What is Cold Form Blister Packaging Market Size?

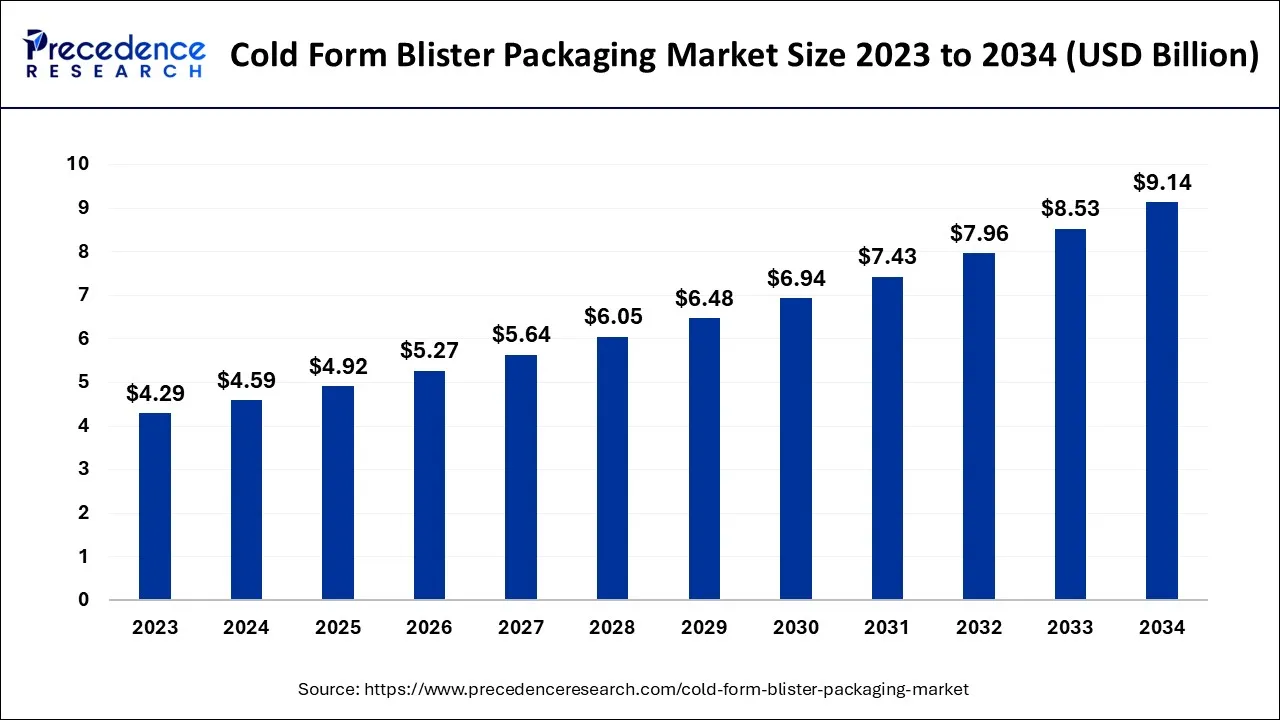

The global cold form blister packaging market size is calculated at USD 4.92 billion in 2025 and is projected to surpass around USD 9.72 billion by 2035, growing at a CAGR of 7.05% from 2026 to 2035

Market Highlights

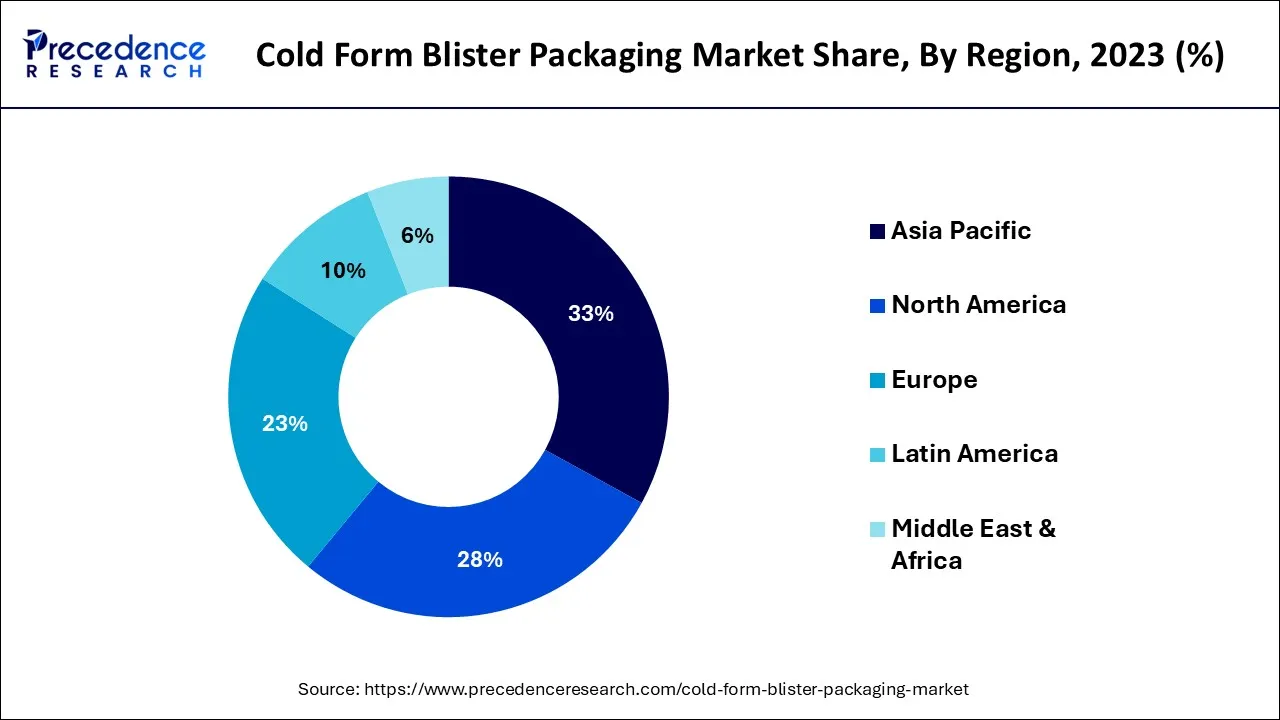

- By region, Asia-Pacific generated more than 33% of revenue share in 2025.

- By material, the aluminum segment contributed more than 43% of revenue share in 2025.

- By application, the market was dominated by the healthcare application segment. The consumer goods application segment is also expected to expand significantly during the scheduled period.

Market Overview

The global cold form blister packaging market revolves around the production, innovation and distribution of blister packaging that is widely used in the pharmaceutical industry. Aluminum-containing laminate film in the shape of thin sheets is used in the cold-form blister packing method. Cold forming employs a stamp to press the sheets into a form, enabling the aluminum-based films to expand and hold the mold shape after removing the stamp to produce blister packs. Pharmaceuticals are packaged frequently using the method of cold-form blister packaging as the aluminum-based film stops moisture from entering the packing.

Cold Form Blister Packaging Market Growth Factors

An important factor influencing the cold-form blister packaging market is the consumer preference for protection and security, which extends the product's shelf life. Other essential market drivers include growing government initiatives to assist healthcare facilities, global urbanization trends, and rising disposable income. In addition, an increase in demand from developing nations will open up more chances and fuel the expansion of the market for cold-form blister packaging throughout the forecast period.

The rising need for cold-form packing across a range of end-use sectors is another factor driving the growth of the global market. Additionally, packaging materials are frequently employed to raise environmental standards; as a result, the worldwide cold-form blister packaging market will likely grow in the future.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.92 Billion |

| Market Size in 2026 | USD 5.27 Billion |

| Market Size by 2035 | USD 9.72 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.05% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Material and By Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand across multiple end-users

Cold blister packaging is less expensive than other packaging types like rigid packaging since it requires less material for packing, takes up less room on store shelves, and offers a fantastic hang-hook display. As the requirement for temper-proof and practical packaging rises, cold blister packaging is becoming increasingly essential in the pharmaceutical industry. As a result of increasing demand from end-use industries like food, healthcare, industrial goods, and consumer goods, the market for cold blister packaging is growing globally.

Restraint

Limitations for packaging

Cold form blister packaging is not considered an effective method for packaging heavy goods, it is typically used to preserve lightweight items such as pharmaceutical drugs. The paperboard or plastic film that supports heavy items during packing will be under more significant strain. This could result in product loss and increased costs due to packaging damage from storing, handling, and shipping the product. Additionally, using blister packaging for pricey and delicate products is not advised as it could result in product damage or cracking. This situation could pose problems with expanding the cold blister packaging market.

Opportunity

Rising application from the food industry

In the food industry, cold blister packaging is most frequently utilized. Retailers can use blister packs, which are pretty helpful, to package a variety of fresh commodities, including meat, fruit, bakery items, candy, ice cream, etc. Blisters effectively display the items and safeguard food from damage during handling and transit. Additionally, blisters offer superior product protection and are more lightweight than materials such as glass or metal. Blisters are affordable, even for packaging relatively simple products, because they make it easier to follow stringent hygiene regulations. Luxury chocolate boxes frequently contain blisters inside of them to package the chocolate. Consequently, the growing need for cold-form blister packaging from the food industry offers lucrative potential for the worldwide cold-form packaging industry. As a result, there is a profitable opportunity for the growth of the worldwide cold-form blister packaging market due to the food sector's rising need for cold-form blister packaging.

Segment Insights

Material Insights

By material, in the cold-form blister packaging industry, the aluminum category holds the most significant market share. It does so because of its distinct qualities, which include guarding against contamination, serving as a strong barrier, and increasing the expected lifespan of the goods by keeping moisture and oxygen out. Aluminum has a strong mechanical resistance and is resistant to numerous external forces. It has the propensity to penetrate other substances and shatter but including plastic resolves these problems.

The PVC category will expand at a sizable rate during the projection period because of its high visibility qualities and affordability. The cost-effectiveness of PVC is its key benefit. PVC sheets are combined with PVDC, or polyvinylidene chloride, to enhance the barrier qualities of the packaging. This offers excellent defense against oxygen and moisture.

The global demand for eco-friendly packaging solutions is driven by rising consumer demand and a focus on sustainability. PET plastic sheet offers outstanding mechanical strength, superior creep resistance, and high stability. PET material is one of the many productive plastics globally because it is affordable, adaptable, and durable.

Application Insights

By application, the market was dominated by the healthcare application segment. Generally, the healthcare sector prefers to use cold-forming packaging supplies, and it seals items like tablets, capsules, medicines, vials, ampoules, syringes, and liquids. Packaging tamper-evident, child-resistant, anti-counterfeit, and senior-friendly is highly sought-after globally.

The consumer goods application segment is also expected to expand significantly during the scheduled period. Consumers must scrutinize the goods and their claims due to the rising demand for a variety of goods, including bar soap, lipstick, shower gel, toothbrushes, and other items. Consumers can view the product within cold-form blister packaging thanks to the application of transparent plastic film materials. The packaging looks better thanks to the transparency, which increases the products' aesthetic attractiveness on the store's shelves and draws customers' attention.

Due to its ability to handle various electronic equipment or components based on their dimensions and particular requirements, the semiconductor and electronics application segment is also expanding significantly.

Regional Insights

Asia Pacific Cold Form Blister Packaging Market Size and Growth 2026 to 2035

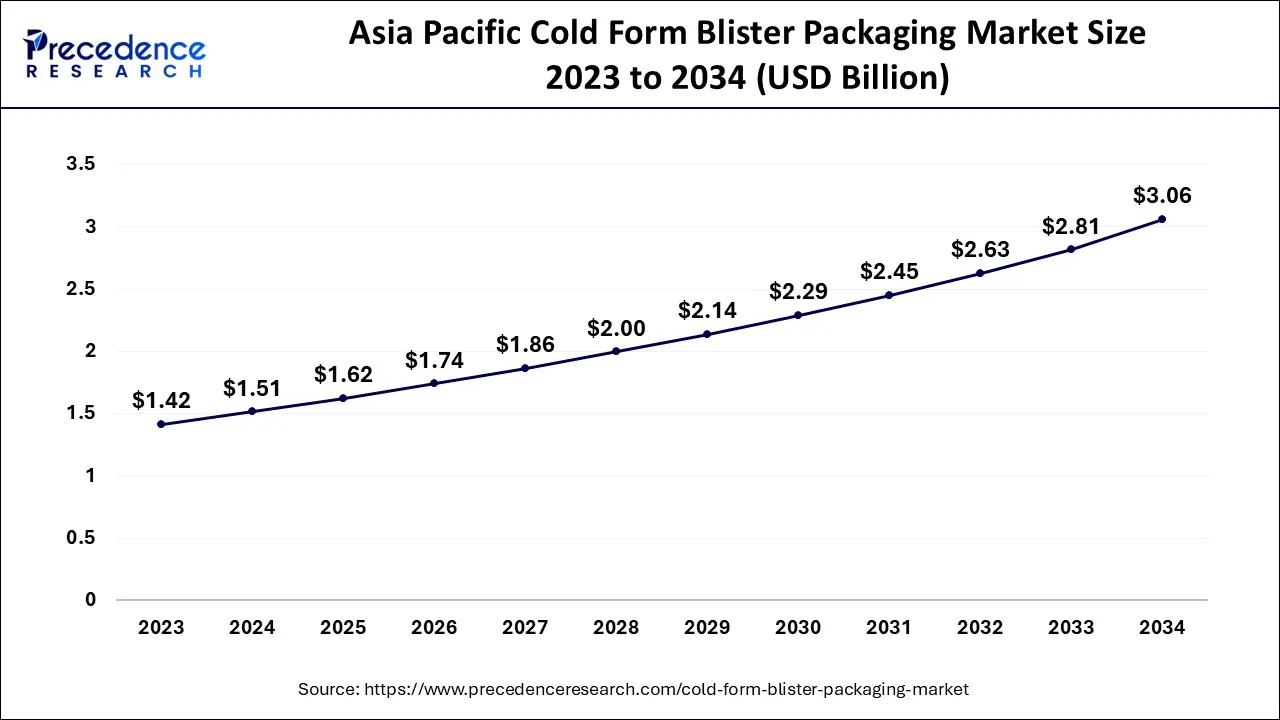

The Asia Pacific cold form blister packaging market size is exhibited at USD 1.62 billion in 2025 and is projected to be worth around USD 3.26 billion by 2035, growing at a CAGR of 7.24% from 2026 to 2035

How did Asia Pacific dominate the Cold Form Blister Packaging Market in 2025?

By region, due to the rapid growth of end-use industries like healthcare, food, consumer goods, and industrial goods, Asia-Pacific is predicted to account for the largest revenue share in the global cold blister packaging market throughout the forecast period. Additionally, the regional market is expected to see revenue growth throughout the projection period due to a rise in high-visibility items, increasing disposable income, a growing middle-class population, and a growing healthcare sector. The overall development of the packaging industry will also accelerate the development of.

Why did North America hold a Significant Share and grow at the Fastest Rate in the Cold Form Blister Packaging Market?

North America held a significant share of the market in 2023. Due to a firmly established pharmaceutical sector, the geographical area of North America continues to grow rapidly. The pharmaceutical industry in North America is heavily focused on developing practical and advanced packaging, competitive key players, and rapid adoption of cutting-edge machinery for innovative packaging. This is due to the region's strong emphasis on producing contamination-free and integrated packaging for medicines.

India Cold Form Blister Packaging Market Analysis

The expansive reach of cold form blister packaging in India is driven by the expansion of the pharmaceutical sector, safety standards, sustainable innovation, and online pharmacies. According to the International Council for Circular Economy, EcoVeda is India's first pioneering medical blister recycling program, launched to tackle the challenge of pharmaceutical packaging waste.

U.S. Cold Form Blister Packaging Market Analysis

The U.S. market's growth is encouraged by the expansion of advanced technologies into fast-moving consumer goods, electronics, and semiconductors. In December 2025, Ember LifeSciences Inc. secured the funding of $16.5 million to advance revolutionary cold chain solutions. Demand is being driven by the rising prevalence of chronic diseases, an aging population, and growing consumption of prescription medications that require robust protection and extended shelf life.

Which Region is Growing Notably in the Cold Form Blister Packaging Market?

Europe is expected to grow at a notable rate in the market in 2025, driven by sustainability and recycling regulations, stringent regulatory standards, pharmaceutical growth, and innovation. This growth is supported by a rising prevalence of chronic diseases, an aging population, and increasing demand for safe, tamper-evident, and extended-shelf-life packaging across the region. Continuous technological advancements, such as improved aluminum foils, automated production lines, and inline inspection systems, are helping manufacturers enhance product protection, reduce defects, and boost operational efficiency.

• In October 2025, the European Union launched a new packaging regulation to strengthen circular economy standards.

What are the Major Factors Contributing to the Cold Form Blister Packaging Market within South America?

South America is expected to experience significant growth during the forecast period due to the increasing demand for nutraceuticals and over-the-counter medications in urban centers like Brazil, Argentina, and Chile, and regulatory and compliance mandates. Rising prevalence of chronic diseases and expanding access to healthcare are driving demand for reliable, tamper-evident packaging with extended shelf life, while regulatory emphasis on patient safety and product integrity is encouraging broader adoption of cold form solutions across the region.

- In October 2025, the International Finance Corporation (IFC) invested in America Embalagens to boost circular economy solutions in Brazil.

What Opportunities Exist in the Middle East and Africa in the Cold Form Blister Packaging Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by stringent regulatory mandates and prominent hubs like Saudi Arabia, Egypt, and the UAE. The government-led healthcare reforms and robust healthcare infrastructure have expanded the regional market. Growth is being driven by expanding healthcare access, rising pharmaceutical consumption, and efforts to improve patient safety through tamper-evident, compliant packaging with extended shelf life.

• In April and May 2025, the members of the East African Community introduced several new standards related to food contact articles and materials to the World Trade Organization, which include requirements, test methods, sampling, etc.

Cold Form Blister Packaging Market-Value Chain Analysis

- Raw Material Sourcing (Plastic, Paper, Glass, etc.)

This stage is gaining momentum due to PVC-free alternatives, sustainable feedstocks, supply chain localization, and mono-material shift.

Key Players: Amcor Plc, Constantia Flexibles, Tekni-Plex, Inc., Sonoco Products Company. - Logistics and Distribution

This stage includes automation in warehousing, IoT, real-time visibility, and sustainable distribution practices.

Key Players: UPS Healthcare, DHL Life Sciences & Healthcare, FedEx Healthcare Priority, Bilcare Limited. - Recycling and Waste Management

This stage is accelerated by the EU packaging regulation, aluminum packaging innovation, paper-based and bio-based options, and India's plastic waste management rules.

Key Players: Amcor plc, Tekni-Plex, Veolia, Clean Harbors, Uflex Ltd.

Cold Form Blister Packaging Market Companies

- Amcor plc

- Bemis Company Inc.

- Winpak Ltd.

- CONSTANTIA

- Svam Toyal Packaging Industries Pvt. Ltd.

- Uflex Limited

- Bilcare Research

- Tekni-Plex

- Essentra plc

- Rollprint.

- Ningbo Dragon Packaging Technology Co Ltd

- Haishun New Pharmaceutical Packaging Ltd.

- Wasdell Packaging Group

- Flexi Pack.

- WISESORBENT TECHNOLOGY LLC

- Accupack

- Aphena Pharma Solutions

- ROPACK INC

- Nuplas Industries.

- Green Pack Foils Pvt. Ltd

Recent Developments

- In April 2025,Amcor plc secured a commercial order for the AmSky™ Blister System by introducing the launch of the new TheraBreath Invigorating Icy Mint chewing gum. The gum is currently available across the U.S.

- In November 2025, ACG announced the launch of cold-form laminate for moisture-sensitive blister packs. These packs are designed to protect moisture-sensitive drug molecules and aim to address issues such as rigid technologies, compatibility issues, and limited availability.

- In November 2022,UK-Shawpak, a manufacturer of medical packaging equipment, unveiled its latest Shawpak Rigid Blister Machine. This made it possible for businesses to quickly create their trays. Installing the Shawpak Rigid Blister Machine enabled the company to provide a full range of packaging solutions to its clients in the medical and pharmaceutical industries. One of the newest additions to the Shawpak portfolio is this packaging machine, which the company developed, designed, and produced. One of the machine's key advantages is that medical device clients can create packaging on order from roll stock without relying on supply chains, giving them complete flexibility. Customers can develop trays in advance due to the quick tool changes that provide full control. This eliminates the need to hold excess stock for months, wasting space and money. By controlling inspection and serialization as packs are created and integrating a company's supply chain, this equipment helps improve quality control.

- In May 2022,TerraCycle, prominently recognized company for PVC and PETG based blisters for PVC and PETG-based blisters, TerraCycle recognized Aclar barrier film blisters from Honeywell as technically recyclable. To achieve technical recyclability, the team has created a lab-scale procedure that separates Aclar from blister packaging. Technical recyclability is the initial stage on the road to practical recyclability, which may allow items previously thought to be challenging to recycle, like chemical equipment, industrial process equipment, and automobile components, to have a second downstream life. Aclar Edge bottles and Aclar ultra-high-barrier film are a component of Honeywell's Life Sciences offering. The moisture barrier protection required for drug stability and maintaining the efficacy of medicines is provided by Aclar Edge bottles and Aclar films, which aid in protecting pharmaceuticals. The fact that existing conventional recycling techniques can only handle less complicated structures, such as monolayer materials, present a problem for both pharmaceutical makers and customers. As a result, multi-layer primary pharma barrier packaging waste is frequently dumped in landfills or burned. Due to client demand, pharmaceutical firms have embarked on an aggressive mission to reduce their environmental impact. They firmly commit to reducing the number of packaging materials used, being carbon neutral, and using PVC-free packaging.

Segment Covered in the Report

By Material

- Aluminum

- Oriented polyamide

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

By Application

- Healthcare

- Electronics & Semiconductors

- Consumer Products

- Food & Confectionery

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting