Electronic Lab Notebook Market Size and Forecast 2025 to 2034

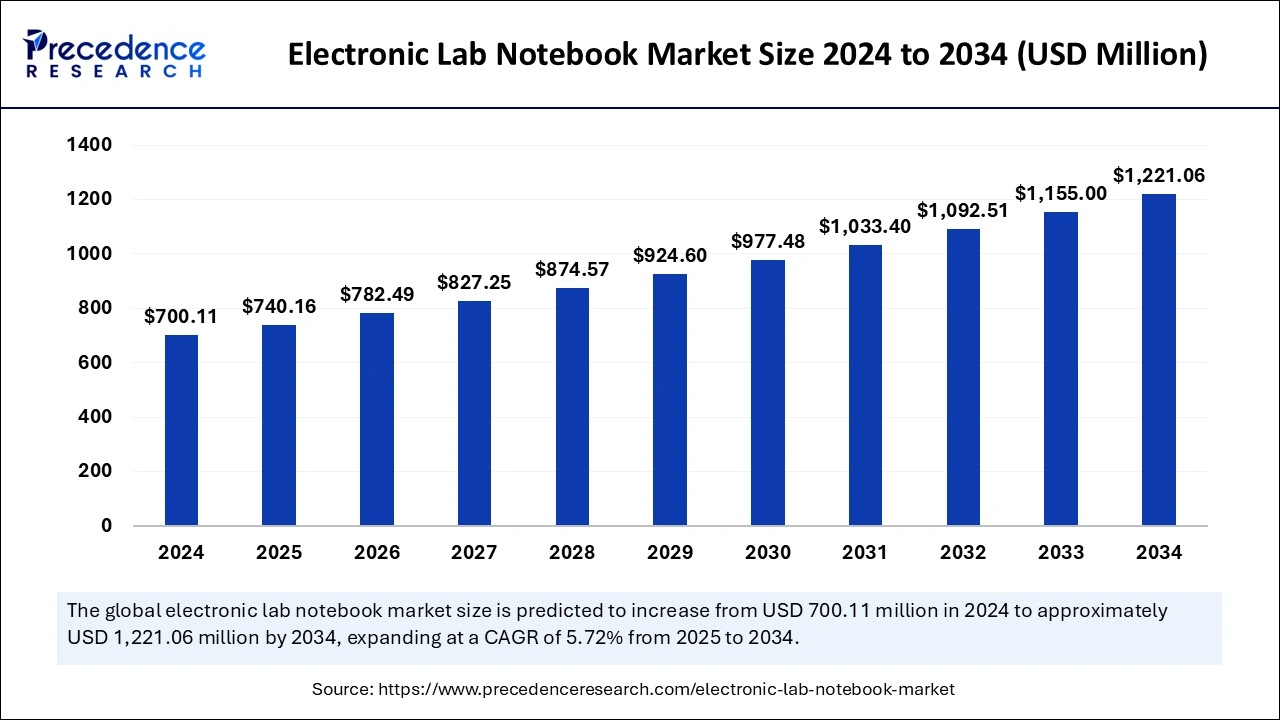

The global electronic lab notebook market was calculated at USD 700.11 million in 2024 and is predicted to increase from USD 740.16 million in 2025 to approximately USD 1,221.06 million by 2034, expanding at a CAGR of 5.72% from 2025 to 2034. The increasing digitization of industrial operations like research laboratories and pharmaceuticals drives the market's growth.

Electronic Lab Notebook Market Key Takeaways

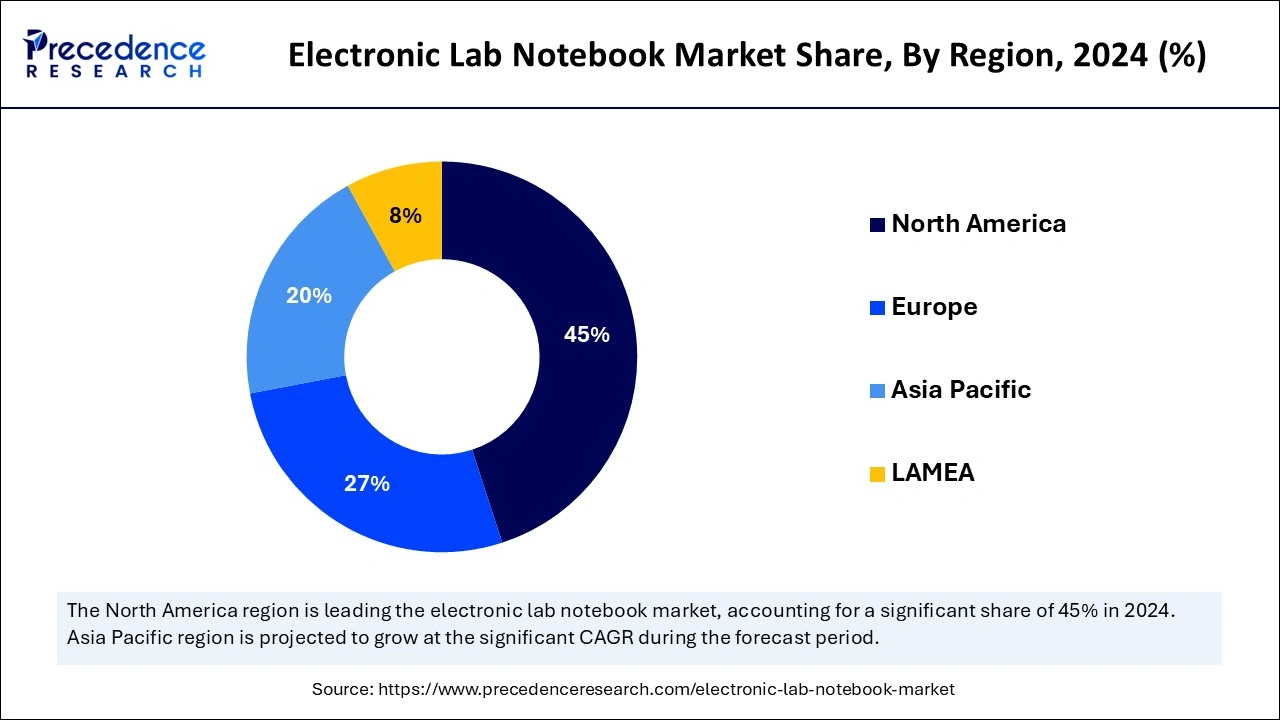

- North America dominated the electronic lab notebook market, with a 5% market share in 2024.

- Asia Pacific is projected to grow at a notable CAGR of 7.79% during the predicted period.

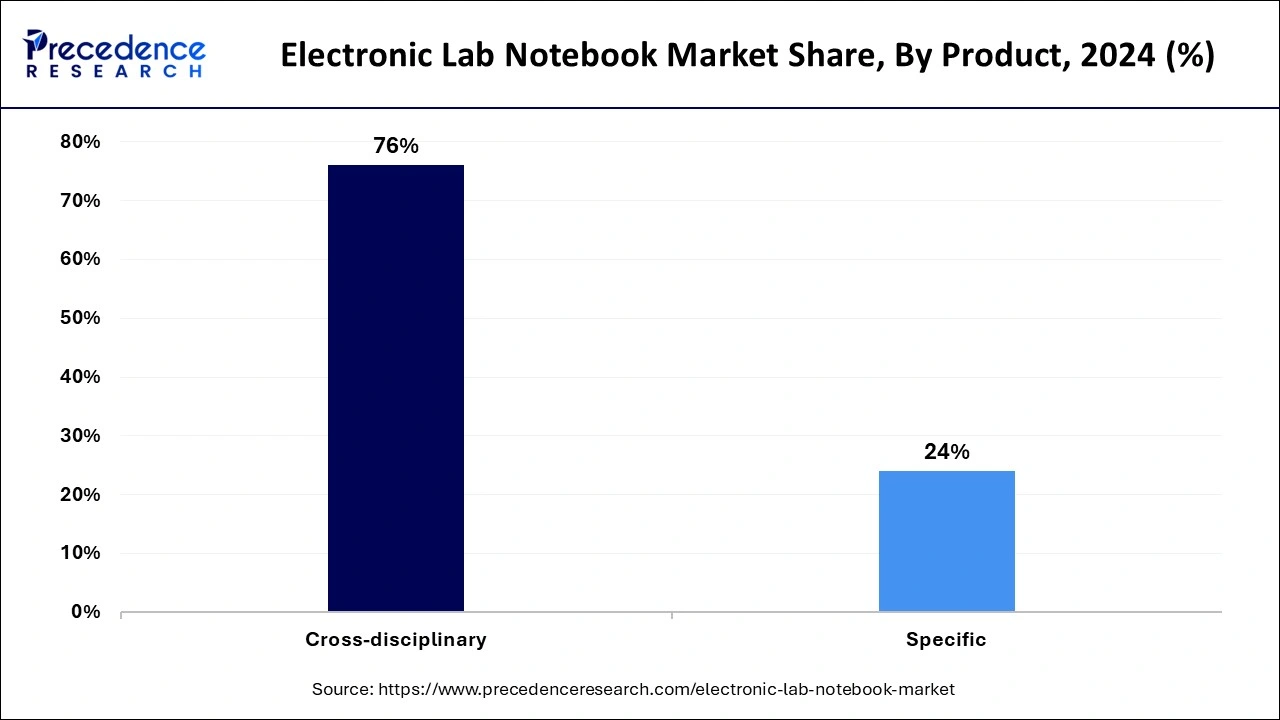

- By product, the cross-disciplinary segment has held a major market share of 76% in 2024.

- The specific segment is expected to expand at a CAGR of 5.04% by product during the forecast period.

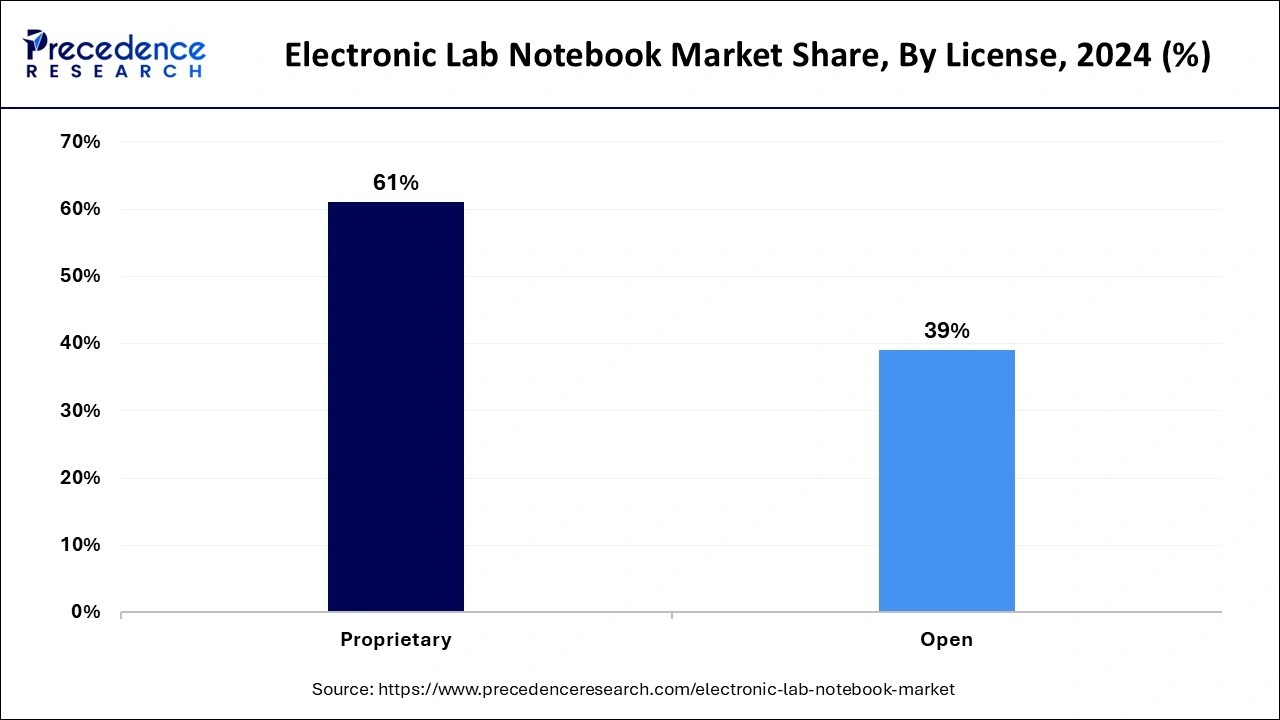

- By license, the proprietary segment recorded the highest market share of 62% in 2024.

- By license, the open segment expects the fastest CAGR of 5.24% during the forecast period.

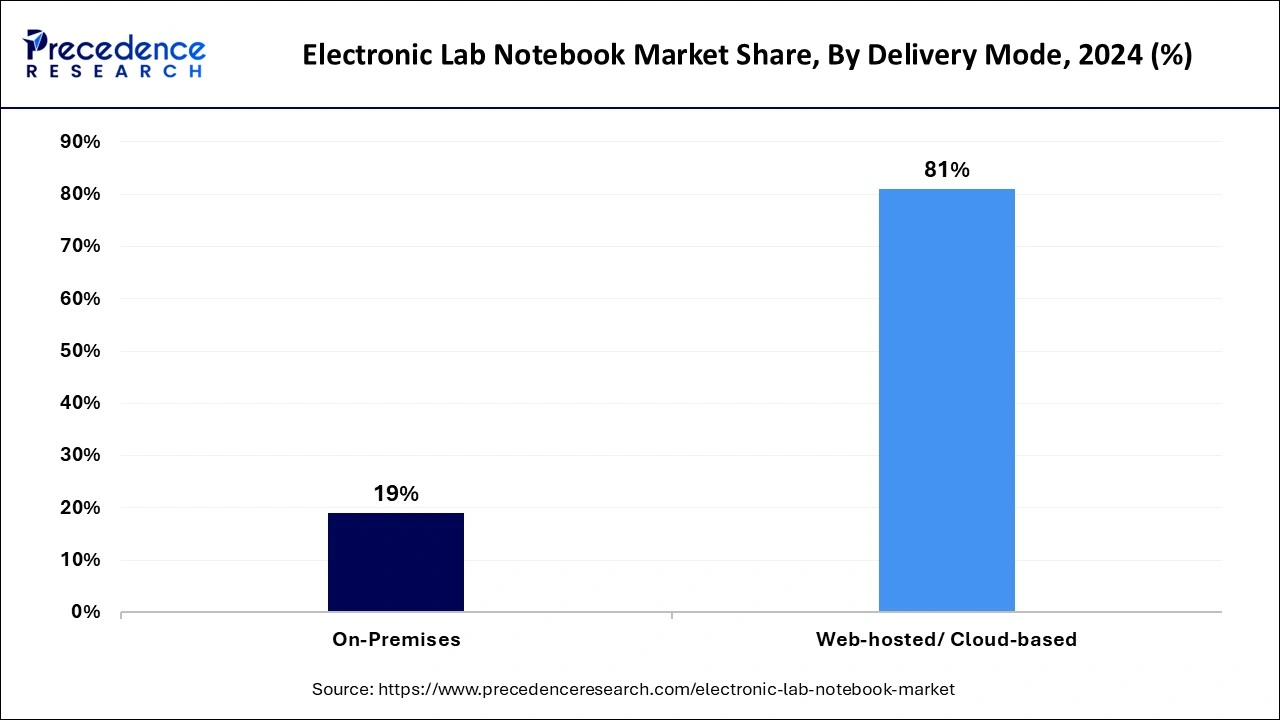

- By delivery mode, the web-hosted/ cloud-based segment contributed the biggest market share of 81% in 2024.

- By delivery mode, the on-premises segment is growing at a CAGR of 4.8% during the predicted period.

- By end use, the life sciences segment accounted for the highest market share of 30% in 2024.

- By end use, the CRO segment is expanding at a CAGR of 6.44% during the predicted period.

How Can Artificial Intelligence (AI) Impact the Electronic Lab Notebook Market?

The integration of artificial intelligence (AI) into the electronic lab notebook market helps in improving the speed and efficiency in the productivity the laboratory operations and other factors such as increasing innovations with the predictive modeling and optimization algorithms, enhanced decision-making process by providing real-time insights by the AI algorithms, improved collaboration, sustainability, and maintaining regularity compliance.

- In September 2024, Sapio Sciences, the science-aware™ lab informatics platform, offered significant advancements to Sapio ELaiN, a novel AI-powered lab assistant that is used to streamline processes and helps scientists to work more efficiently.

U.S. Electronic Lab Notebook Market Size and Growth 2025 to 2034

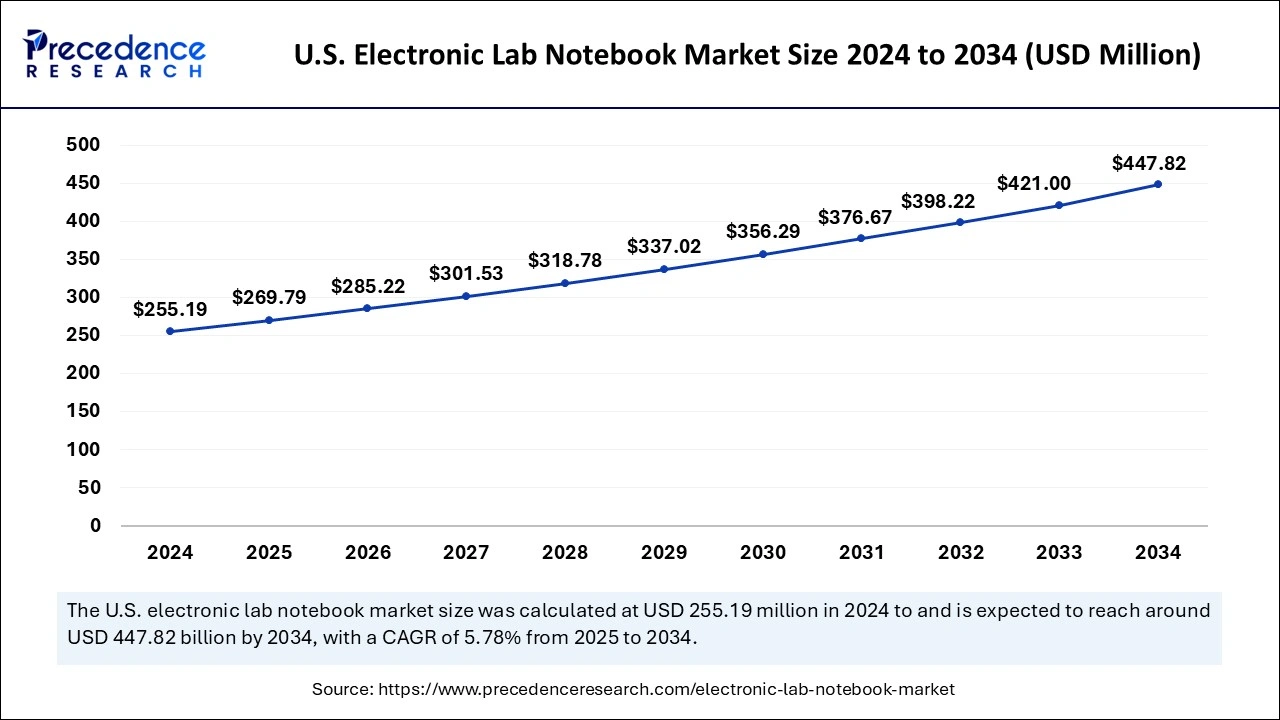

The U.S. electronic lab notebook market size was exhibited at USD 255.19 million in 2024 and is projected to be worth around USD 447.82 million by 2034, growing at a CAGR of 5.78% from 2025 to 2034.

North America dominated the electronic lab notebook electronic lab notebook market in 2024. The growth of the market is attributed to the higher presence of well-developed healthcare and pharmaceutical infrastructure and the technological adaptation in the industries over the traditional devices that boost the demand for the electronic lab notebook. The higher presence of the major pharmaceutical firms in regional countries like the United States and Canada and the increasing innovations in new treatment types, drugs, genetics therapeutics, and other healthcare and pharmaceutical devices.

- The growth of the pharmaceutical industry in the United States was estimated at around USD 1.6 trillion in 2023, with a USD 100 million increase from 2022.

- The investment of PhRMA members within the research and development of the U.S. pharmaceutical industry accounted for over USD 96 million in 2023.

Asia Pacific is expecting substantial growth in the electronic lab notebook market during the predicted period. The growth of the market is owing to the rising demand for healthcare and pharmaceutical operations due to the rising population across the regional countries. The increasing economic development in the countries and the expansion of the pharmaceutical firms are innovating new treatment types and drugs for disease, vaccination, and other diseases.

The Indian pharmaceutical industry is expected to reach USD 130 million and USD 450 million by 2030 and 2045, respectively. India ranked 3rd largest in biotechnology in Asia Pacific and among the top 12 destinations for biotechnology globally.

The medical devices sector's current market size in India is estimated to be USD 11 million, with a 1.5% share in the global medical device market. The government of India is planning to expand the medical device industry by increasing its current valuation from USD 11 million to USD 50 million by 2030.

Market Overview

The electronic lab notebook is the software or the digital devices that replace the traditional form of data collection and management in the laboratories or pharmaceutical industry. In the electronic lab notebook system, researchers or scientists can enter observations, protocols, notes, and other types of research data from any other electronic medium, like a computer or mobile phone. The electronic lab notebook market facilitates good data management practices, supports auditing, provides data security, and allows collaboration.

Electronic Lab Notebook Market Growth Factors

- Increasing healthcare infrastructure: The rise in the healthcare and pharmaceutical infrastructure and the development of novel drugs and treatment procedures drive the demand for technology that can efficiently collect, store, and analyze data.

- Adoption of digitization: The increasing adaptation of digital technologies into industries for the optimum utilization of technologies and increasing inclination towards digital media over traditional media is driving the demand for the electronic lab notebook market.

- Development of the electronic lab: The increasing inclination towards the electronic record of pharmaceutical data, laboratory results, clinical trial data, standard operating procedures (SOPs), manufacturing and quality control documentation, and regulatory submission documents is contributing to the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,211.06Million |

| Market Size by 2025 | USD 740.16 Million |

| Market Size in 2024 | USD 700.11 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.72% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Delivery Mode, License, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Benefits associated with the electronic lab notebook

The rising pharmaceutical and laboratory operations in economically developing countries with the government interference for the development of new drugs, therapies, treatment, vaccination, and others and the adaptation of the digital technologies from the pharmaceutical industries or the research laboratories for the efficient collection, and management of the clinical data with the help of digital medium boosts the growth of the electronic lab notebook market. The integration of electronic lab notebooks into the laboratories further provides several benefits, such as enhanced productivity, quality drug candidates, flexibility, collaboration and sharing, reproducibility, and others.

Restraint

Challenges in scalability

There are a number of research laboratories that still use traditional data collection methods over the modern electronic lab notebook; the high cost of technologies and implementation limits the adoption of the electronic lab notebook and restraints the growth of the market.

Opportunity

Technological advancements in electronic lab notebook

The increasing investment in the expansion of technologies over healthcare and pharmaceutical operations and the inclination towards digital media over the traditional type of recording research data boosts the growth opportunity in the market expansion. There are several leading technology firms that are highly invested in the expansion of electronic lab notebook technologies.

- In December 2024, TeselaGen Biotechnology, a leading player in advanced software solutions for the biotechnology industry, launched the new Electronic Lab Notebook (ELN) designed with a unified user interface for enhancing user experience.

Product Insights

The cross-disciplinary segment led the global electronic lab notebook market in 2024. The rising adaptation of the cross-disciplinary electronic lab notebook is due to its multi-tasking design, which is used in different research and data collection processes. The cross-disciplinary is designed for easy handling and all types of data storage with all the security features. The rising demand for the cross-disciplinary electronic lab notebook by a wide range of scientists who work in different fields of action owing to its higher efficiency, higher security, and easy handling and maintenance capabilities accelerates the demand for the cross-disciplinary electronic lab notebook segment.

The specific segment will show notable growth during the forecast period. The specific electronic lab notebook is specially designed for the specific type of research work in the laboratories. It is designed to work with some specific type of laboratory tools or machines. This type of electronic lab notebook is relevant to the specific topic and provides enhanced support and security to the task and data information.

License Insights

The proprietary segment led the global electronic lab notebook market in 2024. The proprietary license electronic lab notebook enhances the security and customization of the research data; the proprietary license provides strong data protection and regularity compliance. These types of licenses provide more secure platforms than open-sourced platforms.

The open segment expects the fastest growth during the forecast period. The open-licensed or open-sourced electronic lab notebooks are adopted by a number of researchers or scientists due to enhanced efficiency and provide modification and distribution as per the demand and conditions.

Delivery Mode Insights

The web-hosted/ cloud-based segment dominated the electronic lab notebook market in 2024. The increasing adoption of the cloud-based electronic lab notebook is due to its flexibility for updating and accessing research data from any remote location with internet connectivity. Cloud-based electronic lab notebook provides enhanced data security. The cloud-based electronic lab notebook platform offers increased data integrity with strong streamlined inventory and audit trail management.

The government intervention in streamlining data security further boosts the demand for the cloud-based electronic lab notebook platform segment. The on-premises segment expects substantial growth during the predicted period. The rising adoption of the on-premises electronic lab notebook due to its easy handling, cost-effectiveness, functional prioritization, and other factors boosts the demand for it. Several pharmaceutical and research laboratories are adopting the on-premises electronic lab notebook due to its higher security over data and other factors that boost the demand for the segment.

End Use Insights

The life sciences segment led the global electronic lab notebook market in 2024. The rising research cases and data of the life science industry are driving the demand for the electronic lab notebook for the effective data collection, analysis, organizing, and sharing of research data, which boosts the growth of the market. Electronic lab notebooks provide several advantages in data collection in the life science industry, such as enhanced organization and accessibility of scientific data, collaboration and sharing, record-keeping and compliance, timesaving and efficiency, and increased data security and backup.

The CROs segment accounted for the fastest growth in the market during the predicted period. The CRO, also known as the contract research organization, is highly adopted by a number of pharmaceutical companies for streamlining different operation outsourcing such as the development of new treatments, drugs, vaccinations, and others, which drives the demand for efficient modern technology that helps in storing the data information, providing security, collaboration, and other factors.

Electronic Lab Notebook Market Companies

- LabWare

- SciY

- Thermo Fisher Scientific Inc.

- Benchling.

- LabVantage Solutions Inc

- Abbott

- LabLynx LIMS (Laboratory Information Management System)

- Agilent Technologies, Inc.

- Dassault Systemes

Latest Announcement by Industry Leaders

- In March 2023, LabWare announced the significant transformation to its data science and machine learning foundational to its software. The software revolutionized the way laboratories handled data.

Recent Developments

- In October 2024, eLabNext, a major provider of digital lab management solutions, announced the launch of the centralized platform Digital Lab Platform (DLP) for offering changes in the brand consolidation, positioning its three flagship products, including eLabInventory, eLabJournal, and eLabProtocols.

- In January 2025, Sapio Sciences, a leading lab informatics platform, introduced Release 24.12, the new tool for molecular biology, chemistry, immunogenicity, and GMP workflows designed for enhancing accuracy, streamlining lab operations, and supporting the increasing demand for scientific research.

Segments Covered in the Report

By Product

- Cross-disciplinary

- Specific

By Delivery Mode

- On-Premises

- Web-hosted/ Cloud-based

By License

- Proprietary

- Open

By End Use

- Life Sciences

- CROs

- Chemical Industry

- F&B and Agriculture

- Environmental Testing Labs

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries

By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting