What is the Bromelain Market Size?

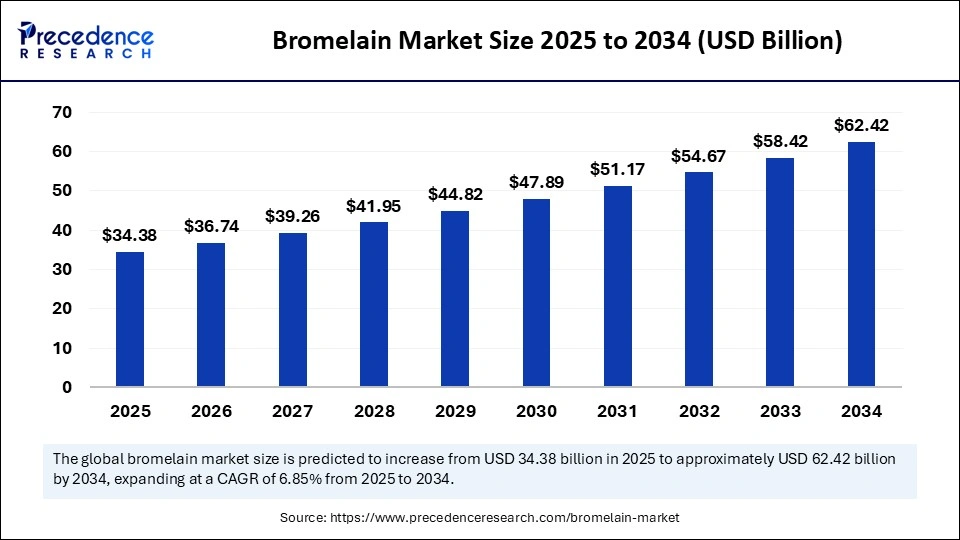

The global bromelain market size is calculated at USD 34.38 billion in 2025 and is predicted to increase from USD 36.74 billion in 2026 to approximately USD 62.42 billion by 2034, expanding at a CAGR of 6.85% from 2025 to 2034. The bromelain market is driven by rising demand in pharmaceuticals, food processing, and cosmetics due to its natural enzymatic and anti-inflammatory properties.

Market Highlights

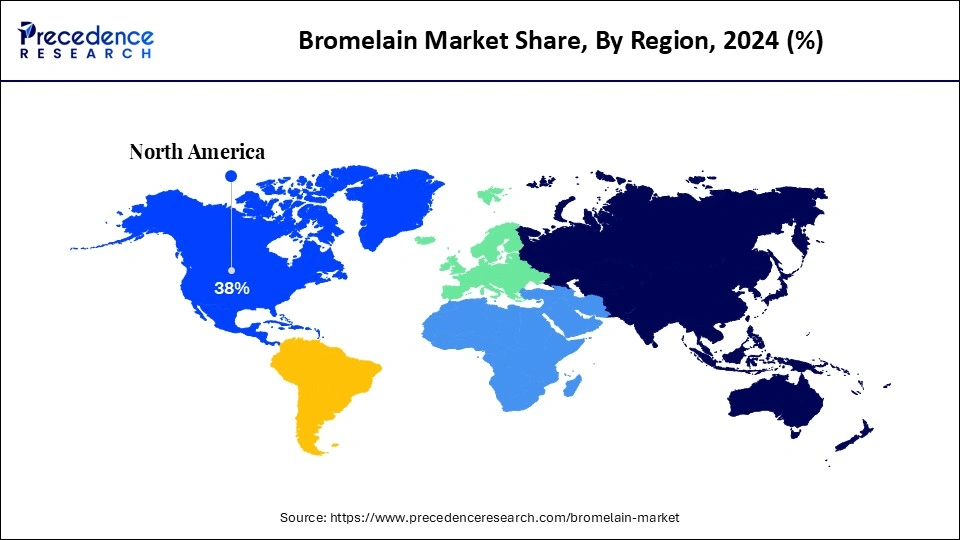

- North America led the global bromelain market with an approximate 38% of market share in 2024.

- Asia Pacific is expected to expand the fastest CAGR between 2025 and 2034.

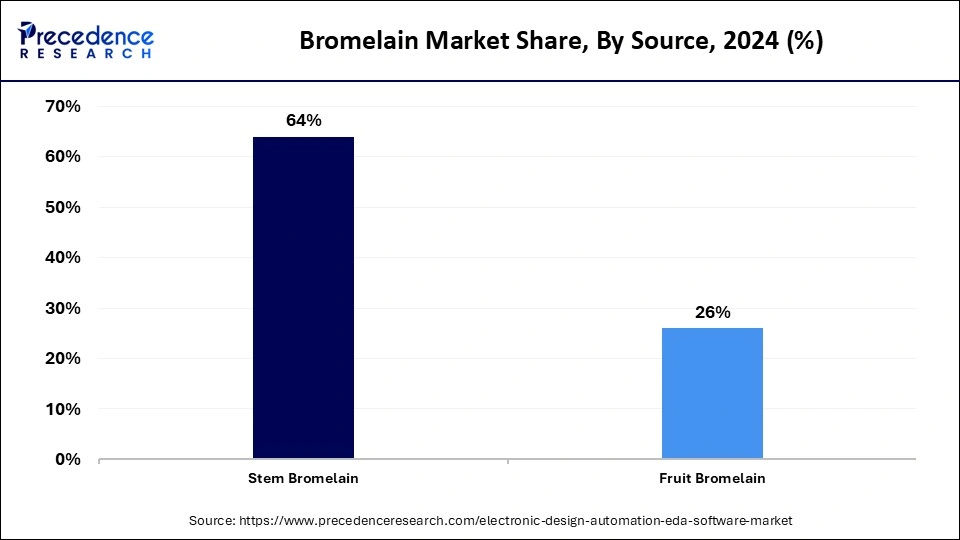

- By source, the stem bromelain segment held approximately 64% of the market share in 2024.

- By source, the fruit bromelain segment is anticipated to grow at the fastest CAGR from 2025 to 2034.

- By application, the healthcare & pharmaceuticals segment captured more than 43% of the market share in 2024.

- By application, the cosmetics (anti-aging, exfoliation, skin-brightening) segment is expected to expand at a notable CAGR from 2025 to 2034.

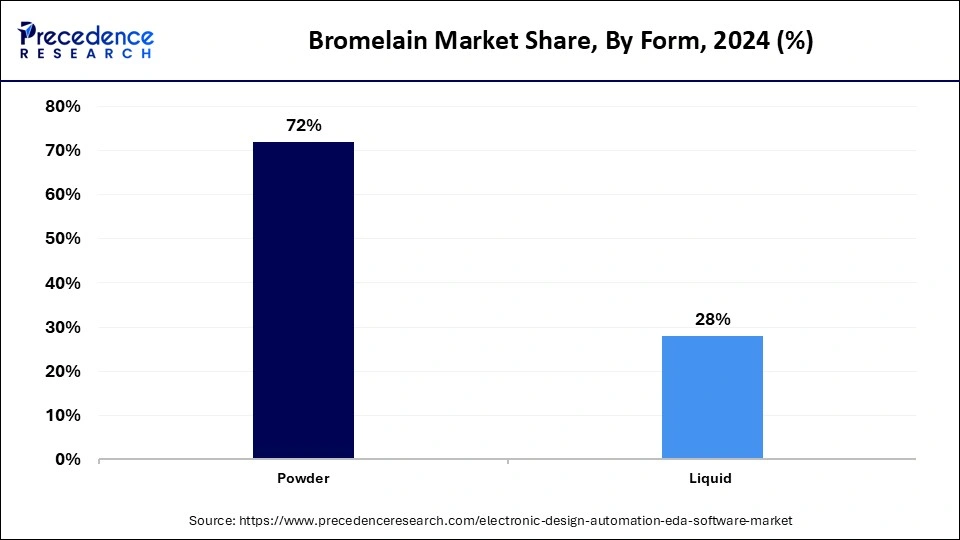

- By form, the powder segment captured approximately 72% of the market share in 2024.

- By form, the liquid segment is expected to expand at a notable CAGR between 2025 and 2034.

- By end-use industry, the pharmaceuticals & nutraceutical segment held around 46% of market share in 2024.

- By end-use industry, the cosmetics & personal care segment is expected to expand at the fastest CAGR between 2025 and 2034.

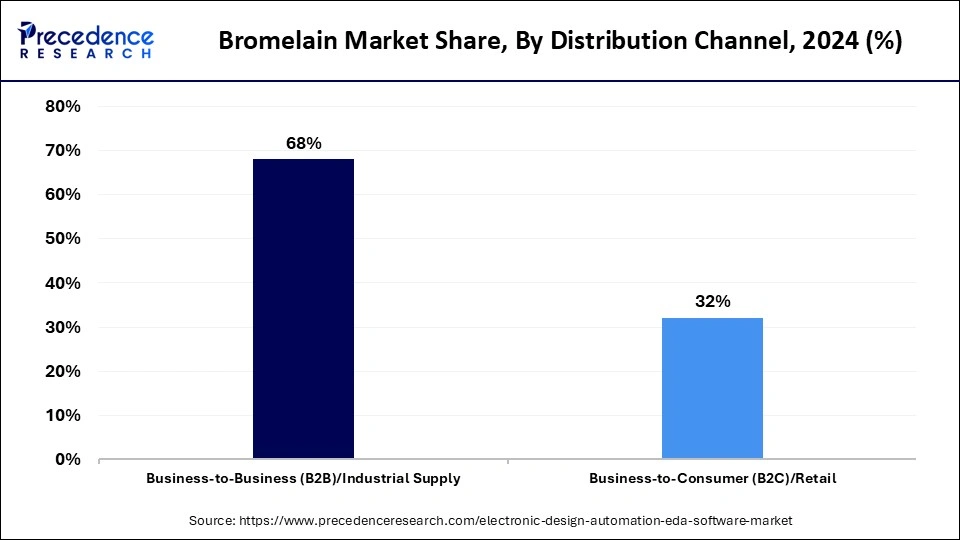

- By distribution channel, the business-to-business (B2B) / industrial supply segment captured approximately 68% of market share in 2024.

- By distribution channel, the business-to-consumer (B2C) / retail segment is expanding at a CAGR of 15% from 2025 to 2034.

Increasing Use of Natural Enzymes Drives the Bromelain Industry

Consumer interest in plant-based and natural health ingredients is driving the bromelain industry. Bromelain is a proteolysis enzyme derived from pineapple stems and fruit, and features anti-inflammatory and digestive properties. It is widely used by pharmaceutical companies, dietary supplement companies, the food processing industry, and in cosmetics. As the healthcare and nutraceutical industries look to adopt enzyme-based therapies for joint pain, wound healing, and immune support, the bromelain market is expanding.

In addition, the transition to clean-label and organic formulations is prompting some manufacturers to investigate sustainable methods for enzyme extraction. With increasing research and development in enzyme applications, bromelain is gaining popularity as a versatile bioactive compound and ingredient across numerous sectors.

Innovative Extraction and Formulation Technologies Transforming the Global Bromelain Market

The bromelain market is undergoing a transformation as extraction and formulation technologies advance, enhancing enzyme purity, stability, and yield. New extraction technologies, including ultrafiltration and microencapsulation, optimize enzyme yield, product quality, and shelf life. Recent advancements in nanotechnology pharmacological properties, including controlled-release formulations, increase bromelains potential use in the pharmaceutical, cosmetic, and nutraceutical industries.

The automation of enzyme processing and continuous manufacturing systems will reduce production costs and ensure consistent quality in the production of bromelain-enriched products. These advancements and technologies place bromelain in a unique position as a high-value bioactive ingredient and an increasingly common product introduction to the global marketplace, identifying it for novel therapeutic and functional applications.

Bromelain Market Outlook

The bromelain market is steadily growing since industries move towards plant-derived enzymes: usage increasing in food processing, nutraceuticals, and cosmetics, is stoking demand. The shift in health awareness and clean-label requirements has also driven demand and created new business opportunities across multiple markets.

Regional growth trajectories appear diverging, mature North American markets continue a solid uptake in bromelain sales, owing to added-value uses in pharma & health, while Asia-Pacific is expected to show the fastest growth due to the abundance of raw materials (pineapple) and increase in domestic enzyme production and adoption in end-use.

R&D investment is also moving from food-processing applications into therapeutic uses, skin-care, and novel delivery systems. Advancements in extraction and purification processes are producing bromelain with higher purity, creating opportunities for higher value and enabling differentiation for enzyme suppliers.

The key drivers of the bromelain market growth is consumer preference for natural, plant-based ingredients; increasing demands for processed meat/seafood as a tenderisation agent; and heightened acceptance among food industry sectors such as functional food, dietary supplements, and personal care, once enzyme benefits are validated.

Constraints in the bromelain market include fluctuations in the supply of pineapples for raw material costs and enzyme yield fluctuations; the need for regulatory and safety approvals for new products for therapeutic uses; and competition from synthetic or alternative enzyme technologies (with scope for developing augmented competencies).

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 34.38 Billion |

| Market Size in 2026 | USD 36.74 Billion |

| Market Size by 2034 | USD 62.42 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Application, Form, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Bromelain MarketSegment Insights

Source Insights

The source type with the largest market share is stem bromelain, at 64%. The predominance of this source type is due to its high protease activity and its easy extraction at relatively low cost, especially from pineapple stems. Bromelain is an important raw material in bulk enzymatic formulations for pharmaceuticals, industrial enzyme applications, and food processing, where it is used to break down proteins for inflammation treatment, etc.

The fastest-growing source type of bromelain is fruit bromelain, thanks to its relatively mild nature of enzymatic activity and its usability in food, beverage, and cosmetic formulations. Fruit bromelain can also have applications in food, drink, and skin care formulations, which are sensitive, and its increased use coincides with growing demand for clean-label, plant-based, and bioactive products globally.

Application Insights

The healthcare and pharmaceutical segments dominate the application segment, accounting for around 43% of the total segment share, due to bromelains therapeutic uses in reducing inflammation, promoting wound healing, and supporting recovery after surgery. It is widely used in oral formulations, topical creams, and in combination with pharmacological agents; therefore, it is present in both prescription and non-prescription products.

The cosmetic segment is the fastest-growing sector due to rising demand for natural exfoliants and anti-aging applications. Bromelain also has enzymatic properties that remove dead skin cells and improve skin texture, appealing to consumers for use in serums, masks, and brightening creams within the natural skincare segment of the global market.

The nutraceutical and dietary supplement segments are increasingly part of the bromelain market as consumers have a greater emphasis on preventive healthcare. Improved digestion, reduced inflammation, and boosted immune function are key benefits of bromelain, which is used to market enzyme blends, protein powders, and functional health products. These applications align with the overall health and activity trends that consumer groups have become more interested in.

Form Insights

The powder form of bromelain leads the market, accounting for around 72%. This is because, overall, powder offers the best stability, shelf life, and ease of incorporation into pharmaceutical, nutraceutical, and food matrices. It also allows for accurate dosage and reliable enzyme activity, making this the preferred method for manufacturers creating tablets, capsules, and high-protein food products.

End-Use Industry Insights

The pharmaceuticals and nutraceutical segment leads the end-use segment, capturing nearly 46% of the market share, owing to bromelain strong therapeutic value in reducing pain and swelling associated with injury or inflammation, as well as its utility in digestive disorders. The use of bromelain in enzyme-based pharmaceuticals, dietary supplements, and swelling-reducing topical products underscores its importance in clinical and preventive health care applications worldwide.

The fastest-growing end-use segment is cosmetics and personal care, driven by increasing consumer demand for natural- or enzyme-based skin care products. The gentle exfoliating, anti-inflammatory, and brightening effects of bromelain make it a staple ingredient in facial cleansers, serums, and anti-aging products designed to meet the clean beauty trend.

Increased bromelain adoption is evident among food and beverage manufacturers, who use the protein-hydrolysing enzyme to tenderize meat. Bromelain improves the texture, digestibility, and nutritional value of foods, and supports food and beverage formulations for health-conscious consumers seeking natural digestive aids.

Distribution Channel Insights

The business-to-business (B2B) or industrial supply channel dominated with nearly 68% share of the bromelain market. Bulk direct sales of bromelain occur primarily with pharmaceutical, food, and cosmetics manufacturers. In this context, B2B distribution supports consistent quality, availability, and cost savings in supply for large-scale production.

Business-to-consumer (B2C) is a fast-growing channel focused on the development of online sales of enzyme supplements and other clean-label health products. In the retail phase, consumers increasingly choose to purchase bromelain-based capsules and powders online, as well as bromelain-based skin care products, from e-commerce websites and specialty health stores.

Pharmacies and health stores are further expanding bromelain market access by offering over-the-counter enzyme supplements and therapeutic blends. Pharmacists and innovative health advocates focus on promoting natural and preventive healthcare products can bridge consumers industrial supply needs with personalized, health-oriented consumer product development featuring enzymes.

Bromelain MarketRegional Insights

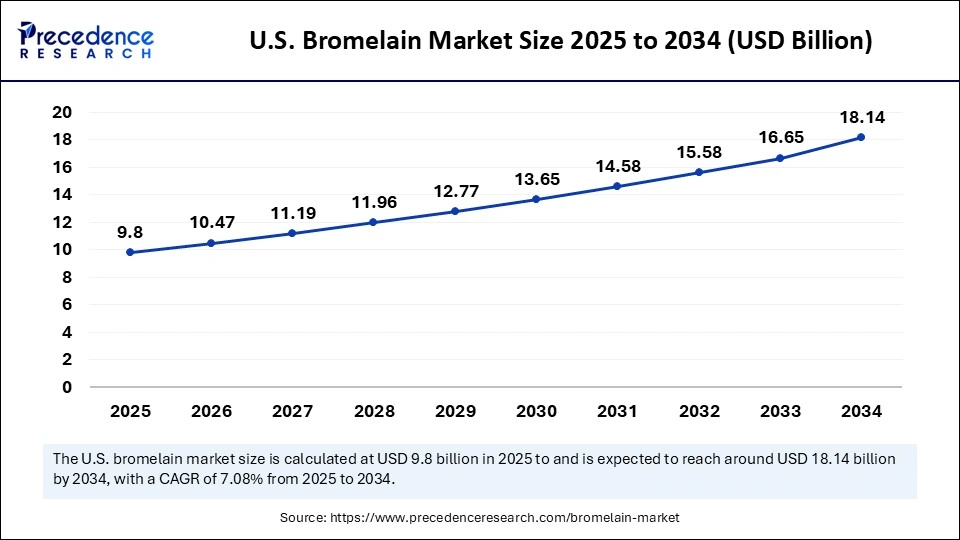

The North America bromelain market size is estimated at USD 13.06 billion in 2025 and is projected to reach approximately USD 24.03 billion by 2034, with a 6.99% CAGR from 2025 to 2034.

What Makes North America the Leading Area for Bromelain?

North America has a very high market demand for dietary supplements, clinical R&D that uses standardized enzyme ingredients, and quality systems to reward the use of standardized enzymes. There is a large population of dietary supplement users in the U.S. (NHANES surveys show 57-58% of adults have used dietary supplements in the past) that creates stable downstream demand from nutraceutical and pharma formulators, while the expectations around regulatory compliance and overall quality creates a market that favours GMP grade, fully documented enzyme supplies from suppliers who can complete tighter testing and traceability using standard methods.

The U.S. bromelain market size is calculated at USD 9.80 billion in 2025 and is expected to reach nearly USD 18.14 billion in 2034, accelerating at a strong CAGR of 7.06% between 2025 and 2034.

United States Bromelain Market

The United States is the commercial and regulatory centre, with consistent availability of dietary supplements, concentrated networks for CDMO and ingredient distribution, clinical investigations into the applications of bromelain, an NIH/NCCIH health information page, and systematic academic reviews. Through these structural elements, U.S. manufacturers can reduce product development time and meet consumer demand for high-specification stem-derived bromelain, increasingly used in anti-inflammatory, digestive, and topical formulations.

Asia Pacific fast-growing market is driven by higher pineapple production, low-cost processing, and rising consumption of functional foods and nutraceuticals. Volume production from larger pineapple producers, including China and India, provides a plentiful, low-cost source of raw materials. The investment in processing and innovative processing technologies in the region also maximizes the extraction yield of enzymes from the raw source. Urban populations are also buying health supplements and traditional remedies containing natural enzymes, resulting in new domestic consumption channels. The initiatives of valorizing the stems or processing residues are also adding capacity, increasing income flows to growers, making the Asia Pacific a dual-purpose center of both inexpensive procurement of raw ingredients and an emerging domestic consumer base.

China Bromelain Market Trend

China is a significant player in the regional bromelain market, given its surging pineapple production areas in southern provinces and growing processing industry. The growing production of functional foods and dietary supplements, supported by the government, is driving a local market for bromelain extraction and value-added products. Several Chinese companies are actively improving the recovery of bromelain from pineapple overflow stems and processing by-products in support of both local nutraceutical markets and export opportunities. Evidence from academic research in China has also highlighted bromelain digestive and anti-inflammatory uses, raising local awareness and boosting consumption, an emerging trend that reinforces China ranking and growth in the bromelain market.

Europes growth trends exceptionally well because it is driven by demand for premium, well-documented natural ingredients, and a strong expectation of compliance with regulatory guidelines calling for standardized extracts for pharmaceutical, medical-food, and cosmetic applications. European procurement markets place tremendous value on the documentation of provenance and overall dossier quality, leading to higher-margin product imports and local formulation driven by supplier compliance. In the premium market segment, Europe is a region where product specifications, clinical evidence, and transparent supply chains are rewarded.

Germany Bromelain Market Trend

Germany functions as a launch and regulatory benchmark market in Europe. Germany is Europes largest pharma market by sales and also has a significant consumer health and food-supplement sector. German regulatory and commercial practice concentrating pharma clusters and significant research & development raises dossier and quality expectations, which influence overall procurement behaviour in the EU. Companies often validate and launch value-added bromelain products before marketing them in the rest of Europe.

Global Bromelain Import–Export Trends (2023–2025)

| Region/Country | Shipment Period | Total Shipments | No. of Exporters | No. of Buyers/Importers | Growth Rate (YoY) | Market Insight/Analytical View |

| Global Exports (Overall) | Nov 2023-Oct 2024 | 645 | 144 | 281 | +15% | The global bromelain trade has shown steady growth, driven by rising demand from the food, pharmaceutical, and cosmetic sectors. |

| India(Exports) | Nov 2023-Oct 2024 | 349 | 69 | 179 | -2% | India remains a key exporter, but a marginal decline indicates competitive pressures and possible supply chain constraints. |

| Indonesia(Exports) | May 2024-Apr 2025 | 140 | 6 | 28 | +3% | Indonesian exports show modest growth, reflecting increasing utilization of local pineapple waste for enzyme extraction. |

| United States (Imports) | Jun 2024-May 2025 | 95 | 25 | 40 | +23% | The U.S. shows strong import growth, driven by pharmaceutical and nutraceutical applications. |

| Italy(Imports) | Jun 2024-May 2025 | 12 | 4 | 7 | -77% | Italys import volume dropped significantly, possibly due to reduced industrial demand or alternative sourcing within Europe. |

Bromelain Market Value Chain

Bromelain production starts with sourcing pineapple stumps and fruits, which determine enzyme quality and yield.

Key Players: Dole Food Company, Del Monte Foods, Fresh Del Monte Produce, Ananas Industries

Bromelain is extracted through mechanical and biochemical methods, then purified for activity and stability.

Key Players: Enzybel International, Advanced Enzyme Technologies, Nanning Pangbo Bioengineering, Xena Bio Herbals

Purified bromelain is processed into powders, capsules, or liquids, enhancing stability and shelf life.

Key Players: Biozym, Enzymatico, Great Food (Biochemical) Co. Ltd., Specialty Enzymes & Biotechnologies

Bromelain products reach pharmaceutical, food, and cosmetic markets via global distributors and cold-chain networks.

Key Players: Brenntag, IMCD Group, Univar Solutions, Barentz International

Used in pharmaceuticals for anti-inflammatory effects, food for tenderizing, and cosmetics for exfoliation.

Key Players: Now Foods, NutraScience Labs, Nestle Health Science, LOreal

Bromelain Market Companies

Corporate Information

- Headquarters: Angleur, Liege, Belgium

- Year Founded: 2009

- Ownership Type: Private

History and Background

Enzybel Group was established in 2009 through the merger of several European enzyme manufacturing companies, bringing together decades of biochemical expertise. The company has since become a leading global producer of natural plant-derived enzymes, particularly bromelain, papain, ficin, and pancreatin, used across food, pharmaceutical, and nutraceutical industries.

In the Bromelain Market, Enzybel Group is a recognized global supplier of high-purity bromelain extracted from pineapple stems and fruit. The company production emphasizes enzyme activity consistency, sustainability, and compliance with international pharmacopeia standards. Enzybels bromelain products are widely used in anti-inflammatory formulations, digestive supplements, wound care, and meat tenderization applications.

Key Milestones / Timeline

- 2009: Formed through the consolidation of European enzyme producers

- 2015: Expanded bromelain production capacity to serve global nutraceutical and pharmaceutical clients

- 2018: Achieved ISO 9001 and FSSC 22000 certifications for enzyme manufacturing excellence

- 2021: Introduced clean-label bromelain formulations for food applications

- 2024: Began R&D on pharmaceutical-grade bromelain for clinical and therapeutic use

Business Overview

Enzybel Group specializes in the production and refinement of natural enzymes derived from plant and animal sources. Its bromelain portfolio serves both industrial and medical markets, providing ingredients for dietary supplements, topical formulations, and protein hydrolysis applications.

Business Segments / Divisions

- Plant Enzymes (Bromelain, Papain, Ficin)

- Animal Enzymes (Pancreatin, Trypsin, Pepsin)

- Customized Enzyme Solutions

Geographic Presence

Headquartered in Belgium, with production facilities in Europe and strategic distribution networks in North America, Asia, and Latin America.

Key Offerings

- Pharmaceutical-grade bromelain with controlled enzyme activity

- Food-grade bromelain for meat tenderization and beverage clarification

- Nutraceutical-grade bromelain for digestive health and anti-inflammatory supplements

- Custom enzyme formulations for biotechnology and industrial use

Financial Overview

Enzybel Group is privately held, with an estimated annual revenue range of 50-70 million USD, driven by steady growth in enzyme-based bio-ingredient demand.

Key Developments and Strategic Initiatives

- April 2023: Introduced new bromelain formulation for wound-healing and inflammation control

- September 2023: Expanded food enzyme portfolio for sustainable plant-based protein processing

- May 2024: Launched microencapsulated bromelain for improved bioavailability in nutraceuticals

- January 2025: Announced clinical research collaboration for bromelain role in anti-inflammatory therapies

Partnerships & Collaborations

- Collaborations with pharmaceutical and nutraceutical companies for bioactive enzyme applications

- Partnerships with food manufacturers for clean-label enzymatic processing solutions

- Alliances with research institutes for enzyme formulation development

Product Launches / Innovations

- Microencapsulated Bromelain (2024)

- Clean-label bromelain blends for food processing (2023)

- Pharma-grade bromelain for clinical research (2025)

Technological Capabilities / R&D Focus

- Core technologies: Enzyme extraction and purification, activity standardization, and encapsulation

- Research Infrastructure: In-house R&D facility in Belgium and partnerships with EU biotech centers

- Innovation focus: Enhanced enzyme stability, sustainable sourcing, and clinical-grade enzyme formulation

Competitive Positioning

- Strengths: High-quality enzyme production, sustainability focus, and global supply reliability

- Differentiators: Proprietary purification techniques and strong regulatory compliance for enzyme standards

SWOT Analysis

- Strengths: Proven enzyme expertise, diversified application base, and EU-certified production

- Weaknesses: Limited scale compared to multinational biochemical producers

- Opportunities: Expanding demand for natural enzymes in pharmaceuticals and functional foods

- Threats: Competition from Asian and U.S. enzyme producers offering cost-efficient alternatives

Recent News and Updates

- March 2024: Enzybel announced pilot studies on bromelains anti-inflammatory potential in medical use

- July 2024: Launched enzyme-based ingredient line for plant protein processing

- January 2025: Partnered with nutraceutical brands to expand global distribution of bromelain supplements

Corporate Information

- Headquarters: Taichung, Taiwan

- Year Founded: 1996

- Ownership Type: Private

History and Background

Challenge Bioproducts Co., Ltd. was founded in 1996 and has grown to become a key biotechnology company specializing in industrial enzyme production, microbial fermentation, and biochemical ingredients. With a strong focus on sustainability and innovation, the company serves clients in the food, pharmaceutical, and agricultural sectors.

In the Bromelain Market, Challenge Bioproducts is a major Asian producer and exporter of bromelain extracted through advanced biotechnological processes. The companys bromelain products are known for high enzymatic activity, stability, and purity, catering to global customers in dietary supplements, pharmaceuticals, and food processing.

Key Milestones / Timeline

- 1996: Founded as a fermentation and enzyme manufacturing enterprise in Taiwan

- 2005: Expanded enzyme portfolio to include proteases and lipases for food and feed applications

- 2015: Achieved international certifications including ISO 9001 and HALAL

- 2020: Strengthened bromelain production capacity for global nutraceutical demand

- 2024: Introduced improved bromelain formulations optimized for pharmaceutical-grade applications

Business Overview

Challenge Bioproducts focuses on biotechnological production of natural enzymes and bioactive ingredients. Its bromelain products are utilized across diverse industries including pharmaceuticals, functional foods, and cosmetics. The company emphasizes quality control, enzyme stability, and large-scale fermentation efficiency.

Business Segments / Divisions

- Industrial Enzymes

- Nutraceutical and Pharmaceutical Ingredients

- Fermentation-based Specialty Biochemicals

Geographic Presence

Headquartered in Taiwan, with export markets across Southeast Asia, North America, and Europe.

Key Offerings

- Food-grade bromelain for meat tenderization and brewing applications

- Pharmaceutical-grade bromelain for anti-inflammatory and digestive supplements

- Custom enzyme blends for industrial applications

- Fermentation-based proteolytic enzyme solutions

Financial Overview

Challenge Bioproducts Co., Ltd. is privately held, with estimated annual revenues in the range of 40-60 million USD, supported by strong exports of natural enzymes and bioactives.

Key Developments and Strategic Initiatives

- April 2023: Expanded bromelain production capacity at Taichung facility

- September 2023: Developed stabilized bromelain enzyme for long-shelf-life nutraceutical products

- May 2024: Introduced hybrid fermentation-bromelain extraction process for enhanced yield

- January 2025: Announced R&D program on bromelain derivatives for cosmetic and therapeutic use

Partnerships & Collaborations

- Collaborations with academic institutions for enzyme stabilization research

- Partnerships with international nutraceutical brands for private-label enzyme products

- Alliances with biotechnology firms for advanced fermentation process development

Product Launches / Innovations

- Stabilized Bromelain Extract (2024)

- Pharma-grade bromelain powder for capsule formulations (2023)

- Hybrid fermentation enzyme production line (2025)

Technological Capabilities / R&D Focus

- Core technologies: Microbial fermentation, enzyme extraction and refinement, and stabilization

- Research Infrastructure: Dedicated R&D facility in Taichung, with partnerships in Japan and South Korea

- Innovation focus: Process optimization, enzyme purification, and bioreactor-based bromelain production

Competitive Positioning

- Strengths: Advanced fermentation expertise, cost-effective production, and global export capabilities

- Differentiators: Integration of microbial fermentation and enzymatic extraction for superior enzyme yield

SWOT Analysis

- Strengths: Strong R&D foundation, consistent enzyme quality, and global distribution network

- Weaknesses: Smaller scale compared to multinational enzyme companies

- Opportunities: Rising demand for plant-derived enzymes in health and nutrition products

- Threats: Raw material supply fluctuations due to pineapple sourcing variability

Recent News and Updates

- March 2024: Challenge Bioproducts expanded exports of food-grade bromelain to the EU and U.S. markets

- August 2024: Launched next-generation bromelain formulation for use in cosmeceuticals

- January 2025: Partnered with regional biotech companies for sustainable bromelain production scaling

Other Companies in the Market

- Enzyme Development Corporation (U.S.): Enzyme Development Corporation is one of the oldest enzyme manufacturers in the U.S., offering high-quality bromelain derived from pineapple stems. The company supplies food-grade and pharmaceutical-grade bromelain for use in food processing, dietary supplements, and pharmaceutical applications.

- Advanced Enzyme Technologies Ltd. (India): Advanced Enzyme Technologies is a global leader in industrial and specialty enzymes, producing bromelain for nutraceutical, food, and therapeutic use. The company focuses on research-based enzyme formulations that enhance bioavailability and efficacy across healthcare and industrial applications.

- Changsha Natureway Co., Ltd. (China): Changsha Natureway manufactures plant-derived enzyme extracts, including bromelain, for the food, cosmetic, and pharmaceutical industries. The company emphasizes sustainable sourcing and advanced purification techniques to ensure consistent enzyme activity.

- Great Food Group of Companies (Thailand): Great Food Group produces natural bromelain extracts from locally sourced pineapples. The companys offerings cater to the global food and dietary supplement sectors, emphasizing quality control and environmentally friendly production practices.

- Nanning Pangbo Bioengineering Co., Ltd. (China): Nanning Pangbo Bioengineering specializes in enzyme extraction and refinement, offering bromelain for pharmaceutical, cosmetic, and food-grade applications. Its production is supported by advanced biotechnological processes to ensure purity and stability of activity.

- Creative Enzymes (U.S.): Creative Enzymes provides high-purity bromelain for research, industrial, and therapeutic use. The company offers both crude and refined enzyme preparations, focusing on enzyme kinetics, stability testing, and customized enzyme formulation services.

- Bio-gen Extracts Pvt. Ltd. (India): Bio-gen Extracts manufactures plant-based bioactives and enzymes, including bromelain, for nutraceutical and pharmaceutical markets. The company leverages eco-friendly extraction methods and offers standardized enzyme concentrations for consistent performance.

- Guangxi Nanning Jiuzhou Group Co., Ltd. (China): Guangxi Nanning Jiuzhou Group is a leading supplier of bromelain and other natural enzyme products. The company serves the food processing and healthcare industries, focusing on large-scale production and export-quality standards.

- M/s Enzyneer India Pvt. Ltd. (India): Enzyneer India produces enzyme formulations, including bromelain, for pharmaceutical and industrial uses. The company expertise lies in enzyme stabilization and activity enhancement through innovative bioprocessing techniques.

- Biozyme Laboratories (U.K.): Biozyme Laboratories develops enzyme-based dietary supplements and formulations featuring bromelain for digestive and anti-inflammatory benefits. The company supplies both consumer and bulk enzyme products under GMP-certified manufacturing facilities.

- Lyven S.A. (France): Lyven produces bromelain and other enzymatic ingredients for food and beverage applications. The company focuses on natural fermentation and bio-based extraction processes, supplying enzyme solutions tailored for texture improvement and protein hydrolysis.

- VTR Bio-Tech Co., Ltd. (China): VTR Bio-Tech is a biotechnology company specializing in enzyme and fermentation technology. Its bromelain products are used in pharmaceuticals, food processing, and cosmetics, supported by strong R&D in enzyme purification and formulation.

- Hong Mao Biochemicals Co., Ltd. (Taiwan): Hong Mao Biochemicals manufactures natural enzymes, including bromelain, for health supplements and functional foods. The company expertise lies in enzymatic hydrolysis and maintaining high activity levels through optimized extraction.

- Natural Factors Nutritional Products Ltd. (Canada): Natural Factors produces dietary supplements containing bromelain for digestive support and inflammation control. The company emphasizes natural sourcing, quality testing, and compliance with North American health standards.

- NutraScience Labs (U.S.): NutraScience Labs formulates and manufactures nutraceutical products featuring bromelain as an active ingredient. The company provides private-label supplement manufacturing, focusing on clean-label, clinically supported formulations.

- Pineapple India Co. (India): Pineapple India Co. produces natural bromelain extracted from locally cultivated pineapples. The company supplies enzyme ingredients for the food, beverage, and nutraceutical sectors, emphasizing eco-friendly extraction and regional sourcing.

- Advanced Biotech Products Pvt. Ltd. (India): Advanced Biotech Products manufactures enzyme-based biotechnological products, including bromelain for medical, cosmetic, and food applications. Its focus is on maintaining enzyme purity and bioactivity through proprietary production methods.

- Aumgene Biosciences (India): Aumgene Biosciences offers plant-based enzyme products, including bromelain, for pharmaceutical and nutraceutical use. The company specializes in research-driven bioactive ingredient development and provides contract manufacturing for enzyme-based health products.

Recent Developments

- In October 2024, Dr.Olive announced the launch of its new diet supplement Ollypine, which uses premium Spanish extra virgin olive oil combined with the enzyme bromelain (derived from pineapple) to improve absorption of fatty acids and polyphenols.(Source: https://www.openpr.com)

- In May 2025, MediWound Ltd. published Phase II trial data for its EscharEx, a bromelain-based enzymatic therapy, showing superior debridement performance compared with collagenase ointment in venous leg ulcers.

- In January 2025, GC Nongshim launched the soft-capsule pain-reliever Teksan RAY large 30-capsule product, targeting menstrual pain and other conditions, though the report does not mention bromelain.(Source:https://biz.chosun.com)

Exclusive Insights

Our experts observe that the bromelain market is poised for sustained growth driven by increased demand for naturally derived bioactive ingredients in medicines, nutraceuticals, and cosmetics. Additionally, the continued shift in consumer demand away from synthetics and towards plant-derived anti-inflammatory and digestive supplements should support a steady growth trajectory. However, access to and availability of the raw input supply, enzyme variability, and a lack of consistency in the standards associated with each product remain the most salient issues for widespread commercialization.

Regardless, the bromelain market still offers plenty of business opportunities in areas such as medical-grade enzyme products and functional food production capabilities. Further, we can see new trends emerging in other sectors, such as the inclusion of bromelain in wound-healing therapy, as part of a sports nutrition line, and even in (anti-aging) skincare. Ultimately, the future of bromelain could include partnering with other sectors to expand across multiple areas. Finally, improvements in biotechnological extraction methods could increase production efficiency and broaden their use in industry.

Bromelain MarketSegments Covered in the Report

By Source

- Stem Bromelain

- Fruit Bromelain

By Application

- Healthcare & Pharmaceuticals

- Food & Beverages (meat tenderizers, beverages, bakery applications)

- Nutraceuticals & Dietary Supplements

- Cosmetics (anti-aging, exfoliation, skin-brightening)

- Others (Biotechnology, Textile processing, Animal feed)

By Form

- Powder

- Liquid

By End-Use Industry

- Pharmaceuticals & Nutraceuticals

- Food & Beverage Industry

- Cosmetics & Personal Care

- Biotechnology & Research

- Animal Feed & Agriculture

By Distribution Channel

- Business-to-Business (B2B) / Industrial Supply

- Business-to-Consumer (B2C) / Retail

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting