What is the Gaming Console Market Size?

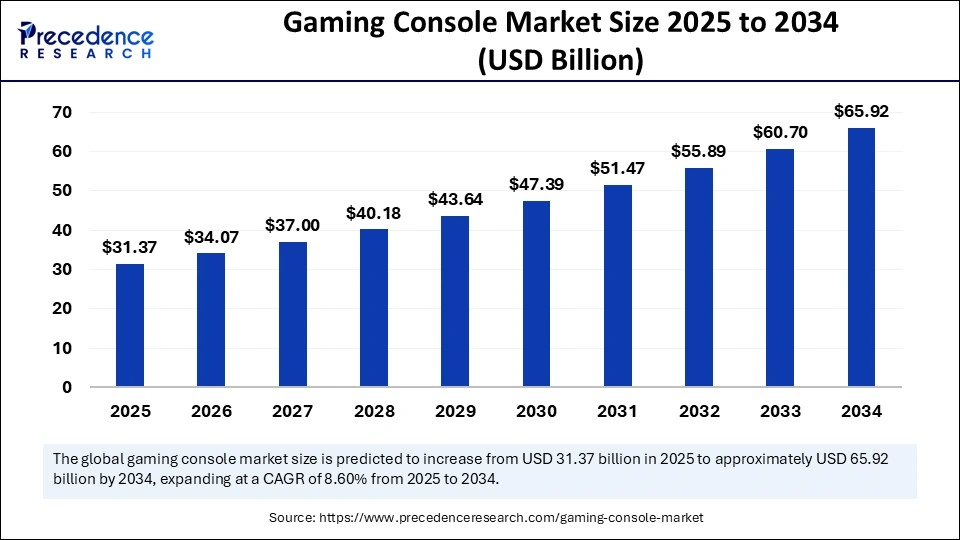

The global gaming console market size is accounted at USD 31.37 billion in 2025 and predicted to increase from USD 34.07 billion in 2026 to approximately USD 70.87 billion by 2035, expanding at a CAGR of 8.49% from 2026 to 2035. The market is driven by technological innovation, the popularity of next-gen consoles, and consumer demand for portability.

Gaming Console Market Key Takeaways

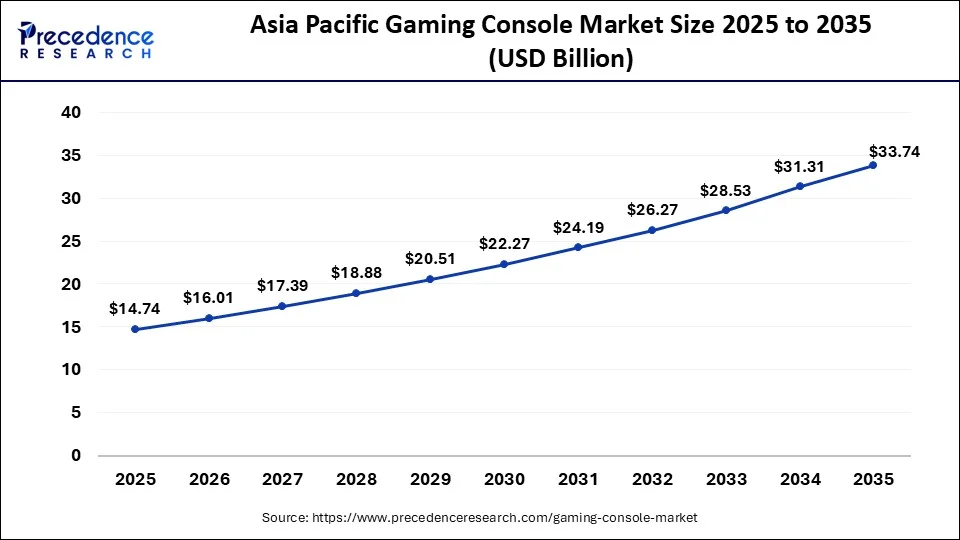

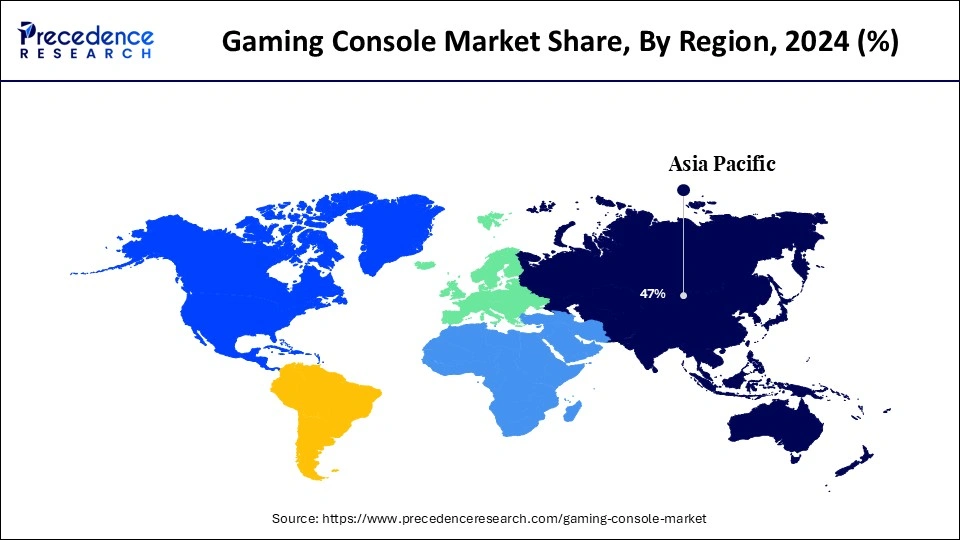

- Asia Pacific accounted for the largest market share of 47% in 2025.

- North America is expecetd to grow at a notable CAGR of 9.1% during the forecasted years.

- By product, the PlayStation segment held a significant market share of 26% in 2025.

- By product, the Nintendo segment is expanding at a CAGR of 10.1% over the forecast period.

- By type, the handheld game console segment contributed the biggest market share of 32%in 2025.

- By type, the hybrid video game console segment is growing at a considerable CAGR of 9.2% over the forecast period.

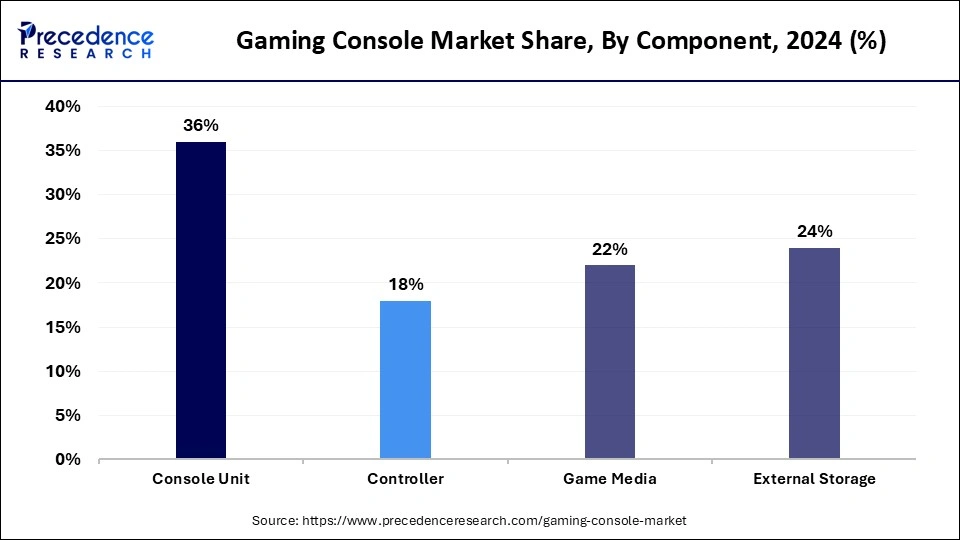

- By component, the console unit segment accounted for the highest market share of 36% in 2025.

- By component, the controller segment is projected to grow at a notable CAGR of 10.2% in the forecast period.

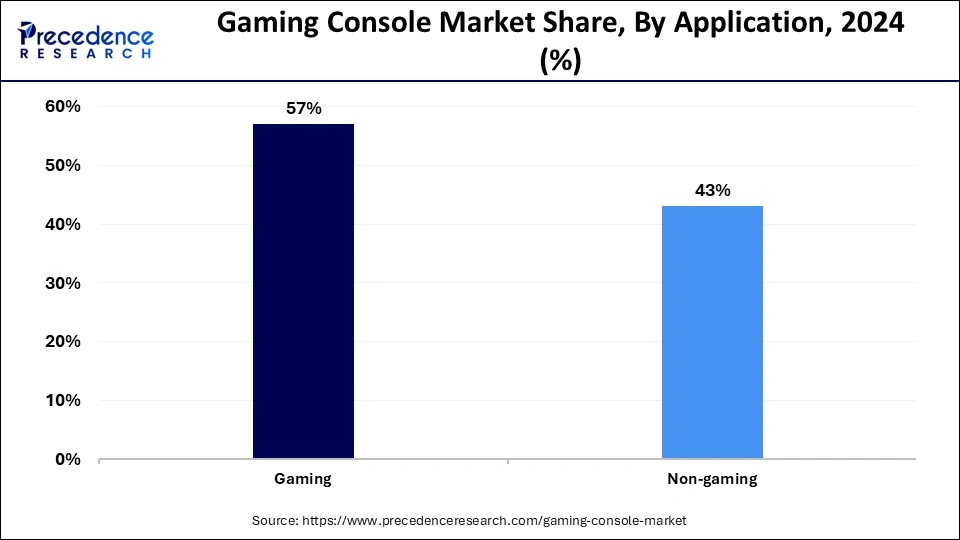

- By application, the gaming segment held the major market share of 57% in 2025.

- By distribution channel, the online distribution channel segment dominated the market in 2025.

- By distribution channel, the offline distribution channel segment is anticipated to show considerable growth over the forecast period.

Market Overview

Specialized gaming consoles function as electronic devices meant exclusively for playing video games because their interactive properties present a superior gaming experience beyond PC or mobile gaming. These consoles generate visual data for display screens to support one or several users playing different games. Gaming consoles began from their simple arcade beginnings to develop into systems that present streaming and virtual reality options, and multiplayer functions, along with augmented reality enhancements.

Modern gaming industry products evolved from arcade devices into cross-functional entertainment systems that connect technology development with networking features to create novel methods of entertainment. The gaming console market expands through continuous advances in technology, which deliver Virtual Reality,Augmented Reality features, and IoT components. Cloud-based storage enables users to access their game libraries through any of their devices, thus fueling an increase in market demand. The global consumer electronics demand increases with next-gen console premium features, which include 4K resolution and high dynamic range imaging, driving market expansion.

Artificial Intelligence (AI) Integration in Gaming Console

Artificial Intelligence with gaming consoles innovative changes occur across areas, which include better gameplay reality, flexible features, and improved user connections. Voice recognition and predictive analysis, as well as real-time system performance enhancement, enable increased utility of console interfaces because of AI. AI-based technology enables system recommendations of content while managing automated game updates to deliver improved satisfaction to users. AI will gain dominance in manufacturing industry innovations for gaming consoles through future technological advancements.

Gaming Console Market Growth Factors

- Integration of virtual and augmented reality: Gaming console manufacturers integrate virtual reality (VR) and augmented reality (AR) to offer their users the chance to interact with highly realistic, real-time action gaming experiences. The advanced user experience growth of gaming systems enhances player engagement and functions as a primary market expansion factor for advanced technology gamers seeking elevated gaming entertainment.

- Adoption of IoT and wireless connectivity: The modern gaming console market adopts IoT features and wireless connectivity options through Bluetooth and infrared, and Wi-Fi. The user satisfaction increases because of wireless controllers, cloud syncing capabilities, and multi-device support, which drives the market demand for technologically advanced gaming systems for residential and commercial applications.

- Expansion of cloud-based gaming libraries: Cloud-based storage allowed players to create single storage hubs for their games that gave them access from multiple devices. Distributed game storage allows users to store digital games directly in the system, leading to reduced physical requirements while providing convenient portability of their gaming inventory.

Market Outlook:

- Industry Growth Overview: The gaming console market is expected to continue to grow at a steady rate as more people around the world become interested in gaming, with the launch of next-generation consoles, the increasing demand for better graphics quality, and the growing popularity of digital gaming ecosystems, both in developed and developing countries.

- Sustainability Trends: Manufacturers are putting a strong emphasis on developing and producing gaming consoles that meet global sustainability and ESG needs through energy-efficient processors, recyclable packaging, and various other methods of reducing power consumption and extending the lifespan of gaming console hardware.

- Global Expansion: Console manufacturers are working diligently to capitalize on the opportunities presented by the growing demand in emerging markets by creating local pricing strategies, providing access to a variety of content through localized libraries, and forming partnerships with telecommunication and broadband companies.

- Startup Ecosystem: The growing startup ecosystem in the gaming console industry has provided significant benefits to the gaming console ecosystem by developing and offering cloud gaming platforms, innovations in controllers, VR/AR accessory products, and AI-based gaming analytics.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 70.87 Billion |

| Market Size in 2025 | USD 31.37 Billion |

| Market Size in 2026 | USD 34.07 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.49% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Type, Component, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for wireless and 3D gaming consoles

The gaming console market is expanding rapidly as customers demand 3D gaming systems that provide stereoscopic visual enhancements to deliver superior depth perception capabilities in gameplay. The implementation of advanced visual gaming functions enables the market expansion by targeting customers who seek superior, realistic, premium, and high-definition gaming experiences. Users achieve better comfort and convenience from gaming consoles when the technology includes wireless integration. Through wireless capabilities, players gain unrestricted gameplay and orderly setup because they do not need to use wired controllers or headphones.

Restraint

Competition from mobile devices

Traditional consoles experience major market challenges because smartphone and tablet technology shows rising capabilities to replace traditional console systems. The combination of high-performance processors and advanced displays, coupled with ventilating systems within mobile devices, establishes them as superior gaming platforms that yield better results. Users have access to a wide collection of mobile gaming applications that operate through mobile platforms without needing extra specialized hardware components. Modern technological progress has eliminated all differences between mobile platforms and standard gaming systems. Cloud gaming functions as a technology platform that delivers high-quality games directly from the cloud to mobile devices without making users depend on specific gaming systems.

Opportunity

Expansion of cloud gaming

Cloud gaming allows players to use streamed games by wirelessly feeding them to their consoles, which eliminates the requirement for expensive hardware improvements to access premium gaming content. Cloud platforms enable subscription plans that supply companies with predictable income streams to boost market expansion. The gaming console market now includes integrated education and health-related features that make their appeal broader than traditional gaming. Modern trends in gaming technology and emerging opportunities are reshaping gaming console consumer interactions which establishing substantial market growth prospects.

Segment Insights

Product Insights

The PlayStation segment led the gaming console market and accounted for the largest revenue share in 2025. The PlayStation 5 introduced gaming features that include fast boot times, 4K picture quality, and 3D audio capabilities to subscribers for a better gaming experience. PlayStation expands through its unique game titles that produce both customer loyalty and increased sales. The exclusive game titles from PlayStation create industry advantages for the company since they draw customers looking for unique, superior game content. The leadership position of PlayStation seems secure as the company continues to produce excellent games while developing new hardware innovations that deliver exceptional value to its users.

The Nintendo segment is anticipated to show considerable growth in the forecast period. Nintendo builds success by developing unique forms of entertainment that allow diverse player groups to connect. When Nintendo released the Nintendo Switch in 2017, they introduced a single device that operated both as a handheld and as a stationary home system. The products Nintendo creates are designed to accommodate gamers' requirements for adaptable solutions through its adaptive design components. The strong market position of Nintendo exists through innovative product development and creative business initiatives that allow it to retain its main customer base.

Type Insights

The handheld game console contributed the most revenue in 2025 and is expected to be dominant throughout the projected period. The success of handheld devices grew due to mobile gaming because they provide a more entertaining gaming experience that exceeds what mobile phones and tablets can offer. The primary function of handheld consoles lies in gaming, where physical buttons exist since many gamers rate this feature more positively than touchscreen interfaces. The segment expands because gamers require mobile gaming solutions that support their gameplay during traveling and other activities

The hybrid video game console segment is expected to show substantial growth in the gaming console market. The Nintendo Switch represents a hybrid console solution that provides gamers access to home console games, also available through portable handheld entertainment. Hybrid consoles attract several consumers because they provide smooth transference between gaming platforms while maintaining excellent performance standards. Hybrid consoles keep thriving due to the increasing gaming preference for flexible solutions that enable high-quality gameplay between residential areas and mobile locations.

Component Insights

The console unit contributed the most revenue in 2025 and is expected to be dominant throughout the projected period. The market expansion occurs because esports reaches more popularity, and gamers demand advanced quality games, and they need upgraded performance and graphics capabilities. Users opt for consoles that provide elevated power features to experience fluent gameplay, coupled with fast loading times, while enjoying superior graphics effects because of their need for a seamless gaming experience.

The controller segment is expected to show substantial growth in the gaming console market. Gamepads, joysticks, and steering wheels represent essential controller systems through which users control their games while receiving important feedback to boost their gaming experience. Updated controllers bring motion sensing and touchpad controls, plus haptic feedback, to create stronger game immersion through touch-based gameplay reactions. Advanced controllers for virtual reality and augmented reality gain better functionality when these platforms adopt modern technology.

Application Insights

The gaming industry contributed the most revenue in 2025 and is expected to be dominant throughout the projected period. Gaming consoles provide users with immersive performance, superior graphics, and substantial game collections. The combination of online multiplayer gaming and virtual reality technology (VR) creates powerful reasons why gaming consoles have become the preferred platform for innovative gaming activities. The global interest in competitive gaming and esports keeps pushing up the demand for premium gaming consoles.

The non-gaming segment is expected to show substantial growth in the gaming console market. The gaming console industry has transformed into an entertainment headquarters that provides video streaming services, music access, and home automation features, besides fitness applications and entertainment functions. Gaming consoles evolved beyond playing video games after companies integrated Netflix and YouTube streaming services and wellness applications into their platforms. Market changes arise from customer demands for one device to deliver complete entertainment solutions. Customers need flexible solutions that have made gaming consoles essential for home entertainment needs.

Distribution Channel Insights

The online distribution channel segment led the global market in 2025 because users value the ease of access and convenience that online store shopping provides. Through their online portals, E-commerce platforms permit customers to shop for gaming consoles by performing online searches, while making home delivery possible. The ability to shop online with detailed product descriptions enhances buying experiences because customers receive thorough reviews and ratings from other consumers.

The offline distribution channel segment is anticipated to show considerable growth in the gaming console market over the forecast period. Most consumers choose actual store visits to physically handle products before buying expensive items such as gaming consoles like Microsoft Xbox One X. Customers who shop at locations owned by retail stores or direct manufacturer outlets, or specialty gaming stores, receive individualized service through which they can touch products for testing and receive information from trained personnel. Despite the growing popularity of online shopping, the offline distribution channel presents fundamental importance for consumers who place importance on face-to-face interaction and immediate purchase possibilities, as well as the chance to physically examine products at retail stores.

Regional Insights

What is the Asia Pacific Gaming Console Market Size?

Asia Pacific gaming console market size is exhibited at USD 14.74 billion in 2025 and is projected to be worth around USD 33.74 billion by 2035, growing at a CAGR of 8.63% from 2026 to 2035.

Asia Pacific held the dominating share of the gaming console market in 2025. Market expansion occurs due to rising internet gaming popularity and increasing household income in regions such as China and India. The market growth in the region expanded due to e-commerce platforms, which provide pre-owned or refurbished consoles. China stands foremost in the region because it possesses the world's biggest gaming population.

Japan and South Korea remain as gaming industry leaders through their constant pursuit of innovation for hardware and software development. As India builds its digital infrastructure at a rapid pace and digitizes its smartphone sector, it has become the fastest market in the region, which drives people to buy gaming consoles. This high-performance gaming system demand exists because young tech experts across these countries want to test the newest gaming innovations.

North America is anticipated to witness the highest growth rate during the forecast period. Market expansion occurs as video game and competitive gaming communities grow through the adoption of online multiplayer gaming and esports environments. Users benefit from the digital distribution platforms PlayStation Store and Xbox Live because these platforms give them an expansive collection of games with downloadable content and provide better convenience and player engagement. The gaming console market in North America continues to grow because the U.S. and Canada have increasing income to spend and thus embrace this entertainment form.

Europe also emerged as a significant market for gaming consoles, accounting for a substantial market share in 2025. The leading gaming console manufacturers, Sony, Microsoft, and Nintendo, operate in Europe, where they launch innovative consoles with modern features. High-performance gaming consoles appeal to European consumers because the gaming culture contains many casual and hardcore gamers who want immersive gameplay experiences. The recognized retail sector in Europe, and growing online shopping penetration, powers the sales of gaming consoles throughout Europe, which makes the region vital for the global market.

The UK Gaming Console Market Trends

The UK market is experiencing steady growth driven by strong consumer demand for next-generation consoles and an expanding gaming culture across all age groups. Digital game downloads, subscription services, and online multiplayer gaming are reshaping purchasing behavior, reducing reliance on physical media.

Latin America: Leveraging Localization Initiatives.

Steady increased use of console gaming is being seen in Latin America due to a younger population, increased internet penetration, and increasing demand for localized pricing and content. Brazil is the fastest-growing in this region due to the hundreds of thousands of console subscriptions and the rapid growth of the ESports segment.

Middle East and Africa (MEA): Rapidly Developing Market for Gaming.

MEA has rapidly developed into a high-growth region for gaming due to government-sponsored programmes to improve the digital ecosystem, increased numbers of smartphone gamers transitioning into console usage, and increased investment in the ESports industry. Saudi Arabia is the fastest-growing country in the MEA due to the application of their national gaming strategy as well as the increased engagement of the youth in Saudi Arabia.

Analysis of Value Chain in the Game Console Market:

- Manufacturing of Components: The advanced semiconductors, graphics processing units (GPUs), storage chips, and controllers are the primary components of console hardware. They have a high reliance on the manufacturers of high-end chips, as well as the precision electronic manufacturers that assemble these components.

Key Players: Advanced Micro Devices (AMD), NVIDIA, Taiwan Semiconductor Manufacturing - Corporation (TSMC), and Samsung Electronics.: Console Assembly and Incorporation into Systems: This step in the value chain is where the components are assembled into consoles, then integrated with the operating system of the console, including any firmware optimizations.

Key Players: Sony Interactive Entertainment, Microsoft, Nintendo, and Foxconn. - Distribution, Publishing and Services: Retail sales, physical and digital, comprise a large percentage of the revenue stream for long-term monetization of consoles, in addition to revenue from game sales and subscriptions.

Key Players: Sony PlayStation Network, Xbox Game Pass, Nintendo eShop, GameStop.

Gaming Console Market Companies

- Activision Blizzard

- Atari Inc.

- Capcom Co. Ltd.

- Cooler Master Co., Ltd.

- Corsair Components Inc.

- Dell Technologies

- Gameloft SE

- Hyperkin Inc.

- HyperX

- Logitech Inc.

- Mad Catz Global Ltd.

- Microsoft Corp.

- Nintendo Co., Ltd.

- NVIDIA Corporation

- Ouya Inc. (Subsidiary of Razer)

- PlayJam

- Razer Inc.

- Redragon

- Republic of Games

- Rockstar Games Inc.

- Sega Holdings Co., Ltd.

- Sony Corp.

- SteelSeries

- Tencent Games

- Ubisoft Entertainment SA

- Valve Corp.

Latest Announcements by Industry Leader

- In February 2024, Epic Games and the Walt Disney Company unveiled a strategic collaboration to co-create an all-new games and entertainment universe. As part of this venture, Disney is investing a substantial USD 1.5 billion into Epic Games, securing an equity stake. The project aims to build a cohesive universe that interconnects Disney's diverse franchises, encompassing Marvel, Star Wars, Pixar, Avatar, and beyond.

Recent Developments

- In December 2024, Sony CEO Hermen Hulst discussed how AI revolutionizes gaming experiences while stressing that human storytelling skills cannot be replaced. Sony celebrated its 30th anniversary of PlayStation by reaching 450 million sales since launching in 1994.

- In May 2024, Gcore declared its strategic association with Xsolla, through which Gcore provides global solutions for edge AI cloud networking security to Xsolla as a video game commerce company. Through this partnership, gamers across the globe receive accelerated access to playing games together with optimized game download processes.

Segments Covered in the Report

By Product

- Nintendo

- Playstation

- Xbox

- Others

By Type

- Home video game console

- Handheld game console

- Portable

- Non-portable

- Hybrid video game console

- Plug and play/retro console

By Component

- Console unit

- Controller

- Paddle

- Joystick

- Gamepad

- Game media

- Game cartridge

- Optical media

- Digital distribution

- Cloud gaming

- External storage

By Application

- Gaming

- Non-gaming

By Distribution Channel

- Online distribution channel

- Offline distribution channel

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting