Cardiac Arrhythmia Monitoring Devices Market Size and Forecast 2025 to 2034

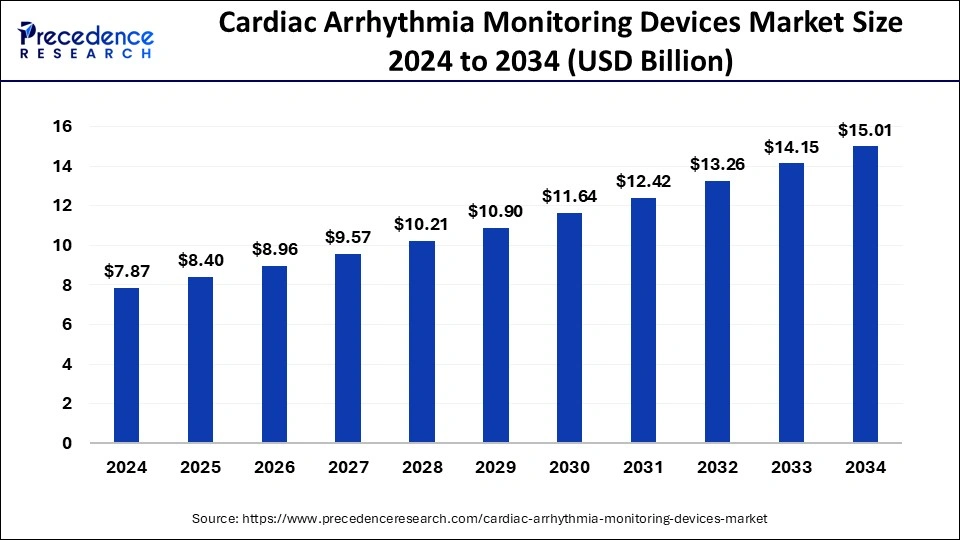

The global cardiac arrhythmia monitoring devices market size accounted at USD 7.87 billion in 2024 and is predicted to increase from USD 8.40 billion in 2025 to approximately USD 15.01 billion by 2034, expanding at a CAGR of 6.67% from 2025 to 2034. The cardiac arrhythmia monitoring devices market is driven by the increasing frequency of heart-related conditions (CVDs) worldwide.

Cardiac Arrhythmia Monitoring Devices Market Key Takeaways

- The global cardiac arrhythmia monitoring devices market was valued at USD 7.87 billion in 2024.

- It is projected to reach USD 15.01 billion by 2034.

- The cardiac arrhythmia monitoring devices market is expected to grow at a CAGR of 6.67% from 2025 to 2034.

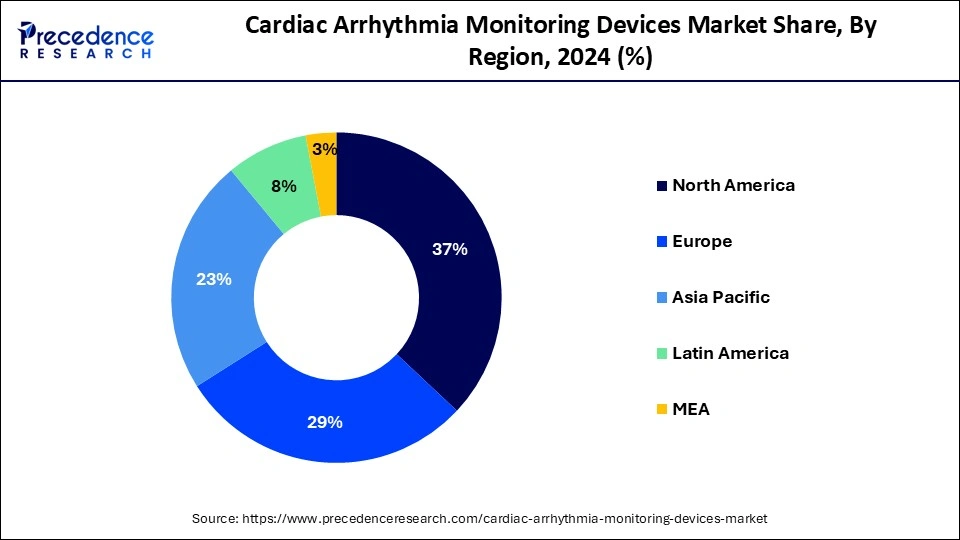

- North America dominated the market with the largest market share of 37% in 2024.

- By device, the holter monitor segment has held the major market share of 43% in 2024.

- By application, the tachycardia segment dominated the market largest market share in 2024.

- By end-use, the hospitals and clinics segment has accounted for more than 46% market share in 2024.

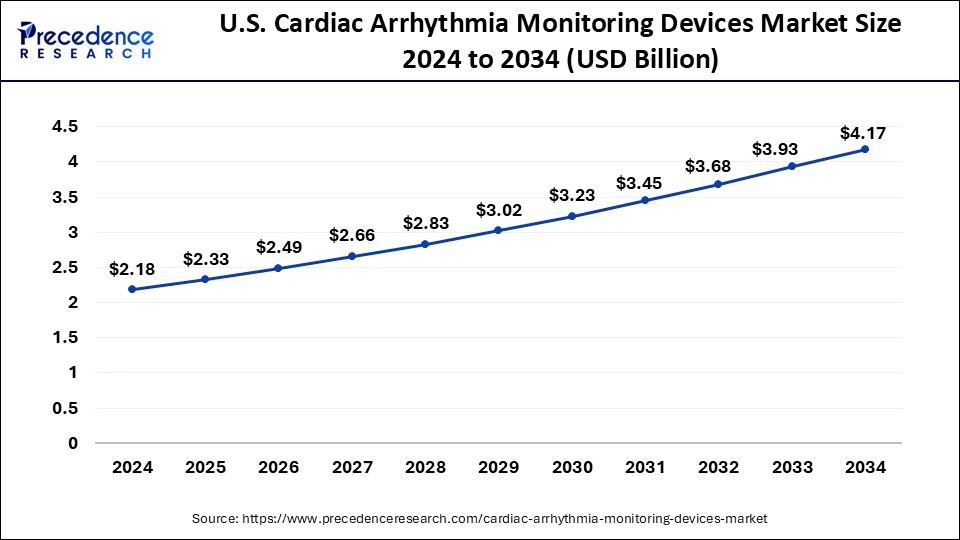

U.S.Cardiac Arrhythmia Monitoring Devices Market Size and Growth 2025 to 2034

The U.S. cardiac arrhythmia monitoring devices market size was exhibited at USD 2.18 billion in 2024 and is projected to be worth around USD 4.17 billion by 2034, growing at a CAGR of 6.70%.

North America carried the largest market share of 37% in 2024 in the cardiac arrhythmia monitoring devices market throughout the predicted timeframe. When it comes to medical technology, the area is leading the way in cardiac monitoring gadget innovation. Modern monitoring technologies are introduced due to ongoing research and development, improving patient comfort, efficiency, and accuracy. Monitoring device use is fueled by rising healthcare spending per capita and growing awareness of the significance of early cardiac arrhythmia identification and therapy. Both patients and medical professionals know how continuous monitoring can enhance patient outcomes and lower medical expenses related to untreated arrhythmias.

Asia-Pacific is the fastest growing in the cardiac arrhythmia monitoring devices market during the forecast period. Rapid technical breakthroughs have created more accurate, portable, and user-friendly cardiac monitoring devices, increasing the market. In Asia-Pacific, wearable monitors, implantable loop recorders, and smartphone-based monitoring systems have become more popular because of how convenient and successful they are at detecting arrhythmias continuously. These cutting-edge solutions meet the increasing need of patients and healthcare professionals for non-invasive, real-time monitoring choices.

The Asia-Pacific region's governments and healthcare institutions are also actively supporting disease management initiatives and investing in preventive healthcare practices, including cardiac monitoring equipment. Additionally, the adoption of these devices throughout the region is further supported by increased healthcare spending and better access to healthcare services.

Market Overview

Medical equipment called cardiac arrhythmia monitoring devices is used to identify and document anomalies in the heart's electrical activity, such as irregular heartbeats. These devices monitor individuals who have or may develop cardiac arrhythmias in various therapeutic situations. Devices for monitoring cardiac arrhythmias are used to diagnose multiple arrhythmias, including bradycardia, ventricular tachycardia, and atrial fibrillation.

Through prolonged, continuous monitoring of the heart's electrical activity, these devices can identify the precise type of arrhythmia a patient suffers from and record occasional occurrences of aberrant rhythms. Some patients have recurrent arrhythmias or chronic illnesses that necessitate long-term cardiac rhythm monitoring.

- According to National Crime Records Bureau data, as of 2022, over 32,457 people died because of heart attacks.

- Over the past 30 years, cardiovascular disease-related deaths have increased by 60% worldwide.

Cardiac Arrhythmia Monitoring Devices Market Growth Factors

- Heart attacks are the world's most significant cause of mortality, and arrhythmias are a frequent side effect. The need for monitoring devices is anticipated to grow as the population ages and the risk factors for CVD rise.

- Growing public knowledge about arrhythmias and easier access to healthcare, particularly in emerging nations, are anticipated to fuel cardiac arrhythmia monitoring devices market's expansion.

- Technological developments are driving the creation of increasingly complex, intuitive, and remote monitoring equipment. This increases market adoption by making it simpler for people to monitor their cardiac health at home.

- Increased funding for healthcare worldwide may make more resources available for arrhythmia diagnosis and treatment, including the utilization of monitoring equipment.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.67% |

| Market Size in 2025 | USD 8.40 Billion |

| Market Size by 2034 | USD 15.01 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device, Application, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing prevalence of cardiovascular diseases

The prevalence of cardiovascular diseases (CVDs) is increasing worldwide, making it more critical than ever to monitor and treat cardiac arrhythmias or irregular heartbeats effectively. If ignored or misdiagnosed, these disorders can dramatically raise the risk of heart failure, stroke, and other consequences. Cardiac arrhythmia monitoring devices are essential to identify, diagnose, and track these atypical cardiac rhythms. This enables medical professionals to act quickly and administer the proper care. Technological developments like wearable monitors and portable devices have made monitoring easier to use and more accessible, which is driving the cardiac arrhythmia monitoring devices market's expansion.

Restraint

Lack of skilled professionals

Cardiologists and technicians are among the skilled experts who correctly interpret data from these devices and deliver the necessary patient care. However, the successful use of cardiac monitoring devices is hampered by a lack of skilled people in many areas. To make matters worse, the intricacy of certain monitoring equipment can necessitate specific training. The lack of qualified personnel restricts the use and effectiveness of cardiac arrhythmia monitoring devices, impeding the growth of the cardiac arrhythmia monitoring devices market.

Opportunity

Increasing adoption of mobile and telemetry cardiac monitors

These devices have several benefits, such as improved patient mobility, remote data transmission, and real-time monitoring. They facilitate early identification and treatment of cardiac arrhythmias by enabling medical professionals to continually track patients' heart rhythms outside of conventional hospital settings. Further, mobile technology facilitates easy contact between patients and medical professionals, enhancing patient outcomes and lowering medical expenses.

Device Insights

The holter monitor segment dominated the cardiac arrhythmia monitoring devices market in 2024. Significant technological developments have improved the accuracy, dependability, and user-friendliness of Holter monitors. Device miniaturization, longer-lasting batteries, better data storage capacities, wireless connectivity for real-time monitoring, and advanced software algorithms for data analysis and interpretation are some of these developments. Due to these technical advancements, Holter monitors are now the go-to option for cardiac arrhythmia diagnosis and monitoring among medical professionals.

People are becoming more conscious of the value of early heart abnormality detection and preventative healthcare. To find underlying heart problems and start treatments on time, more people are getting routine cardiac screenings and diagnostic testing, such as ambulatory ECG monitoring with Holter monitors.

- According to studies, during the 24-hour Holter monitoring period that is employed in standard clinical practice, 45% of all arrhythmias go unnoticed. By extending the monitoring time to seven days, the detection rate of all arrhythmias can be improved to over 97%, lowering the stroke risk.

The mobile cardiac telemetry segment shows a notable growth in the cardiac arrhythmia monitoring devices market during the forecast period. Cardiovascular monitoring equipment, particularly MCT technology, is encouraged by favorable reimbursement policies and healthcare regulations in many areas. Healthcare practitioners are encouraged to use these devices in their practices, fueling the market's expansion and accessibility. Globally, there is an increase in cardiac arrhythmias prevalence due to aging populations, rising rates of lifestyle-related risk factors (such as diabetes, hypertension, and obesity), and better diagnostic techniques. To successfully manage and treat these problems, there is an increasing demand for sophisticated cardiac monitoring systems, such as MCT devices.

Application Insights

The tachycardia segment dominated the cardiac arrhythmia monitoring devices market in 2024. As tachycardia can happen suddenly and sporadically, it cannot be easy to identify and treat using traditional techniques. Continuous cardiac monitoring enables healthcare providers to detect transitory bouts of tachycardia more frequently by collecting and analyzing heart rhythm data over an extended period. This capacity to continuously monitor is vital for patients who have underlying heart problems or who are at a higher risk of consequences from tachycardia.

End-use Insights

The hospitals and clinics segment dominated the cardiac arrhythmia monitoring devices market in 2024. Hospitals and clinics are referral sources for patients with complicated medical disorders, such as cardiac arrhythmias. Primary care doctors and other medical professionals frequently refer patients to these facilities for specialist assessment and care. Consequently, a sizable segment of the patient population in need of cardiac arrhythmia monitoring is managed by hospitals and clinics.

It frequently possesses the financial means to purchase cutting-edge medical technology, such as cardiac arrhythmia monitoring equipment. They can buy top-notch equipment with cutting-edge capabilities like wireless connectivity, data analysis, and real-time monitoring, improving the precision and effectiveness of diagnosis and treatment.

The diagnostic centers segment is the fastest growing in the cardiac arrhythmia monitoring devices market during the forecast period. Holter, event, and telemetry monitoring are only a few of diagnostic centers' extensive cardiac monitoring services. Long-term cardiac rhythm surveillance is made possible by these monitoring services, which makes it possible to identify sporadic or asymptomatic arrhythmias that could go undetected during short-term monitoring in other healthcare settings. All-encompassing monitoring services at diagnostic centers improve patient outcomes by augmenting the diagnostic yield and facilitating the early diagnosis of arrhythmias.

Recent Developments

- In October 2023, The LUX-Dx II+ Insertable Cardiac Monitor (ICM) System, developed by Boston Scientific, is a next-generation insertable monitor intended for long-term arrhythmia monitoring related to disorders like syncope, cryptogenic stroke, and atrial fibrillation (AF).

- In July 2022, Xplore Lifestyle introduced a smartwatch with medical-grade features for continuous cardiac health monitoring. This watch, created in collaboration with the Israeli company Cardiac Sense, is billed as the world's first medical-grade continuous monitoring gadget in the shape of a watch. This medical gadget may distinguish between an arrhythmia, an abnormal or irregular heartbeat, and a normal heart rhythm, particularly atrial fibrillation (AFib).

Cardiac Arrhythmia Monitoring Devices Market Companies

- Applied Cardiac Systems

- AliveCor

- Biotronik

- Biotricity

- GE Healthcare

- iRhythm Technologies

- Koninklijke Philips N.V

- Medtronic plc

- Nihon Kohden Corporation

- St. Jude Medical (Abbott Laboratories)

- Spacelabs Healthcare (OSI Systems, Inc.)

- Welch Allyn (Hillrom Services, Inc.)

Segments Covered in the Report

By Device

- Holter Monitor

- Event Recorder

- Mobile Cardiac Telemetry

- Implantable Cardiac Monitor

- Electrocardiogram (ECG) Monitor

- Others

By Application

- Tachycardia

- Atrial Tachycardia

- Ventricular Tachycardia

- Bradycardia

- Premature Contraction

- Others

By End-use

- Hospitals and Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers

- Homecare Settings

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content