Consumer Genomics Market Size and Forecast 2025 to 2034

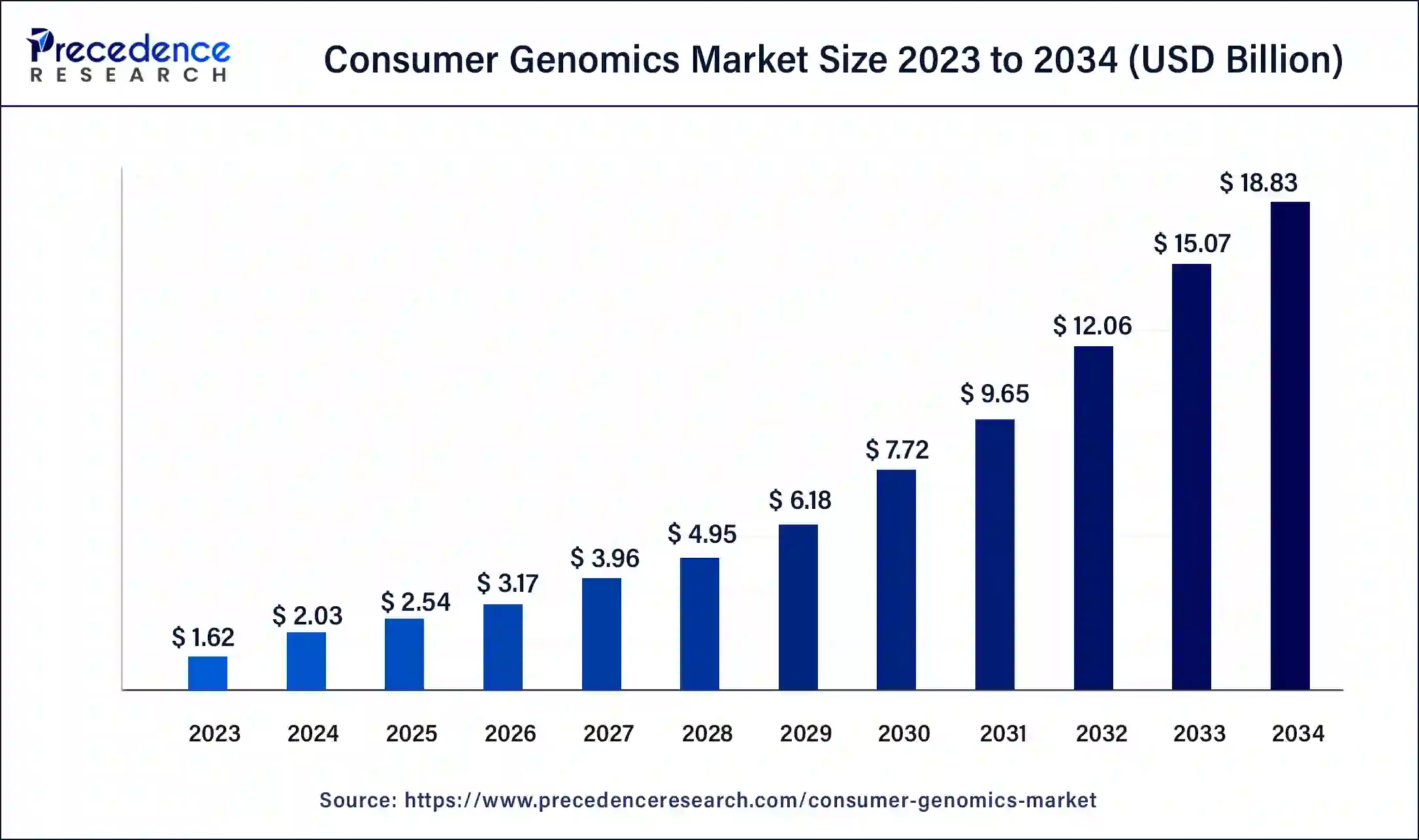

The global consumer genomics market size accounted at USD 2.03 billion in 2024 and is expected to be worth around USD 18.83 billion by 2034, at a CAGR of 24.95% from 2025 to 2034.

Consumer Genomics Market Key Takeaways

- In terms of revenue, the consumer genomics market is valued at $2.54 billion in 2025.

- It is projected to reach $18.83 billion by 2034.

- The consumer genomics market is expected to grow at a CAGR of 24.95% from 2025 to 2034.

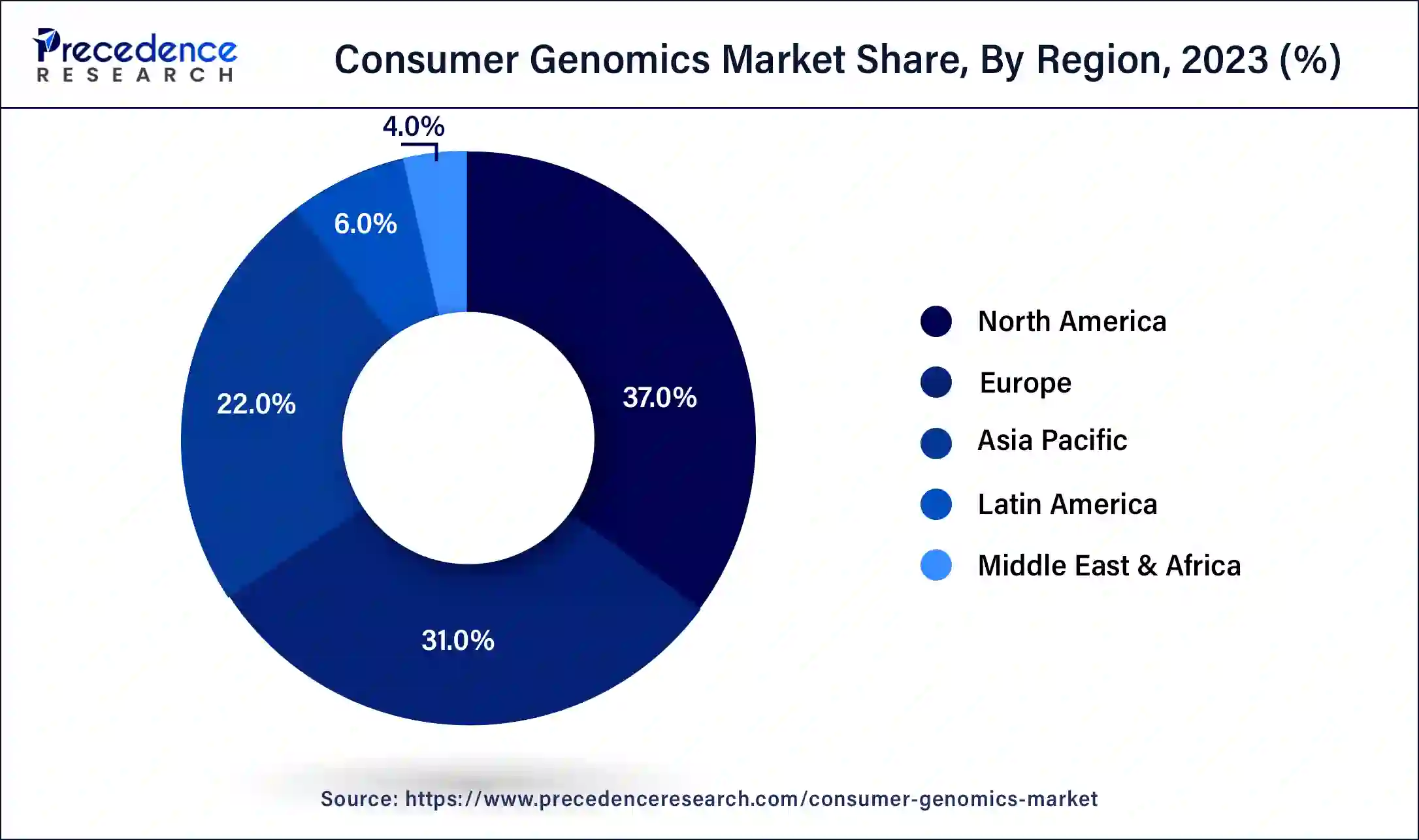

- North America dominated the market and generated more than 37% of revenue share in 2024.

- By Application, the genetic relatedness segment captured more than 22% of revenue share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR from 2025 to 2034.

U.S. Consumer Genomics Market Size and Growth 2025 to 2034

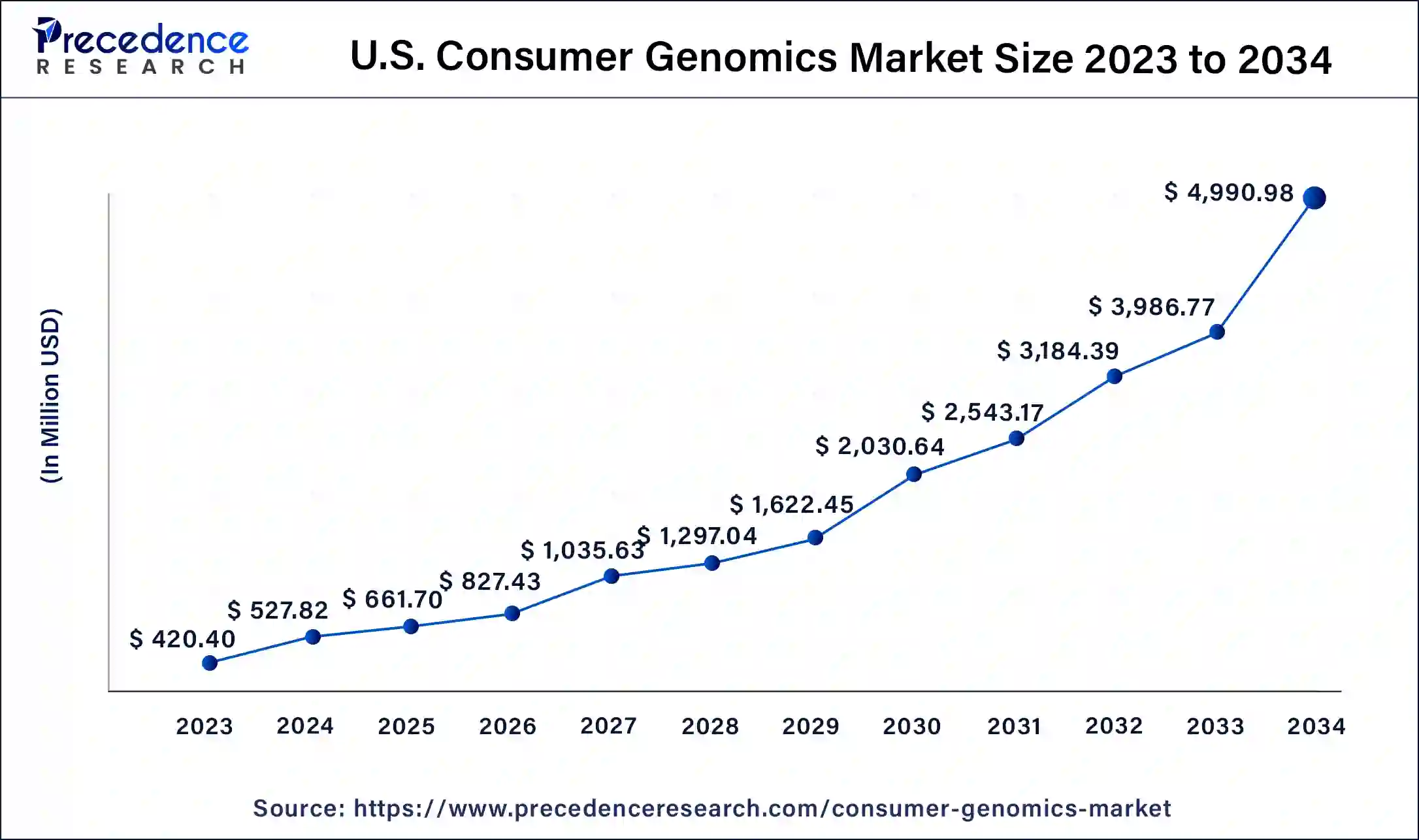

The U.S. consumer genomics market size was estimated at USD 661.70 million in 2024 and is predicted to be worth around USD 4,990.98 million by 2034, at a CAGR of 25.19% from 2025 to 2034.

North America dominated the global consumer genomics market in 2024,the region is expected to continue its dominance throughout the forecast period. The willingness of people to spend on healthcare services, rising awareness about DNA testing and increasing prevalence of target disorders have been supplementing the market's growth for the region. With a well-established healthcare infrastructure, the United States is expected to be the largest contributor to the market's development, followed by Canada. The expansion of the market in North America is due to the increasing prevalence of chronic disorders and rising emphasis on the treatments of chronic disorders. According to the Centers for Disease Control and Prevention, chronic disorders were the main cause of mortality in the United States in 2022.

Moreover, the presence of large-scale gene mapping services and major key players headquartered in the United States and Canada will continue to support the market's growth in the region.

North America is a home to several major consumer genomics companies such as Ancestry DNA, 23 and Me, Helix and MyHeritage, the strong presence of such players in the region plays an active role in the market development. Additionally, the growing interest in understanding genetic risks for any health conditions is supplementing the market's growth in North America. In the end, the supportive regulatory guidelines, government support, rising number of research and innovation along with the boom in business activities, especially in the healthcare sector propel the growth of the consumer genomics market in North America.

On the other hand, Asia Pacific is expected to witness a significant growth during the forecast period.The rising focus on research and development activities and a rise in public awareness for DNA testing are expected to boost the growth of the market during the forecast period. Countries in Asia Pacific such as China, India, South Korea and Japan are observed to be the largest contributors to the market's growth. Rising disposable incomes, growing interest in health-related information, and improving healthcare infrastructure in these countries fuel the market's growth in the Asia Pacific.

- In June 2023, Xcode Life launched a gene Nutrition test in India. The test covers nearly 50 aspects of nutrition, including macro (carbs, protein, and fats) breakdown according to genotype, vitamin and mineral deficiency risk, eating behaviours, weight management with nutrition, taste preferences, diet responses, and food sensitivities.

In September 2024, QIAGEN N.V. announced that Bode Technology, the largest private U.S. forensics laboratory company with a growing presence in other regions, would become the exclusive global commercial partner for theGEDmatch PRO genealogy database, which is used to assist police and forensic teams with investigative comparisons of genetic data. The multi-year agreement between two leading companies in forensic investigative genetic genealogy (FIGG) aims to accelerate the use of GEDmatch PRO in law enforcement and identification of human remains.

Market Overview

Consumer genomics are direct-to-consumer genetic testing which refers to the practice of individuals accessing and exploring their own genetic information using commercial genetic testing services. Consumer genetics is gaining significant importance as they become increasingly popular with the advent of affordable and accessible DNA testing kits.

The consumer genomics market is a segment of the industry that plays around the commercialization of genetic testing services and other associated products. The global market for consumer genomics is fragmented with multiple players that are involved in the distribution of genetic testing kits, analysis of genetic data, and the interpretation of the results for individuals.

Consumer Genomics Market Growth Factors

Factors that drive the market growth of these sectors are mainly increasing consumer and healthcare interest in DTC kits, as well as in technological improvements and the expansion of the application of consumer genomics. Expansion of consumer genomics and governmental regulatory support also help accelerate market expansion. The campaigns that raise awareness of genealogical testing are launched by the organization for consumer gene testing. Thus, the primary key application of the consumer genomics sector is genealogy testing, which came into being to capture the biggest part of the customer and healthcare markets.

Moreover, the advancements in DNA testing services and the increasing public awareness about testing options along with the convenience of such testing services act as growth factors for the growth of the consumer genomics market.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 2.03 Billion |

| Market Size in 2025 | USD 2.54 Billion |

| Market Size by 2034 | USD 18.83 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 24.95% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising focus on personalized healthcare

Consumer genomics enables individuals to understand their genetic predispositions to various diseases and health conditions. By analyzing their DNA, consumers can gain insights into their susceptibility to certain conditions such as cancer, cardiovascular diseases, or genetic disorders. This information empowers individuals to take proactive measures to prevent or manage these conditions, leading to rising demand for consumer genomics services.

Consumer genomics offers insights into various wellness factors, such as nutrition, exercise, and sleep patterns, that are influenced by an individual's genetic predispositions. Understanding how genetic variations affect one's response to different lifestyle factors enables individuals to make informed choices and adopt personalized wellness strategies. The rising focus on holistic health and wellness has contributed to the demand for consumer genomics services.

- In May 2023, Godrej Memorial Hospital introduced India's first comprehensive genome testing that identifies an individual's predisposition to over 150 conditions and genetic traits. The hospital has partnered with Haystack Analytics, a health tech company based out of IIT Bombay.

Personalized healthcare focuses on tailoring medical treatments to an individual's specific genetic makeup. By analyzing genetic data, consumer genomics allows healthcare providers to make more informed decisions about the most effective treatments and medication dosages for each individual. The growing interest in precision medicine has led to increased adoption of consumer genomics, as it provides the necessary genetic information for personalized treatment plans.

Restraint

Privacy concerns

A few severe privacy and security concern act as significant restraints to the growth of the consumer genomics market. Consumers may be concerned about losing control over their genetic information after getting shared with the healthcare provider. The lack of transparency and control over data practices in the consumer genomics industry has contributed to privacy concerns. Consumers worry about the security of their genetic information, as it contains sensitive and personal data. Breaches or unauthorized access to this data can lead to identity theft, discrimination, or misuse.

These concerns make individuals reluctant to share their genetic data, hindering the growth of the consumer genomics industry. Privacy breaches and unethical data handling practices in other sectors have eroded consumer trust. The fear of potential misuse of genetic data, such as discrimination in employment or insurance, has made people hesitant to engage with consumer genomics companies. The lack of trust limits the number of individuals willing to participate and inhibits the market's expansion.

Opportunity

Rising adoption of genealogical services across the globe

Recent technological developments have reduced the cost of sequencing as well as the cost of genomics as a whole. Sequencing is a crucial and insignificant task in genomics and affected populations and an increase in chronic disease prevalence is also included. Growing genomics applications and favorable government policy in developing nations would offer market participants various opportunities. In addition to other genetic skills, CGH, FISH, microarray, karyotyping and gene-editing techniques have significantly changed healthcare systems and fundamental biological research. The market is expanding as a result of increased demographic pressure and an increase in the prevalence of chronic diseases.

- In August 2023, Illumina Inc., a global leader in DNA sequencing and array-based technologies, announced the opening of a new office and state-of-the-art Illumina Solutions Center in Bengaluru, India. Illumina's expansion comes after 16 years of working closely with the company's channel partner in India, Premas Life Sciences.

Rising adoption of genealogical services

In September 2024, MyHeritage announced the acquisition of MesAieux.com, a popular family history service specializing in French Canadian genealogy. As a MyHeritage company, MesAieux.com will benefit from MyHeritage's resources and technological expertise, which will facilitate the publication of new historical record collections and provide greater value to MesAieux.com users.

Application insights

By application, the genetic-relatedness segment had significant growth in the market; the segment will continue to show noticeable growth during the forecast period. The rise in demand for prenatal testing and parenting testing across the globe has boosted the significance of the genetic relatedness segment in recent years.

Moreover, the rising interest in understanding the hereditary or ancestral traits among people supports the development of the segment.

The lifestyle, wellness, and nutrition segment will experience rapid growth during the forecast period. As multiple key players start offering tests to analyze the pattern of wellness and diet will promote the development of the segment. In addition, the rising emphasis on personalized nutrition recommendations will continue to support the segment's growth. With the help of consumer genomics, it has become uncomplicated to understand nutrient metabolism and dietary requirements. This element promotes overall nutrition as well as the healthcare industry to offer proven and improved outcomes for patients. In addition, considering the importance of consumer genomics in nutrigenomics research will help the segment grow.

By application, the genetic-relatedness segmentAccording to the article published in February 2025, the detection of genetic disorders is rapidly rising, as per the geneticists at the Nizam's Institute of Medical Sciences (NIMS) with its department of medical genetics reporting a 418% increase in cases in the last decade. The Nizam's Institute of Medical Sciences (Nims) stated that patients with rare genetic order cases increased from 2,400 in 2014 to 12,042 in 2024.

Consumer Genomics Market Companies

- Ancestry

- Gene By Gene, Ltd. (FamilyTree DNA)

- 23andMe, Inc.

- Color Genomics, Inc.

- Myriad Genetics, Inc.

- Mapmygenome

- Positive Biosciences, Ltd.

- Futura Genetics

- Helix OpCo LLC

- MyHeritage Ltd.

- Pathway Genomics

- Amgen, Inc.

- Xcode Life

- Diagnomics, Inc.

- Toolbox Genomics

- SomaLogic, Inc.

- Inui Health (formerly Scanadu)

- AgeCurve

- QuickCheck Health

- Biomeb

Recent Developments

- In February 2025, an international team of researchers led by the Indiana University School of Medicine has linked a previously uncharacterized gene to a human disorder for the first time. This breakthrough led to the diagnosis of an ultrarare neurodevelopmental disorder for a patient of the Undiagnosed Rare Disease Clinic (URDC), located at Riley Hospital for Children.

- In November 2024, ProPhase Labs, Inc., a next generation biotech, genomics, and diagnostics company, announced the launch of DNA Complete, Inc., a wholly owned subsidiary, offering a groundbreaking direct-to-consumer DNA test that sequences virtually 100% of a customer's genome. This new service provides customers with in-depth insights into health, wellness, and ancestry.

- In May 2025 Hydreight Technologies Inc., a fast-growing digital health platform delivering compliant mobile and telehealth services across all 50 U.S. states, is pleased to announce the launch of a new direct-to-consumer genetic testing and personalized wellness solution via its VSDHOne platform. The new offering enables patients to easily access at-home DNA testing kits and receive personalized health plans based on their unique genetic profile.

- In November 2024, ProPhase Labs announced the launch of DNA Complete, offering comprehensive whole genome sequencing with health, wellness, and ancestry insights. The service includes advanced bioinformatics, genetic counseling, and a subscription model. Additionally, they introduced DNA Expand, allowing users to enhance existing DNA ancestry data.

- In January 2025, Nucleus, the leader in clinical-grade DNA and health technology, secured a USD 14 million Series A round, bringing its total funding to nearly USD 32 million. Backed by investors including Reddit founder Alexis Ohanian and Peter Thiel's Founders Fund, Nucleus offers open access to clinical genetic testing.

- In March 2023, Illumina, Inc. (U.S.) launched Connected Insights, a cloud-based software designed for tertiary analysis of clinical next-generation sequencing data. This innovative tool aids in genomic profiling for advanced tumors and whole-genome sequencing for rare diseases, among other advanced applications.

- In October 2022,A specialty laboratory with life-saving plasma tests, GC LabTech FDA-registered, chose 1health.io to provide its cutting-edge new lab tests directly to consumers.

- In November 2022,a genomics-based research company, Strand Life Sciences announced the launch of a new line of genomic-based tests, Strand Genomic Wellness. The newly launched genomic-based tests are developed for preventive wellness.

- In February 2020,Researchers studying reproductive health will be able to search through 420 genes for indicators of various illnesses, including Gaucher disease, thanks to a new test created by Thermo Fisher Scientific.

Segments Covered in the Report

By Applications

- Genetic Relatedness

- Diagnostics

- Lifestyle, Wellness, & Nutrition

- Ancestry

- Reproductive Health

- Personalized Medicine & Pharmacogenetic testing

- Sports Nutrition & Health

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting