What is Commercial Aircraft Manufacturing Market Size?

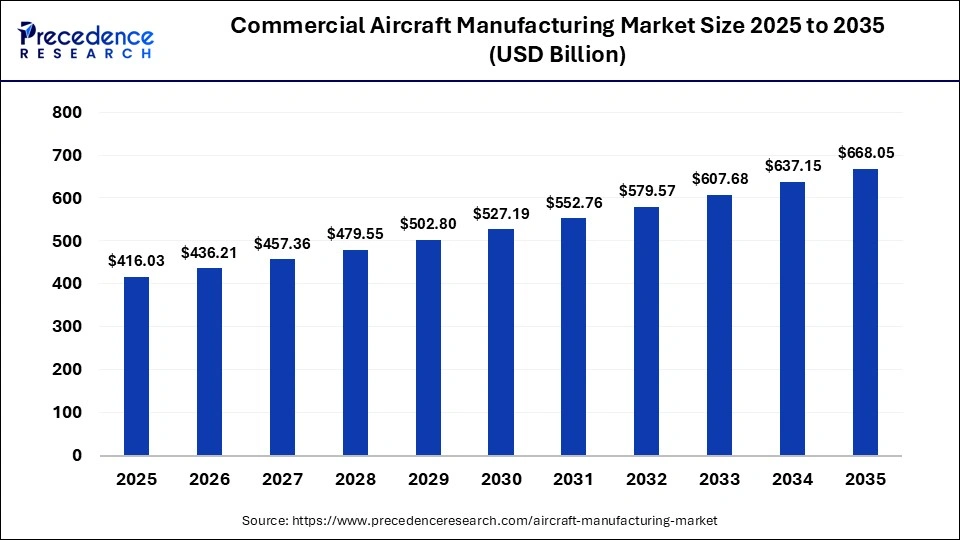

The global commercial aircraft manufacturing market size was calculated at USD 416.03 billion in 2025 and is predicted to increase from USD 436.21 billion in 2026 to approximately USD 668.05 billion by 2035, expanding at a CAGR of 4.85% from 2026 to 2035. The growth of the market is driven by the rising demand for air travel, fueled by the expanding middle-class population in emerging economies and increasing globalization. Additionally, advancements in technology and a focus on fuel efficiency and environmental sustainability are motivating manufacturers to innovate and enhance their aircraft offerings.

Market Highlights

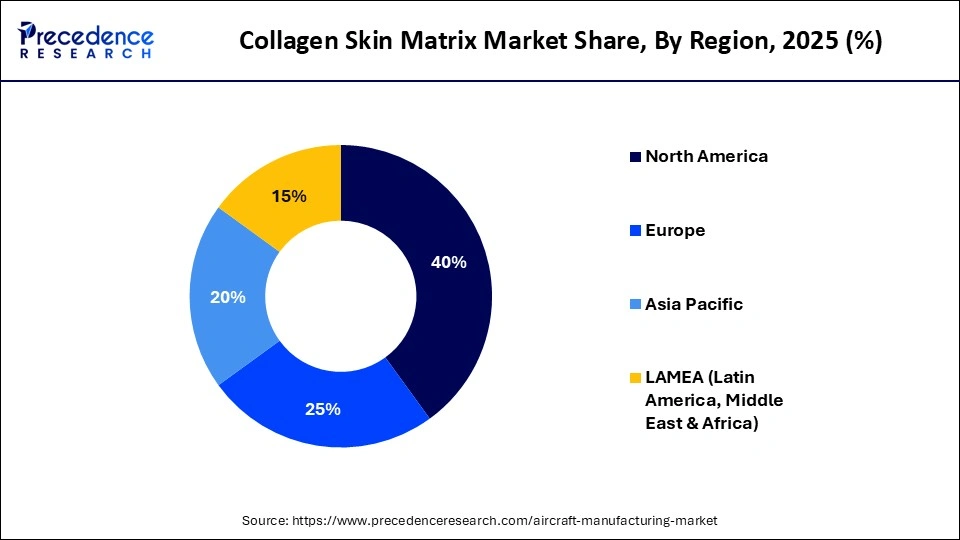

- North America dominated the commercial aircraft manufacturing market with the largest share of approximately 40% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR of 5.8% in the market during the forecast period.

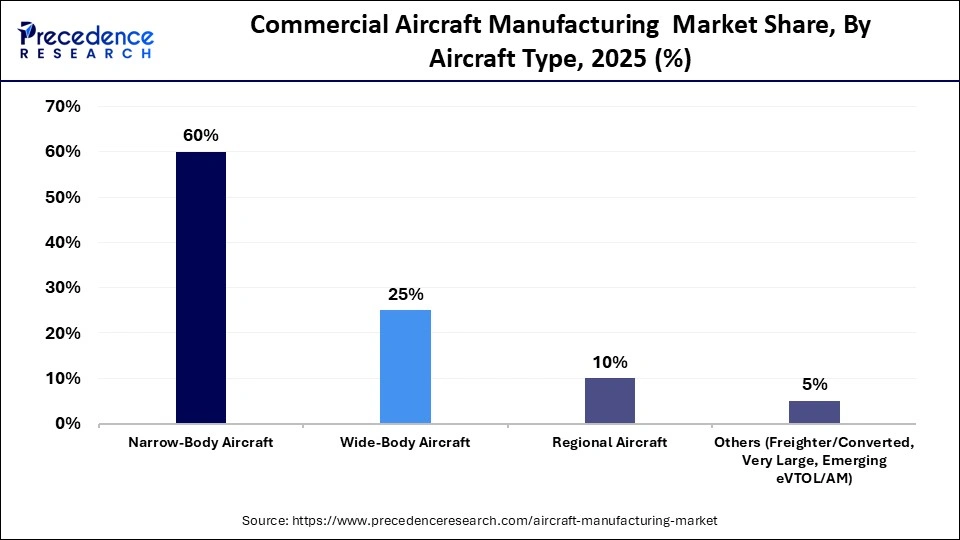

- By aircraft type, the narrow-body aircraft segment held a dominant position in the market with the largest share of approximately 60% in 2025.

- By aircraft type, the regional aircraft segment is expected to grow at the fastest CAGR of 4.7% in the market between 2026 and 2035.

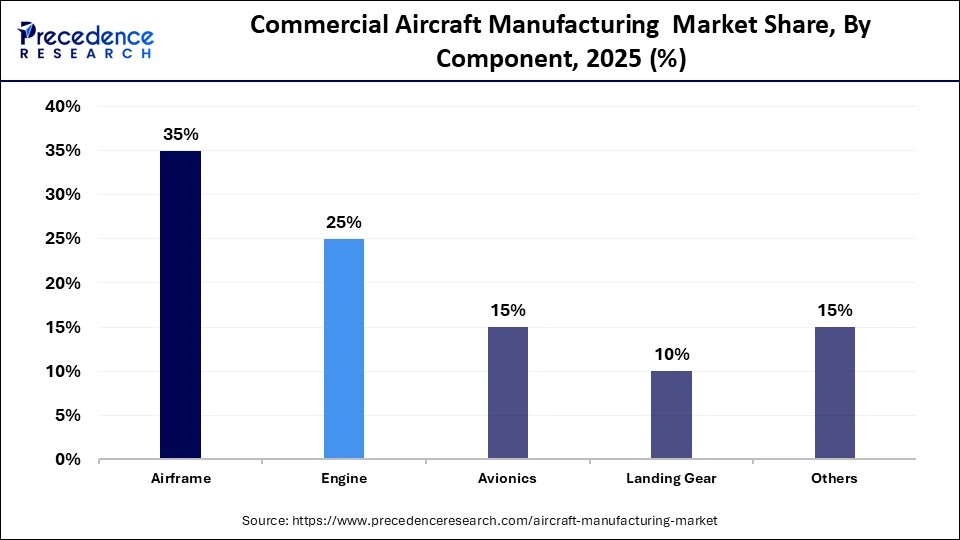

- By component, the airframe segment accounted for a considerable revenue share of approximately 35% in the market in 2025.

- By component, the avionics segment is expected to grow with the highest CAGR of 4.9% in the market during the studied years.

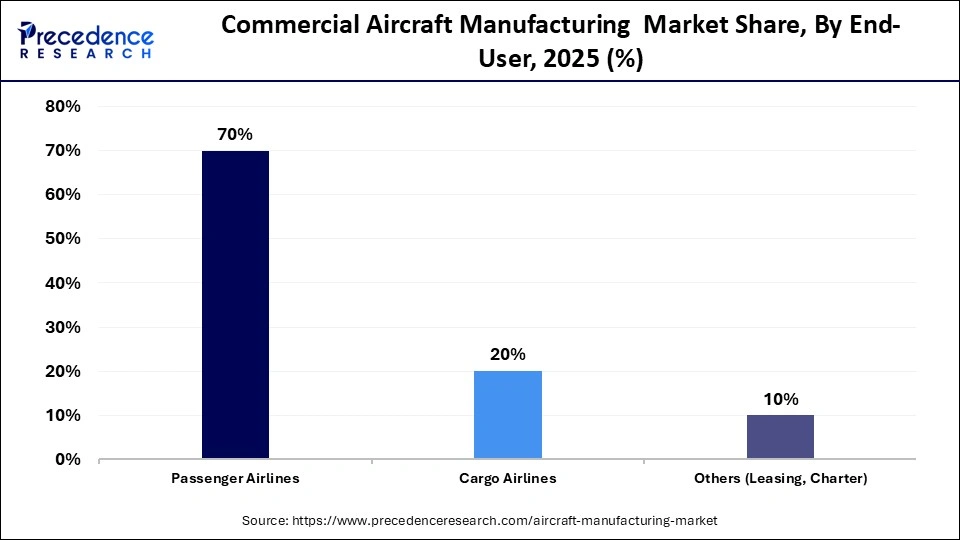

- By end-user, the passenger airlines segment led the global market with a share of approximately 70% in 2025.

- By end-user, the cargo airlines segment is expected to expand rapidly in the market with a CAGR of 5.1% in the coming years.

Forging the Future of Flight: Commercial Aircraft Manufacturing Takes Off

The commercial aircraft manufacturing market involves the design, development, and production of aircraft used for passenger and cargo transport by airlines worldwide. It includes major components such as airframes, propulsion systems, avionics, and landing gear, driven by the demand for fleet expansion, fuel efficiency, and safety standards. The industry is highly consolidated, led by major OEMs with extensive global supply chains.

The market is experiencing strong momentum, driven by rising global air passenger traffic and long-term fleet expansion plans by airlines. Aircraft replacement cycles, raised by the need for fuel-efficient and low-emission models, are reshaping manufacturing priorities. Narrow-body aircraft continue to dominate production due to their suitability for short- and medium-haul routes. Increasing order backlogs from both developed and emerging economies highlight sustained market growth.

What is the Role of AI in the Commercial Aircraft Manufacturing Market?

Artificial intelligence (AI) is transforming commercial aircraft manufacturing by optimizing design, production, and maintenance processes. AI-powered digital twins are enabling manufacturers to simulate aircraft performance, reduce prototyping costs, and shorten development cycles. Predictive analytics driven by AI is improving quality control and minimizing manufacturing defects across complex supply chains. This enables manufacturers to detect potential defects and make proactive decisions. Additionally, AI-enabled robotics and automation are enhancing precision assembly and workforce productivity.

- According to Tata Consultancy Services' Future-Ready Skies Study 2025 on 323 senior aerospace executives in Europe and North America, 1 in 3 believe AI-driven, real-time decision-making will be the single biggest force reshaping aircraft manufacturing by 2035.

Key Market Trends

- Shift Towards Smart Airports: The integrated digital platforms unify airside, landside, and terminal operations.

- Rising Adoption of Predictive Analytics: Predictive analytics is enhancing and encouraging delay reduction, asset utilization, and preventive maintenance.

- Automation: The automation of handling and baggage systems is set up to improve turnaround efficiency.

- Passenger experience management: The increased focus on passenger experience management; it includes real-time crowd control and journey optimization.

- Cloud-based operation: The cloud-based airport operational database is replacing the legacy on-premise systems. Encouraging bot or online operations for the operation staff present on-job. Making things easy and ensuring every operation is on time.

- Sustainability-driven operations: This system is leveraging AI to reduce the fuel burn, emissions, and energy consumption.

Maret Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 416.03 Billion |

| Market Size in 2026 | USD 436.21 Billion |

| Market Size by 2035 | USD 668.05 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Aircraft Type,Component,End-User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Aircraft Type Insights

Which Aircraft Type Segment Dominated the Commercial Aircraft Manufacturing Market?

The narrow-body aircraft segment held a major revenue share of approximately 60% in the market in 2025, because they cover short and medium routes. These aircraft are essential for airlines due to their fuel efficiency, reduced operating costs, and high-frequency flights. High rates of low-cost carrier growth and regional connectivity plans still contribute to high order volumes. Continued innovations on the engine and the use of lightweight materials reinforce the demand in this segment.

The regional aircraft segment is expected to show the fastest growth with a CAGR of 4.7% over the forecast period, driven by the revival of long-haul international flights and the increasing need for high-capacity aircraft. Native wide-body aircraft are increasingly being invested in by airlines as solutions to increase passenger comfort and minimize fuel per seat. Intercontinental tourism and business travel are growing rapidly, driving fleet modernization. Also, wide-body aircraft are becoming popular in premium long-haul routes and high-density routes.

Component Insights

Why the Airframe Segment Dominated the Commercial Aircraft Manufacturing Market?

The airframe segment accounted for the highest revenue share of approximately 35% in the market in 2025, since it is the most dominant in aircraft manufacturing in terms of costs and complexity. The use of high levels of composite and alloy metals is enhancing the strength of the structure by reducing overall weight. Manufacturers are also working on modular airframe designs to improve production efficiency. This segment can be taken over in the long term due to continuous innovation of aerostructures.

The avionics segment is expected to witness the fastest growth in the market with a CAGR of 4.9% over the forecast period, driven by the increasing demand for digital cockpits, sophisticated navigation, and flight management systems. Software-defined avionics are becoming an important consideration in modern aircraft to improve aviation safety, situational awareness, and fuel efficiency. The combination of AI, real-time data analytics, and connection solutions accelerates avionics upgrades. Such regulatory focus on improved safety and communication networks augments the segment's growth.

End-User Insights

Which End-User Segment Led the Commercial Aircraft Manufacturing Market?

The passenger airlines segment led the global market with a share of approximately 70% in 2025, driven by a consistent increase in international traffic and an increasing middle-class population. The sustained demand is caused by fleet growth and the replacement of old models. Airline companies are focusing on fuel-efficient designs to minimize the cost of operation and emissions. The high recovery in passenger traffic is still supporting the leadership of this segment.

The cargo airlines segment is expected to expand rapidly in the market with a CAGR of 5.1% in the coming years, driven by thriving e-commerce and international trade activities. The need to meet the demand for goods of high value and high time sensitivity is driving investment in special-purpose freighter aircraft. Airlines are retrofitting older passenger planes to cargo setups to increase capacity. This segment is likely to continue growing if there is growth in air freight logistics.

Regional Insights

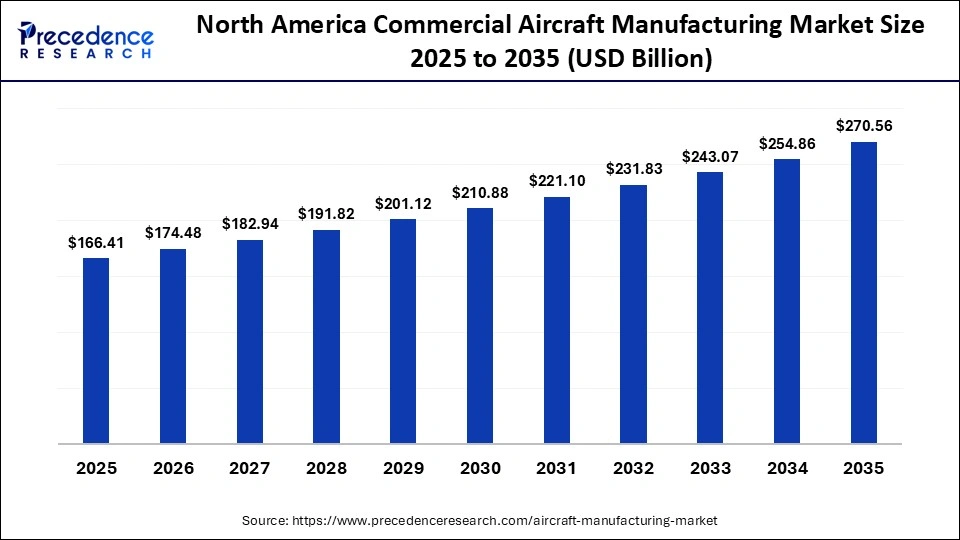

How Big is the North America Commercial Aircraft Manufacturing Market Size?

The North America commercial aircraft manufacturing market size is estimated at USD 166.41 billion in 2025 and is projected to reach approximately USD 270.56 billion by 2035, with a 4.98% CAGR from 2026 to 2035.

Why North America Dominated the Commercial Aircraft Manufacturing Market?

North America dominated the market with a share of approximately 40% in 2025. North America plays a pivotal role in the market, boasting a strong presence of leading manufacturers like Boeing and Airbus. The region is characterized by advanced technological infrastructure, fostering innovation in design and production processes. With significant demand for air travel driven by both domestic and international routes, airlines are continuously expanding their fleets to accommodate passenger growth. Additionally, North America is at the forefront of incorporating sustainable practices and AI technologies into aviation, ensuring that the industry evolves in an environmentally conscious manner.

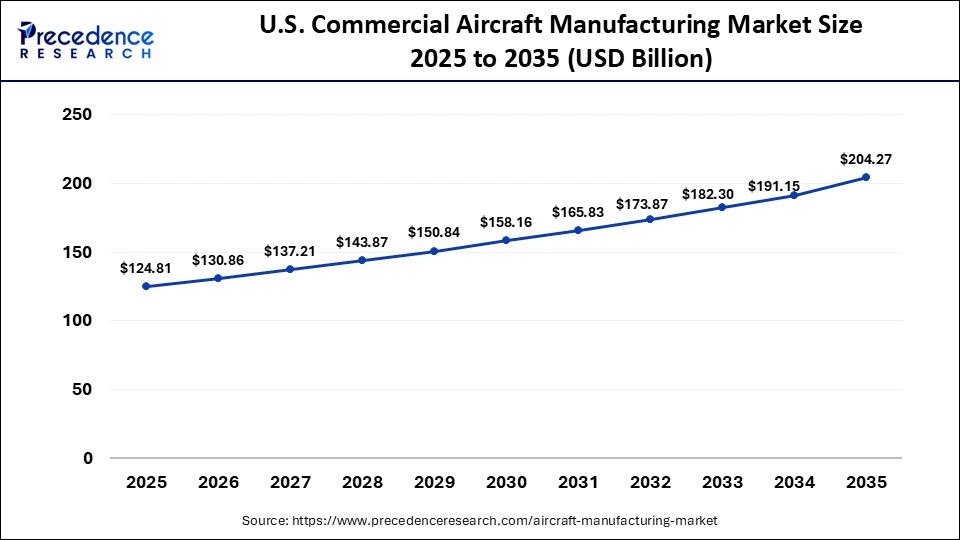

What is the Size of the U.S. Commercial Aircraft Manufacturing Market?

The U.S. commercial aircraft manufacturing market size is calculated at USD 124.81 billion in 2025 and is expected to reach nearly USD 204.27 billion in 2035, accelerating at a strong CAGR of 5.05% between 2026 to 2035.

Country Level Analysis

The U.S. is a dominant player in the market, with major companies like Boeing leading the industry. A robust demand for air travel, particularly post-pandemic, is driving expansion plans among airlines, prompting significant investments in aircraft development. Furthermore, government policies favoring aerospace innovation and sustainability initiatives are shaping the future of manufacturing in the region. As technological advancements, including the integration of AI in manufacturing processes, gain traction, the U.S. is expected to solidify its global market position.

How is Asia-Pacific Growing in the Commercial Aircraft Manufacturing Market?

Asia-Pacific is expected to grow at the fastest CAGR of 5.8% in the market during the forecast period, driven by booming air travel and fast-growing aviation facilities. The growing disposable income, urbanization, and connectivity among emerging economies are leading to a faster pace of aircraft demand. Governments are investing heavily in new airports and regional air routes to enable traffic to increase. The intense competition of low-cost airlines is also enhancing the mass purchasing of aircraft.

Country Level Analysis

China is also a major driver of growth, aided by its local aircraft initiatives and long-term strategies to ensure that it stops relying on foreign producers. The airline fleet expansion, regional connectivity plans, and the increased domestic travel demand are some of the factors that are experiencing sharp growth in India. Japan and South Korea are still playing their roles with high aerospace production and well-developed supplier networks. Other high-growth markets include Southeast Asian countries, such as Indonesia and Vietnam, as tours and air cargo volumes soar.

Commercial Aircraft Manufacturing Market Value Chain Analysis

- Infrastructure Development

Infrastructure development includes aircraft assembly plants, component manufacturing facilities, testing hangars, and airport-based delivery centers that support large-scale aircraft production. Continuous investment in smart factories and advanced tooling infrastructure is critical to meet rising order backlogs.

Key players: Boeing, Airbus, COMAC, Embraer, Spirit AeroSystems

- Warehousing and Inventory Management

Warehousing and inventory management focus on storing high-value aircraft components, engines, avionics, and composites while ensuring just-in-time availability. Digital inventory systems and RFID tracking are increasingly used to manage complex, multi-tier supplier networks.

Key players: Safran, GE Aerospace, Collins Aerospace, Liebherr Aerospace, Honeywell

- Last-Mile Delivery Services

Last-mile delivery services in aircraft manufacturing involve the secure transportation of large components such as wings, fuselage sections, and engines to final assembly lines. Specialized logistics providers use dedicated cargo aircraft, ships, and custom transport solutions.

Key Companies: Airbus Transport International, Antonov Airlines, DHL Aviation,

- Logistics Technology and Platform Development

Logistics technology platforms enable real-time visibility, supplier coordination, and risk mitigation across global aerospace supply chains. Advanced analytics and digital twins help manufacturers anticipate delays and optimize production schedules.

Key Companies: SAP, Oracle, Siemens Digital Industries Software, Dassault Systèmes, IBM

- Regulatory Compliance and Customer Clearance

Regulatory compliance and customs clearance ensure adherence to aviation safety standards, export controls, and international trade regulations. Streamlined certification and cross-border compliance are essential for timely aircraft deliveries.

Key Companies: Boeing Global Services, Airbus Services, SGS, Bureau Veritas, TÜV SÜD

- Product Lifecycle Management

Product lifecycle management covers aircraft design, manufacturing, delivery, maintenance, upgrades, and end-of-life recycling. Integrated PLM systems help manufacturers improve traceability, regulatory compliance, and long-term fleet performance.

Key Companies: Dassault Systèmes, Siemens, PTC, Airbus Lifecycle Services, Boeing AnalytX

Who are the Major Players in the Global Commercial Aircraft Manufacturing Market?

The major players in the commercial aircraft manufacturing market include The Boeing Company, Airbus SE, Lockheed Martin Corporation, Northrop Grumman Corporation, Embraer S.A., Bombardier Inc., Mitsubishi Aircraft Corporation, COMAC (Commercial Aircraft Corporation of China), Textron Aviation, Dassault Aviation, Irkut Corporation, Sukhoi Civil Aircraft (UAC), AVIC (Aviation Industry Corporation of China), General Dynamics Corporation, and Raytheon Technologies / Pratt & Whitney

Recent Developments in the Commercial Aircraft Manufacturing Market

- In January 2026, India's indigenous manufacturing took center stage at an event that highlighted the advantages of local production, including reduced costs, faster delivery times, and the opportunity to tailor aircraft to regional needs and preferences. This focus on home-grown innovation bolsters the domestic aerospace industry and enhances India's position in the global aviation market by fostering self-reliance and encouraging technological advancements.

(Source: https://www.thehindu.com) - In January 2026, Embraer, a Brazilian aerospace manufacturer, signed a Memorandum of Understanding (MoU) with Adani Aerospace and Defence to develop an integrated regional transport aircraft ecosystem in India, spanning aircraft manufacturing. The collaboration was made to establish the country's first final assembly line for a commercial aircraft, along with aftermarket services and pilot training. (Source: https://www.thehindu.com)

- In October 2025, Airbus launched its second A320 final assembly line (FAL) at its manufacturing facility in Mobile, Alabama, for the manufacturing of commercial aircraft. The line is projected to reach a monthly production rate of 75 A320 family aircraft in 2027 through a resilient, efficient, and globally diversified network. (Source: https://www.aerospacemanufacturinganddesign.com)

Segments Covered in the Report

By Aircraft Type

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Aircraft

- Others (Frieghter/Converted, Very Large, Emerging eVTOL/AM)

By Component

- Airframe

- Engine

- Avionics

- Landing Gear

- Others

By End-User

- Passenger Airlines

- Cargo Airlines

- Others (Leasing, Charter)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting