What is the Blister Packaging Market Size?

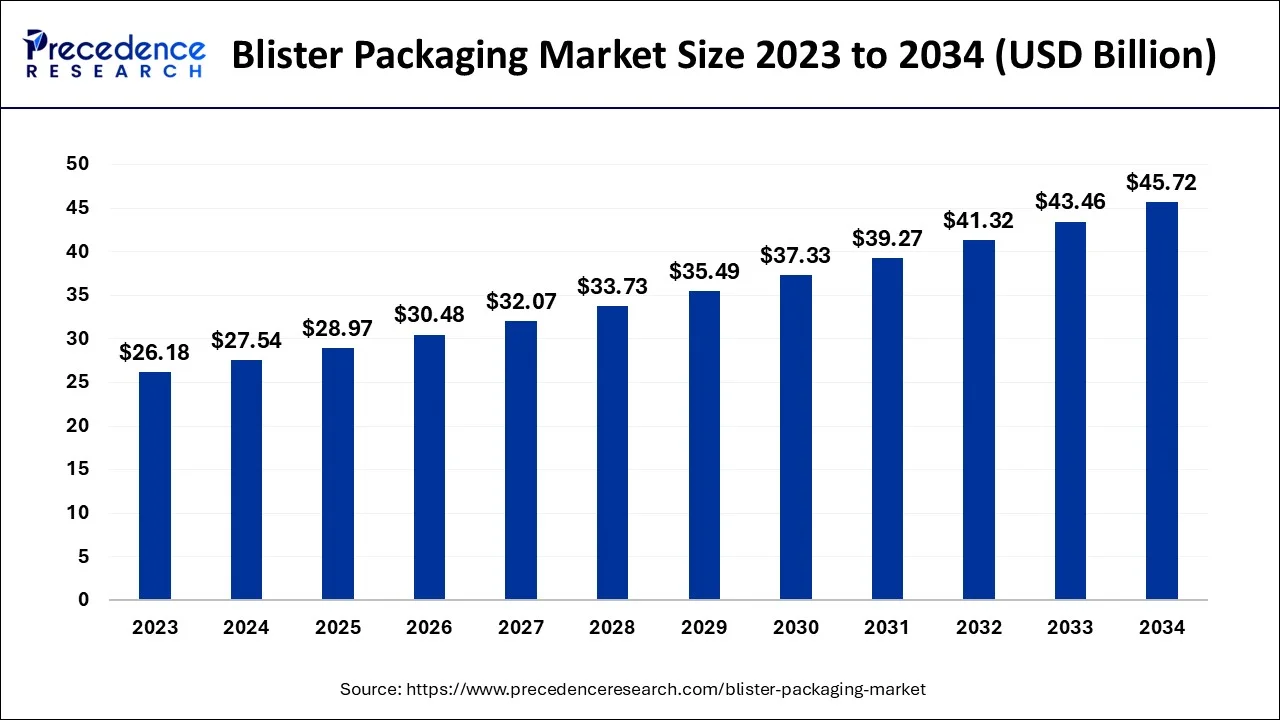

The global blister packaging market size is valued at USD 28.97 billion in 2025 and is predicted to increase from USD 30.48 billion in 2026 to approximately USD 45.72 billion by 2034, growing at a CAGR of 5.20% from 2025 to 2034.

Blister Packaging Market Key Takeaways

- By material, the plastic films segment accounted highest revenue share of around 44% in 2024.

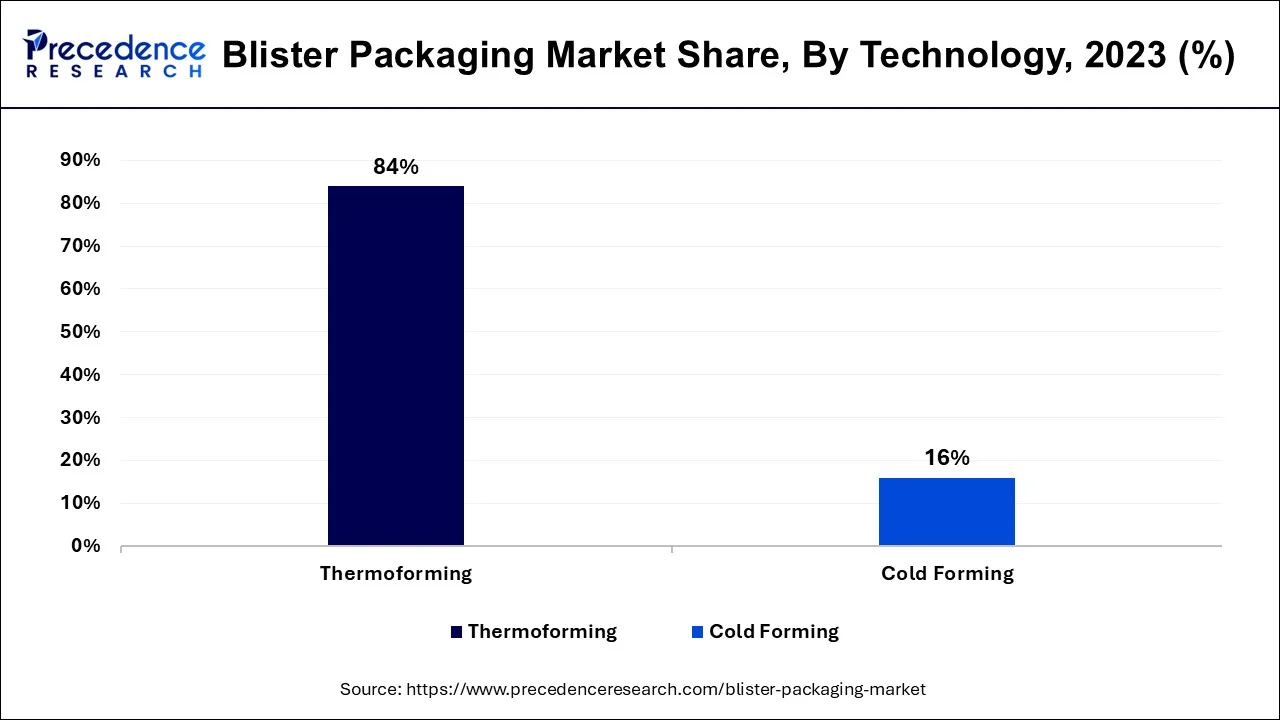

- By technology, the thermoforming technology segment has captured the highest revenue share of 84% in 2024.

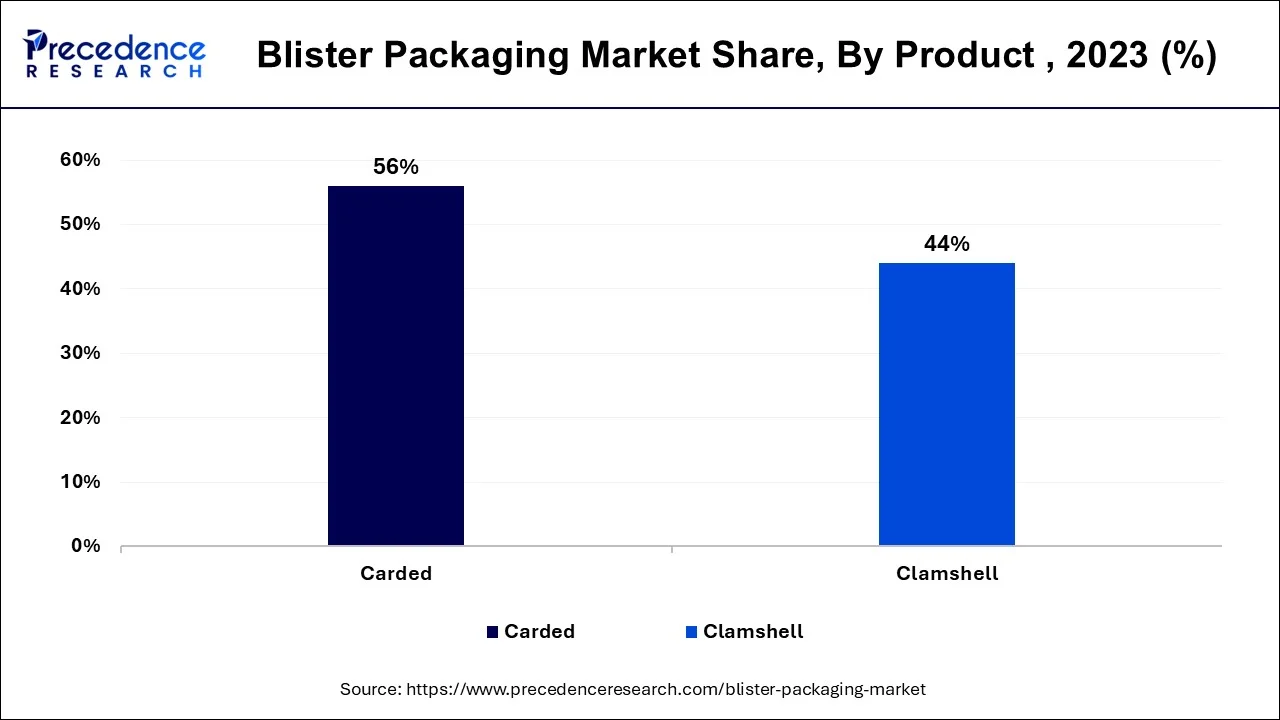

- By product, the carded blister packaging generated the highest revenue share of around 56% in 2024.

- By end-use, the healthcare segment has generated the highest revenue shares of around 64.5% in 2024.

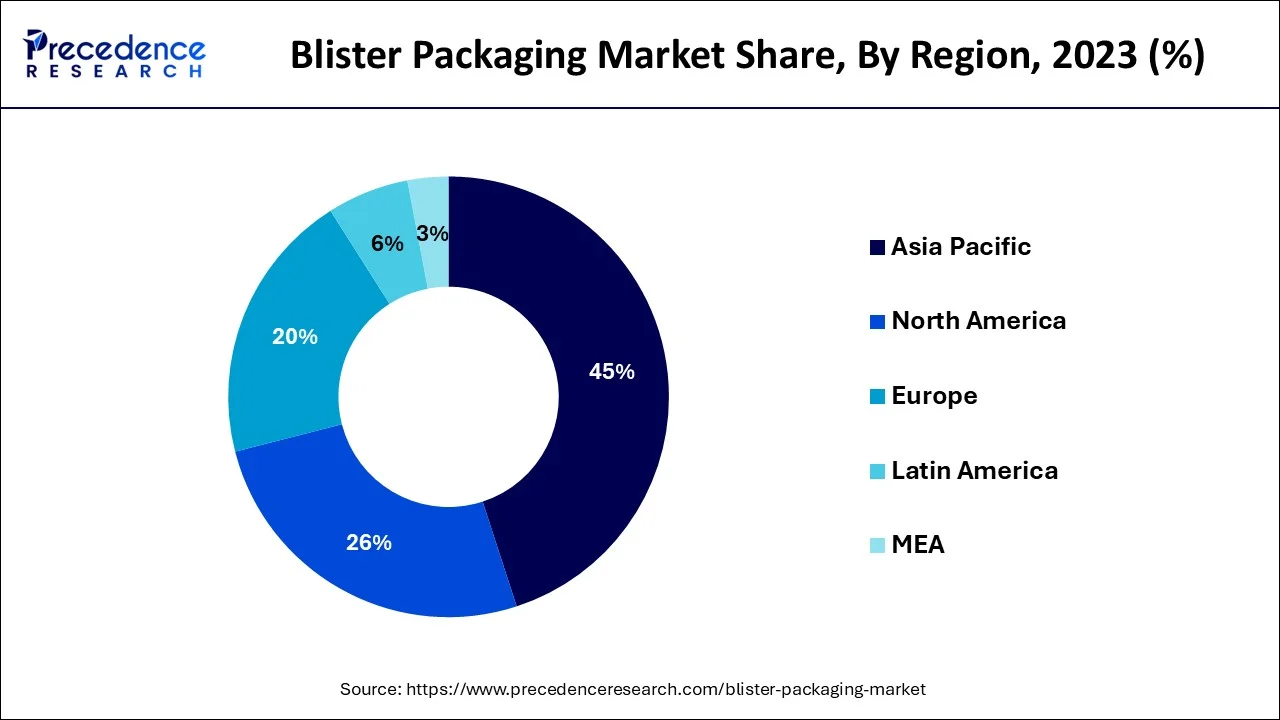

- Asia Pacific dominated the blister packaging market with the largest market share of 45%.

Market Overview

A pre-formed plastic container with a hollow made by thermoforming plastic and a paper or aluminum foil back is referred to as "blister packing." This kind of packaging allows customers to view a large percentage of the content while protecting it from impurities, heat, UV radiation, and humidity. It eliminates the need for cartons as a consequence, which minimizes the cost of packing. In addition, because it enables for easy product handling and transportation, it is frequently used to pack toys, consumer goods, food, and pharmaceuticals. The industry for blister packaging will expand as a result of the increased demand for medicinal tablets and the creation of creative packaging techniques. Blister Packaging market expansion is anticipated to be fueled by the brisk industrialization of emerging nations and the rising demand for packaged meat and fruit products.

Blister packaging solutions, which are made up of molded plastic components that are generally attached to a piece of paper or metal, are used to package items like tablets and high-volume, low-priced consumer electronics. This kind of packaging mostly utilizes three elements: plastic substrates as a forming film, paper & paperboard or metal as lidding materials. In comparison to other packaging options, this sort of packaging has a variety of benefits, including affordability, ease of handling, protection for each little packed material, and others. In the healthcare sector, blister packs are used to package pharmaceuticals and medical equipment.

Blister solutions are also commonly utilized in the packaging of consumer products and food. Additionally, blister manufacture uses little resources, and the products take up little shelf space, are simple to use, offer great environmental protection, and have a superb hang hook display characteristic. Blister packaging's market share increased due to package manufacturers' ability to provide cost-effective solutions for a variety of clients despite their modest resource requirements and simple access to raw materials.

The rising need for various healthcare facilities is being driven by the aging populations in industrialized economies, particularly in the U.S. and Europe. The Center for Medicare and Medicaid Services estimates that by 2027, national health spending in the United States would increase from 14.9% of GDP in 2016 to 19.5% of GDP. This demonstrates that many elderly populations are anticipated to experience some sort of medical emergency, and medical tablet consumption will increase significantly. As blister packaging is one of the widely used pharmaceutical packaging types, this will drive demand for blister packaging in the coming years. Since many pharmaceutical items are extremely vulnerable to moisture and harsh tropical climates in Asia Pacific economies, improved blister packs are required for these products. Players in the sector are able to improve their packaging features and provide high-protection packaging solutions thanks to ongoing R&D investments and collaboration with pharmaceutical manufacturers.

Blister Packaging Market Growth Factors

Consumer preference for pharmaceutical items has gradually shifted away from traditional bottles in favor of blister packaging, which is unit-dose packaging. In the healthcare sector, blister packs are used to package pharmaceuticals and medical equipment. They have several more uses in the culinary, industrial, and consumer products sectors. Blister packaging also offers a great hang-hook presentation, uses fewer resources for packing, and takes up less space on store shelves. Blister packs are therefore more affordable than other packaging types like hard bottles and are therefore more cost-effective.

How Large Will the Global Blister Packaging Market Be in 2025?

The global blister packaging market is positioned for substantial growth, driven by increased demand from the pharmaceutical industry, better shelf-life demands, and an increase in tamper-evident options. As the healthcare and consumer goods industries continue to grow, manufacturers are utilizing eco-friendly and high-barrier materials to create a secure package for shipment. The continued growth of e-commerce, coupled with advancements in digital printing, is fostering the blister packaging market as a key aspect of global packaging strategies.

Trends of the Blister Packaging in 2025

Child Resistant and Senior Friendly Designs

Blister packs that are accessible to seniors but resistant to children have become increasingly popular. Designs that guarantee safety without sacrificing usability include push-through and peel-push formats. The adoption of packaging that conforms with accessibility and CRP (Child Resistant Packaging) regulations is being influenced by new international standards. Additionally, these designs help pharmaceutical companies enhance patient safety and reduce liability.

Sustainable & Eco-Friendly Materials

The industry as a whole is making a big push toward sustainability in 2025. To lessen their impact on the environment, businesses are turning to recyclable plastics, paperboard-based solutions, and blisters made of just one material. Regulations like the Plastic Waste Management (Amendment) Rules 2025 in India are driving this change. Companies are also taking advantage of this change to conform to global ESG standards, and consumers who care about the environment

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 30.48 Billion |

| Market Size in 2025 | USD 28.97 Billion |

| Market Size by 2034 | USD 45.72 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.20% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Material, Application, and Geography |

Market Dynamics

Key Market Drivers

- Cost-effectiveness: Buyers are gradually moving away from unit-dose packaging, such as traditional bottles for pharmaceutical items, toward blister packaging. In the healthcare industry, pharmaceutical blister packaging is used for pharmaceuticals and medical devices. Additionally, they are widely used in a variety of industrial, consumer, and food and beverage products. Blister packaging uses less packaging resources, takes up less space on retail shelves, and offers a superior hang-hook presentation. Blister packing is therefore less expensive than other packaging methods, including hard bottles, and is therefore more economical.

- Outsourcing: Growing healthcare spending and a corresponding rise in the need for a wide array of pharmaceutical products have led several pharmaceutical producers to opt for outsourcing via contract development. Active pharmaceutical ingredients (API), medication manufacturing, and packaging services are provided by contract development and manufacturing organizations (CDMO). The landscape for blister packaging is quickly changing as large pharmaceutical companies aggressively scale up their outsourcing operations to reduce production and packaging costs. Moreover, the blister packaging for pharmaceutical medications is being produced in greater quantities because to the present outsourcing trend.

Key Market Challenges

- Unsuitable for Heavy Items: Blister packaging is primarily used to protect lightweight goods and is not an ideal solution for the packing of heavy goods. Heavy products put too much strain on the plastic wrapping that surrounds them or the paperboard that supports them. This causes packaging to shatter when storing and transporting the contents, which raises the cost and results in product loss. Blister packaging is therefore inappropriate for such commodities. Additionally, it is not advised for priceless or sensitive objects since the poor blister packaging might damage or shatter the contents, costing the producers money.

- Adherence to Strict Regulations - Manufacturers of blister packaging have challenges due to the strict regulations that have been implemented, particularly in the healthcare industry. Compliance with the rules is crucial since even the smallest flaw in the packing can cause the products to be damaged and result in a loss for the distributors. The Food and Drug Administration (FDA) has mandated that all blister cells include labels with the manufacturer's name, lot number, strength, bar code, patented and established name, and expiration date. Adhering to such standards requires work, resources, and time, which presents a challenge for market participants in the blister packaging marketing.

Key Market Opportunities

- Adoption of biodegradable packaging: In addition, governments all over the globe are promoting the use of biodegradable packaging over plastic-based packaging due to growing environmental concerns about the overuse of plastics. During the forecast period, this is anticipated to restrain the growth of the worldwide blister packaging market. Because of this, major businesses are concentrating on offering innovative alternatives for recyclable blister packaging solutions. For instance, Push Packs, which are made from recyclable polyolefin laminates, were created by Romaco in November 2019 for solid medicinal items. Push Packs use around 60% less material to produce than traditional blister packs, which results in cheaper production costs overall.

- R&D activities and expanding product innovations – Pharmaceutical businesses, both large and small, are substantially investing in R&D projects to increase manufacturing output, create innovative medications, and improve their product development pipelines. Additionally, there is a significant increase in demand for blister packaging because to private sector engagement. Additionally, the blister packaging market will expand considerably over the course of the projection period due to the introduction of various types of packaging such as child-resistant, senior citizen-friendly, and temper protection.

Product Insights

Over the projected period, the carded product type is predicted to gain importance due to its practicality, safety, flexibility, marketing exposure, and capacity to accept several dosages. PVC, PET, or PETG are used in card blister packing to offer strength and protect against any external damages. Packaging that moves very little both helps keep the product's form while reducing the chance of harm. Carded blister packaging is anticipated to increase at a CAGR of about 6.8% throughout the evaluation period.

Technology Insights

Due to the vast range of end-use sector it may be used in, including the food and healthcare industries, thermoforming now commands the largest market share in the blister packaging industry. For blister packaging, thermoforming technique is chosen over cold forming technology because it has lower initial tool and equipment expenses. Thermoforming technique offers comparative advantages over cold forming, such as safe travel since the compartments are more tightly defined and smaller, reducing the chance of damage, visibility because the blister plastic is transparent, and the ability to create a wide variety of products. Manufacturers like thermoforming because of its large volume manufacturing capacity as well as its dependability, uniformity, and cleanliness. The main driver of demand for thermoforming technology is its low cost, efficient administration, and ease.

Material Insights

During the anticipated period, the plastic films sector will have the biggest market share. The reasons for this segment's high demand may be linked to the product's superior visibility, security, and beautiful packaging. The plastic films sector is going to grow at a highest CAGR during the forecast period.

Application Insights

The consumer goods section came in second on the market behind the healthcare segment. Healthcare items are packaged in blisters to prevent product contamination and to shield them from moisture, gases, light, and temperature. This is fueling the end-use industry in healthcare's need for blister packaging.

Regional Insights

Asia Pacific Blister Packaging Market Size and Growth 2025 to 2034

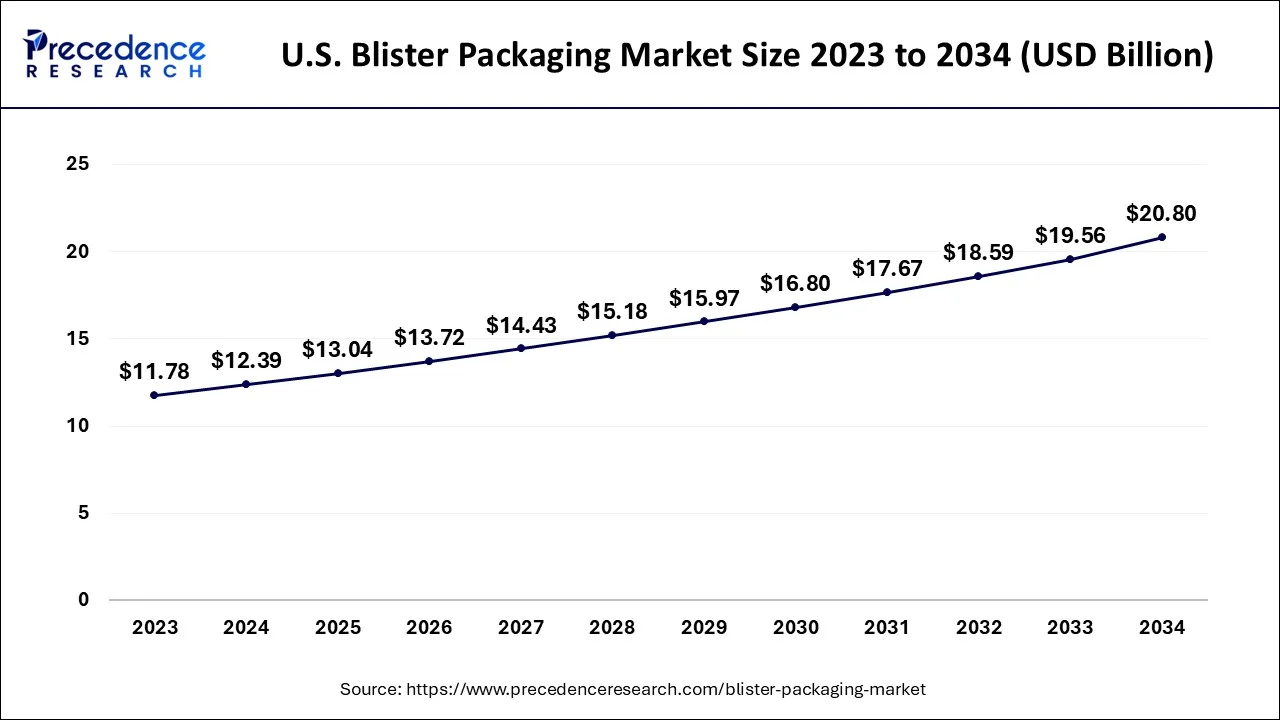

The Asia Pacific blister packaging market size is evaluated at USD 13.04 billion in 2025 and is predicted to be worth around USD 20.80 billion by 2034, rising at a CAGR of 5.30% from 2025 to 2034.

The blister packaging industry is predicted to be dominated by Asia Pacific, which in 2024 had a volumetric share of around 45%. The supremacy is attributable to the region's rapid economic development and the promising prospects for the pharmaceutical sector. The rise of the product is being fueled by the presence of several pharmaceutical medication factories and the substantial population in the area. In addition to housing almost 60% of the world's population, the region serves as a manufacturing powerhouse for the electronics and other consumer goods sectors. Furthermore, the blister packaging industry is expanding due to rising healthcare costs and rising disposable income in China, South Korea, and India.

Asia Pacific: China Blister Packaging Market Trends

China's market is growing strongly, powered by rapid expansion in its pharmaceutical and healthcare sectors. There's a clear shift toward more sustainable materials, with recyclable plastics and paper-based blisters gaining traction. Aluminum remains a high barrier material of choice, especially for cold form applications. Automated, high-speed blister packaging machinery with smart features like track and trace is increasingly being adopted.

North America: North America's Blister Packaging Market: Rapid Growth Driven by Pharma Innovation

The North American blister packaging market is witnessing its fastest growth, fueled by increasing demand from the pharmaceutical and nutraceutical sectors. High adoption of single-dose and tamper-evident packs is driving market expansion, as these formats improve patient compliance and safety. Advances in thermoforming and cold-form technologies are enabling manufacturers to produce high-quality, efficient, and customizable blister packs. Sustainability is a key trend, with recyclable and eco-friendly materials gaining popularity due to environmental regulations and consumer awareness.

U.S. Blister Packaging Market Trends

The U.S. blister packaging market is expanding strongly, with growth driven mainly by pharmaceutical applications and rising use of single dose and tamper evident packs. Thermoforming technology is increasingly adopted for its flexibility and cost efficiency, while cold form blistering remains important for high-barrier pharmaceutical needs.

What Is Causing the Blister Packaging Market to Grow Rapidly in Latin America?

The blister packaging market in Latin America is experiencing rapid growth primarily due to the upsurge in manufacturing pharmaceutical products in markets such as Brazil and Mexico. The advancement of healthcare and treatment awareness, increase in pharmaceutical exports, and utilize of over-the-counter (OTC) medicines have instigated the adoption of blister packaging in this region.

Local manufacturing companies are also investing in the production of low-cost and recyclable materials to meet sustainability objectives. Blister packaging is supported for pharmaceutical and healthcare infrastructure from government entities, and through the modernization of pharmaceutical packaging facilities in the region, continues to augment the growth of blister packaging in Latin America.

What Is Contributing to the Demand for Blister Packaging Throughout Europe?

Europe's blister packaging market is thriving with strict regulatory norms related to the safety of pharmaceuticals, technological developments and advancements, and sustainability being the pressing industry objectives. Germany, the UK, and France are the leaders in sustainability practices, where recyclable blister packs and aluminum materials utilize materials that are recyclable. The growing demand for unit-dose packaging and the ever-increasing requirements imposed by nutraceutical and personal care will continue to add to Europe's dominant market position in the global blister packaging market.

What is the relationship between blister packaging value chain, efficiency, and innovation?

The blister packaging markets' value chain includes multiple elements, including the sourcing of raw materials, product manufacturing, packaging design and optimization, distribution, and end-use delivery of products. Each element in the value chain contributes to the function, quality, compliance, and sustainability of the product.

- Raw Material Optimizing: Manufacturers are focusing on the use of sustainable plastic such as PVC, PVDC, and PET and eco-friendly coatings to provide sustainability, product safety, and lower carbon impacts.

- Technological Advances: The adoption of smart printing, labeling, RFID, and high-speed forming machines delivers improved efficiency and better traceability along the supply chain.

- Distribution and End-use Partnerships: Partnerships with logistics and end-use applications, developing collaborations, whether logistical or healthcare providers, ensure safe delivery of products and compliance through product development from pharmaceutical or retail packaging colleagues. As the industry recognizes double-digit market growth in blister packaging it is important that the industry considers all the variable production optimization factors

What Is the Future for the Blister Packaging Market?

Blister packaging has a bright future due to increasing usage in pharmaceuticals, food, and electronics. The drive for sustainable materials, unique pack design, and personalized packaging for healthcare will all continue through 2030, shaping market trends.

- Industry Growth Overview: The blister packaging industry is set for steady growth due to the increasing consumption in medical applications, heightened standards for product protection, and the rapid uptake of technology into the industry. The adaptability of blister packaging to many different industries indicates that blister packaging will remain relevant globally in the long term.

- Sustainability Trends: The use of recyclable plastics, biodegradable films, and water-based coatings are all initiatives being adopted by manufacturers to help minimize environmental harm. Packaging sustainable initiatives and regulations are promoting a shift to the principles of a circular economy for blister packaging.

- Global Expansion: Companies invested in blister packaging are expanding packaging production facilities in growing markets (developing, emerging, or transitional countries/regions), and establishing their positions in smart packaging. Cross-border partnerships and mergers is helping expand blister packaging reach into North America and the Asia-Pacific Region, and Europe.

- Startup Ecosystem: There are an increasing number of startups entering the market with technologies like eco-design, AI-based production monitoring, and digital printing materials/products and processes. These additions to the landscape will help competition and accelerate the rate of sustainable packaging in blister packaging globally.

Blister Packaging Market Companies

- Amcor

- Dowdupont

- Westrock

- Sonoco Products

- Constantia Flexibles

- Klockner Pentaplast

- Honeywell

- Tekni-Plex

- CPH GROUP

- Pharma Packaging Solutions

- Shanghai Haishun

Recent Developments

-

On 23 January 2025, the Ministry of Environment, Forest and Climate Change (MoEFCC). The Indian government notified the Plastic Waste Management (Amendment) Rules, 2025, mandating that from July 1, 2025, all plastic carry bags and multilayered packaging must display a barcode or QR code. This code must include details such as the thickness of the material and the manufacturer's identification. The move is aimed at enhancing traceability and promoting sustainable packaging practices, directly impacting the use of plastics in formats like blister packaging.

-

On 13 December 2024, Ecobliss India, a Hyderabad-based packaging innovator, reported significant advancements in pharmaceutical blister packaging. The company emphasized the importance of innovative packaging solutions in enhancing drug efficacy and patient compliance. Hyderabad, contributing approximately 15% to India's $75 billion organized packaging industry, is emerging as a hub for advanced packaging technologies, including child-resistant and senior-friendly blister packs.

-

In January 2025, Keystone Folding Box Co. observed a surge in demand for its Key-Pak child-resistant, paperboard-based blister cards in India. This increase is attributed to India's new sustainability guidelines and the growing need for child-resistant pharmaceutical packaging. The Key-Pak series offers eco-friendly solutions with reduced plastic content, aligning with global sustainability trends.

- In Michigan, the US, and Ghent, Belgium, Amcor Plc opened two e-commerce testing facilities in September 2019. By supplying simple and environmentally friendly packaging materials, this expansion will assist the business in capturing considerable online sales growth.

- WestRock Company will introduce recyclable EnviroFlex PE flexible polyethylene packaging in September 2019. It may be applied to a range of retail goods and meet the rising need for recyclable and ecological packaging.

- Constantia Flexibles released a blister packaging solution in January 2019 for the application of oral dose prescription tablets, nutritional supplements, and personal care products.

- Sonoco Products Company introduced an all-paper retail blister package in February 2020 as a good, environmentally friendly substitute for thermoformed plastic blister packaging.

Segments Covered in the Report

By Product

- Carded

- Clamshell

By Technology

- Thermoforming

- Cold Forming

By Material

- Paper & Paperboard

- Plastic Films

- PVC/Vinyl

- PET

- PE

- Others

- Aluminum Foil

- Others

By Application

- Healthcare

- Consumer Goods

- Industrial Goods

- Food

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content