What is the Data Conversion Services Market Size?

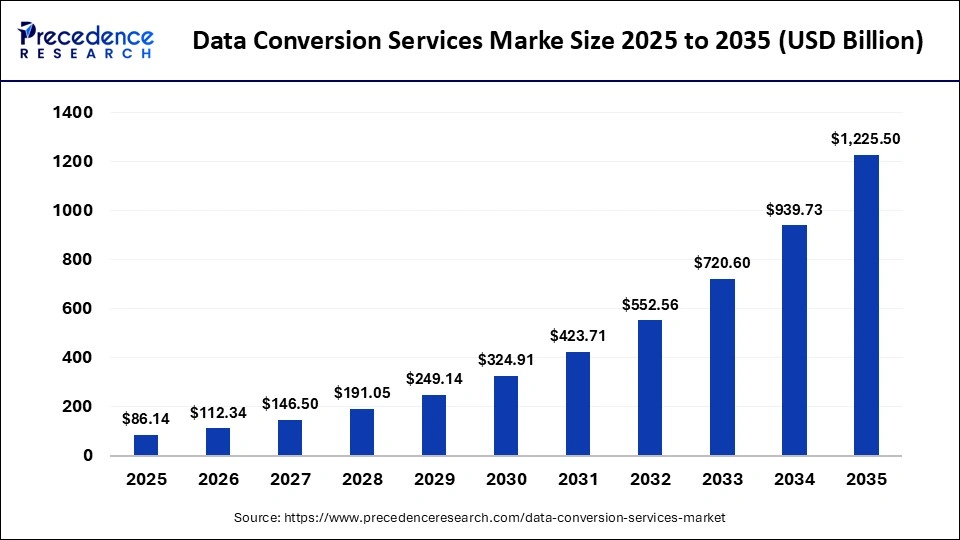

The global data conversion services market size accounted for USD 86.14 billion in 2025 and is predicted to increase from USD 112.34 billion in 2026 to approximately USD 1,225.50 billion by 2035, expanding at a CAGR of 30.41% from 2026 to 2035. The data conversion services market is primarily driven by rapid digitization across industries such as IT, Telecom, Healthcare, BFSI, and others.

Market Highlights

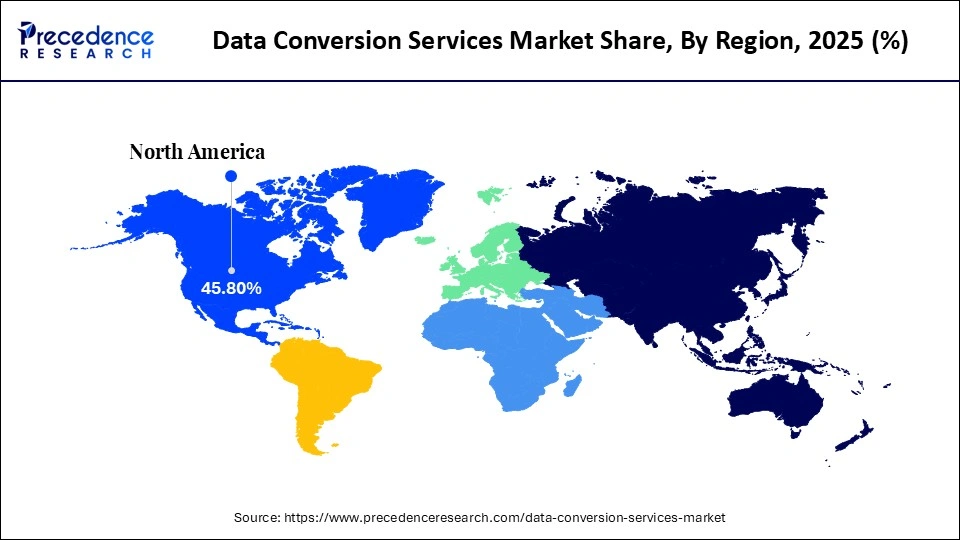

- North America dominated the market, holding the largest market share of 45.8% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 9% between 2026 and 2035.

- By service type, the document conversion segment contributed the largest market share of 35.4% in 2025.

- By service type, the cloud data conversion segment is growing at a strong CAGR of 7.9% between 2026 and 2035.

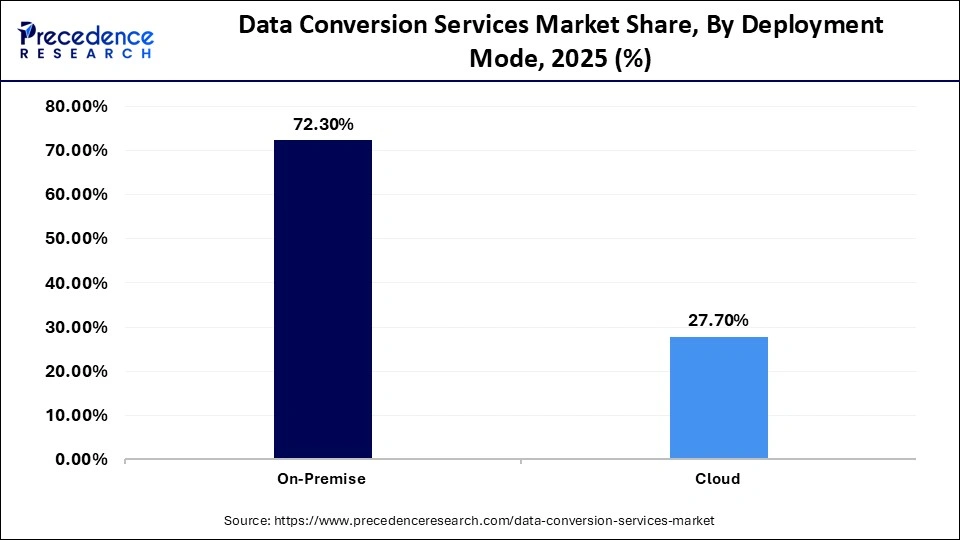

- By deployment mode, the cloud segment held the major market share of 72.3% in 2025.

- By deployment mode, the on-premise segment is expected to grow at a significant CAGR of 8.1% between 2026 and 2035.

- By end-user industry, the IT & telecom segment generate the biggest market share of 38.6% in 2025.

- By end-user industry, the healthcare segment is expanding at a remarkable growth rate of 8% CAGR between 2026 and 2035.

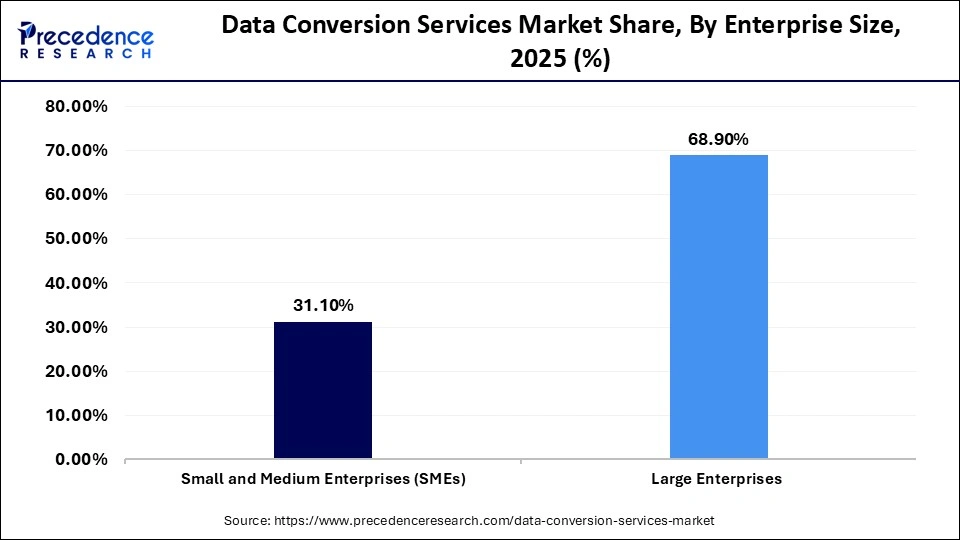

- By enterprise size, the large enterprises segment held the largest share of 68.9% in 2025.

- By enterprise size, the SMEs segment is set to grow at a solid CAGR of 8.3% between 2026 and 2035.

- By application, the data migration segment captured the highest market share of 43.5% in 2025.

- By application, the legacy system modernization segment is projected to grow at a significant 8.2% CAGR between 2026 and 2035.

Understanding the Data Conversion Services Market: Integration Demands, Compliance Needs, and Technology Drivers

The data conversion services market comprises service providers that transform data from one format, structure, or storage environment into another to ensure compatibility, accessibility, and usability across digital systems. These services include document conversion for scanned files, legal records, and archives; database conversion to migrate relational, non-relational, or legacy data models into modern architectures; media conversion for audio, video, and image formats; and cloud data migration to transfer on-premises datasets to cloud-native storage frameworks. Data conversion vendors employ extraction, transformation, and validation workflows to preserve metadata integrity, eliminate redundant or corrupted entries, and standardize schema definitions during migration.

Enterprises rely on these services to maintain data accuracy, streamline digital workflows, support analytics and machine-learning models, and ensure smooth system upgrades or transitions to cloud ecosystems. Accurate conversion also helps organizations comply with regulatory requirements related to audit trails and data-retention policies. As companies modernize IT infrastructure and expand digital operations, the demand for structured, reliable data conversion continues to grow.

How Are AI-Driven Innovations Reshaping the Data Conversion Services Market?

As technology continues to advance, the integration of artificial intelligence is driving innovation and accelerating the growth of the data conversion services market. AI-driven innovations are significantly reshaping the data conversion servicess by introducing advanced capabilities that improve efficiency, scalability, and accuracy. Major areas of transformation include intelligent ETL, advanced data processing, and hyper-automation.

AI is making data conversion servicess faster, more accurate, and capable of handling a wider range of data types, turning raw, chaotic information into a critical asset for businesses. AI is transforming data conversion servicess by leveraging natural language processing (NLP), machine learning (ML), and deep learning to automate processes, improve accuracy, and enable real-time processing of diverse data types. AI enables real-time processing and conversion of data streams, enabling businesses to make informed decisions promptly.

Data Conversion Services Market Outlook

- Industry Growth Overview: Between 2026 and 2035, the industry is expected to grow at an accelerated pace, driven by rapid digital transformation, legacy modernization, compliance requirements, and the growing need for seamless data interoperability across industries.

- Global Expansion: Leading players in the data conversion servicess market, including IBM, Accenture, Amazon Web Services (AWS), and Noventiq, have announced strategic initiatives to expand their geographic presence and gain market share. For instance, in April 2024, Noventiq announced the opening of its new office in Bangalore. This new facility marks a significant milestone in Noventiq's expansion in the region and is part of the company's ongoing commitment to growth and innovation.

- Major Investors: Major investors and key players in the data conversion servicess market are primarily the large technology corporations and specialized IT consulting firms that invest heavily in developing tools and services. The significant investors include technology and cloud giants such as IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and Google Cloud. For instance, in December 2025, Software giant Microsoft announced its plan to invest USD 17.5 billion in India between 2026 and 2029 to advance India's Cloud and artificial intelligence (AI) infrastructure, skilling, and ongoing operations. This will be in addition to the USD 3 billion the company announced in January this year for India. This investment will also be used to build secure, sovereign-ready hyperscale infrastructure that can enable AI adoption in the country.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 86.14 Billion |

| Market Size in 2026 | USD 112.34 Billion |

| Market Size by 2035 | USD 1,225.50 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 30.41% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Deployment Mode, End-User Industry, Enterprise Size, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Data Conversion Services Market Segmental Insights

Service Type Insights

Document Conversion: The document conversion segment held the largest market share in 2025, at 35.4%. Document conversion involves transforming physical or digital documents into formats that are easier to store, manage, search, and access within modern information systems. Service providers convert paper archives into OCR-enabled digital files, migrate legacy formats such as TIFF or XML into standardized PDFs, and restructure unorganized datasets into machine-readable formats suitable for automated workflows. Growth is strongest in sectors that handle large volumes of historical records or sensitive information, including retail, BFSI, and healthcare. Banks, for example, convert loan files, compliance documents, and KYC records to maintain regulatory readiness and eliminate storage inefficiencies. Hospitals convert medical records to support interoperable electronic health record systems, while retailers digitize invoices, product catalogues, and transaction logs to enhance analytics.

Cloud Data Conversion: The cloud data conversion segment is expected to grow at a remarkable 7.9% CAGR between 2026 and 2035, driven by the accelerating shift of enterprise operations and legacy datasets to cloud platforms. Cloud data conversion supports migrating on-premises databases, file systems, and application data to cloud-native structures that align with the architectures of platforms such as AWS, Azure, and Google Cloud. Companies adopt these services to achieve scalability, flexibility, and cost efficiency while reducing dependence on legacy hardware. Conversion workflows often include schema mapping, metadata normalization, secure batch transfers, and validation steps to ensure data integrity during migration. Enterprise-wide digital transformation initiatives further strengthen demand, as cloud environments enable advanced analytics, machine-learning integration, and real-time application performance monitoring.

Deployment Mode Insights

Cloud: segment dominates the data conversion services industry, holding a 72.3% share. Cloud-based deployment models continue to lead because they offer cost-effectiveness, flexibility, and seamless scalability for organizations managing large, diverse datasets. By eliminating the need for high upfront capital investment in servers, storage hardware, and maintenance infrastructure, cloud platforms allow enterprises to allocate resources toward digital transformation rather than physical IT overhead. Cloud environments also support automated scaling, enabling data conversion workloads to expand or contract based on project size, system load, or migration complexity.

On-Premise: segment is the fastest-growing in the data conversion services market, with a CAGR of 8.1%. On-premise infrastructure remains the preferred option for organizations that must maintain strict control over data privacy, security, and regulatory compliance. Sectors such as banking, government, and healthcare often handle highly sensitive or classified information, making local data storage and restricted access essential. On-premise solutions provide full control over system configurations, encryption methods, access permissions, and internal data-governance policies. These environments allow enterprises to customize software settings, define specialized workflows, and tailor conversion tools to meet unique operational requirements that shared cloud architectures cannot support. In addition, organizations with legacy applications or air-gapped systems rely on on-premise deployments to ensure compatibility and maintain uninterrupted access during large-scale data conversion projects.

End-user industry Insights

IT & Telecom: The segment dominates the data conversion services sector, accounting for 38.6% of the total share. This leadership is driven by rapid technological advancements, the explosive growth of digital data traffic, and the constant need to modernize legacy systems within the sector. Telecom operators manage massive volumes of customer records, network logs, billing information, and geospatial data that must be converted into standardized formats to support next-generation platforms. As companies transition to cloud computing for storage, security, and operational flexibility, the demand for specialized cloud-data conversion servicess increases. Migration from traditional OSS and BSS systems to cloud-native architectures requires schema mapping, metadata normalization, and real-time validation to ensure service continuity.

Healthcare: The segment is the fastest-growing in the data conversion servicess market, with an 8% CAGR, driven by the need to manage large volumes of sensitive patient data securely, compliantly, and interoperably. Hospitals, clinics, and research institutions are shifting from paper-based systems and fragmented legacy databases to unified electronic health-record platforms, which require extensive document conversion, image-format conversion, and structured-data migration. Interoperability requirements enforced by national health authorities and standards such as HL7, FHIR, and ICD coding frameworks accelerate the adoption of professional data conversion servicess to ensure consistent structure across clinical systems.

Enterprise Size Insights

Large Enterprises: The segment dominates the data conversion services market, accounting for 68.9% share. Large enterprises are the dominant adopters of data conversion servicess. Large enterprises generate and manage massive volumes of data, necessitating specialized conversion services to ensure data accessibility and interoperability. In recent years, large enterprises have undertaken several large-scale digital transformation projects that require cloud-based platforms to remain competitive.

Small & Medium Enterprises (SMEs): This segment is the fastest-growing in the data conversion services market, projected to grow at a CAGR of 8.3%. Small and Medium Enterprises (SMEs) are increasingly focusing on digitalization strategies to explore new business models, improve operational efficiency, and customer service. SMEs are leveraging cloud-based platforms for their benefits, including flexibility, scalability, and cost reduction. The shift to cloud computing helps lower upfront investment costs for data management and conversion, making these services more accessible to SMEs.

Application Insights

Data Migration: The segment dominates the data conversion services industry, accounting for 43.5% of the market share. The growth of the data migration segment is driven by several factors, including ongoing digital transformation, an accelerating shift to cloud and hybrid cloud environments, and an increasing focus on enhancing business efficiency. Data migration involves shifting digital information from one computer storage system, application, and database to another, such as from an on-premises server to a cloud-based platform.

Legacy System Modernization: The system modernization segment is the fastest-growing in the data conversion services industry, with an 8.2% growth rate. The legacy system modernization segment is a vital, rapidly growing segment of the data conversion servicess market. Legacy system modernization is the disciplined process of updating, replacing, and transforming outdated, monolithic, and inefficient legacy systems to meet the current business requirements and enable the use of modern technologies.

Data Conversion Services Market Regional Insights

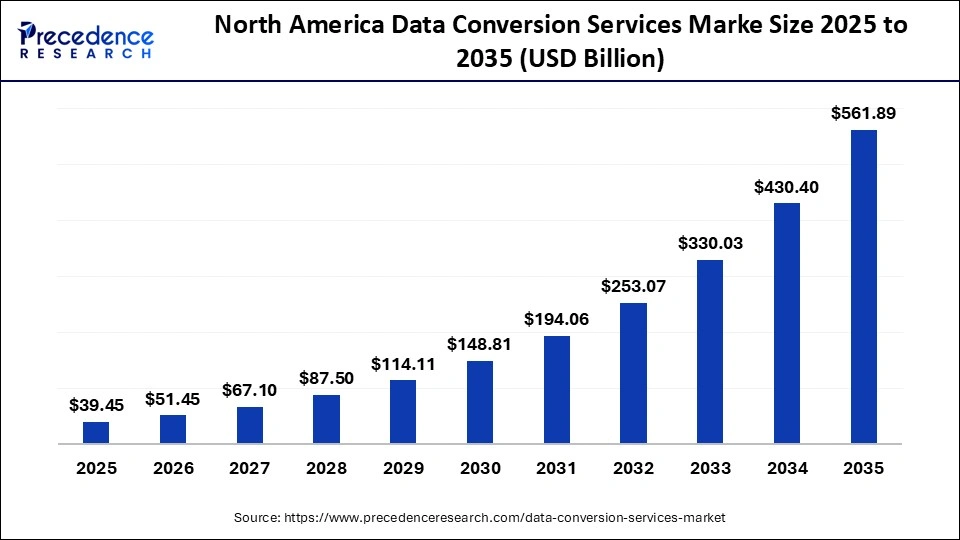

The North America data conversion services market size is estimated at USD 39.45 billion in 2025 and is projected to reach approximately USD 561.89 billion by 2035, with a 30.42% CAGR from 2026 to 2035.

How Can North America Dominate the Market for Data Conversion Servicess?

North America dominates the data conversion services market, with a 45.8% share. Growth in the region is supported by a strong concentration of data-conversion service providers, a rapid pace of digital transformation across industries, and an established regulatory environment with strict data security and compliance requirements. Organizations across BFSI, IT and telecom, and healthcare are actively converting legacy datasets into modern, machine-readable formats to support the deployment of AI and machine learning models, IoT architectures, and advanced analytics tools.

The region's migration toward cloud ecosystems, including AWS, Microsoft Azure, and Google Cloud, generates significant demand for secure, high-accuracy conversion workflows that preserve metadata integrity and ensure regulatory compliance. North America's mature data-governance culture, shaped by standards such as HIPAA, GLBA, SOX, and state-level privacy regulations, further drives adoption by requiring organizations to modernize outdated systems and maintain consistent data structures across distributed environments.

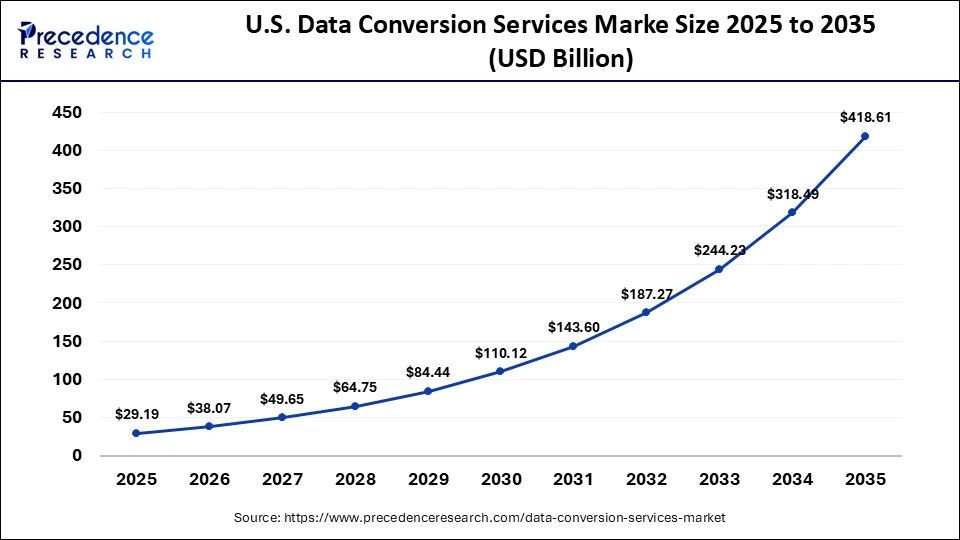

The U.S. data conversion services market size is calculated at USD 29.19 billion in 2025 and is expected to reach nearly USD 418.61 billion in 2035, accelerating at a strong CAGR of 30.51% between 2026 and 2035.

How Is the United States Transforming the Data Conversion Services Industry?

The United States leads the data conversion services industry and is one of the major contributors to it. The country is home to the leading market players such as Microsoft Corporation, SAP SE, Oracle, IBM, Cognizant Technology Solutions, and Accenture. Regulations such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA) increase demand for data conversion servicess as organizations seek to ensure compliance and improve data management practices. The market's growth is also driven by innovation in AI-driven solutions and the rising shift towards specialized services such as HTML/XML conversion.

Asia Pacific is the fastest-growing region in the data conversion services market, with a CAGR of 9%. The region's expansion is driven by an urgent need for digital transformation across both developing and advanced economies, strict regulatory compliance requirements, and the rapid rise of SMEs operating in highly complex IT environments and handling massive data volumes. Countries such as India, China, South Korea, and Singapore are witnessing strong adoption of AI, IoT, and cloud-based platforms, which increases demand for high-quality data-conversion services to unify disparate systems and enable analytics-driven decision-making.

Industries such as IT and telecom, BFSI, healthcare, and manufacturing are converting legacy files, structured databases, and paper-based records into standardized digital formats to enable automation and improve operational efficiency. Government-backed digital initiatives, such as India's Digital India program and Singapore's Smart Nation initiative, further accelerate the need for accurate data migration and system integration, reinforcing Asia Pacific's position as the fastest-advancing regional market.

India's Data conversion services Industry Analysis

India's data conversion services industry is experiencing growth. The country's growth is supported by the growing need for seamless digital transformation, the increasing emphasis on data-driven decision-making, the rising investment in AI-driven and cloud computing technology infrastructure, and the rising presence of key players, such as Tata Consultancy Services, Wipro, and HCL Technologies. Moreover, supportive government initiatives are promoting digital transformation, which further fuels the market's growth in the country.

The European market is experiencing notable growth, supported by the region's rapid digital transformation, favorable government frameworks, and some of the world's most stringent data-protection regulations. The enforcement of the General Data Protection Regulation (GDPR) has intensified demand for structured, compliant data-conversion services, as organizations must maintain high levels of data accuracy, integrity, and traceability during system upgrades or cloud transitions.

Europe's growing adoption of cloud computing across industries, including banking, retail, public administration, and healthcare, is driving demand for services that migrate legacy datasets to secure, cloud-native architectures. As enterprises accelerate cloud adoption under regional digital strategies such as the European Union Digital Strategy and Horizon Europe, the requirement for seamless data interoperability and validated conversion processes continues to grow. These factors collectively strengthen Europe's trajectory as a mature and expanding market for data conversion servicess.

Germany Data conversion services Market Analysis

Germany is experiencing significant growth, driven by the growing need for regulatory compliance, the demand for data accessibility, and the need for seamless data interoperability across industries. The integration of sophisticated technologies, such as artificial intelligence (AI) and machine learning (ML), IoT, and Cloud-based platforms, is revolutionizing the landscape of data conversion servicess. Leveraging these advanced technologies enables more efficient data processing. It enables organizations to handle massive volumes of data with high accuracy, precision, and speed, ultimately driving better data-driven decision-making.

The data conversion services sector is expected to grow at a notable rate in the Middle East and Africa region, driven primarily by rising demand for digital transformation, cloud adoption, and big data analytics across both public and private sectors. SMEs throughout the region are increasingly adopting data-management tools to enhance operational efficiency, streamline workflows, and support digital expansion. South Africa demonstrates particularly strong momentum due to its rapidly improving digital infrastructure and the enforcement of the Protection of Personal Information Act (POPIA), which requires organizations to maintain accurate, secure, and well-governed data systems.

Gulf countries, including the UAE and Saudi Arabia, are investing heavily in cloud platforms and smart-government programs, further boosting demand for data conversion servicess that enable system modernization and cross-platform data consistency. These developments collectively reinforce the region's upward trajectory in the data conversion services market.

South Africa Data conversion services Market Analysis

The country is experiencing remarkable growth. The country's growth is driven by the increasing volume of unstructured data within enterprises that needs to be converted into structured formats for analysis and storage. In addition, the rising adoption of advanced technology and the increasing demand for digital transformation are expected to drive market expansion during the forecast period.

Key Players in the Data Conversion Services Market

- IBM

- Accenture

- Cognizant

- Infosys

- Wipro

- Tata Consultancy Services (TCS)

- Capgemini

- HCL Technologies

- Oracle

- Fujitsu

- Dell Technologies

- NTT Data

- Adobe

- Micro Focus

- Iron Mountain

Recent Developments

- In April 2025, Barclays and Brookfield Asset Management Ltd. announced a long-term strategic partnership through its Financial Infrastructure strategy to grow and transform Barclays' payment acceptance business. Barclays and Brookfield will work to create a standalone entity over time.(Source: https://home.barclays)

- In November 2025, SAP launched a new SAP Cloud Application Service for SAP Cloud ERP Private, designed to enhance business process stability and streamline IT operations. By providing managed support for daily ERP processes, the service will help minimize operational risks and foster innovation, allowing internal IT teams to concentrate on strategic initiatives rather than routine maintenance. These new offerings will join the SAP Cloud Application Services portfolio to help customers manage their IT operations.(Source: https://www.sap.com)

Data Conversion Services Market Segments Covered in the Report

By Service Type

- Document Conversion

- Image Conversion

- Audio/Video Conversion

- Database Conversion

- E-Book Conversion

- CAD Conversion

- HTML/XML Conversion

- Cloud Data Conversion

By Deployment Mode

- On-Premise

- Cloud

By End-User Industry

- IT & Telecom

- BFSI

- Healthcare

- Retail & E-Commerce

- Manufacturing

- Government

- Education

- Media & Entertainment

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By Application

- Data Migration

- Data Integration

- Data Archiving

- Data Processing

- Legacy System Modernization

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting