Cereal Ingredients Market Size and Forecast 2025 to 2034

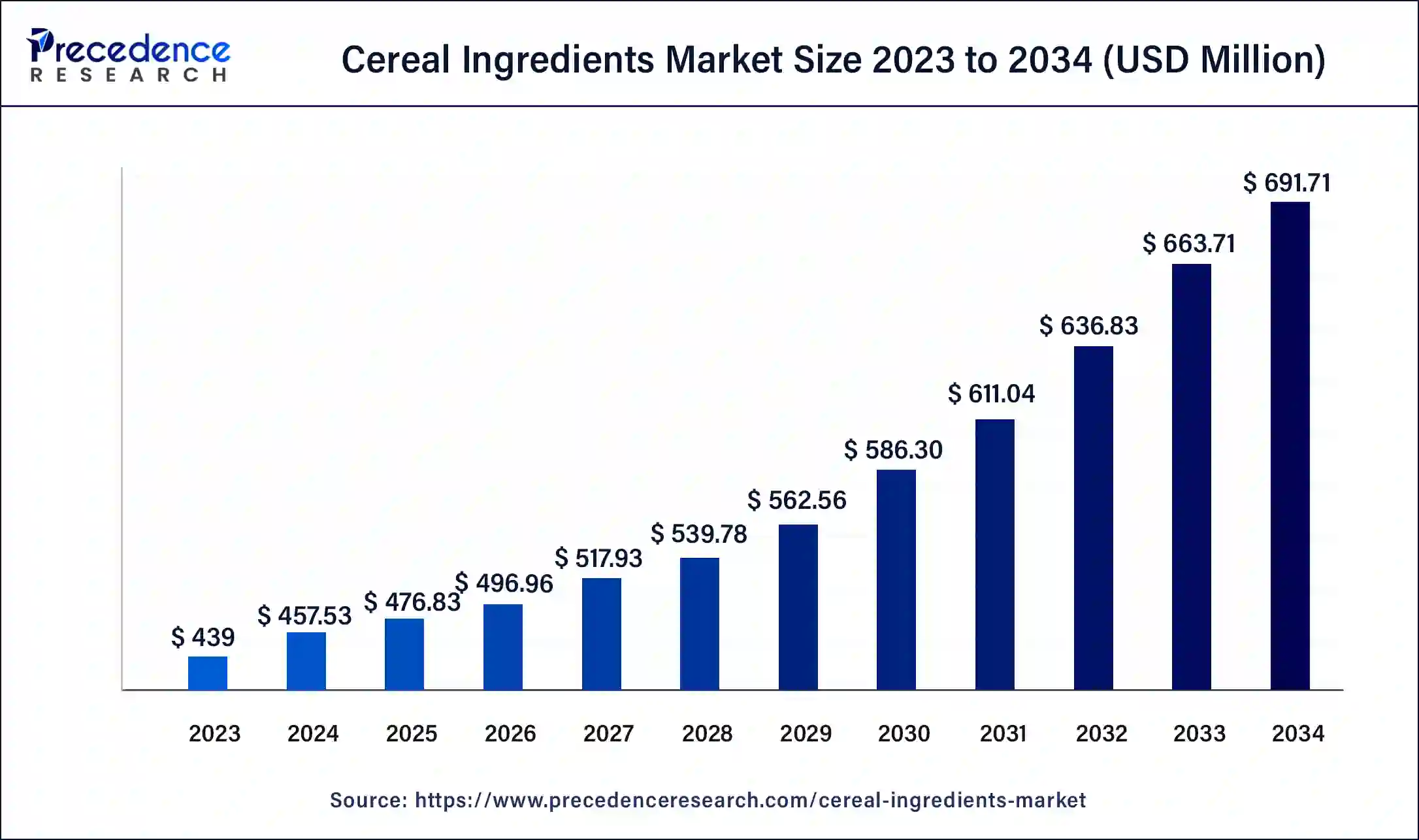

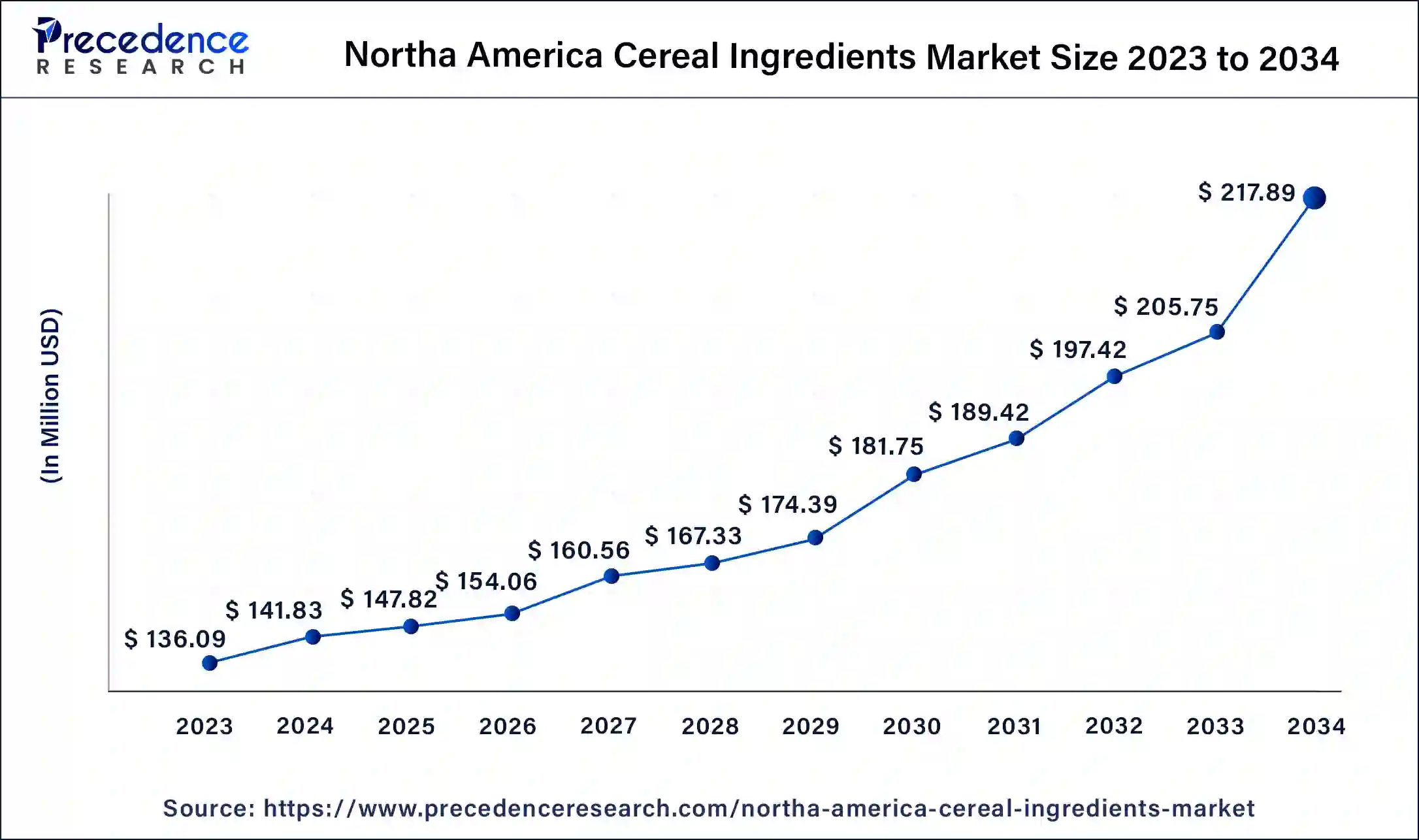

The global cereal ingredients market size was estimated at USD 457.53 million in 2024 and is anticipated to reach around USD 691.71 million by 2034, growing at a CAGR of 4.22% over the forecast period 2025 to 2034. The North America cereal ingredients market size reached USD 141.83 million in 2024. The cereal ingredients market growth is attributed to increasing consumer demand for healthy and convenient breakfast options.

Cereal Ingredients Market Key Takeaways

- The global cereal ingredients market was valued at USD 457.53 million in 2024.

- It is projected to reach USD 691.71 million by 2034.

- The cereal ingredients market is expected to grow at a CAGR of 4.22% from 2025 to 2034.

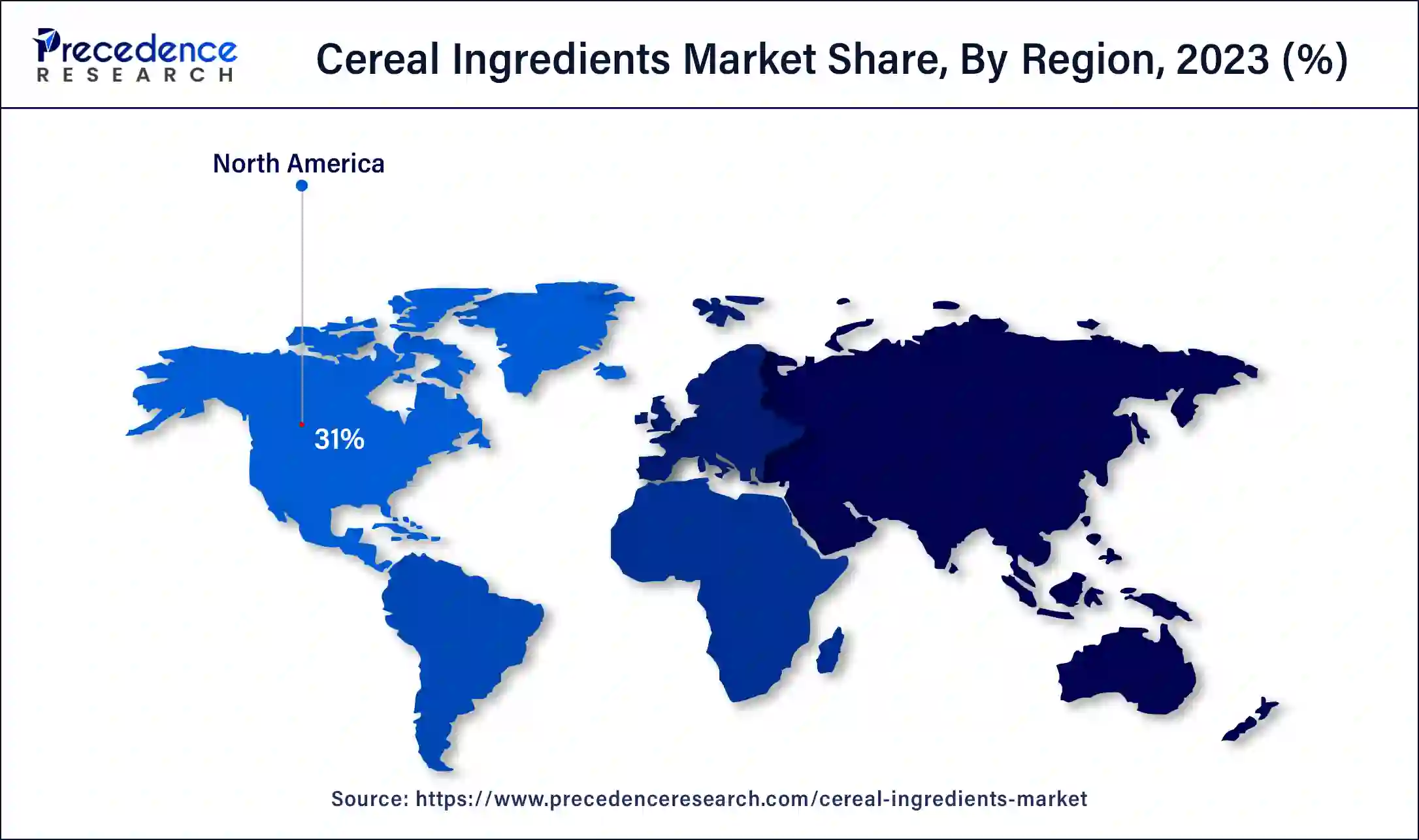

- North America dominated the cereal ingredients market with the largest market share of 31% in 2024.

- Asia Pacific is anticipated to proliferate at a significant rate in the market over the forecast period.

- By type, the wheat segment dominated the global market in 2024.

- By type, the oats segment is anticipated to grow at the fastest rate in the market over the forecast period.

- By source, the conventional segment held the largest share of the market in 2024.

- By source, the organic segment is projected to grow rapidly in the market in the coming years.

- By form, the flakes segment dominated the global market in 2024.

- By form, the puffs segment is projected to expand rapidly in the market in future years.

- By application, the food & beverages segment dominated the global market in 2024.

- By application, the animal feed segment is projected to grow significantly in the market in future years.

Impact of Artificial Intelligence on the Cereal Ingredients Market

Businesses use AI to make cascaded processes and supply chains more effective and cheap, making them more productive and competitive. The algorithms of AI involve the use of statistical tools to sort enormous data sets in order to identify relationships that help organizations in making sound decisions. Furthermore, AI also enables the designing of unique solutions that accommodate consumers' needs better than existing solutions. Instant and personal solutions for customers through AI-controlled chatbots and virtual assistants are incorporated into customers' service experiences. The integration of AI in the food sector can drive growth in the cereal ingredients market.

North America Cereal Ingredients Market Size and Forecast 2025 to 2034

The North America cereal ingredients market market size was exhibited at USD 141.83 million in 2024 and is projected to surpass around USD 217.89 million by 2034, poised to grow at a CAGR of 4.39% from 2025 to 2034.

North America emerged as the dominant presence in the cereal ingredients market in 2024. This region's population contributes to the demand for easy-to-prepare and healthy breakfast foods. Consumers similarly have a high inclination for a range of cereals products with higher health benefits, such as fiber and whole grains. Many companies have already developed in the region, and a good distribution channel is beneficial for the market. Additionally, the factor of higher health awareness among the consumers of North America, along with the enhanced demand forfunctional foods, boosted the demand for enhanced cereal ingredients.

Asia Pacific is anticipated to proliferate at a significant rate in the cereal ingredients market over the forecast period. Consuming habits of people that involve the consumption of meals prepared from cereal products are also expected to improve as disposable income increases in countries including China and India. The middle-income group in the region has gradually risen, and this requires purchases of more packaged and fortified cereal products. Furthermore, additional spending on the manufacturing and distribution channels in the Asia Pacific is expected to propel the market growth in the coming years.

Market Overview

Cereal ingredients have easily assimilated nutritive values on various food products and effectively be utilized in various processed foods as they are cheap. These grains include wheat, oats, barley, and corn, and from these grains, various high-fiber. Cereals are healthy and rich sources of certain vitamins, minerals and being cornerstones of many diets in the world today. The growing trend toward consuming more nutritious foods and the growing vegetarianism are also expected to boost the cereal ingredients market for a healthier diet.

Cereal ingredients are present in processed foods such as breakfast cereals, snack bars, and bakery products, thus expanding the market demand. The globalized culture of clean-label products and the use of ancient grains, such as quinoa and amaranth, in cereals' formulation, have also played a key role in expanding the cereal ingredients market because it meets consumer demands for nutritious foods with minimum processing. It was established that the ingredients used in cereals are set for high upcoming growth due to changes in customer preference and improved production variety.

Cereal Ingredients Market Growth Factors

- The cereal ingredients market is projected to grow in future years, driven by increasing consumer demand for natural and sustainably sourced products.

- High demand for cereal-based products in breakfast cereals, snacks, and bakery items has been observed in recent years.

- Animal feed promotion supported by increasing awareness of the nutritional benefits of cereal-based feed for livestock. The growing livestock industry and focus on sustainable farming practices contribute to the demand for the cereal ingredients market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 691.71 Million |

| Market Size in 2025 | USD 476.83 Million |

| Market Size in 2024 | USD 457.53 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Source, Form, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising consumer demand for convenient, nutritious breakfasts

Increasing consumer demand for healthy and convenient breakfast options is projected to drive the cereal ingredients market expansion. People are now looking for meals that can be prepared quickly due to their demanding schedules, and since hot cereals are easy to prepare and consume. This convenience, coupled with the nutritional value of whole grain, is creating demand among people who are conscious of their health and are willing to take cereals. Manufacturers are counteracting this by the development of many flavors and formulations as the products come with different tastes and for a variety of diets.

The young generation is more conscious about their health and ensures they are fed nutritious foods. Information about the benefits of whole grains and high-fiber cereals provided by celebrities on social media and various trends in the wellness industry push the consumers and make them interested in the products. The growing trend in the purchase of grocery products also enhances consumers' easy access to cereal products, thus boosting the cereal ingredients market.

- According to the report published by Texas Health Resources on April 25, 2023, stating that around 80% of millennials are conscious of selecting health-beneficial foods compared to 64% of baby boomers.

Restraints

Rising prevalence of health concerns related to processed food

Health implications associated with the consumption of processed foods are expected to hinder the market in the coming years. Consumers are now fully aware of some of the dangers of eating highly processed foods, including some cereals that contain extra sugars and other artificial components. This increasing awareness about health makes people shift towards organic food that is not processed. Thus affecting the dynamics of the cereal ingredients market.

Manufacturers in the cereal ingredients market need to allocate resources for product reinforcements that align with health-related trends, yet this takes time and is expensive, thus slowing down market growth. Moreover, the specified trend toward clean labels and the consumer desire for more transparency accentuates the difficulties in new product creation, as it is mandatory to report the origin of the ingredients and nutritional values. All these factors are contributing to hampering the market.

Opportunity

Rising demand for functional and fortified cereals

Growing focus on developing and purchasing functional and fortified cereals is expected to create immense opportunities for the players competing in the cereal ingredients market. Producers and retailers have noticed that consumers want extra value, such as vitamins, minerals, and probiotics included, with the cereals. This has resulted in a change in consumer demands, where people are in search of functional cereals. Those that have knowledge-enhancing properties or even fiber-enhancing properties are seen in the market trends by manufacturers. Additionally, the addition of ingredients, such as antioxidants, omega-3fatty acids, and adaptogens to the cereals further fuels the intentioned-by-wellness-consumer-base consumers.

Type Insights

The wheat segment dominated the global cereal ingredients market in 2024 due to its high availability and low cost of production. Wheat is widely used for cereal ingredients. These products contain proteins and fibers that are vital for human nutrition. Consumers prefer these food products as they provide balanced nutrition for their bodies. Moreover, well-developed superb wheat products and the steady innovation of new wheat cereals will further boost the segment in the coming years.

The oats segment is anticipated to grow at the fastest rate in the market over the forecast period, owing to the trends toward the consumption of healthy and functional products. Raising consumers' shifts towards healthcare properties for consuming oats, including fiber content. Oats are also expected to have increased demand due to the increase in the population of people with gluten intolerance since they are naturally free from gluten. Moreover, the shift towards plant-based products and the tendency to use natural ingredients is expected to fuel demand for oats in the cereal ingredients market.

Source Insights

The conventional segment held the largest share of the cereal ingredients market in 2024. These sources are commonly used and provide a general variety of ingredients, from simple grains to composed recipes. Traditional components used in confectionery usually come at a lower price than their organic equivalent, thus ensuring that costs are kept low when it comes to the consumer. Furthermore, conventional sources benefit from proper development and extensive coverage of distribution channels that enhance their accessibility, which further boosts the segment.

The organic segment is projected to grow rapidly in the cereal ingredients market in the coming years. Consumers' interest in natural and eco-friendly foods is expected to create organic cereal ingredients in the coming years. Shoppers are conscious of their diet as organic foods have less pesticide content and are grown in an environmentally friendly way. Furthermore, technological advances in organic farming and an increase in organic certification programs help boost the accessibility of organic products, thus fuelling their demand.

Form Insights

The flakes segment dominated the global cereal ingredients market in 2024. Familiar with the flakiness of these products as they are easy to prepare and take very little cooking time, and are therefore suitable for busy and working people. Moreover, flakes retain the bran and germ, which makes them nutrient-dense and suitable, especially for health-conscious consumers. All these factors contribute to boosting the segment in the coming years.

The puffs segment is projected to expand rapidly in the cereal ingredients market in future years. There is usually a correlation between the puff particle size and its density, which usually lowers the calorie density of other cereals. Thus, customers who prefer a low-calorie but very satisfying breakfast prefer puff cereals. Puff cereals have extended themselves into snack categories, and their use in different rebalancing recipes is bound to improve their consumer share. Furthermore, the growing demand for cereal puff ingredients further propels the segment.

Application Insights

The food & beverages segment dominated the global cereal ingredients market in 2024 due to the increasing demand for cereal products, especially as a solid breakfast meal, snacks, and baked products. The public continues to look for easy and healthy meals that also introduce new opportunities for free-flowing cereal components such as oats, wheat, and barley. Furthermore, the awareness of a healthy diet and lifestyle enhancement has continued to create more market demands for manufacturers to use whole grain and fortified cereal formulations, thereby fueling market growth.

The animal feed segment is projected to grow significantly in the cereal ingredients market in future years. Higher awareness regarding the consumption of high nutritional value cereal base feed for cattle is expected to push the demand. Fodder producers, alongside feed millers, use cereal by-products, including maize, barley, and wheat, in animals' diets to improve health standards and productive efficiency. The increasing livestock industry and meat consumption across the world are expected to boost the market.

Cereal Ingredients Market Companies

- SunOpta Inc.

- RiceBran Technologies

- Kellogg's

- General Mills

- Cll Foods

- Cargill Inc.

- Bunge Limited

- Associated British Foods Plc

- ADM

Recent Developments

- In April 2024, Ghost LLC, a leading provider of healthy food and supplements, unveiled its new GHOST Protein Cereal in ‘Peanut Butter' and ‘Marshmallow' flavors. These cereals are designed to be a good source of calcium and support nutritional goals throughout the day. Moreover, with the 7 grams of protein per saving, GHOST protein cereal is expected to be a popular choice among health-conscious consumers.

- In August 2023, Tata Soulfull, a prominent manufacturer of healthy snakes, announced the launch of their JoyFull Millets cereals in the United Kingdom. This marks Tata Soulfull's first significant foray into a new product category in the UK beyond its established hot and cold beverages. Initially, this product was available exclusively at Tesco, a leading UK supermarket. Furthermore, Soulful offers three varieties, Fruit & Nut, Honey & Nut, and Choco & Nut, which were developed in collaboration with Tesco.

Segments Covered in the Report

By Type

- Rice

- Wheat

- Barley

- Oats

By Source

- Organic

- Conventional

By Form

- Flakes

- Puff

By Application

- Food & Beverages

- Animal Feed

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting