What is the Commercial Rice Cooker Market Size?

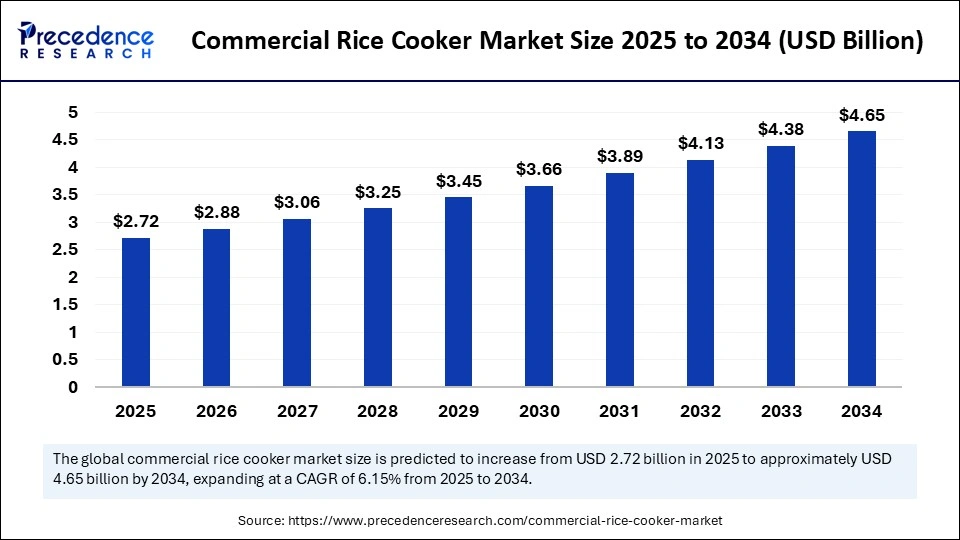

The global commercial rice cooker market size was estimated at USD 2.56 billion in 2024 and is predicted to increase from USD 2.72 billion in 2025 to approximately USD 4.65 billion by 2034, expanding at a CAGR of 6.15% from 2025 to 2034. The market is witnessing substantial growth due to the increasing demand for high-volume and efficient rice preparation in the foodservice sector. This expansion is supported by technological advancements, such as induction heating and smart connectivity, which enhance efficiency and reduce costs. Additionally, the growth of the catering and hospitality industries is further driving demand, leading to market expansion.

Market Highlights

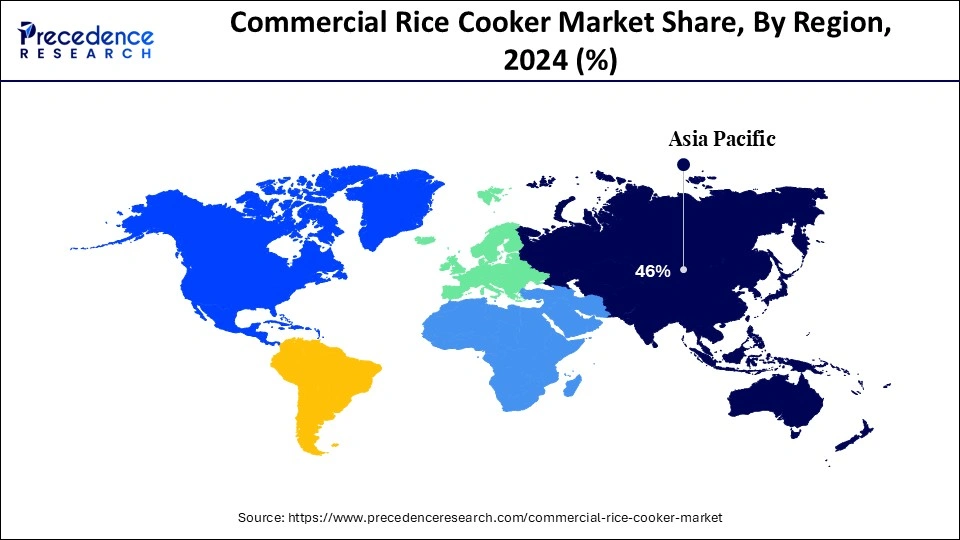

- Asia Pacific dominated the commercial rice cooker market with the largest market share of 46% in 2024.

- North America is expected to witness the fastest CAGR during the foreseeable period.

- By product type, the electric rice cookers segment held the biggest market share in 2024.

- By product type, the multi-functional/ smart cooker segment is expected to witness the fastest CAGR during the foreseeable period.

- By capacity, the 10–20-liter segment led the market in 2024.

- By capacity, the over 40-liter segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By application, the restaurants and food chains segment captured the biggest market share in 2024.

- By application, the catering services segment is expanding at a significant CAGR from 2025 to 2034.

- By distribution channel, the distributors and dealers segment contributed the maximum market share in 2024.

- By distribution channel, the online sales segment is expected to witness the fastest CAGR during the foreseeable period.

- By end user, the full-service restaurant segment generated the major market share in 2024.

- By end user, the institutional segment is projected to grow at a CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 2.56 Billion

- Market Size in 2025: USD 2.72 Billion

- Forecasted Market Size by 2034: USD 4.65 Billion

- CAGR (2025-2034): 6.15%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

The commercial rice cooker market includes heavy-duty cooking appliances designed for restaurants, hotels, catering services, and institutional kitchens to prepare rice and related grain dishes in bulk. These cookers are built for durability, consistency, and efficiency, featuring large capacity, fast cooking times, multi-functional settings, and energy-efficient operation. They are widely used in the foodservice industry to produce standardized cooking results across high-volume needs. Product categories include electric, gas, induction, and multi-functional models with digital controls and automation. The market is growing due to rising demand for Asian cuisine worldwide, rapid expansion of the hospitality sector, and the adoption of smart connected cookers. Key customers include hotels, restaurants, canteens, catering companies, and institutional food providers.

How Can AI Make an Impact on the Commercial Rice Cooker Market?

Artificial intelligence (AI) is transforming commercial rice cookers by optimizing performance through sensors that monitor and adjust heat and pressure based on rice type and water content, enhancing rice quality and consistency. AI analyzes factors like rice type, moisture, and water levels, including difficult-to-cook varieties. Automation driven by AI allows precise control over cooking times and temperatures, producing high-quality results while reducing manual oversight. AI also supports predictive maintenance, improves energy efficiency, and enables remote monitoring, ultimately boosting reliability and cutting operational costs for foodservice businesses.

What Are the Key Trends in the Commercial Rice Cooker Market?

- Expansion of the Food Service Industry: The rising number of restaurants, hotels, and other food service businesses directly increases the demand for high-capacity, efficient cooking appliances worldwide, which in turn drives the demand for commercial rice cookers.

- Urbanization and Busy Lifestyles: The increasing trend of people dining out due to busy lives and hectic schedules boosts the need for food service establishments, which subsequently increases the demand for high-efficiency cooking appliances like commercial rice cookers.

- Technological Advancements: Smart features enhance user convenience and kitchen automation, as key players are investing in research and development to introduce innovations such as IoT connectivity, programmable settings, and enhanced safety mechanisms.

- Focus on Energy Efficiency and Sustainability: Growing environmental awareness and regulatory pressures are driving demand for energy-efficient appliances. Manufacturers are developing products with lower emissions and sustainable materials.

- Government Initiatives and Regulations: Initiatives focused on food safety and public health, along with environmental mandates, encourage the adoption of advanced cooking technologies and sustainable product designs in institutional and food service settings.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 2.56 Billion |

| Market Size in 2025 | USD 2.72 Billion |

| Market Size by 2034 | USD 4.65 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.15% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Capacity, Application, Distribution Channel, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Need for Automation and Efficiency in Commercial Kitchens

The main driver for the commercial rice cooker market is the growing need for automation and efficiency in commercial kitchens, supported by the global popularity of rice and the trend towards convenience. Commercial kitchens are increasingly adopting automated processes to boost efficiency and consistency. Rice cookers that provide simplified, hands-free cooking, programmable settings, and automatic shut-off meet this demand by reducing labor, improving cooking accuracy, simplifying operations, and catering to tech-savvy chefs.

Restraints

Competition From Multi-Functional Appliances

A major restraint in the commercial rice cooker market is competition from multi-functional appliances like pressure cookers and multi-cookers. This is compounded by low awareness and high costs in developing areas, along with issues in the rice supply chain, such as export restrictions. Devices like pressure cookers and multi-cookers offer a wider range of cooking options beyond rice, appealing to businesses seeking versatile equipment. In some regions, the market is saturated with existing rice cookers, while in others, awareness of electric models' benefits is limited.

Opportunity

Integration of Smart Features, AI, and Sustainability into Rice Cooker Technology

A key growth opportunity is integrating smart features, AI, and sustainability into rice cooker technology. Manufacturers are focusing on advanced tech to create smarter, more versatile, and efficient rice cookers. Features like app connectivity, voice control, and remote operation via mobile apps are becoming standard, offering greater convenience and control. Beyond cooking rice, new models include functions such as steaming vegetables or making soups, increasing their versatility and value for commercial kitchens.

Segments Insights

Product Type Insights

What Made the Electric Rice Cookers Segment Lead the Commercial Rice Cooker Market in 2024?

The electric rice cookers segment led the market in 2024. This is primarily due to their convenience, automation, energy efficiency, and ability to produce consistent results with various rice types. The trend towards busy lifestyles and health consciousness continues to raise demand for these versatile appliances. Electric models are often more energy-efficient compared to other cooking options, making them attractive to both households and commercial facilities. Additionally, modern electric rice cookers come with multiple functions such as steaming, slow cooking, and porridge making, making them valuable kitchen tools.

The multi-functional/ smart cooker segment is expected to grow the fastest, driven by demand for convenience, advanced technology, precise cooking, and varied culinary options. Consumers and businesses want appliances that simplify cooking. Smart cookers with preset menus, timers, and remote-control apps reduce prep time and effort required for meal preparation. Beyond rice, these cookers offer multi-functionality, enabling users to prepare a variety of dishes such as grains, soups, and specialty dishes, providing diverse menu options.

Capacity Insights

How Did the 10–20-Liter Segment Dominate the Commercial Rice Cooker Market in 2024?

The 10–20-liter segment led the market in 2024. This is mainly stemming from as this capacity range strikes the optimal balance for various commercial uses like restaurants, hotels, and catering. It supports high-volume needs without being too large or inefficient for smaller businesses. Growth in the hospitality, food service, and catering industries directly fuels the demand for rice cookers that can handle considerable output, a need fulfilled by this capacity segment. Demand for these mid-to-high-capacity rice cookers, high can serve many customers efficiently.

The over 40-liter segment is expected to experience the fastest growth, mainly due to demand from large-scale foodservice providers such as hospitals, schools, and big restaurants that need bulk cooking capabilities for efficient and consistent meal prep. This growth is further supported by rapid urbanization and changing lifestyles, which create higher demand for quick, automated, and convenient cooking methods in large commercial settings. Innovations like intelligent cooking algorithms and precise temperature controls ensure consistent results.

Application Insights

How Did the Restaurants and Food Chains Segment Dominate the Commercial Rice Cooker Market in 2024?

The restaurants and food chains segment dominated the market in 2024. This is due to the need for consistent, high-volume, reliable rice preparation, efficiency, and labor savings in fast-paced kitchen environments, and the reliability and convenience these cookers offer to maintain food quality and taste. This segment thrives because restaurants and food chains require large quantities of perfectly cooked rice to meet widespread customer demand by free up staff for other crucial tasks, and offering durability and reliability needed for continuous, daily operation.

The catering services segment is projected to grow the fastest, driven by increased consumer spending on dining out, expansion of food delivery, and the rise of cloud kitchens. These facilities rely on efficient, automated cooking solutions for staples like rice. The growth of cloud kitchens, which focus on technology-driven efficiency and cost-effectiveness, creates a significant demand for automated rice cookers to handle high volumes of staple food production, driving the demand for commercial rice cookers in catering operations.

Distribution Channel Insights

Why Did the Distributors and Dealers Segment Dominate the Commercial Rice Cooker Market in 2024?

The distributors and dealers segment maintained the market dominance in 2024. This is primarily because these businesses provide essential services such as sales support, local market access, and product expertise, which are crucial for reaching commercial customers like restaurants and hotels that require large-capacity, specialized equipment. Many businesses prefer to see, touch, and test commercial equipment before purchasing, a benefit offered through physical showrooms and demonstration facilities.

The online sales segment is the fastest-growing segment, driven by digital transformation and a shift in consumer lifestyles and preferences towards convenience and e-commerce. This channel makes it easier for businesses to access innovative products and extends the reach of manufacturers and distributors to commercial establishments beyond their physical locations. Additionally, the incorporation of smart technology and energy efficiency enhances accessibility.

End User Insights

How Did the Full-Service Restaurant Segment Lead the Commercial Rice Cooker Market in 2024?

The full-service restaurant segment led the market in 2024. This is largely due to the need for consistent food quality, high-volume rice production as a staple, and the efficiency gains and reduced labor costs that automated cooking provides, all of which directly support the operational demands of these establishments. Maintaining a high and consistent quality of food is essential to satisfy their discerning customer base. Commercial rice cookers ensure that every batch of rice meets the required taste and texture standards while improving kitchen safety and ease of use.

The institutional segment is projected to experience the fastest growth in the market, driven by the necessity for bulk cooking in schools, hospitals, and other large-scale food service operations. This demand is increasing for large-capacity, high-efficiency rice cookers. New models offer enhanced features like precise temperature control, programmable settings, and advanced safety features, making them more appealing for institutional use. Institutions often operate on tight budgets, so adopting energy-efficient rice cookers is attractive for reducing operational costs.

Regional Insights

Asia Pacific Commercial Rice Cooker Market Size and Growth 2025 to 2034

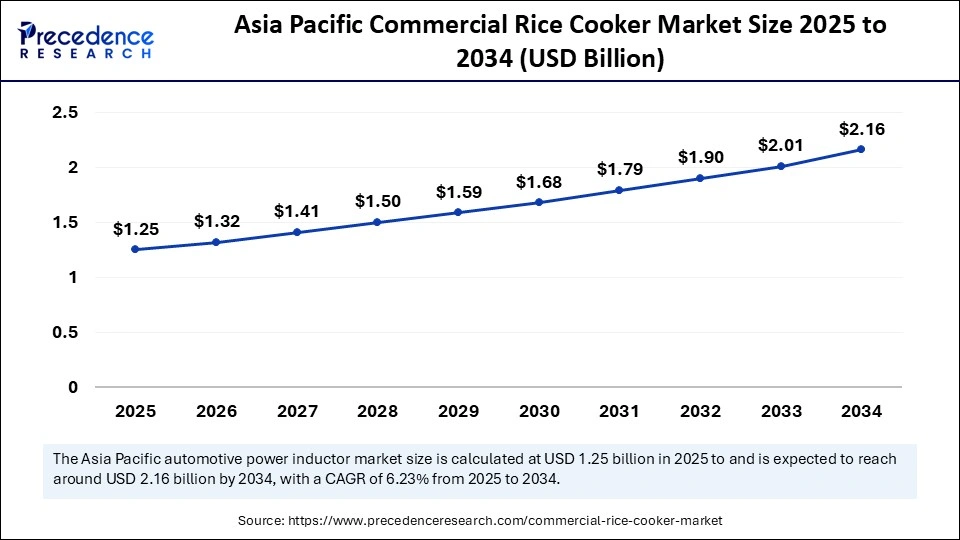

The Asia Pacific commercial rice cooker market size is evaluated at USD 1.25 billion in 2025 and is projected to be worth around USD 2.16 billion by 2034, growing at a CAGR of 6.23% from 2025 to 2034.

How Did the Asia Pacific Lead the Commercial Rice Cooker Market in 2024?

Asia Pacific dominated the commercial rice cooker market with the largest market share of 46% in 2024. This is mainly due to high demand from the hospitality sector and a large population with a rice-heavy diet. The region benefits from established manufacturing capabilities and widespread adoption of cooking appliances. The expanding hospitality industry, including hotels, restaurants, and catering services, directly drives the demand for high-capacity commercial rice cookers. Countries like Japan are known for their innovation and manufacturing of advanced electric appliances, including rice cookers.

China Commercial Rice Cooker Market Trends

China plays a dominant role in the market, functioning as both the world's leading manufacturer and a massive consumer base. Chinese factories leverage vast production capabilities and cost-effective manufacturing to produce a significant volume of commercial rice cookers for global export, while also catering to a growing domestic foodservice industry, improving product quality, and establishing strong global brands.

India Commercial Rice Cooker Market Trends

India plays an evolving role in the market, characterized by burgeoning domestic demand driven by a rapidly expanding foodservice industry, increased urbanization, and rising disposable incomes. The market is fueled by the proliferation of restaurants, hotels, cloud kitchens, and event caterers that are replacing traditional cooking methods with efficient, high-capacity electrical rice cookers. Domestic manufacturers such as TTK Prestige and Bajaj Electricals are also contributing to this growth.

Why is North America Considered the Fastest-Growing Region in the Commercial Rice Cooker Market?

North America is anticipated to experience the fastest growth during the forecast period. This is primarily due to increasing demand for Asian cuisine, the need for efficient cooking in the foodservice industry, and the growing popularity of convenient and time-saving cooking solutions amidst changing lifestyles. The busy nature of modern life in North America necessitates convenient, time-saving kitchen appliances, including rice cookers. The market also benefits from advancements in digital and multifunctional rice cookers, which offer precise controls, consistent results, and the capability to prepare diverse cuisines.

Commercial Rice Cooker Market Companies

- Zojirushi Corporation

- Panasonic Corporation

- Tiger Corporation

- Toshiba Corporation

- Cuckoo Electronics Co. Ltd.

- Aroma Housewares Company

- Hamilton Beach Brands

- Sunpentown International Inc. (SPT)

- Black+Decker (Stanley Black and Decker)

- Philips Domestic Appliances

- Breville Group Limited

- Electrolux AB

- Sharp Corporation

- Conair Corporation (Cuisinart)

- Joyoung Co. Ltd.

- Midea Group

- Supor Co. Ltd.

- Tatung Company

- Oster (Newell Brands)

- West Bend (Focus Products Group)

Leaders' Announcements

- In April 2024, Electrolux Professional Group acquired Adventys, a French manufacturer of induction cooking solutions. Induction cooking significantly reduces CO2 emissions compared to other technologies, paving the way for sustainable cooking. By acquiring Adventys, we gain access to the development of our own induction technology, which helps maintain and strengthen our leadership in horizontal cooking, remarked Alberto Zanata, President and CEO of Electrolux Professional Group.(Source: https://www.electroluxprofessionalgroup.com)

Recent Developments

- In August 2024, TOSHIBA launched its latest innovation, the Dew Series. This series features the world's first rice cooker equipped with advanced Japanese-style steam replenishment technology, designed to elevate the daily dining experience by making it easier to cook sweet and chewy rice. This allows people around the world to prepare the perfect bowl of rice.(Source: https://www.prnewswire.com)

- In August 2024, Xiaomi introduced its latest kitchen appliance, the Mijia Rice Cooker N1. This 4-liter rice cooker offers nine cooking modes, each with precise temperature control to optimize rice texture and flavor. It utilizes a double-row, six-hole multi-circuit bubble extrusion system to prevent overflow during the boiling process.(Source: https://www.gizmochina.com)

Segments Covered in the Report

By Product Type

- Electric commercial rice cookers

- Standard electric rice cookers

- Digital electric rice cookers

- Gas commercial rice cookers

- Induction commercial rice cookers

- Multi-functional/smart rice cookers

- Others

By Capacity

- Up to 10 liters

- 10–20 liters

- 20–40 liters

- Above 40 liters

By Application

- Restaurants and food chains

- Hotels and hospitality

- Catering services

- Institutional kitchens (schools, hospitals, corporate canteens)

- Others

By Distribution Channel

- Direct sales (B2B)

- Distributors and dealers

- Online sales channels

By End User

- Full-service restaurants

- Quick-service restaurants (QSRs)

- Hospitality groups

- Catering companies

- Institutions

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting