Confidential Computing Market Size and Forecast 2025 to 2034

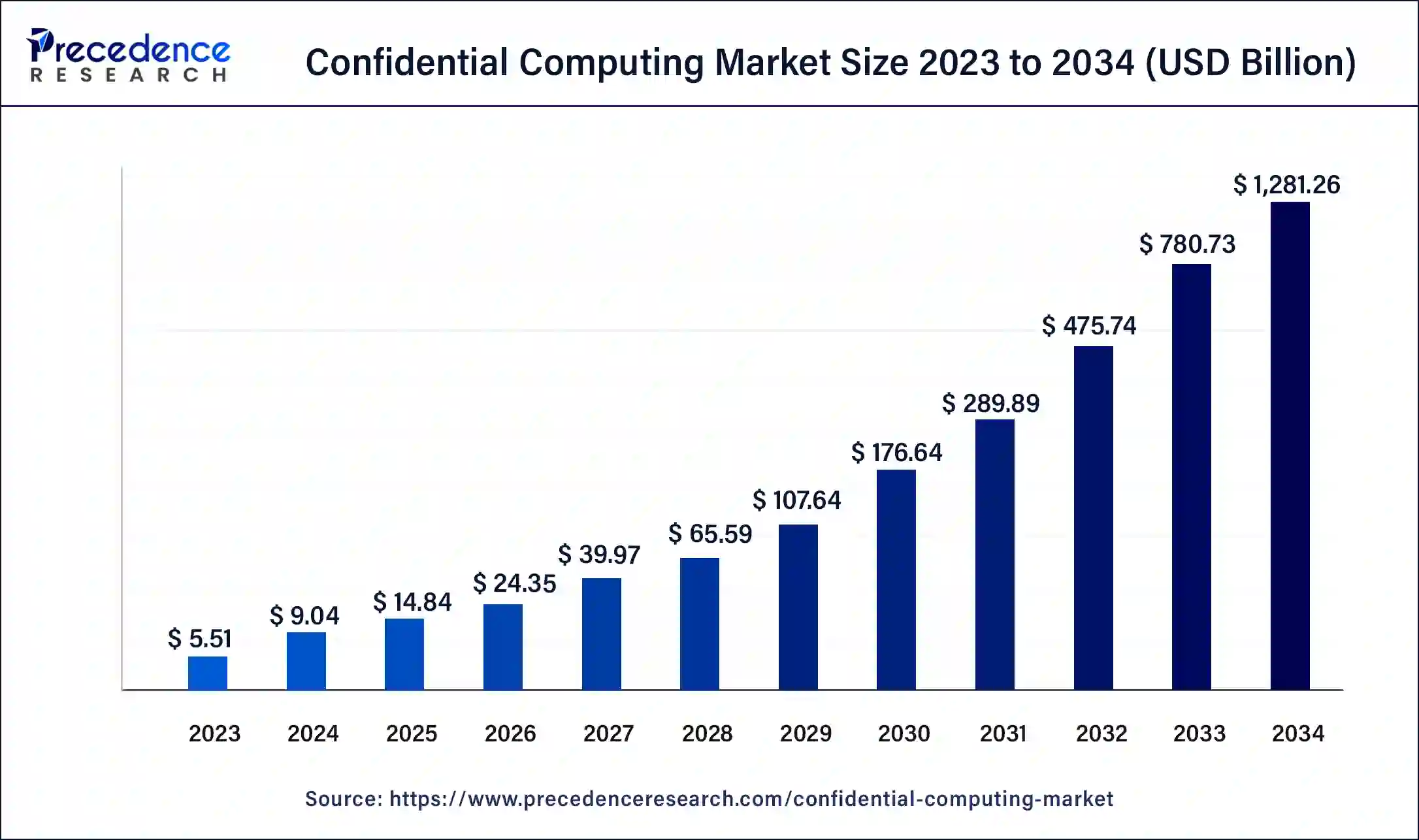

The global confidential computing market size was USD 9.04 billion in 2024, estimated at USD 14.84 billion in 2025, and is anticipated to reach around USD 1,281.26 billion by 2034, expanding at a CAGR of 64.11% from 2025 to 2034. The rising demand for effective data protection solutions by the end-use industries is driving the growth of the market

Confidential Computing Market Key Takeaways

- In terms of revenue, the global confidential computing market was valued at USD 9.04 billion in 2024.

- It is projected to reach USD 1,281.26 billion by 2034.

- The market is expected to grow at a CAGR of 64.11% from 2025 to 2034.

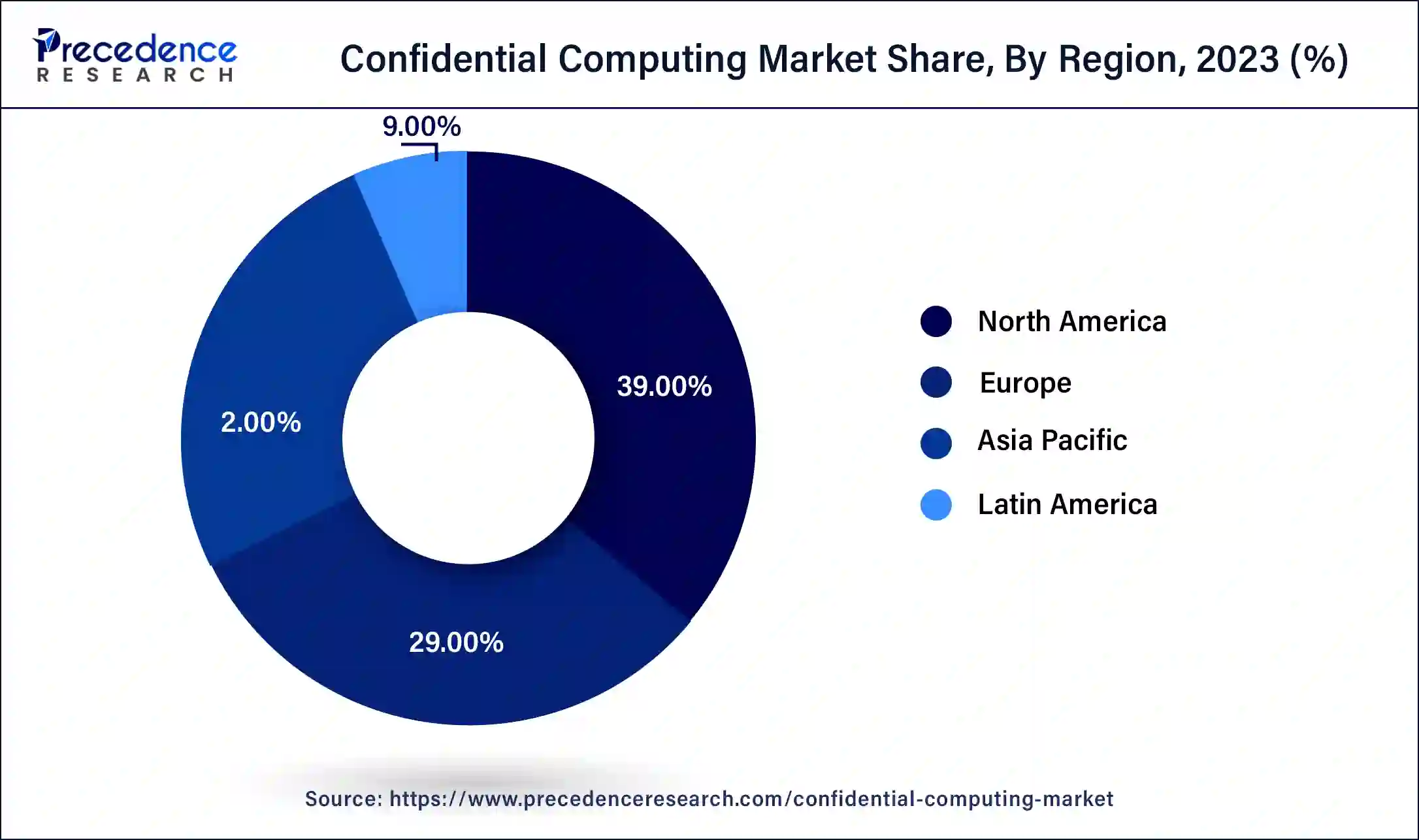

- North America dominated the confidential computing market with the largest market share of 39% in 2024.

- Asia Pacific is expected to be the fastest-growing region during the forecast period.

- By component, the hardware segment dominated the market in 2024.

- By deployment, the cloud-based segment held the dominant share of the market in 2024.

- By application, the pellucidity between user segments dominated the market with the largest market share in 2024.

- By industry vertical, the retail industry segment accounted for the largest market share in 2024.

How can AI impact Confidential Computing?

The rising implementation of artificial intelligence into industrial applications enhances the productivity and efficiency of industries' working capabilities. AI plays a significant role in confidential computing and cybersecurity; it protects the data and allows organizations to continue using AI power to maintain privacy, security, and required standards for the business. Confidential AI is the combined term of artificial intelligence and confidential computing. Confidentiality AI is filling a gap between zero-trust policies made for generative AI and secure private data. AI-enhanced the protection of digital systems and data from cyber threats with the help of neural networks, machine learning, and other AI technologies that help detect, analyze, and prevent data from potential cyber threats.

For Instance,

- Intel is efficiently developing the technologies and platform that drive the convergence of confidential computing and artificial intelligence, allowing customers to secure diverse AI workloads in the entire ecosystem.

U.S. Confidential Computing Market Size and Growth 2024 to 2034

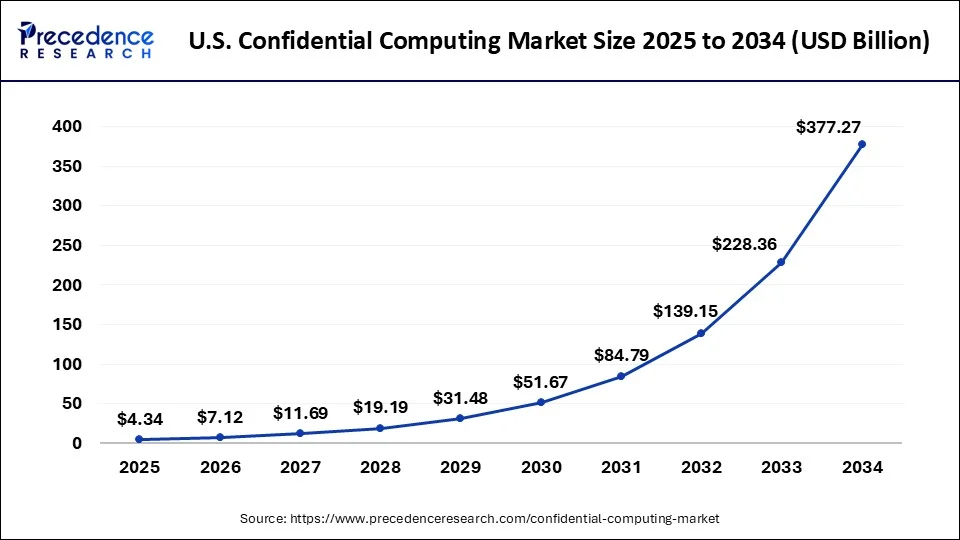

The U.S. confidential computing market size was exhibited at USD 2.64 billion in 2024 and is predicted to be worth around USD 377.27 billion by 2034, growing at a CAGR of 64.25% from 2024 to 2034.

North America dominated the market with the largest market share in 2024. The growth of the market is attributed to the rising industrial infrastructure, which is driving the demand for confidential computing for the data security process. The increasing presence of technology leaders in regional countries like the U.S. and Canada and the rising digitization and automation in the industries are accelerating the growth of the confidential computing market in the region.

For Instance,

- Cloud computing is one of the leading parts of the economy, accounting for $576 billion in cloud computing in 2023.

- It is expected that 463 exabytes of data will created every year globally by 2025.

- Retail sales increased by 1.1% from June 2024 and a 2.6% increase from last year in the U.S. According to the Global Power of Retailing 2023 report, the top 250 companies consisting of 8.5% year-on-year growth in retail revenue and increase from 5.2% over the previous year. The digitization in the retail industry is driving the sales and revenue of the retail industry.

Asia Pacific is expected to be the fastest-growing confidential computing market during the forecast period. The growth of the market is attributed to the rising global population and the rising industrial infrastructure, and the demand for data security is driving the growth of the market. The rising technological advancement in industry verticals such as banking and finance, healthcare, retail, and others drives the growth of the confidential computing market in the region.

What Factors Are Fueling the Growth of the European Confidential Computing Market?

The European confidential computing market is expected to witness significant growth over the forecast period, propelled by an increase in the number of cyber threats. The European organisations that are predominant, especially in the bank-based sectors like healthcare, government, among others, are focusing more on data protection. Confidential computing brings this problem under control by using trusted execution environments to encrypt data. Due to this, confidential computing has emerged as an essential element of enterprise cybersecurity strategies at a very fast pace.

The expanding digitalisation of the region, as well as the use of cloud, is aiding the adoption of this technology. Cloud service providers and the hardware vendors are also teaming up to design confidential computing functions into their systems, deployment, and end-user scenarios, providing scalable and safe solutions.

How Are Cybersecurity Concerns Shaping the Middle East & Africa Confidential Computing Market?

The Middle East & Africa confidential computing market is experiencing a remarkable boost due to the increase in the number of digital efforts spearheaded by national governments. The UAE, Saudi Arabia, and Egypt are some of the countries that are actively implementing massive digital transformation initiatives and integrating such technologies as cloud computing, artificial intelligence, and IoT. Confidential computing is used to offer an additional layer of security that helps to achieve compliance and also safeguards mission-critical workloads against insider threats and external attacks.

Market Overview

Confidential computing is a technology that is highly adopted by a number of end-use industries for dealing with cybercrime and secured data processing activities. Confidential computing is a cloud-based computing technology that aims to protect the data during processing. The technology had the overall control over the end-to-end encryption of the data processing. The technology stores the sensitive data in the CPU enclave during the processing. Confidential computing can help organizations in many ways, including protecting sensitive data during processing, increasing cloud computing benefits to sensitive workloads, protecting intellectual property, helping in securely collaborating with partners on new cloud solutions, reducing threats while choosing to collaborate with cloud providers, and protecting data at the edge. The rising concern about data breaches and cybersecurity drives the growth of the confidential computing market.

Market Trends

- 2365 cyberattacks occurred in 2023, with 343,338,964 victims. 72% of data was breached in 2021. The data breach costs about $4.45 million on average.

- 35% of the malware is detected from email, and approximately 94% of the enterprises reported email security incidents, which accounted for over $2.7 billion in losses.

- Apple (4%), Wells Fargo (3%), LinkedIn (3%), Home Depot (3%), Facebook (3%), Microsoft (33%), Amazon (9%), Google (8%), Netflix (2%), and DHL (2%) these are some of the most prevalent companies are targeted in phishing scams.

Confidential Computing Market Growth Factors

- The rising industrialization due to the rising global population and the economic standards of several countries are driving investment in the development of various industries that boost the demand for the confidential computing market.

- The rising demand for data processing security and the rising industrial transactions between organizations are boosting the demand for efficient end-to-end data encryption software solution that drives the growth of the market.

- The major goal of confidential computing is to offer greater reliability over data that is protected, confidential, and cost-effective, which also propels the growth of the confidential computing market.

- Rising concerns related to data security in a number of industries, such as banking and finance, healthcare, telecommunication, IT, and others, are driving the demand for confidential computing to handle and assure data security while processing, which boosts the growth of the market.

- The rising digitization and the adoption of AI in industries and the increasing cyber threats over the industries are driving the growth of the confidential computing market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1281.26 Billion |

| Market Size in 2025 | USD 14.84 Billion |

| Market Size in 2024 | USD 9.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 64.11% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Application, Industry Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rise in confidential computing in IT and telecommunication

IT and telecommunication are two of the major and leading industries in the country's overall development. Confidential computing plays a significant role in securing data related to the telecom industry. It helps in various applications of the telecom, such as moving virtualized network functions like 5G core applications to the public cloud while keeping data encrypted, reducing the requirement of infrastructural development and potential security risk, and protecting digital assets with encryption and remote attestation. The rise in the 5G network has also increased the data quality and quantity and has the potential threat to cybercrime, which also boosts the growth of the confidential computing market.

Restraint

Complex infrastructure

The complex cloud infrastructure and the high-cost installation of confidential computing in organizations are limiting the growth of the confidential computing market.

Opportunity

The integration of GPU into confidential computing

The increasing demand and the availability of confidential computing in small to medium-scale organizations. The rising investment by major technology giants such as Microsoft and NVIDIA is planning to offer a solution that will help scale the large language models. Businesses are highly adopting confidential computing to enhance the safety of a wide range of applications. The rising research and development activities in the development of technologies drive the growth of the confidential computing market.

Component Insights

The hardware segment dominated the confidential computing market in 2024. The rising demand for confidential computing hardware by the number of end-use industries for higher security is driving the demand for confidential computing hardware. The hardware segment enhances the security solution at the lowest layer possible. Hardware can deliver efficient defense-in-depth mechanisms and security boundaries by confidential computing.

For Instance

- In October 2023, Web3 platform IoTeX and ARM Research, the provider of hardware and chip technology, launched the IoTeX's DePIN stack, a confidential computing of encrypted data platform.

Deployment Insights

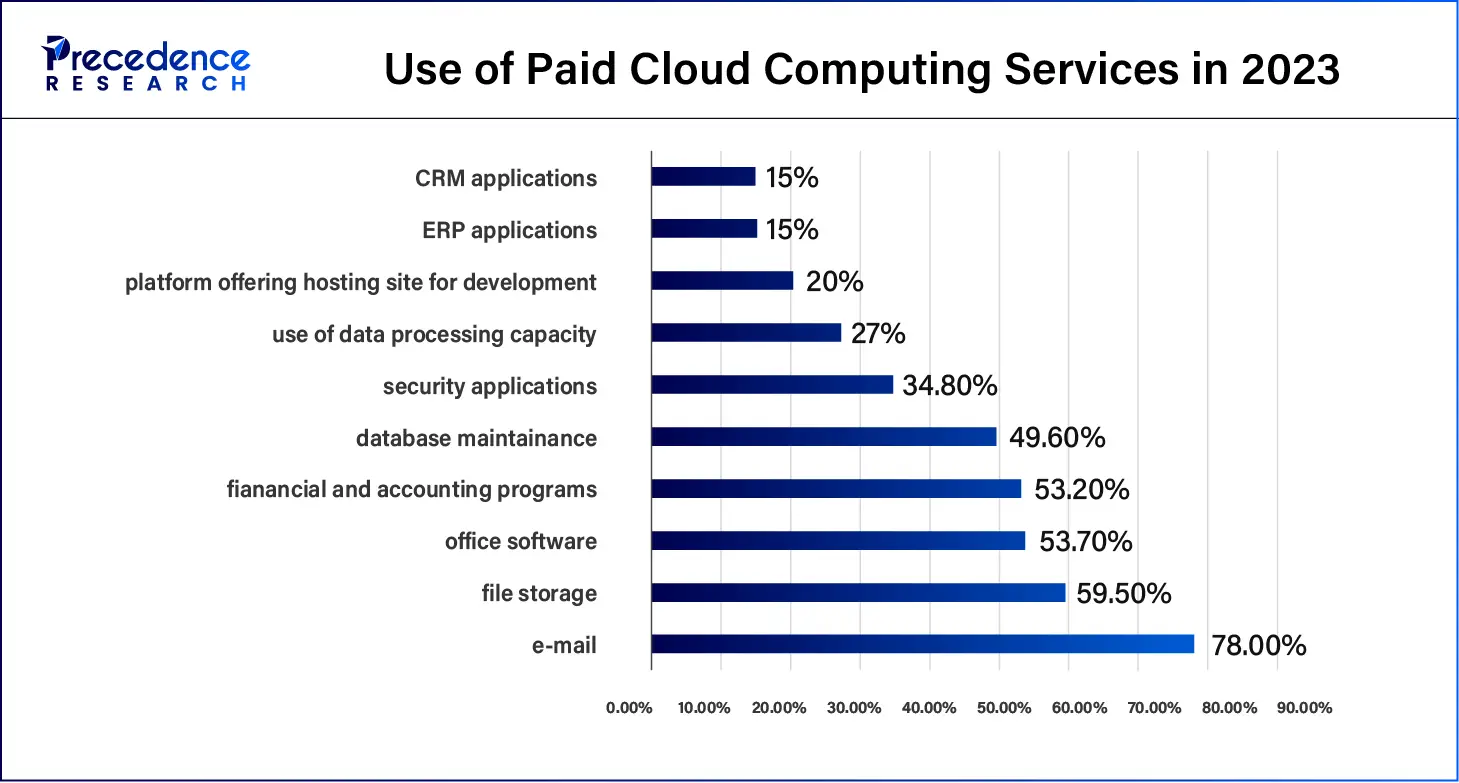

The cloud-based segment held the largest share of the confidential computing market in 2024. There is an increasing demand for cloud-based solutions in organizations for hosting and managing confidential computing environments. Cloud-basedsoftware eliminates the requirement of infrastructure development, and it can efficiently hold secure data processing without the need for heavy infrastructure. It is a more durable, scalable, and cost-efficient solution than the on-premise deployment in the organizations. The rising investment in cloud-based solutions by the major market players is driving the demand for the segment.

For instance,

- 44.6% of enterprises used cloud computing services in 2023, a 7.2% increase from 2021. The large enterprises paid for cloud services by 79.7%, the medium-sized enterprises by 51.7%, and the small enterprises by 32.0%.

Application Insights

The pellucidity between users segment dominated the market with the largest confidential computing market share in 2024. The confidential computing helps I enhanced the communication ad transparency between the organizations. Confidential computing allows organizations to share data without compromising security; it helps in enhancing the trusted and secure execution environment. The pellucidity between users allowed safer collaboration and data sharing between the organizations.

Industry Vertical Insights

The retail industry accounted for the largest market share in 2024. The increasing global population and the disposable income in the population are driving the demand for consumer goods and accelerating demand for the retail industry. The rising implementation of confidential computing for security purposes boosts the growth of confidential computing in the retail industry. The increasing use of online or mobile payment drives the demand for an efficient security process. Confidential computing helps protect payment information during the transaction process. It reduces fraudulent activities and data breaches in the online transaction process, which also boosts the growth of the confidential computing market.

Confidential Computing Market Companies

- Amazon Web Series (AWS)

- Anjuna Security

- Advanced Micro Devices (AMD)

- Arm Holdings

- Cyxtera Technologies

- Decentriq AG

- Fortanix

- Google LLC

- IBM Corporation

- Intel Corporation

- Google LLC

Top Companies in the Confidential Computing Market

- Microsoft Corporation: Azure Confidential Computing service to secure processing environments to process data from sensitive workloads. Its focus has been on advances made in Trusted Execution Environment (TEE) technologies, where trusted processing and TEE should help to round off the concept of secure data processing.

- Intel Corporation: Intel Corporation aligns itself as an important player in the confidential computing space, entails being an active participant in building out its programs via partnerships, and product implementations. Intel's program strategy closely works with industry associations to improve and develop security standards and security solutions, as with the work being undertaken at the Confidential Computing Association.

Recent Developments

- In March 2024, Edgeless Systems GmbH, a confidential computing startup, introduced a new solution designed to increase the security of artificial intelligence by providing confidential AI capabilities allowing the sharing of data within AI services.

- In June 2024, Opaque Systems, a startup based in security data analytics, introduced the latest platform for the execution of AI workloads on encrypted data. The platform is announced at the 2024 Confidential Computing Summit in San Francisco, CA.

- In September 2023, Intel Corporation announced the general availability of the attestation service as the first provision of its Intel Trust Authority umbrella. The launch is to enhance the organization's confidential computing by offering a scalable, independent, and unified assessment of trusted execution environments (TEEs) in the multiple deployment models.

- In May 2024, Arcium, a leading provider in parallelized confidential computing networks, secured funding worth $5.5 million led by Greenfield Capital, with other investors participating, such as Heartcore Capital, Longhash VC, Coinbase, L2 Iterative Ventures, Smape Capital, Everstake, and Staking Facilities. These launches strengthen the framework for encrypted computations.

- In February 2024, Arm launched the Neoverse compute subsystems (CSS) developed on the latest third generation of its Neoverse IP. The new products like N3 and V3 will enable technologies like chipsets.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Deployment

- Cloud-based

- On-premise

By Application

- Data Security

- Secure enclaves

- Pellucidity between users

- Others

By Industry Vertical

- BFSI

- Healthcare

- Government and Defense

- IT & Telecommunication

- Manufacturing

- Retail

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting