What is the Breakfast Cereal Market Size?

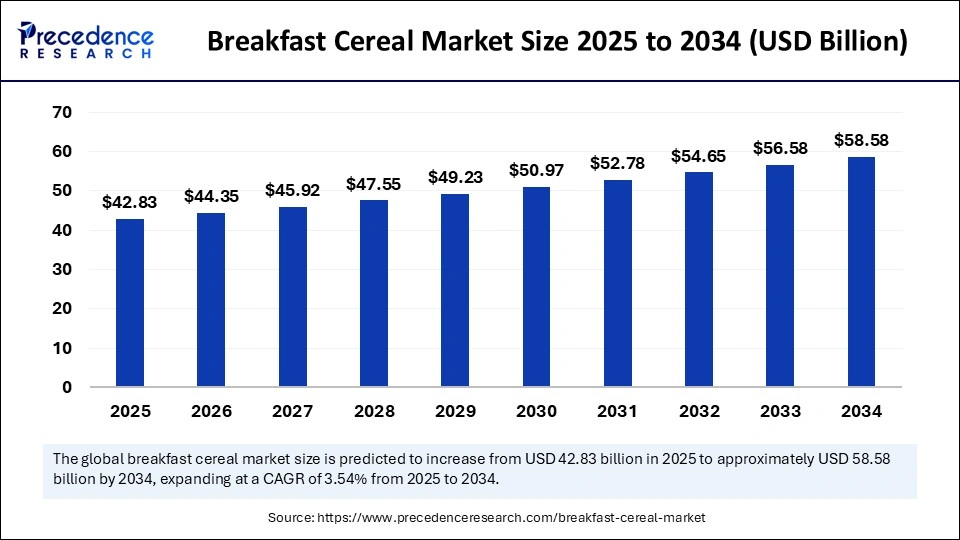

The global breakfast cereal market size is calculated at USD 42.83 billion in 2025 and is predicted to increase from USD 44.35 billion in 2026 to approximately USD 58.58 billion by 2034, expanding at a CAGR of 3.54% from 2025 to 2034. The growth of the breakfast cereals market is driven by increasing consumer demand for convenient, nutritious, and ready-to-eat meals.

Breakfast Cereal Market Key Takeaways

- In terms of revenue, the breakfast cereal market is valued at $42.83 billion in 2025.

- It is projected to reach $58.58 billion by 2034.

- The market is expected to grow at a CAGR of 3.54% from 2025 to 2034.

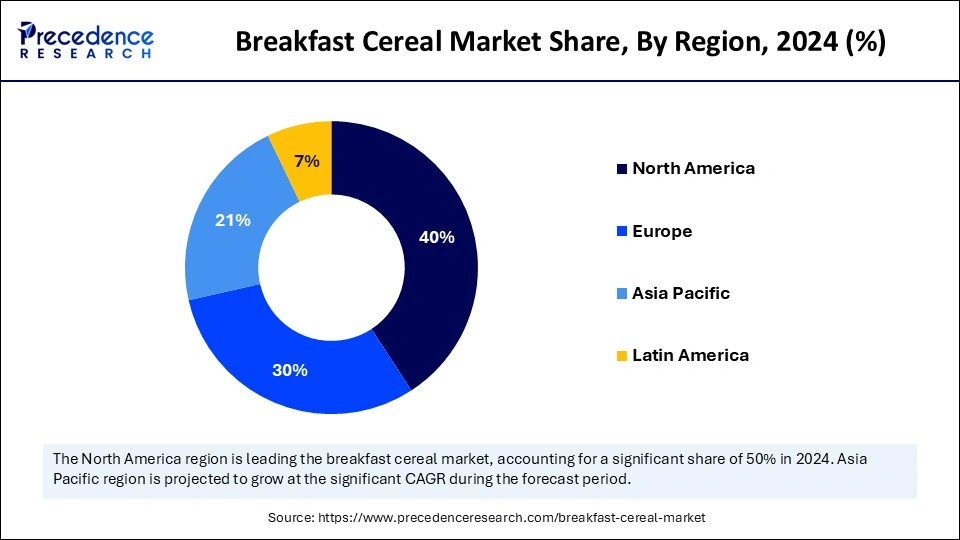

- North America accounted for the largest revenue share of 40% in 2024.

- Asia Pacific is expected to grow at a notable CAGR of 5.42% from 2025 to 2034.

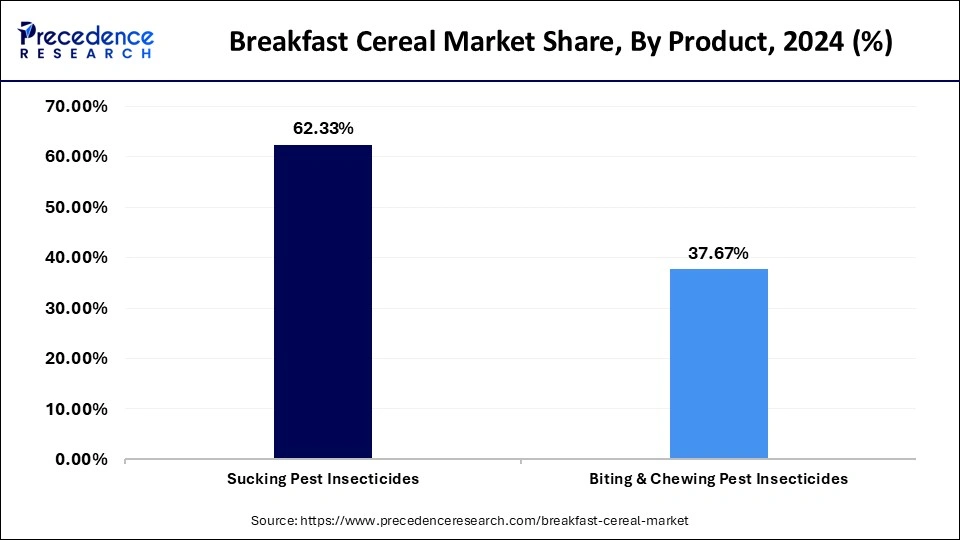

- By product, the ready-to-eat segment held the biggest revenue share of 88% in 2024.

- By product, the hot cereals segment is growing at a significant CAGR of 4.92% from 2025 to 2034.

- By distribution channel, the supermarkets and hypermarkets segment contributed the highest market share of 50% in 2024.

- By distribution channel, the e-commerce segment is expanding at a CAGR of 5.52% from 2025 to 2034.

Impact of Artificial Intelligence on the Breakfast Cereal Market

The market for breakfast cereals has continued to adopt artificial intelligence to optimize efficiency, personalization, and engagement of the customers. AI-driven tools are deployed by manufacturers in forecasting demand, managing inventories, and making the supply chain efficient, hence reducing wastage while increasing efficiency. In marketing, data analytics that are AI-driven, aid brands in providing individualized promotions and recommendations guided by the consumers' behavior. The digital transformation, AI emerges as a critical tool to create competitiveness and innovation in the breakfast cereal industry as it allows making smarter decisions and providing a better customer experience.

Market Overview

Breakfast cereals are processed food products, mainly composed of grains like wheat, corn, oats, and rice, and preferred by most people at breakfast. Offered in two formats, that is, ready-to-eat (RTE) and ready-to-cook (hot cereal), these cereals are cited for convenience, nutritive value, and variety. The common forms include flakes, puffs, granola, and clusters, and they are usually fortified with the essential vitamins and minerals. Breakfast cereals are usually eaten with milk, yogurt, or fruits. They are sold as a convenient, healthy way of providing daily energy requirements, which is very popular with working professionals, children, and health-conscious consumers.

The move to easier, time-saving meals in urban homes has made breakfast cereals an appealing choice for hectic lives. Also, increased awareness of health has resulted in an increased demand for nutritious alternatives, including cereals that are high in fiber, low in sugar, and whole grain. Manufacturers are coming up with premium and functional product lines that serve wellness trends like protein-supplemented or gluten-free cereals. Digital marketing and e-commerce are further beyond supplying shops with consumers, boosting the number of brand-targeted health enthusiasts and tech-savvy consumers, hence speeding up the world market development.

Growth Factors of the Breakfast Cereal Market

- Rising Demand for Convenience Foods: Consumers in urban settings increasingly tend to look for easy and fast meal solutions because of their lifestyles. Their ready-to-eat or quick-cooking formats are just perfect for working people and students, which contributes largely to the worldwide market expansion, as time-saving foods are established as a necessity for everyday life.

- Growing Health and Nutrition Awareness: People become more health-conscious; consumers are looking for nutritious breakfast alternatives. This trend towards healthy eating patterns drives demand for premium and functional cereals through bustling innovation and growing the market.

- Western Influence on Global Diets: The trend of Western food culture adoptions in areas like Asia-Pacific and the Middle East is creating new habits of morning meals. Media, international travel, and global chains of food have made cereals a mainstream meal for breakfast, especially among the young and urban.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 58.58 Billion |

| Market Size in 2025 | USD 42.83 Billion |

| Market Size in 2026 | USD 44.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Adoption of the Western Diet and Processed Foods

As lifestyles are changing and urbanization continues, consumers in regions like Asia Pacific, South America, and the Middle East & Africa are shifting from traditional breakfasts to more convenient processed food. Younger generations and working professionals, who look for quick and satisfying breakfasts, are especially under the influence of Western food culture. With the growing demand, manufacturers are innovating a wide variety of flavors, textures, and forms from which consumers can choose. The trend is further facilitated by the increased retail infrastructure and the increasing number of international brands, which make such products more accessible. Therefore, the penetration of processed foods into daily intake habits is substantially increasing the breakfast cereal market in emerging regions.

Increased Health Awareness and Demand for Nutritious Cereals

Health and wellness trends heavily influence the breakfast cereal market, as consumers are becoming more cautious about their nutrition and immunity. Awareness of health, immunity, and diet was raised due to the pandemic, which changed the food preferences of consumers to healthier foods. Leading corporations such as Kellogg, Nestlé SA, and General Mills to reformulating their existing products and introducing new products with additional health benefits. Brands are cutting down the sugar content, using natural ingredients, and promoting functional effects, such as weight management, heart health, and digestive support.

Restraint

Concerns Over Sugar Content

The rising awareness of health issues related to high sugar content is a major factor restraining the growth of the breakfast cereal market. A large proportion of ready-to-eat cereals contain large amounts of added sugars and refined carbs. This has left noticeable changes in consumers' behaviors, with a decline in high sugar cereal sales in the past year. With the constant increase in awareness concerning sugar-related health problems such as obesity and diabetes, as well as cardiovascular diseases, more consumers are turning to low-sugar, high-fiber alternatives. As a result, brands are being forced to reformulate products, create sugar-free products, and be open about the health benefits.

Opportunity

Plant-Based and Alternative Ingredients

Increased popularity of plant-based diets and alternative ingredients is opening huge growth opportunities in the breakfast cereal market. As consumers become more health and eco-conscious, the tendency is well pronounced for the consumption of cereals made from non-traditional grains like quinoa, amaranth, teff, and chickpeas. These alternatives address the increasingly appetizing orders for gluten-free, high-protein, and allergen-friendly products. This trend also follows the pattern of dietary inclusivity, catering for people with food allergies and for people who have a specific dietary requirement. Complemented by the growing scope of e-commerce that enhances the availability of the products and the visibility of the brands, this wave of plant-based products is transforming the cereal industry.

Product Insights

The ready-to-eat segment led the breakfast cereal market with the largest share in 2024. This is mainly due to the increased demand for ready-to-eat meals. The large variety of flavors, textures, and nutritional varieties make them more attractive to eat for people of all ages. Dominated by the major players such as Kellogg's, Nestle, and General Mills, which invest hugely in innovation, marketing, and product diversification, the segment witnessed rapid growth in the last few years. RTE cereals have superior brand identification and shelf appeal. Moreover, the presence of single-serve packs and fortified products meant for a particular health benefit, such as high fiber, added protein, or low sugar, also builds into the rising need for convenient healthy foods. Constant new product development, including the use of superfoods and clean label types, also contributes to the growth of this segment.

The hot cereals segment is anticipated to grow at a significant rate in the market over the forecast period. Hot cereals, e.g., oats, wheat bran, oat bran, and porridge, are especially popular with consumers who are searching for higher fiber, whole foods options to traditional breakfast items. Though traditionally required to be cooked, introducing instant or quick-cook versions has added ease of access and convenience. In emerging economies such as India, hot ones are gaining more traction than their ready-to-eat options, mainly driven by increased health consciousness. Oats have specifically become popular because of their apparent health benefit. As a result of urbanization, double-income households, and increased population within the middle-class bracket, demand for healthy, fast, and warm breakfasts is increasing. Brands are responding to this demand by launching flavored and fortified hot cereals that are attractive to various tastes.

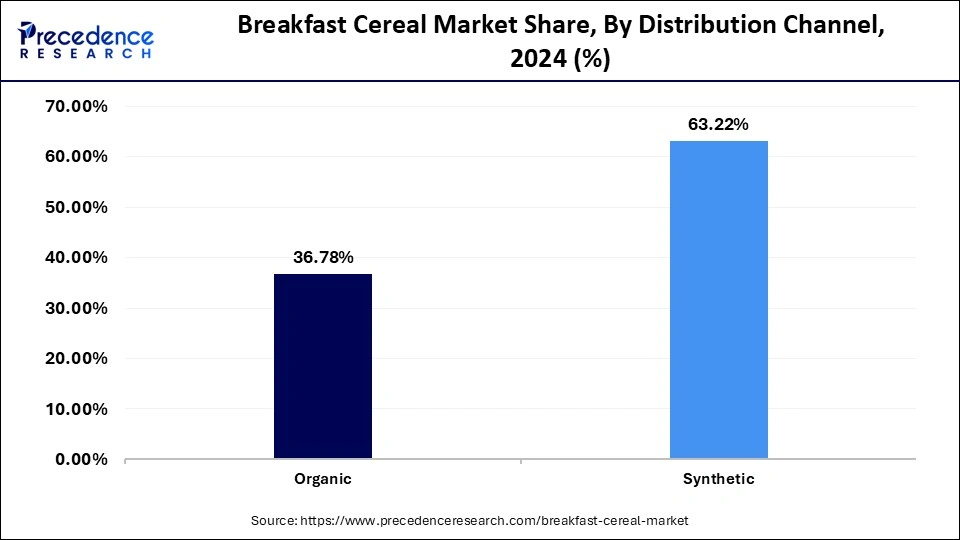

Distribution Channel Insights

The supermarkets & hypermarkets held the largest share of the breakfast cereal market in 2024. Large shelf-space availability ensures increased product visibility, which is complemented by in-store promotions, discounts, and decisive product placements, which are commonly placed in high-traffic areas, leading to increased consumer engagement and impulse buying. Supermarkets and hypermarkets are also a trusted point of purchase because of known brands' reliability and the capacity to physically examine the products before purchase. This segment is set to maintain its leadership in the global breakfast cereal market as urbanization as well as retail infrastructure increases both in developed and emerging economies.

The e-commerce segment is anticipated to grow at the fastest rate in the coming years. Digital technology penetration with the internet, smartphones, and digital payment has profound effects on a consumer's purchasing behavior and has shifted towards online consumption. E-commerce platforms provide convenience with the provision of home delivery, 24-hour availability, and a wide variety of cereal products that fit different people's dietary predispositions and needs. This channel is especially attractive for tech-savvy millennials and Gen Z consumers who like hassle-free shopping and are willing to experiment with niche or emerging brands that are not easily accessible from a physical store.

Regional Insights

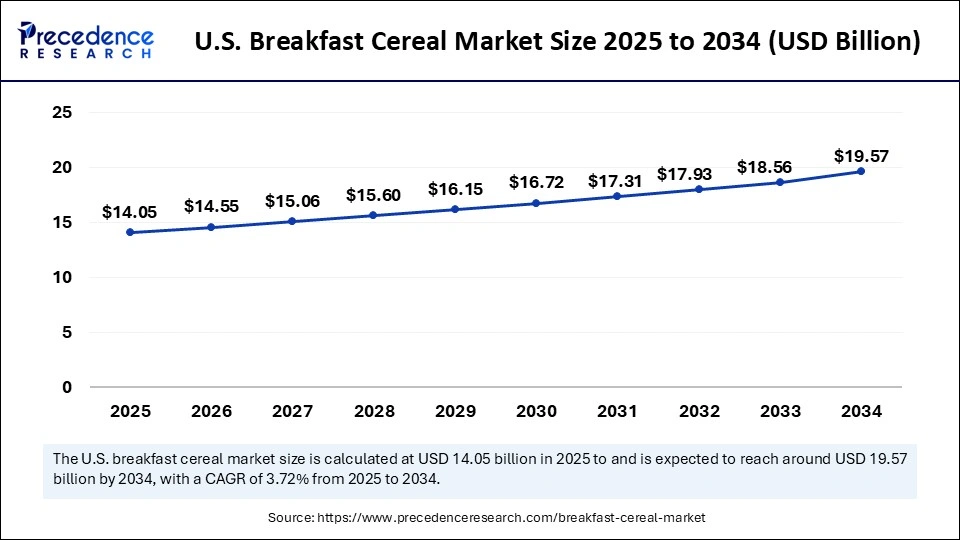

U.S. Breakfast Cereal Market Size and Growth 2025 to 2034

The U.S. breakfast cereal market size is exhibited at USD 14.05 billion in 2025 and is projected to be worth around USD 19.57 billion by 2034, growing at a CAGR of 3.72% from 2025 to 2034.

North America held the dominant share of the breakfast cereal market in 2024. This is mainly due to the existence of well-developed brands and highly innovative products. Cereal has been part of people's breakfast culture, hence making it a staple food item in the region. Leading major brands like Kellogg and General Mills still lead by bringing new products and flavors to cater to the health and convenience-seeking consumers. The high disposable income and fast-paced lifestyles also amplify the demand for convenient meal solutions such as breakfast cereals.

The U.S. is a major market in the region. The well-developed retail system and high availability of cereals in supermarkets and hypermarkets in the country increase the accessibility to a variety of cereals. The growth of e-commerce has increased the market for breakfast cereal. The rising demand for ready-to-eat meals due to busy lifestyles is boosting the growth of the market.

- In January 2024, Kellogg Co. made the first move to enter the vegan space with its new Eat Your Mouth Off cereal brand, to attend to the Gen Z shoppers' snacking calls. Eat Your Mouth Off, brought into the world by the American food mammoth behind kitchen staples, including Corn Flakes and Rice Krispies, is a plant-based protein cereal that is sugar-free.

Asia Pacific is expected to witness the highest growth during the forecast period. This is mainly due to the changing dietary patterns and people's increasing preference for healthier food. With a lot of people in the region adopting Western lifestyles, breakfast cereals are becoming the preferred breakfast. There has been an extended range of cereal goods by the cereal producers in the region, from the basic cornflakes to a variety of sweet, flavored, and fortified breakfast cereals to capture a new generation of consumers. Several manufacturers are also coming up with cereals fortified with fiber, vitamins, and minerals targeted to appeal to health-conscious people. In addition, growing health consciousness among people supports market growth.

In December 2023, Kellogg's, a major global player in the food industry, is determined to double its household reach in India's breakfast cereal category. Kellogg's holds 75% market share and is the leader in the category, which is primarily divided evenly among children, adults, and families. The company plans to improve the breakfast cereal category in India through strategic initiatives.

Europe also emerged as a significant market for breakfast cereal, accounting for a substantial market share in 2024, and is expected to sustain its position in the market throughout the forecast period. There is a high demand for whole grain and organic cereals in the region. The shift toward cleaner and more natural foods is gaining popularity, contributing to the breakfast cereal market. With the European market gravitating toward innovations and sustainability, breakfast cereals are becoming a healthy, convenient, and environmentally friendly breakfast option.

Recent Developments

- In April 2025, PepsiCo's Life rolled out multi-grain cereal to functionalize the breakfast table. The cereal has 2 varieties: Strawberry Blueberry Bliss to promote a strong immune system and Very Vanilla to develop strong bones.

- In February 2025, Nestlé India is thrilled to announce a new launch in the breakfast cereals category, Munch Choco Fills, now available all over India. This cereal is all set to make the breakfast eventful with its deliciously crisp outer shell and a chocolatey filling for a feel-good morning breakfast.

- In April of 2024, GHOST, joined the food category with a new high-protein cereal line, this venture evolved alongside General Mills, a master in the cereal industry. The line draws such products as GHOST PROTEIN CEREAL “PEANUT BUTTER” and GHOST PROTEIN CEREAL “MARSHMALLOW,” claimed to be the “Breakfast of Legends” on the back of epic flavors and high-protein levels.

Breakfast Cereal Market Companies

- Kellogg Co.

- General Mills Inc.

- Post Holdings, Inc.

- Nestlé S.A.

- PepsiCo

- Nature's Path Foods

- Calbee

- B&G Foods, Inc.

- Bob's Red Mill Natural Foods

- Marico Limited

Segments Covered in the Report

By Product

- Hot Cereals

- Ready-to-Eat

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- E-commerce

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting