What is the On-Orbit Satellite Servicing Market Size?

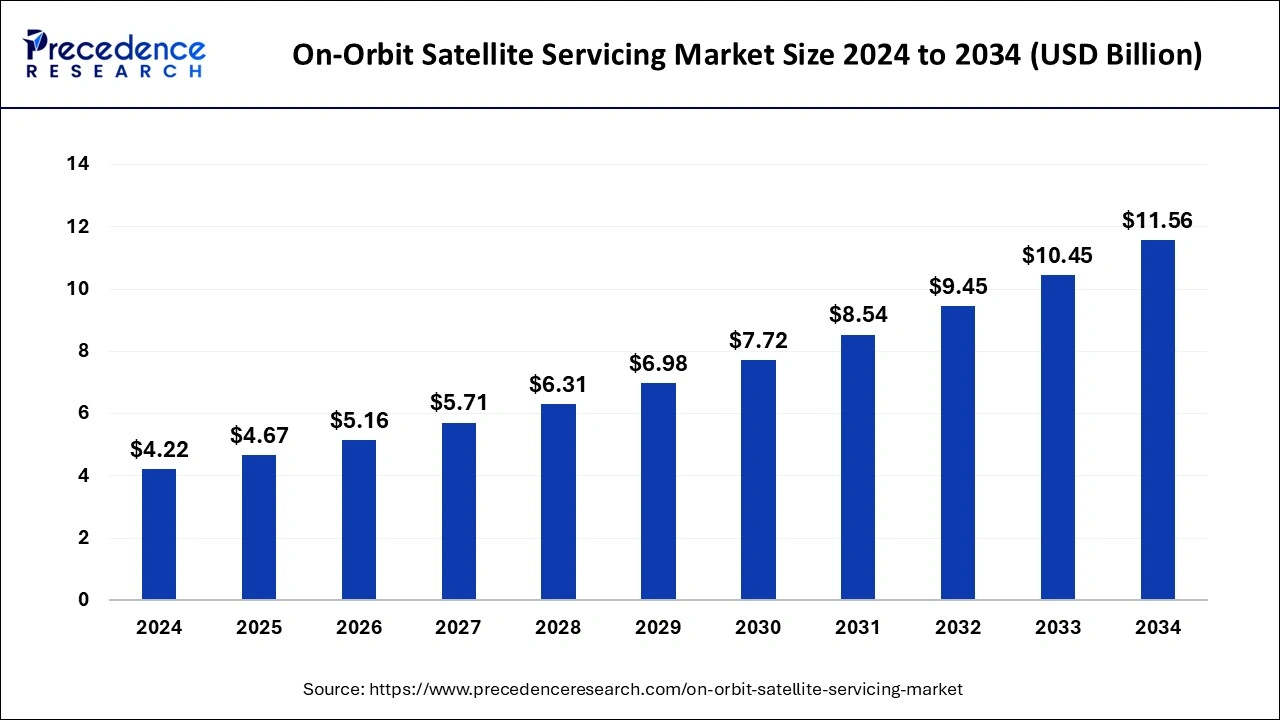

The global on-orbit satellite servicing market size is accounted at USD 4.67 billion in 2025 and predicted to increase from USD 5.16 billion in 2026 to approximately USD 12.60 billion by 2035, representing a CAGR of 10.43% from 2026 to 2035. The rising demand to maintain and repair satellites in space, which is essential to extending the life of satellites and improving their performance, contributes to the growth of the on-orbit satellite servicing market.

On-Orbit Satellite Servicing Market Key Takeaways

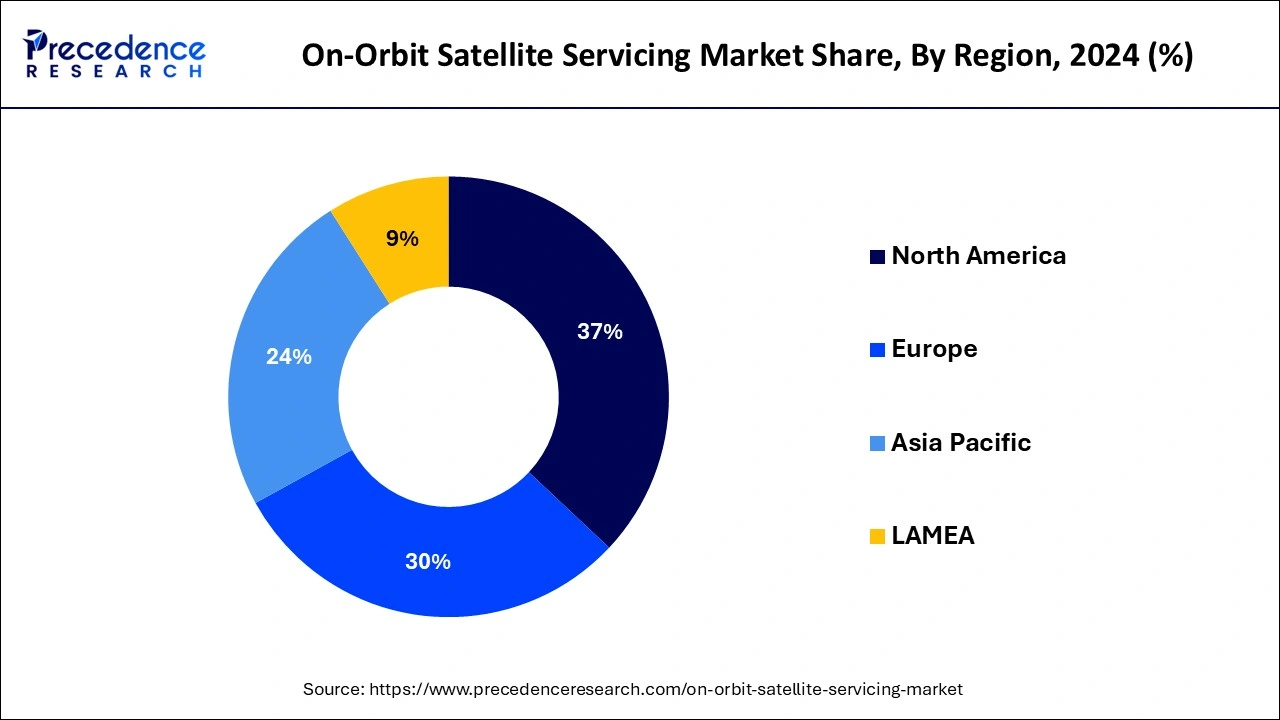

- North America dominated the on-orbit satellite servicing market with the largest market share of 37% in 2025.

- Asia Pacific is projected to expand at the fastest CAGR during the forecast period.

- By service, the robotics servicing segment contributed the highest market share in 2025.

- By service, the refueling segment will show significant growth during the forecast period.

- By orbit type, the LEO (Low Earth Orbit) segment captured the largest market share in 2025.

- By orbit type, the GEO (Geostationary orbit) segment is expected to grow at the fastest CAGR during the forecast period.

- By end-user, the commercial segment has held a major market share of 59% in 2025.

- By end-user, the military and government segment is projected to expand rapidly over the coming years.

How is Artificial Intelligence (AI) Changing the On-Orbit Satellite Servicing Market?

Integration of artificial intelligence in the on-orbit satellite servicing market has the potential to transform in terms of streamlining operations, managing complex network systems, and improving data processing. Artificial intelligence facilitates decision-making, solving problems, and performing tasks automatically. In addition, the incorporation of machine learning helps the system to learn and improve with the help of analyzed data patterns to make predictions or optimize satellite performance in real-time bases.

Market Overview

On-orbit satellite servicing comprises servicing, refueling, repairing, and upgrading satellites present in orbit. The on-orbit satellite servicing market is a rapidly growing transformative and disruptive capacity that offers operators unprecedented flexibility and resilience for space assets. The capabilities are achieved through new infrastructure for earth observation, communication, space exploration, space travel, and habitat, which are integral parts of creating a better world. The broad application of on-orbit satellite servicing benefits on a scientific, economic, strategic, and societal level. This on-orbit satellite servicing technology reduced the chances of failure with the help of cheaper and faster development of satellites and repair missions.

On-Orbit Satellite Servicing Market Growth Factors

- On-orbit satellite servicing supports maintaining space traffic by facilitating safe operation for about 1.5 billion vehicles circulating the Earth. The help of advanced infrastructure such as roads, bridges, tunnels, networks of fuel stations, and much more helps accomplish it.

- The involvement of government and institutes in developing and producing innovative technology is expanding the on-orbit satellite servicing market. Additionally, governments and institutes help small-scale and start-up companies to grow.

- With the help of investors and entrepreneurs who provide a great deal of investment for new opportunities and encourage the growth of start-up companies and technologies poised to transform the space industry.

Market Scope

| Report Coverage | Details |

| Market Size by 2026 | USD 5.16 Billion |

| Market Size in 2025 | USD 4.67 Billion |

| Market Size in 2035 | USD 12.60 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.43% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, Orbit Type, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Debris removal

The challenge of space debris elimination is the primary driver of the on-orbit satellite servicing market. This practice is greatly achieved through the government and space agencies/organizations, particularly in countries such as Europe, the United Kingdom, and Japan, where these regions invest in projects designed to develop demonstrators for debris removal. This is an essential initiative, as debris poses a substantial threat to satellite services. International collaboration helps in propelling debris removal by reducing the cost of OOS.

- The Zero Debris approach signed by 12 European Countries is a collaborative initiative for signatories, distributing the costs of achieving debris neutrality by the year 2030.

Restraint

Policy Challenges

An on-orbit satellite servicing market company only succeeds when there is a set of regulations and liability issues addressed. Along with that, the servicing company must have a remote sensing license as they use cameras for inspecting the client's satellite without any intention of clicking pictures of the Earth. Acquiring this license is a lengthy process as it needs to be reviewed by national security. This challenge can be resolved by obtaining a federal government outline of high-level policy priorities for servicing. Furthermore, there are other OOS industrial regulations.

Opportunity

Collaborative initiative

The collaboration between companies and governments is expected to expand the on-orbit satellite servicing market as this will multiply the stakeholders in the space industry who are working towards improving satellite performance, reducing cost, and ensuring safety. The satellite servicing companies recognize the areas of development for future necessities, which will help in economic growth in space and various opportunities for refurbishment.

Service Insights

The robotics servicing segment contributed the highest on-orbit satellite servicing market share in 2025. The dominance of the segment is observed due to the extensive utilization of robotics arms to repair, refuel, or exchange parts of the satellite. Along with that, it offers inspection, assembly, and maintenance of large space infrastructure and the removal of orbital debris. Many researchers and representative engineering applications and technology verification have shown individual interest in space robots for OOS. Modern space robots are equipped with features such as high intelligence and performance which help in dealing with OOS's increasing complexity.

- In November 2024, the U.S. Naval Research Laboratory (NRL) and the Defense Advanced Research Projects Agency (DARPA) built a groundbreaking robotic system tailored to repair and upgrade satellites in space.

The refueling segment will show significant growth in the on-orbit satellite servicing market during the forecast period. The expansion of this segment is noticed due to the rising demand for refueling capacity for future space exploration. This technology is gradually bringing significant savings by reducing the cost associated with replacing satellites with new ones. Along with that, this technology also encourages sustainable ways of designing missions and reducing the number of deorbited satellites.

- In August 2024, PIAP Space, a Warsaw-based technology, launched the INORT (In-Orbit Refuelling Technology for Unprepared and Prepared Satellites) project. The aim of this initiative is to analyze and develop solutions to extend the operation lifetime of satellites by designing in-orbit refueling technology.

Orbit Type Insights

The LEO (Low Earth Orbit) segment captured the biggest on-orbit satellite servicing market share in 2025. As Low Earth Orbit (LEO) is close to the Earth at 1200 to 2000 kilometers, it is the easiest orbit to reach for satellites. LEO is extensively used for communication, spaying, military reconnaissance, and other imaging applications. The preference of LEO is high compared to any other orbit due to its reduced latency which holds the ability to provide service with a lower latency rate.

The GEO (Geostationary orbit) segment is expected to grow at the fastest CAGR in the on-orbit satellite servicing market during the forecast period. The demand for GEO is as it is the ideal orbit if a satellite needs to stay fixed above at a specific location. This is commonly used as a telecommunication satellite for weather data, broadcast TV, and many more. As of July 2023, according to UCS satellite database lists, there are 6,718 known satellites, and 580 are at GEO.

End-User Insights

The commercial segment dominated the on-orbit satellite servicing market in 2025. The dominance of this segment is credited to the presence of on-orbit satellite servicing companies, which are integrated with advanced technology such as robotic arms,sensors, and software to command, interact, and manipulate the satellite. Additionally, commercial companies use automation, robotics, and navigation technology to maneuver satellites to position them for servicing.

The military and government segment is projected to expand rapidly in the on-orbit satellite servicing market over the coming years. The growth of this segment is owed to the utilization of OOS for satellite intelligence gathering, navigation, and communication by the military and government. Along with that, they are also being used for disaster management, agriculture, and forestry. Some established OOS from the military and government are OSAM-1 and the On-orbit Satellite Servicing Study by NASA project.

Regional Insights

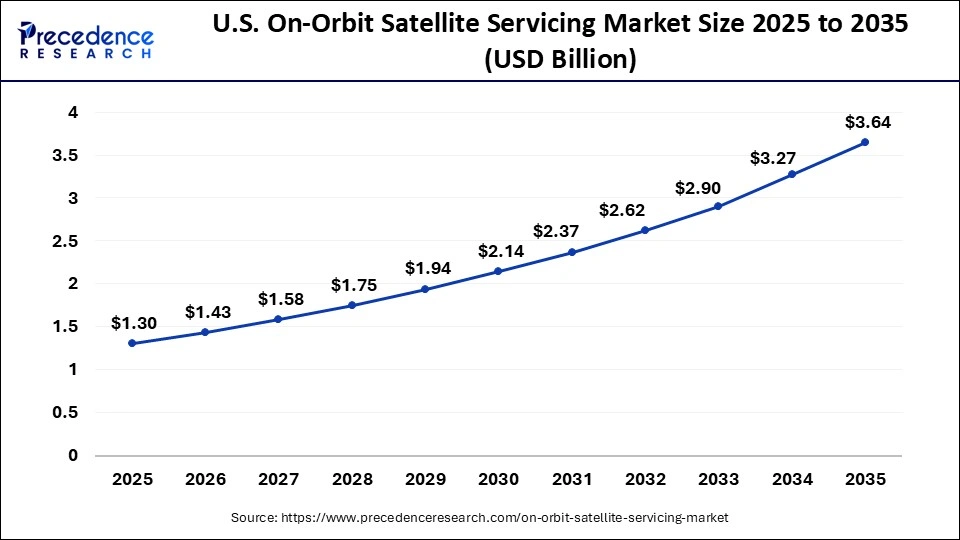

U.S. On-Orbit Satellite Servicing Market Size and Growth 2026 to 2035

The U.S. on-orbit satellite servicing market size was evaluated at USD 1.30 billion in 2025 and is projected to be worth around USD 3.64 billion by 2035, growing at a CAGR of 10.84% from 2026 to 2035.

North America held the largest share of the on-orbit satellite servicing market in 2025. The dominance of this region is observed due to the consistent advancement, strategic investment, and developed infrastructure. The Space Force is making a robust investment of USD 200 million each year to develop an initial operational satellite refueling and sustainment capacity. They also believe that a great investment benefits the development of the commercial industry.

The investment in on-orbit refueling capabilities is maintaining America's strategic advantage in space. In North America, particularly in the United States, NASA plays a crucial role in advancing programs such as NASA Satellite Servicing Capabilities Office (SSCO), which develops cutting-edge technologies such as robotic systems, tools, and many more.

- The U.S. Space Force is investing in increasing resilience with a great number of smaller, less costly satellites for communication and missile warning.

Asia Pacific is projected to expand at the fastest rate in the on-orbit satellite servicing market during the forecast period. The growth of this region is primarily observed due to the increasing satellite deployment into orbit to meet the demand for earth observation, communication, and navigation services. The region is highly dominating in countries such as China, India, and Japan. China is developing a comprehensive approach to space operation issues such as stainability, efficiency, and reducing debris. Several companies established in China are planning refueling and active debris removal demonstration missions.

- In January 2025, China launched its Shijian-25 satellite. The aim is to advance its major technologies for on-orbit refueling and extend the lifespan of satellites. Shijian-25 is China's first orbital launch in 2025.

What are the Advancements in the On-Orbit Satellite Servicing Market in Europe?

Europe is set to experience significant growth in the market throughout the forecast period. This growth is driven by the region's increasing government and ESA-led initiatives that are focused on in-orbit servicing and satellite life extension. The region has a strong emphasis on space sustainability and compliance, with emerging space traffic management regulations further boosting demand for advanced servicing capabilities. Moreover, the growing need for infrastructure to support satellite constellations also contributes to the growth in the regional market.

UK On-Orbit Satellite Servicing Market Trends: The UK satellite servicing market is expected to grow at a significant rate in the upcoming years. This is because the country benefits from its advanced space infrastructure and strong government backing through agencies like the UK Space Agency.

What are the Key Trends in the On-Orbit Satellite Servicing Market in Latin America?

The Latin American market is experiencing significant growth. This growth and development is driven by increasing demand for satellite maintenance, upgrades, and end-of-life solutions. The region is witnessing expansion in telecommunications, defense, and scientific research sectors, which are thus driving investments in satellite technology. Governments and private entities in the region are also recognizing the importance of satellite longevity and resilience, prompting increased adoption of servicing solutions.

Brazil On-Orbit Satellite Servicing Market Trends: The country's market is benefiting from international collaborations and regional initiatives that are aimed at boosting space infrastructure. Technological advancements in robotics, propulsion, and on-demand repair services are also enhancing operational efficiency.

How is the Middle East and Africa growing in the On-Orbit Satellite Servicing Market?

The Middle East and Africa are growing at a steady pace in the market. This growth is driven by the region's increasing interest in space exploration and satellite technology. Various government initiatives that are aimed at enhancing national capabilities in space are gaining traction, although regulatory frameworks still appear to be developing. Countries are making significant progress, with investments in satellite technology and partnerships with global players.

Saudi Arabia On-Orbit Satellite Servicing Market Trends: The country's growth is due to various factors like the rising deployment of satellite constellations, the need to extend satellite lifespan, technological advancements in servicing platforms, and high regional investments in space infrastructure. Technological advancements in autonomous rendezvous, docking systems, and robotic servicing tools are enhancing operational capabilities and making on-orbit servicing more viable for commercial and governmental users.

On-Orbit Satellite Servicing Market Companies

- Maxar Technologies

- Astroscale Holdings Inc.

- SpaceLogistics LLC

- Airbus SE

- Thales Alenia Space

- Tethers Unlimited

- NanoRacks

- Aerospace Corporation

- Momentus Space

- Orbit Fab, Inc

- D-Orbit

- Katalyst Space

- Motiv Space

Latest Announcements by Industry Leaders

- In November 2024, Rob Hauge, president of SpaceLogistics (Northrop Grumman Corporation), said, “We are creating an in-space servicing infrastructure that has never existed before. Our successful experience in rendezvous, proximity operations, and docking has laid the foundation for this critical next step in creating a more sustainable model for future satellite operations.”

Recent Development

- In November 2024, Northrop Grumman Corporation's SpaceLogistics LLC received a robotics shipment from the U.S. Naval Research Laboratory (NRL), which includes two robotics arms and electronics for the Mission Robotic Vehicle (MRV). This delivery is edging towards providing the first commercial spacecraft with robotic servicing capabilities for commercial and government satellites.

- In July 2025, Maxar Technologies entered into a partnership with a leading telecommunications provider to develop advanced satellite servicing solutions. This collaboration is indicative of Maxar's strategy to expand its service portfolio and leverage synergies with established players in the telecommunications sector. By aligning with a telecommunications giant, Maxar (US) not only enhances its market reach but also positions itself to capitalize on the growing demand for integrated satellite services. (https://www.businesswire.com)

- In August 2024, Airbus unveiled its new satellite servicing platform, which aims to provide comprehensive maintenance solutions for both commercial and governmental satellites. This initiative reflects Airbus's commitment to innovation and its strategic focus on diversifying its service offerings. The introduction of this platform is likely to attract a wide range of clients, further solidifying Airbus's position in the competitive landscape of satellite servicing. (Airbus and Astroscale to advance in-orbit servicing and space debris removal - SatellitePro ME)

Segments Covered in the Report

By Service

- Active Debris Removal (ADR) and Orbit Adjustment

- Robotics Servicing

- Refuelling

- Assembly

By Orbit Type

- GEO (Geostationary Orbit)

- LEO (Low Earth Orbit)

- MEO (Medium Earth Orbit)

By End-User

- Commercial

- Military and Government

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting