What is the Cerebral Angiography Market Size?

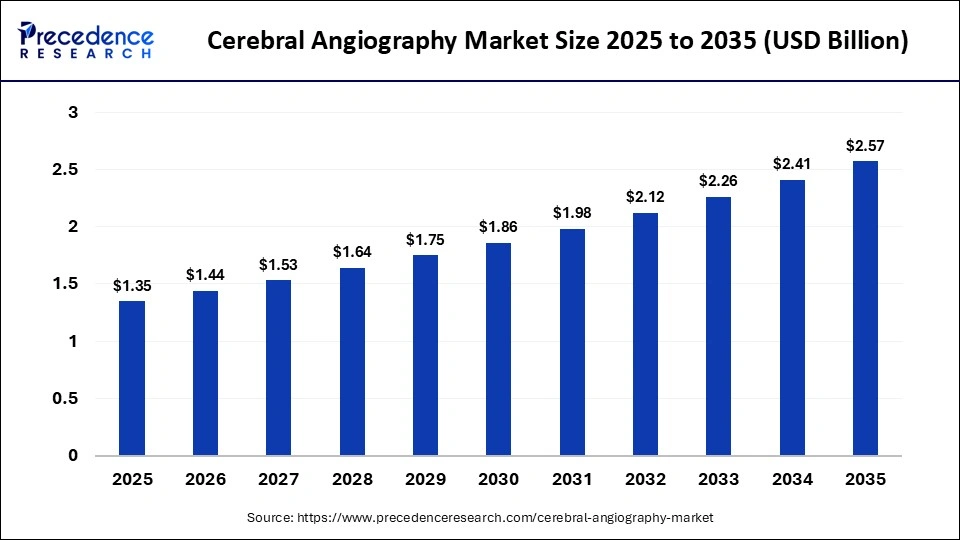

The global cerebral angiography market size was calculated at USD 1.35 billion in 2025 and is predicted to increase from USD 1.44 billion in 2026 to approximately USD 2.57 billion by 2035, expanding at a CAGR of 6.63% from 2026 to 2035.The cerebral angiography market is growing steadily, driven by rising stroke incidence, wider neurovascular imaging adoption, and continuous advancements in digital subtraction and AI-assisted angiography systems.

Market Highlights

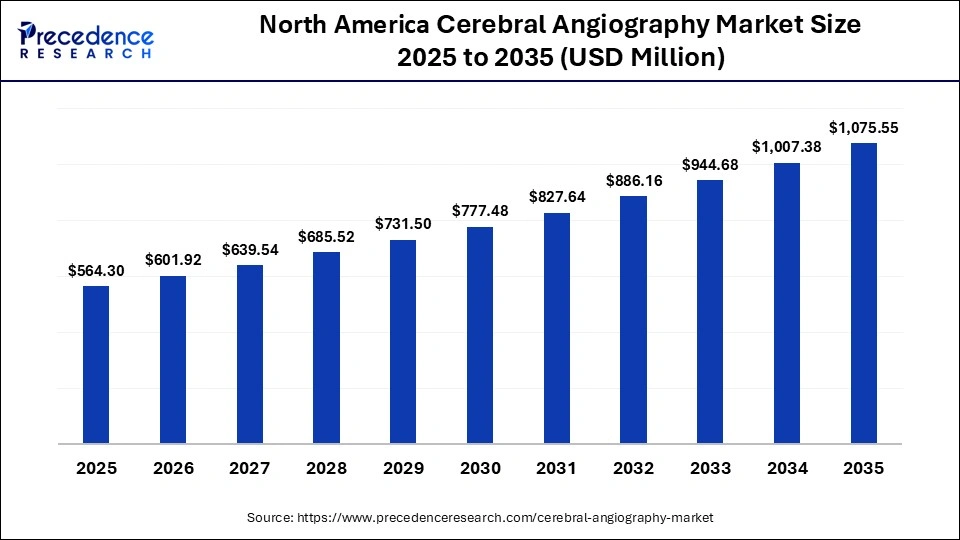

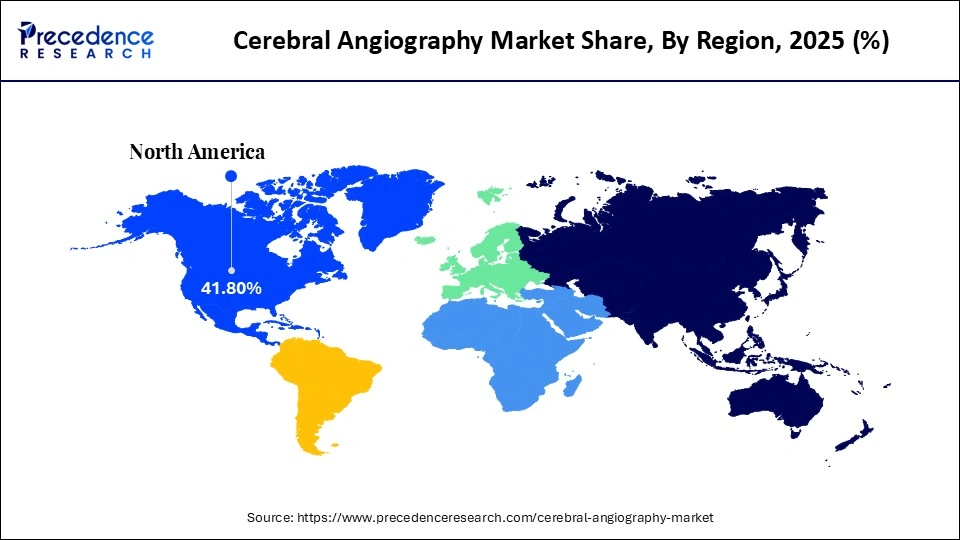

- North America led the global market with a largest market share of 41.8% in 2025.

- The Asia Pacific is estimated to grow at the fastest CAGR of 7.4% between 2026 and 2035.

- By product type, the cerebral angiography systems segment held the largest market share of 38.4% in 2025.

- By product type, the angiography catheters segment is growing at a strong CAGR of 6.90% between 2026 and 2035.

- By technology, the digital subtraction angiography (DSA) segment contributed the biggest market share of 46.7% in 2025.

- By technology, the other application segment is growing at a notable CAGR of 7.10% from 2026 to 2035.

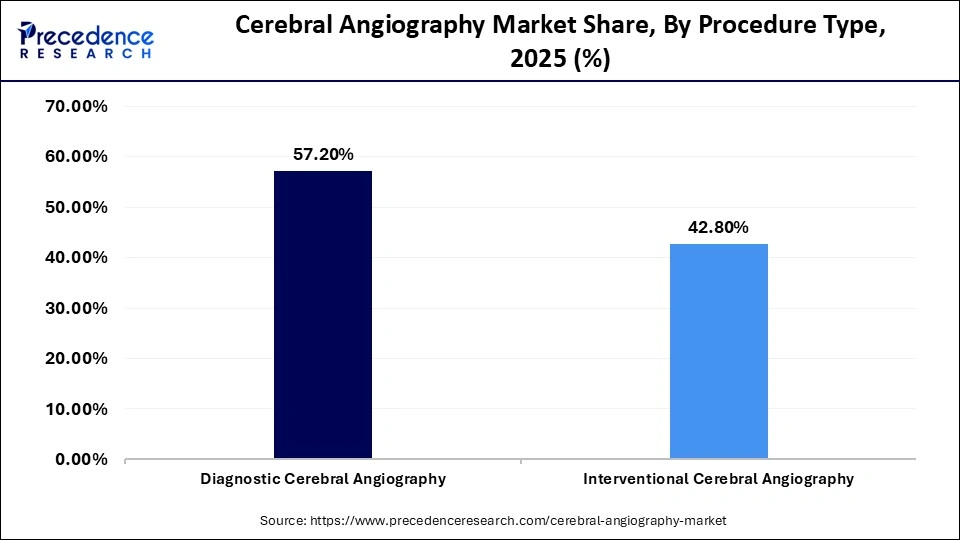

- By procedure type, the diagnostic cerebral angiography segment captured the biggest market share of 57.2% in 2025.

- By procedure type, the interventional cerebral angiography segment is poised to grow at a healthy CAGR of 6.8% between 2026 and 2035.

- By end-user, the hospitals segment accounted for the biggest market share of 63.90% in 2025.

- By end-user, the specialty neurology clinics segment is projected to grow at a solid CAGR of 6.7% between 2026 and 2035.

- By indication, the stroke segment generated the 34.60% market share in 2025.

- By indication, the aneurysm segment is expanding at the fastest CAGR of 6.6% between 2026 and 2035.

Cerebral Angiography Market Is Experiencing Increased Clinical Adoption

The cerebral angiography market comprises advanced imaging systems, contrast media, and catheter-based technologies used to visualize cerebral arteries and evaluate blood flow within the brain. These tools are critical for diagnosing complex neurovascular conditions, as cerebral angiography remains one of the most accurate and definitive techniques for assessing cerebrovascular anatomy and pathology. Its ability to provide high-resolution, real-time visualization makes it indispensable in cases where non-invasive imaging modalities may be insufficient.

Market growth is being driven by an increasing clinical focus on early and accurate detection of stroke, cerebral aneurysms, arteriovenous malformations, and vascular tumors. Technological advancements such as digital subtraction angiography, flat-panel detector systems, and real-time 3D imaging are significantly improving diagnostic precision while reducing procedure time and radiation exposure. These innovations are also expanding the role of cerebral angiography beyond diagnosis, as integration into interventional neurology workflows allows clinicians to use these systems for treatment planning, intra-procedural guidance, and post-intervention assessment.

Hospitals remain the primary end users due to their comprehensive infrastructure, availability of specialized staff, and capacity to manage complex neurovascular cases. However, demand is steadily increasing in specialized neurological and stroke centers, particularly for catheter-based angiography systems that support minimally invasive interventions. Ongoing emphasis on patient safety, reduced procedural invasiveness, and improved clinical outcomes is expected to reinforce long-term adoption of cerebral angiography technologies across diagnostic and interventional care settings.

AI Transforming The Cerebral Angiography Diagnostics & Care

The cerebral angiography market includes imaging machines, contrast media, and catheter-based methods to visualize and assess cerebral arteries in order to diagnose neurovascular disorders. It remains one of the most reliable ways for doctors to assess complex cerebrovascular diseases. Increased focus on early detection of stroke, aneurysms, arteriovenous malformations (AVM), and vascular tumors has driven the growth of the market. Furthermore, innovative technology advancements using digital subtraction angiography, flat-panel detector systems, and real-time 3D imaging are allowing for greater accuracy when diagnosing cerebrovascular disease and providing shorter procedures.

- In April 2025, Viz.ai unveiled its AI-powered Viz 3D CTA software that automatically converts CT angiography scans into detailed 3D views, enhancing neurovascular diagnostic clarity and providing interactive tools for faster, comprehensive imaging interpretation.

The integration of cerebral angiography into the intervention neurology workflow is significantly increasing the work of cerebral angiography beyond the diagnostic process and into treatment planning and guidance. Hospitals remain the primary users of cerebral angiography products due to their infrastructure support, however, there is growing demand for catheter based systems in specialized neurological centers. The continual emphasis on minimally invasive process improvements and patient safety will further strengthen the growth of the cerebral angiography market long-term.

Primary Trends Influencing the Development of the Cerebral Angiographic Market

- AI Assisted Imaging: The use of artificial intelligence to increase the quality of vessel visibility, improve lesion identification, and streamline the user's workflow has resulted in improved speed of diagnoses as well as increased effectiveness when treating complicated neurovascular cases for the clinician.

- Growth of Minimally Invasive Neuroimaging: There has been a shift in the market from invasive procedures to less invasive methods of obtaining diagnostic information, which has resulted in an increase in demand for cerebral angiographic systems as they pose lower risk to patients, shorter recovery times, and better results for the evaluation of strokes and aneurysms.

- Advances in flat panel detector technology: The advancement of next-generation flat panel detector systems has resulted in improved spatial resolution, dose efficiency, and overall image clarity for the imaging of cerebral vessels, as well as improved overall treatment due to the greater emphasis placed by regulators on the reduction of radiation exposure and improved image quality by optimizing imaging protocols through the development of new technology.

- Expanding Use in the Management of Acute Stroke: Increasingly, physicians are relying on the use of cerebral angiography in the acute stroke pathway to provide timely assessment of the vasculature and treatment options for their patients, as healthcare providers continue to place increasing importance on providing the fastest means of intervention for patients suffering from an ischemic stroke.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.35 Billion |

| Market Size in 2026 | USD 1.44 Billion |

| Market Size by 2035 | USD 2.57 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Technology, Procedure Type, End User, Indication, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why are Cerebral Angiography Systems so Dominant?

Cerebral angiography systems have the greatest market share of 38.40% in 2025 because of their importance in providing accurate visualization of neurovasculature with high-quality neurovascular imaging. Furthermore, the systems comprise a number of different items, such as imaging hardware, imaging software, and process improvements. Hospitals invest in upgrading their cerebral angiography system to improve the clarity of their images, their ability to limit radiation doses, and their process efficiencies. As a result, Cerebral Angiography Systems are considered one of the key investments that neuroimaging divisions make.

The angiography catheter segment is expected to be the fastest-growing, with an expected 6.9% CAGR, which consists of products that use catheters to access the blood vessels in the brain and is growing the fastest within the market. The increased volume of new minimally invasive procedures associated with the treatment of neurovascular disease is driving this growth rate. The ability to use the most flexible catheters, combined with the use of hydrophilic coatings for catheter navigation and improved navigation capabilities, is increasing the number of procedures conducted using catheters in the more complex anatomy of the brain. Also, as more angiographic procedures are performed for the management of both strokes and aneurysms, the recurring demand for catheters is increasing because they may only be used once and must be replaced after each use.

Technology Insights

What Is the Reason for DSA to be the Leader in This Market?

The digital subtractive process (DSA) dominated the technology segment with a 46.7% share by providing high levels of spatial (3D) resolution and temporal (2D) resolution, allowing highly detailed images of the cerebral arteries. The DSA is used throughout the world as the primary method for diagnosing and treating patients with complex cerebral vascular disease, including stroke and aneurysms. As patients with neurovascular disease require real-time accuracy in their diagnoses and treatments, the DSA will remain an integral part of any advanced neurointerventional suite, despite expensive support costs associated with DSA systems.

The computed tomographic angiography is set to become the fastest-growing technology with a 7.1% CAGR because it is not only noninvasive to the patient, but it can also produce images much faster than DSA. The CTA is now most often used for the initial evaluation of patients with suspected stroke in emergency departments, where the speed at which a diagnosis can be made and treatment started is critical. Improvements in image quality due to improved scanner resolution and enhanced contrast optimization will lead to more CTA systems being placed in secondary hospitals and diagnostic imaging centers.

Procedure Type Insights

Why Does Delegation of Diagnostic Cerebral Angiography Represent the Largest Segment during 2025?

As the diagnostic cerebral angiography segment dominated the cerebral angiography market with a 57.2% share in 2025, it was that a person had an abnormal vascular (blood vessel) condition prior to any treatment decision being made. The use of the diagnostic cerebral angiography will continue to rise, as the need for an accurate and fast diagnosis of neurological disorders and an increase in neurological disorders are increasing. This will support continued volumes of procedures taking place worldwide.

Interventional cerebral angiography, on the other hand, is predicted to be the fastest-growing segment with a 6.8% CAGR, as there is a trend of adopting minimally invasive (non-surgical) treatments of neurovascular disease, including angiographic thrombectomy procedures, coiling of an aneurysm, or placement of a stent, which are becoming the preferred method of treatment compared to open surgical techniques. Continued technological advancements and increasing knowledge and experience of clinicians in treating patients in comprehensive stroke centers have resulted in increased performance of procedures in comprehensive stroke centers, and subsequently more individuals will now be seeking neurovascular intervention using this technique.

End User Insights

Why Hospitals Dominate the Cerebral Angiography Market in Terms of End Users in 2025?

Hospitals are the largest end-user segment in 2025 with a 63.9% share, due to their superior imaging resources and multidisciplinary neurocare capabilities. Cerebral angiography is normally provided with intensive care support and also requires specialized imaging suites and neuro-interventional teams, all of which are only available in hospitals. Hospitals' emergency stroke treatment and increased number of patients support hospital-oriented procedures.

Specialty neurology clinics are expected to be the fastest-growing segment with a 6.7% CAGR, as outpatient neurodiagnostic services continue to expand. Neurology clinics are progressively utilizing advanced imaging technology for precise neurological evaluations and pre- and post-procedure evaluations and have supported growth by providing decentralized care, shorter hospital stays, and increased demand for more specialized, patient-centered neurological services.

Indication Insights

Why Is the Stroke Segment Dominating the Cerebral Angiography Market During 2025?

Stroke is the primary indication in the cerebral angiography market in 2025 with a 34.6% share, because cerebral angiography has an important role in the diagnostic work-up and treatment planning. Without imaging ability to assess the location and severity of the vessel occlusions, stenosis, and collateral circulation, stroke care cannot be adequately planned. Since ischemic stroke incidents are increasing while at the same time there are newer, advanced modalities of stroke care being offered, there is a sustained high volume of angiographic procedures.

Aneurysms are set to be the fastest-growing segments in the coming years with a 6.6% CAGR because of the increased number of clinically positive aneurysm patients who have not yet been diagnosed. The increased incidence of aneurysms being discovered incidentally through the increased use of advanced imaging techniques has resulted in higher volumes of procedures being performed for aneurysms. Additionally, endovascular management of aneurysms is becoming preferred to existing open surgical approaches. As a result, there is an increasing reliance on cerebral angiography both as a means of diagnosing aneurysms and as a way of providing guidance during procedural interventions.

Regional Insights

How Big is the North America Cerebral Angiography Market Size?

The North America cerebral angiography market size is estimated at USD 564.30 million in 2025 and is projected to reach approximately USD 1,075.55 million by 2035, with a 6.66% CAGR from 2026 to 2035.

Why is North America the top region for Cerebral Angiography Market?

North America dominated the cerebral angiography market with a 41.8% share, supported by its highly developed healthcare infrastructure, widespread access to state-of-the-art imaging technologies, and consistently high healthcare expenditure levels. Hospitals across the region are increasingly expanding interventional radiology and neurointerventional services, which is driving higher utilization of cerebral angiography for both diagnostic evaluation and image-guided treatment of complex cerebrovascular conditions.

The region also benefits from a strong concentration of highly trained neurologists, interventional radiologists, and neurosurgeons, enabling safe and effective use of advanced angiographic systems. Continuous improvements in imaging quality, radiation dose management, and procedural efficiency are further strengthening clinical confidence and adoption. Combined with ongoing technology upgrades and strong institutional investment, these factors are reinforcing North America's sustained leadership in the cerebral angiography market.

What is the Size of the U.S. Cerebral Angiography Market?

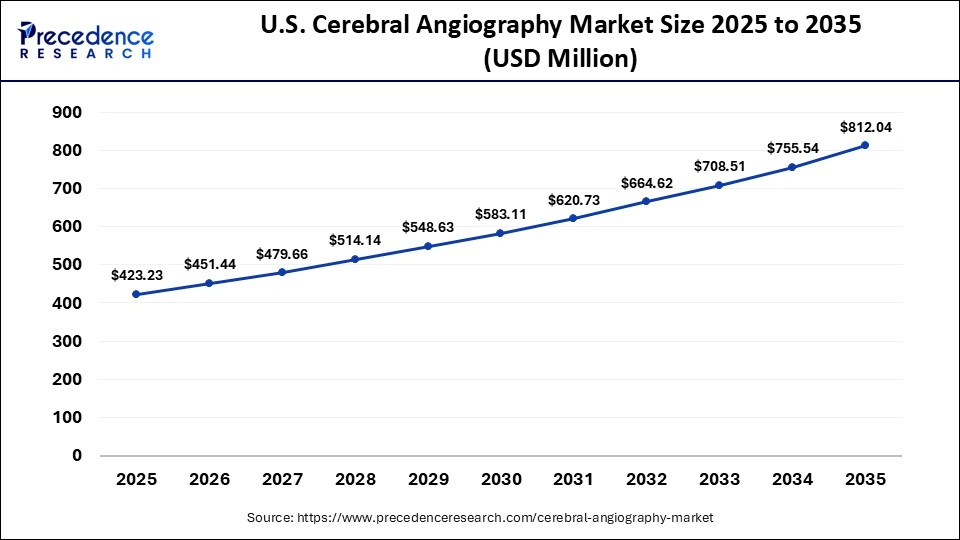

The U.S. cerebral angiography market size is calculated at USD 423.23 million in 2025 and is expected to reach nearly USD 812.04 million in 2035, accelerating at a strong CAGR of 6.73% between 2026 and 2035.

U.S. Cerebral Angiography Market Trends

The United States has one of the most extensive healthcare systems and is among the earliest adopters of advanced imaging technologies capable of producing high-resolution angiograms. In the United States, there is a strong clinical focus on diagnosing and treating neurological conditions, with advanced imaging tools routinely used for stroke, aneurysm, and cerebrovascular disease management. High concentrations of specialized stroke centers, academic medical institutions, and interventional radiology programs further support widespread cerebral angiography use.Robust reimbursement frameworks and continuous investment in imaging innovation reinforce the country's position as the leading hub for cerebral angiography in North America.

How Europe is Entering a New Era of the Cerebral Angiography Market?

Europe is entering a new phase in the cerebral angiography market, driven by universal access to healthcare systems and a growing strategic emphasis on the management of cerebrovascular diseases. Stroke prevention, early diagnosis of aneurysms, and treatment of complex neurovascular conditions are increasingly prioritized within national health agendas, ensuring consistent utilization of cerebral angiography services. The availability of structured referral pathways and standardized care protocols across many European countries supports timely deployment of angiographic procedures in both diagnostic and interventional settings.

At the same time, modernized healthcare initiatives across Western and Northern Europe are accelerating the adoption of advanced angiography systems with improved imaging resolution, lower radiation exposure, and enhanced procedural efficiency. Investments in hospital infrastructure are being complemented by strong collaboration between academic medical centers and imaging equipment manufacturers, enabling faster clinical research translation and broader dissemination of new technologies. These partnerships are improving operator training, refining procedural techniques, and expanding clinical applications, collectively positioning Europe at the forefront of the next generation of cerebral angiography adoption.

Germany Cerebral Angiography Market Trends

Germany has established itself as a leader in the provision of healthcare services across Europe due to its well-developed and extensive healthcare delivery system that provides high-quality diagnostic imaging services. Furthermore, Germany has developed a substantial infrastructure to ensure that hospitals, physicians, and other licensed professionals receive ongoing training and access to new technologies, which supports increased or improved usage of next-generation angiographic platforms throughout Germany.

Why Is the Middle East & Africa Region Driving the Use Of Cerebral Angiography?

The Middle East and Africa are emerging as important growth regions for cerebral angiography, largely due to sustained investment in healthcare infrastructure and diagnostic capacity expansion. Governments across the region are prioritizing the development of advanced diagnostic services as part of broader healthcare modernization strategies, with a strong focus on addressing the rising burden of neurological and cerebrovascular diseases. Several countries are actively establishing specialized “centers of excellence” for neurology and stroke care, where cerebral angiography is a core capability for accurate diagnosis and image-guided intervention.

These centers of excellence are equipping radiologists and neurologists with access to advanced angiography systems, trained personnel, and integrated interventional suites. Rapid urbanization is further strengthening this trend, as expanding metropolitan areas demand higher-quality tertiary care and specialized neurovascular services. In parallel, growing collaboration between public healthcare providers, private hospital groups, and international imaging technology manufacturers is improving access to advanced cerebral angiography systems. These partnerships are accelerating technology transfer, clinical training, and adoption of best practices, enabling broader availability of high-precision neurovascular imaging across the Middle East and Africa.

UAE Cerebral Angiography Market Trends

The UAE is playing a leadership role in the development of state-of-the-art hospitals within the Middle East & Africa region through the inclusion of advanced imaging equipment. By developing strategic healthcare initiatives and establishing international partnerships, these measures are enabling the UAE to enhance the standard of care it provides as well as be one of the most likely countries to adopt cerebral angiography in the Middle East & Africa. Centralized stroke programs and neurointerventional centers in the United Arab Emirates are accelerating clinical utilization of cerebral angiography for both diagnosis and image-guided treatment. Targeted investment in specialist training and high-throughput interventional suites is further supporting procedural volume growth across public and private hospitals.

Why Is the Cerebral Angiography Market Growing in Latin America?

Latin America's cerebral angiography market is expanding as hospitals and diagnostic centers increase capacity through targeted investments in radiology and interventional imaging infrastructure. Public-private collaboration is playing a central role, enabling healthcare facilities to upgrade angiography suites, acquire modern imaging systems, and expand neurointerventional services. This is particularly evident in large metropolitan areas across Brazil and Mexico, where tertiary hospitals are strengthening stroke and neurovascular care capabilities to meet rising patient demand.

Growth is further supported by increasing awareness of cerebrovascular diseases and wider adoption of screening and early diagnostic protocols. As stroke, aneurysms, and other neurovascular conditions gain recognition as major public health concerns, clinicians are relying more frequently on cerebral angiography as part of comprehensive diagnostic workups. Improved access to trained neurologists and interventional radiologists, combined with better referral pathways in urban healthcare systems, is leading to a higher volume of angiographic procedures and reinforcing steady market growth across Latin America.

Brazil Cerebral Angiography Market Trends

Brazil represents a major hub for the cerebral angiography market in Latin America, supported by a large base of public and private healthcare facilities actively upgrading their imaging and interventional radiology infrastructure. Major hospitals in Brazil are investing in modern angiography suites to strengthen stroke care, neurovascular diagnostics, and image-guided interventions, particularly in high-volume urban centers. In parallel, expanded training programs for interventional radiologists and neurologists, along with broader availability of advanced diagnostic methods, are improving procedural capability and clinical confidence. These developments are enabling earlier diagnosis, more complex interventions, and higher procedural volumes, positioning Brazil as a leading contributor to the growth of the cerebral angiography market across Latin America.

Who are the Major Players in the Global Cerebral Angiography Market?

The major players in the cerebral angiography market include Abbott, B., Braun Melsungen AG, AngioDynamics, Medtronic, Shimadzu Corporation, Cardinal Health., Boston Scientific Corporation, Canon Inc., Siemens Healthcare GmbH, Koninklijke Philips N.V., General Electric Company, Merit Medical Systems, MEDTRON AG, and InterMed Medical.

Recent Developments

- In December 2025, Stratasys announced full commercial availability of its RadioMatrix radiopaque 3D printing material across the U.S., enabling healthcare providers and researchers to create patient-specific models with tunable X-ray visibility for imaging and training.(Source: https://www.genengnews.com)

- In February 2025, The FDA granted 510(k) clearance to RapidAI's Lumina 3D software, which delivers AI-powered 3D CTA reconstructions of head and neck scans within minutes, improving visualization and accelerating neuroradiology workflow.(Source: https://www.diagnosticimaging.com)

Segments Covered in the Report

By Product Type

- Cerebral Angiography Systems

- Angiography Catheters

- Guidewires

- Contrast Media

By Technology

- Digital Subtraction Angiography (DSA)

- Computed Tomography Angiography (CTA)

- Magnetic Resonance Angiography (MRA)

By Procedure Type

- Diagnostic Cerebral Angiography

- Interventional Cerebral Angiography

By End User

- Hospitals

- Diagnostic Imaging Centers

- Specialty Neurology Clinics

By Indication

- Stroke

- Aneurysm

- Arteriovenous Malformation (AVM)

- Carotid Artery Disease

- Brain Tumors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting