What is the Clinical Trials Matching Software Market Size?

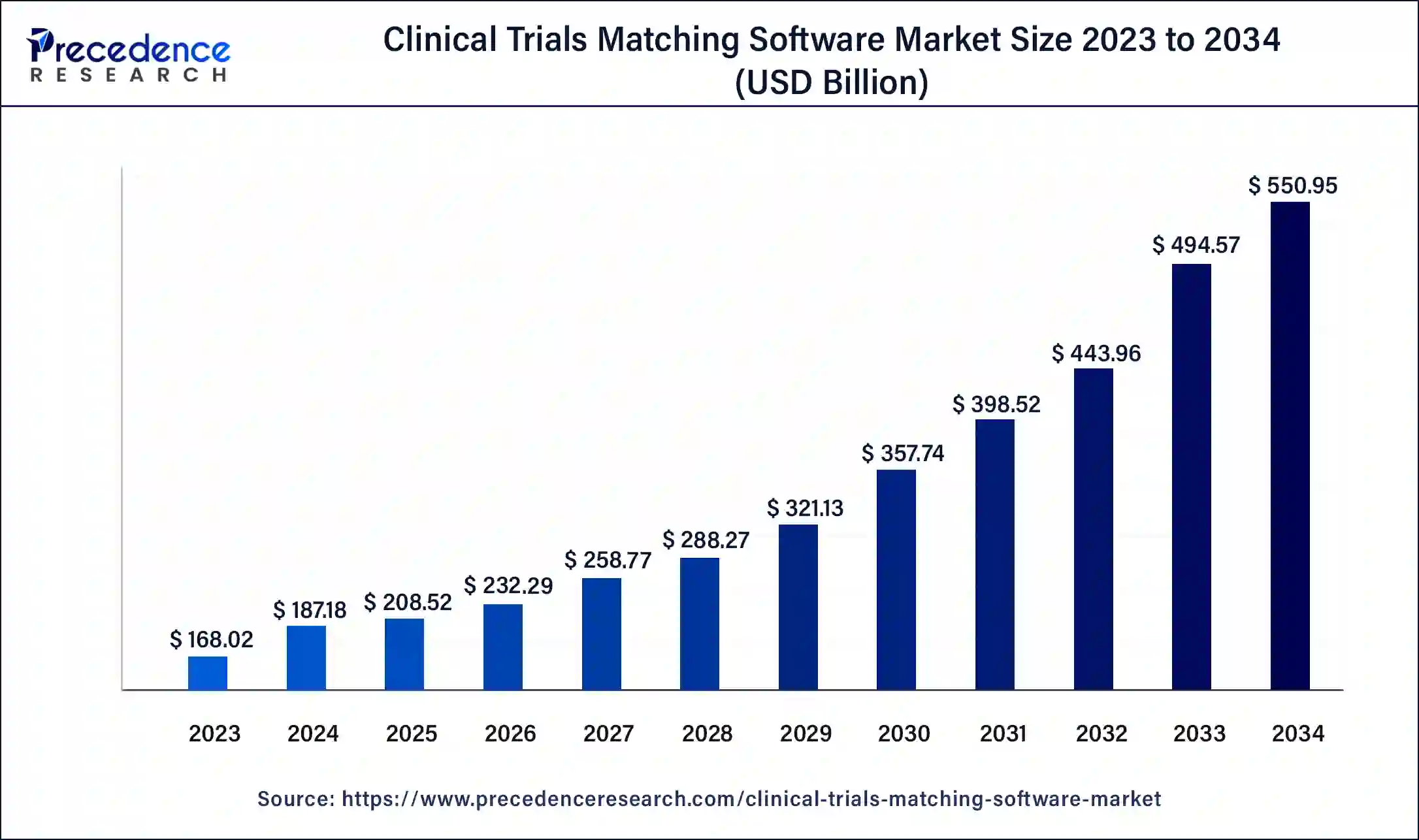

The global clinical trials matching software market size is calculated at USD 208.52 billion in 2025 and is predicted to increase from USD 232.29 billion in 2026 to approximately USD 603.48 billion by 2035, expanding at a CAGR of 11.21% from 2026 to 2035.

Clinical Trials Matching Software Market Key Takeaways

- The North America region dominated the global market and contributed more than 51% revenue share in 2023.

- The Asia pacific is about to record a rapid CAGR from 2026 to 2035.

- On the basis of end-user, the pharmaceutical and biotechnology companies segment captured more than 41% revenue share in 2025.

- On the basis of deployment mode, the web and cloud-based segments dominated the market and captured a significant revenue share in the market.

What is Clinical Trials Matching Software?

Biotech companies, clinical research organizations, medical device manufacturers, and pharmaceutical manufacturers regularly conduct drug trials to test the safety and efficiency of trials, new drugs, diagnostics, and therapies. The growing prevalence of chronic disease and the increasing need for drug trials are anticipated to drive the growth of the clinical trials matching software market. Clinical trials matching software are time-consuming and cost-effective. Therefore, trials are progressively being conducted in developing regions, as the availability of patient recruitment and trials matching is an important part of drug trials. Clinical trial matching software is one of the most recent expansions in research.

The COVID-19 pandemic led this market to drive significantly globally. Investors are collaborating directly with drug trial-matched software vendors for the advancement of technology and to find solutions for their research purpose. This technology matches patients with drug trials in a simple process for both patients and donors and can also guide patient recruitment. North America is expected to generate the highest revenue share in the global clinical trial matching software in upcoming years.

How is AI contributing to the Clinical Trials Matching Software Industry?

AI has fast-tracked the process from patient identification to trial participation by evaluating intricate medical data, spotting criteria that would be missed in manual checks, and translating unstructured notes with the help of natural language processing. It also gives an estimate of the patient's reaction and the chances of them/quitting, thus making the trial more likely to succeed.

The AI-based preventive notifications not only improve the doctor's involvement but also the use of federated learning ensures that the patient's data remains anonymous throughout the process. The recruitment period is thus shortened, and a more diverse patient population is reached and all of which is done with greater accuracy, consequently making the trial process more efficient and enabling faster drug development.

Market Outlook

- Industry Growth:

Digital recruitment innovation that is transforming the efficiency of trial procedures and allowing for more accurate patient matching processes is the main factor in the growth of the industry. - Sustainability Trends:

It is the digital participation that is being emphasized, and the interoperability that is giving a secure support to the research ecosystems, being more focused on the patients. - Global Expansion:

Increasing trial activities in different areas, leading to the modernization of research operations by incorporating the use of the latest matching software with great support. - Major Investors:

IBM, Microsoft, Antidote Technologies, Deep 6 AI, General Catalyst, and Faro Health are the ones who are pushing the strategic development through their investments. - Startup Ecosystem:

It is the innovative ventures that are taking the lead in the development of recruitment tools based on AI that will eventually have a wider impact technologically on the changing research landscapes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 208.52 Billion |

| Market Size in 2026 | USD 232.29 Billion |

| Market Size by 2035 | USD 603.48 Billion |

| Growth Rate from 2026to 2035 | CAGR of 11.21% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Components, By End-User, By Deployment Mode |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers

Increasing clinical trial activities is expected to drive market growth

The increasing clinical trial activities globally is anticipated to drive the clinical trials matching software market during the forecast period. The number of clinical trials has risen significantly over the few decades. This is due to the increased infiltration of advanced healthcare technologies coupled with the growing demand for innovative drugs with greater effectiveness. However, a clinical trial matching system is cost-effective and fast, as clinical trials are used to collect and organize data that can also be shared with multiple healthcare providers and distributed across multiple systems. This technology can assist with location identification and recruitment, as well as monitoring and tracing of patient registrations and databases.

Thus, the increasing number of drug trial activities is propelling the clinical trial-matching software market. For instance, according to the World Health Organization (WHO) International Clinical Trials Registry Platform (ICTRP), for the duration of 1999-2021 the United States (157,620) registered the maximum number of drug trials, followed by China (80,330) and japan (57,750)

Restraint

The high cost of matching software's hampering the growth of the clinical trial matching software market

The high cost of matching systems is hindering the market growth of the clinical trial matching software market. Initiation, contractual term commitment, per user, per the study, training, support and maintenance, validation/ 21 part 11 compliance, and system integration fees cumulatively rise the overall cost requires for the adoption of the clinical trial matching software solutions. Both on-premises systems and SaaS systems include setup fees.

Additional configuration and customization costs are charged to companies based on specific organizational and research requirements. Different cost structures are observed depending on the number of users and the number of sites considered. There are also some fees or terms to consider for clinical trial matching software, as well as routine system maintenance and upgrades.

Opportunity

The supportive government initiatives and companies collaborations for clinical trials matching the software market creating new opportunities.

The supportive government initiatives and various companies partnerships for the Clinical trial matching software market is likely to drive the entry for new participants in the future, driven by awareness and adoption of a growing number of trial activities and technology process. Rapid advancement in technology further encourages market participants to focus significantly on a new applications and the development of innovative devices. In addition, the increasing number of companies offering updated and customized features is contributing to the growth of the market during the forecast period.

However, software developers and companies will likely to depend on partnerships, mergers, collaborations and acquisitions to hold their market position. For instance, in December 2021, Optima pharma, one of the top European CRO, acquired SSS international. The acquisitions support the company to expand its portfolio of Clinical Research study.

Segment Insights

Components Insights

Based on the components, the global clinical trials matching software market is segmented into services and software. The software segment is expected to hold a large revenue share in the forecast period for global clinical trial matching software. The growth of this segment is backed by high usage and increased adoption of drug trials. Many biotechs, pharma, and other clinical research organization companies, life science organizations are promoting to conduct of complex drug trials. These trials aim to discover new drugs and medical products. In addition, increase in drug trial activity and the proliferation of multisite drug trials, there is a requirement for effective tools to easily manage research, maintain accurate data, and manage aspects of drug trials.

The use of software tools allows investors to efficiently manage drug trials. For instance, in January 2021, as part of the Cancer Research UK's (CRUK) UpSMART Accelerator, digital ECMT has created and developed clinical trial matching software to support clinical decision-making, profile matching genetics of tumor patients with optimal drug trials, supporting their precision medicine research.

However, the service segment is anticipated to hold considerable growth during the forecast period, owing to the rise in the number of drug trials and the growth of the healthcare insurance industry.

End-User Insights

Based on the End-User, the global clinical trials matching software market is segmented into clinical research organizations, pharmaceutical and biotechnology companies, and medical device firms. The pharmaceutical and biotechnology companies segment accounted more than 41% of revenue share in 2021 and is expected to dominate the market with significant revenue share in forecast period for global clinical trials matching software. The growth of this segment is attributed to the large number of drug trials needed to launch the product. This CRO segment is expected to grow at the fastest CAGR during the forecast period.

Clinical research organizations (CROs) provide drug development services through pharmacovigilance, commercialization, and post-approval services to manufacturing organizations with low research and development funds. An investor contracts with the CRO, a project-by-project basis, for drug trials. Companies that cannot afford to conduct extensive drug trials prefer to outsource these services. As a result, the demand for CRO is growing rapidly.

Deployment Mode Insights

Based on Deployment mode, the global clinical trials matching software market is segmented into on-premises, web, and cloud-based. The web and cloud-based segment dominated the global clinical trials matching software market and accounted for a significant revenue share in the market, owing to the cloud computing model, which is easier to maintain without maintenance cost. Since in-house server infrastructure is not needed, improvement costs are reduced. Referral time is greatly reduced and is accessible from anywhere. Sharing data is very convenient and allows partnerships on various projects.

The on-premises model needs in-house infrastructure, IT support, software license, and longer integration time. Therefore, this model is more expensive and less popular. On the other hand, organizations with highly confidential data, including governments and financial institutions, need the security and privacy of the on-premises environment.

Regional Insights

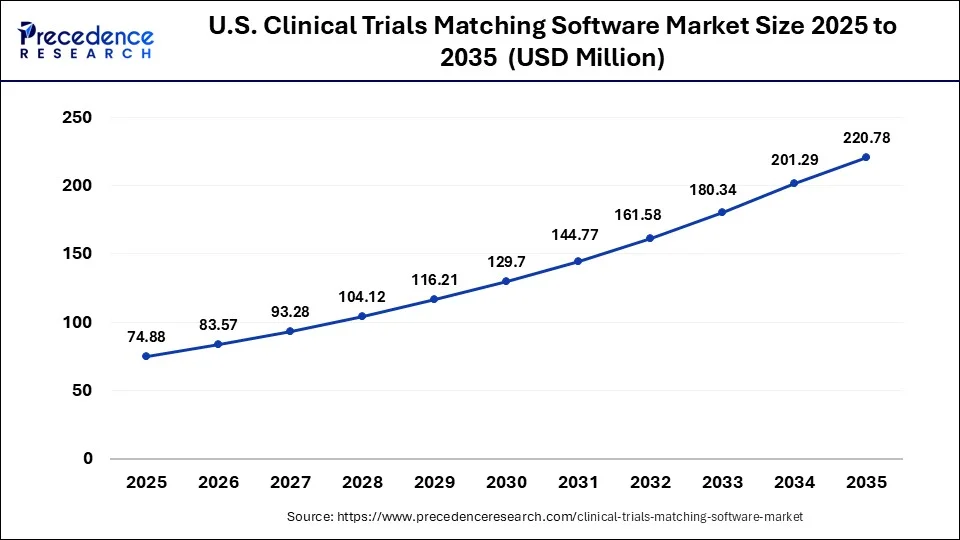

What is the U.S. Clinical Trials Matching Software Market Size?

The U.S. clinical trials matching software market size was estimated at USD 74.88 million in 2025 and is predicted to be worth around USD 220.78 million by 2035, at a CAGR of 11.42% from 2026 to 2035.

North America dominated the global clinical trials matching software market and accounted for more than 51% of revenue share in 2021. The growth is credited to the adoption of drug trial matching systems by the pharma and biotechnology companies in the United States. Additionally, the supportive government initiatives toward IT, and the increasing adoption of clinical trial matching software and patient matching software are helping to the market growth in this region.

For instance, according to the World Health Organization (WHO) International Clinical Trials Registry Platform (ICTRP), the United States reported the highest number of clinical trials during 1999-2021. Europe is expected to hold significant market share for the clinical trials matching software market, owing to increasing research and development events in the pharmaceutical and biotechnology sector. Major clinical trial companies are partnering with technology service vendors to integrate advanced technologies into the clinical trial process.

How is North America leading in the Clinical Trials Matching Software Market?

A mature market driven by strong healthcare IT systems, advanced trial activity, and supportive regulation. Growth focuses on AI adoption, EHR-based data integration, and decentralized trial models supporting improved recruitment efficiency and broader patient participation across diverse therapeutic areas.

U.S. Clinical Trials Matching Software Market Trends:

In general, the opportunities are focused on the areas of AI-based data extraction, enhanced interoperability, and management of decentralized trials on the cloud, which is the main point. The patient-centricity technologies lead to recruitment efficiency.

How is Asia-Pacific performing in the Clinical Trials Matching Software Market?

The region is being characterized by the expanding research activity, the increasing digital healthcare adoption, and the growing trial outsourcing. The demand for scalable platforms capable of supporting diverse populations is rising. Governments' alignment with the global standards encourages the trial operations to be more efficient, and at the same time, the modern AI-driven recruitment technologies to be widely used.

Asia Pacific is about to record the rapid CAGR during the forecast period due to the availability of a large number of patients in the region. A large number of companies are aiming to place their research and development activities in Asia Pacific, thereby supporting to the market growth in this region. This growth can be attributed to a rise in the number of healthcare IT projects, a growing economy and an overall improvement in healthcare infrastructure, especially developing countries, such as India and china.

India Clinical Trials Matching Software Market Trends:

The adoption is sped up by the pharmaceutical activity and the digital solutions that are friendly and supportive. The focus on the economic cloud platforms permits the scalability of the solutions intended for diverse groups. The tech maturation that is happening will support the integration of the AI-based matching tools that are meant to facilitate access and speed up trial operations.

Latin America & Middle East and Africa (LAMEA) is the lowest clinical trial matching software market due to adequate technology, healthcare infrastructure, few players working in the clinical trial market, and low per capita incomes in underdeveloped regions in Africa.

What are the driving factors of the Clinical Trials Matching Software Market in Europe?

The market growth is led by the implementation of strict privacy standards, the use of advanced infrastructure, and the interest in cross-border studies. The increasing focus on interoperable systems and precision medicine has given rise to the demand for AI-powered tools that can interpret the complex clinical and molecular datasets for precise patient trial alignment.

Germany Clinical Trials Matching Software Market Trends:

The driving factors are the implementation of health initiatives and the cooperation among hospitals and research partners. There are chances included in the enhancement of interoperability between various systems and the use of AI for patient matching based on privacy regulations.

Clinical Trials Matching Software Market-Value Chain Analysis

- R&D: systematic evaluation of research and discovery activities enabling prioritization of innovative projects with strong market potential.

Key players: Pfizer, Roche, and Johnson & Johnson. - Clinical Trials and Regulatory Approvals: designing studies and navigating regulatory processes, ensuring safe, efficient development within complex compliance frameworks.

Key players: IQVIA, PPD - Formulation and Final Dosage Preparation: transforming ingredients into stable, convenient final products, ensuring quality and scalable therapeutic manufacturing.

Key players: Catalent and Lonza - Packaging and Serialization: packaging finished products and applying serialization technologies, ensuring transparency, integrity, and secure inventory management.

Key Players: Uhlmann and Optel Group - Distribution to Hospitals, Pharmacies of Clinical Trials Matching Software: delivering products and integrating matching systems, enhancing accessibility, efficiency, and improving patient engagement in trial processes.

Key Players: McKesson, AmerisourceBergen, and Cardinal Health

Clinical Trials Matching Software Market Companies

- Advarra: Offers platforms for trial management that support the monitoring of recruitment as well as provide tech solutions to streamline operations among sponsors, sites, and research organizations.

- Antidote Technologies, Inc.: Employs precision recruitment tools that match patients to the right studies, thereby speeding up research through better discovery and participation paths.

- IBM Clinical Development: Delivers a data management platform that allows for the collection of data, cleaning of data, and analysis that, in turn, supports the efficient execution of trials and structured research workflows.

Other Major key Players

- Clinical Trials Mobile Application

- SSS International Clinical Research

- Aris Global

- Clario

- Bsi Business Systems Integration AG

- Microsoft Corporation

- Ofni Systems

Recent Developments

- In August 2025, Massive Bio launched a new feature on its Patient Connect app, enhancing access to electronic health records (EHRs) for patients and healthcare providers. This simplifies the process of advanced cancer care and clinical trial enrollment. (Source: https://www.businesswire.com )

- In February 2025, Inovalon launched Clinical Research Patient Finder, an AI-driven solution that accelerates clinical trial patient recruitment by integrating with EHRs. It offers real-time patient identification and data monitoring, reducing recruitment bottlenecks and enhancing trial efficiency for faster therapeutic market release. (Source: https://www.businesswire.com )

- In July 2022, Advarra Cloud solution, driven and developed through partnership with Advarra's Site-Sponsor Consortium, provides end-to-end integration and automated, seamless exchange of research documents between sites, sponsors, and CROs.

- In April 2021, ERT, the international leader in clinical endpoint data solutions, merged with Bioclinica and the name of the combined company was changed to Clario. This merger combines Bioclinica's expertise in imaging, eClinical software and drug safety solutions with ERT's expertise in eCOA, cardiac, respiratory and wearable safety. The development aims to combine the technical aspects of both companies to provide improved service to a broader customer base.

- In March 2021, Advarra, a one of the top research company offering solutions to make clinical trials safer smarter and faster announced the completion of its acquisition of Bio-Optronics, creator of CCTrialSuite and which offers clinical trial matching system (CTMS) solutions for the healthcare system and clinical research. This acquisition strategy enabled the company to enhance its product portfolio and increase its customer base.

Segments Covered in the Report

By Components

- Services

- Software

By End-User

- Clinical Research Organizations (CRO)

- Pharmaceutical and biotechnology Companies

- Medical Device Firms

By Deployment Mode

- On-Premise

- Web and Cloud based

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content