What is the Cancer Registry Software Market Size?

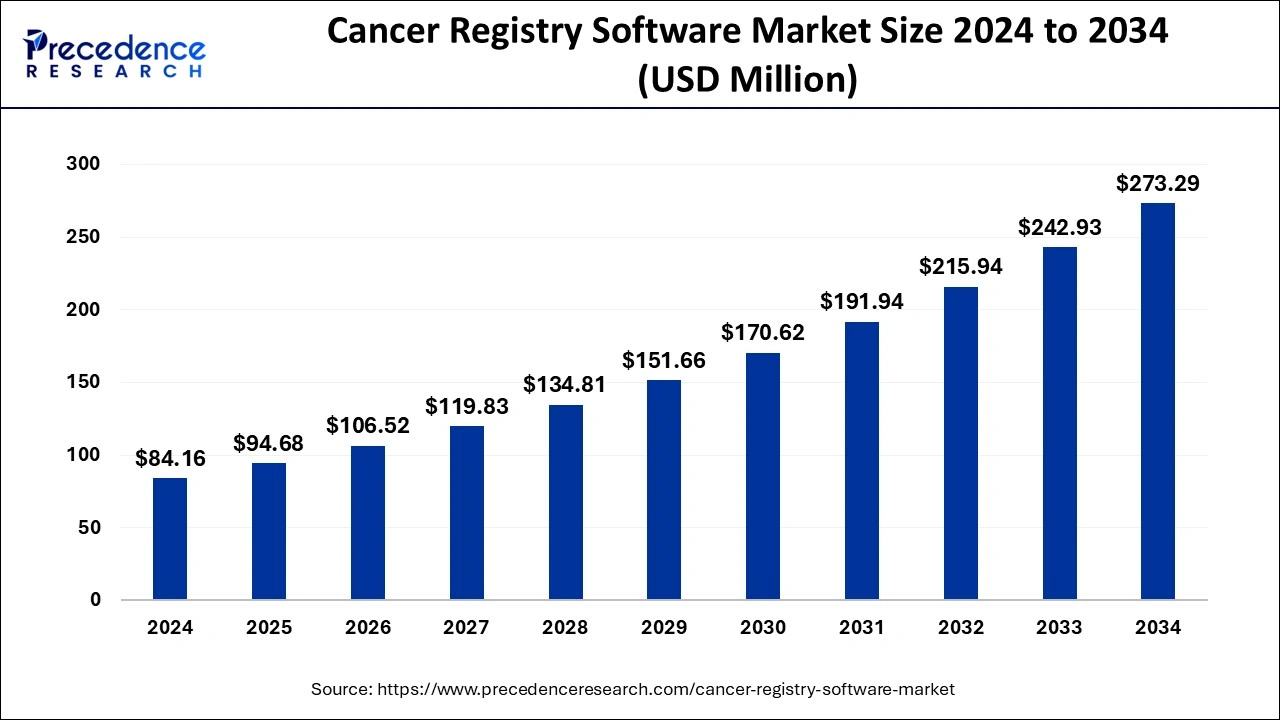

The global cancer registry software market size is estimated at USD 94.68 million in 2025 and is anticipated to reach around USD 273.29 million by 2034, expanding at a CAGR of 12.50% from 2025 to 2034.

Market Highlights

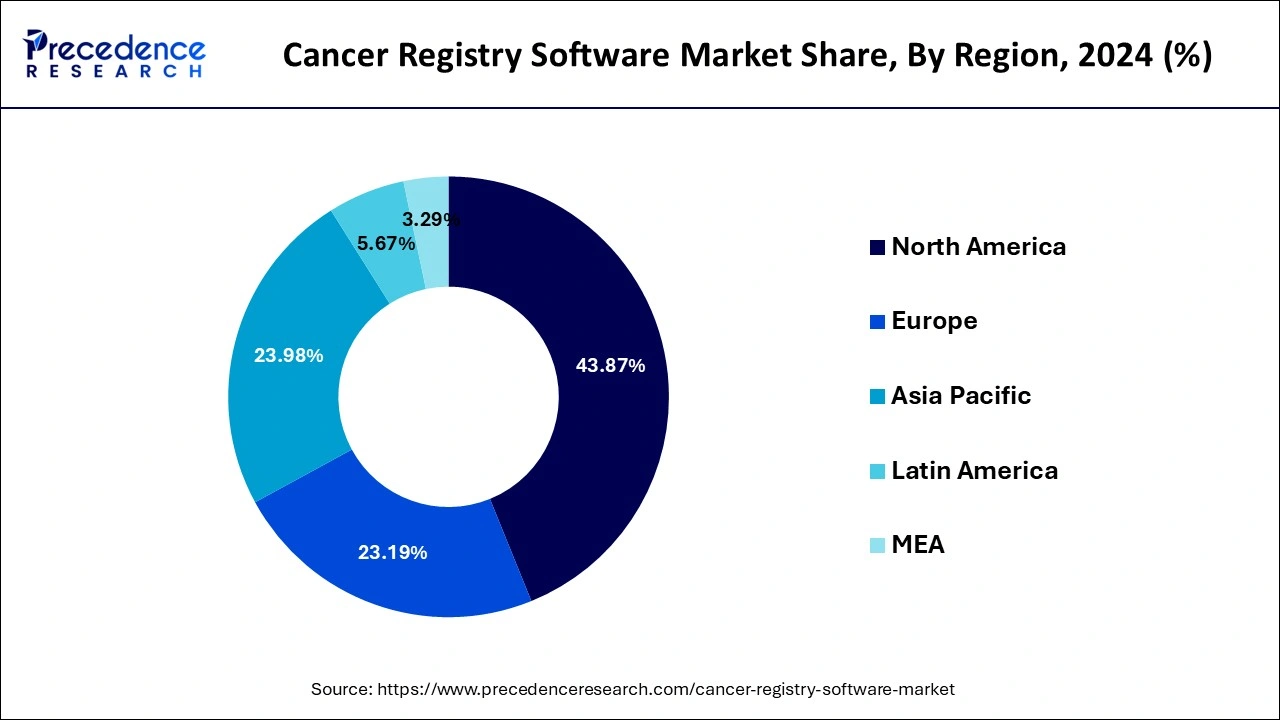

- North America dominated the cancer registry software market with the largest market share of 43.87% in 2024.

- Asia Pacific is expected to expand at a double digit CAGR of 14.5% during the forecast period.

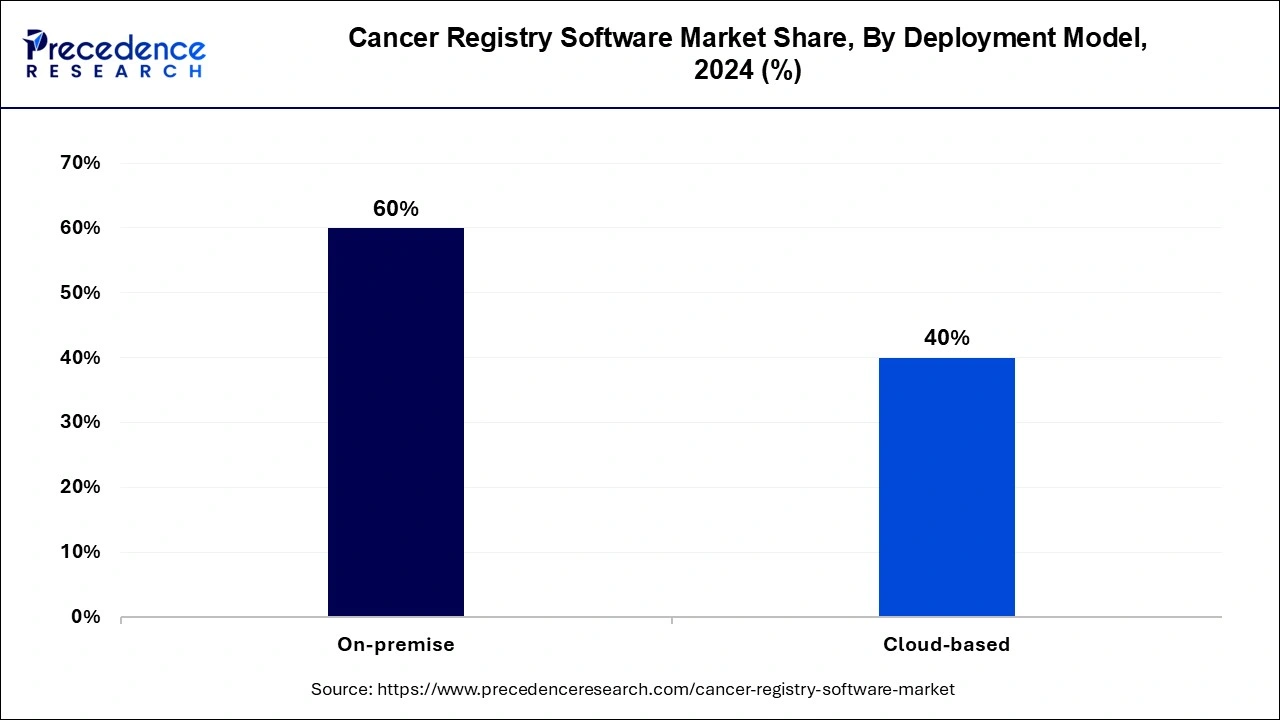

- By deployment model, the on-premise segment accounted for the highest market share of 60% in 2024.

- By deployment model, the cloud-based segment is projected to grow at a solid CAGR of 13.2% during the forecast period.

- By component, the commercial segment has held the biggest market share of 76% in 2024

- By component, the public segment is registering a remarkable CAGR of 13.54% during the forecast period.

- By End-use, the government & third-party segment contributed the maximum market share of 28% in 2024

- By End-use, the research institutes segment is projected to grow at a solid CAGR of 13.24% during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 94.68 Million

- Market Size in 2026: USD 106.52 Million

- Forecasted Market Size by 2034: USD 273.29 Million

- CAGR (2025-2034): 7.11%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

How AI is Redefining the Future of Cancer Registry Software Market?

Using artificial intelligence (AI) techniques to process, enhance and integrate cancer registry data to make oncology and research security easier than ever. The relative advantages of AI over traditional methods. The traditional cancer registry process is time-consuming and prone to human error. The AI cancer registry automation module revolutionizes registry operations with a seamless end-to-end solution that automates data collection, analysis and reporting.

- For Instance, August 2024, Azra AI, a leading healthcare technology company that uses artificial intelligence (AI) and automation to improve cancer diagnosis and treatment, announced its partnership with Registry Partners, a leader in medical record registration and management services. The collaboration aims to transform oncology data management and optimize the cancer registry by combining technology with professional services.

Cancer Registry Software Market Growth Factors

- By maintaining high data collection standards and following a changing process, cancer registries play a significant role in developing cancer research blood, treatment strategies and ultimately improving patient outcomes, which has led to the growth of the cancer registry software market.

- Cancer registries track the treatment and outcomes of cancer patients to help clinicians continuously improve the quality of care and prevent cancer in population testing, which has led to the growth of the cancer registry software market.

- Registries is important in controlling patterns in cancer diagnosis. From patient care standards to cancer incidence and mortality, these data form the basis of cancer research and clinical trials, which has led to the growth of the cancer registry software market.

- In September 2024, The Registry Plus Development group funding is primarily being used to support the NPCR-funded Central Cancer Registry and is unable to provide support for Registry Plus products to other countries, which has led to the growth of the cancer registry software market.

Cancer Registry Software Market Outlook

- Industry Growth Overview: The market for cancer registry software is projected to experience substantial growth between 2025 and 2034. This growth is fueled by the rising global incidence of cancer, stringent regulatory requirements for data reporting (e.g., from the American College of Surgeons Commission on Cancer (CoC) and NAACCR), and the increasing adoption of electronic health records (EHRs).

- Major Trends: Key trends in healthcare focus on boosting efficiency and outcomes through adopting digital, interoperable solutions that lessen administrative tasks and improve data accuracy. This shift is also strongly centered on maintaining solid data security and privacy measures to meet regulations like HIPAA and GDPR, while building consumer trust.

- Global Expansion: Leading players are expanding their presence globally, with a significant focus on emerging markets in Asia-Pacific, Latin America, and MEA regions. Growth in these regions is driven by increasing healthcare investments, government initiatives to improve national cancer registries for public health planning. North America and Europe remain dominant markets due to well-established healthcare infrastructure and a high degree of technology adoption.

- Major Investors: The market is attracting significant investment from venture capital, private equity, and strategic investors drawn by the critical need for effective cancer data management. Key corporate players and investment firms active in the space include Elekta, Oracle, IBM, McKesson, and Blackstone Group, as well as various health tech-focused VCs.

- Startup Ecosystem: The startup ecosystem is maturing rapidly, with innovations focused on leveraging AI and natural language processing (NLP) to automate data entry and improve data quality. Emerging firms are attracting considerable funding by offering specialized solutions such as real-time patient monitoring platforms, advanced predictive analytics for data management in healthcare delivery.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 94.68 Million |

| Market Size in 2026 | USD 106.52 Million |

| Market Size by 2034 | USD 273.29 Million |

| Growth Rate from 2025 to 2034 | CAGR of 12.50% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Software, By Deployment Model, By Component, By End User, and By Functionality, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Enhanced Capabilities of Cancer Registry Software

The ability of the cancer registry to expand its processes for additional data collection, training, development, and electronic reporting drives the growth of cancer registry software market. This system is important because it supports the comparative effectiveness of research and makes the improvement of public health and research data more efficient. Cancer registries provide a census of cancer patients and enable cancer to be tracked at regional, state, and national levels. In addition, they can investigate cancer treatment patterns and evaluate public health measures to prevent cancer and improve survival, driving demand for advanced cancer treatment software solutions.

Opportunity

Advancements in Cloud-Based Cancer Registry Systems

The new cloud computing system developed by the national cancer registry program (NPCR) for the central cancer registry presents a significant opportunity in the cancer registry software market. This development, currently being, allows for increased collection, aggregation, and storage of cancer data. With real-time data access, the Central Cancer Registry can quickly access and analyze cancer data, allowing for faster submission of data to the CDC. Automating activities in the system will increase the accuracy, completeness, and timeliness of information. Additionally, the potential for collaboration between NPCR and other organizations to develop additional capabilities creates additional opportunities for innovation and growth in the cancer registry software market.

Restraints

Challenges in Cancer Registry Data Management and Compliance

Many healthcare organizations face significant challenges in managing timely referrals and cancer follow-up, particularly due to limited access to oncology data specialist certified (ODS-C). Additionally, fragmentation of cancer data across multiple systems and aggregation in medical records due to manual and EMR access impacts data management. Additionally, not every organization needs a complete solution, as each organization has unique needs, and changes may impact their needs over time. These factors have limited the growth of the cancer registry software market as they hinder the integration and development of software solutions.

Segment Insights

Software Insights

The standalone segment dominated the cancer registry software market in 2024. The standalone cancer registry software is integrated with latest and advanced features. It is also easy to use and operate. The standalone cancer registry software also helps in the reduction of overhead costs. Thus, all of these factors are propelling the growth of the segment.

The integrated segment is expected to witness strong growth during the forecast period. The integrated cancer registry software helps to collaborate with the hospitals' software. This software helps to locate patients in any location. The integrated cancer registry software also assists to track and monitor the health of patients.

Deployment Model Insights

The on-premise segment accounted for the highest market share of 60% in 2024. The on-premise cancer registry software is mostly adopted by research institutes who are doing research on cancer. The on-premise cancer registry software is embedded with advanced features which help to store data easily. The on-premise cancer registry software is less risky as compared to other types of models. Thus, the on-premise cancer registry software is widely used in hospitals and research centers.

The cloud-based segment is projected to grow at a solid CAGR of 13.2% during the forecast period. The cloud-based cancer registry software can be integrated with the real time data and standard guidelines. This software helps in the reduction of information technology overhead costs. In addition, the cloud-based cancer registry software is efficient in nature, which is driving the growth of the segment.

Component Insights

The commercial segment has held the biggest market share of 76% in 2024. The data stored in the commercial database is quite safe as compared to public database. The data stored in the commercial database can be easily tracked. The commercial database can be used across research centers and government agencies. Thus, the commercial segment is rising at a rapid pace.

The public segment is registering a remarkable CAGR of 13.54% during the forecast period. The public database is used for the various cancer research programs. The utilization of public database is growing due to the growing number of research centers all over the globe. The public database can help to track patient data from any corner of the world.

End Use Insights

The government & third-party segment contributed the maximum market share of 28% in 2024. The government of established and emerging nations is adopting cancer registry software on the large scale. This software helps to track and monitor cancer patients in their respective region. In addition, the investments made by government for the implementation of cancer registry software in hospitals. This factor is boosting the growth of the global cancer registry software market over the forecast period.

The research institutes segment is projected to grow at a solid CAGR of 13.24% during the forecast period. The cancer registry software is widely used in research institutes due to growing prevalence of cancer. The growing research and development initiatives by biotechnology and pharmaceutical industry players are also driving the growth of the global cancer registry software market.

Regional Insights

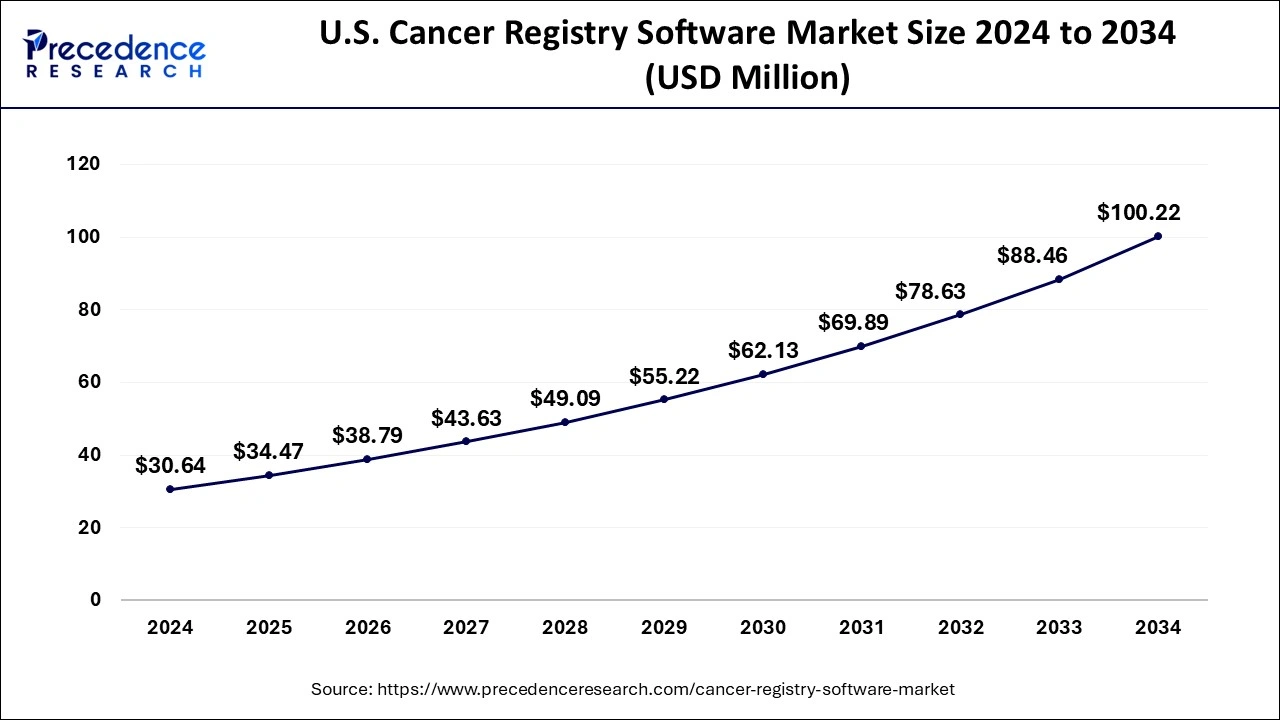

U.S. Cancer Registry Software Market Size and Growth 2025 to 2034

The U.S. cancer registry software market size is evaluated at USD 34.47 million in 2025 and is predicted to be worth around USD 100.22 million by 2034, rising at a CAGR of 12.58% from 2025 to 2034.

U.S. Cancer Registry Software Market Trends

The U.S. holds a leading position in the global market due to its advanced healthcare IT infrastructure, strong government support and funding for surveillance programs (such as the CDC's NPCR and NCI's SEER program), and the presence of major software providers like IBM, Elekta, and McKesson. It influences market trends such as the adoption of AI, machine learning, and cloud-based solutions to improve data accuracy and interoperability with EHRs, while also establishing quality and compliance standards under HIPAA for the global market.

North America dominated the cancer registry software market with the largest market share of 43.87% in 2024. The U.S. dominated the cancer registry software market in North America region. The North America region has presence of major market players operating in the cancer registry software market. The cancer registry software market in this region is growing due to the rising prevalence of cancer. In addition, due to high investments in the technology, the demand for cancer registry software is rising on a large scale in North America.

- For Instance, The National Program of Cancer Registries (NPCR) provides funding and support to centralized cancer registries and collects data on cancer cases in North America.

What Makes Asia Pacific the Fastest Growing Region?

Asia-Pacific is expected to expand at a double digit CAGR of 14.5% during the forecast period. The government of emerging nations such as Japan and China are taking constant efforts for the development of the cancer registry software market. Moreover, the key market players are collaborating with the government agencies for the expansion of the healthcare sector. This factor is driving the growth of the cancer registry software market in Asia-Pacific region.

China Cancer Registry Software Market Trends

China plays a significant role in the Asia Pacific market, experiencing rapid growth driven by increasing cancer rates, higher healthcare spending, and strong government efforts to digitize its extensive healthcare system. The Chinese market focuses on large-scale implementation and scalability, using government-led programs like the National Central Cancer Registry to create a comprehensive national surveillance system for effective public health policies and cancer control strategies.

Which Forces are Reshaping the European Cancer Registry Software Market?

Europe is experiencing significant growth in the cancer registry software market, supported by strict EU regulations on data quality, privacy (GDPR), and interoperability. The market is characterized by a high level of standardization, with a strong emphasis on using data for extensive research, public health policy, and monitoring the performance of cancer care services. Key trends include the use of AI and machine learning for data analysis, automation of data collection from EHRs, and cross-border data sharing for large-scale epidemiological studies.

Germany Cancer Registry Software Market Trends

Germany has a complex but well-developed system of state-level cancer registries working toward a national platform. The market for cancer registry software is mature, driven by a focus on high data quality and the need to track cancer trends for public health planning and research. The market is highly regulated, with strong emphasis on data protection and privacy laws. There is ongoing demand for advanced software solutions that integrate with existing hospital information systems and meet strict national data standards.

A Deep Dive into the Latin American Cancer Registry Software Landscape

Latin America is experiencing an opportunistic rise in the cancer registry software market, primarily driven by rising cancer incidence rates, a growing focus on public health initiatives, and a need for better data collection to inform policy. Countries are in the early stages of digitalization, often transitioning from manual, paper-based systems. Key drivers include government funding for healthcare infrastructure upgrades and a push for interoperability between different healthcare systems. The market sees opportunities for international software providers to offer cloud-based, scalable, and cost-effective solutions adapted to regional needs.

Brazil Cancer Registry Software Market Trends

Brazil has the most advanced cancer registry system in Latin America, although it remains fragmented. The market for cancer registry software is driven by the large population, the high cancer burden, and national health agencies advocating for improved data quality and standardization. Key trends include a shift toward integrated health information systems and a focus on using data for epidemiological research and treatment planning to meet evolving national health informatics regulations.

The MEA Diagnostics Boom: A New Era for Cancer Registries

The MEA cancer registry software market is emerging quickly, driven by rising cancer rates and government initiatives to enhance healthcare data management and national cancer control efforts. Mandatory reporting laws are a significant factor in some Middle Eastern countries. The market offers opportunities for simple, reliable software solutions that operate effectively despite differences in infrastructure. Public-Private Partnerships (PPPs) are supporting the funding and deployment of new systems.

Saudi Arabia Cancer Registry Software Market Trends

Saudi Arabia is a key player in the MEA region, driven by robust government investment in healthcare technology. The Saudi National Cancer Registry (SCR) is well-developed and is a vital part of the national health information system. The market focus is on advanced, integrated software solutions that offer comprehensive data analysis to support public health policy, research, and resource allocation, ensuring high data accuracy and interoperability with other national health databases.

Value Cain Analysis

- R&D: Researches, develops, and tests new drug compounds for therapeutic efficacy and safety.

Key players: Roche (Genentech), Pfizer, Novartis - Human Trials and Regulatory Approvals: Human testing, safety, and efficacy monitoring; approval sought by global health regulators.

Key Players: Labcorp, ICON plc, Parexel International - Formulation and Final Dosage Preparation: Converts an active pharmaceutical ingredient into a stable dosage form for administration to the patient, such as tablets and injections.

Key Players: Pinnacle Life ScienceSyngene International, Piramal Pharma Solutions, Laurus Labs - Packaging and Serialization: Packaging, labeling, and identification for the security of products and traceability.

Key Players: Systech International, OPTEL Group, Arvato Systems - Distribution to Hospitals, Pharmacies: Logistics and transportation of medicines for providers and pharmacies worldwide.

Key players: McKesson Corporation, AmerisourceBergen (now Cencora), Cardinal Health - Patient Support and Cancer Registry Software Services: Provides post-treatment support and cancer registry solutions to track patients and improve health outcomes.

Key Players: Elekta, Oracle Corporation, ONCO, Inc.

Cancer Registry Software Market Companies

- C/Net Solutions: Provides comprehensive software (CNExT) for all types of registries, focusing on regulatory compliance and data submission.

- Elekta AB:Offers registry functions within its broad oncology informatics suite (METRIQ), integrating data management with clinical workflows.

- McKesson Corporation: Provides integrated registry and data solutions through its Ontada business, focused on compliance and quality reporting within oncology practices.

- ONCO, Inc.: Specializes in dedicated software products (OncoLog) for efficient data entry, casefinding, and reporting for hospital and central registries.

- Rocky Mountain Cancer Data Systems (RMCDS):A non-profit provider of affordable, compliant software tailored for state, regional, and hospital data submission requirements.

- IBM Corporation

- Ordinal Data Inc.

- Himagine Solutions Inc.

- Electronic Registry Systems Inc.

- CONDUENT Inc.

Recent Developments

- In November 2023, ONCO, Inc., a market leader in cancer registries and services, partnered with Oncora Healthcare, a new oncology startup, to advance data-driven cancer research, analytics, and public health reporting.

- In February 2024, CooperSurgical and Fulgent Genetics, Inc. a global leader in fertility and women's health, are collaborating to deliver a family-specific genetic screening program for the Cord Blood Registry (CBR).

- In November 2023, Outcome Capital, a life sciences research and investment banking firm, announced the acquisition of Electronic Registry Systems, Inc. (ERS), a leader in cancer care, compliance and education services, has been acquired by Health Catalyst, Inc. Consumers, including 110 million patients. Outcome Capital is serving as the exclusive and financial advisor to ERS

- In April 2025, Elekta partners with Azra AI to enhance cancer registry workflows through AI automation, streamlining data management and ensuring compliance with international standards.

https://pharmatimes.com

Segments Covered in the Report

By Software

- Cross disciplinary

- Specific

By Deployment Model

- On-premise

- Cloud-based

By Component

- Commercial

- Public

By End Use

- Government and third party

- Private payers

- Hospital and medical practice

- Pharma biotech and medical device companies

- Research institutes

By Functionality

- Cancer Reporting to Meet State & Federal Regulations

- Patient Care Management

- Product Outcome Evaluation

- Medical Research and Clinical Studies

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting