What is the Ceramide Market Size?

The global ceramide market size is calculated at 449.34 million in 2025 and is predicted to increase from USD 475.49 million in 2026 to approximately USD 747.62 million by 2034, expanding at a CAGR of 5.82% from 2025 to 2034. The increased use of ceramides in the nutraceutical industrial sector, pharmaceutical industrial sector, and cosmetics industrial sector and growing ceramide-based antiaging skincare products contribute to the growth of the market

Ceramide Market Key Takeaways

- In terms of revenue, the global ceramide market was valued at USD 424.62 million in 2024.

- It is projected to reach USD 747.62 million by 2034.

- The market is expected to grow at a CAGR of 5.82% from 2025 to 2034.

- Asia Pacific dominated the ceramide market in 2024.

- By type, the natural ceramides segment dominated the market in 2024.

- By type, the synthetic ceramides segment is expected to grow at a significant rate during the forecast period.

- By process, the fermentation ceramides segment dominated the ceramide market in 2024.

- By process, the plant extract ceramides segment is anticipated to be the fastest-growing during the forecast period.

Ceramide Market: Skin Barrier & Anti-Aging Solution

The ceramide market refers to buying and selling ceramides, which are a family of waxy lipid molecules. These are composed of sphingosine and a fatty acid joined by an amide bond. The benefits of ceramides include protecting our skin from infection-causing germs like fungi and bacteria and allergies. It helps to protect our skin from environmental damage, prevent irritation and dryness by locking moisture into the skin, protect our skin from breakouts, reduce the appearance of wrinkles, help the skin to maintain an ideal amount of moisture, and protect the skin's natural barrier.

How can AI help the Ceramide Market?

The use of artificial intelligence (AI) in the ceramide can improve the growth of the ceramide market. The benefits of AI include improved cyber security, improved agriculture, improved financial services, scientific discovery, customer service excellence, advanced transportation, climate change mitigation, increased economic growth, and improved healthcare. Artificial intelligence gives humans the ability to achieve a high range of goals and solve problems. In the cosmetic industry, AI can help in product creation. AI can used as an analytical tool for creating personalized shopping experiences and inventory management. It is used as an additional channel for sales, communication, and promotion.

Market Outlook

- Industry Growth Overview:

The ceramide market is growing, driven by rising consumer awareness of skin health, demand for anti-aging and skin barrier repair products, and increasing applications in various fields. Manufacturers are launching more products, which drives the growth of the market. - Global Expansion:

The ceramide market is growing worldwide, driven by increasing customer demand and innovation used beyond cosmetics, like in pharmaceuticals and the food sector. North America is dominant in the market due to strong demand for organic, natural, and science-backed beauty products. - Major investors:

Major investors in the ceramic market contribute large, publicly traded companies like Kajaria Ceramics, Cera Sanitaryware, and Somany Ceramics, which have a significant market capitalization and strong presence.

Ceramide Market Growth Factors

- Ceramides have many applications in skincare. Some ways to use ceramides include, after cleansing skin, applying topical ceramides twice daily.

- Ceramides can be used on the entire body from face to legs. Include ceramides into your skincare routine by using moisturizers, cleansers, and creams.

- Ceramides can reduce redness, increase skin hydration, protect against environmental damage, and ease irritation.

- Ceramide applications also include pharmaceuticals, dietary supplements, food and beverages, and cosmeceuticals which help to the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 747.62 Million |

| Market Size in 2025 | USD 449.34 Million |

| Market Size in 2026 | USD 475.49 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.82% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Process, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

The growing cosmetic industry

Ceramides are highly used in cosmetic products like skin care products, including eye creams, serums, face oil, face masks, and face creams. Ceramides are essential lipids that are naturally found in our body, help hold hydration in the skin, and maintain the integrity of the skin barrier. So, ceramide-based products are used in skin care products, which help to keep skin looking firm, plump, and healthy by reducing the appearance of fine lines, which helps the growth of the ceramide market. The benefits of ceramide include infection-causing germs like fungi and bacteria and allergies. It protects your skin from environmental damage and prevents irritation and dryness by locking moisture into your skin. It protects our skin from breakouts and drying out, reduces the appearance of wrinkles, helps the skin maintain an ideal amount of moisture, etc.

Restraints

Regulatory compliance

The regulatory compliance challenges include inefficient task management, cyber security, and data privacy risks, the convergence of finance and technology, managing third-party technologies, addressing new policies and guidelines, a burden on compliance teams due to rapidly evolving regulations, etc. Regulatory risks may cause human error, negligence, and inadequate controls. These factors can hamper the growth of the ceramide market.

Opportunity

Increasing use in the pharmaceutical industry and changing consumer preferences

In the pharmaceutical industry, ceramides are used in drug delivery, which helps the ceramide market grow. It belongs to the sphingolipid group of lipids that acts as intercellular and intracellular messengers and as regulatory molecules that play important roles in signal transduction, metabolic, inflammation, and angiogenesis disorders like cancer cell degradation, diabetes, and neurodegenerative diseases. Effective supply chain management, including customer satisfaction, distribution, logistics, production, and sourcing, leads to the growth of the market.

Segment Insights

Type Insights

The natural ceramides segment dominated the ceramide market in 2024. The natural ceramide sources include whole grains like quinoa, wheat, corn, brown rice etc., olives, spinach, sesame seeds, broccoli, eggs, almonds, whole grains, sweet potatoes, wild-caught salmon, soybeans, avocadoes, etc. Olives and olive oil have ceramide-rich compositions that have skin-boosting properties that help improve skin hydration and elasticity. Spinach contains vitamins, minerals, and ceramides, and its iron content helps to support skin cell regeneration and improve blood circulation and overall skin health. Sesame seeds have important minerals like zinc and copper and are a rich source of ceramides, which can help reduce inflammation, enhance skin elasticity, and improve skin health. Broccoli is a cruciferous vegetable that has nutrients and ceramides that help to reduce toxins from the body and support digestion, helping to improve skin radiance and clarity. Eggs are a rich source of ceramides that help maintain and repair skin cells and help create a radiant and healthy complexion.

- In August 2024, a new range of ceramide-based skincare, supporting the retailer's own brand offering was launched by Boots. The new 7-piece collection harnesses the power of a triple ceramide complex and aims to balance, support, and restore the skin's natural barrier for a radiant and healthy complexation.

The synthetic ceramides segment is expected to grow significantly during the forecast period. Synthetic ceramides are lab-derived. Natural and synthetic ceramides are both effective and safe to use. Synthetic ceramides are also called pseudoceramides, which are man-made. These are more stable than natural ceramides because they are free from contaminants. The use of topical ceramides can be effective at increasing water retention and restoring barrier function, and, in patients with atopic dermatitis, helps to enhance the skin barrier.

Process Insights

The fermentation ceramides segment dominated the ceramide market in 2024. In some of the companies, ceramides are obtained from the fermentation method. The Evonik company has developed fermentation or green production technology for producing ceramides that can be converted into human skin-identical molecules for cosmetics. The fermentation method can create molecules like hyaluronic acid, peptides, and lactic acid, which can improve the production of ceramides that help retain skin moisture and form the skin's barrier. It also helps to stimulate the skin's natural antimicrobial peptide production, which regulates acne-causing bacterial and pathogenic levels.

- In June 2024, Syensqo launched Cerafy, a range of biomimetic natural ceramides for hair care and skin care applications. Cerafy is produced by a fermentation process that aligns with the focus of Syensqo's biotechnology and renewable materials growth platform. Natural ceramides are important ingredients for skin cleansing and hair care formulations.

The plant extract ceramides segment is anticipated to be the fastest-growing during the forecast period. Natural ceramide is a biologically active compound present in plants that is used highly in the cosmetics, pharmaceutical, and cosmetic industries. The ceramide contents in plants can be obtained by a ceramide extract analysis, which is helpful for the development of ceramide sources. The plants that are rich in ceramides, including spinach, sesame seeds, broccoli, almonds, whole grains like quinoa and brown rice, sweet potatoes, soybeans, avocadoes, etc., contribute to the growth of the ceramide market.

Regional Insights

Asia Pacific: Innovation in ceramide-based products

Asia Pacific held the largest share of the ceramide market in 2024. In the Asia Pacific region, there is a high consumption rate of wheat, soybeans, and rice products through many cosmetic products and food supplements. China has the highest rice consumption compared to India. Japan is the leading country for the growth of the ceramide market in the Asia Pacific region. Additionally, China and India have significant demand for soybean oil and wheat products, which are important natural sources of ceramides. The high number of consumers spending on cosmetics and personal care products.

- In October 2023, the Viral Pink Serum in India was launched by The Ordinary. It includes ceramide-based skincare products.

- In March 2024, a new study reinforces the study of ceramide-based moisturizers for enhanced skin hydration levels and quality of life in Indian Patients was launched by L'Oreal Dermatological Beauty India.

China: Increasing online market

China's massive population and growing disposable income drive an increasing demand for skincare products, such as those with ceramides, to address challenges such as dryness, aging, and skin barrier repair. The quick growth of online platforms in China has augmented brand visibility and made ceramide-based products more accessible to customers, further driving production.

North America: Strong presence of major companies and R&D

U.S.: High consumer awareness and demand

U.S. consumers are well aware of skin health and the advantages of ceramides for hydration, anti-aging, and repairing skin challenges. This leads to an increasing demand for advanced-quality, science-backed products. There is a predominant prevalence of skin health such as eczema and psoriasis, in the U.S., and ceramide-based products.

North America is observed to be the fastest growing in the upcoming years. In North America, consumers find solutions to reduce the appearance of wrinkles and fine lines, which leads to increased demand for ceramides. Ceramides are popular anti-aging products in this region, which helps to the growth of the market. The senior population contributes to the demand for ceramides. Consumers' awareness of maintaining skin hydration and health increased the demand for ceramides for beauty products and skincare products. Increased use of ceramides as food additives and functional foods.

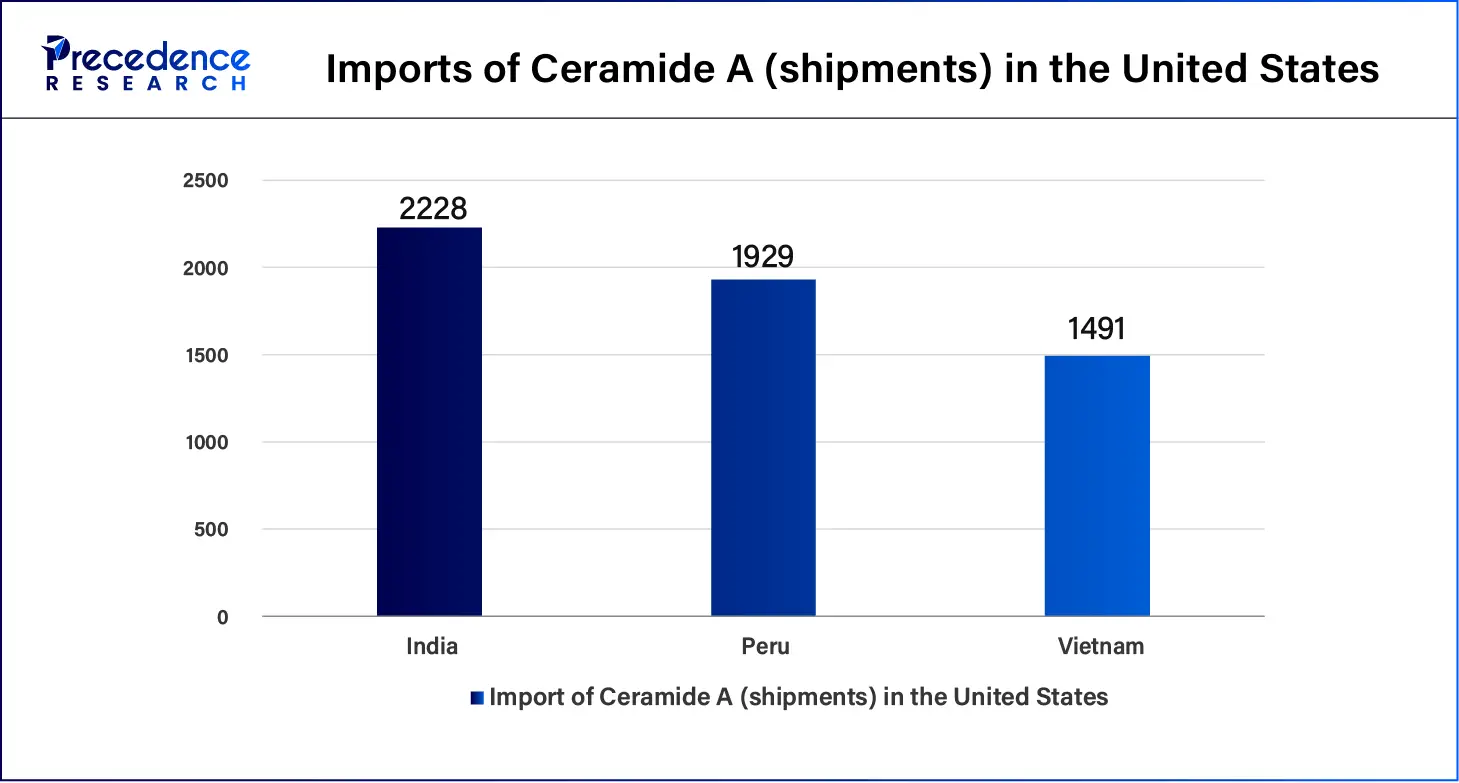

According to Volza's United States Import Data

The United States imports most of the Ceramide A from China.

Globally, the top three importers of Ceramide A are Vietnam, India, and Peru. India leads the world in Ceramide A imports with 2228 shipments, Peru with 1929 shipments, and Vietnam with 1491 shipments.

Europe: Strong cosmetic industry and innovation

Europe is significantly growing in the market a well-established history in cosmetics and pharmaceuticals, which offers a strong foundation for ceramide manufacturing and novelty. European organizations are spending heavily in research and development for novel ceramide applications, leading to advancement in luxury skincare and multifunctional beauty products that appeal to consumers.

UK: Increased awareness of skin health

In the UK, a robust and innovative cosmetic sector, supported by a favorable government environment, enables the advancement of a broad range of ceramide-based products. Increasing consumer awareness about skin health, containing conditions such as eczema and psoriasis, is a main driver for the application of ceramides in both cosmetic and dermatological uses.

Ceramide Market- Value Chain Analysis

- R&D:

R&D processes include raw material science, developing forming and additive manufacturing, and optimizing sintering and thermal technology.

Key Players: Evonik Industries and Croda International - Clinical Trials:

Clinical trials of ceramide include cosmetic/dermatological application studies and pharmaceutical development for specific diseases.

Key Players: Ashland Global Holdings and Kao Corporation. - Patient Services:

The significant consumer services in the ceramide market predominantly revolve around skincare and haircare products, as well as pharmaceutical applications and nutraceuticals.

Key Players: Doosan Corporation and Arkema S.A.

Top Vendors in the Ceramide Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Kao Corporation |

Japan |

Ethical business practices |

In July 2025, Kao Unveils Innovative Curél Products Featuring Carbonated Foam Technology to Combat Dryness-Induced Dullness |

|

Ashland Global Holdings Inc. |

United States |

Personal and home care |

In April 2025, Ashland unveils collapeptyl™, a revolutionary biofunctional delivering superior performance for the collaverse™ ecosystem. |

|

Vantage Specialty Ingredients |

Chicago, Illinois |

Naturally derived ingredients and formulations |

Ceramide TIC-001 plays a significant role in the establishment of the stratum corneum barrier function, thus preventing transepidermal water loss to enhance skin. |

|

SK Bioland Co., Ltd |

South Korea |

Biotechnology Expertise |

SK Bioland Co., Ltd. is engaged in the manufacturing, distribution, and sale of raw materials used in pharmaceuticals, nutraceuticals, and cosmetics. |

|

Doosan Corporation |

South Korea |

Innovation and advanced technology |

Doosan produces ceramide ingredients based on sphingolipids and fermentation technology for personal care applications. |

Other Ceramide Market Companies

- Evonik Industries AG

- Croda International Plc.

- Daebongls

- Bo-Kwang Chemical Co., Ltd.

- Shaanxi Pioneer Biotech Co., Ltd.

- Wuhan Saiguang Pharm & Chem Co., Ltd.

- Arkema

- Brenntag

- Anderson Global Group LLC

- Toyobo

- Surfachem

- Manus Aktteva Biopharm LLP

- Tocris Cookson Ltd.

- Incospharm Corporation

- Unitika Ltd.

- Sederma

- Cayman Chemical

- Macrocare Tech Ltd.

- Allergen

- Xi'an Aladin Biological Technology

Recent Developments

- In January 2024, the biggest-ever campaign for a new ceramide-based moisturizer named the Bio-Active Ceramide Repairing and Plumping Moisturizer ($20) was launched by The Inkey List. This new ceramide-based moisturizer helps improve six aging signs, including firmness, lift, plumpness, wrinkles, fine lines, barrier, and elasticity functions.

- In May 2024, a complete range of ceramides designed for cosmetic applications, named SphingoCare was released by Croda Beauty. These trusted ingredients are highly biotechnology and plant-based and present at high purity levels, biomimetic, or pre-depression blends. These ingredients offer extended activities for hair and skin care, like hair cuticle smoothing, microbiome balance, lip care, environmental protection, smoothing, scalp well-being, and skin hydration.

- In May 2024, a new range of body creams designed to give South Africans more radiant, firmer, and healthier skin was developed by Dove's team of world-renowned scientists. Introduced with Ceramide restoring serum, the Dove range of creams works from inside to outside, leading to locking moisture, boosting protective barriers, and softer skin.

- In August 2024, the new ‘Retinol and HPR Ceramides Capsules', an anti-aging product, was launched by luxury skincare brand Elizabeth Arden. It helps to promote youthful skin appearance by stimulating collagen production, fading hyperpigmentation, smoothing skin texture, and improving tone.

- In November 2022, Nykaa launched SKINRX Ceramide Moisturizers. The goals of the moisturizer include a healthy skin barrier, which is key to nourishing and fresh skin. Because of the changing lifestyle, external aggressors like air pollution and UV rays may break the skin's protective barrier and create great damage to the skin.

Segments Covered in the Report

By Type

- Natural Ceramides

- Synthetic Ceramides

By Process

- Fermentation Ceramides

- Plant Extract Ceramides

- Food and Beverages

- Dietary Supplements

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting