What is the Connected Living Room Market Size?

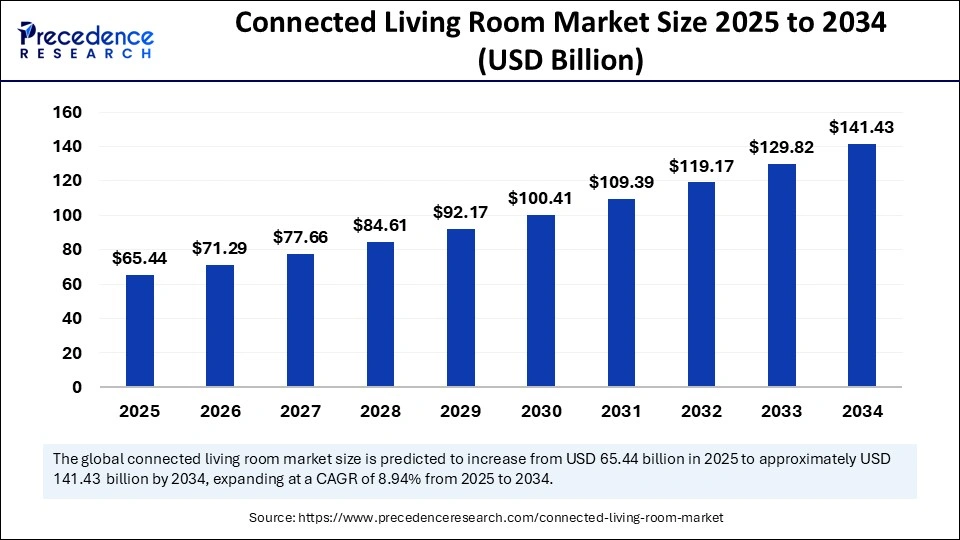

The global connected living room market size accounted for USD 65.44 billion in 2025 and is predicted to increase from USD 71.29 billion in 2026 to approximately USD 141.43 billion by 2034, expanding at a CAGR of 8.94% from 2025 to 2034. This market is growing due to increasing consumer demand for smart home integration and seamless entertainment experiences.

Connected Living Room Market Key Takeaways

- Asia Pacific dominated the global market with the largest market share of 40% in 2024.

- The Asia Pacific market is expected to grow at the fastest CAGR over the period studied.

- Europe emerged as a significant player in the global market.

- By product, the smart TVs and streaming devices segment held the biggest market share of 30% in 2024.

- By product, the connected security segment is anticipated to grow at the fastest CAGR over the projected period.

- By application, retrofit segment generated a major market share in 2024.

- By application, the new construction segment is expected to grow at the fastest CAGR over the projected period.

- By end-use, the home entertainment and media segment held the highest market share in 2024.

- By end-use, the gaming and e-sports segment is projected to grow at a notable CAGR over the forecast period.

How is AI Transforming the Connected Living Room Experience?

Artificial intelligence (AI) is revolutionizing the connected living room market by facilitating advanced control systems, streamlined automation, and hyper-personalized user experiences. While sophisticated algorithms curate content according to user preferences, Intelligent virtual assistants facilitate hands-free interaction across integrated security, lighting, and entertainment ecosystems. Cloud-based gaming offers immersive experiences while voice and gesture recognition improve accessibility.

AI improves security through real-time threat detection and biometric authentication, going beyond convenience. By adjusting settings based on user behavior, predictive learning makes homes more intelligent and user-friendly. 5G and edge computing developments will make connected living areas even more exciting in the future. Energy-efficient automation optimizes device performance, contributing to a highly responsive and adaptive living environment.

- LG Electronics and Microsoft's Copilot AI transform smart homes by enabling voice control, predictive maintenance, and automated adjustments for lighting, temperature, and entertainment. AI-driven security and biometric authentication create a seamless, intelligent living experience.

How is The Living Room Becoming the Smartest Room in the House?

The connected living room market is evolving rapidly due to advancements in smart home technology, increasing internet penetration, and growing consumer demand for seamless digital experiences. This market comprises IoT-enabled home entertainment systems, gaming consoles, voice assistants, streaming devices, and smart TVs that connect for increased automation and convenience. To provide smarter AI-powered solutions, major players like Apple, Google, Amazon, and Samsung are constantly coming up with new ideas. Personalized content, cloud gaming, and 5G are all driving growth, turning connected living rooms into a major hub for home automation, communication, and entertainment.

Connected Living Room Market Growth Factors

- Advancements in smart technology: Integration of AI, IoT, and machine learning in smart home devices enhances automation and user experience.

- Increasing internet penetration and 5G deployment: Faster internet speeds and widespread connectivity enable seamless streaming, gaming, and smart device integration.

- Rising demand for streaming and digital entertainment: Growth of OTT platforms, cloud gaming, and personalized content boosts the need for smart TVs and media devices.

- Growing smart home adoption: Consumers are investing in interconnected smart devices like voice assistants, smart speakers, and home automation systems.

- Affordable and accessible: Declining prices of smart devices and increasing availability in emerging markets are expanding the consumer base.

Market outlook

- Industry Outlook: The cconnected living room market is poised for rapid growth from 2025 to 2034, driven by drivers like streaming & content ecosystems proliferation of streaming platforms and interactive content drives demand for high-quality displays, multi-room audio, and smart remotes; content bundling with device purchases reduces friction and increases lifetime customer value and faster broadband, Wi-Fi 6/6E and affordable home-mesh systems enable smoother multi-device experiences and low-latency gaming, making premium living-room features accessible to more households.

- Major investment: Godrej is one of the most major investors as investing heavily in exclusive streaming partnerships and UI integrations that drive device sales and create sticky platform ecosystems for living-room vendors. And other investor smart homes are funding broadband infrastructure upgrades, in-home mesh Wi-Fi programs, and retailer financing schemes that lower entry barriers for high-performance connected living setups.

- Sustainability trend: Sustainability influences product design longer lifecycles, modular repairable hardware, energy efficiency, low-power displays, smart power management, and packaging. Smart-home integration enables energy savings by coordinating HVAC, lighting and AV usage via presence sensors and scheduling reducing household carbon footprints.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 141.43 Billion |

| Market Size in 2025 | USD 65.44 Billion |

| Market Size in 2026 | USD 71.29 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.94% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for smart home automation

Consumers are increasingly investing in smart home technologies that offer seamless connectivity, enhanced operational efficiency, and user convenience. Demand for integrated smart home ecosystems is being driven by the convenience of controlling climate settings, lighting, security, and entertainment systems from a single interface. Voice assistants such as Google Assistant and Amazon Alexa allow for hands-free operation, improving the usability of smart living spaces.

Adoption rates for smart home technology are rising across all income brackets as it becomes more reasonably priced. Since home automation is now a necessity rather than a luxury in contemporary life, more innovation in this area is being encouraged. Expanding IoT ecosystems and improving device compatibility are being driven by manufacturers' increasing desire for a connected lifestyle.

Expansion of the IoT ecosystem

The core of the connected living room is the Internet of Things (IoT), which enables devices to interact and work together. Voice assistants, gaming consoles, security systems, and smart TVs can now all work together to create a cohesive experience. Cross-brand compatibility is becoming more popular because it guarantees that consumers are not restricted to the ecosystem of a single manufacturer, which raises adoption rates. Automation driven by the Internet of Things (IoT) improves energy efficiency by maximizing device usage according to occupancy and user behavior.

Smart living environments are integrating wearable technologies and health monitoring devices, thereby expanding the functional scope of IoT ecosystems. Consumer confidence in smart home appliances is rising along with IoT security, which is propelling market growth. New possibilities for innovation in smart living spaces are presented by the growing number of IoT-enabled appliances and household devices.

Restraints

Dependence on third-party platforms and services

A major constraint in the connected living room market stems from the ecosystem's reliance on third-party platforms and services for content streaming, voice control, and system integration. Since modifications to licensing contracts service interruption may impair device performance and user satisfaction, this dependence exposes producers and customers to possible operational disruptions. The need for more robust proprietary ecosystems or varied platform partnerships is highlighted by the strategic risks and the limited control manufacturers have over the user experience posed by such reliance.

Technical complexities and maintenance

The integration of connected living room devices often presents significant technical challenges for end users, particularly those lacking technical proficiency. The difficulty of pairing devices, controlling firmware updates, and fixing connectivity problems can lead to a less-than-ideal user experience from initial setup to continuing maintenance. In addition to slowing adoption rates, this technical barrier raises support expenses for service providers and manufacturers. In this market, maintaining customer engagement and brand loyalty now depends heavily on providing dependable customer support and ensuring long-term functionality.

Opportunities

Emerging markets and affordable smart devices

A wider audience can now enjoy the connected living room thanks to the rising affordability of smart TVs, streaming devices, and Internet of Things products, particularly in emerging markets. Consumers are searching for affordable smart home solutions that improve their digital lifestyle as internet penetration increases in developing nations. In areas where consumers are price-conscious, low-cost smart devices with necessary features like voice control and app integration are becoming more and more popular.

Local producers can create smart home products tailored to geographic areas and economic niches. Furthermore, middle-class consumers can have easier access to high-end smart devices through financing options like EMI plans and subscription-based hardware rentals. Through programs like smart city initiatives and subsidized internet access, governments in emerging markets are also encouraging digital transformation and hastening adoption.

Home security and privacy enhancements

As smart home devices become more widely used, cybersecurity and privacy issues have taken center stage, giving businesses the chance to create cutting-edge security solutions. Surveillance cameras with AI capabilities can detect threats in real-time and notify homeowners of odd activity. Smart device communication that encrypts project data privacy by thwarting illegal access and cyberattacks. Smart locks and home security systems are incorporating biometric authentication, like fingerprint and facial recognition, to improve security.

By Product

The smart TVs and streaming devices segment held the largest connected living room market share in 2024. This dominance has been largely attributed to the growing popularity of on-demand streaming services like Netflix, Amazon Prime, and Disney+. The user experience has also been improved by developments in display technology such as OLED and QLED screens, which have made smart TVs an option. Improved user interfaces and integration with AI-powered voice assistants have increased their uptake even more. Additionally, collaborations between content providers and TV manufacturers have produced bundle subscriptions and exclusive features, which have increased the allure of smart TVs. Customers' interest in updating their home entertainment systems has also been fueled by the affordability of large-screen TVs and flexible payment options.

The connected security segment is anticipated to grow at the fastest CAGR over the projected period, driven by increasing consumer awareness of home security and advancements in smart surveillance technology. They offer remote access and real-time alert products like motion sensors, security cameras, smart locks, and AI-powered monitoring systems are becoming more and more popular. These systems' efficiency and convenience have been greatly increased by the combination of AI and the IoT, which makes automated responses and predictive threat detection possible. Furthermore, rising disposable incomes, the growth of smart home ecosystems, and growing home safety concerns are all contributing to the demand for connected security solutions. In the upcoming years, this market is expected to grow significantly due to ongoing advancements and the rising affordability of smart security equipment. 3

By Application

In 2024, the retrofit segment generated a major connected living room market share, as it allows consumers to transform traditional homes into smart homes without requiring complete renovations. A lot of homeowners would rather update their current living space. Many homeowners prefer upgrading existing living spaces with advanced home security systems, AI-powered voice assistants, and intelligent lighting solutions. Retrofit solutions have become more attractive due to the affordability and simplicity of installation of smart plugs, wireless sound systems, and streaming devices. Furthermore, DIY home automation kits are becoming more and more popular because they let users personalize their smart home experience without the need for expert installation. The need for costly upgrades is avoided thanks to retrofit solutions' compatibility with current home infrastructure, which guarantees a smooth transaction. The adoption of retrofit solutions has been further boosted by smart hubs that combine multiple devices from different brands, making them a popular option for customers.

The new construction segment is expected to grow at the fastest rate over the projected period, driven by the increasing integration of smart technologies in newly built homes to meet consumer demand for connected living solutions. To improve the appeal of contemporary housing projects, real estate developers are implementing centralized home control systems, automated blinds, and smart thermostats. The emergence of eco-friendly and energy-efficient smart homes is also fueling this trend as features like intelligent climate control systems and solar-powered IoT gadgets become more popular. The need for pre-integrated smart home solutions is being further fueled by the promotion of smart city initiatives by governments and regulatory agencies across multiple nations. Homes with cutting-edge security systems, voice-activated lighting, and entertainment centers are becoming more and more desirable to buyers.

By End User

The home entertainment and media segment held the largest connected living room market share in 2024, due to the rising demand for streaming services and smart devices that enhance the home entertainment experience. This trend has been fueled by the ease of accessing a sizable library of content from various platforms without the need for traditional cable subscriptions. The proliferation of Wi-Fi 6 technology and increasing accessibility to high-speed internet have significantly enhanced the quality of home entertainment ecosystems. Multiroom audio systems, wireless soundbars, and surround sound configurations have become more popular as people seek to create a home theater experience. Additionally, user engagement on streaming platforms has increased with the advent of personalized recommendation algorithms. It is anticipated that the home entertainment sector will continue to hold its dominant market position because of significant tech companies investing in original content and exclusive streaming agreements.

The gaming and e-sports segment is projected to grow at a notable rate over the forecast period due to the increasing popularity of online gaming platforms and advancements in gaming consoles. The competitive gaming tournaments that draw millions of viewers worldwide have contributed to the exponential growth of the global e-sports industry. High-end PCs are no longer necessary thanks to the advent of cloud gaming services, which enable users to play AAA games on mobile devices and smart TVs. The growing adoption of Virtual Reality (VR) and Augmented Reality (AR) in gaming is enhancing immersive experiences within connected living room environments. With their faster load times and ray tracing capabilities, next-generation gaming consoles like the Xbox Series X and PlayStation 5 are further improving gaming experiences. Support for cross-platform games and social gaming tools is luring more players into the gaming community and propelling market expansion.

Regional Insights

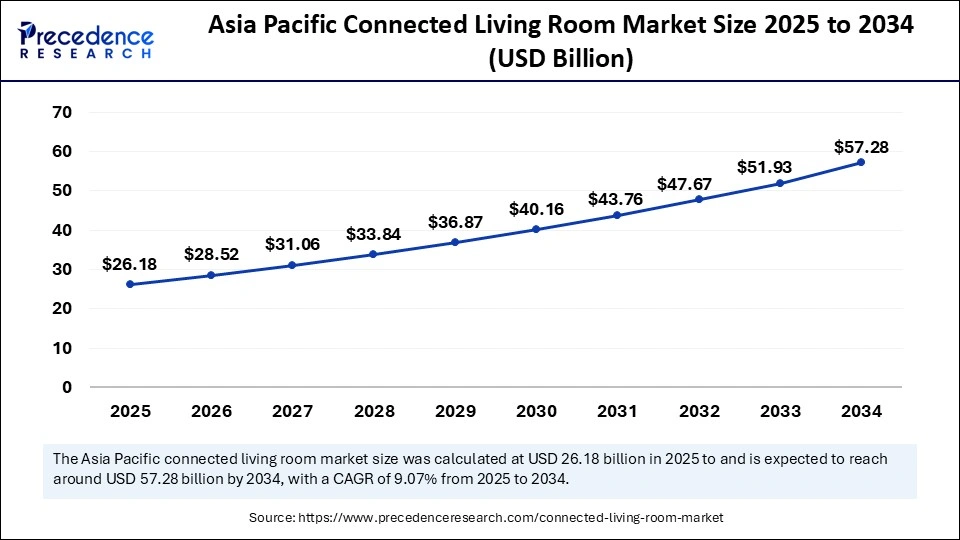

Asia Pacific Connected Living Room Market Size and Growth 2025 to 2034

The Asia Pacific connected living room market size is exhibited at USD 26.18 billion in 2025 and is projected to be worth around USD 57.28 billion by 2034, growing at a CAGR of 9.07% from 2025 to 2034.

Asia Pacific dominated the connected living room market in 2024, the studied due to increasing smartphone penetration, rapid urbanization, and rising disposable incomes. A growing number of tech-savvy consumers in the region are also embracing Internet of Things-enabled devices for entertainment and convenience, which greatly accelerates market growth. Smart device adoption has increased as a result of the growth of e-commerce platforms, which have made them more accessible. Government programs that promote digital infrastructure are also speeding up market growth.

North America connected living room market is expected to grow at the fastest CAGR over the period, driven by high consumer spending on smart home technologies and strong internet infrastructure. The extensive use of high-speed internet, the region's established tech ecosystem, and the need for cutting-edge home entertainment systems all contribute to its dominance. Furthermore, big businesses consistently release cutting-edge goods, guaranteeing smooth interaction between gadgets like voice assistants, gaming consoles, and smart TVs. The existence of major corporations like Apple and Amazon bolstered market expansion.Furthermore, user experiences are being improved by growing investment in AI-powered home automation.

Europe emerged as a significant player in the global connected living room market due to its strong focus on technological innovation and smart home automation. IoT-enabled home security, entertainment, and energy-efficient products are becoming more and more popular among consumers in the area. Adoption is being accelerated by government initiatives supporting digital transformation as well as consumer demand for smart and sustainable living spaces. The development of smart home solutions is being influenced by the region's emphasis on cybersecurity and data privacy. Additionally, the availability of cutting-edge connected living room solutions is being improved by partnerships between local companies and tech giants.

Will Middle East Africa Luxury and Infrastructure Drive Smart Living Uptake?

Middle East & Africa reflect a split: affluent urban centers embrace premium connected-living installations in new developments, while broader markets await cheaper devices and expanded broadband coverage. Smart-living pilots in high-end residential towers, hospitality projects, and smart-city districts showcase integrated AV, automated shading, and concierge voice services. In many African markets, mobile-first content and solar-friendly device designs make connected living practical where grid reliability varies. Partnerships between developers, telcos, and device vendors accelerate bundled offers that lower the entry barrier.

The UAE Connected Living Room Market Trends

UAE drives high-profile smart-residence deployments featuring integrated media walls, voice-enabled home services, and concierge automation reflecting luxury lifestyles. South Africa sees adoption in premium residential and co-working sectors, with an emphasis on multi-room entertainment and hybrid work-from-home setups. Success in MEA depends on resilient device design, telco partnerships for content, and financing models for high-capex installations. Pilot projects in hospitality and mixed-use developments often become local showcases for broader consumer uptake.

Can Latin America Leapfrog into the Connected Living Era?

Latin America is experiencing steady connected-living growth as streaming consumption, affordable smart TVs, and broadband access expand in urban centers. Consumers prioritise cost-effective bundles TV + streaming + basic smart speakers that deliver immediate lifestyle upgrades. Challenges include inconsistent broadband quality outside metros, fragmented payment systems, and variable device after-sales networks. Localised content, multilingual voice interactions, and financing options (instalment plans) can significantly accelerate mainstream adoption.

Brazil Connected Living Room Market Trends

Brazil leads in sheer scale with high streaming engagement and a strong appetite for smart TVs and audio systems. Mexico shows rapid uptake in urban middle classes, embracing service bundles and device financing through retailers. Chile and Colombia are maturing markets where smart-home add-ons find traction among tech-savvy consumers. Overall, LATAM gains when global vendors adapt pricing, content, and support to local market realities.

Connected Living Room Market Value Chain Analysis

- Raw Material Sourcing: The connected living room market relies on a blend of electronic components, semiconductor chips, sensors, display panels, and connectivity chipsets sourced from global manufacturing hubs across the globe.

Key players: Amazon.com, Inc, Murata Manufacturing and Foxconn - Retail Sales and Distribution: Distribution in the connected living room market flows through omnichannel networks that include online marketplaces, consumer electronics retailers, and brand-exclusive stores.

Key players: Media Market

Top Companies in the Connected Living Room Market & Their Offerings:

- Samsung Electro-Mechanics: Supplies advanced chipsets, sensors, and display components that form the backbone of smart living devices.

- Murata Manufacturing: Provides high-precision connectivity modules essential for seamless device-to-device communication.

- Foxconn: Acts as a large-scale contract manufacturer supplying assembled electronic modules for major smart home brands.

- LG Innotek: Delivers imaging sensors and power modules that elevate the performance of connected entertainment systems.

- Texas Instruments: Offers processors, microcontrollers, and power-management ICs vital for energy-efficient smart home devices.

Connected Living Room Market Companies

- ABB

- Amazon.com, Inc.

- Apple Inc.

- ASSA ABLOY

- Google LLC

- Honeywell International Inc.

- Legrand SA

- LG Electronics

- Signify Holding

- Robert Bosch GmbH

- SAMSUNG

- Schneider Electric

- Siemens

- Sony Corporation

Latest Announcement

In March 2025, LG Electronics launched AI-powered smart home integration in partnership with Microsoft. CTO Dr. Park II-pyung states, “This collaboration redefines AI-driven smart living, making automation and security more seamless than ever. The integration of Microsoft's Copilot AI enhances voice control, predictive maintenance, and device synchronization, thereby strengthening LG's smart home ecosystem.”

Recent Developments

- In January 2025, Amazon introduced the Echo Show 15, a smart display designed to serve as a central hub for managing connected devices. It features improved Alexa AI, multi-user facial recognition, and enhanced home automation controls.

- In December 2024, Google launched the Nest Hub Max 2.0, which integrates advanced gesture controls, AI-enhanced voice recognition, and improved compatibility with smart home devices. The development reinforces Google's position in the connected living room market.

Segments Covered in the Report

By Product

- Smart TVs and Streaming Devices

- Gaming Consoles

- Smart Speakers and Voice Assistants

- Home Theater Systems and Soundbars

- Smart Set-top Boxes

- Computers and Laptops

- Smartphones and Tablets

- Connected Security Systems

- Connected Lighting

- Others

By Application

- New Construction

- Retrofit

By End User

- Home Entertainment and Media Streaming

- Gaming and E-sports

- Home Automation and Control

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting