What is the Genomics in Cancer Care Market Size?

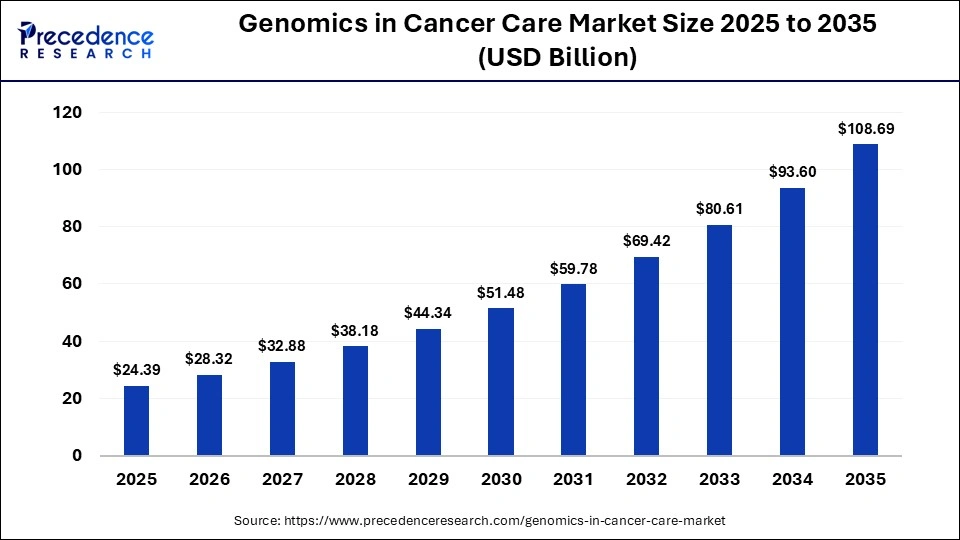

The global genomics in cancer care market size was estimated at USD 24.39 billion in 2025 and is predicted to increase from USD 28.32 billion in 2026 to approximately USD 108.69 billion by 2035, expanding at a CAGR of 28.32% from 2026 to 2035.The market is gaining strong momentum as oncology shifts toward precision and personalized medicine. Advances in next-generation sequencing, biomarker discovery, and liquid biopsy are improving early detection and treatment decisions. Growing clinical adoption and supportive research ecosystems continue to strengthen market development worldwide.

Market Highlights

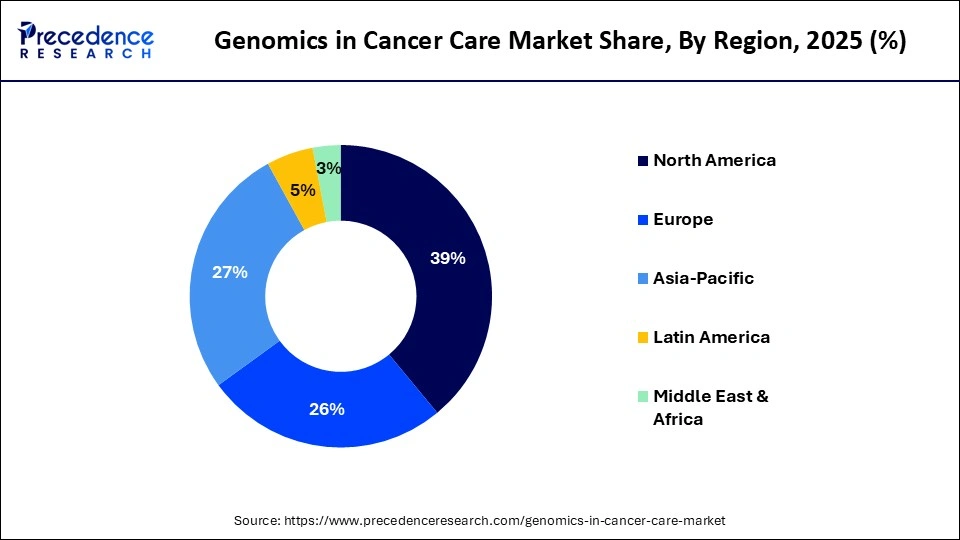

- North America led the genomics in cancer care market with a share of approximately 39% in 2025.

- Asia-Pacific is expected to expand at the highest CAGR in the market between 2026 and 2035.

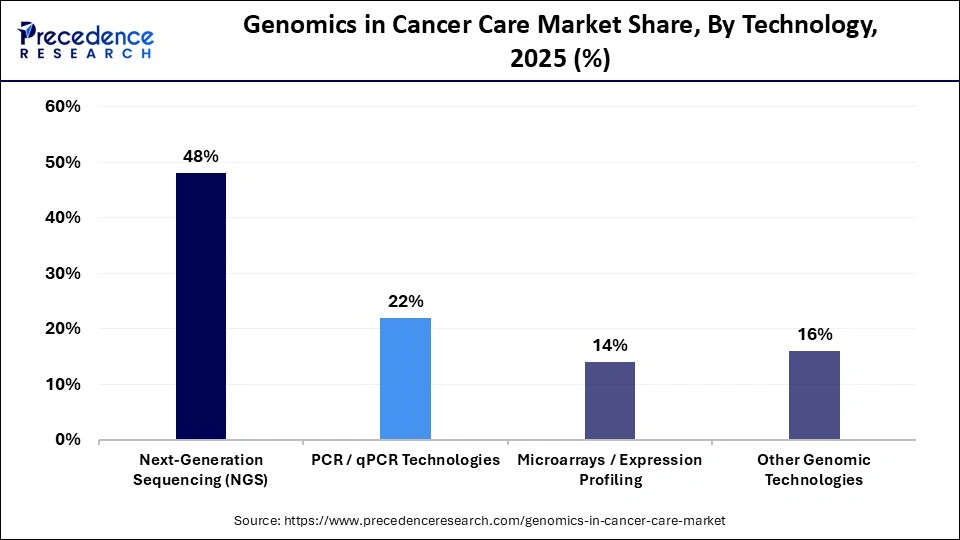

- By technology, the next-generation sequencing (NGS) segment held a dominant revenue share of approximately 48% in the market in 2025.

- By technology, the other genomic technologies segment is growing at the highest CAGR between 2026 and 2035.

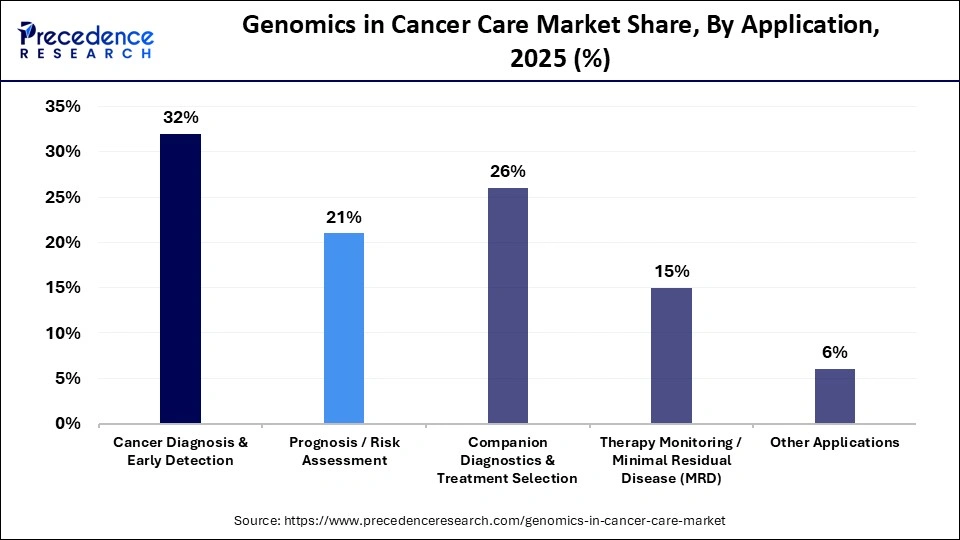

- By application, the cancer diagnosis & early detection segment dominated the market with a share of approximately 32% in 2025.

- By application, the therapy monitoring/minimal residual disease (MRD) segment is expected to expand at the fastest CAGR from 2026 to 2035.

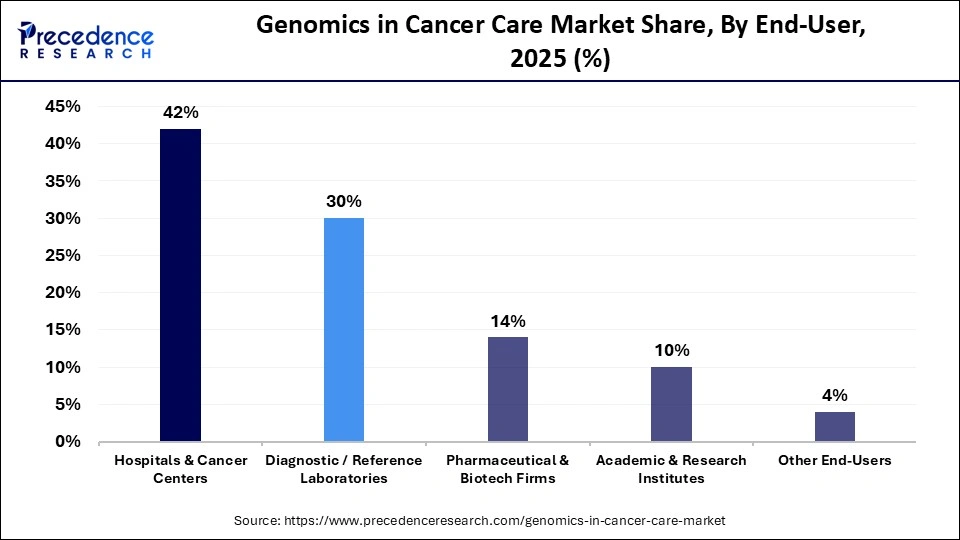

- By end-user, the hospitals & cancer centers segment held a dominant genomics in cancer care market share of approximately 42% in 2025.

- By end-user, the academic & research institutes segment is expected to grow with the highest CAGR in the coming years.

- By cancer type, the breast cancer segment held a dominant revenue share of approximately 26% in the market in 2025.

- By cancer type, the hematologic/blood cancers segment is expected to expand rapidly in the market over the studied period.

Why is the Genomics in Cancer Care Market Gaining Strategic Importance?

The market includes technologies, tools, and services that use genomic sequencing, gene expression profiling, mutation analysis, and bioinformatics to support cancer diagnosis, prognosis, treatment selection, therapy monitoring, and personalized medicine. The market spans next-generation sequencing (NGS), PCR-based assays, microarrays, companion diagnostics, panels & kits, and associated analytics platforms that aid targeted therapies and immunotherapy decisions.

Genomics in the cancer care industry is gaining strategic importance, enabling precise tumor profiling, early diagnosis, and personalized treatment planning. By identifying genetic mutations and biomarkers, clinicians can select targeted therapies and predict treatment response. The increasing demand for precision oncology, improved patient outcomes, and integration of genomic data into clinical decision-making are reinforcing its critical role in modern cancer management.

How Is AI Reshaping the Genomics in Cancer Care Market?

Artificial intelligence (AI) is reshaping genomics in cancer care by enabling faster, more accurate analysis of complex genomic datasets and improving clinical decision-making. Advanced algorithms support precise mutation detection, variant interpretation, and biomarker identification from next-generation sequencing data.

AI integration helps oncologists match patients with targeted therapies, predict treatment response, and monitor disease progression through real-time insights. It also accelerates drug discovery and clinical research by uncovering hidden genetic patterns. As adoption expands in 2026, AI-driven platforms are becoming essential tools for advancing precision oncology and personalized cancer treatment.

Primary Trends Influencing the Genomics in Cancer Care Market

- Expansion of Next Generation Sequencing (NGS) Technologies:NGS continues to be fundamental to genomics in cancer care, enabling comprehensive analysis of tumor genomes faster and more affordably. Clinicians and researchers increasingly use NGS for whole-genome, whole-exome, and targeted gene panel sequencing, which improves detection of actionable mutations and supports personalized treatment decisions across diverse cancer types. Higher throughput and lower costs are making NGS an essential tool in routine oncology practice.

- Liquid Biopsy and Non-Invasive Diagnostics: Liquid biopsy technologies that analyze circulating tumor DNA (ctDNA) are transforming cancer screening and disease monitoring. Unlike traditional tissue biopsies, these blood-based tests are less invasive, allow frequent sampling, and offer real-time insights into tumor evolution, treatment response, and minimal residual disease. This trend improves patient compliance and enables earlier intervention with tailored therapies.

- Integration of AI and Bioinformatics: AI and ML are increasingly used in the genomics in cancer care market to interpret complex genetic data more accurately and efficiently. These tools help identify significant mutation patterns, predict treatment outcomes, and suggest personalized therapeutic strategies. AI-enhanced bioinformatics platforms significantly reduce analysis times and support clinicians in making more informed decisions based on large genomic datasets.

- Multi-Omics and Holistic Cancer Profiling: Beyond genomics alone, multi-omics approaches that combine genomics with proteomics, transcriptomics, and metabolomics are gaining traction. This holistic profiling provides deeper insights into tumor biology, enabling researchers and clinicians to discover new biomarkers and understand complex disease mechanisms. Multi-omics integration supports more accurate patient stratification for clinical trials and targeted therapies.

- Precision Oncology and Personalized Treatment Design: The industry trend toward precision oncology continues to grow as genomic data guides individualized therapy plans. Biomarker-driven drug development and companion diagnostics ensure patients receive treatments most likely to work based on their genetic profiles. This personalization enhances treatment efficacy, reduces adverse effects, and improves overall patient prognosis.

- Direct-to-Consumer and Patient-Centric Genomic Service: There is increasing availability of direct-to-consumer genomic testing and home-based cancer risk assessment tools. These services empower individuals to understand their genetic predispositions and make proactive health decisions. While clinical interpretation and follow-up remain essential, broader access to genetic information is raising public awareness and demand for preventive oncology services.

- Regulatory Support and Strategic Collaboration: Regulatory bodies worldwide are streamlining approvals for genomic diagnostics and targeted therapies, supporting faster integration into clinical settings. At the same time, strategic partnerships between biotech firms, research institutions, and healthcare providers are accelerating innovation, data sharing, and new product development. These collaborations enhance the quality and clinical utility of genomics in cancer care.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 24.39Billion |

| Market Size in 2026 | USD 28.32 Billion |

| Market Size by 2035 | USD 108.69Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 28.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, End-User, Cancer Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Technology Insights

Which Technology Segment Dominated the Genomics in Cancer Care Market?

The next-generation sequencing (NGS) segment dominated the market with a share of approximately 48% in 2025 because it provides comprehensive, high-throughput genetic profiling critical for identifying actionable mutations. Its speed, accuracy, and scalability improve diagnosis, treatment selection, and patient monitoring. Broad clinical adoption, declining costs, and expanding applications in precision oncology and biomarker discovery further reinforce its leading role in cancer genomics research and care.

The other genomic technologies segment is expected to grow at the fastest CAGR in the market between 2026 and 2035 due to the expanding use of liquid biopsy, single-cell sequencing, and multi-omics approaches that provide deeper insights into tumor biology. Improvements in sensitivity, non-invasive testing, and integration with bioinformatics enhance early detection, treatment monitoring, and personalized therapy, driving rapid adoption across clinical and research settings.

Application Insights

Which Application Segment Led the Genomics in Cancer Care Market?

The cancer diagnosis & early detection segment led the market with a share of approximately 32% in 2025 because genomic tools improve the accuracy and speed of identifying cancer at initial stages. Advanced assays, such as gene panels and liquid biopsies, enable the detection of actionable mutations and minimal residual disease. The growing emphasis on early intervention, better survival outcomes, and widespread clinical adoption further strengthens its leading position.

The therapy monitoring/minimal residual disease (MRD) segment is expected to grow with the highest CAGR in the market during the studied years due to its ability to detect trace levels of cancer DNA after treatment. Genomic MRD testing supports early relapse identification, real-time treatment adjustment, and personalized follow-up care. Rising adoption of liquid biopsy, increasing clinical validation, and strong demand for outcome-driven oncology management are accelerating growth across both hematological and solid tumor applications.

End-User Insights

Why Did the Hospitals & Cancer Centers Segment Dominate the Market?

The hospitals & cancer centers segment held the largest revenue share of approximately 42% in the genomics in cancer care market because they provide integrated clinical services, access to advanced diagnostic platforms, and multidisciplinary expertise. Their ability to implement genomic testing within patient care pathways, support precision oncology programs, and collaborate on research enhances adoption. Strong institutional demand for personalized diagnostics and treatment planning further reinforces their leading role in genomic cancer caredelivery.

The academic & research institutes segment is expected to expand rapidly in the market in the coming years because these institutions drive innovation through cutting-edge research, biomarker discovery, and the development of new genomic tools. Increased funding, collaborations with industry, and focus on translational studies accelerate genomic applications. Their role in validating novel assays, training specialists, and advancing precision oncology supports rapid adoption and market expansion.

Cancer Type Insights

How the Breast Cancer Segment Dominated the Market?

The breast cancer segment contributed the biggest revenue share of approximately 26% in the genomics in cancer care market in 2025 because genomic testing plays a crucial role in breast cancer risk assessment, early detection, and treatment decision-making. Widely adopted assays guide targeted therapies and help identify hereditary cancer risk. High prevalence, established clinical guidelines for genomic profiling, and extensive research supporting personalized treatment pathways further reinforce its leading position in genomic cancer diagnostics and care.

The hematologic/blood cancer segment is expected to witness the fastest growth in the market over the forecast period due to the increasing burden of leukemia, lymphoma, and myeloma worldwide. These cancers are highly dependent on genetic and molecular abnormalities for diagnosis and treatment decisions, driving strong adoption of genomic testing. Wider use of next-generation sequencing, improved biomarker discovery, and the shift toward personalized therapies further support rapid growth in this segment.

Regional Insights

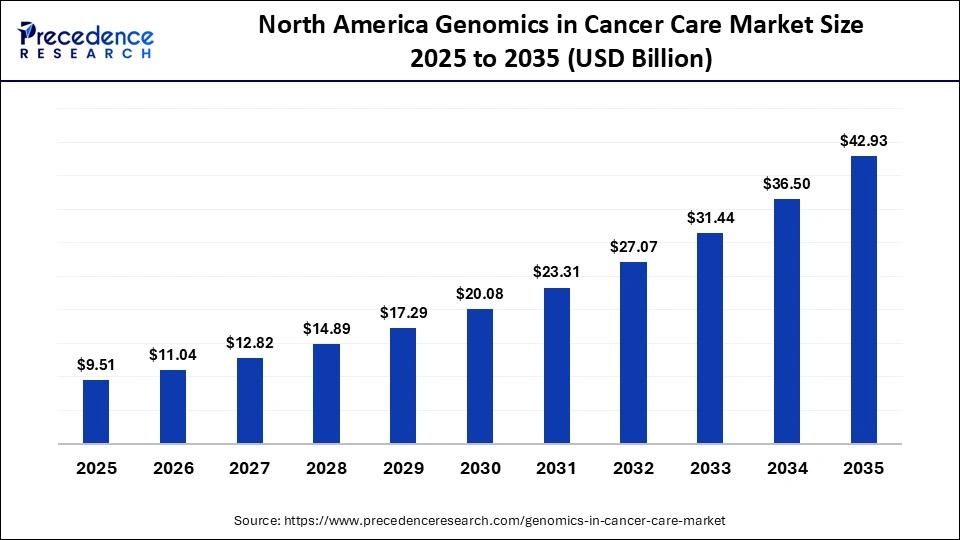

How Big is the North America Genomics in Cancer Care Market Size?

The North America genomics in cancer care market size is estimated at USD 9.51 billion in 2025 and is projected to reach approximately USD 42.93 billion by 2035, with a 16.27% CAGR from 2026 to 2035.

Why North America Dominated the Genomics in Cancer Care Market?

North America held a major revenue share of approximately 39% in the market in 2025 due to high cancer prevalence, growing demand for advanced diagnostics, strong healthcare infrastructure, and widespread establishment of new cancer care and genomic testing centers. Robust R&D investment, early adoption of cutting-edge sequencing technologies, favorable reimbursement policies, and support from regulatory agencies enhance clinical integration. A concentration of major biotech and pharmaceutical firms and extensive clinical trial networks further strengthen the region's leadership in genomic cancer care.

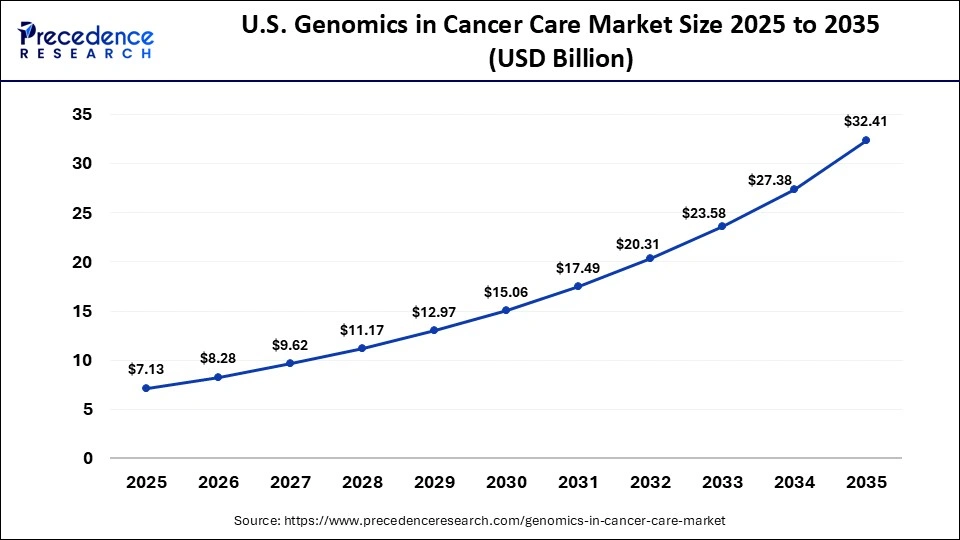

What is the Size of the U.S. Genomics in Cancer Care Market?

The U.S. genomics in cancer care market size is calculated at USD 7.13 billion in 2025 and is expected to reach nearly USD 32.41 billion in 2035, accelerating at a strong CAGR of 16.35% between 2026 and 2035.

U.S. Genomics in Cancer Care Market Trends

The U.S. holds a major regional share in North America due to its high burden of cancer, which drives strong demand for advanced genomic testing and precision oncology solutions. The country benefits from a mature healthcare infrastructure, rapid adoption of next-generation sequencing technologies, and continuous expansion of specialized cancer care centers. Strong regulatory backing, favorable reimbursement policies, intensive research funding, and the presence of leading biotechnology and genomics companies further reinforce its leadership.

How is Asia-Pacific Growing in the Genomics In Cancer Care Market?

Asia-Pacific is expected to witness the fastest growth during the predicted timeframe due to rapidly increasing cancer incidence and a large, aging population. Rising healthcare investments, expansion of modern hospitals and oncology centers, and improving access to advanced diagnostic technologies are key drivers. Supportive government initiatives, growing adoption of cost-effective genomic testing, and increasing awareness of precision medicine further accelerate regional growth.

China Market Trends

China's genomics in cancer care industry is advancing rapidly, driven by a strong national focus on precision medicine, expanding cancer screening programs, and rising cancer incidence. In 2026, domestic companies are increasingly developing cost-efficient sequencing platforms, liquid biopsy solutions, and AI-enabled genomic analysis tools. Greater integration of genomics into hospital oncology workflows, growth of local biotech innovation, and collaborations between hospitals and genomics firms are key trends shaping China's market momentum.

Will Europe Grow in the Genomics in Cancer Care Market?

Europe is expected to grow at a notable CAGR in the foreseeable future, driven by the increasing integration of genomic testing into public healthcare systems. Rising cancer prevalence, expansion of national cancer genomics and precision oncology programs, and sustained government and EU-level research funding support adoption. Growing collaboration between academic institutes, hospitals, and biotechnology companies, along with improving access to advanced sequencing technologies, further enhances Europe's potential in genomic-based cancer care.

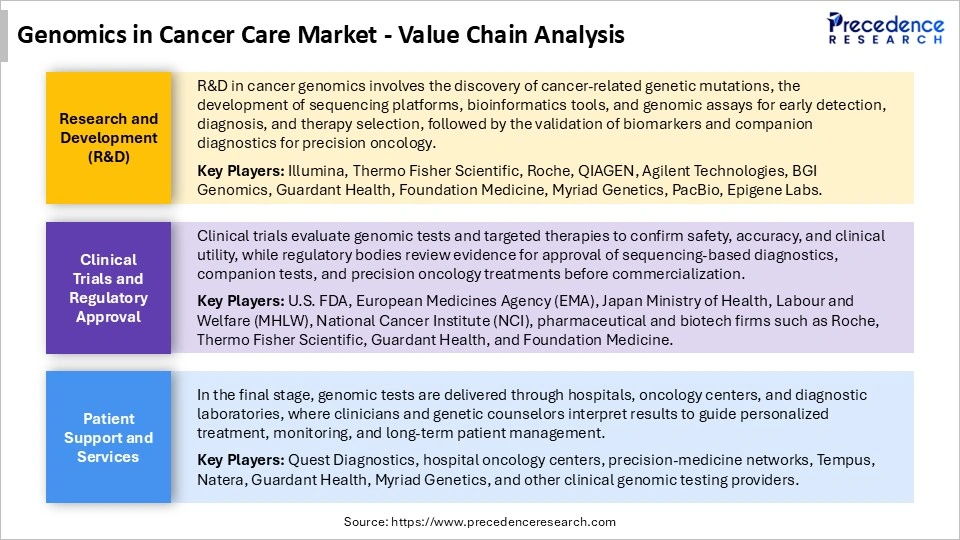

Genomics in Cancer Care Market Value Chain Analysis

Who are the Major Players in the Global Genomics in Cancer Care Market?

The major players in the genomics in cancer care market include Illumina, Inc,. Thermo Fisher Scientific, Inc. F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc., Qiagen N.V., Bio-Rad Laboratories, Inc., Pacific Biosciences of California, Inc., PerkinElmer, Inc., Abbott Laboratories, GE Healthcare, Quest Diagnostics Inc., Myriad Genetics, Inc., Foundation Medicine, Inc., Guardant Health, Inc., Oxford Nanopore Technologies, Becton, Dickinson and Company, 10x Genomics, Inc., GRAIL, Inc., Invitae Corporation, Adaptive Biotechnologies Corporation

Recent Developments

- In February 2026, the Indian Institute of Technology (IIT), Madras, launched a first-of-its-kind pediatric leukemia, colorectal, and pancreatic cancer genome database to support precision oncology. The database aims to address challenges in the genomic landscape for different cancer types in India. (Source: https://www.iitm.ac.in)

- In January 2026, 10x Genomics strengthened its position in cancer genomics by collaborating with Dana-Farber Cancer Institute to analyze tumor samples from patients with major solid cancer types through advanced single-cell and spatial profiling platforms. The development supports improved understanding of tumor heterogeneity, immuno-oncology response, and biomarker discovery, accelerating precision cancer diagnostics and therapy development globally.(Source: https://www.prnewswire.com)

- In January 2026, Illumina launched the world's largest genome-wide genetic perturbation dataset to accelerate drug discovery through AI across the pharmaceutical ecosystem. The Illumina Billion Cell Atlas can build a 5 billion cell atlas over three years and will be the most comprehensive map of human disease biology.(Source: https://www.illumina.com)

Segments Covered in the Report

By Technology

- Next-Generation Sequencing (NGS)

- Whole genome sequencing

- Targeted panels

- Exome sequencing

- PCR/qPCR Technologies

- Microarrays/Expression Profiling

- Other Genomic Technologies

By Application

- Cancer Diagnosis & Early Detection

- Prognosis/Risk Assessment

- Companion Diagnostics & Treatment Selection

- Therapy Monitoring/Minimal Residual Disease (MRD)

- Other Applications

By End-User

- Hospitals & Cancer Centers

- Diagnostic/Reference Laboratories

- Pharmaceutical & Biotech Firms

- Academic & Research Institutes

- Other End-Users

By Cancer Type

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate & Genitourinary Cancers

- Hematologic/Blood Cancers

- Other Cancers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting