Crude Oil Pour Point Depressant Market Size and Forecast 2025 to 2034

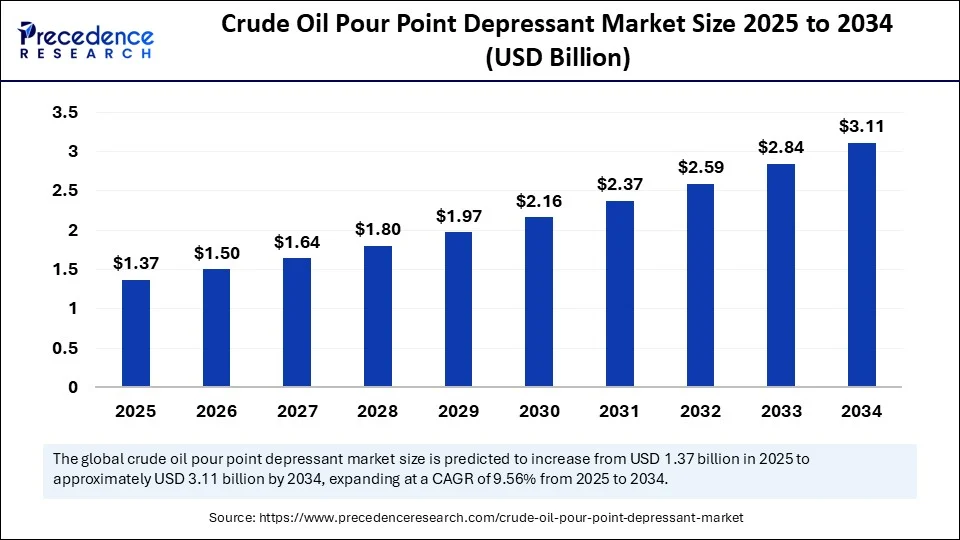

The global crude oil pour point depressant market size accounted for USD 1.25 billion in 2024 and is predicted to increase from USD 1.37 billion in 2025 to approximately USD 3.11 billion by 2034, expanding at a CAGR of 9.56% from 2025 to 2034. The increasing demand for crude oil is driving the global market. The ongoing advancements in extraction technology are contributing to the market growth.

Crude Oil Pour Point Depressant Market Key Takeaways

- In terms of revenue, the global crude oil pour point depressant market was valued at USD 1.25 billion in 2024.

- It is projected to reach USD 3.11 billion by 2034.

- The market is expected to grow at a CAGR of 9.56% from 2025 to 2034.

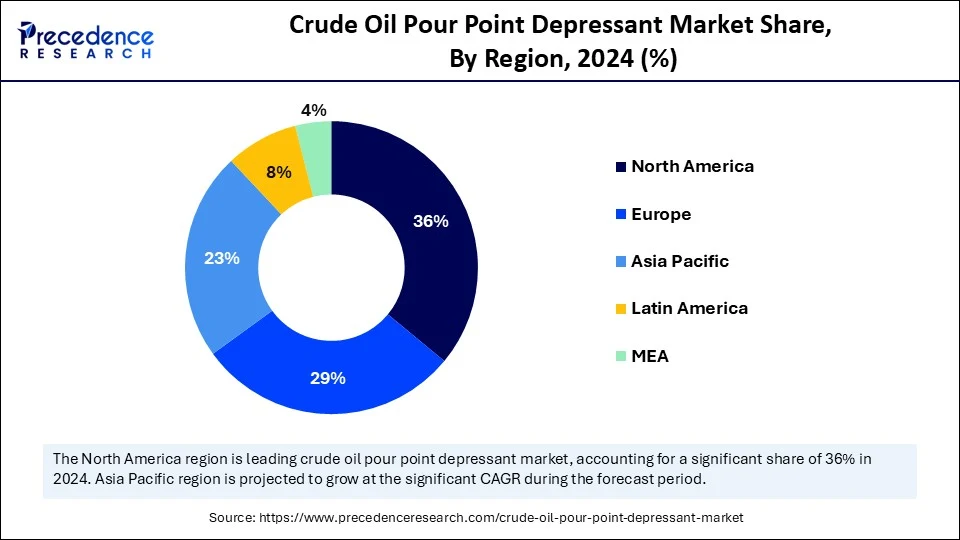

- North America dominated the global crude oil pour point depressant market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 20245 to 2034.

- Europe is a notable player in the global market.

- By chemistry type, the ethylene-vinyl acetate (EVA) copolymers segment contributed the largest market share in 2024.

- By chemistry type, the polyalkyl methacrylates (PAMAs) segment is expected to grow at a notable rate, with a CAGR between 2025 and 2034.

- By crude oil type, the heavy crude oil segment captured the biggest market share in 2024.

- By crude oil type, the ultra-heavy crude oil segment is expected to grow at a notable rate, with a CAGR between 2025 and 2034.

- By application, the transportation & pipeline segment led the market in 2024.

- By application, the extraction (upstream) segment will grow at a CAGR between 2025 and 2034.

- By end-use industry, the oil & gas (E&P) companies segment held the highest market share in 2024.

- By end-use industry, the oilfield service companies segment will grow at a CAGR between 2025 and 2034.

- By distribution channel, the direct sales segment generated the major market share in 2024.

- By distribution channel, the online sales segment is expected to grow at a notable rate, with a CAGR between 2025 and 2034.

AI Role in Crude Oil Pour Point Depressant Market

Artificial intelligence is playing a crucial role in crude oil pour point depressants by enhancing pour point depressant design, synthesis, oil flowability, and offering precise PPD (pour point depressant) applications. AI algorithms help researchers to develop and design more effective pour point depressants (PPDs) by analyzing vast and complex relationships between molecular structure and performance. AI enhances formulations through analyzing factors like wax content, API gravity, and asphaltene presence.

AI analysis enables to enhancement of cold flow properties and reduces the cost burden. AI optimization in pour point depressant development and improvement in performance prediction, enabling innovation in novel technologies like rheology and wax crystal formation, enabling the use of pour point depressant (PPD) in various crude oil systems.

U.S. Crude Oil Pour Point Depressant Market Size and Growth 2025 to 2034

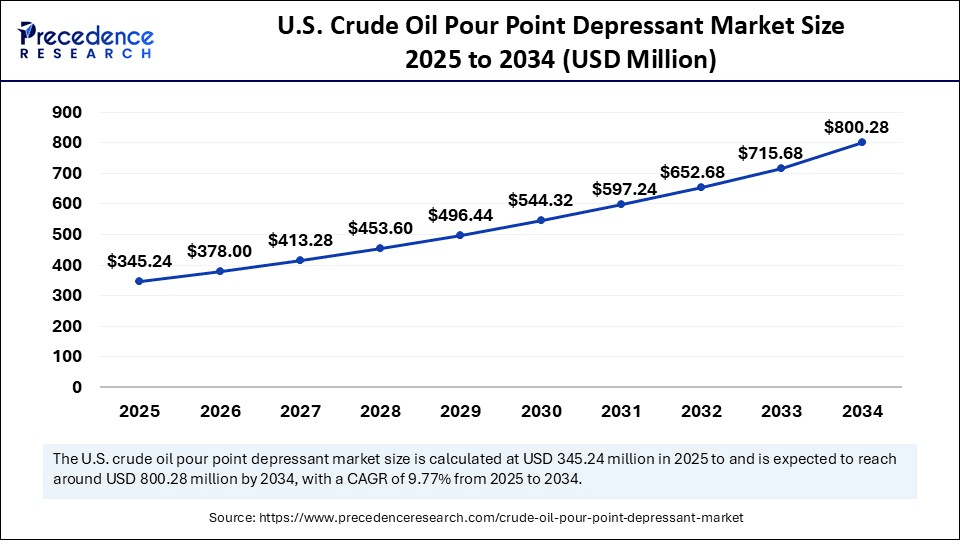

The U.S. crude oil pour point depressant market size was evaluated at USD 315.00 million in 2024 and is projected to be worth around USD 800.28 million by 2034, growing at a CAGR of 9.77% from 2025 to 2034.

North America Crude Oil Pour Point Depressant Market

North America dominates the global crude oil pour point depressant market, driven by the region's large oil & gas industry. North America has experienced significant growth in oil & gas exploration. The strong focus on advancements in polymer chemistry, sustainability, and the strong pace of strict environmental regulations are fostering innovation, development, and adoption of advanced crude oil pour point depressants.

The U.S. is a major player in the regional market, driving growth due to increased crude oil production in the country. The vast lubricant industry and presence of key lubricant manufacturers are contributing to the high demand for pour point depressant in the U.S. Additionally, the ongoing focus on technological advancement and investments in the mining and construction sectors are fostering the growth.

Asia Pacific Crude Oil Pour Point Depressant Market

Asia Pacific is the fastest-growing region in the global market, contributing to growth due to the region's rapid industrialization and increasing demand for lubricants. The growing automotive sector and economic growth in countries like China and India are fostering the adoption of advanced pour point depressants. The expanding oil and gas industry and production activities, driven by growing consumer demands and government support driving the need for pour point depressants. The existence of key market players further adds to enhancing innovations and developments of crude oil pour point depressants in Asia.

China is a major player in the regional market, growth driven by expanding oil & gas production and refining activities. The government support for local manufacturing industries, the expanding automotive sector, and rapid economic growth in industrialization are driving this growth. Additionally, the ongoing innovations at the Chinese research institute in polymer chemistry are fostering the market.

Europe Crude Oil Pour Point Depressant Market

Europe is a notable player in the global market, contributing to growth due to large oil-producing countries in a harsh environment. The robust industrial base. The presence of strict environmental regulations and a focus on sustainable practices is driving the adoption of crude oil pour point depressants. European companies are highly committed to sustainable initiatives, driving demand for pour point depressants for more efficiency and eco-friendly oil and gas operations.

Germany and the UK are leading the regional market due to expanding oil and gas operations, growing investments in offshore and unconventional oil & gas projects, and a strong presence of stringent environmental regulations. The well-established industrial base and strong investments in research and development are fostering this growth.

Crude Oil Pour Point Depressant Market: An Overview

The crude oil pour point depressant market refers to the global industry focused on the production, distribution, and application of chemical additives used to lower the pour point of crude oil. Pour point depressants modify wax crystal formation in crude oil, improving its low-temperature flow properties and enabling transportation and handling under cold climatic conditions. These additives are essential in oil extraction, transportation, and refining processes, particularly in regions with extreme winter conditions.

The expanding oil & gas industry, mining, and refining activities are driving demand for pour point depressants. These depressants are crucial to maintain oil flow in extreme climates and draining transpiration. Many manufacturers are driving the adoption of pour point depressant to balance supply, transportation, enhance efficiency, and reduce the cost associated with production and transportation.

What are the Key Growth Factors in the Crude Oil Pour Point Depressant Market?

- Growing Exploration and Production Activities: The demand for pour point depressants has increased in remote oilfields and colder areas like offshore areas and the arctic, fueling the global market.

- Advancements in Extraction Technology: The researchers are enhancing methods to handle low-temperature crude oil, driving growth in the use of crude oil pour point depressants.

- Energy Efficiency Focus: Companies are focusing on reducing fuel consumption and enhancing energy efficiency, driving demand for cutting-edge lubricants for low-temperature crude oil handling, driving the market growth.

- Unconventional Crude Oils: The production of heavy oils and bitumen with higher pour points has increased, driving demand for crude oil pour point depressants for effective transportation and processing.

- Automotive Industry Demands: The rising adoption of vehicles in harsh winter areas is driving demand for advanced and high-performance lubricants to operate engines smoothly in freezing temperatures, driving the need for crude oil pour point depressants.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.11 Billion |

| Market Size in 2025 | USD 1.37 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.56% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Chemistry Type, Crude Oil Type, Application, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expanding Oil and Gas Industry

The expanding oil & gas industry in the Arctic and more remote oilfield areas is driving demand for the crude oil pour point depressant market. The oil & gas industry has shifted toward unconventional crude oils, driving the need for pour point depressants for more effective transportation and processing. Various newly discovered oil reserves contain heavy crude oils, which have higher pour points, which increases the requirements of crude oil pour points to handle low temperatures. The growing global oil demands and advancements in extraction technology like triple-frac technology to handle low-temperature crude oil have boosted in expansion oil & gas industry.

Restraint

Crude Oil Price Fluctuations

The fluctuation in crude oil prices leads to volatility and uncertainty. Price fluctuation can disrupt the balance between demand and the supply chain. The volatility in crude oil prices challenges manufacturers and consumers to predict their demands and prices. This fluctuation can also create a barrier for investments in pour point depressant technologies. The volatility effects on price margin lead to creative pricing instability in the global crude oil pour point depressant market.

Opportunity

Advancements in PPD Technology

The PPD (pour point depressant) technology ensures flowability of crude oils in low-temperature conditions, reduces transportation issues, and improves pipelines. The ongoing advancements in PPD technology, including enhanced wax crystal interaction, reduced pour point, better flow assurance, and higher thermal stability, are improving the efficiency of pour point depression in crude oil and making it more suitable in a wide range of applications. Effect PPDs (pour point depressants) help to reduce cost in oil production, processing, and transportation. The developments of novel PPD technologies like smart polymers and nano-aditives are enabling high-performance and efficiency of crude oil pour point depressants.

Chemistry Type Insights

Which Chemistry Type Segment Dominates the Crude Oil Pour Point Depressant Market in 2024?

The ethylene-vinyl acetate (EVA) copolymers segment dominated the market in 2024, due to their superior low-temperature toughness and stress-crack resistance properties. The ethylene-vinyl acetate (EVA) copolymers play an effective role in enhancing flow properties of wax crude oils by modifying of wax crystal structure and inhibiting wax deposition. This chemistry prevents pipelines from clogging and reduces the cost of heating crude oil operations. The UV radiation resistance characteristics of ethylene-vinyl acetate (EVA) copolymers help to reduce the pour point of crude oils. Manufacturers are preferring pour point depressants with ethylene-vinyl acetate (EVA) copolymers chemistry type for enhancing the efficiency of crude oil transportation and processing.

The polyalkyl methacrylates (PAMAs) segment is the second-largest segment, leading the market due to its key role in enhancing the low-temperature fluidity of crude oil. The polyalkyl methacrylates (PAMAs) chemistry has superior performance and is widely accessible in crude oil operations for reducing energy consumption, lowering operational cost, and reducing pipeline blockages. The increased use of polyalkyl methacrylates (PAMAs) in automotive and oil & gas industries for enhancing low-temperature flow properties of crude oil and lubricants contributes to the segment growth.

Crude Oil Type Insights

What Made the Heavy Crude Oil Segment Lead the Crude Oil Pour Point Depressant Market in 2024?

In 2024, the heavy crude oil segment led the market due to increased production of heavy crudes. The heavy crude oil has higher pour points, driving demand for advanced pour point depressants (PPDs) to enhance flowability and viscosity. The pour point depressant ensures efficient transportation and storage of the heavy crude oils. The growing demand for energy and requirements to comply with regulations are further driving the adoption of pour point depressants in heavy crude oil operations. The growing production of heavy crude oil and the need to handle flow are driving significant innovations in pour point depressant (PPD) formulations.

The ultra-heavy crude oil segment is expected to grow fastest over the forecast period, due to increased demand for high-quality fuels and lubricants. The ultra-heavy crude oil has high viscosity and pour points. The ultra-heavy crude oil becomes solidified and very thick at high temperature, leading to creat conditions for transportation and refinery processes. The pour point depressants (PPDs) help to enhance the flowability and viscosity of the ultra-heavy crude oil to ensure storage and transportation are done efficiently.

Application Insights

Which Application Dominates the Crude Oil Pour Point Depressant Market?

The transportation & pipeline segment dominated the market in 2024, due to increased use of pour point depressants in the transportation & pipeline of crude oils. The pour point depressant (PPDs) enables efficient transportation of wax crude oils through pipelines. The pour point depressants are essential for the transportation of wax crude oils in cold climates, helping to prevent wax deposition and ensure smooth flow. These additives are cost-effective solutions for the transportation of crude oils.

The extraction (upstream) segment is the fastest-growing segment in the market, driven by rising oil & gas exploration and production. Pour points play a crucial role in maintaining oil flow in low-temperature environments and preventing pipeline blockages in the extraction and transportation of crude oils. These additives help to prevent the risk of equipment failure by thickening fluids and enable smoother operations.

End-Use Industry Insights

Why Oil & Gas (E&P) Companies Segment Dominated the Crude Oil Pour Point Depressant Market in 2024?

In 2024, the oil & gas (E&P) companies segment dominated the market due to increased exploration and production activities of crude oil. The demand for pour point depressant (PPD) is high in oil & gas (E&P) companies due to their need for ensuring efficient crude oil production, extraction, transportation, and storage. The growing oil & gas (E&P) activities in cold climates and subsea environments require efficient flow and transportation through pipelines, making pour point depressant a crucial choice. Additionally, the growing emphasis on oil & gas (E&P) companies on reducing energy consumption and enhancing sustainable practices is driving opportunities for pour point depressants.

The oilfield service companies segment is the second-largest segment, leading the market due to increased demand for efficient crude oil production, transportation, and storage. The oilfield service companies are a significant intermediary for applying pour point depressants (PPDs) in oil & gas extraction, transportation, and refining. The oilfield service companies work in oil & gas exploration, drilling, and transportation, driving the need for advanced pour point depressants (PPDs). Major key players, including Schlumberger Limited, Baker Hughes, and Halliburton Company, offer a significant pour point depressant (PPD) solution as part of their specialized oilfield services portfolios.

Distribution Channel Insights

What Made Direct Sales Lead the Crude Oil Pour Point Depressant Market in 2024?

The direct sales segment led the market in 2024, due to the major preference of manufacturers to sell their pour point depressant (PPD) solution through direct sales for a more profitable margin and convenience. Direct sales enable manufacturers to control pricing, customer relations, and distribution, helping to enhance their profitability and market share. The growing emphasis on companies over personalized services is making direct sales the best option. Additionally, direct sales can help customers to receive technical expertise and quality assurance over the pour point depressant solutions.

The online sales segment is expected to lead the market over the forecast period, due to the rising adoption of e-commerce and online platforms. The growing need for affordable and convenient services is driving the purchasing value of pour point depressants through online platforms. The wide accessibility and comprehensive pricing of solutions make online sales more convenient and profitable. Additionally, the rapidly growing shift toward online platforms is contributing to the segment's growth.

Crude Oil Pour Point Depressant Market Companies

- BASF SE

- Clariant AG

- Chevron Phillips Chemical

- Evonik Industries AG

- Afton Chemical Corporation

- Lubrizol Corporation

- Innospec Inc.

- Croda International Plc

- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- Dorf Ketal Chemicals

- Infineum International

- Thermax Limited

- Petroleum Additives LLC

- China National Petroleum Corporation (CNPC)

- Sinopec

- NewMarket Corporation

- TotalEnergies Additives and Special Fuels

- Ecolab Inc.

Recent Developments

- In May 2025, SLB collaborated with ONGC in India for the development of the new product, DS-73063, designed to reduce the pour point of crude oil by approximately 40% and enable flow assurance in the deepwater block KG-DWN-98/2 in the Bay of Bengal. (Source: https://www.slb.com)

- In February 2025, the Journal of Molecular Liquids published a research article that explores the synthesis, evaluation, and characteristics of a vinyl acetate/octadecyl acrylate copolymer as an energy-saving liquid pour point depressant for waxy crude oil. (Source: https://www.sciencedirect.com)

- In November 2024, researchers at Lanzhou University in China synthesized and characterized a new long-chain polymer, polyacrylic acid advanced ester-styrene pour point depressant (P-PPD) to improve crude oil flow, especially in cold environments when pour point depression is essential. (Source:https://www.azom.com)

Segment Covered in the Report

By Chemistry Type

- Polyalkyl methacrylates (PAMAs)

- Styrene Esters

- Ethylene-Vinyl Acetate (EVA) Copolymers

- Poly Alpha Olefins (PAOs)

- Other Chemistries

By Crude Oil Type

- Light Crude Oil

- Medium Crude Oil

- Heavy Crude Oil

- Ultra-Heavy Crude Oil

By Application

- Extraction (Upstream)

- Transportation & Pipeline

- Storage

- Refining (Downstream)

By End-Use Industry

- Oil & Gas (E&P) Companies

- Pipeline Operators

- Refineries

- Oilfield Service Companies

By Distribution Channel

- Direct Sales (OEMs, Oilfield Services)

- Distributors/Wholesalers

- Online Sales

By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting