What is the Chemoinformatics Market Size?

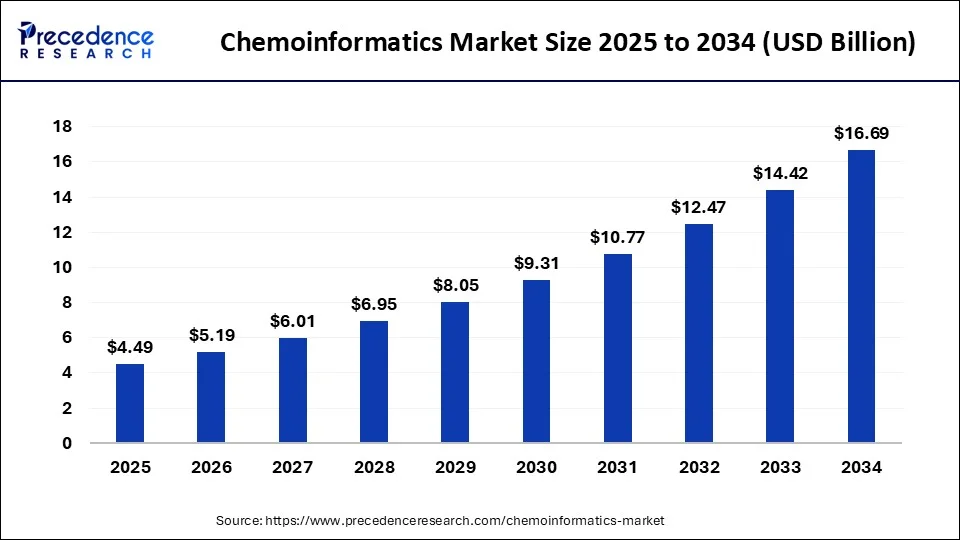

The global chemoinformatics market size is valued at USD 4.49 billion in 2025 and is predicted to increase from USD 5.19 billion in 2026 to approximately USD 16.69 billion by 2034, expanding at a CAGR of 15.71% from 2025 to 2034.

Chemoinformatics Market Key Takeaways

- The global chemoinformatics market was valued at USD 3.88 billion in 2024.

- It is projected to reach USD 16.69 billion by 2034.

- The chemoinformatics market is expected to grow at a CAGR of 15.71% from 2025 to 2034.

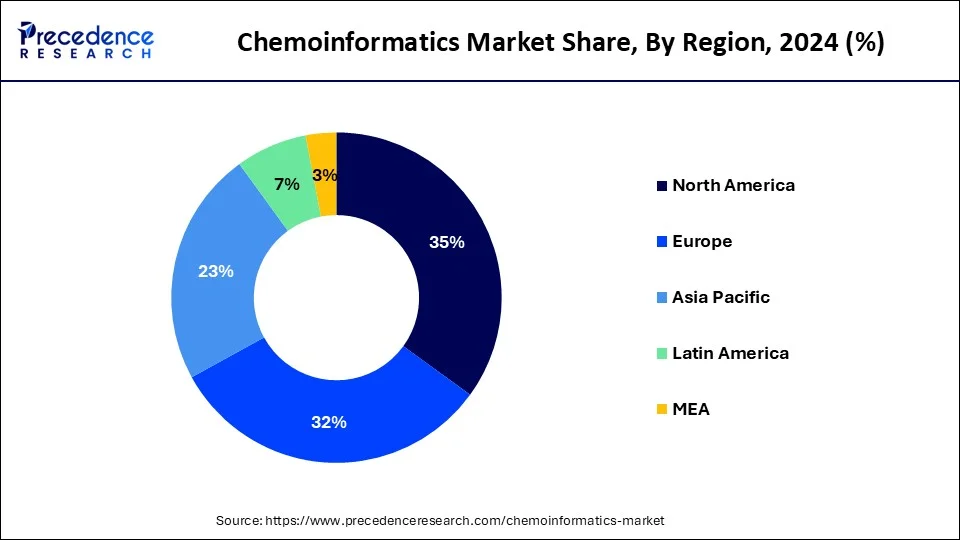

- North America contributed more than 35% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product type, the software segment has held the largest market share of 41% in 2024.

- By product type, the services segment is anticipated to grow at a remarkable CAGR of 9.5% between 2025 and 2034.

- By application, the chemical analysis segment generated over 30% of revenue share in 2024.

- By application, the molecular modeling segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Chemoinformatics is a specialized field that applies computer science techniques to handle and analyze chemical data. It involves using computational methods to organize, store, retrieve, and study information related to chemical structures. This discipline is particularly valuable in drug discovery and materials science, where understanding the relationships between molecular structures and properties is crucial.

In drug discovery, chemoinformatics aids researchers by predicting the activities of compounds, optimizing their structures, and facilitating virtual screening. It relies on the development of databases, algorithms, and software tools to efficiently manage vast amounts of chemical information. By harnessing computational approaches, chemoinformatics streamlines the process of discovering and designing new compounds, contributing significantly to advancements in pharmaceuticals and materials science. As technology progresses, chemoinformatics continues to provide researchers with essential tools to navigate the intricate realm of chemical information and make well-informed decisions in their scientific pursuits.

Chemoinformatics Market Growth Factors

- Increasing Drug Discovery Demands: Growing emphasis on drug development and discovery is a significant factor propelling the demand for advanced chemoinformatics tools.

- Rising Application in Material Science: The expanding role of chemoinformatics in material science applications is driving market growth, particularly in designing and optimizing materials.

- Technological Advancements: Ongoing advancements in computational technologies enhance the efficiency and capabilities of chemoinformatics tools, fostering market expansion.

- Drug Repurposing Trends: The trend of drug repurposing, where existing drugs are explored for new therapeutic indications, boosts the need for sophisticated chemoinformatics approaches.

- Increased Collaboration in Research: Growing collaboration among research institutions and pharmaceutical companies amplifies the utilization of chemoinformatics tools, contributing to market growth.

- Big Data Integration: The integration of big data analytics in chemoinformatics enables handling and analysis of large datasets, supporting more comprehensive research efforts.

- Personalized Medicine Initiatives: The shift towards personalized medicine drives the demand for tailored drug design, creating opportunities for chemoinformatics solutions.

- Rising Focus on Green Chemistry: The increasing emphasis on sustainable and environmentally friendly practices in chemistry contributes to the adoption of chemoinformatics for eco-friendly materials design.

- Expanding Role in Toxicology Studies: Chemoinformatics tools play a crucial role in predicting and assessing the toxicity of chemical compounds, supporting advancements in toxicology studies.

- Growing Adoption in Agrochemical Research: The agriculture sector's increasing focus on chemical research for crop protection and enhancement fuels the growth of chemoinformatics applications.

- Surge in Computational Chemistry: The rise of computational chemistry as a field intensifies the demand for chemoinformatics tools for data analysis and modeling.

- Regulatory Compliance Needs: Stricter regulatory requirements in pharmaceutical and chemical industries drive the adoption of chemoinformatics tools for compliance and documentation.

- Advancements in Machine Learning: Integration of machine learning algorithms into chemoinformatics platforms enhances predictive modeling and decision-making capabilities.

- Globalization of Research Efforts: International collaborations and the globalization of research initiatives contribute to the widespread adoption of chemoinformatics tools.

- Focus on Rare Diseases: The increasing focus on rare diseases prompts the use of chemoinformatics in identifying potential treatments and accelerating drug development.

- Demand for Open-Source Platforms: The preference for open-source chemoinformatics platforms increases, fostering community-driven development and accessibility.

- Growing Biotechnology Sector: Expansion of the biotechnology industry further propels the demand for chemoinformatics tools in areas like genomics and proteomics.

- Enhanced Chemogenomics Applications: The integration of chemoinformatics with genomics data enhances applications in chemogenomics, supporting drug target identification.

- Escalating Data Integration Challenges: The complexity of integrating diverse chemical data sources boosts the need for advanced chemoinformatics solutions for seamless data handling.

- Increasing Funding for Research: Rising investments and funding in chemical and pharmaceutical research provide the financial support necessary for the development and adoption of innovative chemoinformatics technologies.

- Bio-Rad Laboratories annual revenue for 2021 was $2.923B, a 14.81% increase from 2020. Bio-Rad Laboratories annual revenue for 2020 was $2.546B, a 10.12% increase from 2019.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 15.71% |

| Market Size in 2025 | USD 4.49 Billion |

| Market Size in 2026 | USD 5.19 Billion |

| Market Size by 2034 | USD 16.69 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Material science applications and drug discovery demands

The surge in material science applications and drug discovery demands significantly propels the growth of the chemoinformatics market. In material science, chemoinformatics tools play a pivotal role in designing and optimizing materials with specific properties, enabling researchers to make informed decisions in material development. The demand for novel materials in industries such as electronics, energy, and aerospace amplify the need for advanced chemoinformatics solutions, driving market expansion. In the realm of drug discovery, the ever-increasing demand for innovative and effective pharmaceuticals fuels the adoption of chemoinformatics.

These tools expedite the drug discovery process by facilitating virtual screening, predicting molecular activities, and optimizing chemical structures. As pharmaceutical companies strive to bring new and improved drugs to market, the reliance on chemoinformatics for data analysis and modeling becomes paramount, stimulating market growth. The intersection of material Science Applications and drug discovery Demands positions chemoinformatics as a critical enabler for advancements in both fields, driving sustained market demand.

Restraint

Integration complexities and lack of interoperability

Integration complexities and a lack of interoperability act as substantial restraints on the chemoinformatics market. The challenge lies in seamlessly integrating chemoinformatics tools with existing laboratory information management systems (LIMS) and other software used in research workflows. This complexity can disrupt the efficiency of data exchange and collaboration within research environments, impeding the adoption of chemoinformatics solutions. Researchers often face hurdles in ensuring a harmonious integration that allows for smooth interoperability between diverse chemoinformatics software and databases. The absence of standardized formats and protocols exacerbates these integration challenges, hindering the development of a unified ecosystem. This lack of interoperability limits the fluid exchange of chemical information, stifling the collaborative potential of chemoinformatics across different research domains. As a result, organizations may encounter difficulties in achieving a cohesive and integrated approach to data analysis, slowing down the overall market demand for chemoinformatics solutions in scientific research and drug discovery.

Opportunity

Increasing adoption in agriculture and rapid growth in biotechnology

The increasing adoption of chemoinformatics in agriculture and the rapid growth of biotechnology present significant opportunities in the market. In agriculture, chemoinformatics plays a pivotal role in optimizing crop protection and enhancing agricultural practices. By leveraging chemoinformatics tools, researchers can design more efficient and targeted agrochemicals, contributing to sustainable farming practices and improved crop yields. This adoption in agriculture creates a substantial market opportunity as the agriculture sector seeks innovative solutions for precision farming and sustainable agrochemical development.

Simultaneously, the rapid growth in biotechnology provides a fertile ground for the application of chemoinformatics. The expanding biotechnology sector relies on chemoinformatics in genomics, proteomics, and other molecular biology domains. As biotechnological research becomes increasingly data-driven, the demand for advanced chemoinformatics tools rises, creating opportunities for market growth. Chemoinformatics facilitates the analysis of complex biological data, aiding researchers in drug discovery, biomarker identification, and other biotechnological applications, thereby positioning itself as a crucial component in the evolving landscape of biotechnology.

Product Type Insights

In 2024, the software segment had the highest market share of 41% on the basis of the product type. In the chemoinformatics market, the software segment comprises computational tools and applications designed for the analysis, modeling, and visualization of chemical data. These software solutions assist researchers in drug discovery, materials science, and other chemical research domains. Trends in the software segment include the integration of artificial intelligence and machine learning, enhancing predictive modeling capabilities. Additionally, there's a growing emphasis on user-friendly interfaces, facilitating broader adoption across research communities and industries, and an increased focus on developing open-source platforms for collaborative and accessible chemoinformatics solutions.

The services segment is anticipated to expand at a significant CAGR of 9.5% during the projected period. In the chemoinformatics market, the services segment encompasses a range of offerings provided by companies specializing in chemical informatics. These services may include consultancy, training, software customization, and data analysis support. The trend in the services segment reflects a growing demand for tailored solutions to address specific research and development needs. Companies are increasingly seeking expert guidance in optimizing their chemoinformatics workflows, implementing efficient data management strategies, and ensuring seamless integration of chemoinformatics tools into their existing systems.

Application Insights

According to the application, the chemical analysis segment has held 30% revenue share in2024. In the chemoinformatics market, the chemical analysis segment involves the application of computational methods to analyze and interpret chemical data. It aids in the identification, characterization, and optimization of chemical compounds, crucial for drug discovery and materials science. A prominent trend in this segment is the integration of advanced algorithms and machine learning techniques, enhancing the precision and efficiency of chemical analysis. The demand for chemoinformatics solutions in chemical analysis is driven by the need for accurate predictions, structure-activity relationship modeling, and data-driven decision-making in diverse industries.

The molecular modeling segment is anticipated to expand fastest over the projected period. Molecular modeling, a key segment in the chemoinformatics market, involves the computational representation and simulation of molecular structures to analyze their properties and interactions. This segment is witnessing a trend towards increased accuracy and efficiency in predictive modeling, driven by advancements in machine learning and artificial intelligence. Researchers are leveraging molecular modeling to streamline drug discovery, predict chemical reactions, and optimize materials design. The continual refinement of algorithms and methodologies in molecular modeling within the chemoinformatics market reflects a growing emphasis on precision and innovation in computational chemistry applications.

Regional Insights

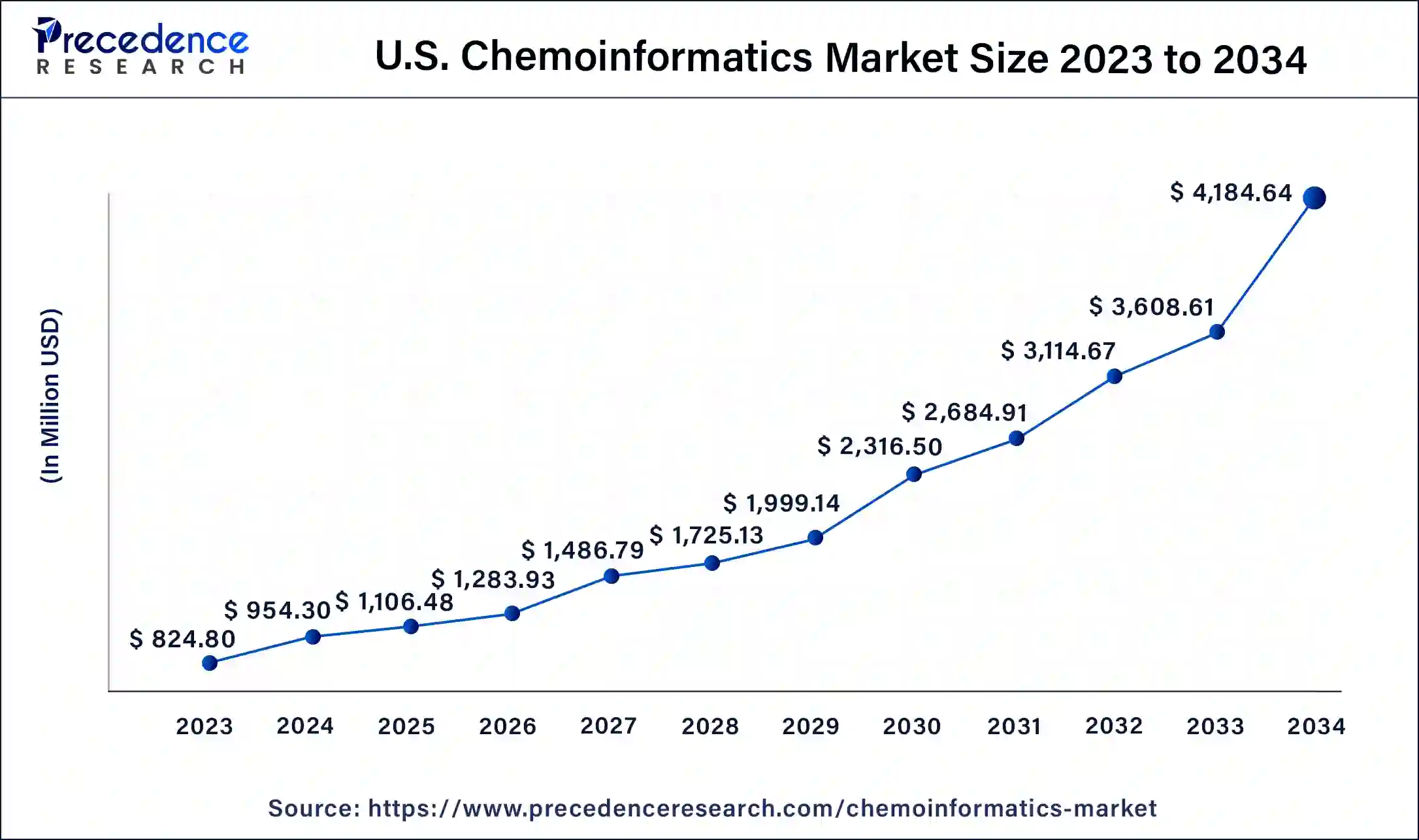

U.S. Chemoinformatics Market Size and Growth 2025 to 2034

The U.S. chemoinformatics market size is estimated at USD 1.11 billion in 2025 and is predicted to be worth around USD 4.18 billion by 2034, at a CAGR of 15.97% from 2025 to 2034.

North America has held the largest revenue share 35% in 2024. North America dominates the chemoinformatics market due to its robust research infrastructure, substantial investments in pharmaceutical and biotechnology industries, and a high concentration of key market players. The region benefits from advanced technological capabilities and a strong emphasis on innovation, driving the adoption of chemoinformatics tools in drug discovery and materials science. Additionally, favorable government initiatives and strategic collaborations further contribute to North America's significant share in the chemoinformatics market, making it a focal point for industry growth and advancements.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific dominates the chemoinformatics market due to factors such as the region's robust pharmaceutical and biotechnology sectors, growing investments in research and development, and increasing adoption of advanced technologies. The presence of a large pool of skilled professionals, coupled with rising government initiatives supporting scientific research, contributes to the market's substantial share. Moreover, the burgeoning demand for novel drugs and materials in countries like China and India propels the utilization of chemoinformatics tools, solidifying Asia-Pacific's position as a key player in this dynamic market.

Chemoinformatics Market Companies

- ChemAxon

- OpenEye Scientific Software

- BIOVIA (Dassault Systèmes)

- Schrödinger

- PerkinElmer

- CDD (Collaborative Drug Discovery)

- ACD/Labs

- BioSolveIT

- Jubilant Biosys

- Genedata

- ChemComp

- Molecular Networks

- Cheminformatics Inc.

- ChemBridge Corporation

- ChemZoo Inc.

Recent Developments

- In September 2022, BIOVIA introduced BIOVIA Materials Studio 2022, focusing on polymer simulation and modeling. This latest release amplifies capabilities in modeling polymers and nanocomposites.

- In June 2021, PerkinElmer unveiled Signals Notebook as part of its Signals software suite, providing electronic lab notebook features to streamline workflow automation and foster collaboration.

- March 2020witnessed the launch of Schrödinger's FEP+ software, designed for more precise free energy perturbation calculations, leading to improved predictions of drug binding affinities.

- BIOVIA expanded its materials modeling expertise for polymers, crystals, and surfaces in January 2022 through the acquisition of CISS.

- In June 2021, PerkinElmer collaborated with Hexagon Bio to enhance informatics capabilities for biopharmaceutical companies.

Segments Covered in the Report

By Product Type

- Software

- Services

- Others

By Application

- Chemical Analysis

- Drug Discovery

- Molecular Modeling

- Regulatory Compliance

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting