Conductive Polymer Capacitor Market Size and Forecast 2025 to 2034

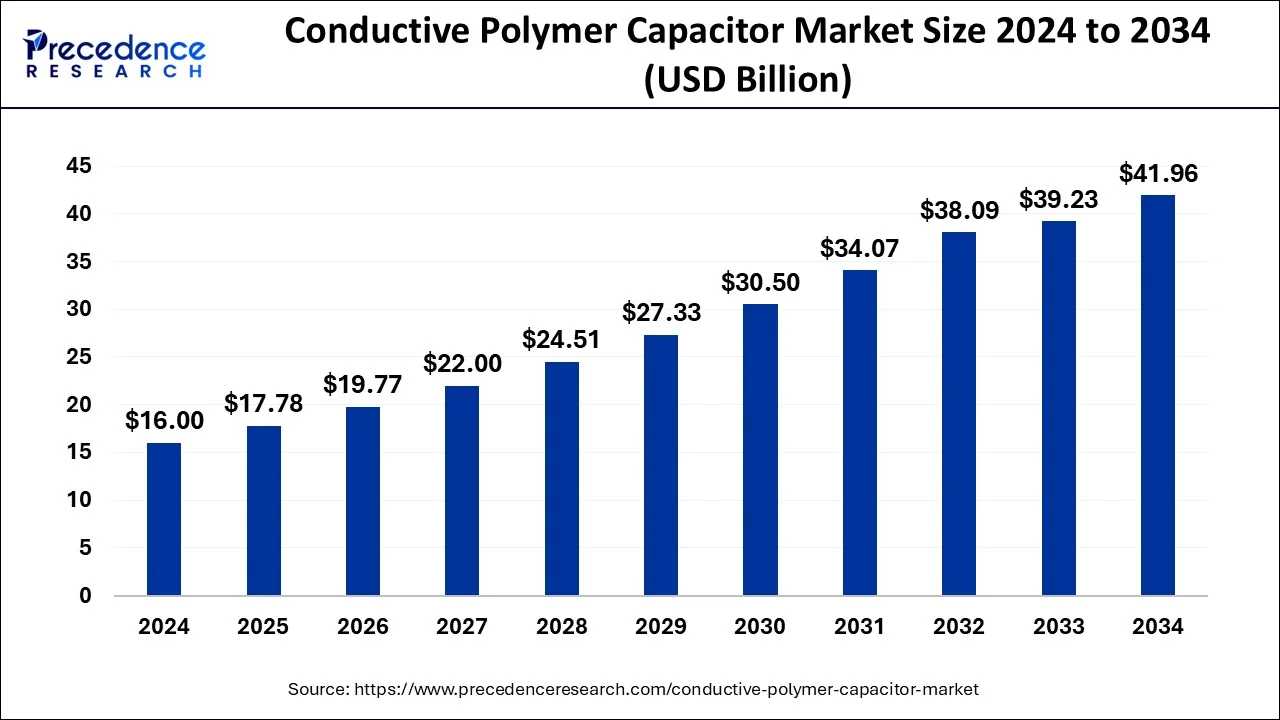

The global conductive polymer capacitor market size was estimated at USD 16 billion in 2024 and is anticipated to reach around USD 41.96 billion by 2034, expanding at a CAGR of 10.12% from 2025 to 2034. The increasing use of conductive polymer capacitors in various sectors due to their superior performance compared to traditional capacitors boost the growth of the conductive polymer capacitor market.

Conductive Polymer Capacitor Market Key Takeaways

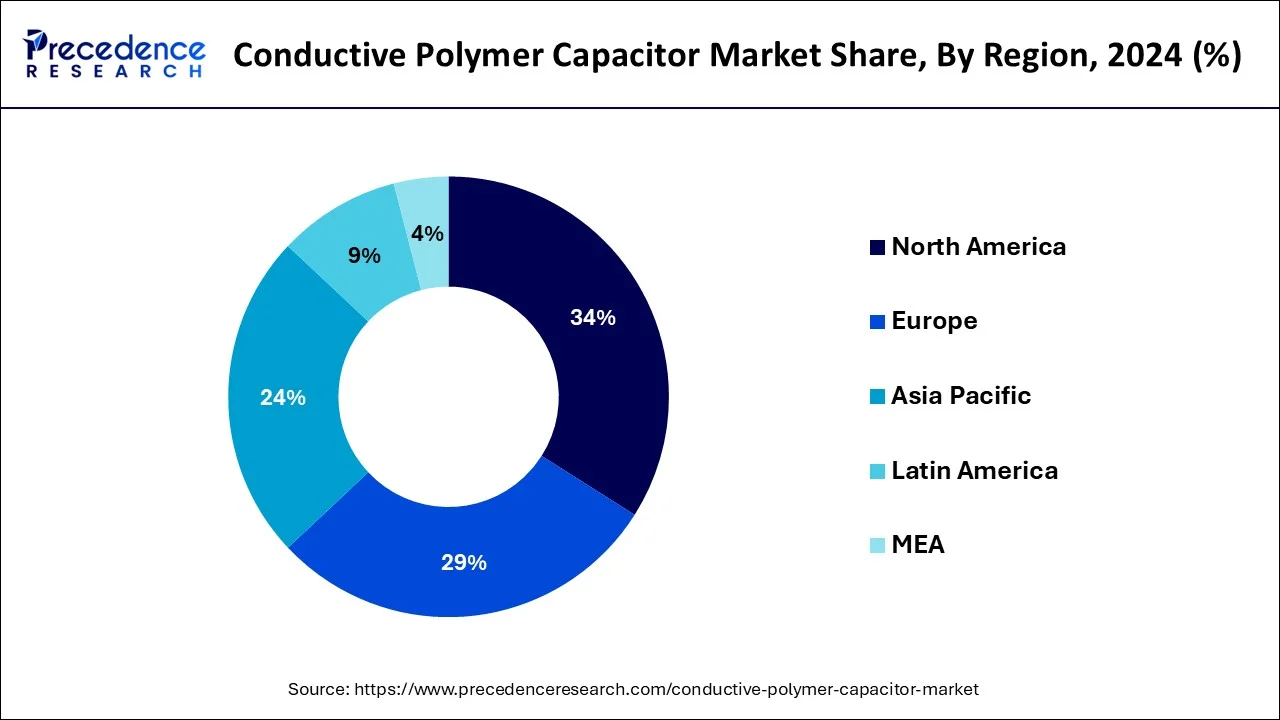

- North Americadominatd the conductive polymer capacitor market and contributd the highest market share of 34% in 2024.

- By product type, the conductive polymer aluminum capacitor segment has held the biggest market share in 2024.

- By type of anode material, The aluminum segment generated the maximum market share in 2024.

- By application, the IT and telecommunication segment led the market in 2024.

AI Integration in the Conductive Polymer Capacitor Market

AI algorithms help in the design process of conductive polymer capacitors by stimulating various materials and configurations. artificial intelligence (AI) algorithms have the potential to improve the performance characteristics of these capacitors, such as lower equivalent series resistance and higher capacitance, further improving efficiency in electronic devices. Moreover, AI streamlines manufacturing processes. It automates the overall processes and helps in quality control, leading to higher yields.

U.S. Conductive Polymer Capacitor Market Size and Growth 2025 to 2034

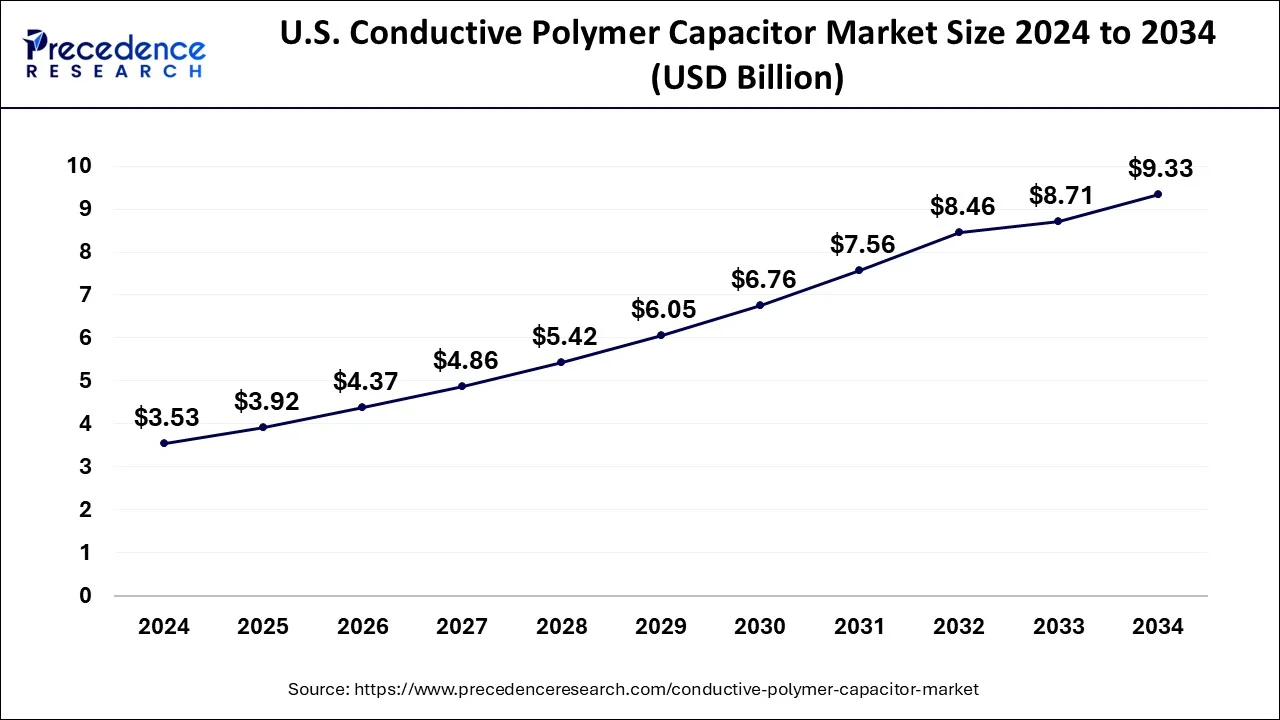

The U.S. conductive polymer capacitor market size was evaluated at USD 3.53 billion in 2024 and is predicted to be worth around USD 9.33 billion by 2034, rising at a CAGR of 10.20% from 2025 to 2034.

North America is Likely to be the Largest Market for Conductive Polymer Capacitor

The study report contracts with the business predictions of conductive polymer capacitor products around areas counting Europe, Latin America, Asia-Pacific, North America, Middle East and Africa. Conductive polymer capacitor market is occupied by Asia Pacific due to augmented intake of the conductive polymer capacitor in various end use applications, coupled with presence of major electronics manufacturing companies in the Asia Pacific and business plans that are executed by the chief players in the nations. North America is probable to list the remarkable CAGR, on account of growing in the demand for the conductive polymer capacitor in automotive and IT telecommunication industry. Likewise, utmost of the companies functioning in the market are advancing heavily in order to get the modest edge in the conductive polymer capacitor market in North America. Further, the Latin America as well as Middle East and Africa regions will likely to register moderate growth in the coming.

- Increased adoption of consumer electronics further bolstered the market in the region. According to a survey conducted in September 2024, about 91% of people in Mexico use smartphones.

Conductive Polymer Capacitor Market Growth Factors

- Benefits offered by conductive polymer capacitor

- Growing adoption of conductive polymer capacitor in end use applications including computing, smart device, industrial, power supply, automotive etc.

- Growing consumer and industrial electronics sector worldwide

Key Market Insights

Conductive polymer capacitor industry is witnessing significant growth during the forecast period of time. Growing adoption of conductive polymer capacitor's in the IT and telecommunication and electronics industries due to its excellent characteristics is main factor driving growth of the target industry. Addition this, increasing penetration of electronics systems designed for use at industrial sites can create lucrative growth opportunities for the key players operating in the global market. The need for more powerful and reliable capacitors has also been generated for the Internet of Things (IoT) associated monitors as well as controllers. Under unforgiving settings, these demanding devices often run owing to which not accessible to traditional capacitor technologies are. Also, the conductive polymer capacitors offer efficient and cost-effective solution to this problem.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 16 Billion |

| Market Size in 2025 | USD 17.78 Billion |

| Market Sizeby 2034 | USD 41.96 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.12% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Anode Material, Shape of Capacitor, Application, Product |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Future of Global Conductive Polymer Capacitor Market

The major trend witnessed in the global market in growing numbers of strategic partnerships among major key players. This trend is anticipated to continue and will boost growth of the market in the near future. For instance, Panasonic a leading player of the target industry has introduced OS-CON SVPT series of the conductive polymer capacitors based on aluminum material.

Segment Trends

Conductive Polymer Aluminum Product Type Segment Testified Leading Market Stake in Year 2024

Conductive polymer aluminum product type is anticipated to register highest growth rate as well as market share over the forecast period of time. The growth is attributed to its noteworthy characteristics such as high voltage range, its temperature and frequency characteristics, capacity range among others. Along with this the conductive polymer tantalum product type segment will be growing at considerable pace and will fuel growth of the conductive polymer capacitor industry in the near future.

Aluminum Anode Material Segment Reported Foremost Market Stake in 2024

Aluminum anode material segment is expected to account for the major share in the owing to its rising popularity in the leading countries and developing areas. Along with this the tantalum segment is anticipated to grow at the noteworthy growth rate and will augment the market revenue. The growth of the tantalum segment will be driver by the increasing adoption of the tantalum based conductive polymer capacitor owing to its increasing acceptance in the industrial as well as household electronics including automobiles, smart meters, set top box etc.

IT and Telecommunication Industry Segment Reported Foremost Market Stake in 2024

IT and telecommunication application segment is expected to account for the major share in the target market. IT and telecommunication industry is adopting conductive polymer capacitor owing to the excellent benefits offered by the conductive polymer capacitors such as high capacitance, along with the compact size. Further, the conductive polymer capacitors are have long life which is another factor responsible for its increased adoption in the IT and telecommunication industry. All these factors are driving growth of the IT and telecommunication segment in the target market. Along with this the industrial electronics segment is anticipated to grow at the important growth rate and will expand the market revenue.

Conductive Polymer Capacitor Market Companies

- CDE Cornell Dubilie

- Tecate Group

- Panasonic Corporation

- Nippon Chemi-Con

- Sun Electronics

- Samsung Electronics

- KEMET

- ROHM

- Lelon Electronics

- Vishay

Latest Announcement by Industry Leader

- In February 2024, Shinji Sakamoto, a Representative Director, President, and CEO of Panasonic Industry Co., Ltd. announced that the company begun commercial production of its ZL series conductive polymer hybrid aluminum electrolytic capacitors. The series includes the industry's first high-capacitance type models guaranteed to operate at 135°C. These capacitors are suitable for electronic control units (ECUs) for electric vehicles, including hybrids.

Recent Development

- In August 2023, Nippon Chemi-Con added high capacitance to expand the product line for the PXG Series of SMD type conductive polymer aluminum solid capacitors. The company expanded its lineup of products with a rated voltage of 25Vdc by adding products that achieve roughly 20% to 40% higher capacitance compared to existing products of the same size.

Segments Covered in the Report

By Product Type

- Conductive Polymer Aluminum Capacitor

- Solid Capacitor

- Electrolytic Capacitor

- Hybrid Aluminum Electrolytic Capacitor

- Conductive Polymer Tantalum Solid Capacitor

- Conductive Polymer Niobium Capacitors

- Solid Capacitor

- Electrolytic Capacitor

By Type of Anode Material

- Aluminum

- Tantalum

By Shape of Capacitor

- Chip Type

- Lead Type

- Large Can Type

By Application

- Automotive

- Consumer Electronics

- Industrial Electronics

- IT and Telecommunication

- Aerospace and Defense

- Power and Energy

- Healthcare

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting