What is the Connected Game Console Market Size?

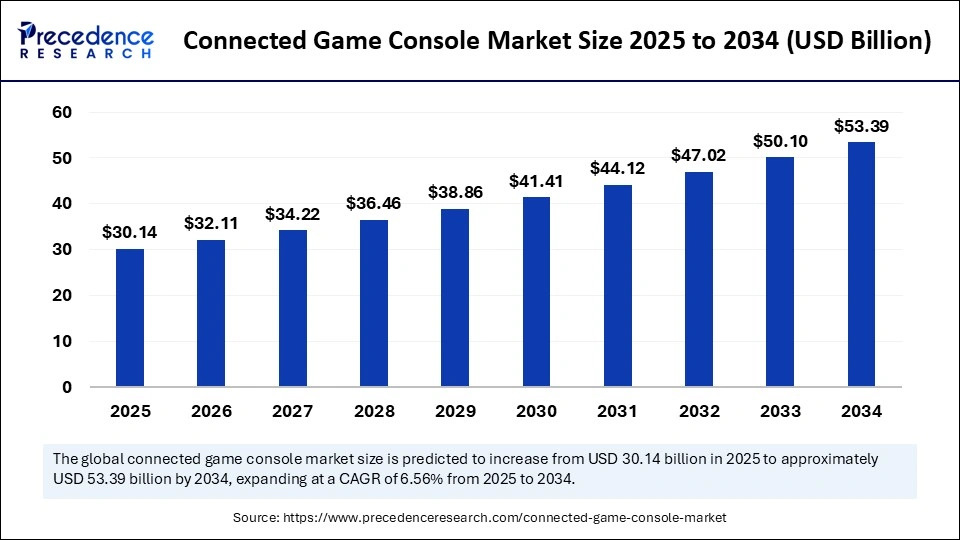

The global connected game console market size accounted for USD 28.28 billion in 2024 and is predicted to increase from USD 30.14 billion in 2025 to approximately USD 53.39 billion by 2034, expanding at a CAGR of 6.56% from 2025 to 2034. The market for connected game consoles has experienced significant growth and is expected to continue expanding over the next decade. With technological advancements and increasing consumer demand, this industry is poised for substantial development.

Market Highlights

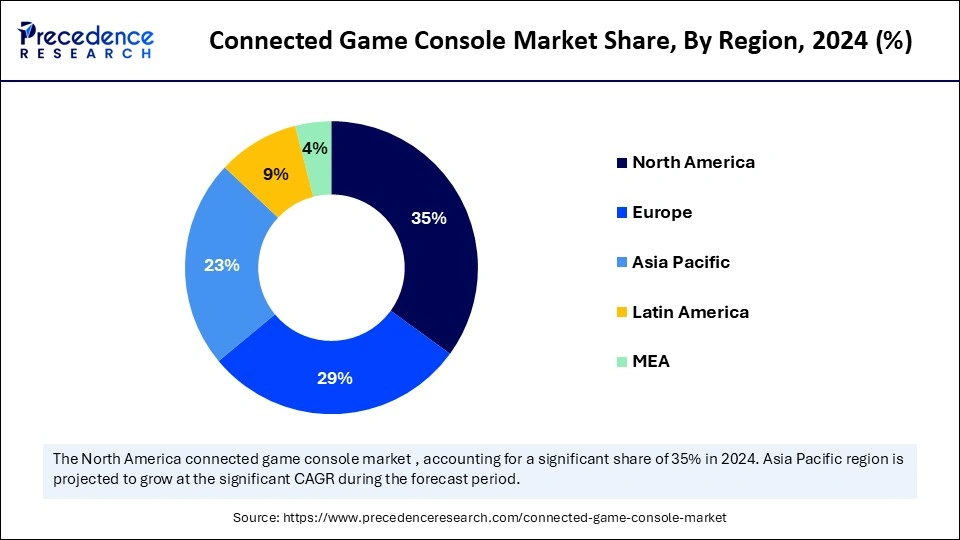

- North America dominated the connected game console market with the largest market share of 35% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By component, the hardware segment held the biggest market share in 2024.

- By component, software is expected to grow at a remarkable CAGR between 2025 and 2034.

- By console type, the home consoles segment captured the highest market share in 2024.

- By console type, hybrid consoles are expected to grow at a remarkable CAGR between 2025 and 2034.

- By connectivity, the wireless segments contributed the maximum market share of 65% in 2024.

- By connectivity, 5G-enabled consoles are expected to grow at a remarkable CAGR between 2025 and 2034.

- By storage type, the digital segments led the market in 2024.

- By storage type, cloud-only gaming is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-use application type, the online multiplayer gaming segment accounted for the significant market share in 2024.

- By end-use application type, VR/AR gaming & esports is expected to grow at a remarkable CAGR between 2025 and 2034.

- By distribution channel type, the offline segment held the largest market share of in 2024.

- By distribution channel type, online is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user demographics type, the young adults segment generated the major market share in 2024.

- By end-user demographics type, kids & teenagers is expected to grow at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 28.28 Billion

- Market Size in 2025: USD 30.14 Billion

- Forecasted Market Size by 2034: USD 53.39 Billion

- CAGR (2025-2034): 6.56%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Are Consoles Evolving into the Nerve Centre of Digital Entertainment?

The connected game console market has transcended its erstwhile identity as a mere conduit for gaming, metamorphosing into a sophisticated ecosystem of entertainment, connectivity, and immersive experiences. These consoles are no longer tethered solely to discs and cartridges; instead, they embody a seamless convergence of cloud gaming, multimedia, streaming, and online social interaction. Consumers are increasingly gravitating towards devices that not only deliver high-fidelity gameplay but also serve as portals to digital communities and content universes. With rising internet penetration, the proliferation of 5G, and a growing appetite for interactive engagement, connected consoles are gaining significant traction across demographics. The market thrives as a nexus of technological innovation and cultural zeitgeist, drawing strength from both nostalgic gamers and digitally native generations.

How AI Is Impacting the Connected Game Console Market?

Artificial intelligence is imbuing the products in the connected game console market with unprecedented capabilities, reshaping both player experiences and developer ambitions. From hyper-personalized recommendations to adaptive gameplay that learns from user behavior, AI transforms static entertainment into a dynamic, responsive dialogue. Console manufacturers are increasingly deploying AI-driven graphics enhancements, natural language processing for virtual assistants, and predictive analytics for optimizing cloud-based content delivery. Moreover, AI-powered matchmaking systems foster balanced and engaging online multiplayer ecosystems, thereby enhancing retention. Developers are leveraging machine learning to fine-tune in-game economies, procedural content generation, and even real-time cheat detection. The cumulative effect is a paradigm shift. AI is not a supplementary feature but the very substratum upon which the future of connected gaming is being constructed.

Market Key Trends

- Cloud-first experiences: Cloud gaming integration reduces hardware dependence, making consoles hybrid platforms for both local and streamed gameplay.

- Subscription economy: Growth of Game Pass-like services underscores consumer preference for access over ownership.

- Social convergence: Consoles are becoming digital salons, where gaming, video chat, and live streaming intersect.

- Cross-platform fluidity: Increasing interoperability across console, PC, and mobile ecosystems enhances engagement.

- Immersive enhancements: VR/AR integration and haptic feedback peripherals are expanding sensory frontiers.

- Sustainability push: Energy-efficient designs and modular hardware are emerging under consumer and regulatory pressure.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 28.28 Billion |

| Market Size in 2025 | USD 30.14 Billion |

| Market Size by 2034 | USD 53.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.56% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Console Type, Connectivity, Storage Type, End-Use Application, Distribution Channel, End-User Demographics, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

When Connectivity Fuels Immersion

The foremost propellant of the connected game console market is the insatiable demand for immersive, interconnected experiences that extend beyond solitary gaming. Consumers, particularly millennials and Gen Z, seek devices that double as social arenas, facilitating collaboration, competition, and shared entertainment. High-speed internet proliferation and the rollout of 5G networks are catalyzing seamless multiplayer environments and low-latency cloud gaming. The surge of digital-first lifestyles post-pandemic has only accelerated this trajectory, positioning consoles as vital entertainment nodes. Furthermore, the symbiosis between streaming services, esports, and online communities enhances the indispensability of connected consoles. In essence, the convergence of social, cultural, and technological currents serves as a rising tide that lifts the entire market forward.

Restraints

The Achilles Heel of Connectivity

Notwithstanding their promise, the connected game console market confront significant impediments that temper market expansion. Chief among these is the reliance on robust broadband infrastructure, which remains inconsistent across geographies. Hardware costs, subscription fatigue from proliferating digital services, and rising inflationary pressures deter price-sensitive consumers. Cybersecurity vulnerabilities also loom large, as consoles interlinked with payment systems and personal data become attractive targets for malicious actors. Additionally, the rapid obsolescence cycle, fueled by technological leaps, can dissuade users wary of investing in soon-to-be-outdated devices. Fragmentation across competing platforms further engenders consumer indecision. Thus, while the market trajectory is upward, it is not bereft of formidable headwinds that necessitate prudent navigation.

Opportunity

The Golden Arcade Ahead

The future of the connected game console market brims with tantalizing opportunities, particularly as technology converges with entertainment and lifestyle. Emerging markets with burgeoning middle classes present untapped reservoirs of demand, especially as internet access and disposable incomes proliferate. Cross-sector synergies, such as integrating health, education, and fitness applications, can expand the utility of consoles beyond play. The ascent of the metaverse promises to transform consoles into immersive gateways to digital universes, spurring hardware and software innovation. Meanwhile, partnerships between console makers, content creators, and telecom operators can unlock bundled ecosystems that enhance stickiness. For those willing to innovate, the connected console is poised to transcend gaming, evolving into a holistic digital experience hub.

Segment Insights

Component Insights

Why Hardware Is Dominating the Connected Game Console Market?

Hardware continues to dominate the connected game console landscape, serving as the tangible gateway to immersive digital experiences. Premium graphics processes, high-capacity storage, and sophisticated controllers define the competitive edge, while consumers consistently gravitate toward devices offering superior visual fidelity and tactile engagement. The cyclical launch of next-generation consoles further stimulates demand, with each iteration raising the bar for performance and realism. The appetite for cutting-edge accessories from VR headsets to adaptive controllers reinforces hardware's irreplaceable role in the ecosystem. Manufacturers invest heavily in industrial design, cooling technologies, and energy efficiency, underscoring the continued primacy of hardware as the market's cornerstone. For many households, the console itself remains both a cultural icon and a functional centrepiece.

Simultaneously, the durability and longevity of hardware solidify its position as a stable revenue driver in an otherwise dynamic digital landscape. Consumers often perceive the acquisition of a console as a long-term investment, fostering brand loyalty that persists across generations of devices. Bundling strategies with popular titles and streaming services amplify hardware adoption, creating a symbiotic relationship between physical devices and digital offerings. Moreover, global enthusiasm for esports and cinematic gaming experiences propels consumers toward high-specification hardware that can keep pace with evolving demands. Hardware thus represents more than a product; it embodies the aspiration to access the pinnacle of interactive entertainment.

Software, while secondary in historical precedence, has emerged as the fastest-growing segment, fuelled by the rise of digital distribution and subscription-based models. Titles are no longer static commodities but evolving ecosystems enriched with downloadable content, live updates, and multiplayer expansions. AI-driven personalization and cloud-based delivery systems enable software to transcend geographical and physical limitations, appealing to a global audience. Developers are now experimenting with adaptive narratives and procedurally generated environments, thereby heightening engagement while extending product lifecycles. This dynamism translates into compounding revenues for publishers and console manufacturers alike. In essence, software increasingly defines the true value proposition of a console, eclipsing mere hardware specifications.

Equally, the growing appetite for cross-platform interoperability elevates software's importance, allowing gamers to migrate seamlessly between console, PC, and mobile environments. Indie developers, empowered by digital storefronts, contribute to a vibrant and diverse software library that broadens consumer choice and diversity. Subscription services akin to a digital buffet of entertainment have redefined consumer expectations, transforming ownership into access. Moreover, the monetization of in-game economies, skins, and microtransactions ensures recurring revenue streams long after the initial sale. With innovation occurring at breakneck speed, software is the crucible where creativity and commerciality coalesce, rendering it the market's most agile growth engine.

Console Type Insights

How Home Consoles are the Sovereigns of Living Rooms?

Home consoles reign supreme as the dominant console type for the connected game console market, embodying a tradition of high-performance, large-screen gameplay within domestic environments. Their appeal lies in their ability to deliver cinematic visuals, surround-sound immersion, and seamless multiplayer connectivity. With ample storage, powerful GPUs, and ergonomic controllers, home consoles have become digital sanctuaries for millions of households. Consumers often associate them with premium entertainment hubs, integrating video streaming, music, and even fitness applications. The dominance of these consoles stems from their multi-functionality, positioning them as indispensable entertainment anchors. The gravitas of established brands further cements their enduring popularity across diverse geographies.

Furthermore, the aspirational allure of home consoles resonates across demographics, from competitive gamers seeking performance to families desiring shared entertainment. Their robust architecture ensures compatibility with expansive, graphically demanding titles unavailable on smaller devices. The proliferation of exclusive franchises nurtures brand loyalty, encouraging successive upgrades with each generational release. Home consoles also serve as cultural touchstones, celebrated in esports arenas and pop culture alike. By offering longevity, content depth, and multimedia versatility, they secure their dominance in an increasingly fragmented entertainment landscape.

Hybrid consoles capable of seamless transitions between handheld portability and docked home use represent the fastest-growing category. Their meteoric rise is anchored in their versatility, allowing consumers to switch between solitary play, on-the-go gaming, and social living-room experiences. They cater to the contemporary preference for fluid entertainment, untethered by location or rigid use cases. The appeal is amplified by younger, mobile-first demographics who seek flexibility without sacrificing quality. Moreover, hybrid consoles blur the demarcation between portable devices and traditional systems, creating a new paradigm of experiential gaming. Their adaptability positions them as the future-facing disruptors of the industry.

Beyond flexibility, hybrid consoles align with broader cultural shifts toward multifunctional devices. Their lower cost relative to high-end home consoles broadens accessibility, capturing aspirants in emerging markets. Developers increasingly optimize content for both handheld and docked play, further legitimizing hybrid systems as mainstream rather than niche. These consoles also thrive in urban environments where commuting and mobile lifestyles dictate consumer behaviour. Their rapid ascent underscores a market hungry for choice and adaptability, challenging the historical hegemony of home consoles while signalling a new era of ubiquitous play.

Connectivity Insights

Why Wireless Consoles are the Unfettered Leaders?

Wireless connectivity dominates the connected game console market, liberating consoles from physical constraints and enriching user convenience. Gamers enjoy seamless multiplayer experiences, cloud integration, and cross-platform interoperability facilitated by Wi-Fi networks. Wireless controllers, headsets, and peripherals further augment immersion, reducing clutter and enhancing aesthetics. For households, eliminating tangled cords enhances usability and accessibility, particularly in shared entertainment spaces. The dominance of wireless consoles reflects broader lifestyle shifts toward untethered, agile digital ecosystems. Consumers now expect connectivity that is instantaneous, intuitive, and invisible.

This dominance is reinforced by the ubiquity of Wi-Fi infrastructure across both developed and developing markets. Manufacturers capitalize on this trend by embedding advanced wireless protocols, ensuring low-latency performance essential for competitive play. Wireless systems also enable effortless updates, content downloads, and integration with smart home ecosystems. For consumers, the value lies not merely in functionality but in the elegance of a frictionless, cordless experience. By harmonizing design, performance, and convenience, wireless connectivity secures its place as the reigning modality of the connected console era.

5G-enabled consoles constitute the fastest-growing segment, heralding a revolution in low-latency, high-bandwidth gaming experiences. They empower seamless cloud streaming, enabling consoles to transcend storage and processing limitations. With speeds rivalling wired broadband, 5G unleashes the potential for ultra-responsive competitive play and immersive VR/AR applications. These consoles align with the vision of gaming “anytime, anywhere,” appealing to mobile-first generations. By collapsing geographical barriers, they unlock access for consumers in regions with limited wired infrastructure. In essence, 5G-enabled consoles epitomize the democratization of high-quality gaming.

Their potential is further amplified by partnerships between console makers and telecom providers, who bundle hardware with connectivity services. Such collaborations create sticky ecosystems, reducing churn while expanding market penetration. The prospect of edge computing integration promises even greater efficiency, ensuring smoother, more scalable experiences. Although nascent, the 5 G console nexus embodies the industry's most futuristic trajectory, melding technological sophistication with consumer convenience. As 5G networks proliferate globally, these consoles are poised to redefine the parameters of gaming's reach and realism.

Storage Type Insights

Why is Digital/Cloud-Based Storage the Ascendant Standard?

Digital and cloud-integrated storage dominates the connected game console market, reflecting the inexorable shift away from physical discs toward downloadable and streamable content. Gamers now prioritize convenience, instant access, and expansive digital libraries over tangible ownership. This evolution dovetails with the proliferation of subscription services, which thrive on digital delivery. Cloud synchronization ensures portability of game progress, enhancing continuity across devices. For publishers, digital storage reduces distribution costs while expanding global reach. In short, digital/cloud-based storage embodies the prevailing logic of modern gaming consumption.

Environmental and economic considerations also reinforce its dominance. The decline of plastic packaging, disc manufacturing, and logistics resonates with sustainability-conscious consumers. Meanwhile, digital marketplaces empower developers to launch directly to global audiences, bypassing retail intermediaries. Enhanced security protocols and improved download speeds further strengthen consumer confidence in digital-first approaches. The cumulative effect is an entrenched dominance, whereby digital/cloud-based storage is no longer a convenience but a default expectation.

Cloud-only gaming represents the fastest-growing storage model in the connected game console market, as it eliminates the very notion of hardware-based storage. By streaming titles in real time, these systems reduce dependency on local storage capacity while lowering upfront hardware costs. This model appeals to consumers in price-sensitive regions and those who prefer agility over ownership. Cloud-only platforms thrive on the strength of internet infrastructure, aligning perfectly with the rollout of 5G and fibre networks. Their adoption symbolizes a radical reimagining of how games are consumed and distributed.

In parallel, the economic model of cloud-only gaming expands inclusivity by offering pay-per-use or tiered subscriptions. This fosters accessibility for casual gamers while still accommodating hardcore audiences. Cloud-only ecosystems also allow developers to push updates seamlessly, ensuring games remain perpetually optimized and bug-free. Yet, their rapid ascent is not without challenges, as latency concerns and infrastructural disparities persist. Nevertheless, as connectivity strengthens worldwide, cloud-only gaming emerges as the boldest frontier in storage innovation.

End-Use Application Insights

How is Online Multiplayer Gaming is Digital Colosseum?

Online multiplayer remains the dominant application, transforming consoles into arenas of social interaction and competitive spectacle. Players revel in collaborative missions, global tournaments, and cooperative storytelling, creating experiences far richer than solitary play. Esports, livestreaming, and cross-border matchmaking further elevate the cultural significance of multiplayer. This segment thrives on network connectivity, social integration, and community-building features. Its dominance reflects gaming's evolution from pastime to participatory phenomenon. For millions, consoles are no longer personal devices but social portals.

Moreover, online multiplayer gaming sustains high engagement levels, fostering recurring revenues through in-game purchases, season passes, and downloadable expansions. Communities built around franchises engender loyalty, ensuring the longevity of titles across years. Multiplayer ecosystems also feed into the esports industry, where console-based tournaments draw global viewership. For console makers, this dominance is a boon, as multiplayer content drives hardware adoption and subscription uptake alike. Thus, online multiplayer gaming stands as both the cultural heartbeat and economic engine of the connected console market.

VR/AR gaming and esports together represent the fastest-growing end-user application, ushering in an era of heightened immersion and interactivity. VR headsets paired with connected consoles enable consumers to transcend passive observation, immersing them in 360-degree universes. AR integrations overlay digital elements onto physical surroundings, blending realities in novel and exhilarating ways. These innovations appeal to advantageous, tech-savvy demographics eager for next-generation experiences. Esports, meanwhile, amplifies visibility by turning gamers into celebrities and arenas into a venue for competition. The meteoric ascent of these applications reflects gaming's inexorable march toward greater sensory and cultural integration.

Distribution Channel Insights

Why Is Offline Dominating the Connected Game Console Market?

Offline retail channels continue to dominate, driven by consumers' desire for tactile interaction with products before making a purchase. Brick-and-mortar outlets allow gamers to test consoles, experience demos, and receive personalized recommendations. For many, physical stores still confer trust, authenticity, and the reassurance of after-sales service. Exclusive retail bundles and launch events further amplify offline channels' cultural resonance. Particularly in emerging economies, offline distribution remains vital due to patchy digital infrastructure. Thus, the enduring relevance of offline retail reflects its irreplaceable experiential and relational value.

Retailers also play a key role in creating brand visibility and consumer education, especially during console generational shifts. Physical presence fosters community through gaming events and demonstrations, adding dimensions that online platforms cannot replicate. Additionally, offline outlets serve as crucial last-mile delivery mechanisms in regions less penetrated by e-commerce. Although growth may plateau, the sheer tangibility of offline retail ensures its continued dominance. It is not merely a point of sale, but a locus of cultural and social affirmation for the gaming community.

Online channels, however, are the fastest-growing, propelled by the twin forces of convenience and digital integration. E-commerce platforms offer consumers unparalleled choice, price transparency, and home delivery, reshaping purchasing behaviors. Gamers now expect to procure both hardware and software instantaneously, a demand met by proliferating online storefronts. Digital exclusives, pre-order bonuses, and seamless integration with digital wallets further incentivize online purchases. The COVID-era digital acceleration has cemented online as an indispensable channel. Online retail thus epitomizes the speed, scale, and sophistication of modern commerce.

End User Demographics Insights

Why does the young adult demographic dominates the connected game console market?

Young adults dominate as the primary demographic, striking a balance between disposable income and enthusiasm for immersive entertainment. They form the backbone of subscription services, multiplayer ecosystems, and esports audiences. Their appetite for cutting-edge technology ensures rapid adoption of next-generation consoles. Furthermore, young adults often drive social trends, embedding gaming into broader cultural currents of streaming, fashion, and lifestyle. Their dominance is reinforced by their dual role as consumers and influencers within digital ecosystems. For console makers, this cohort represents both the present and the foreseeable future of demand.

Kids and teenagers, though younger in purchasing power, constitute the fastest-growing demographic. Their affinity for mobile-first entertainment and gamified education primes them for console adoption. Parents increasingly view consoles as not merely recreational devices but platforms for cognitive stimulation and safe socialization. Franchises targeting this segment cultivate loyalty early, establishing lifetime engagement pipelines. The meteoric growth of esports idols further inspires aspiration among this cohort. As digital natives, they represent the market's most promising long-term opportunity.

Regional Insights

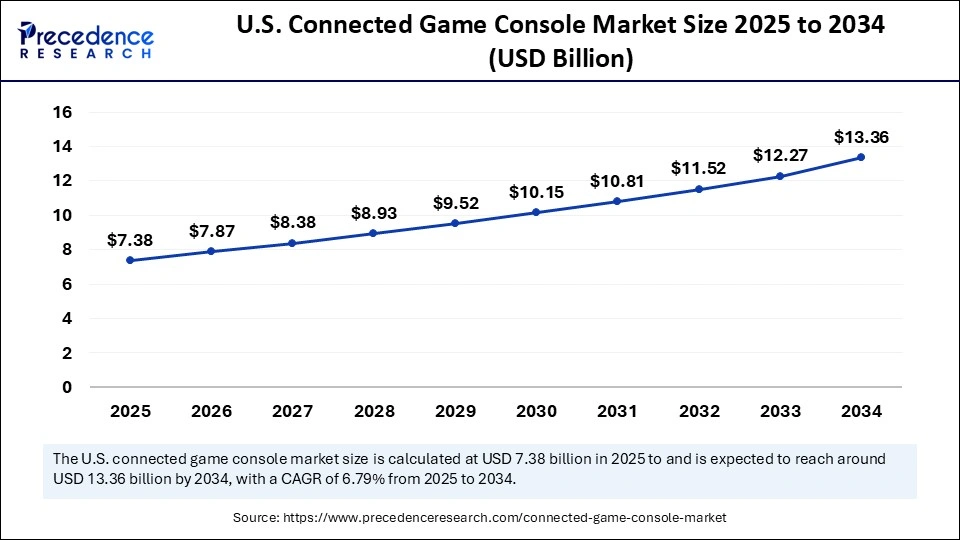

U.S. Connected Game Console Market Size and Growth 2025 to 2034

The U.S. connected game console market size was exhibited at USD 6.93 billion in 2024 and is projected to be worth around USD 13.36 billion by 2034, growing at a CAGR of 6.79% from 2025 to 2034.

How is North America the Commanding Stronghold?

North America remains the undisputed bastion of the connected game console market, anchored by a culture that reveres gaming as both recreation and profession. With industry titans headquartered in the region, the ecosystem benefits from a steady infusion of innovation, capital, and content. Consumers here demonstrate strong proclivities for premium devices, subscription models, and early adoption of next-generation technologies. The esports boom, coupled with a vibrant streaming culture, further reinforces the indispensability of consoles in entertainment diets. Additionally, robust broadband infrastructure and high purchasing power underpin the region's dominance. North America not only leads in consumption but also significantly influences global industry trajectories through its impact on design, marketing, and cultural trends.

In a parallel vein, the region is witnessing diversification in user demographics, with women and older adults increasingly entering the gaming fold. Educational institutions and corporate entities are experimenting with gamification, adding new layers of utility to connected consoles. Regulatory scrutiny around data privacy and consumer protection, however, poses emerging challenges. Moreover, with the proliferation of cross-platform play, consoles are becoming bridges rather than barriers in the digital ecosystem. The region's maturity ensures resilience, yet its future growth will likely hinge on leveraging AI, VR, and metaverse integration to maintain its pioneering edge.

How Is Asia Pacific Accelerating Frontier for the Connected Game Console Market?

Asia-Pacific is the crucible of growth, fueled by a demographic dividend, surging internet adoption, and a cultural shift towards digital leisure. Nations like China, Japan, and South Korea boast deep-rooted gaming cultures, while Southeast Asia and India are rapidly ascending as high-potential markets. Mobile-first gaming has already primed the population for digital play, creating fertile ground for console adoption as the affordability of these devices improves. The region's appetite for competitive online multiplayer and esports tournaments fuels console relevance, particularly among younger cohorts. Localization of content, language, and culturally resonant themes further catalyzes consumer engagement. Consequently, the Asia-Pacific has emerged as the fastest-growing theatre in the global connected console narrative.

At the same time, infrastructural advancements in broadband and 5G networks are catalyzing seamless gaming experiences across urban and semi-urban geographies. The proliferation of affordable subscription bundles and pay-per-use models appeals to price-conscious consumers while expanding the addressable market. Strategic alliances between global console makers and regional developers are ensuring a steady pipeline of locally relevant content. Yet challenges such as piracy, regulatory hurdles, and economic disparities temper the pace of growth. Nevertheless, Asia-Pacific's trajectory is undeniably upward, positioning it as the crucible where the next wave of console innovation and consumer engagement will be forged.

Connected Game Console Market Companies

- Microsoft Corporation

- Sony Group Corporation

- Nintendo Co., Ltd.

- Valve Corporation

- Nvidia Corporation

- Google LLC

- Apple Inc.

- Amazon.com, Inc.

- Sega Corporation

- Atari SA

- Logitech International S.A

- Razer Inc.

- Meta Platforms, Inc.

- HTC Corporation

- Tencent Holdings Ltd.

- NetEase, Inc.

- Ubisoft Entertainment SA

- Electronic Arts Inc.

- Square Enix Holdings Co., Ltd.

- Bandai Namco Entertainment Inc

Recent Development

- In September 2025, Union Information and Technology Minister Ashwini Vishnaw announced on Thursday that the new regulations governing online gaming will take effect from October 1.(Source: https://timesofindia.indiatimes.com)

Segments Covered in Report

By Component

- Hardware

- Software

- Services

By Console Type

- Home Consoles

- Handheld Consoles

- Hybrid Consoles

By Connectivity

- Wired

- Wireless

By Storage Type

- Physical Media (Discs, Cartridges)

- Digital/Cloud-Based

By End-Use Application

- Online Multiplayer Gaming

- Cloud Gaming & Streaming

- Esports & Competitive Gaming

- Media & Entertainment (OTT, Music, Video Stream)

- VR/AR Gaming

By Distribution Channel

- Online (E-commerce, Brand Stores)

- Offline (Retail, Electronics Stores, Gaming Stores)

By End-User Demographics

- Kids & Teenagers

- Young Adults (18–35 years)

- Adults (35+ years)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting