What is the Botanical Extracts Market Size?

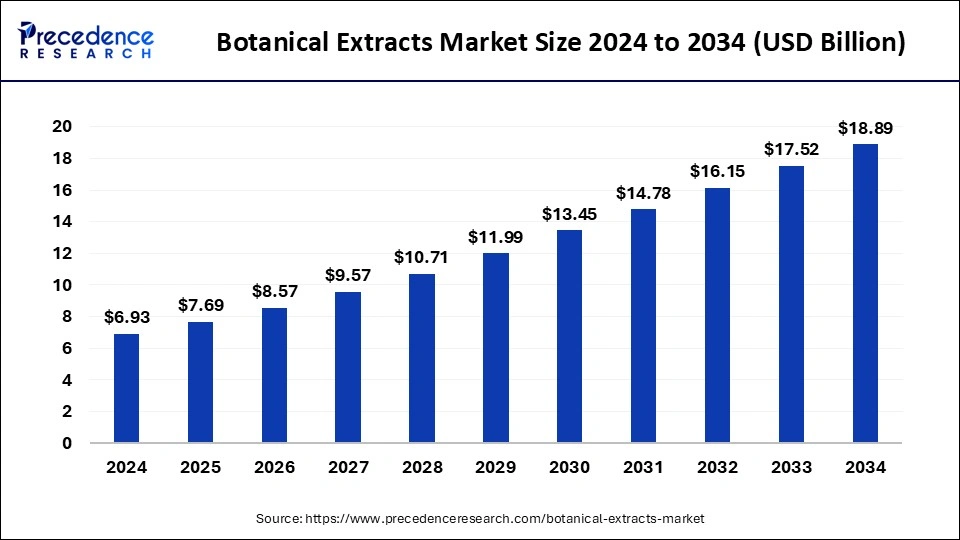

The global botanical extracts market size was calculated at USD 7.69 billion in 2025 and is predicted to increase from USD 8.57 billion in 2026 to approximately USD 20.26 billion by 2035, expanding at a CAGR of 10.17% from 2026 to 2035.

Botanical Extracts Market Key Takeaways

- In terms of revenue, the market is valued at $7.69 billion in 2025.

- It is projected to reach $20.26 billion by 2035.

- The market is expected to grow at a CAGR of 10.17% from 2026 to 2035.

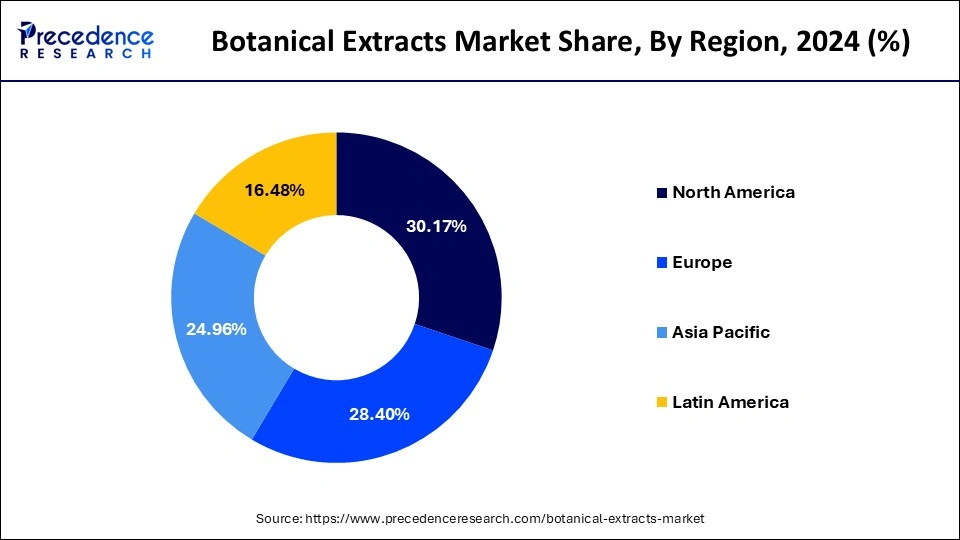

- North America led the global market with the highest market share of 30.17% in 2025.

- Asia Pacific region is estimated to expand at the fastest CAGR of 12.48% between 2026 to 2035.

- By application, the pharmaceuticals segment is projected to experience the highest growth rate in the market between 2026 to 2035.

- By technology, the supercritical fluid extraction segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By form, the powder segment us predicted to witness significant growth in the market over the forecast period.

- By product, the spices segment is set to experience the fastest rate of the market growth from 2026 to 2035.

What is the Botanical Extract?

Demand for goods that have health benefits has increased as consumer attitudes have shifted toward healthier living. Due to their numerous health-promoting qualities, including anti-inflammatory, antibacterial, and antioxidant activities, botanical extracts are becoming increasingly popular as components of functional meals, drinks, and dietary supplements. Customers are looking for items with natural and clean labels as they become more concerned about synthetic substances and the possible health dangers they pose. Growing knowledge of preventative healthcare and the effectiveness of traditional herbal medicines has increased the demand for herbal supplements. Botanical extracts are prized for their anti-aging, anti-acne, and hydrating qualities in skincare products.

Ongoing research and development efforts are being made to investigate the medicinal potential of plant extracts and create novel products, promoting the botanical extracts market. This covers the identification of new bioactive substances, the production of standardized formulations for reliable quality, and applying extraction techniques to increase the potency and bioavailability of extracts. Different regions have different regulatory frameworks controlling the use of botanical extracts, and market participants must adhere to safety and quality criteria. There are many competitors in the fiercely competitive market for botanical extracts, ranging from small-scale growers to major international corporations. Sustainable sourcing methods and traceability along the entire supply chain are becoming more and more critical to guarantee the moral and ecologically sound extraction of botanical raw materials.

Advancements and Innovations in Technology

- Laser-guided framing systems for on-site applications.

- 3D CAD-based layout tools for pre-construction detailing.

- Integration of IoT-enabled sensors to track alignment and stress in structural members.

- Robotic assembly and CNC cutting tools for manufacturing high-precision frames off-site.

How is AI contributing to the Botanical Extracts Industry?

AI optimizes extraction operations based on real-time operation. Machine learning is used to predict bioactivity and toxicity. NLP has been used to speed up the review process of scientific literature. Plant species are detected by computer vision. Automation enhances uniformity, productivity, security, and discovery of compounds in botanical research pipelines.

Key Market Trends

- Increased adoption of prefabricated framing systems, especially in commercial and urban housing projects.

- Integration of Building Information Modelling (BIM) in design stages to ensure dimensionally accurate framing.

- Rising preference for light-gauge steel framing over traditional wood due to fire resistance and structural integrity.

- A surge in customisation demand in residential buildings, fuelling tech-driven framing solutions.

- Incentives for green building practices are pushing developers to adopt framing systems with less material waste.

- Affordable housing missions in many countries are encouraging modular, precise construction solutions to reduce costs and time.

- Support for digital construction technology like AI-integrated design tools is driving precision adoption.

Botanical Extracts Market Growth Factors

The usage for plant extracts is expected to rise significantly during the projected period due to its various health advantages and capacity to function as a substitute to contemporary treatment. Growing appetite for ready meals, expanding knowledge about the benefits of organic goods versus synthetic products, and growing preference from food and other uses are all expected to drive growth of the market. For the previous few years, world consumption for fast food products such as bakery & confectionary, sauces & dressing, ready-to-eat, ready-to-drink (RTD) drinks and sports & energy drink has been quickly expanding. This growth is mainly attributed largely to shifting customer lifestyles, an increment in the population of working women, the introduction of food products in innovative packaging by producers and retailers, rapid expansion of brick and online retail channels, and a rise in spending power, particularly in emerging economies such as India, China, and Brazil.

Botanical components are often used in convenience foods to offer scent, taste, and nutritive quality. Botanical extracts provide enhanced flavour and a longer lifespan, thus convenience food and beverage makers choose botanical extracts or concentrated over fresh botanicals. Furthermore, botanical components have a more realistic flavour since they are taken directly from vegetation, generally from the fruits, leaves, and flowers, as well opposed to non-botanical extracts. As a result, rising intake of convenience foods is expected to drive growth for these extracts in future years.

With the increasing frequency of chronic and lifestyle diseases, rising medical issues necessitate a much more creative strategy that treats the illness while minimising detrimental effects. Botanical pharmaceuticals can be used in place of allopathic medications. These medications are derived from natural ingredients that have health-promoting or therapeutic properties. As a result, increased knowledge about the harmful effects of allopathic drugs is yet another contributing force in the industry. Unlike many other chemical-based substances used within personal care and cosmetics, medications, and food and beverage items, botanical extracts have no adverse side effects.

Furthermore, the issue of environmental and natural component sourcing has risen to the top of the priority list for producers, particularly in North America and Europe. Natural extracts' extensive overall health advantages are expected to stimulate product sales in pharmaceutical and nutraceutical industries. These variables are anticipated to have a substantial influence on product consumption in the coming years.

Market Outlook

- Industry Growth Overview: The botanical market is on stable growth owing to the functional foods, supplements, cosmetics, and the increasing demand for natural ingredients.

- Sustainability Trends: Sustainability is enhanced by ethical sourcing, environmentally friendly extraction, and clean-label, consistent processing policies.

- Major investors: Key players are Givaudan, International Flavors & Fragrances Inc., Synthite Industries, Kerry Group, Arjuna natural and Dohler GmbH.

- Startup Ecosystem: Startups employ biotechnology and green chemistry that augment bioavailability and the creation of special botanical extracts.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 20.26Billion |

| Market Size in 2025 | USD 7.69 Billion |

| Market Size in 2026 | USD 8.57 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.17% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Source, Technology, Form, Product, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Restraints:

The botanical extracts market depends heavily on the consistent availability of high quality plant materials, yet supply chains are often disrupted by seasonal fluctuations, climate change, and shifting agricultural priorities. Droughts, floods, and pest outbreaks can significantly affect yield and quality, while increased demand for certain botanicals can lead to overharvesting and resource depletion. For manufacturers, these factors create instability in pricing and can force reliance on alternative sources that may not meet required quality standards. This variability makes long term planning and cost control challenging for both producers and buyers of botanical extracts.

Botanical extracts face complex and often fragmented regulatory requirements across different markets. Variation in permissible claims, ingredient approvals, and labelling standards can slow down product launches and increase compliance costs. For companies operating in multiple regions, navigating this patchworks of rules requires significant investment in legal expertise., documentation, and testing. Regulatory scrutiny is specially high for extracts used in pharmaceuticals, nutraceuticals, and cosmetics, where proof of safety, efficacy, and traceability is essential; These hurdles can be particularly burdensome for smaller companies with limited resources, restricting their ability to compete internationally.

Opportunities:

Growing consumer preference for clean label, plant based, and sustainably sourced ingredients is driving innovation across food, beverage, personal care, and nutraceutical applications. Botanical extracts, often perceived as healthier positioned to benefit from this shift. Brands are leveraging botanical ingredients to differentiate products and meet demand for transparency in sourcing and formulation. This trend also opens opportunities for premiumizations, where high quality, ethically sourced extracts command higher margins.

Innovations in extraction technologies, such as supercritical fluid extraction, ultrasonic assisted extraction, and enzyme assisted methods, are improving yield, purity, and bioavailability of botanical compounds. These advancements allow for more targeted extraction of active components while minimizing the use of harsh solvents. Companies adopting these methods can create differentiated products with enhanced efficacy, appeal to eco conscious consumers, and comply more easily with stringent purity standards. As technology becomes more accessible, it will also enable smaller players to compete more effectively in niche, high value botanical segments.

Segment Insights

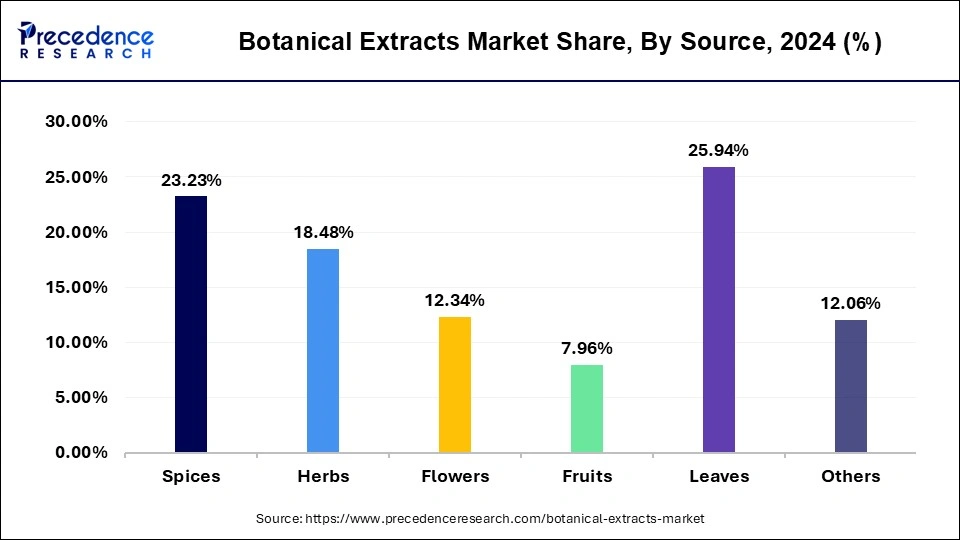

Source Insights

Leaves segment dominated the market and garnered the largest revenue share in 2025. Any flattening green sprout within the stems of vascular plants is referred to as a leaf. A leaf's principal job is to produce food for plants through photosynthesis. Chlorophyll, it is the chemical that imparts plants their green colour and helping them absorb light. Botanically, leaves are an important component of the stems system. A continuous vascular system connects them to the entire plant, enabling unrestricted flow of water, nourishment, and photosynthetic end products like as carbohydrates and oxygen.

Herbs are leafy parts of plants that are utilised in a number of purposes including nutritional supplements cosmetics, food and beverage and medications. Because of their widespread use in traditional remedies, herbs are projected to fuel the expansion of this industry. Herb-based pharmaceutical solutions are gaining popularity across the world since it is their health advantages such as hormone stabilisation, metabolism, and immune system improvement, as well as the fact that they are less expensive than traditional drugs.

Technology Insights

Supercritical fluid extraction is poised to expand at the fastest pace among extraction technologies in the botanical extracts without the use of harmful solvents makes it an attractive choice for both food grade and pharmaceutical grade applications. This method allows precise targeting of specific compounds, preserving their potency and stability while minimizing thermal degradation. Growing consumer demand for clean label products is pushing manufacturers toward technologies that deliver consistent quality and meet stringent purity standards. In addition, advancements in equipment design and process efficiency are making superficial fluid extraction more accessible to mid-sized producers, accelerating its market penetration.

Application Insights

The pharmaceuticals segment is expected to record the fastest growth in the botanical extracts market over the coming years. This momentum is driven by the increasing preference for plant based active ingredients in drug formulations, owing to their perceived safety profiles, lower incidence of side effects, and alignment with the global trend toward natural health solutions. Pharmaceutical companies are bioactive compounds with botanicals that offer therapeutic benefits in area such as cardiovascular health, metabolic disorders, and immune support. Regulatory frameworks in many regions are also evolving to support the integration of botanical extracts into mainstream drug pipelines, which further strengthens their adoption in prescription and over-the-counter medicines.

Global Botanical Extracts Market Revenue, By Application, 2022-2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Food | 1,584.89 | 1,755.72 | 1,962.40 |

| Beverages | 1,190.64 | 1,309.14 | 1,452.32 |

| Pharmaceutical & Nutraceutical | 1,769.37 | 1,950.38 | 2,169.21 |

| Cosmetic and Personal Care | 1,079.28 | 1,199.14 | 1,344.24 |

Form Insights

The powder form segment is projected to experience the most rapid growth in the botanical extracts market. Powdered botanical extracts offer advantages in terms of storage stability, ease of transportation, and compatibility with wide range of formulations, from dietary supplements to functional foods and cosmetics. Manufacturers and formulators value the extended shelf life and reduced risk of microbial contamination compared to liquid forms. Powders also offer flexibility in blending and dosing, making them ideal for creating custom formulations that caterto specific consumer preferences. Rising demand for convenient, versatile product formats is expected to keep this segment on a strong upward trajectory.

Product Insights

The spices segment is set to be the fastest-growing product category within the botanical extracts market. This growth is supported by the increasing recognition of spices for their health-promoting properties, beyond their traditional culinary uses. Bioactive compounds in spices such as curcumin, capsaicin, and cinnamaldehyde are being studied for their potential benefits in managing inflammation, metabolic health, and oxidative stress. The global shift toward functional food, beverage, nutraceutical, and personal care industries. Furthermore, growing consumer interest in ethnic cuisines is encouraging broader adoption of spice extracts in product innovation across multiple sectors.

Global Botanical Extracts Market Revenue, By Product, 2022-2024 (USD Million)

| By Product | 2022 | 2023 | 2024 |

| Organic | 3648.97 | 4042.22 | 4518.03 |

| Conventional | 1975.21 | 2172.16 | 2410.13 |

Regional Insights

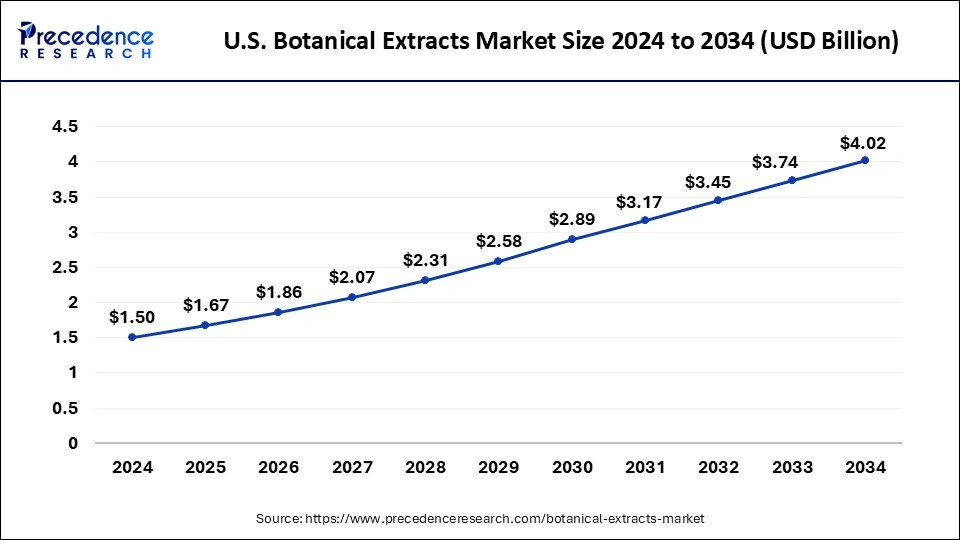

What is the U.S. Botanical Extracts Market Size?

The U.S. botanical extracts market size was exhibited at USD 1.67 billion in 2025 and is projected to be worth around USD 4.31 billion by 2035, growing at a CAGR of 9.95% from 2026 to 2035.

North America held the largest share of the botanical extracts market in 2025. The market for botanical extracts includes a range of product kinds, including fruit, vegetable, herb, and spice extracts. These extracts are used in food and beverage, pharmaceutical, cosmetic, and nutraceutical industries. The market for botanical extracts in North America has been significantly influenced by customer demand for natural and clean-label products; consumers are looking for products with few artificial components and additives. Due to this trend, producers create pure and effective botanical extracts to satisfy consumer demands. The market has grown due to rising interest in plant-based diets and more excellent knowledge of the advantages of botanical extracts for health. Consumers are adopting them into their everyday routines because they believe that botanical extracts have anti-inflammatory, immune-stimulating, and health-promoting qualities.

North America_ major factors leading towards the growth of this region

- Strong presence of technology-driven construction firms.

- High rate of adoption of framing software and prefabrication plants.

- Supportive policy environment encouraging energy-efficient and modular buildings.

- Continued urban redevelopment and retrofitting needs in the U.S. and Canada.

- Increasing demand for disaster-resilient structures in hurricane and earthquake-prone zones.

- The precision framing market is experiencing a dynamic shift driven by the need for faster construction timelines, energy-efficient buildings, and modular housing demands.

Asia Pacific is the fastest-growing region in the botanical extracts market. Due to health and wellness concerns, consumer preferences have clearly shifted in favor of natural and plant-based products. In the nutraceutical business, there has been a sharp increase in demand for botanical extracts due to growing knowledge of the health advantages of herbal supplements. The Asia Pacific cosmetics sector is expanding rapidly due to several causes, including changing customer preferences, rising disposable incomes, and evolving lifestyles. Because of their purported benefits for skin and natural attractiveness, botanical extracts are frequently employed in cosmetics and personal care products. Businesses in the botanical extracts industry are concentrating more on R&D endeavors to create novel goods and expand their product lines.

India

India is merging as a vibrant market for botanical extracts, supported by a dep heritage of plant based medicine and a diverse agricultural base that supplies a wide variety of raw materials. The country's botanical industry benefits from abundant biodiversity and well established supply chains for medicinal and aromatic plants. Demand is rising across multiple applications, including nutraceuticals, functional foods, personal care, and pharmaceuticals, as north domestic consumers and export partners increasingly seek natural and plant derived products. India's strong position in Ayurveda and traditional herbal remedies gives local producers an edge in product authenticity, while ongoing modernization of extraction facilities and quality assurance practices is helping to meet global compliance standards, Government initiatives promoting herbal product exports and sustainable cultivation methods are further supporting industry expansion.

United Kingdom

The United Kingdom represents a sophisticated and innovation driven market for botanical extracts, characterized by strong consumer interest in wellness, natural health products, and clean label ingredients. Demand spans food and beverage, nutraceutical, cosmetic and pharmaceutical applications, with a noticeable shift toward products that emphasize sustainability, ethical sourcing, and transparency. The country's well regulated environment fosters consumer confidence while also encouraging investment in research and development for novel botanical formulations. Collaborations between universities, food innovators, and cosmetic brands are advancing the development of high value botanical ingredients with targeted health and sensory benefits. The U.K., openness to premium and niche botanical products positions it as a strategic market for both domestic producers and international suppliers seeking to established a foothold Western Europe.

Asia Pacific Top countries

The Engine Room of Precision Framing

- China: Massive urban projects, government support for green construction, and domestic innovations in prefabrication.

- India: Huge housing demand coupled with a push for fast-track infrastructure through public-private partnerships.

- Japan: High-quality construction standards and advanced automation in the building sector.

- South Korea: Investment in smart buildings and extensive use of BIM.

Value Chain Analysis of the Botanical Extracts Market

- Raw Material Procurement: The sourcing of traceable botanicals by sustainable harvesting, supplier audit, and quality-based sourcing activities all around the world.

Key Players: Martin Bauer Group, Synthite Industries, Indena S.p.A., Nutra Green Biotechnology - Processing and Preservation: Extraction, drying, and stabilization of botanicals to preserve active constituents and increase shelf stability.

Key Players: Givaudan, Koninklijke DSM N.V. (dsm-firmenich), Flavex Naturextrakte - Quality Testing and Certification: Testing purity, safety, and phytochemical profiles by means of laboratory testing that complies with international standards.

Key Players: Eurofins Scientific, Alkemist Labs, NSF International, SGS - Packaging and Branding: Securing bioactives with packaging and developing labeling and high-end differentiation of compliant products.

Key players: Amcor, Tetra Pak, Berry Global, Constantia Flexibles - Cold Chain Logistics and Storage: The controlled environments during transportation and storage are used to ensure the prevention of degradation.

Key Players: Kuehne + Nagel, DHL Supply Chain, DB Schenker, Maersk

Botanical Extracts Market Companies

- Blue Sky Botanics Ltd: Blue Sky Botanics produces plant-based extracts used in cosmetics, food, and beverage companies with a focus on natural sourcing and formulation flexibility.

- Dohler: Doehler is offering botanical extracts of herbs, flowers, spices, and roots to help in the production of authentic flavors.

- Frutarom Industries Ltd.: Frutarom markets botanical extracts in food, beverage, cosmetics, and pharmaceutical areas to help in natural formulation strategies.

Other Major Key Players

- Kalsec Inc.

- P.T. Haldin Pacific Semesta

- Prinova Group LLC.

- PT. INDESSO AROMA.

- Ransom Naturals Ltd

- Synergy Flavors Inc

- Synthite Industries Private Ltd.

Recent Developments

- In October 2025, Vidya launches Biotical GH, the first placebo-controlled ingredient targeting the hair microbiome. This formulation combines probiotics and botanicals, leveraging the gut-hair axis to enhance hair density and promote internal microbial balance for sustainable scalp health. (Source: https://nutraceuticalbusinessreview.com )

- In July 2025, Herbalife Ltd. (NYSE: HLF), valued at $1 billion, launched MultiBurn, a dietary supplement featuring botanical extracts to aid weight loss and metabolic health. It includes Morosil, Metabolaid, and Capsifenâ„¢, targeting overall weight loss, healthy fat reduction, and enhanced energy expenditure, respectively. (Source: https://www.investing.com )

- December 2024, Biotechnology is democratizing advanced botanical ingredients development within the beauty industry. Previously, only large multinationals could invest in biotech based activities, but bow even small and indie brands are gaining access. Companies like One Skin and Mother Science are creating bioengineered topical such as malssezin a gentler alternative to vitamin C thanks to innovation hubs like the BiotechXBeauty Lab. At the same time, industry gains such as Shiseido, DSM, Firmenich, and Givaudan are investing in sustainable, bio sourced extracts: including animal free collagen and bioengineered fragrance notes like amber replacements, reducing environmental pressure on overharvested plants. This trend enhances both ingredients performances and ethical credentials across cosmetic and personal care.

(Source: The beauty exec's guide to biotechnology | Vogue Business ) - In a ground-breaking academic development, researchers in Nepal have unveiled a mobile application that leverages deep learning to accurately identify local herbal species. By training convolutional neural networks on thousands of herb images, the app enables real time recognition of regional flora. This innovation not only aids botanical research but also helps preserve traditional botanical knowledge, supports conservation efforts, and improves the reliability of raw material sourcing in herbal based industries.

(Source: [2505.02147] Local Herb Identification Using Transfer Learning: A CNN-Powered Mobile Application for Nepalese Flora)

Segments Covered in the Report

By Source

- Spices

- Herbs

- Flowers

- Fruits

- Mangoes

- Pomegranate

- Grapes

- Others

- Leaves

- Roots

- Beetroot

- Others

- Others

By Technology

- CO2 Extraction

- Solvent Extraction

- Steam Distillation

- Enfleurage

- Others

By Form

- Powder

- Liquid

- Leaf Extracts

By Product

- Organic

- Conventional

By Application

- Food

- Bakery and Confectionery

- Sauces and Dressings

- Others

- Beverages

- Carbonated Soft Drinks

- Ice Tea

- Flavored Dairy Products

- Sport Drinks

- Others (Functional Juices, Energy Drinks, among others)

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Pharmaceutical and Nutraceutical

- Cosmetics and Personal Care

- Hair Care Products

- Skin Care Products

- Oral Care Products

- Sun Care Products

- Decorative Cosmetic Products

- Body Care Products

- Perfumery Products

- Other Products

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content