IoT Sensors Market Size and Forecast 2025 to 2034

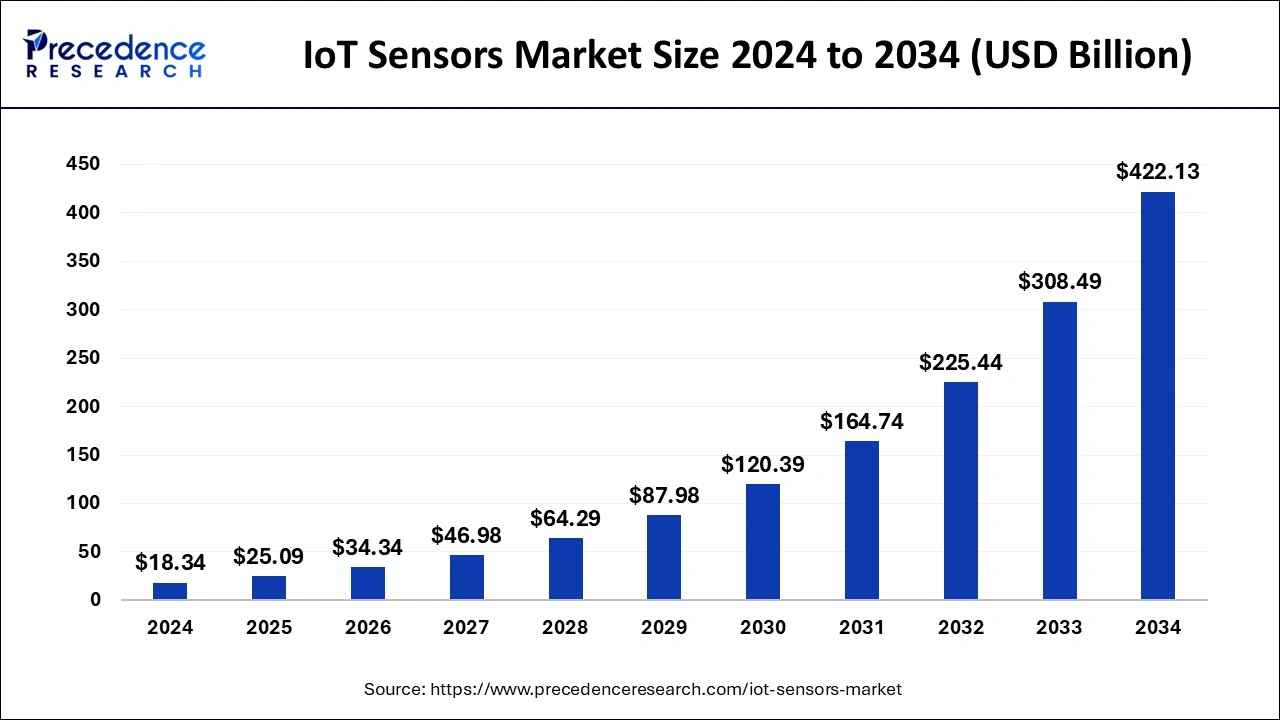

The global IoT sensors market size was estimated at USD 18.34 billion in 2024 and is predicted to increase from USD 25.09 billion in 2025 to approximately USD 422.13 billion by 2034, expanding at a CAGR of 36.84% from 2025 to 2034. The fundamental drivers of IoT adoption include falling device costs and the emergence of new applications and business models.

IoT Sensors MarketKey Takeaways

- In terms of revenue, the global IoT sensors market was valued at USD 18.34 billion in 2024.

It is projected to reach USD 422.13 billion by 2034.

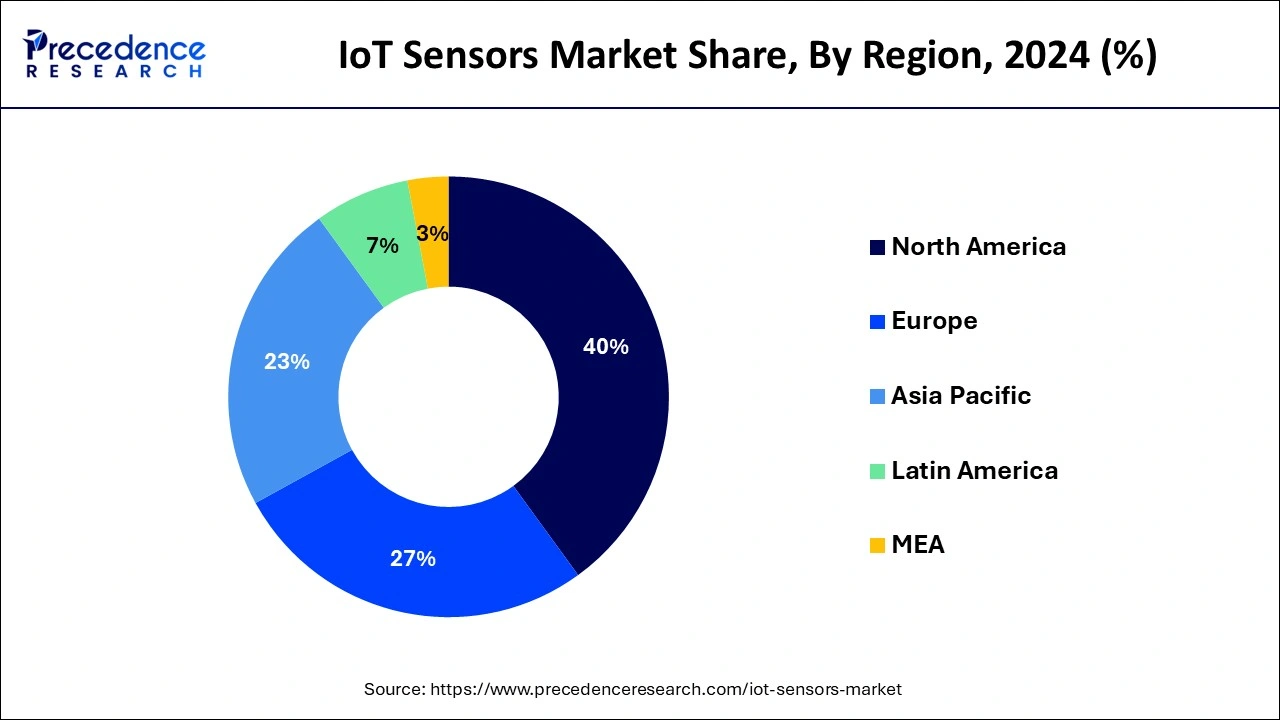

The market is expected to grow at a CAGR of 36.84% from 2025 to 2034. - North America dominated the global IoT sensors market with a revenue share of 40% in 2024.

- Asia Pacific will host one of the fastest-growing marketplaces for the upcoming years.

- By sensor type, the pressure sensors segment dominated the market in 2024.

- By sensor type, the inertial sensors segment is expected to capture a significant share of the market over the forecast period.

- By network type, the wired segment held the largest share of the market in 2024, under the segment, the ethernet subsegment is observed to capture a promising share in upcoming years.

- By network type, the wireless technology segment is expected to expand rapidly during the forecast period.

U.S. IoT Sensors Market Size and Growth 2025 to 2034

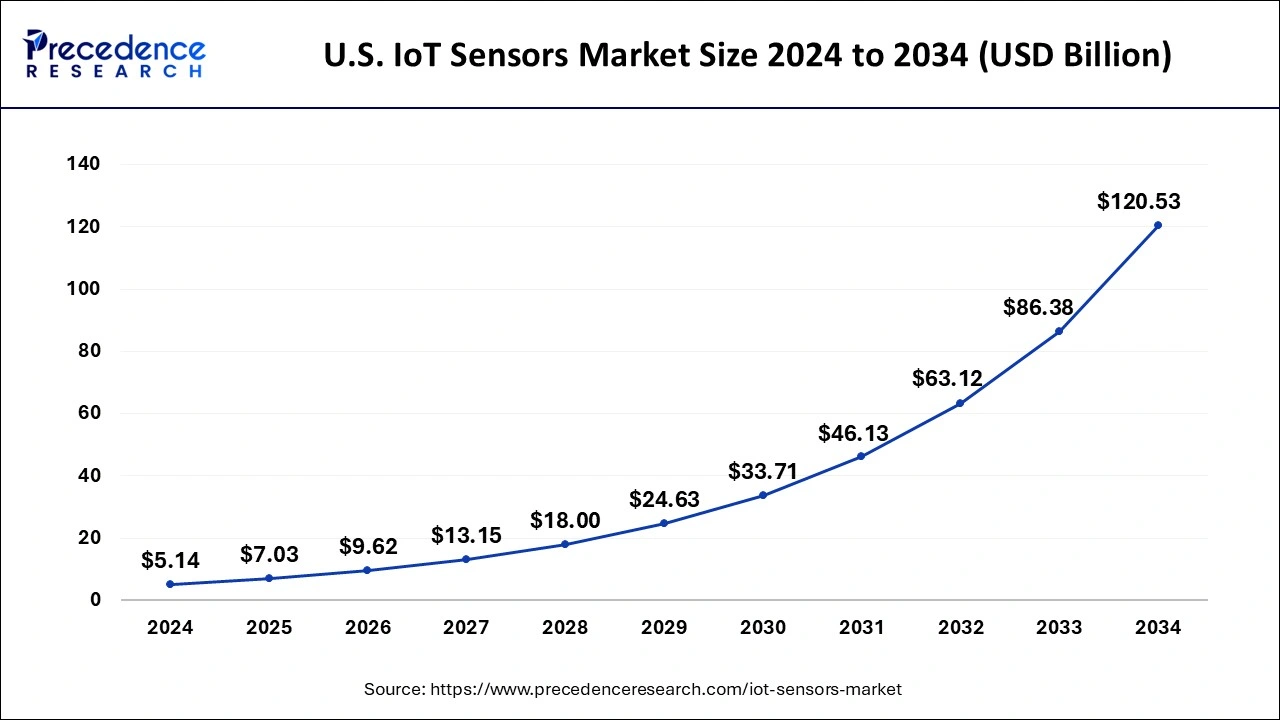

The U.S IoT sensors market size was valued at USD 5.14 billion in 2024 and is predicted to surpass USD 120.53 billion by 2034, expanding at a CAGR of 37.09% from 2025 to 2034.

North America dominated the global IoT sensors market with a revenue share of 40% in 2024. owing to numerous established vendors and early adoption of IoT technology across various industries. Companies in this region are increasingly turning to IoT to monitor the performance of their offerings, preventing costly breakdowns or inefficient maintenance shutdowns. The widespread use of IoT in North America is evident, with a study by Stanford University and Avast revealing that homes in this region have the highest density of IoT devices globally. Nearly 66% of North American homes have at least one IoT device, and 25% have more than two.

Asia Pacific holds one of the fastest growing area in the IoT sensors market,Countries like India, China, Japan, South Korea, and Australia are prominent users of IoT sensors, particularly in consumer electronics, vehicles, and healthcare products. APAC has become a key hub for significant investments and corporate expansion on a global scale. Implementing Industry 4.0 initiatives, especially in regions like Europe and China, drives the widespread deployment of IoT sensors in this region.

- Accenture reports that 60% of manufacturing companies are involved in IoT projects, with over 30% in the early deployment stages. Additionally, the decreasing cost of IoT sensors is a significant factor expected to drive increased adoption of this technology over the forecast period.

Market Overview

Before the advent of IoT technology, only personal computers and smartphones could connect to the internet. However, IoT innovations have enabled the connection of various physical objects to the internet. Entities like houses, factories, office buildings, and even cities are interconnected to collect data for diverse purposes. The IoT sensors market provides solutions that are crucial for creating IoT technologies, detecting external information, and translating it into signals understandable by humans and machines.

Sensors play a vital role in medical care, logistics, transportation, nursing care, disaster prevention, agriculture, industry, tourism, regional businesses, and more. A variety of IoT sensors are available for detecting and measuring physical phenomena and the five human senses: smell, sight, taste, touch, and hearing. Based on the communication interface, sensors are categorized into embedded sensors, USB, and wireless & Bluetooth modules. IoT sensors find applications in home security, online business support, wearable devices, remote monitoring for older people, women's healthcare, hazard detection, and more.

IoT Sensors Market Growth Factors

- The IoT sensors market is fueled by several factors, including the increasing usage of IoT sensors in various sectors, particularly the automotive and industrial segments. Additionally, a rising demand for smart T.V.s in the consumer electronics sector contributes to the market's growth.

- The growth of the IoT sensors market is driven by the various applications of IoT sensors, including registering changes in temperature, light, sound, pressure, and motion. The increasing adoption of smartphones and related devices further propels the demand for IoT sensors.

- The anticipated robust growth in the IoT sensors market is attributed to the heightened emphasis on implementing a connected ecosystem and the standardization of 3GPP cellular IoT technologies.

- With the emergence of smart cities, Car2Car connectivity and advanced fleet management are anticipated to become prominent, creating opportunities for the IoT sensors market. This surge in innovation and the adoption of intelligent sensor technology drive the demand for IoT sensors.

- The scope of the market is expected to expand with advancements in field devices, sensors, and robots. IoT technologies play a crucial role in addressing the labor shortage in the manufacturing sector. Many organizations incorporate Industry 4.0 technologies, including robotization, into their day-to-day operations.

- The global automotive sector is steadily moving towards an autonomous era, driven by recent business collaborations and joint ventures among cybersecurity providers, chip makers, system integrators, and automotive giants.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 36.84% |

| Market Size in 2025 | USD 25.09 Billion |

| Market Size by 2034 | USD 422.13 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Sensor Type, By Network Technology, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The rise in demand for smart factories and IIoT

The global demand for smart factories has been rising, a trend expected to persist due to the emergence of the Industrial Internet of Things (IIoT). IIoT integrates Industrial robots, smart machines, warehouses, and manufacturing plants. To achieve business objectives and key performance indicators. In these smart factories, various IoT sensors play a crucial role by collecting and relaying real-time information, enabling informed decisions on the ground, and assisting operators. Thereby, the demand for smart factories is observed to promote the growth of the IoT sensors market.

Sensor data guides robots and machines in production and assembly processes, ensuring the workforce's safety and the protection of machines. As IIoT integration becomes more widespread, factories transform into connected and synchronized entities. Countries like China and Germany are at the forefront, adopting IoT sensors to enhance communication and coordination in manufacturing processes.

- In April 2022, Arm Limited launched two innovative solutions, the Arm Cortex-M85 and Cortex-A, aiming to provide enhanced customer offerings. These new products will attract new clients and contribute to the company's accelerated revenue growth.

Rising demand for real-time data monitoring for predictive analytics

Industries globally are leveraging big data to enhance process efficiency. In the past, disconnected devices hindered real-time data collection, making obtaining insights challenging. Now, with IoT-connected smart devices, operators can access real-time factory data. Predictive analytics play a crucial role in maintenance planning, allowing companies to anticipate issues based on data analysis. Collecting real-time data enables vendors to assess the actual condition of plant equipment, predicting potential failures and preventing unnecessary downtime.

Restraint

Challenges to offering high quality at low cost

Engineers and system developers are consistently exploring products with enhanced features to diversify their offerings. In the growing industrial automation market, industrial sensor vendors must offer easily customizable and cost-effective sensors. The expense of industrial sensors is often driven by the customization needed to ensure accurate and reliable performance for end-users. However, the overall cost of sensors is decreasing annually, primarily due to the availability of off-the-shelf sensor variants widely utilized in industrial automation systems and equipment.

Opportunities

Application of IoT in the automotive and transportation sector

The global automotive sector is gradually moving towards an autonomous era, propelled by recent collaborations among cybersecurity providers, automotive giants, chip makers, and system integrators. IoT is revolutionizing the automotive, transportation, and logistics industries, driven by preventative maintenance, connected mobility, and real-time data access.

The global spending on IoT in transportation and logistics has significantly increased. IoT enables efficient route mapping, maximizes fuel usage, provides track-and-trace capabilities for logistics, and offers real-time monitoring of parking spaces. Major companies like Google, Mercedes-Benz, Toyota, Volkswagen, and Volvo. They invest in developing smart cars with advanced features for safer and more comfortable driving experiences.

- According to NASDAQ, driverless cars will dominate the market by 2030. Additionally, initiatives like DHL SmarTrucking aim to deploy a fleet of 10,000 IoT-enabled trucks by 2028, contributing to the widespread adoption of IoT sensors in the foreseeable future.

Increasing government funding and initiatives to support IoT projects

The government sector is expected to be a significant user of IoT, leading to global initiatives and funding for IoT-related developments while offering a significant opportunity for the IoT sensors market. Governments are particularly interested in advancements in smart traffic control, energy-saving with smart meters, and security enhancements through smart cameras. Additionally, governments sponsor IoT research initiatives for smart city development, playing a crucial role in expanding IoT in the coming years.

Furthermore, sensors, driven by a rapid decrease in size and the widespread use of microelectromechanical systems technology, are extensively employed in healthcare, automotive, and consumer products. The adoption of smaller sensors in wearables, smartphones, drones, and robotics has significantly contributed to the overall growth of the sensor industry in the last five years.

Sensor Type Insights

The pressure sensors segment dominated the IoT sensors market in 2024. A pressure sensor is a tool that detects and measures pressure, which is the force applied over an area. Using pressure sensors allows for specialized maintenance strategies like predictive maintenance. These devices gather real-time data on equipment conditions. In IoT, a pressure sensor senses pressure and transforms it into an electric signal. The voltage produced by the sensor corresponds to the applied pressure level. These sensors are crucial in IoT sensors market that monitor devices propelled by pressure, contributing to efficient monitoring and maintenance.

- In January 2024, Honeywell and NXP Semiconductors N.V. joined forces to improve energy management in commercial buildings. Their collaboration focuses explicitly on enhancing pressure sensing and ensuring secure control.

The inertial sensors segment is expected to capture a significant share of the IoT sensors market over the forecast period. In various fields like robotics, aerospace, automotive, virtual reality, motion analysis, and navigation systems, inertial sensors are frequently employed. These sensors are essential for tracking and comprehending how objects move and orient themselves in three-dimensional space.

Network Type Insights

The wired segment held the largest share of the market in 2024, under the segment, the ethernet subsegment is observed to capture a promising share in upcoming years. Ethernet is a technology that provides the necessary components, like the computer chip, port, cable, and protocol, to connect a desktop or laptop to a local area network (LAN). This connection allows for fast data transmission using coaxial or fiber optic cables. This also benefits the overall IoT sensors market.

- In February 2024, OMAC, a prominent industry association for machine automation and control, partnered with ei3 to release a guide titled 'Wired for Success: Strategic Insights into the Deployment of Ethernet Networks in Manufacturing.' The unveiling of this guide is scheduled to take place at the esteemed 28th Annual ARC Industry Leadership Forum.

The wireless technology segment is rapidly expanding in the IoT sensors market. The rising demand for wireless data from mobile devices and smart grids propels this growth. Additionally, the increasing adoption of cloud platforms contributes to the significant growth of this segment.

IoT Sensors Market Companies

- AMS OSRAM AG

- Analog Devices Inc.

- Broadcom Inc.

- Emerson Electric Co.

- Honeywell International Inc.

- Infineon Technologies AG

- Innovative Sensor Technology IST AG

- International Business Machines Corp.

- Knowles Corp.

- Libelium Comunicaciones Distribuidas SL

- Monnit Corp.

- NXP Semiconductors NV

- OMRON Corp.

- SENSATA TECHNOLOGIES HOLDING PLC

- Siemens AG

Recent Developments

- In January 2024, Nozomi Networks introduced its IoT security sensor, Guardian Air, in Australia in collaboration with partners CyberCX and The Missing Link.

- In June 2023, STMicroelectronics launched the first MEMS pressure sensor that is waterproof and designed for industrial IoT applications. This sensor has a declared 10-year longevity program, making it a durable solution for industrial use.

Segments Covered in the Report

By Sensor Type

- Magnetometer

- Gyroscope

- Inertial Sensor

- Image Sensor

- Touch Sensor

- Temperature Sensor

- Pressure Sensor

- Humidity Sensor

- Flow Sensor

- Accelerometer

- Others

By Network Technology

- ZIGBEE

- Z-WAVE

- NFC

- RFID

- Wired

- KNX

- LonWorks

- Ethernet

- MODBUS

- DALI

- Wireless

- Bluetooth Smart

- Wi-Fi

- Bluetooth Smart

- Bluetooth Smart / Ant+

- Bluetooth 5

- Others

By Vertical

- Industrial

- Consumer

- Commercial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content