What is the Outdoor Commercial Grills Market Size?

The global outdoor commercial grills market size accounted for USD 3.93 billion in 2025 and is predicted to increase from USD 4.17 billion in 2026 to approximately USD 6.66 billion by 2034, expanding at a CAGR of 6.03% from 2025 to 2034. The market is expanding due to a growing consumer preference for outdoor dining, the continued growth of the food service industry, and the introduction of smart, energy-efficient grill technologies by leading manufacturers.

Market Highlights

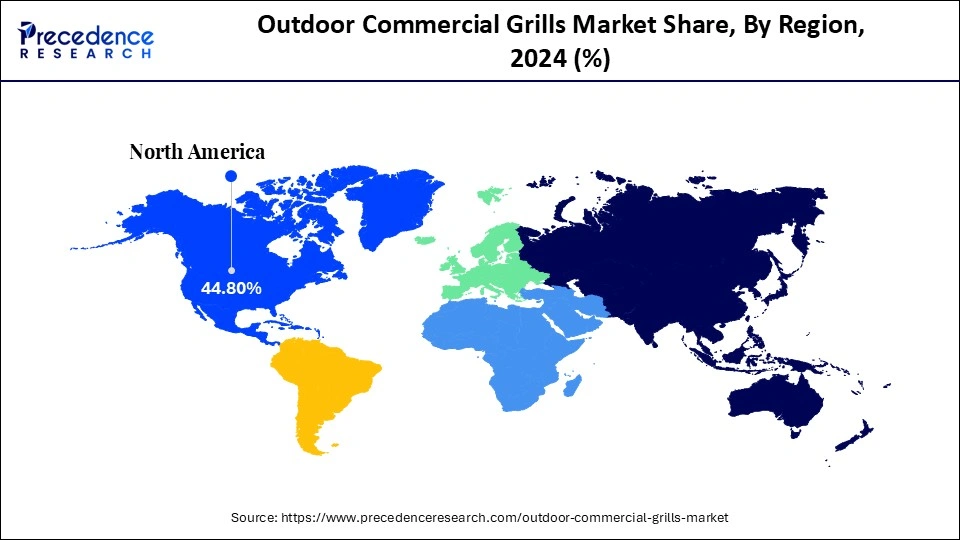

- North America held the largest market share of 44.80% in 2024.

- The Asia Pacific is expected to expand at the fastest CAGR of 7.5% from 2025 to 2034.

- By product type, the freestanding grills segment contributed the biggest market share of 51.4% in 2024.

- By product type, the built-in grills segment is growing at the fastest CAGR of 7.1% between 2025 and 2034.

- By fuel type, the gas grills segment contributed the highest market share of 40.4% in 2024.

- By fuel type, the charcoal grills segment is growing at a strong CAGR of 7.0% from 2025 to 2034.

- By application, the outdoor cooking segment recorded the biggest market share of 43.4% in 2024.

- By application, the grilling and barbecue segment is expected to witness the fastest CAGR of 6.9% from 2025 to 2034.

- By end user, the restaurants segment contributed the biggest market share of 47.5% in 2024.

- By end user, the hotels & resorts segment is expected to witness the fastest CAGR of 7.1% between 2025 and 2034.

- By distribution channel, the direct sales segment held the largest market share of 55.4% in 2024.

- By distribution channel, the online sales / e-commerce segment is expanding at a notable CAGR of 7.3% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 3.93 Billion

- Market Size in 2026: USD 4.17 Billion

- Forecasted Market Size by 2034: USD 6.66 Billion

- CAGR (2025-2034): 6.03%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What are Outdoor Commercial Grills?

Outdoor commercial grills are professional-grade grills designed for commercial use in restaurants, hotels, catering, and other foodservice establishments. These grills provide high-performance cooking, durability, and versatility for preparing a wide variety of foods. Market growth is driven by the expanding foodservice industry, increasing demand for outdoor cooking experiences, innovations in fuel types and grill technologies, and rising consumer preference for outdoor dining. These grills include gas, charcoal, electric, and hybrid models tailored to commercial requirements.

Key Technological Shifts: Integration of IoT and AI in Outdoor Commercial Grills

A major technological shift in the outdoor commercial grills market is the integration of IoT and AI technologies to enhance precision cooking, food safety, and overall operational efficiency. Commercial kitchens are now using AI-powered predictive maintenance systems that analyze equipment health by tracking usage patterns. These systems can detect anomalies and predict potential failures in critical components like burners and ignition systems, helping prevent unexpected downtime.

In addition, IoT sensors combined with AI enable real-time monitoring of temperature fluctuations, an essential factor for ensuring food safety and regulatory compliance. These systems can automatically send alerts if grill temperatures deviate from the safe operating range, reducing the risk of accidents or food safety violations. Furthermore, AI-powered monitoring systems can help enforce kitchen hygiene protocols by tracking compliance, ultimately reinforcing consumer trust in foodservice providers.

Outdoor Commercial Grills Market Outlook

The outdoor commercial grills market is expected to grow significantly between 2025 and 2034, driven by several key trends. These include the increasing consumer preference for dining out, especially in urban areas, the rising popularity of fast food and food trucks, and substantial investments in innovative, efficient kitchen equipment. Additionally, the integration of smart technologies, such as AI-powered cooking devices, is enhancing productivity for both kitchen operations and foodservice businesses.

The industry is undergoing a major shift toward sustainable and eco-friendly grilling solutions. This includes the development of energy-efficient electric and gas-powered models equipped with features like precise temperature control and automatic shutdown systems. Manufacturers are increasingly using recyclable materials, low-emission burners, and biodegradable grease traps to reduce environmental impact.

The startup ecosystem in the commercial kitchen and FoodTech sectors is highly dynamic, with new entrants leveraging smart kitchen technologies and automation to offer sustainable solutions. Many of these startups are developing specialty equipment tailored to emerging culinary trends, such as plant-based cuisine, low-fat or low-carb diets, and high-protein cooking.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.93 Billion |

| Market Size in 2026 | USD 4.17 Billion |

| Market Size by 2034 | USD 6.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.03% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Fuel Type, Application, End-User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Outdoor Commercial Grills MarketSegments Insights

Product Type Insights

The freestanding grills segment dominated the market by capturing the largest share of 51.4% in 2024. This dominance is primarily due to the versatility, portability, and flexibility that freestanding grills offer across various commercial settings such as catering services, restaurants, and outdoor events. These grills support high-volume cooking with ease, making them a cost-effective solution for commercial use. Their adaptability continues to be a key driver behind their strong market position.

The built-in grills segment is expected to grow at the fastest CAGR of 7.1% during the foreseeable period. This growth is fueled by rising demand for outdoor dining experiences and the growing trend of designing outdoor living spaces in commercial properties. Built-in grills contribute to an integrated and aesthetically pleasing environment, which appeals to hospitality businesses looking to enhance their outdoor ambiance.

Fuel Type Insights

The gas grills segment led the market while holding the largest share of 40.4% in 2024. This is mainly due to their various benefits, such as high speed and efficiency, precise temperature control, fuel versatility, easy use, and constant performance. Gas grills can be turned on easily and reach temperature instantly as expected, making it highly convenient for chefs to adjust the temperature with ease. Also, gas grills can operate on various types of gas, like propane and natural gas, which offer easy use and installation.

The charcoal grills segment is expected to witness the fastest CAGR of 7.0% during the foreseeable period. The segment is significantly growing due to its unique smoky flavor, increasing popularity for traditional food types with grilling methods, and increasing shift to exploring diverse outdoor culinary experiences. Thus, various restaurants, barbecues, and catering services are adopting charcoal grills to attract consumers.

Application Insights

The outdoor cooking segment dominated the market with a 43.4% share in 2024. The segment's dominance is primarily attributed to the growing popularity of outdoor dining themes in several restaurants, increasing outdoor social gatherings, and higher demand for various grilled foods. Advances in grilling technology further enable commercial services like restaurants and catering to incorporate grilling facilities into their daily work.

The grilling & barbecue segment is expected to expand at the fastest CAGR of 6.9% during the projection period. The segment growth is attributed to the explosive growth of restaurants and food trucks, including quick services for various grilled foods, which require efficient and high-volume cooking solutions. A growing focus on healthy eating with various food options is also supporting segmental growth.

End User Insights

The restaurants segment held the largest market share of 47.5% in 2024. This is mainly due to the growing demand from commercial restaurants for high-volume grilling solutions. These establishments require grills that can efficiently prepare a wide variety of grilled dishes within limited timeframes to meet increasing consumer expectations. Commercial grills are known for their durability and ability to support daily, high-capacity food preparation, making them essential equipment for restaurant kitchens.

The hotels & resorts segment is expected to register the fastest CAGR of 7.1% during the foreseeable period. This growth is fueled by the rising demand for premium guest experiences, such as live cooking demonstrations and outdoor grilling setups. Consumers increasingly seek customizable and diverse grilled food options as part of luxury and leisure dining experiences, which is driving investment in advanced grilling equipment within this segment.

Distribution Channel Insights

The direct sales segment led the market, holding about 55.4% share in 2024. This dominance is attributed to the nature of commercial purchases, which often involve complex, high-volume transactions that require specialized support and personalized service. Direct sales channels help ensure that equipment specifications align precisely with kitchen layouts and operational needs. This tailored approach builds strong trust between vendors and buyers, making it the preferred choice for many commercial clients.

The online sales / e-commerce segment is expected to witness the fastest CAGR of 7.3% during the foreseeable period. The segmental growth is driven by the convenience of online purchasing, increasing digitalization in the food service industry, and access to a wide selection of customizable grilling equipment. E-commerce platforms offer greater flexibility and choice, particularly appealing to smaller businesses and startups seeking cost-effective, high-performance solutions.

Outdoor Commercial Grills MarketRegional Insights

The U.S. outdoor commercial grills market size is exhibited at USD 1.34 billion in 2025 and is projected to be worth around USD 2.29 billion by 2034, growing at a CAGR of 6.16% from 2025 to 2034.

What Made North America a Dominant Force in the Outdoor Commercial Grills Market?

North America dominated the market by capturing the largest share of 44.8% in 2024. This dominance is primarily driven by the region's strong barbecue culture, high consumer spending on home and outdoor events, and a well-developed foodservice industry that supports outdoor dining and upscale catering services. Barbecuing is deeply rooted in North American traditions and is closely associated with family gatherings, holidays, and social events. This cultural significance translates into consistently strong demand for outdoor cooking solutions.

Additionally, many consumers in the region are increasingly adopting smart kitchen products with premium features, such as commercial-grade grills and outdoor decks. This trend further contributes to the market's growth, as businesses and households alike seek advanced, high-performance grilling equipment.

U.S. Outdoor Commercial Grills Market Trends

The U.S. is a major contributor to the market in North America, driven by the growing demand for outdoor dining, the deep-rooted culture of grilled food products, and its popularity, along with the technological advancements in smart and eco-friendly grills with premium features. Also, the increasing disposable income in the U.S. drives demand for high-end, feature-filled outdoor grills. Consumers are also willing to pay more for enhanced durability and performance of commercial grills.

Asia Pacific is expected to expand at the fastest CAGR of 7.5% during the foreseeable period of 2025-2034. This growth is primarily driven by rapid urbanization and rising disposable incomes, which are prompting consumers to embrace modern lifestyle trends. In response, the foodservice industry is evolving to meet changing consumer preferences, offering more enhanced and diverse culinary experiences. Additionally, the rising popularity of Western-style outdoor grilling, such as backyard barbecues and recreational cooking, is gaining momentum, largely influenced by social media trends and global exposure. These cultural shifts are directly contributing to the expansion of the market in Asia Pacific.

China Outdoor Commercial Grills Market Analysis

China is a leading force in the expansion of the outdoor commercial grills market, driven by its strong focus on high-volume manufacturing and cost-effective production of advanced foodservice equipment, including smart grills. The country is a major hub for OEM (Original Equipment Manufacturer) production, catering to the growing global demand for commercial grilling solutions. Prominent Chinese manufacturers such as BBQ Industry Co., Ltd. and Ningbo Huige Outdoor Products Co., Ltd. are key contributors to this growth. These companies produce a wide range of outdoor grilling equipment for the foodservice sector, supporting both domestic needs and international exports.

Europe is expected to experience notable growth in the outdoor commercial grills market, driven by the increasing adoption of outdoor dining facilities and events. Rising disposable incomes are encouraging urban consumers to celebrate occasions with a focus on aesthetic appeal and current lifestyle trends. The growing culture of alfresco dining, especially in Southern Europe, is further boosting demand for commercial grills among restaurants and the broader foodservice industry across the region.

Germany Outdoor Commercial Grills Market Trends

Germany is emerging as a key contributor to the growth of the European outdoor commercial grills market, holding the largest revenue share in the region. The country leads in product launches and innovation within the foodservice equipment sector. With its highly developed outdoor kitchens and backyard setups, Germany is driving strong demand for smart, high-quality commercial grills.

Outdoor Commercial Grills Market Value Chain

Outdoor Commercial Grills Market Companies

Tier I: Market Leaders

These companies dominate the global outdoor commercial grills market by offering comprehensive product ranges, advanced grilling technologies, strong global distribution networks, and substantial manufacturing capacity.

| Company | Key Offerings |

| Weber-Stephen Products LLC | Leading range of commercial-grade grills known for durability, innovation, and global reach. |

| Traeger Pellet Grills LLC | Pioneer in smart pellet grill technology with advanced controls and connectivity. |

| Napoleon | High-quality, versatile grills designed for commercial use with strong North American presence. |

| Middleby Corporation | Owner of multiple commercial kitchen equipment brands, offering high-capacity grilling solutions. |

| Pit Boss Grills | Affordable, durable grills catering to high-volume commercial operations. |

Tier II: Established Players

These companies maintain a significant regional or niche market presence, focusing on innovation, customization, and specialized commercial grilling solutions.

| Company | Key Offerings |

| Crown Verity | Commercial outdoor grills designed for catering and event industries, with rugged build quality |

| Blackstone | Popular for flat-top griddles and portable grills ideal for food trucks and outdoor venues. |

| Lynx Grills, Inc. | Premium grills tailored for upscale commercial and luxury outdoor kitchens. |

| Char-Broil LLC | Broad portfolio including commercial and residential grills with innovative features. |

| Dyna-Glo | Variety of grills and smokers, targeting foodservice and commercial barbecue markets. |

Tier III: Emerging and Niche Players

These companies are niche specialists or emerging brands offering innovative or customized grilling solutions, gaining market share through innovation or regional focus.

| Company | Key Offerings |

| R&V Works | Custom-built outdoor cooking equipment for specialized commercial applications. |

| Southern Pride | Commercial smokers and rotisserie ovens catering to traditional barbecue markets. |

| Old Country BBQ Pits | Traditional-style barbecue pits and smokers for niche customers. |

| Holstein Manufacturing | Diverse range of outdoor commercial cooking equipment with emphasis on quality. |

| Meadow Creek | Premium smokers and grills focused on barbecue operations and commercial catering. |

| Kamado Joe | Ceramic grills with growing popularity in commercial and high-end outdoor kitchens. |

| Louisiana Grills | Pellet grills blending technology and traditional grilling for commercial use. |

Recent Developments

- In October 2025, Current, the world's first electric outdoor cooking company, launched the Model G+ Dual-Zone Electric Grill, its most advanced all-electric grill to date. Building on patented technology and sleek design, the Model G+ now offers expanded color options, including the popular Slate finish and the new matte black Eclipse Edition.(Source: https://www.globenewswire.com)

- In January 2025, Weber LLC, a global leader in outdoor cooking technology, unveiled its 2025 lineup of grills, smokers, griddles, and accessories. The new collection combines expert engineering and quality craftsmanship to deliver versatile, high-performance products that enhance the outdoor cooking experience. With these innovations, Weber continues to set the standard for outdoor cooking and bring more joy to backyards worldwide.(Source: https://finance.yahoo.com)

Exclusive Analysis on the Outdoor Commercial Grills Market

The outdoor commercial grills market presents a compelling growth trajectory, underpinned by evolving consumer behaviors and macroeconomic shifts that signal robust expansion opportunities. Urbanization and rising disposable incomes, particularly in emerging economies, catalyze demand for innovative, high-efficiency grilling solutions within the foodservice ecosystem. This dynamic is further amplified by a paradigm shift toward experiential dining, where outdoor and alfresco culinary experiences increasingly influence commercial investment strategies.

Technological advancements, most notably the integration of IoT and AI-driven smart grills, are redefining operational efficiency, precision cooking, and safety compliance. This digital convergence not only enhances user engagement but also drives differentiation in an otherwise commoditized market, unlocking premiumization pathways.

Sustainability imperatives offer a strategic lever, as regulatory frameworks and consumer consciousness converge to favor energy-efficient, low-emission equipment. Manufacturers poised to innovate with eco-friendly materials and adaptive fuel technologies will capture emergent segments and fortify market positioning.

Furthermore, the burgeoning startup ecosystem and FoodTech collaborations are accelerating the commercialization of niche applications, such as plant-based and health-centric cooking modalities, thereby broadening market scope beyond traditional grilling paradigms.

Geographically, the Asia Pacific region's accelerated urban development and Western lifestyle adoption constitute a high-growth frontier, complementing mature markets in North America and Europe, where demand for premium and smart grilling solutions persists.

In aggregate, the market embodies a fertile landscape for value creation, driven by convergent trends in technology adoption, sustainability, and evolving consumer preferences. Strategic stakeholders equipped to navigate these vectors with innovation-led differentiation will unlock significant competitive advantage and sustainable growth.

Outdoor Commercial Grills MarketSegments Covered in the Report

By Product Type

- Freestanding Grills

- Built-In Grills

- Portable / Mobile Grills

By Fuel Type

- Gas Grills

- Charcoal Grills

- Electric Grills

- Hybrid Grills

By Application

- Outdoor Cooking

- Grilling & Barbecue

- Fast Food & Quick Service

- Entertainment & Hospitality

By End-User

- Restaurants

- Hotels & Resorts

- Catering Services

- Food Trucks/Mobile Kitchens

- Event Venues

By Distribution Channel

- Direct Sales

- Retail Stores

- Online Sales/E-Commerce

By Region

- North America

- Europe

- Asia-Pacific (APAC)

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting