What is the 5G NTN Market Size?

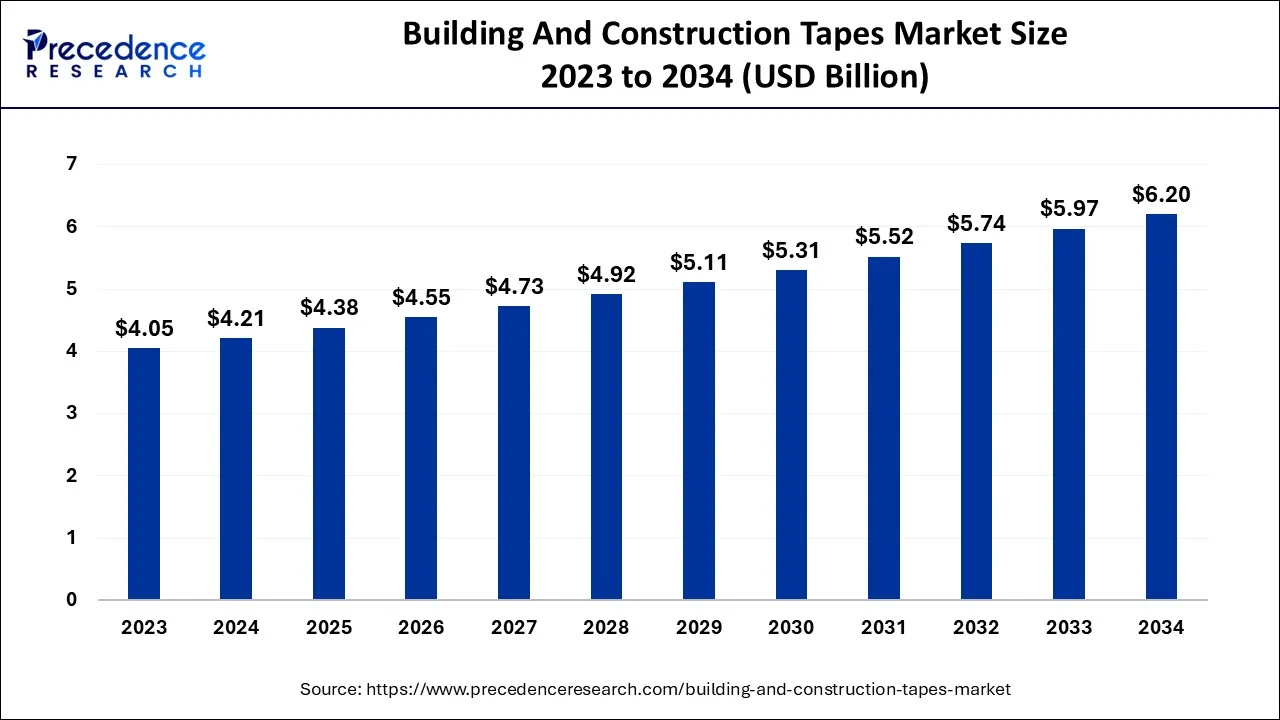

The global building and construction tapes market size was valued at USD 4.38 billion in 2025, and is projected to hit around USD 4.55 billion by 2026, and is anticipated to reach around USD 6.20 billion by 2034, expanding at a CAGR of 3.95% over the forecast period from 2025 to 2034. The rising infrastructural activities in developing countries are boosting the growth of the building and construction tapes market.

Building And Construction Tapes Market Key Takeaways

- In terms of revenue, the market is valued at $4.38 billion in 2025.

- It is projected to reach $6.2 billion by 2034.

- The market is expected to grow at a CAGR of 3.95% from 2025 to 2034.

- Asia Pacific generated the maximum share of the global market.

- North America is expected to expand at a remarkable rate between 2025 and 2034.

- By product, the double-sided tapes segment is predicted to dominate the market from 2025 to 2034.

- By product, the masking tape segment is expected to show a significant growth from 2025 to 2034.

- By backing material, the polyvinyl chloride (PVC) segment is projected to grow at a significant rate between 2025 and 2034.

- By backing material, the foil segment is expected to witness a remarkable growth from 2025 to 2034.

- By application, the wall and ceilings segment led the global market with the majority of revenue share.

- By function, the protection segment captured the largest share of the global market.

- By function, the glazing segment is expected to expand at a remarkable rate from 2025 to 2034.

- By end-use, the residential segment is predicted to grow at a CAGR of 5.5% from 2025 to 2034.

Market Overview

Building and construction tapes are used to offer extensive adhesion for various applications in an infrastructure. Building and construction tapes are made up of synthetic materials that bond two surfaces to support contraction. Apart from providing aesthetic appearance to both internal and external structures of the building, Building and construction tapes have unmatched benefits, including easy and fast application on any surface and protection of walls and windows.

Moreover, the Building and construction tapes are used to remodel the building structure, insulate the building, paint, and hold or bundle wires. Buildings' systems and components require proper protection from adverse weather conditions, external forces, pollution, cracks, excess sounds/vibrations and multiple other factors that harm the well-being of the construction.

Building and construction tapes address acoustic, sealing, waterproofing and fireproofing obstacles/challenges. Moreover, building and construction tapes reduce the overall cost of materials required at the construction site. The rising trend and popularity of innovative and valuable residential and commercial buildings will fuel the demand for Building and construction tapes in the upcoming years.

Technological Advancement

Technological advancements in the building and construction tapes market feature hot melt technology, customization, digitization, and specialization. Digitization in the integral digital solution and sensor-protected smart tapes provides real-time insights into construction. Hot melt technology uses solid adhesives. It is a famous and most used technology that fastens the construction process. New technologies are beneficial for manufacturers. Specialization and customization are a new advancement to the market.

Sensor technology in the building and construction tapes market is a common feature of all technologies. Mostly used in many markets. The smart tapes detect damage and stress in structures. This real-time data supports quality control. These advanced technologies contribute to development and innovation. It's mainly beneficial for modern, equipped projects to approach the fastest-moving advancements in their construction process.

Building And Construction Tapes Market Growth Factors

The global Building and construction tapes market is expected to witness a significant increase during the forecast period, with rising construction activities in developing countries across the globe. The rising demand for advanced solutions in wire harnessing in newly constructed buildings is another significant driver for the market's growth. However, the increasing environmental concerns and fluctuating prices of raw materials are prone to hinder the development of the global Building and construction tapes market.

The building and construction tapes are observed as an excellent solution for the interior design of the building; the requirements for advanced door and window locking systems are expected to boost the demand for Building and construction tapes during the projected timeframe. Prominent companies involved in the automotive adhesive tape market are focused on developing more environmentally friendly yet efficient building construction tapes. This factor is considered to boost the market's growth during the projected time.

Along with the rise in new construction, the demand for Building and construction tapes is increasing for retrofit or renovation applications. The growth of the global building and construction tapes market is attributed to the rising demand for tapes in wiring and other electrical applications.

The increasing demand for advanced plumbing solutions in the new construction of residential buildings is fueling the demand for building construction tapes. Factors such as product expansion, partnerships, innovations in tapes, improving adhesion quality and opportunities in well-established countries are propelling the growth of the building and construction tapes market.

Building and Construction Tapes Market Outlook:

- Industry Growth Overview: The building and construction tapes market is projected to grow significantly from 2025 to 2034, driven by rising infrastructure investments worldwide, high urbanization rates, and an increased focus on energy-efficient building materials. Governments around the world are heavily investing in infrastructure, smart cities, and eco-friendly housing, which fuels the demand for pressure-sensitive and double-sided adhesive tapes.

- Sustainability Trends: Sustainability has become a key trend transforming the building and construction landscape, with manufacturers increasingly shifting toward eco-friendly materials and production methods. The rising demand for low-VOC adhesives, solvent-free formulations, and recyclable backing films reflects the global move toward green building standards. As sustainability becomes a competitive differentiator, businesses that adopt circular economy principles and renewable chemistry are likely to gain a stronger strategic advantage.

- Global Expansion: Global expansion has become a key strategic goal for market leaders looking to seize new opportunities in emerging economies with rapid construction growth. Nitto Denko, Berry Global, and Intertape Polymer Group have been expanding their production bases and distribution channels in Southeast Asia. Increased investments in commercial real estate, industrial zones, and transport infrastructure across the Asia-Pacific are boosting demand for tubes, especially in sealing, insulation, and HVAC applications.

- Major Investors: The building and construction tapes market has begun attracting significant interest from private equity firms, infrastructure funds, and strategic investors seeking stable, high-margin industrial properties. These investors recognize the market's resilience, the recurring demand cycle, and the influence of ESG-driven construction trends. Capital inflows are expected to grow among high-performance, environmentally conscious tape manufacturers over the next five years as sustainability, automation, and smart material innovation revolutionize the industry.

- Startup Ecosystem: The startup ecosystem is flourishing, driven by innovative adhesive chemicals and eco-friendly manufacturing technologies. New companies like XFasten (USA), ECHOtape (Canada), and Green Bond Technologies (Germany) are leveraging nanotechnology, hybrid polymers, and recyclable substrates. They produce tapes that are both highly adhesive and environmentally friendly. Moreover, the industry is becoming more sustainable, customized, and digitally integrated. This growing startup ecosystem is likely to play a key role in shaping the future of building tape technologies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.20 Billion |

| Market Size in 2026 | USD 4.55 Billion |

| Market Size in 2025 | USD 4.38 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.95% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Backing Material, Application, Function, End-Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising construction activities in developing countries

The rising industrialization and commercialization in developing countries located in Africa, Latin America and Asia are fueling the demand for construction activities. The construction industry plays a vital role in the emerging economies of such countries.

Developing countries require adequate building structures for businesses, housing, and other purposes. Considering India is one of the most prominent developing nations, revolutionary schemes such as the smart city mission, which has targeted 100 cities in the country is, projected to improve the infrastructure with advancements and modernization.

Improvements in the construction of buildings require innovative solutions; building and construction tapes can offer advanced insulation and protection solutions. Thus, the rise in construction activities is observed to boost the growth of the building and construction tapes market.

Restraint

Weather limitations associated with the building and construction tapes

Despite offering unmatched advantages to the building structure, few adverse weather conditions can affect the adhesion and overall productivity of building construction tapes. Excess heat can completely change the adhesive performance of building construction tapes; high-temperature conditions melt the adhesion. In contrast, shallow temperature conditions fail the application of tapes. Moreover, certain building and construction tapes are sensitive to UV rays.

Along with this, tapes with no water-resistant properties cannot perform well in the rainy season. Excess humidity and even dryness in the weather are prone to affect the adhesion of tapes. Thus, such weather limitations hamper the market's growth by creating an obstacle. However, the market players are focused on developing tapes that can withstand extreme weather conditions to combat such obstacles.

Opportunity

Production of eco-friendly tapes

Building and construction tapes are non-biodegradable. Also, the production of such tapes releases volatile organic compounds. Overall, building and construction tapes can be harmful to the environment. The rising environmental concerns have forced market players to develop green or eco-friendly tapes that can combat severe environmental issues, this is also observed to offer lucrative opportunities to manufacturers.

Multiple companies involved in the global building and construction tapes market have already shifted their focus to the production of eco-friendly tapes in order to contribute to the environment. For instance, in July 2022, a globally leading manufacturer of tapes, nitto denko corporation, announced a new scheme for recognizing environmentally friendly products.

Nitto Denko Corporation has announced identifying its products by assigning PlanetFlags and HumanFlags. This step by the company highlights its social contribution. Low VOC- double-sided adhesive tape launched by Nitto Denko Corporation in 2021 has been recognized under the PlanetFlags category.

Product Insights

The double-sided Building and Construction Tapes segment is expected to dominate the market during the forecast period. Double-sided building and construction tapes hold unmatched properties such as vibration dampening, shock absorption and compensation of uneven surfaces. Considering these advantages, the demand for double-sided building and construction tapes has increased tremendously in recent years.

The masking tape segment is anticipated to show a noticeable growth during the analyzed period owing to the rising adoption of masking tapes for temporary protection. Masking tapes are widely used during painting work, and masking tapes are considered ideal for holding the initial grip for newly fitted components in the building structure.

Duct tape is considered to remain an attractive segment of the global Building and Construction Tapes market. Duct tapes are widely used in HVAC applications. Duct tapes provide an excellent bond with metals, copper, ceramic and concrete. Duct tapes are single-sided tapes used to generate thermal comfort.

Backing Material Insights

The polyvinyl chloride (PVC) segment is expected to boost at a significant rate during the forecast period. Polyvinyl chloride (PVC), being an excellent thermoplastic material, offers proper mechanical properties. This material is water and flame resistant and hence, used as a backing material for interior and exterior applications in the building construction industry.

At the same time, the foil segment is projected to witness a significant increase during the forecast period. Aluminum or copper foil tapes are utilized in the construction industry to protect critical electrical compounds present in the building structure. Foil Building and construction tapes offer excellent frame-retardant properties, and aluminum and copper materials' excellent malleability and flexibility make them an ideal component for foil tapes.

Application Insights

The application segment of the global building and construction tapes market is competitive. By application, the market is segmented into flooring, walls & ceilings, windows, doors, roofing, plumbing and HVAC.

The wall and ceilings segment dominates the global market with the highest revenue share. Building and construction tapes offer quality covering between the plaster borders on walls and ceilings. The rising demand for temporary repair of ceiling joints is boosting the growth of the wall and ceilings segment.

The growth of the window segment is attributed to the rising requirement for flexible tapes to cover corners and angles of windows to limit the penetration of wind and water. Building and construction tapes provide permanent and reliable fixing of glass panels. At the same time, the door segment is growing owing to the recent advancements in adhesive tapes for the installation of doors. Building and construction tapes offer fast and easy fixation of minor components of windows and doors.

Function Insights

The protection segment holds the largest share of the global Building and Construction Tapes market. Components of buildings are vulnerable to corrosion due to adverse weather conditions, and building and construction tapes protect windows, doors and other surfaces from the potential danger of corrosion. The enormous demand for tapes to offer a waterproof, permanent and airtight seal to the building structure has supplemented the growth of the protection segment.

The glazing segment is expected to significantly increase during the projected timeframe owing to the rising demand for glazing windows from the commercial segment. Building and construction tapes used for glazing purposes typically create an inside seal to prevent water and wind penetration. Sensitive acrylic foam tapes are utilized for glazing functions in buildings.

The insulation segment is growing at a pace due to significant demand for aluminum foil Building and construction tapes that can control the energy loss and gain in order to offer thermal insulation to the building structure.

End-Use Insights

The residential segment dominates the market, and the segment is expected to grow at a CAGR of 5.5% during the analyzed period. In recent years, the construction industry has witnessed a significant requirement for aesthetic interiors of residential buildings; this has highlighted the function of building and construction tapes in the residential segment. Moreover, the growth of the residential segment is attributed to the rising demand for building and construction tapes for both permanent and temporary repair at residential structures.

At the same time, the commercial segment is expected to witness a significant increase. Developing countries are expected to boost the growth of the commercial segment due to the rising construction of commercial structures, including institutions, theatres, and malls.

Regional Insights

How Does Asia Pacific Hold the Largest Share of the Building and Construction Tapes Market?

Asia Pacific holds the largest share of the global building and construction Tapes market. The rising infrastructural activities in India and China are observed to be the major drivers for the growth of the building and construction tapes market in Asia Pacific. China is one of the largest distributors of raw materials required in the tape manufacturing industry. Along with this, the availability of cost-effective o cheap raw materials and low-cost labor in various Asian countries are fueling the market's growth. The rising number of commercial, institutional, residential and energy & utilities construction in Japan is anticipated to grow the demand for building construction tapes.

China Building and Construction Tapes Market Trends

China leads the Asia Pacific market, supported by significant government investments in smart city projects, public transportation, and urban residential development. The rapid construction activity in the country, spurred by its Belt and Road Initiative and urban renewal efforts, has sustained strong demand for construction materials. Residential and commercial building is also growing due to rising disposable incomes and increasing industrial output.

North America is expected to grow at a significant rate during the forecast period. The rising commercial construction activities in the United States are supplementing the growth of the building and construction tapes market in North America. The presence of significant players and increased business activities in the country have made the United States the most important contributor to the growth of the building and construction tapes market in North America.

U.S. Building and Construction Tapes Market Trends

The U.S. leads the North American building and construction tapes market, driven by major infrastructure renewal programs and strict energy-efficiency standards under the Infrastructure Investment and Jobs Act. The ongoing construction of housing and commercial structures creates a demand for high-quality, stable construction materials. The high level of industrialization, supported by the use of advanced materials in roofing and insulation, is expected to sustain steady market growth.

How Big is the Opportunity for the Building and Construction Tapes Market in Latin America?

The rising government's initiatives for transforming cities and housing in Latin America are offering a plethora of opportunities to the construction industry under the Latin America and Caribbean's development model; this is projected to boost the demand for smart construction solutions, which highlights the growth of Building and construction tapes market in Latin America. Moreover, the expansion of construction activities with rising redevelopment projects in Gulf countries is expected to boost the market's development in the Middle East.

Brazil Building and Construction Tapes Market Trends

Brazil holds the largest share of the market in Latin America, supported by government efforts to modernize infrastructure and promote housing development. Sector confidence has been restored through economic reforms and renewed public works initiatives driven by national growth plans. The real estate and energy projects involving private sector participation are expected to sustain long-term market growth in the country.

How is the Notable Rise of Europe in the Building and Construction Tapes Market?

Europe is experiencing notable growth in the market driven by strict environmental regulations and the continent's leadership in green building practices. The move toward using low-emission materials and embracing the circular economy has encouraged manufacturers to develop sustainable building solutions. This steady market expansion is supported by increased investments in energy-efficient retrofitting projects in Germany, France, and the Nordic countries.

Germany Building and Construction Tapes Market Trends

Germany leads the market in Europe because of its robust regulatory framework, which favors low-carbon construction and serves as a hub for advanced materials manufacturing. Thanks to the country's commitment to the Green Deal targets and EU climate-neutral building codes, eco-friendly construction products are being adopted more quickly. Market demand is rising as retrofitting programs for residential and commercial buildings expand to meet energy-saving standards.

What Factors Drive the Growth of the Building and Construction Tapes Market in the Middle East and Africa?

The market in the Middle East and Africa is growing due to large-scale smart city projects, urban expansion, and infrastructure diversification. Saudi Arabia, the UAE, and Qatar are the growth centers, and they invest heavily in environmentally friendly and technologically advanced construction materials. The trend toward building systems that are sustainable, highly efficient, and energy-efficient aligns with national ambitions like Saudi Vision 2030, thereby boosting demand for innovative construction solutions.

Saudi Arabia Building and Construction Tapes Market Trends

Saudi Arabia leads the regional market, driven by massive urban expansion projects under Vision 2030, including NEOM, The Line, and Qiddiya. Increasing diversification activities beyond oil are boosting expenditure on infrastructure in commercial, residential, and industrial developments. These developments have helped Saudi Arabia become one of the fastest-growing markets in the Middle East & Africa region.

Building and Construction Tapes Market – Value Chain Analysis

Raw Material Sourcing -The production of building and construction tapes begins with sourcing essential base materials, such as adhesives (acrylic, rubber, silicone), backing materials (PVC, PET, PE, paper, foil), and liners, that determine the tape's adhesion strength, flexibility, and durability across varying construction environments.

- Key Players: Dow Chemical Company, BASF SE, ExxonMobil Chemical, Arkema Group, Henkel AG & Co. KGaA

Adhesive Formulation and Coating - Raw polymers and resins are processed into specialized adhesive formulations and coated onto chosen backing materials. Advanced coating technologies, like solvent-based, hot-melt, and water-based systems, enhance bonding performance, heat resistance, and weatherability.

- Key Players: 3M Company, Tesa SE, Nitto Denko Corporation, Avery Dennison Corporation, Saint-Gobain Performance Plastics

Tape Conversion and Slitting - Coated jumbo rolls are converted into specific tape formats through precision cutting, slitting, and lamination processes. At this stage, tapes gain their final dimensions, thickness, and layer configurations suitable for applications such as insulation, sealing, jointing, and protection.

- Key Players: Intertape Polymer Group Inc., Berry Global Inc., Canadian Technical Tape Limited, Scapa Industrial (Berry Global), Ahlstrom Corporation

Packaging and Distribution - Finished tapes are labeled, packed, and distributed to wholesalers, retailers, and distributors catering to building, HVAC, electrical, and infrastructure projects. Efficient supply chain management ensures timely delivery and product traceability across regions.

- Key Players: Shurtape Technologies LLC, ADDEV Materials, Lohmann GmbH, Nitto Denko Corporation, Tesa SE

End-Use Application in Construction - Tapes are applied in various construction processes such as insulation, surface protection, window sealing, flooring, roofing, and moisture barriers. These applications support improved building durability, energy efficiency, and safety compliance in both residential and commercial projects.

- Key End Users: Saint-Gobain Construction, Skanska, Vinci Construction, Turner Construction, Bechtel, Lendlease

Building and Construction Tapes Market Companies

- The Dow Chemical Company: A global leader in materials science, Dow provides advanced adhesive and polymer technologies that enhance durability, bonding, and insulation performance in building and construction tape applications.

Saint-Gobain Performance Plastics Corporation (France): Renowned for high-performance materials, Saint-Gobain offers a wide range of construction tapes designed for sealing, protection, and insulation across industrial and architectural applications. - Canadian Technical Tape Limited:Specializing in pressure-sensitive tapes, CTT delivers innovative adhesive solutions for construction, HVAC, and industrial sectors with a focus on reliability and application-specific performance.

Berry Global Inc. (USA): A major manufacturer of engineered materials and adhesives, Berry Global produces a diverse line of construction tapes that provide superior bonding, moisture resistance, and long-term durability.

Nitto Denko Corporation (Japan): Nitto is a global innovator in adhesive technologies, offering high-performance building and construction tapes for sealing, insulation, and surface protection with advanced polymer chemistry.

Intertape Polymer Group Inc. (Canada): IPG manufactures a broad portfolio of pressure-sensitive and water-activated tapes tailored for construction, industrial, and packaging applications, emphasizing strength and weather resistance.

Ahlstrom Corporation (Finland): Ahlstrom specializes in advanced fiber-based materials, producing sustainable and high-performance backing materials used in various construction tape solutions for improved adhesion and eco-efficiency.

Recent Developments

- In January 2023, a leading company in custom engineered sealing and insulating solutions, Zone Enterprises, announced the acquisition of Can-Do National Tape. Can-Do National Tape is a Nashville-based specialized company in adhesive and customized tape manufacturing. The acquisition aims to offer lucrative opportunities for Zone Enterprises to expand its consumer base.

- In August 2022, a manufacturer and marketer of adhesive tapes, Shurtape Technologies, announced a strategic partnership with Nastro Technologies, a Texas-based tech startup. The partnership aims to combine both companies to launch an innovative line of scannable adhesive tapes that will allow users to link digital information.

- In November 2022, Bostik launched two new materials for tape manufacturing in India; Bostik HM2060 and Bostik HM2070 are two products launched by Bostik. These materials for tape manufacturing can be utilized in various industries. The newly launched tape materials are hot melting pressure sensitive, and they also offer oil and solvent resistance with better adhesion properties.

Segments Covered in the Report

By Product

- Double-sided Tapes

- Masking Tapes

- Duct Tapes

By Backing Material

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate

- Polypropylene

- Foil

- Polyethylene

- Foam

- Paper

- Others

By Application

- Flooring

- Walls & Ceilings

- Windows

- Doors

- Roofing

- Plumbing

- HVAC

By Function

- Bonding

- Protection

- Sound Proofing

- Insulation

- Cable Management

- Glazing

By End-Use

- Residential

- Commercial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content