What is the Blockchain in Asset Management Market Size?

The Blockchain in Asset Management Market enhances transparency, security, and efficiency in managing financial assets using blockchain technology. The increased need for improved security, transparency, and efficiency in industrial digital assets, driving the global blockchain in asset management market.

Blockchain in Asset Management Market Key Takeaways

- North America dominated the global market with the largest share in 2025.

- Asia Pacific is expected to grow at a notable CAGR from 2026 to 2035.

- By component, the platform segment held the major market share in 2025.

- By component, the services segment will grow at a CAGR between 2026 and 2035.

- By application, the compliance and risk management segment contributed the biggest market share in 2025.

- By application, the smart contracts segment will expand at a significant CAGR between 2026 and 2035.

- By deployment type, the cloud segment contributed the biggest market share in 2025.

- By deployment type, the on-premises segment will expand at a significant CAGR between 2026 and 2035.

- By end user, the banks and financial institutions segment dominated the market in 2025.

- By end user, the hedge funds and pension funds segment is expected to grow at a significant CAGR over the projected period.

What is the use of blockchain in asset management?

The blockchain in the asset management market refers to the way people in investing, trade, and manage their digital assets. Around 64% of industries are using digital assets managed by enterprises. The blockchain in asset management is a rapidly growing industry where blockchain technology is being leveraged to manage digital assets' security, transparency, trust, and efficiency. Industries like finance & banking, supply chain management, real estate, and healthcare are the major adopters of blockchain-based asset management systems. These industries are playing a vital role in enhancing transparency, trust, efficiency, cost reduction, security & fraud protection, and accessibility and financial inclusion in their digital asset management.

Industries are looking for real-time settlement solutions to improve interaction with users, driving a surge for blockchain-based asset management solutions. The smart contracts to automate compliance processes are gaining significant popularity around the globe, driven by the need to comply and meet with regulatory standards. Distributed Ledger, Immutable Nature, Cryptography, Smart Contracts, and Tokenization are key opportunities for blockchain-based asset management solutions. Major key players, including IBM, Microsoft, SAP SE, and Oracle, are providing significant solutions in areas of finance, supply chain, procurement, healthcare, and other industries.

2025 Federal Developments on Blockchain in Asset Management

- On May 15, 2025, "An Incremental Step Along the Journey" was issued by the US Securities and Exchange Commission (SEC) Commissioner Hester M. Peirce. The issue "An Incremental Step Along the Journey" is a statement that addresses the SEC's Division of Trading and Markets' release of FAQs concerning cryptoasset activities and distributed ledger technologies.

- On May 7, 2025, Interpretive Letter 1184, guiding the authority of national banks and federal savings associations to engage in cryptoasset custody and execution services, was issued by the Office of the Comptroller of the Currency (OCC). The OCC clarifies bank authority for crypto custody and services and emphasizes the importance of risk management and regulatory compliance in activities.(Source: https://www.dlapiper.com)

Why is AI playing a crucial role in the blockchain in asset management?

Artificial Intelligence and blockchain technology are transforming the financial services industry. Businesses are leveraging AI in existing asset management solutions to enhance risk management and reduce costs by enhancing creditworthiness assessments and fraud detection. AI is impacting blockchain technology in asset management by providing improved transparency and trust. AI is helping to improve security, efficiency, and smart contract optimization. The predictive analytics of AI algorithms helps to predict trends, potential risk, and optimize asset management strategies, to build reliability and cost-saving advantages. AI is playing a crucial role in blockchain-based asset management solutions, leading to more innovations and efficiency.

Which Trends Are Increasing the Adoption of Blockchain-based Asset Management in Industries?

- Government Decentralization: Governments worldwide are providing support in the growth of blockchain and asset management by increasing adoption in areas of digital identity, debt-based money instability, monetary policy, and asset management.

- Enhance Security and Transparency: Blockchain's decentralized and immutable ledger provides secure, transparent, and tamper-proof asset transactions, and reduces the risk of counterfeiting and unauthorized and fraud.

- Improved Efficiency and Cost Saving: The asset management process streamlined by blockchain through automation helps to reduce intermediaries, increases efficiency, and reduces process time.

- Growth of Liquidity: Tokenization, a seamless blockchain asset, helps to bring financial ownership and improved liquidity, ensuring easier exploration and trade of different assets with improved security measures.

- Federated Blockchain: federated blockchain offers a decentralized and secure platform for asset management, ensures businesses become clear at insurance claims, financial services, supply chain management, multiparty collaboration, and record security, and scalability.

Blockchain in the Asset Management Market Outlook

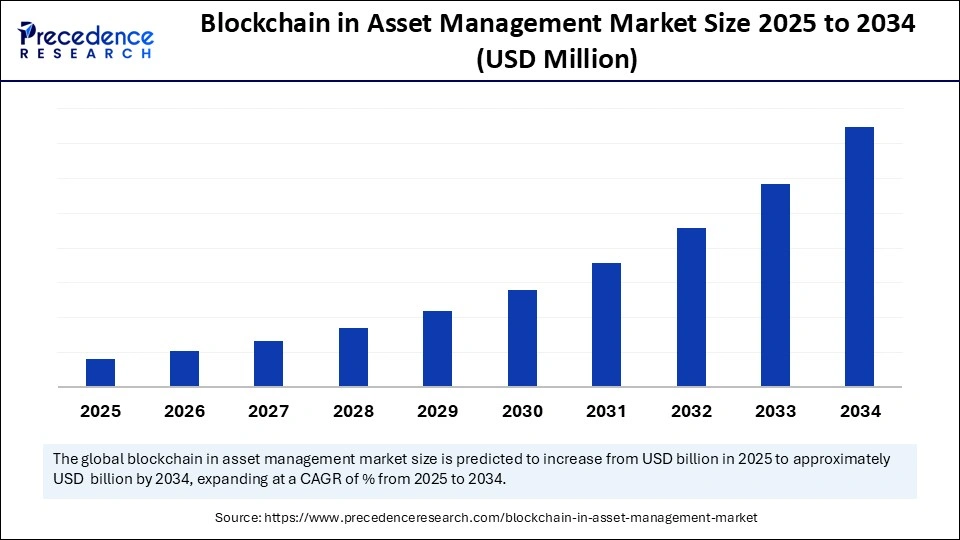

Between 2025 and 2030, this market is expected to rise significantly due to the rising adoption of cloud-based solutions in the BFSI sector, coupled with technological advancements in the AI industry.

Numerous market players are actively entering this market, drawn by partnerships, R&D, and joint ventures. Several asset management companies, such as Kyber Network, RealBlocks, Consensys, and some others have started investing rapidly for developing asset management solutions around the world.

Various startup brands are engaged in developing asset management solutions across the globe. The prominent startup companies dealing in blockchain-based asset management consist of Vertalo, imToken, Nydig, and some others.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Application, Deployment Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Decentralization of Networks

The rising adoption of decentralized blockchain networks is driving the blockchain in the asset management market, driven by enabling a secure way to manage assets, enhance transparency, efficiency, and gain control over all digital assets. Decentralized blockchain technology helps to reduce the requirement of intermediaries and central authorities by providing transparent and secure asset management. This technology enables asset tokenization, decentralized finance, and real-time tracking and verification of assets in supply chain management. Industries are adopting decentralized blockchain networks to improve their process scalability, accessibility, and reduce counterparty risks.

Restraints

High Implementation Cost of Blockchain Technology

Blockchain technology in asset management requires high investment in development, specialized expertise, and potentially licensing. The high implementation cost hampers its entry into smaller organizations or startups. The implementation of blockchain technology needs investments in infrastructure, skills, and training, causing challenges for organizations with limited resources and budgets. However, the ongoing innovation and development of cloud-based blockchain technology can help to reduce the upfront cost of implementation.

The changing regulatory landscape

The changing regulatory framework associated with blockchain technology for risk of cryptocurrencies is causing challenges of uncertainty, compliance, and limiting the adoption of blockchain in asset management. Business is limiting their investments and innovations in blockchain-based asset management solutions, due to the frequently changing regulatory landscapes. Additionally, various regulatory frameworks approach jurisdiction, creating a complex environment for asset managers' operations globally.

Opportunity

The Adoption of Distributed Ledger Technology (DLT) Solutions and Fund Tokenization

Businesses are focusing on the adoption of distributed ledger technology and fund tokenization to enable their real-time settlements, reduce transaction costs, and improve transparency and efficiency in the asset management process. The transparent and tamper-proof record of transactions is being enabled due to the advanced component of blockchain technology in asset management, including distributed ledger technology. Additionally, fund tokenization enables traditional assets on blockchain, helps to improve liquidity, and fractional ownership. the digital assets, Art & collectibles, and real estate are the major applications of this technology. The rising surge toward modernization, including updated legacy systems, operations, and settlement distribution, is fostering adoption of the Distributed Ledger Technology (DLT) Solutions and Fund Tokenization.

- In April 2025, Kin Capital launched a US$100 million real estate debt fund on Chintai for qualified institutional investors with less investment needs of US$50,000. It is designed to be one of the first-performing real estate trusts globally.(Source: https://www2.deloitte.com)

Segment Insights

Component Insights

In 2025, the platform segment dominated the market, driven by the increased need for customized, scalable, and cost-effective solutions. The platform provides foundational infrastructure to develop and run blockchain applications. The platforms enable to creation of decentralized applications (dApps), smart contracts, and blockchain networks, crucial components of blockchain-based asset management solutions. Platforms including asset tokenization, blockchain asset tracking & monitoring, and smart contract functionality are gaining popularity in the global market.

The services segment is expected to grow at a significant growth in the forecast period due to the increased adoption of blockchain in asset management for more transparency, trust, efficiency, scalability, and security. Services, including custody, back-office operations, and settlement, enable blockchain technology to offer substantial improvements. Consulting, implementation, integration, and maintenance & support are the key services that help asset managers to use, as well as help to develop and design blockchain solutions.

Application Insights

The compliance and risk management segment dominated the market in 2025, driven by increased adoption of blockchain-based asset management to comply with compliance and risk, reduce fraud, enhance data accuracy, security, and enable more efficient and effective asset processes. An immutable transaction helps to reduce the risk and compliance associated with the asset. The digital ledger is also a key component of blockchain-based asset management, enabling detection of potential risk and fraud. Blockchain technology in asset management helps to build trust between stakeholders and meet regulatory standards.

The smart contracts segment is the second-largest segment, leading the market. The smart contracts automate transactions and agreements, increase transparency, and enhance security, reducing the risk of unauthorized and fraud. Smart contracts provide automated tasks, including trade settlements, payments, and compliance checks, eliminating intermediaries and manual processes. The smart contracts enable high efficiency, accuracy of transactions, and improve trust among stakeholders by providing transparent and tamper-proof contracts.

Deployment Type Insights

In 2025, the cloud segment generated the largest market share. The organization has increased adoption of cloud-based blockchain technology in asset management to reduce the cost burden associated with infrastructure and maintenance of the technology. Public and private are two components of cloud-based blockchain in asset management solutions. The public cloud segment accounted largest market share due to high use of public cloud blockchain technologies for scalable and cost-effective infrastructure for deployment of blockchain solutions. The need for scalable, highly secure, and cost-effective solutions drives the adoption of cloud-based blockchain in asset management solutions.

The on-premises segment is anticipated to witness the fastest growth over the forecast period due to major adoption of on-premises-based blockchain in asset management solutions for greater control, security, customization, and reliability. On-premises solutions offer specific business needs and requirements, and higher reliability to the organizations. Large enterprises are the prior adopters of on-premise blockchain technology in asset management solutions, to enable high security and control over their robust IT infrastructure.

End-user Insights

In 2025, the banks and financial institutions segment led the market due to increased adoption of blockchain-based asset management solutions to simplify banking processes and reduce structural costs. The blockchain-based asset management solutions, including asset tokenization, smart contracts, and digital asset custody, are the major solutions being used in banks and financial institutions, for more accessibility, an automated asset management process, and securing, storing, and managing assets for the clients. Banking and financial services are stepping toward becoming more efficient and diversified with the use of blockchain-based asset management technologies.

The hedge funds and pension funds segment is the second-largest segment, leading the market. The blockchain-based asset management solutions provide simple and sorted solutions to the fund administrations. The solutions streamline the calculation of net asset values, the subscription process, and investor data management. Organizations are adapting blockchain-based asset management solutions to enhance process efficiency, security, and transparency. The transparent and secure nature of blockchain technology helps asset managers to comply with regulatory requirements and reduce the risk of errors or unauthorized activity.

- On May 7, 2025, the new law Hampshire enacted HB 302, was enacted to permit the State Treasurer to invest public funds in digital assets and precious metals as part of a strategic reserve. Under the new law, the State Treasurer is expected to allocate up to 5% of total public funds from the general fund, the revenue stabilization fund, and other funds to investments in precious metals and digital assets.

(Source: https://www.dlapiper.com)

Regional Insights

North America is the major player in the global blockchain in asset management market, driven by regions' early adoption of new and innovative technologies, the existence of robust infrastructure, including finance and advanced technology, regulatory support for blockchain and digital assets, and heavy investments and funding in blockchain startups and projects. Collaborative approaches between major companies are fostering growth in the crypto trading market in North America.

- For instance, in May 2025, a major U.S. fintech company agreed with a Toronto Stock Exchange-traded crypto trading platform in an all-cash transaction to focus on crypto trading, staking, and custody services. The collaboration targeted regulatory approvals for the company's offerings. (Source: lexology.com)

The U.S. is leading the regional market, due to major financial institutions and technology businesses are exploring asset management potential and increased adoption of blockchain technologies. Additionally, the U.S. government supports the leverage of blockchain solutions to improve transparency, cost-effectiveness, and reduce the risk of fraud and data breaches in well-established infrastructure. For instance, in 2022, the U.S. government and companies invested US$4.2 billion in Blockchain solutions. Around 48% of blockchain startups are found in the U.S.

The upcoming Trump administration's plans focus on the establishment of a crypto advisory council, aligned with the implementation of regulatory bodies for enhancing growth and innovation in the country's digital asset industry. This proposal helps to reserve national Bitcoin and brings pro-crypto officials to the top, fostering the adoption of blockchain-based asset management technologies.

Asia Pacific is anticipated to witness the fastest growth over the forecast period, due to rising government regulatory establishments, driven by rapid adoption of blockchain technology and a growing digital economy. Asian countries are focusing on digital assets, including tokens and cryptocurrencies, driving growth in the regional blockchain technology market. The Southeast Asia and Middle Eastern countries have witnessed spectacular growth in recent years. The collaboration between the U.S. regulatory environment and well-established frameworks in jurisdictions like Singapore and the UAE is shaping global digital asset environments. With countries focusing on broader institutional adoption and developments and trends at the federal and state levels, regulations are fostering the need for blockchain-based asset management technology. Additionally, the ongoing war situation in Asia is shaping developments and the adoption of advanced blockchain-based asset management systems to protect and secure countries' financial ecosystems.

- For instance, in March 2025, Pakistan launched the national crypto council for regulation and the leveraging of blockchain technology and digital assets in the country's financial system.(Source: https://www.thehindu.com)

Europe held a significant share of the market. The rising adoption of cloud-based asset management solutions in the financial sector in numerous countries, including Germany, France, Italy, the UK, and some others, has boosted the market expansion. Additionally, numerous government initiatives aimed at strengthening security in the BFSI sector are expected to accelerate the growth of blockchain in the asset management market in this region.

What made Latin America hold a considerable share of the market?

Latin America held a considerable share of the industry. The growing demand for advanced security solutions from the insurance companies across numerous countries, including Argentina, Brazil, Peru, and some others, has driven the market growth. Also, rapid investment by market players for opening up new research and development centers is expected to propel the growth of the blockchain in the asset management market in this region.

The Middle East and Africa held a notable share of the market. The increasing deployment of asset management solutions in brokerage firms in several nations, such as the UAE, Saudi Arabia, South Africa, and others, has propelled the industrial expansion. Moreover, technological advancements in the BFSI sector are expected to drive the growth of blockchain in the asset management market in this region.

Which Countries Led the Asian Blockchain in the Asset Management Market in 2025?

Countries like China, Japan, Singapore, and India are leading the Asian blockchain in the asset management market in 2025. China is the major player in the regional market, with growth driven by the country's government-initiated projects and collaboration among academia and industries for blockchain advancements, leading China to become a leader in blockchain technology. Government projects, including NEO, “China's Ethereum.” Platforms for offering to build decentralized applications (dApps) and smart contracts are expanding the blockchain environment in the country. Additionally, the TRON, Qtum, and VeChain programs are also optimizing blockchain scalability.

Singapore is a significant player driving market growth due to the country's progressive regulatory framework for blockchain technology. The virtual asset service providers in Singapore are mandated to have a license, under law passed in April 2022, to conduct the country's business overseas, with a focus on anti-money laundering (AML) and countering the financing of terrorism (CFT) concerns(Source: https://www.trmlabs.com)

- Additionally, In April 2024, Singapore's central bank implemented crypto custody and licensing requirements.

Blockchain in Asset Management Market Companies

Coinbase Global, Inc. is a U.S.-based company that operates cryptocurrency exchange platforms, allowing users to buy, sell, and trade crypto assets. This company was founded in 2012 and serves individual consumers, institutions, and developers with a suite of products, including trading platforms, self-custody wallets, and blockchain infrastructure services.

Galaxy Digital Holdings Ltd. is a diversified financial services and investment management firm specializing in the digital asset, cryptocurrency, and blockchain technology sector. This company is headquartered in New York City and operates across multiple business segments, including asset management, trading, principal investments, and advisory services.

IBM Corporation is a multinational technology company focused on hybrid cloud, AI, and consulting solutions. This company provides a wide range of products and services, including hardware, software, cloud computing, analytics, and cybersecurity, for various industries like finance, healthcare, and retail.

Bitmain Technologies Ltd. is a privately held, multinational semiconductor company and the world's leading manufacturer of cryptocurrency mining equipment. Headquartered in Beijing, China, the company is a dominant player in the crypto mining industry, primarily known for its Antminer series of products.

Blockchain App Factory is a technology company that provides blockchain and AI development services, focusing on creating custom solutions like decentralized applications (DApps), cryptocurrency exchanges, and NFT marketplaces. They offer end-to-end services, including consulting, development, and marketing, catering to a wide range of industries and helping businesses enter the Web3 and AI eras.

Chainlink Labs is a company that develops and contributes to Chainlink, an open-source oracle network and decentralized computing platform. Its mission is to power a world where cryptographic truth is the foundation for a decentralized internet, enabling smart contracts to securely interact with real-world data, APIs, and off-chain systems.

Crypto Finance Group is a Swiss-based company that provides professional digital asset solutions to institutional clients as part of the Deutsche Börse Group. It operates through FINMA-regulated entities in Switzerland and a BaFin-licensed subsidiary in Germany, offering services like 24/7 brokerage, custody, staking, tokenization, and infrastructure.

Other Major key Players

- Kyber Network

- RealBlocks

- Consensys

Major Company Trends in Blockchain in Asset Management- 2025

Bitwise Asset Management, a premier crypto-specialist asset manager with over $12 billion in client assets, witnessed tremendous growth during 2025 and has conducted $70M in Backing from Financial Institutions and Technology Investors for FY 2025.

In February 2025, Bitwise Asset Management, has completed a $70 million equity raise to expand its capabilities and services. The funding round was led by Electric Capital, with participation from MassMutual, Highland Capital, among others.

Companies' client assets have increased more than 10x to over $12 billion across three business lines, including beta, alpha, and on-chain solutions.

(Source:https://www.businesswire.com)

Recent Developments

- On May 14, 2025, CoKeeps Sdn Bhd, a Malaysia-based blockchain infrastructure company, collaborated with a wholly owned subsidiary of Malayan Banking Berhad, Maybank Trustees Berhad, to sign a memorandum of understanding (MOU) for exploring and implementing blockchain-based custodial and asset management solutions. The agreement aims to support the national digital transformation ambitions of Malaysia.

(Source: https://technode.global) - In April 2025, a global leader in blockchain-based financial technology, Blockchains Finance, launched a cutting-edge AI integration framework, created to transform users' interaction with decentralized finance (DeFi) and digital assets. The launching of converging AI and blockchain technologies to enhance intelligence, autonomy, and precision of crypto asset management.

(Source: https://www.globenewswire.com) - In November 2025, LCPC AI launched the ETH blockchain platform. This new platform is designed for financial investors in different parts of the world.

(Source: globenewswire.com) - In November 2025, AIUSD launched an AI-powered trading platform. This platform is integrated with blockchain to enhance security in the trading sector.

(Source: www.businesswire.com) - In October 2025, IBM launched IBM Digital Asset Haven. IBM Digital Asset Haven is a blockchain-integrated solution that finds application in the financial sector.

(Source: newsroom.ibm.com)

Segment Covered in the Report

By Component

- Platform

- Services

By Application

- Trade Processing and Settlement

- Compliance and Risk Management

- Identity Management

- Smart Contracts

- Record Keeping

- Billing and Reporting

By Deployment Type

- On-Premises

- Cloud

By End User

- Banks and Financial Institutions

- Asset Management Firms

- Hedge Funds and Pension Funds

- Insurance Companies

- Brokerage Firms

- Wealth Management Firms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting