Commercial Satellite Imaging Market Size and Forecast 2025 to 2034

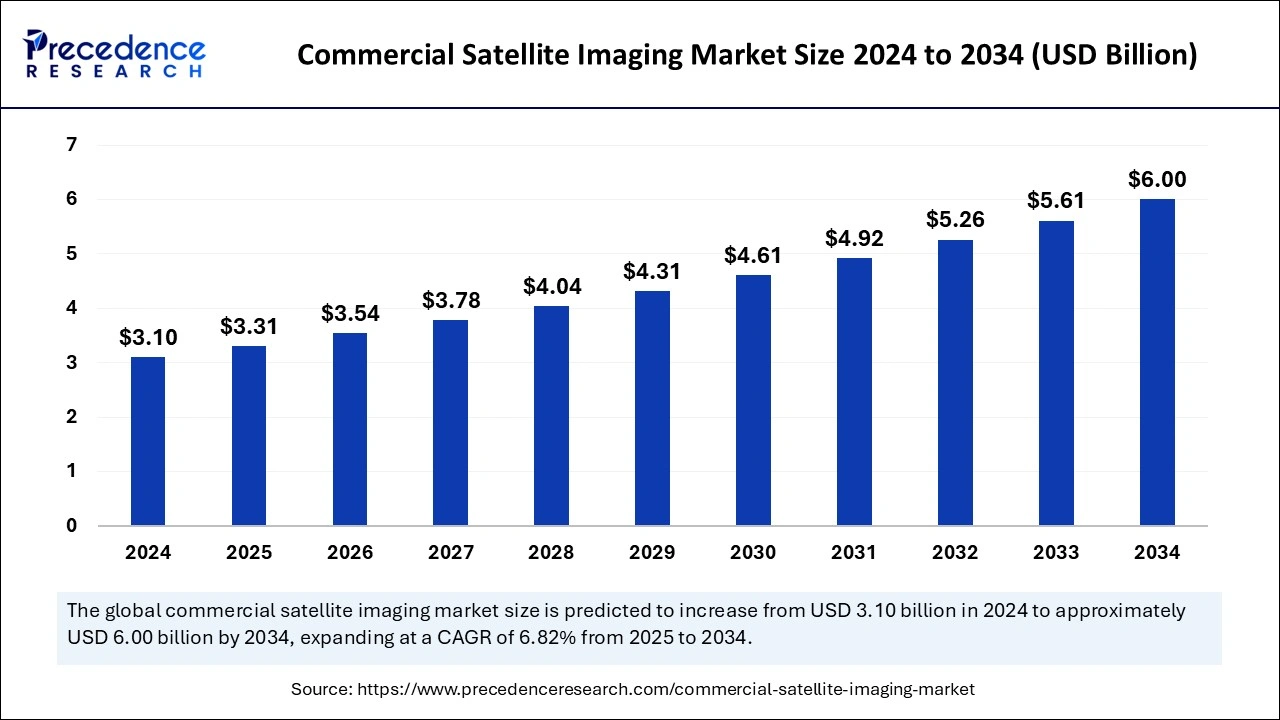

The global commercial satellite imaging market size was estimated at USD 3.10 billion in 2024 and is predicted to increase from USD 3.31 billion in 2025 to approximately USD 6.00 billion by 2034, expanding at a CAGR of 6.82% from 2025 to 2034. The market is propelled by rising demand for geospatial data, technological advancements, government investments, growing defense applications, climate change monitoring, and e-commerce logistics.

Commercial Satellite Imaging Market Key Takeaways

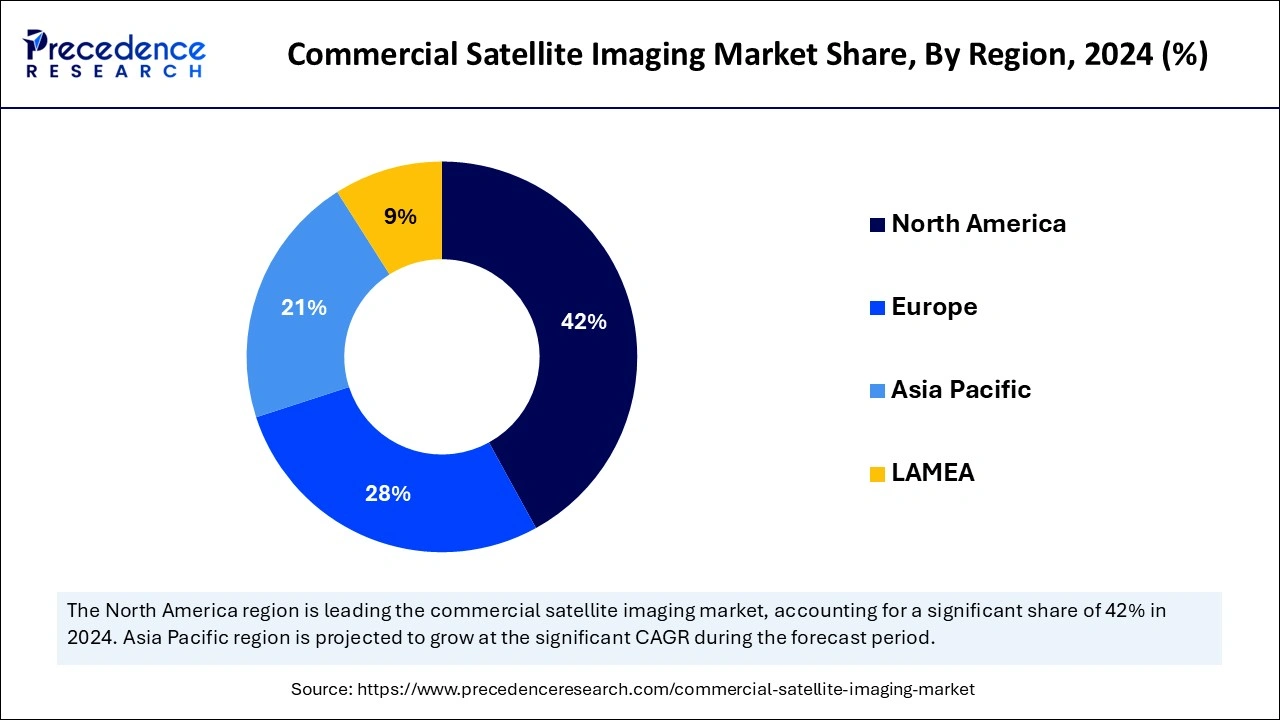

- North America dominated the market with the largest share of 42% in 2024.

- Asia Pacific is anticipated to witness the fastest growth in the market during the forecasted years.

- By application, the geospatial data acquisition and mapping segment generated the largest share of the market in 2024.

- By application, the urban planning and development segment is estimated to witness the fastest growth during the forecast period.

- By end-use, the government segment noted the largest market share in 2024.

- By end-use, the military and defense segment is estimated to witness the fastest growth in the forecast period.

Artificial Intelligence (AI) Integration in the Commercial Satellite Imaging Market

Commercial satellite imaging growth in the global market strengthens because of Artificial Intelligence integration with advanced data analytics capabilities. The combined technologies deliver faster and more precise interpretations of satellite images, which provide essential information for agricultural applications in urban planning, environmental monitoring, and disaster response operations.

The commercial satellite imaging market will expand its technological capabilities through ongoing AI and data analytics developments so it can provide enhanced solutions that merge modern technological advancements with geospatial data. The combination of these technologies allows users to obtain faster and more insightful information. Businesses utilize accelerated processing methods to analyze big satellite data volumes. They continue increasing their demand for AI-driven solutions in satellite imaging because they need data to support their strategic decisions.

U.S. Commercial Satellite Imaging Market Size and Growth 2025 to 2034

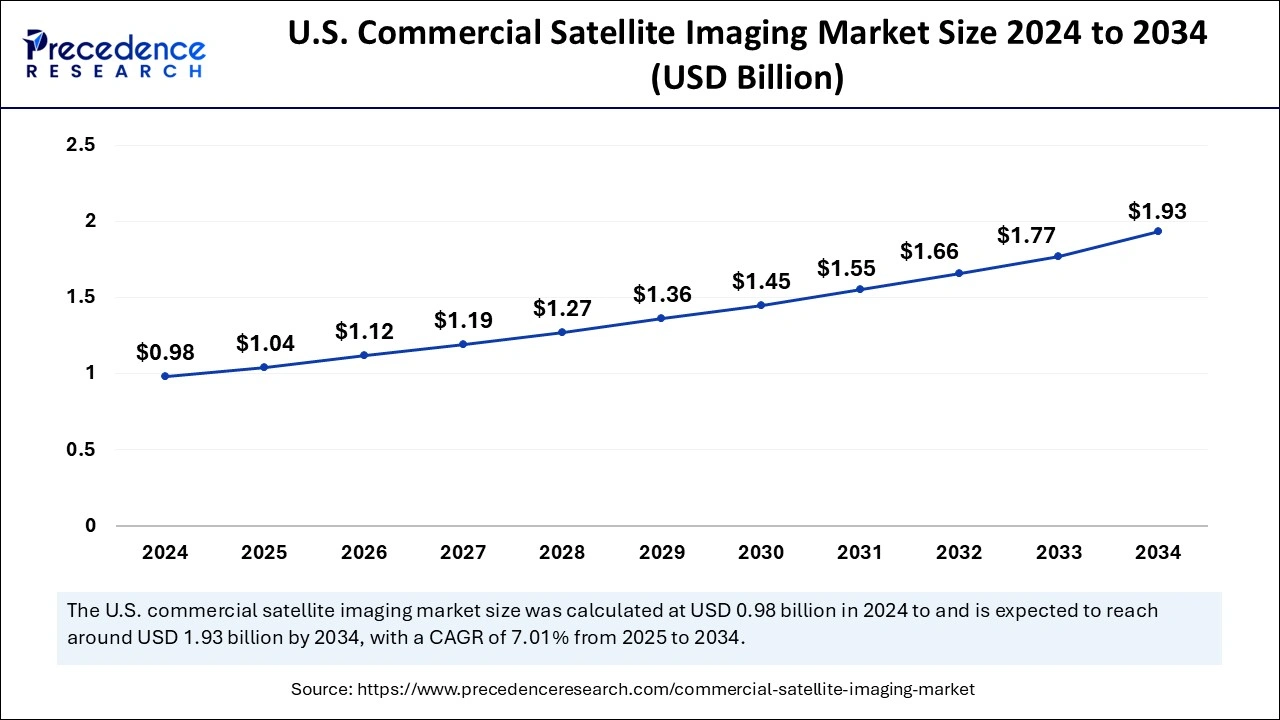

The U.S. commercial satellite imaging market size was exhibited at USD 980 million in 2024 and is projected to be worth around USD 1.93 billion by 2034, growing at a CAGR of 7.01% from 2025 to 2034.

North America accounted for the largest commercial satellite imaging market share in 2024 due to its robust infrastructure and sophisticated technological capabilities. Industrious players in the market combined with extensive research and development funding drove the advancements in satellite imaging technology. Public entities and private sector organizations working together have expanded access to usable data through their collaborative efforts within government programs aimed at defense operations, agricultural sector activities, and environmental monitoring initiatives.

The United States will become a major satellite data services market because of its numerous established satellite data providers and space operating companies. Various regional government agencies continue making substantial investments to support commercial satellite launches because these launches will drive future expansion in commercial satellite imaging.

Asia Pacific is anticipated to witness the fastest growth in the commercial satellite imaging market during the forecasted years. Satellite technological advancement with heavy spending from Asian Pacific nations, including China, Japan, India, and South Korea, will drive the Asia Pacific market to achieve the fastest expansion rates. These Asian-Pacific countries show growing appreciation for satellite images because of their value for infrastructure development, disaster relief operations, urban planning, and agricultural applications.

Rapid urbanization, along with rising population numbers in this area, drives increased requirements for precise and current data. The commercial satellite imaging market experiences accelerated growth due to government initiatives supporting space capability advancements with public-private partnership stimulations. The Asia Pacific market is projected to reveal substantial growth with innovative practices shortly.

- In January 2025, India's space tech startup Pixxel unveiled three of its six hyperspectral imaging satellites aboard a SpaceX rocket from California. SpaceX launched the satellites at 1915 GMT, which followed midnight in India from the Vandenberg Space Force Base, through a SpaceX broadcast that was displayed live.

Market Overview

Commercial satellite imaging refers to obtaining geospatial data through a satellite-controlled planetary or terrestrial surface surveillance process. Satellite imaging delivers real-time imagery that performs several applications, such as geographical border surveillance, environmental monitoring, and natural resource monitoring. The commercial satellite imaging market can capture fast images and provide global coverage creating satellite imaging as the better imaging solution. Also, satellite imagery is collected digitally, which aids in preventing data from any kind of loss. The technology delivers exceptional economic growth advantages and environmental conservation strengths.

Commercial Satellite Imaging Market Growth Factors

- Increased demand for geospatial data: The rising need for geospatial data pushes industries to prioritize satellite imaging because these industries require accurate mapping for agriculture with urban planning and environmental monitoring functions.

- Technological advancements: Research and development of satellite technology produces better resolution and speedier image processing and upgraded sensors, which results in more precise and timely data availability.

- Government initiatives: Several governments across the world continue to invest in satellite systems for the purposes of national security alongside research and national infrastructure needs.

- Rise in defense and intelligence applications: Military organizations with intelligence services depend on satellite imagery since it provides them with monitoring capabilities to track global conflicts and perform surveillance and reconnaissance activities. The real-time defense data requirements have led to a drastic rise in commercial satellite imaging service acquisitions.

- Climate change awareness: Satellite imaging serves crucial purposes in recognizing and evaluating climate changes and developing sustainable policy frameworks because of heightened climate awareness.

- E-commerce growth:The supply chain industry raises high-resolution images from commercial satellite imagery services to monitor infrastructure plan routes effectively, which drives increased demand within this sector.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.00 Billion |

| Market Size in 2025 | USD 3.31 Billion |

| Market Size in 2024 | USD 3.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.82% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, End-User, |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing need for location-based services (LBS)

The commercial satellite imaging market demonstrates rapid expansion because location-based services face increasing market demand globally. Businesses and consumers depend on LBS to deliver customized contexts-sensitive experiences in the modern digital environment. LBS employs accurate location data to generate personalized content with services that use navigation, geotagging, real-time asset tracking, and targeted advertising. Industries such as logistics, transportation, retail, and urban planning benefit immensely from LBS-powered solutions.

The optimized delivery route planning of services results in rapid shipments alongside smartphone promotions from retailers targeting specific consumer locations and urban development supported by geospatial data analysis. The demand for accurate and reliable satellite imagery continues to rise because of this trend, which establishes the global market as a leader in technological advancements for the location-based services ecosystem.

Crucial applications in government and defense sectors

Government and defense authorities depend on satellite imaging as an established information source that supports enhanced security programs using distinct information and top-quality images. Satellite image data enables governments to evaluate existing scenarios properly, thus sparking program development for life preservation alongside property defense and strengthening community economic growth.

The commercial satellite imaging market enables tracking of defense sector threats stemming from terrorism along with critical infrastructure attacks so preventive measures ensure protection for specific sites. This process assists with clear decision-making processes in addition to providing precise geographical mapping that serves military planning operations, search and rescue missions, and future project development applications.

Restraint

High initial investment costs in satellite technology

The high costs connected to satellite deployment and maintenance pose a significant challenge. The commercial satellite imaging market faces occasional challenges because of high space technology development and satellite launch expenses. The substantial expenses involved in establishing and launching satellites serve as an entry barrier that prevents new, smaller organizations from accessing the market.

The substantial investment requirements pose an entrance challenge that constrains market competition and emerging innovations, thus restricting overall market expansion. Market expansion faces significant barriers due to the financial costs involved in launching satellites. Implementing satellite launches requires extensive funding along with specialized competencies.

Opportunity

Growing development of smart city projects

The implementation of commercial satellite imaging market technology enables smart cities to enhance urban planning and transportation management with public services by processing spatial data in detail. The effective implementation of smart city initiatives depends on satellite imagery to deliver precise information about both built environment features and their current state, including structures, roadways, and infrastructure elements.

Data collection allows urban planners to track settlement patterns while improving infrastructure management operations. The combination of remote sensing technologies with zoning applications and urban infrastructure modeling responds to growing city resident needs for sustainable urban development control. The growing trend of urban concentration with urban area observation to support smart city approaches has driven the adoption of satellite imaging solutions.

Application Insights

The geospatial data acquisition and mapping segment generated the largest share of the commercial satellite imaging market in 2024. Several industries use accurate modern geospatial information from the segment to execute numerous objectives, including urban planning for infrastructure development, environmental monitoring, and disaster response. Space-based imaging provides precise surface observations that enable strategic choices and transformative solutions within multiple modern economic areas. Geospatial data acquisition and mapping will continually grow because urbanization resource management and environmental conservation have become more important. Modern businesses with governmental institutions and industrial entities acknowledge the strategic worth of geospatial data since it helps create sound decisions and enhance operational effectiveness and business competitiveness.

- In February 2024, the National Geospatial-Intelligence Agency plans to strengthen its commercial satellite imagery capabilities through “Luno.” Through the Luno program, NGA will utilize commercial satellite data and analytics to strengthen its worldwide monitoring capabilities.

The urban planning and development segment is estimated to witness the fastest growth during the forecast period. Satellite imaging enables sophisticated decision-making processes for several types of planning and development activities. Urban planning stands out as one of the primary application fields. Planners acquire comprehensive awareness of land-use patterns through the analysis of satellite data. These data provide essential information that helps professionals optimize city design processes and position infrastructure properly while identifying development opportunities. Satellite imaging permits teams to monitor project development in real-time, which enables both scheduling precision and cost control.

End-Use Insights

The government segment noted the largest commercial satellite imaging market share in 2024. Through satellite technology, the analysis and management of disaster causation factors can be made possible, which improves civil protection and humanitarian services. Through risk evaluation and prevention planning activities, satellite imagery allows organizations to improve their disaster relief and response capabilities. The combination of high-resolution satellite data helps communities recover their facilities and improve both their financial capabilities and their standard of living. Government organizations deploy satellite imagery data to conduct border protection alongside planning infrastructure development for disaster preparedness and environmental tracking activities. Accurate real-time spatial data play a crucial role in driving the industry because they help organizations make better decisions while enhancing operational effectiveness. Governments enhance public service delivery by employing satellite imagery due to advances in data analytics with satellite technology.

The military and defense segment is estimated to witness the fastest growth in the forecast period. The military defense and security agencies use satellite images extensively during their operations to gain border intelligence through remote monitoring. Satellite imaging serves as a vital component that affects strategic planning during the entire process. The military sectors rely primarily on real-time satellite-based situational awareness and vital infrastructure monitoring with threat detection capability. The advancement of the commercial satellite imagery market depends heavily on government financial support.

- In May 2024, Maxar Intelligence and Lockheed Martin established an agreement to simplify geospatial product buying procedures for the F-35 fighter jet's flight simulation training system.

Commercial Satellite Imaging Market Companies

- Exelis, Inc.

- SPACEKNOW

- GALILEO GROUP INC

- URTHECAST CORP

- IMAGESAT INTERNATIONAL N.V

- MAXAR TECHNOLOGIES INC

- TELESPAZIO FRANCE

- PLANET LABS INC

- BLACKSKY GLOBAL LLC

- HARRIS CORPORATION

- EUROPEAN SPACE IMAGING

Recent Developments

- In December 2024, Dhruva Space, the Hyderabad-based start-up, introduced 'AstraView' as its new commercial satellite imagery service, which provides real-time earth observations.

- In June 2024, Hydrosat announced that its climate technology satellite VanZyl-1 will receive launch services from SpaceX's Transporter-11 mission from Vandenberg Air Force Base in California.

- In May 2024, RTX's new generation of commercial satellite imagers launches with Maxar's WorldView Legion. The first two of six WorldView Legion satellites launched by Maxar will deliver improvements to Earth observation by enhancing the capabilities for surveillance and monitoring purposes.

Segments Covered in the Report

By Application

- Geospatial Data Acquisition and Mapping

- Urban Planning and Development

- Disaster Management

- Energy and Natural Resource Management

- Surveillance and Security

- Defense and Intelligence

- Others

By End-User

- Government

- Military and Defense

- Forestry and Agriculture

- Energy

- Civil Engineering and Archaeology

- Transportation and Logistics

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting