Cleanroom Technology Market Size and Forecast 2025 to 2034

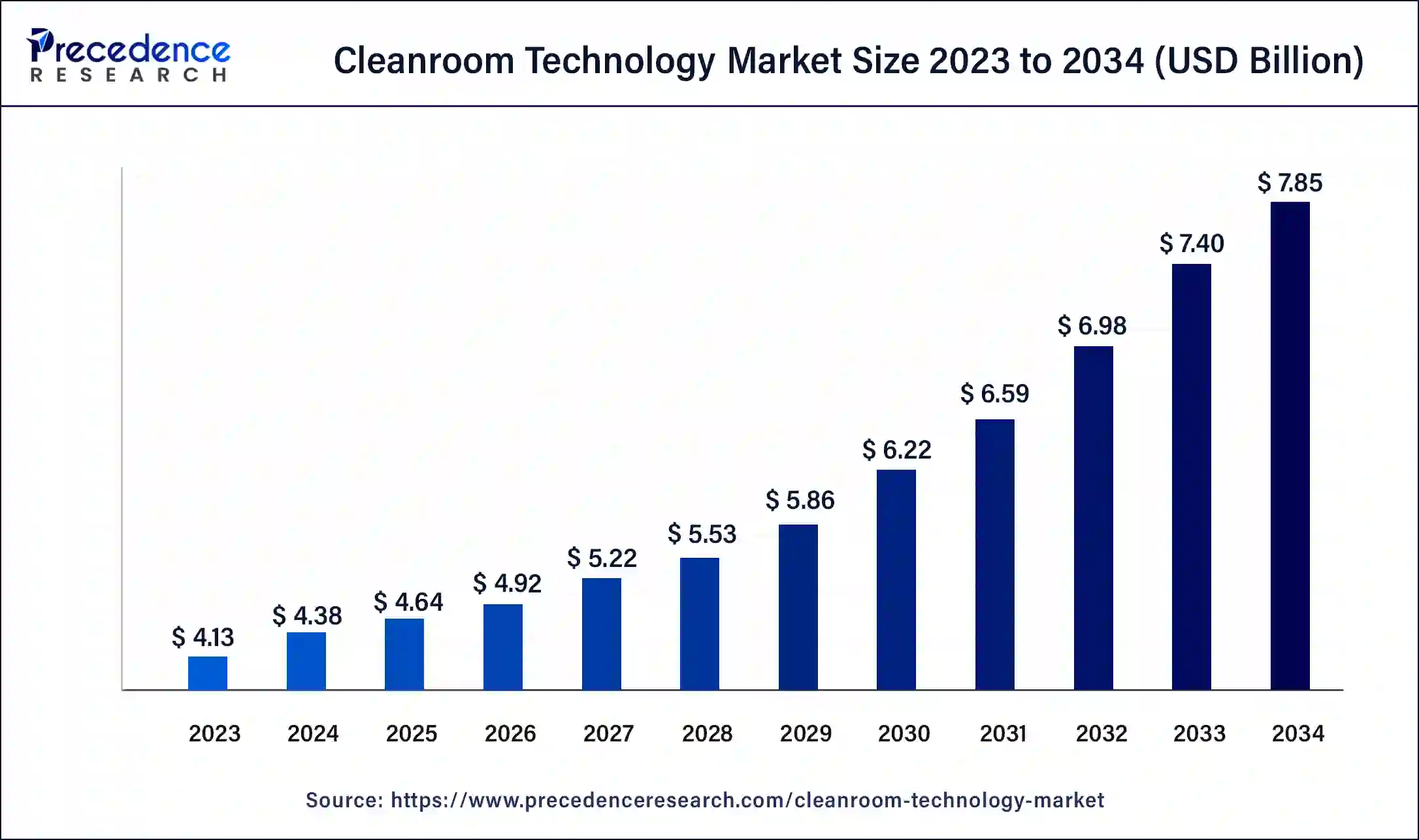

The global cleanroom technology market size accounted at USD 4.38 billion in 2024 and is expected to be worth around USD 7.85 billion by 2034, at a CAGR of 6.01% from 2025 to 2034.

Cleanroom Technology Market Key Takeaways

- In terms of revenue, the cleanroom technology market is valued at $4.64 billion in 2025.

- It is projected to reach $7.85 billion by 2034.

- The cleanroom technology market is expected to grow at a CAGR of 6.01% from 2025 to 2034.

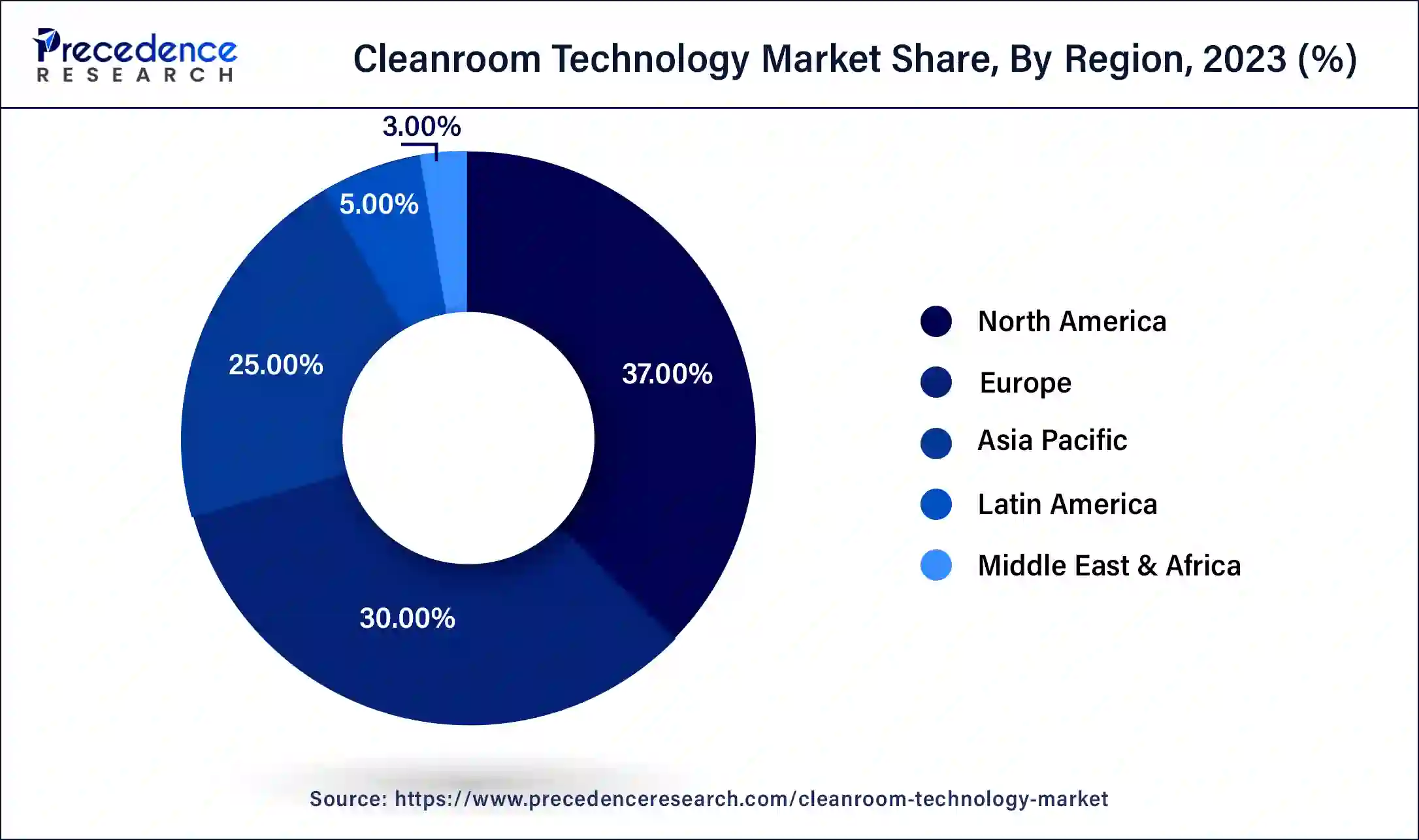

- North America dominated the global market and contributed more than 37% of the revenue share in 2024.

- By product type, the equipment segment dominated the market by holding 58.70% share in 2024.

- By product type, the consumables segment is expected to grow at the highest CAGR of 7.90% in 2024.

- By type of cleanroom, the standard cleanroom segment held a 41.50% market share in 2024.

- By type of cleanroom, the modular cleanroom segment is expected to grow at the highest CAGR of 8.80% over the forecast period.

- By construction type, the new cleanroom construction segment led the market by holding 46.70% share in 2024.

- By construction type, the restrooms and renovations segment is expected to grow at the highest CAGR of 7.20% in 2024.

- By end user industry, the pharmaceutical industry segment dominated the market with a 31.90% share in 2024.

- By end user industry, the biotechnology segment is expected to grow at the highest CAGR of 8.60% in 2024.

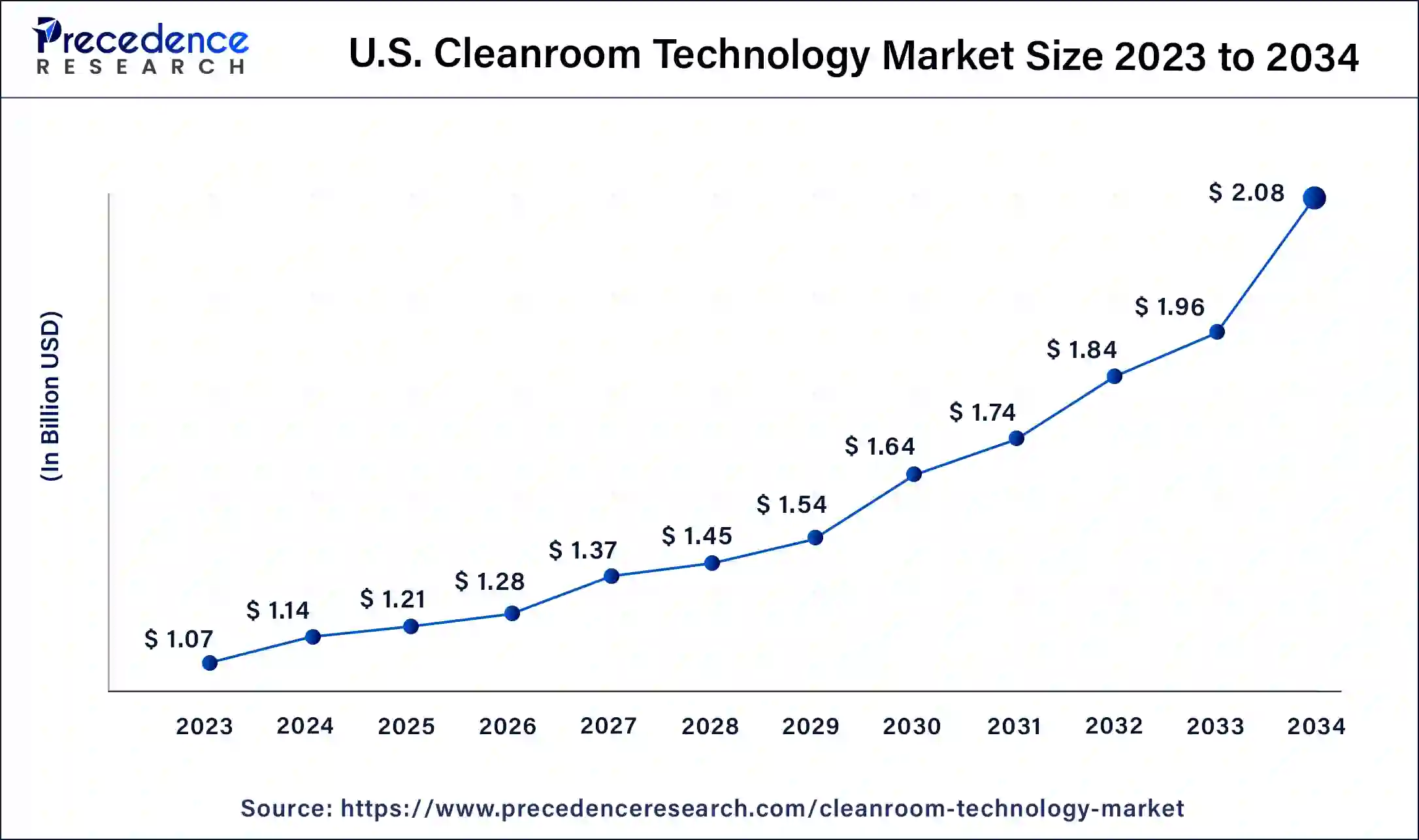

U.S. Cleanroom Technology Market Size and Growth 2025 to 2034

The U.S. cleanroom technology market size was estimated at USD 1.14 billion in 2024 and is predicted to be worth around USD 2.08 billion by 2034, at a CAGR of 6.20% from 2025 to 2034.

North America is the dominant region in the clean room technology market in 2024, driven by the presence of a well-established pharmaceutical and biotechnology industry, stringent regulatory requirements, high healthcare expenditure, and advanced technological capabilities. The pharmaceutical industry in North America is characterized by a high level of research and development activities, advanced manufacturing processes, and a strong emphasis on product quality and patient safety. This drives the demand for cleanroom technology to maintain controlled environments and prevent contamination during drug development and manufacturing processes.

Additionally, the stringent regulatory requirements set by FDA and other regulatory bodies in North America necessitate the use of cleanroom technology to comply with quality and safety standards. Moreover, the high healthcare expenditure in the region, along with the increasing focus on infection control in healthcare settings, further fuels the adoption of cleanroom technology, particularly in hospitals and diagnostics centers. The presence of advanced technological capabilities and a strong manufacturing base in North America also supports the dominant position of the region in the clean room technology market.

Market Overview

Cleanroom technology refers to a technological environment designed and constructed to minimize the presence of airborne particles, such as dust, bacteria, and other contaminants, to maintain a controlled level of cleanliness. Cleanrooms are commonly used in pharmaceuticals, biotechnology, electronics, aerospace, and healthcare industries, where maintaining a sterile or particle-free environment is crucial for product quality, safety, and regulatory compliance.

Cleanroom technology has gained significant traction recently due to increasing awareness about maintaining clean and controlled environments in various industries. The market for cleanroom technology has witnessed steady growth, driven by factors such as the growing demand for high-quality and contamination-free products, stringent regulatory requirements, and advancements in manufacturing processes and technologies.

Trends

- Increasing adoption of modular cleanroom systems from various industries such as biotechnology, electronics, and pharmaceuticals drives the growth.

- Cleanroom facilities are focusing on reducing environmental impact and putting innovation into the energy recovery system.

- Automation and integration of AI in the system will help analyse the data and predict maintenance needs.

- The integration of advanced sensors and Internet of Things devices will help in transforming cleanroom monitoring.

- The demand for durable, easy-to-clean, and particle-resistant materials drives the high-performance options like powder-coated steel. Non-porous composite panels increase the demand.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 4.38 Billion |

| Market Size in 2025 | USD 4.64 Billion |

| Market Size by 2034 | USD 7.85 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.01% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Stringent regulatory standard

Cleanroom technology has stringent regulatory standards imposed by various industries. Industries such as pharmaceuticals, biotechnology, electronics, and healthcare are subject to strict regulations to ensure product quality, safety, and compliance with industry standards. Cleanrooms play a crucial role in meeting these regulatory requirements. For instance, in the pharmaceutical and biotechnology industry, regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have established guidelines such as Good Manufacturing Practices (GMP) and Good Distribution Practices (GDP) that mandate the use of cleanrooms for manufacturing, processing, and packaging of drugs and medical devices.

Failure to comply with these regulations can result in severe consequences, including product recalls, fines, and loss of reputation. Similarly, cleanrooms are essential in the electronics and semiconductor industry to prevent contamination during manufacturing processes, such as wafer fabrication, assembly, and testing, to ensure the production of high-quality and reliable electronic components. Cleanroom standards such as ISO 14644 and Federal Standard 209E set specific limits for airborne particle counts in cleanrooms, which are strictly regulated to meet industry requirements.

The need to comply with these stringent regulatory standards is a driving force for adopting cleanroom technology, as companies strive to meet the requirements and maintain compliance with industry regulations.

Restraints

High initial investment

Cleanroom technology requires a significant upfront investment for the design, construction, and maintenance of cleanroom facilities. These facilities need to meet strict standards and regulations, including specialized HVAC systems, air filtration systems, and monitoring equipment, which are expensive to install and maintain. As a result, the high initial investment is a restraint for the growth of the cleanroom technology market, especially for small and medium-sized enterprises (SMEs) or startups with limited financial resources.

Stringent regulatory compliance

Cleanroom technology is subject to various regulatory standards and guidelines, such as ISO 14644, FDA guidelines, and EU GMP, which require strict compliance. Ensuring adherence to these regulations is complex and time-consuming, involving regular testing, monitoring, and documentation of various parameters, such as airborne particle counts, temperature, humidity, and pressure differentials. Non-compliance results in fines, product recalls, and damage to the reputation of the company. Meeting these stringent regulatory requirements is a restraint for some companies, particularly those with limited expertise or resources, to implement and maintain the necessary compliance measures, which impact their entry and growth in the cleanroom technology market.

Opportunities

Increasing demand for advanced manufacturing processes

The cleanroom technology market presents opportunities with the growing demand for advanced manufacturing processes in various industries such as pharmaceuticals, semiconductors, electronics, aerospace, and automotive, among others. Advanced manufacturing processes often require clean and controlled environments to ensure high-quality production, and cleanroom technology provides the necessary infrastructure to meet these requirements. As industries continue to advance and adopt new technologies, the demand for cleanroom technology is expected to increase, presenting opportunities for companies involved in the design, construction, and maintenance of cleanroom facilities.

Focus on energy efficiency and sustainability

As sustainability and environmental concerns become more prominent, there is a growing emphasis on developing cleanroom technologies that are energy-efficient and environmentally friendly. There is an opportunity for companies to invest in research and development to develop cleanroom solutions that minimize energy consumption, reduce waste, and incorporate renewable energy sources. Additionally, incorporating sustainable materials and construction practices in clean room facilities can also be an opportunity to attract environmentally conscious customers and meet green building certifications.

As the demand for eco-friendly cleanroom solutions increases, companies that prioritize energy efficiency and sustainability can gain a competitive edge and capitalize on the growing market for environmentally responsible technologies.

Product Insights

The equipment segment dominated the market by holding 58.70% share in 2024. Cleanroom equipment refers to the specialized machinery, tools, and systems used in the design, construction, operation, and maintenance of cleanroom facilities. This includes HVAC (Heating, Ventilation, and Air Conditioning) systems, air filtration systems, laminar flow systems, cleanroom enclosures, air showers, and other specialized equipment that is essential for creating and maintaining a clean and controlled environment.

The consumables segment is expected to grow at the highest CAGR of 7.90% in 2024. The growth of the segment can be attributed to the increasing need for contamination-free environments in the semiconductor sector, along with the rising focus on energy-efficient and sustainable cleanrooms. Also, consumables such as wipes, gloves, and apparel are often used in large quantities in cleanroom operations.

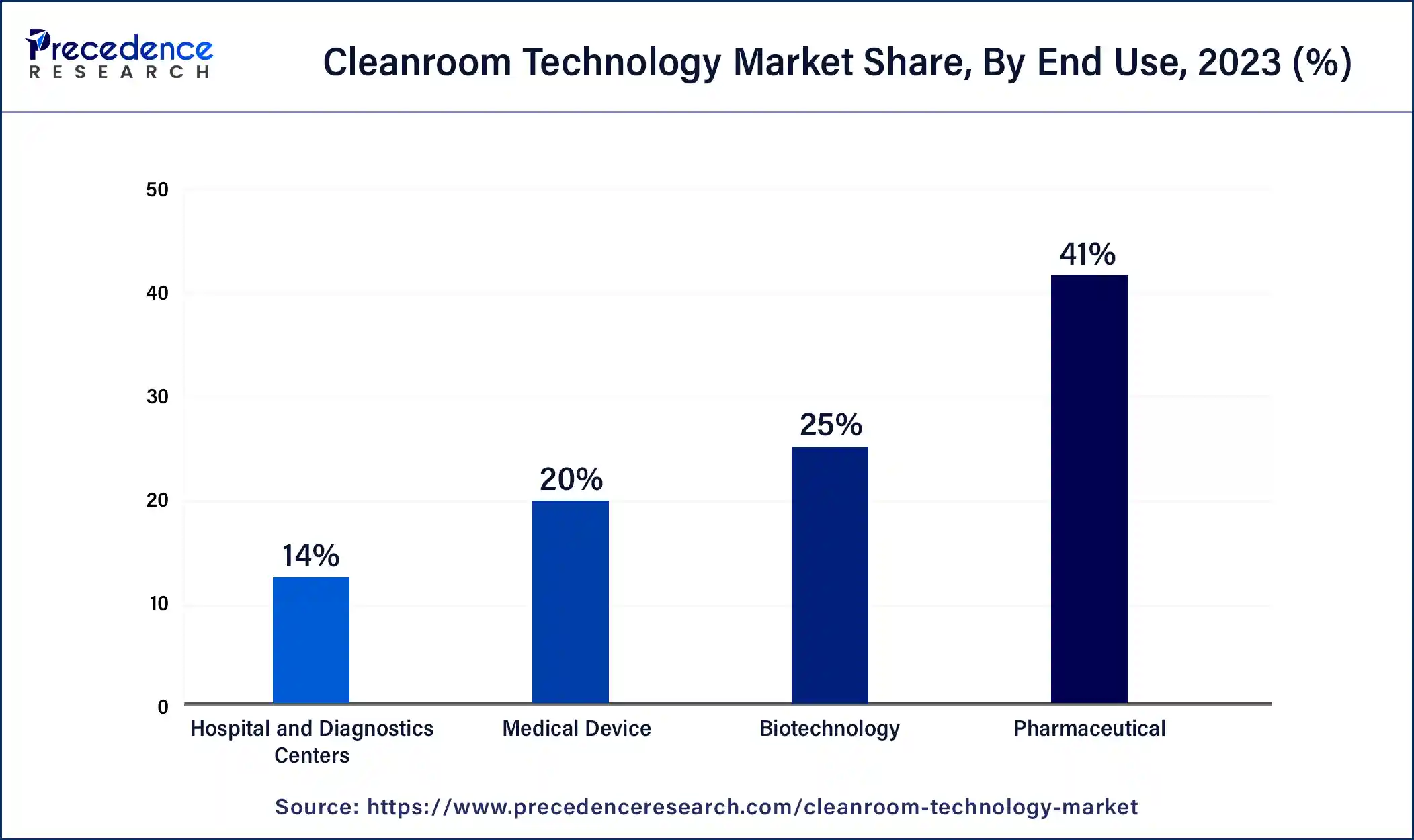

End Use Insights

Based on end-use, the market is segmented into Pharmaceutical, Medical devices, Biotechnology, Hospital and diagnostics centers. In 2024, the pharmaceutical segment dominated the market and is expected to continue its dominance throughout the forecast period. The segment growth is driven primarily due to strict regulations and standards, the criticality of clean environments, increasing demand for pharmaceutical products, complex and diverse manufacturing processes, and a strong focus on patient safety and product quality.

The pharmaceutical industry is subject to stringent regulations and standards, such as good manufacturing practices (GMP) and FDA guidelines, to ensure the safety, efficacy, and quality of pharmaceutical products. Cleanroom technology is extensively used in various stages of pharmaceutical manufacturing, including drug development, production, packaging, and testing, to maintain sterile and controlled environments, prevent contamination, and comply with regulatory requirements.

In addition, the criticality of clean environments in the pharmaceutical industry cannot be overstated. To prevent cross-contamination, protect product integrity, and ensure patient safety, pharmaceutical manufacturing facilities require highly controlled and sterile environments. Cleanroom technology plays a vital role in maintaining the required air quality, temperature, humidity, and particulate levels, which are crucial for the production and storage of pharmaceuticals.

The pharmaceutical industry segment dominated the market with a 31.90% share in 2024. The segment growth is driven primarily by strict regulations and standards, the criticality of clean environments, increasing demand for pharmaceutical products, complex and diverse manufacturing processes, and a strong focus on patient safety and product quality.

The biotechnology segment is expected to grow at the highest CAGR of 8.60% in 2024. The growth of the segment can be credited to the increasing demand for personalised solutions for sensitive biopharmaceutical manufacturing and the overall expansion of the healthcare sector. Furthermore, market players are providing customized cleanroom solutions catered to the specific demands of biotechnology clients.

Type of Cleanroom Insights

The standard cleanroom segment held a 41.50% market share in 2024. The dominance of the segment can be credited to the growing demand from the biotechnology, pharmaceutical, and semiconductor sectors, which necessitate robust contamination control. In addition, the standard cleanrooms are crucial for maintaining consistent and strict environmental controls for high-volume production operations.

The modular cleanroom segment is expected to grow at the highest CAGR of 8.80% over the forecast period. The growth of the segment can be linked to their speed and flexibility in construction, cost-effectiveness, and scalability to fulfil changing market needs. Furthermore, the growing use of materials like steel, aluminium, glass, and polycarbonate enables the creation of more flexible and durable modular cleanrooms.

Construction Type Insights

The new cleanroom construction segment led the market by holding 46.70% share in 2024. The dominance of the segment can be driven by the ongoing technological innovations in filtration and HVAC systems and the growth of medical infrastructure in developing economies. Moreover, major players are providing customized cleanroom solutions to fulfil the specific demands of a wide consumer base, which involves designing and constructing new facilities.

The restrooms and renovations segment is expected to grow at the highest CAGR of 7.20% in 2024. The growth of the segment is owing to the growing demand for improved contamination control in pharmaceuticals and electronics, coupled with the rising need for adaptable and modular cleanroom designs that can be easily installed and expanded.

Cleanroom Technology Market Companies

- Kimberly-Clark Corporation

- DuPont

- Terra Universal, Inc.

- Camfil Group

- M+W Group

- Ardmac

- Taikisha Ltd.

- Clean Air Products

- Nicomac

- Airtech Japan, Ltd.

Recent Developments

- In May 2025, Contec, an expert in disinfectant, launched the EcoShield sustainability designation. The EcoShield symbol will now accompany selected products within Contec Professional's portfolio, indicating their alignment with the company's commitment to sustainability and environmental responsibility.

- In May 2025, QleanAir Scandinavia announced the launch of QleanGuard Environmental Monitoring solutions in the US. The new system is a standalone monitoring platform for pharmaceutical cleanroom environments. QleanGuard has real-time data tracking, versatile compatibility, and remote access to the cloud.

- In May 2025, Dubai-based R&D firm Leader Biotech Pharma has partnered with Integrated Cleanroom Technologies (iClean) to introduce new cleanroom solutions for pharmaceutical research to the region. Integrated Cleanroom Technologies is an India-based provider of cleanroom solutions and equipment that is known for its HPL and GI cleanroom panels. The new partnership was revealed at Arab Health Exhibition 2025.

- In February 2025, Jansen Cleanrooms & Labs launched a new line of cleanroom construction products. The new line from the Belgium-based company is called J'Clean, and it is said to be designed to meet high standards of cleanliness and efficiency. The new line consists of five main products: Hinged door system, Wall system, Interlock system, Lighting, and Pass box. The company claims to offer modular wall systems to reliable interlock and door systems, and ensure that the product will provide a contamination-free environment for critical processes.

- In May 2022,MyCellHub, a Belgium-based company specializing in providing validated toolkits for digitalization, data integration, and data analytics of regulated laboratory and cleanroom workflows, entered a sustainable partnership with ABN Cleanroom Technology. This collaboration aims to leverage MyCellHub's expertise in GMP and 21 CFR Part 11 compliant solutions for laboratory and cleanroom workflows, combined with ABN Cleanroom Technology's experience in cleanroom technology, to deliver innovative and sustainable solutions for the cleanroom industry. This partnership has the potential to drive efficiency, compliance, and sustainability in cleanroom operations through advanced digital solutions.

Segment Covered in the Report

By Product Type

- Equipment

- HVAC Systems

- HEPA Filters / ULPA Filters

- Fan Filter Units (FFU)

- Laminar Airflow Units

- Air Diffusers & Showers

- Pass-Through Systems

- Cleanroom Furniture (Benches, Cabinets)

- Others (e.g., Biosafety Cabinets, Trolleys, Glove Boxes)

- Consumables

- Apparel

- Coveralls

- Gloves

- Shoe Covers

- Hoods and Masks

- Cleaning Products

- Mops & Wipes

- Disinfectants & Detergents

- Stationery and Tapes

- Swabs and Adhesive Mats

- Others

- Apparel

By Type of Cleanroom

- Standard Cleanroom

- Modular Cleanroom

- Softwall Cleanroom

- Hardwall Cleanroom

- Mobile Cleanroom

By Construction Type

- New Cleanroom Construction

- Restrooms and Renovations

By End User / Industry

- Pharmaceutical Industry

- API & Formulation Plants

- Biologics Manufacturing

- Biotechnology

- Medical Devices

- Hospitals & Diagnostic Centers

- Electronics & Semiconductor

- Food & Beverage Processing

- Aerospace & Defense

- Automotive

- Optics and Laser Industry

- Research Laboratories / Academic Institutes

By ISO Cleanroom Classification (Air Cleanliness Class)

- ISO 1–ISO 3 (Ultra-clean)

- ISO 4–ISO 5 (Very High Cleanliness)

- ISO 6–ISO 7 (Moderate Cleanliness)

- ISO 8–ISO 9 (General Cleanliness)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting