What is the building Thermal Insulation Market Size ?

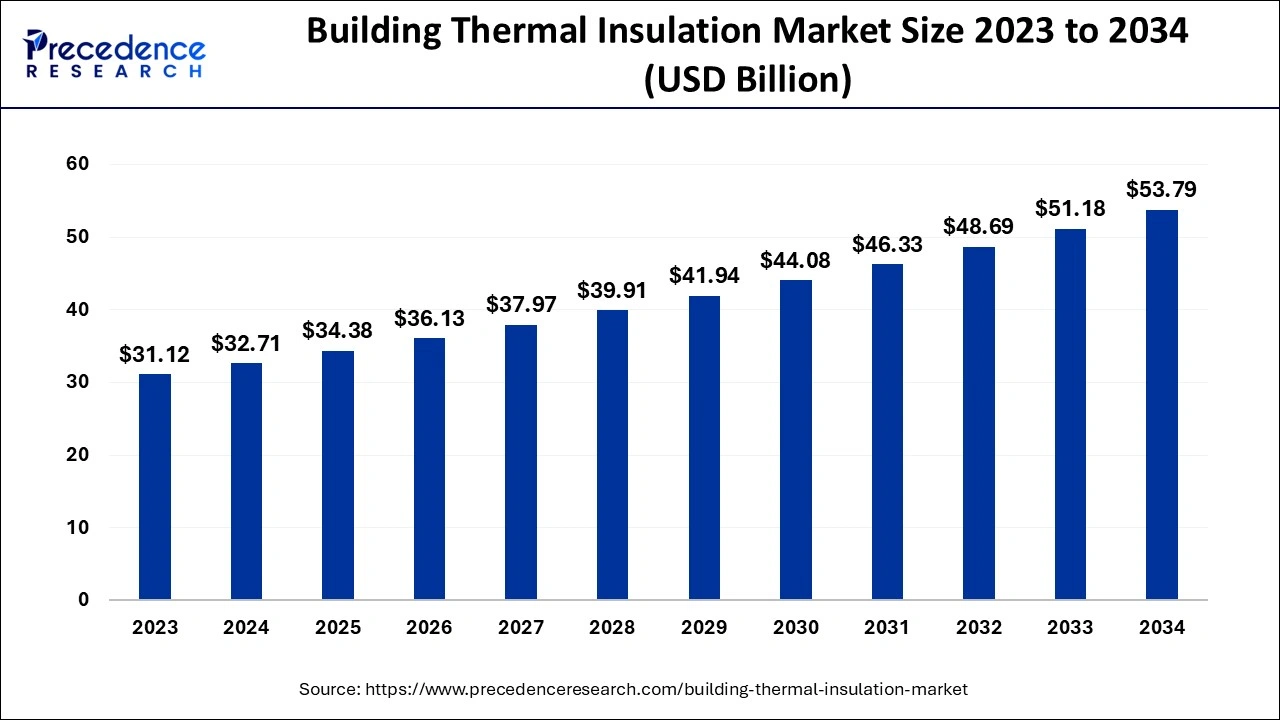

The global building thermal insulation market size is estimated at USD 34.38 billion in 2025 and is predicted to increase from USD 36.13 billion in 2026 to approximately USD 56.32 billion by 2035, expanding at a CAGR of 5.06% between 2026 to 2035.

Building Thermal Insulation Market Key Takeaways:

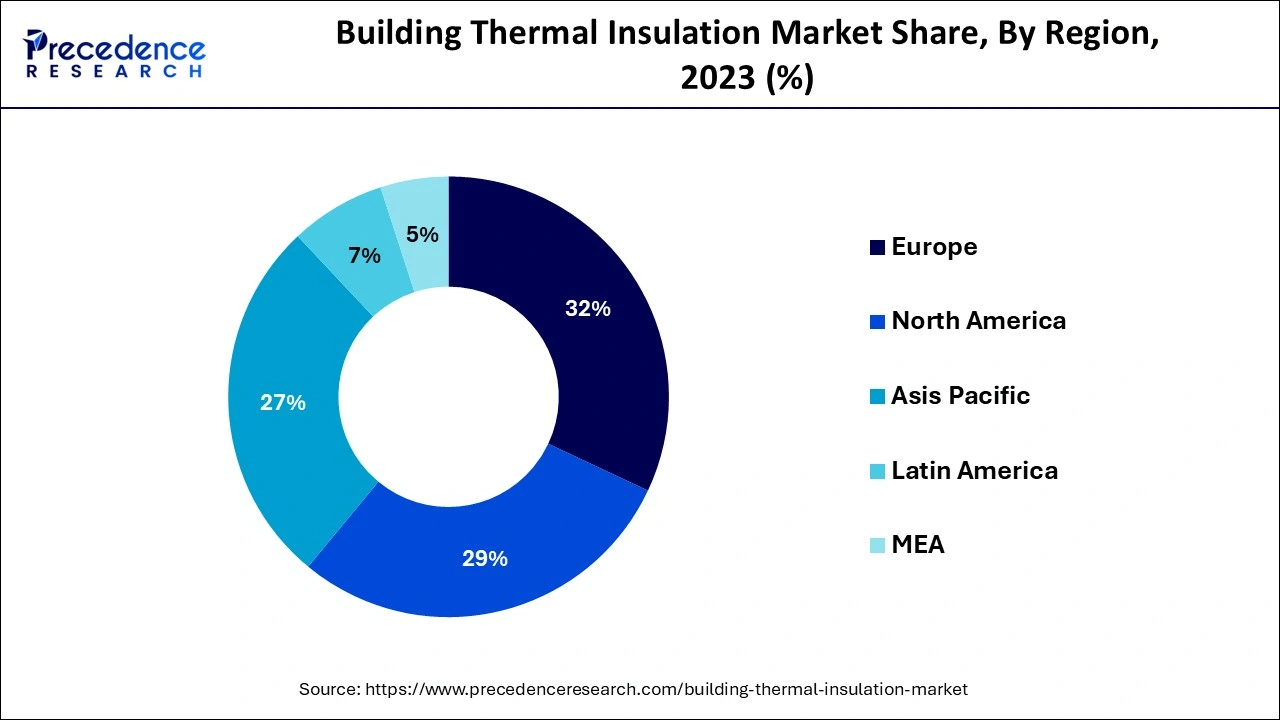

- Europe region captured more than 32% of revenue share in 2025.

- By material, the foamed plastic segment held the maximum market share in 2025.

- By product, the expanded polystyrene segment is expected to maintain the biggest share between 2026 to 2035.

- By product, the mineral wool segment is predicted to grow at a remarkable CAGR from 2026 to 2035.

- By application, the wall insulation segment is predicted to expand rapidly between 2026 to 2035.

- By end-user, the residential segment is predicted to grow at the fastest CAGR between 2026 to 2035.

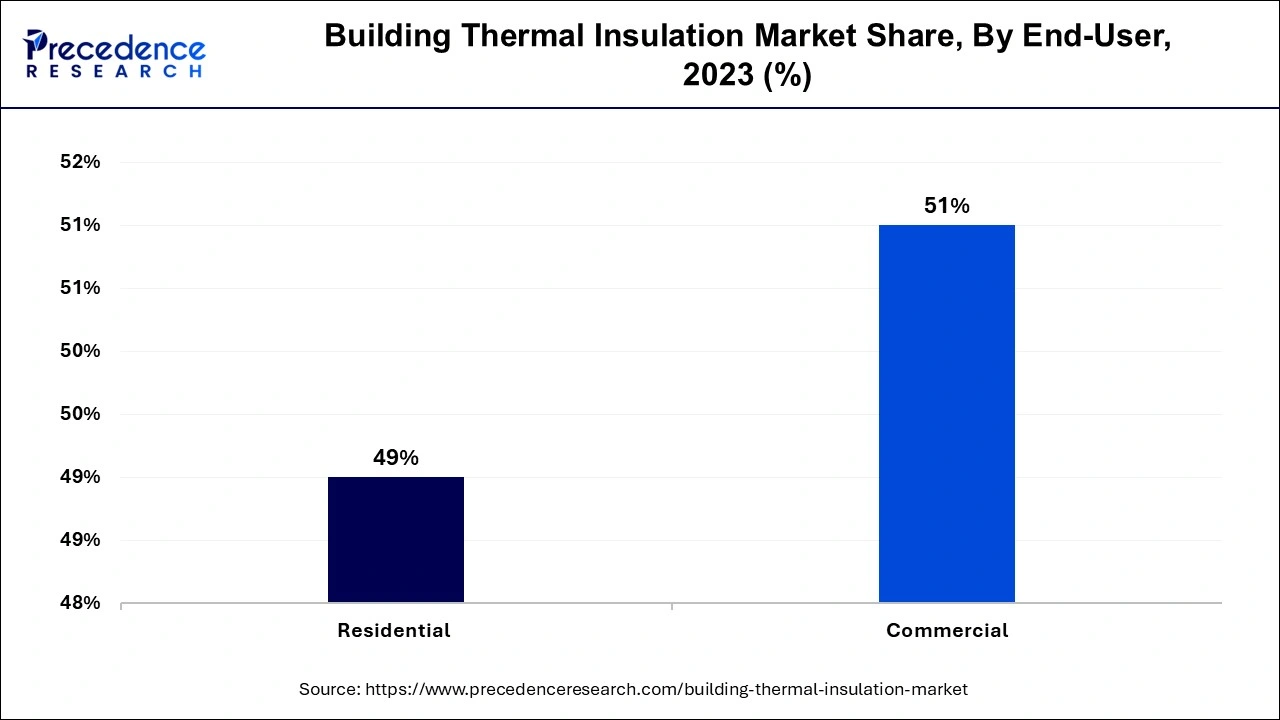

- By end-user, the commercial construction segment generated more than 51% of total revenue in 2025.

What is the Building Thermal Insulation?

Thermal insulation in buildings inhibits heat from traveling from one compound to another as they come into thermal contact. Insulation thermal conductivity is measured and achieved by utilizing low thermally conductive substances.

The market's expansion can be caused by the growing use of building thermal insulators to achieve better heat/cold protection. They are widely used in areas with harsh weather for insulating buildings with either heating or cooling systems, as this saves both energy and money. Thermal insulators maintain the temperature inside the building and also save energy on electric heaters. Furthermore, they inhibit extreme cold or heat waves from penetrating the building.

The increasing use of cooling and heating systems in houses is expected to drive market growth. Furthermore, rising energy preservation awareness is projected to fuel market expansion. Global temperature increases, as well as climate change due to different human activities, are also expected to boost the market growth.

How is AI contributing to the Building Thermal Insulation Process?

AI finds applications in the insulation process by means of material choice, predictive heat loss simulation, real-time thermal control, optimization of facade design, adjustments of the HVAC, accelerated diagnostics, preventative care, energy maximization, increased comfort, and customized insulation plans based on the patterns of building utilization and the environmental conditions. These options make the insulation process more efficient.

Market Outlook

- Industry Growth Overview: Growth of the market has been mainly attributed to the growing energy efficiency requirements and construction activity.

- Sustainability Trends: Insulation that is bio-based, recycled, and low-emission is more prevalent in eco-friendly construction projects.

- Global Expansion: One of the key causes of insulation use is urbanization and infrastructure investments, especially in the Asia-Pacific region, where the population is growing at a very rapid pace.

- Major Investors: Owens Corning, Saint-Gobain, BASF SE, Kingspan Group, and Knauf Insulation are the big players that enhance innovation and production capacity.

- Startup Ecosystem: The new companies are introducing new technologies in the fields of aerogels and foams, which can improve the performance of insulations, as well as alter the competitive environment.

Market Scope:

| Report Coverage | Details |

| Market Size in 2025 | USD 34.38 Billion |

| Market Size by 2035 | USD 56.32 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.06% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Material, By Product, By Application and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising development of green buildings.

The increased development of green buildings is expected to drive the growth of the building thermal insulation industry over the coming years. Green building reduces or eliminates adverse impacts on the climate as well as the natural environment throughout design, construction, and operation. Green structures do not deplete natural resources and improve living standards.

Thermal insulation is utilized in the development of green buildings to produce more energy efficiency and to maintain them cool naturally. For example, as per Times Property, an India-based property purchases, and sale platform, in 2020, the development of green buildings rose in India. Furthermore, according to CBRE, a commercial real estate firm based in the United States, India's total amount of green assets has expanded to nearly 40%.

Furthermore, as stated by the singapore green building council, 49% of singapore's buildings will be green by 2021, and this is expected to rise to 80% by 2030. As a result, the growth of constructing thermal insulation is being fueled by a rise in the development of green buildings.

The adoption of energy certification organizations such as the US Green Building Council (USGBC), as well as Leadership in Energy and Environmental Design (LEED), as well as favorable building codes in the United States and Canada, are projected to increase the need for building thermal insulation.

Increasing global warming as well as climate changes

Air pollution is the primary cause of global warming, which is defined as the occurrence of rising temperatures on the earth's surface as a result of dangerous pollutants generated into our atmosphere as a result of uncontrolled energy use. The significance of improving building energy efficiency for decreasing greenhouse gas emissions, energy consumption, and costs has been widely recognized in Europe, and EU-level obligations for new building energy efficiency demands have been imposed.

Restraints

Existence of alternative material

Plastic foams as well as recyclable insulation, have been gaining popularity due to strict government laws regulating materials and programs. Rising demand for renewable, biodegradable, and recyclable goods in the commercial and residential industries, as a result of a greater focus on ecological sustainability, is projected to raise the risk of alternatives in the industry over the predicted period.

Due to their poor biodegradability and carcinogenic effects, the US Environmental Protection Agency (EPA) imposed stringent rules on the use of foamed plastics, potentially impeding market growth. Moreover, rising plastic foam expenses are anticipated to restrict market expansion, encouraging the development of alternative materials.

Opportunity

Technological advancement

Technological progress is a crucial trend that is gaining traction in the building thermal insulation industry. Large businesses functioning in the building thermal insulation industry are concentrated on developing novel technologies to achieve a competitive edge. For example, in March 2022, ACC Ltd. introduced the ACC Atrium, a better thermal temperature control concrete system produced using based insulating technology. This unique technology insulates the ceiling while it is being built.

With its thermal insulation, the component is appropriate for both residential and commercial buildings and is sustainable and fire-resistant. The market is also anticipated to increase due to rising usage in spacecraft, aircraft, marine vessels, railcars, and other sectors.

Segment Insights

Material types Insights

The mineral wool segment held the largest share of 43.20% in the 2024 global building thermal insulation market. The mineral wool segment is important for the market due to its brilliant acoustic, fire-resistant, and thermal properties. The segment consists of glass wool and stone wool. The glass wool's (fiber glass) development is specified by the extension in the infrastructure, and rapid use in the commercial and residential sectors. The stone wool (rock wool/slag wool) aims to discover new sustainable production methods and introduce innovative products. The segment is emerging with the requirements of the residential and commercial sectors.

The biobased materials (natural/organic) are expected to grow at a CAGR of 7.90% during the forecast period. The biobased material segment is popularly characterized as a natural/organic process in the global building thermal insulation. The segment provides sustainable options to synthetic materials. The biobased materials include cork, hemp fiber, sheep's wool, wood fiber, cellulose, and other biobased for example, cotton and straw. The development of organic materials is empowered by their low embodied energy, the ability to gather biogenic carbon during the growth period, and groundbreaking thermal properties.

Product Insights

The expanded polystyrene sector is anticipated to maintain the largest share between 2024 and 2034. This is because of its long life and excellent thermal insulating materials capabilities. Furthermore, increasing consumer interest in the product due to its rot-proof, recyclable, and non-toxic properties is anticipated to drive growth due to its water resistance, capacity to save energy, and ability to minimize moisture-related damage. Furthermore, growth is anticipated to be assisted by its ability to prevent fungal or microbial development in the insulated area.

The mineral wool sector is anticipated to grow at a significant CAGR from 2024 to 2034. The growth is owing to the unique qualities of the product, such as an efficient heat barrier, environmental compatibility, dimensional stability, and fire safety. Volcanic rocks produce mineral wool like diabase, basalt, and dolomite that are generated in abundance. The increasing need for mineral wool in applications as a thermal barrier is anticipated to propel its growth during the predicted period.

Application Insights

The roofs segment is expected to grow at a CAGR of 6.80% during the forecast period. The pitched and flat roof insulation is emerging in the global building thermal management, mainly considered for its lower cost, convenience, and energy efficiency, with both introduced to fit into different strategies and explore materials to control heat transfer. The pitched roof has largely ruled the market, whereas the growth of the flat roofs for sustainability, functional, and aesthetic reasons has accelerated the demand for excellent insulation solutions.

Floor insulation is anticipated to witness remarkable growth over the projected period due to increasing demand to lower the energy expenses of HVAC functions. Thermal insulation is used in flooring, such as for garages, crawl spaces, cantilevers, and basements. Rising product demand for floor insulation in cold regions is anticipated to propel the growth of the building thermal insulation market.

End-User Insights

The residential buildings segment held the largest share of 52.40% in the 2024 global building thermal insulation market. The new constructions for multi-family or single-family, and renovation and retrofit for the same have been emerging due to the growing population. The residential buildings are thriving with the demand for urbanized living in sustainable homes. The modernized urge of individuals to renovate their home setting promotes energy-efficient and sustainable materials. The new constructions are in continuous need of high material volume, which doubles the growth of the market globally.

The commercial buildings segment is expected to grow at a CAGR of 6.90% during the forecast period. The commercial buildings, such as educational institutions, healthcare facilities, hospitality, retail (supermarkets and shopping malls), office spaces, and other commercial buildings like data centers and public buildings, have largely covered the global building thermal insulation sector. The emerging new businesses, educational, health, and retail sectors are building smart spaces for talent to flourish and solutions to perform across the large spectrum, with a sufficient boost to productivity. Alongside, complementing best to the work or operational environment is a key focus of the commercial buildings sector.

In 2023, the commercial construction sector accounted for more than 51% of total revenue. The growing importance of public and commercial building energy efficiency because of elevated energy prices that result in higher costs of maintenance is projected to drive growth. Buildings for universities, office spaces, hypermarkets, department stores, supermarkets, shopping malls, restaurants, hotels, hospitals, and resorts are included in this segment. One of the primary drivers behind the expansion of building thermal insulation is the rapidly ongoing trend of sustainable buildings.

Furthermore, rising office space in emerging nations, particularly in the subtropical region, is projected to generate significant demand for insulating materials to maintain energy standardization and regulate temperature levels.

Regional Insights

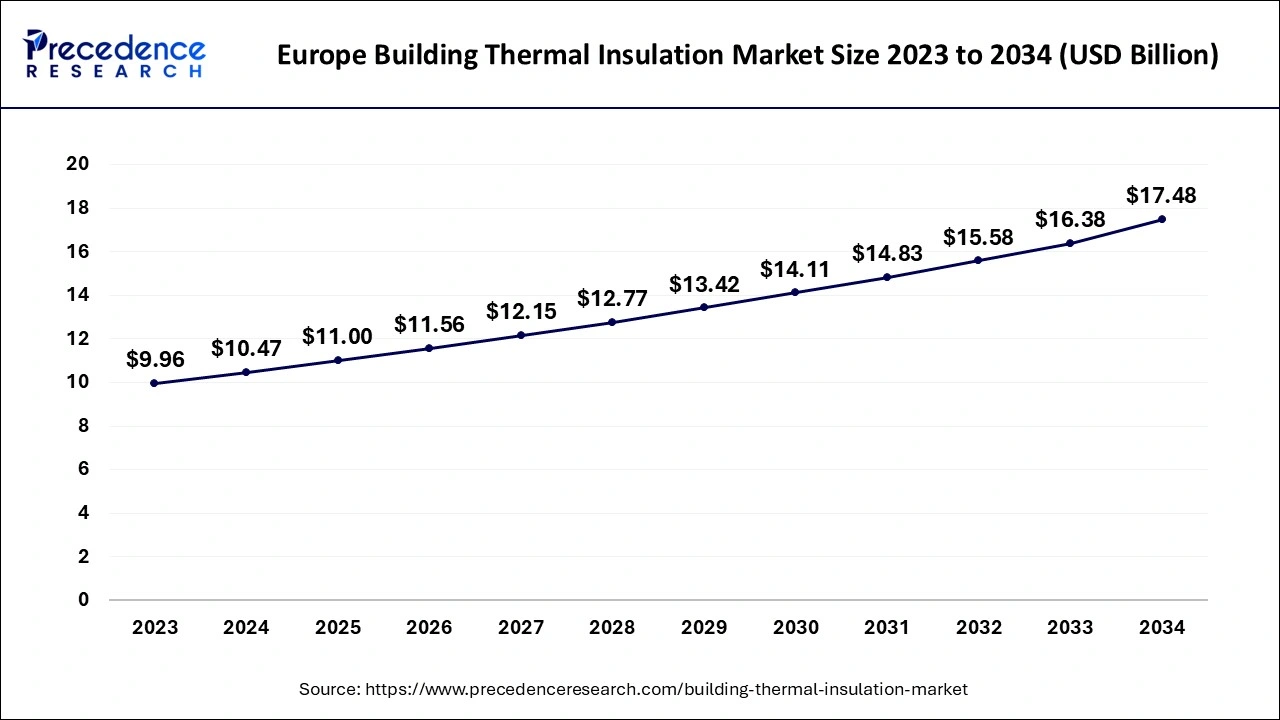

What is the Europe Building Thermal Insulation Market Size?

The global building thermal insulation market size is estimated at USD 11 billion in 2025 and is anticipated to reach around USD 18.38 billion by 2035, expanding at a CAGR of 5.27% between 2026 to 2035.

Europe is anticipated to influence the Building Thermal Insulation Market. In 2022, the Europe region generated more than 32% of the revenue share and is projected to have the largest share of the market.The energy-saving benchmark by European Commission's and REACH's initiative to promote thermal insulation is anticipated to contribute to regional market expansion.

The rapidly growing construction of residential and commercial building industries in North America and strong green building standards that have been adopted to lower power consumption per structure are projected to fuel market expansion in North America. Furthermore, favorable federal regulations regarding the utilization of the product in commercial and residential facilities are predicted to propel development over the projected time frame.

Due to the remarkably cold weather conditions in Canada as well as some areas of the US, the market in North America is expected to gain the most significant share of the market throughout the projected period.

How Is Asia-Pacific Performing in The Building Thermal Insulation Market?

Asia-Pacific is expected to grow at a notable rate during the forecast period due to improved infrastructure and the demand for efficient buildings. Building works are increasing insulation requirements in residential, business, and industrial regions, and a constant emphasis on cost, performance dependability, and scalable production facilities is being exercised.

China Building Thermal Insulation Market Trends

The factors that have contributed to the expansion of the insulation market in China are the development of cities and the growth of industries. It is also influenced by the policies of the government that encourage green construction practices, supported by the use of insulation. Economical material dominates the market, and simultaneously, the desire for prefabricated buildings, cold-chain infrastructure, localized material development, and enhanced energy performance standards establishment is increasing.

Value Chain Analysis of the Building Thermal Insulation Market

- Feedstock Procurement: Purchasing of important chemicals or polymers that are assured of consistent quality and supply in the insulation production.

Key players: BASF SE, Dow Inc., and ExxonMobil Chemical - Chemical Synthesis and Processing: Transforming raw materials through controlled reaction to functional base materials used in insulation products.

Key players: BASF SE, Dow Inc., SABIC, and Mitsubishi Chemical Corporation - Quality Testing and Certification. Before it is sold commercially, insulation testing to verify that it satisfies performance, safety, and regulatory requirements is performed.

Key players: ASTM, ISO

Building Thermal Insulation Market Companies

- BASF SE: The company provides other types of foam solutions, in addition to chemical building blocks, which allow creating the insulation materials that consume less energy and leave less footprint on the environment.

- Johns Manville Corporation: The company offers a range of insulation products, which are fiberglass, foam, and mineral wool, and they satisfy the requirements of residential, commercial, and industrial buildings.

- Kingspan Group plc: The company not only manufactures and markets panels and systems with insulation properties that are very good, but it also uses innovative methods when developing and producing bio-based and low-carbon insulation materials.

Other Major Key Players

- Saint-Gobain SA.

- Knauf Insulation, Inc.

- Huntsman Corporation

- Owens Corning

- Rockwool International A/S

- Cabot Corporation

- Firestone Building Products Company

- Dow Corning Corporation

- URSA Insulation, SA.

- Covestro AG

- Atlas Roofing Corporation

- Paroc Group Oy

Recent Developments:

- In May 2025, AkzoNobel launched a thermal insulation coating system in China that enhances building energy efficiency. This system includes a radiative cooling topcoat and a thermal radiation barrier mid-coat, lowering surface temperatures by up to 10% in summer compared to traditional coatings. (Source: https://www.coatingsworld.com )

- In May 2021,Saint-Gobain SA purchased Buitex Industries. This acquisition helped the company expand its multi-material insulating materials solutions.

- Owens Corning plans to open a new facility in Joplin, Missouri, in July 2020 to produce Thermafiber mineral fiber insulation for commercial, residential, and industrial applications.

- Owens Corning declared the acquisition of vliepa GmbH in July 2021. The merger of these companies increased the company's global nonwoven investments, accelerating growth as well as strengthening options for European construction and building markets.

- Saint-Gobain announced the acquisition of Strikolith, in September 2020. The company offers a wide variety of expanded polystyrene sheets and boards for façade insulation.

- In September 2020, Paroc launched a stone wool recycling system. The REWOOL system efficiently reuses off-cuts of stone wool generated by building projects and building sites, enabling the sector to attain its carbon neutrality objective.

Segments Covered in the Report:

By Material Types (Revenue and Volume (Tons)

- Mineral Wool

- Glass Wool (Fiberglass)

- Stone Wool (Rock Wool/Slag Wool)

- Plastic Foam

- Expanded Polystyrene (EPS)

- Extruded Polystyrene (XPS)

- Polyurethane (PUR)

- Polyisocyanurate (PIR)

- Phenolic Foam

- Biobased Materials (often referred to as Natural/Organic)

- Cellulose

- Wood Fiber

- Cork

- Hemp Fiber

- Sheep's Wool

- Other Biobased (e.g., straw, cotton)

- Other Advanced/Emerging Materials

- Aerogels

- Vacuum Insulation Panels (VIPs)

- Foamed Glass

- Reflective Insulation (Radiant Barriers)

- Cementitious Foam

By Application

- Walls

- External Wall Insulation (EWI)

- Internal Wall Insulation

- Cavity Wall Insulation

- Roofs

- Flat Roof Insulation

- Pitched Roof Insulation

- Floors

- Ground Floor Insulation

- Intermediate Floor Insulation

- Basement/Below-Grade Insulation

- Ceilings (distinct from roof if applicable, e.g., attic floor vs. sloped roof)

- Other Applications (e.g., HVAC ducts, pipes, windows/doors insulation, partitions, building envelope details)

By End-User Sector

- Residential Buildings

- New Construction (Single-Family, Multi-Family)

- Renovation & Retrofit (Single-Family, Multi-Family)

- Commercial Buildings

- Office Spaces

- Retail (Shopping Malls, Supermarkets, etc.)

- Educational Institutions

- Healthcare Facilities (Hospitals, Clinics)

- Hospitality (Hotels, Restaurants)

- Other Commercial (e.g., public buildings, data centers)

- Industrial Buildings

- Manufacturing Facilities

- Warehouses & Logistics Centers

- Specialized Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content