PLA. PLA (polylactic acid) is a popular material used to produce bioplastic packaging, made from renewable resources such as sugarcane and cornstarch. The transparency and versatility of this new material are a demanding choice for new businesses, willing to adopt an environmentally friendly manufacturing process.

PHA (polyhydroxyalkanoates) material is used in traction in the bioplastic packaging companies. PHA is used in several packaging applications, consists film and food packaging. It also supports in amalgamation of biodegradable and non-biodegradable materials.

Bio-based polybutylene succinate (Bio-PBS) is another traction alternative for bioplastic packaging. It strengthens mechanical and water resistance factors. This packaging benefits biodegradability, sustainability, mechanical properties, and barrier properties. Bio-PBS applications include industrial, food, and flexible packaging.

Market Outlook

- Start-up Ecosystem:The start-up growth is accelerating due to their dedication to discover waste derived materials instead of just focusing on the normal corn starch bags. This transition has fuelled the demand for sustainable/eco-friendly packaging.

- Industry growth overview:The industry growth is rising due to the diversified preferences and trends in the food and beverage market and among consumers as well. The ban on single-use plastics has automatically drawn the attention of the food and beverages sector towards sustainable alternatives for healthy eatables.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 83.84 Billion |

| Market Size in 2025 | USD 23.13 Billion |

| Market Size in 2026 | USD 26.37 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 13.74% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Largest Market | Europe |

| Segments Covered | Material, Type, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

All F&B companies now place a significant emphasis on packaging solutions. Manufacturers of food and beverage goods continue to use the best packaging techniques, adapting them to the needs of different products.

Due to the numerous benefits, bioplastic packaging will likely become more prevalent in the worldwide food and beverage industry. Bioplastics or biopolymers are cutting-edge food packaging materials made from biomass sources, and their demand is closely tied to customer tastes.

Consumer preferences will likely impact the growth of the bioplastics packaging market for organic/natural materials. Additionally, governments' policies encourage the manufacture of bioplastics rather than risky plastic and polymer materials.

The expansion of the worldwide bioplastics packaging market will also be fueled by the sustainability of bioplastics packaging materials compared to other options, in addition to customers' strong preference for eco-friendly products and good backing from industrial regulatory bodies and governments.

The primary trend encouraging the expansion of the worldwide bioplastics packaging market has been identified as improving the physical qualities of packaging materials by making them more appealing, easily printed, and antistatic.

However, chemical additives in manufacturing bioplastics have increased worries about their toxicity from a health perspective. In addition to health issues, the market's expansion will likely constrain by the difficulty of methods for separating bioplastic materials from disposal locations based on resin kinds.

Segment Insights

Material Insights

Due to the increasing demand for bio-based plastics across a range of end-use sectors, which is anticipated to increase their demand during the assessment period, the biodegradable category accounted for 53% of the share of revenue in the year 2023. Polylactic acid, PBAT, starch blends, PBS, polycaprolactone, PHA, and cellulose acetate are biodegradable plastics. The highest revenue-generating category of biodegradable products in 2021 was starch blends and PBAT.

Easily accessible natural resources like tapioca, potato, rice, wheat, and corn make starch-based polymers. Starch blends are an excellent substitute for traditional plastics since they are readily available in large quantities. Polylactic acid (PLA) will likely develop faster during the projection period. Increasing product demand across various applications, including packaging, agriculture, transportation, electronics, and textiles, will fuel segment expansion.

The demand for polylactic acid is significantly increasing due to its low carbon output compared to conventional plastics. For instance, the production of 1 kg of polylactic acid results in the release of about 0.5 kg of carbon dioxide, compared to the release of 5.0 kg, 2.2 kg, 2.0 kg, 2.0 kg, and 1.7 kg of carbon dioxide, respectively, during the production of conventional polycarbonate, polyethylene terephthalate, polystyrene, polypropylene, and low-density polyethylene.

Type Insights

According to type, the flexible packaging category held a significant market share of 57% in 2024. The usage of case-ready packaging, improvements in packaging techniques, and advancements in bioplastic production methods likely increase demand for flexible packaging's bioplastics. Also, there is a considerable demand for flexible packaging, particularly for beverages and snack items.

Modern retail industries, consumer lifestyle changes, technology advancements, and the rising popularity of quick-service restaurants are propelling the demand in the market. For instance, consumers want lightweight and aesthetically pleasing packaging, especially in North America and Europe. Flexible packaging made of bioplastic will become more prevalent in the upcoming years.

Application Insights

Regarding application, the food and beverage sector held a significant market share in 2024, accounting for 59%. The market is being driven by the increased prominence of quick-service restaurants and the demand for packaged food. The industry for flexible packaging will likely rise during the forecast period because manufacturers are expanding their production capacity in response to the rising demand for packaged goods.

Additionally, the rising popularity of nutrient-dense foods and the European Commission's measures to control the use of polymers in food packaging applications is providing lucrative opportunities for the4 development of the market. Bioplastic packaging is frequently used for producing jars, bottles, and containers, as well as for packaging fresh foods.

Gloss and clarity are additional features of PLA plastic bottles that are strong and single-use. Polylactic acid is readily biodegradable and does not emit harmful gases when burned, in contrast to items manufactured from petroleum. As a result, its demand in the food packaging market would stay quite strong during the projection period.

Regional Insights

What is the Europe Bioplastic Packaging Market Size?

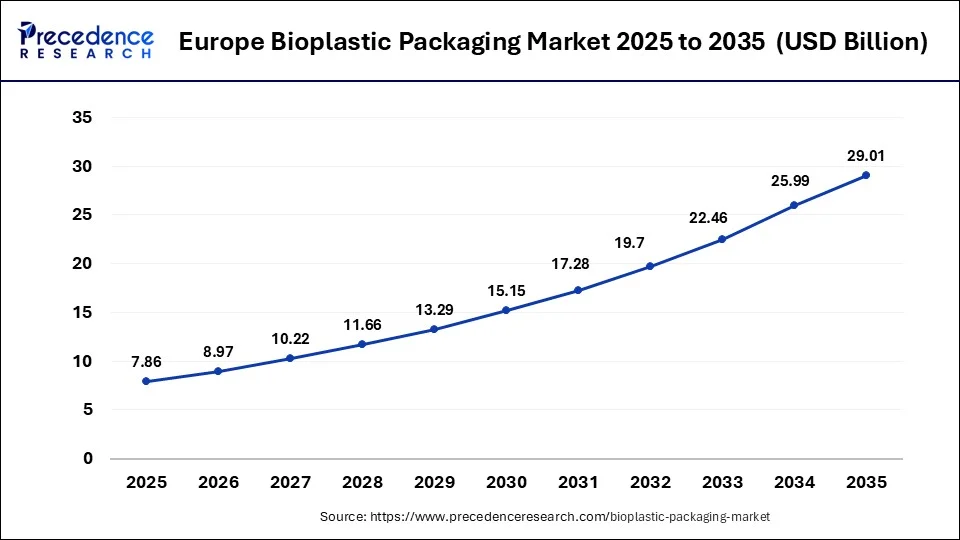

The Europe bioplastic packaging market size accounted for USD 7.86 billion in 2025 and is predicted to attain around USD 29.01 billion by 2035, expanding at a CAGR of 13.95% between 2026 and 2035.

In terms of revenue, the bioplastics packaging market in Europe held the highest share 34% in 2025. Due to strict environmental legislation and rising consumer concern for the environment, the region will likely experience significant growth in the years to come.

Government initiatives will also increase bioplastic demand over the evaluation period, such as the decision of the E.U. to lessen the widespread use of single-use plastic products. The European Parliament decided to ban single-use plastic products like cutlery and straws in 2019 as part of a comprehensive rule against plastic rubbish that damages beaches and pollutes waterways. In July 2021, a ban on single-use plastics was anticipated to go into effect.

- In October 2024, Fortum Recycling & Waste, a leading waste company from Finland, succeeded in producing biodegradable plastic from carbon dioxide (CO2) emissions from waste incineration at its plant in Riihimäki, Finland. This breakthrough, based on carbon capture and utilization (CCU), is a significant step towards reducing and utilizing industrial carbon dioxide emissions.

Bioplastics are widely employed in many critical applications, including bottles, loose packaging, shopping bags, mulch films for agriculture, and refuge bags. In the European Union, almost 100 billion bags are used annually.

North America is expected to grow at the fastest rate over the forecast period. The growth of the region can be attributed to the increasing adoption of bioplastic packaging by retailers and large corporations to meet their sustainability goals. Furthermore, the strong presence of innovative manufacturing infrastructure and increasing investment in biopolymer R&D are optimizing the development of high-quality bioplastic materials.

Asia Pacific is dominating the bioplastic packaging market. Asia Pacific is a sustainable packaging solution-driven region. The demand for eco-friendly packaging is a preference of most of the population in the region. The innovative development is the most used agenda to promote product packaging on a large scale. With the consumer awareness and the government's initiative towards the green project uplift the region is poised to approach and upgrade in this particular market.

How is Latin America's Advancement Elevating the Bioplastic Packaging Market growth?

Latin America's advancement in this market is popular for its stringent sustainability and massive biomass resources. Within the region, Brazil is the leading hub fuelling its sugarcane market to create polyethylene and bio-based ethylene. The Bio-PEF has proved an ideal choice of replacement to traditional PET.

By using familiar crops such as corn and cassava, the region is largely producing starch-related bioplastic films for e-commerce and food packaging. The regional growth is backed by the integrity of their native presence that further unify sustainable approach altogether.

What Major Initiatives of MEA in the Bioplastic Packaging Market are Confirming Growth in the market?

MEA's initiatives to date in this market are linked to the policy frameworks that influence the high adoption rate of bioplastic packaging. This purpose-built adoption is to promote biodegradability and bolster it into the vast packaging market to match the transformation shift occurring in the bioeconomy, according to the trend and fluctuating demand rate.

The initiative is sponsored to alleviate single-use plastics and invest more in the bio-based options. India's BioE3 policy encourages a quality performance of bio-manufacturing that involves biopolymers to turn chemical-based models into sustainable ones. The focus of the initiatives is centralised on infrastructure development, financial incentives, EPR, etc.

Value Chain Analysis of the Bioplastic Packaging Market

- Raw material sourcing: The raw material sourcing for bioplastic packaging includes plant-based biomass, fossil fuel, or microbially created biodegradable polymers. The use of this raw material largely affects the final product's end-of-life alternatives, cost, and properties. The right choice of feedstock analysis the feasibility of numerous biomass sources and the relevant reading scenario among the usage of the materials.

- Logistics and Distribution: The logistics and distribution of bioplastic packaging analyses supply chains activities that aims on feedstock sourcing, confirming apt EoL management systems, and a comprehensive transport facility. The distribution growth relies on the choices, quality, and technique of the process to gain business profit in the bioplastic packaging.

- Recycling and Waste Management: The recycling technologies are gaining traction in the recycling and waste management analysis. The analysis addresses the gap in the collection, segregation, and recycling infrastructure that affects the performance of the bioplastics. After the issues are detected, the recycling technologies recover energy level and improve chemical recycling, mechanical recycling, and industrial composting.

Bioplastic Packaging Market Companies

Packaging made of bioplastic is experiencing rapid market growth. Businesses in the bioplastic packaging industry provide various packaging options for different end-use sectors. Additionally, it enables specialized packaging that further assists in meeting the needs of individual customers.

Important players are investing more money in the creation of bio-based packaging. For instance, in October 2020, SABIC and Schwarz Group, a European retailer, unveiled a pilot initiative to use transparent film bags made from certified circular polyethylene (P.E.) from the former in vegetable packing. The project will use various P.E. technologies from SABIC that are based on feedstock recycled from mixed and old plastics. In the market for bioplastic packaging, some significant companies are:

- NovamontS.p.A

- Amcor Plc.

- Coveris

- NatureWorks, LLC.

- Alpha Packaging

- Sealed Air

- Mondi

- Constantia Flexibles

- ALPHA

- Transcontinental Inc.

Recent Developments

- In May 2025, the new Horizon Europe-funded GRECO project introduced innovative bio-based, biodegradable, and recyclable food packaging based on novel PLA copolymers, functional coatings, additives, and green catalysts.

- In January 2025, IITM's centre of biodegradable packaging created sustainable alternatives to plastic, using organic by-products and microorganisms. With this purpose, IIT-M established a centre to develop zero-waste bioplastics.

- In April 2025, AIMPLAS began work with Venvirotech and Enplast on a bioplastics project. The COM4PHA project aims to aim at providing new packaging for the cosmetics, agricultural, and food sectors.

- In January 2025, the Indian Institute of Technology-Madras (IIT-M) launched a new initiative aimed at developing zero-waste bioplastics. The development emphasizes developing sustainable alternatives to conventional plastics by creating cost-effective and scalable alternatives that are not only biodegradable but also microplastic-free.

- In September 2024, CSIRO, Australia's national science agency, and Murdoch University launched the Bioplastics Innovation Hub, a USD 8 million collaboration with industry partners to develop a new generation of 100% compostable plastics. The Bioplastics Innovation Hub aims to transform plastic packaging by developing biologically derived plastic that can break down in compost, land, or water.

- In October 2024, SK Leaveo, a company under SKC, announced its plans to build the world's largest biodegradable plastic plant in HaiPhong, Vietnam, starting construction in the first half of 2024. This facility is expected to produce polybutylene adipate terephthalate (PBAT) with an annual capacity of 70,000 tons.

- In November 2024, Walki and Lactips formed a strategic collaboration aimed at developing fully biodegradable and plastic-free food packaging. This collaboration focuses on using natural polymers, specifically a casein-based polymer provided by Lactips, which is derived from milk processing. The aim is to create packaging that is not only biodegradable but also recyclable within the paper stream, aligning with European regulations targeting single-use plastics.

Segments Covered in the Report

By Material

- Biodegradable

- Starch Blends

- PolylacticAcid

- Polybutylene Succinate (PBS)

- PolybutyleneAdipate Terephthalate (PBAT)

- Others

- Non-biodegradable

- Bio Polyethylene Terephthalate

- Bio Polyethylene

- Bio Polyamide

- Others

By Type

- Rigid Packaging

- Flexible Packaging

By Application

- Consumer Goods

- Food & Beverages

- Pharmaceuticals

- Cosmetic & Personal Care

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting