Decanter Centrifuge Market Size and Forecast 2025 to 2034

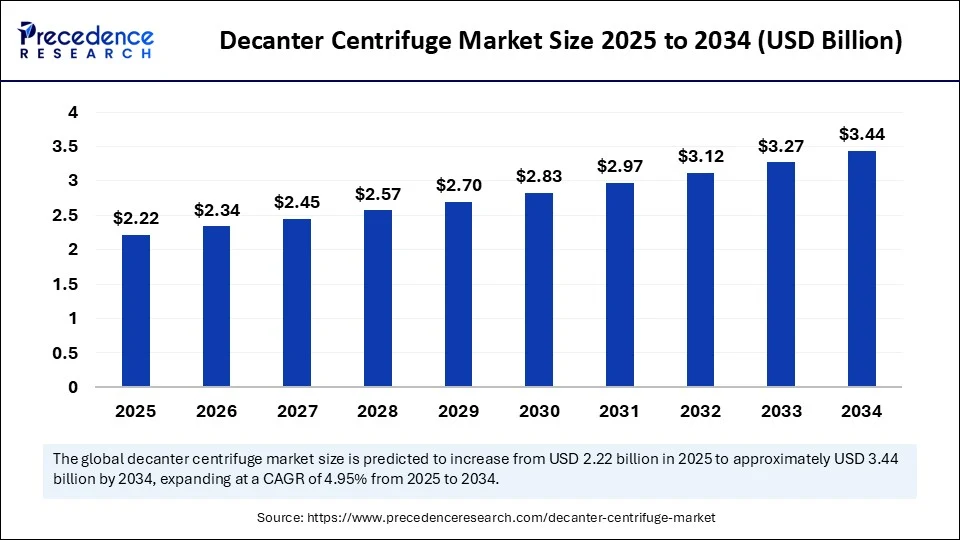

The global decanter centrifuge market size was estimated at USD 2.12 billion in 2024 and is predicted to increase from USD 2.22 billion in 2025 to approximately USD 3.44 billion by 2034, expanding at a CAGR of 4.95% from 2025 to 2034. The global decanter centrifuge market is experiencing significant growth due to the rising demand for efficient solid-liquid separation across various industries, including wastewater treatment, oil & gas, food processing, and pharmaceuticals.

Decanter Centrifuge Market Key Takeaways

- In terms of revenue, the global decanter centrifuge market was valued at USD 2.12 billion in 2024.

- It is projected to reach USD 3.44 billion by 2034.

- The market is expected to grow at a CAGR of 4.95% from 2025 to 2034.

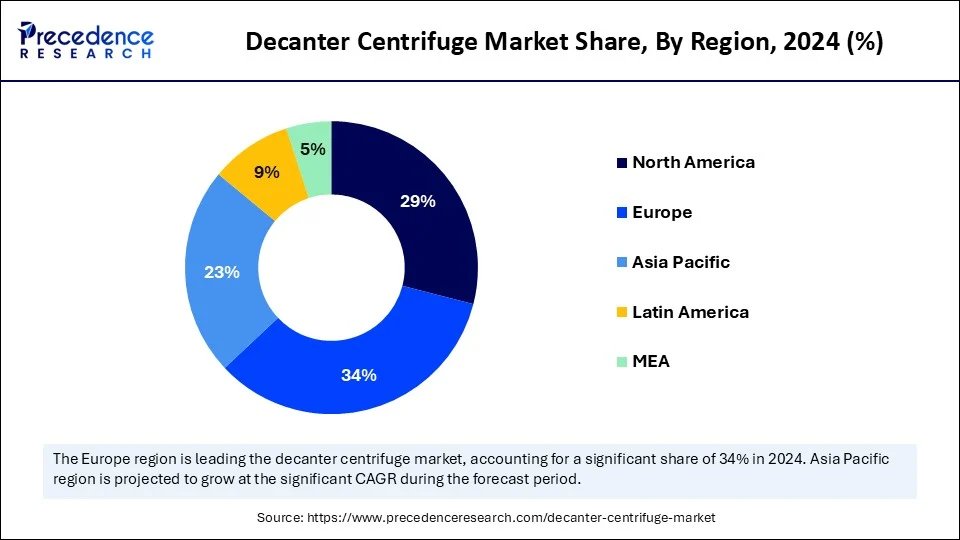

- Europe dominated the decanter centrifuge market with the largest market share of 34% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

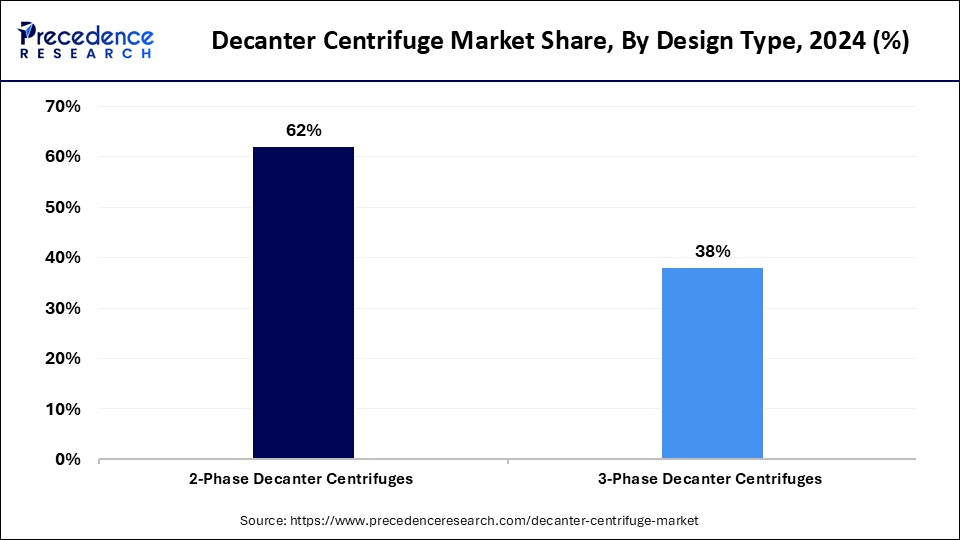

- By design type, the 2-phase decanter centrifuges segment held the biggest market share of 62% in 2024.

- By design type, the 3-phase decanter centrifuges segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By bowl design, the cylindrical-conical bowl segment contributed the highest market share of 68% in 2024.

- By bowl design, the peeler bowl design segment is expected to grow at a significate CAGR between 2025 and 2034.

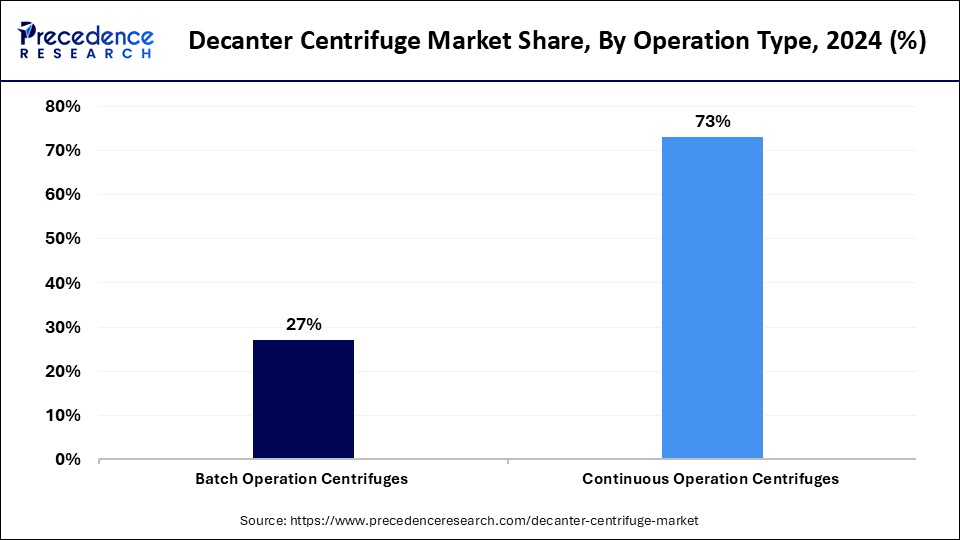

- By operation type, the continuous operation captured the major market share of 73% in 2024.

- By application insight, the wastewater treatment segment generated the major market share of 37% in 2024.

- By application, the oil and gas segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By capacity, the medium capacity (10–50 m³/h) segment accounted for largest market share of 48% in 2024.

- By capacity, the high capacity (>50 m³/h) segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user insight, the municipal utilities segment held the biggest market share of 35% in 2024.

- By end-user insight, the oil and gas companies segment is expected to grow at a remarkable CAGR between 2025 and 2034.

Impact of AI on the Global Decanter Centrifuge Market

Artificial intelligence is revolutionizing the market for decanter centrifuge by enabling predictive maintenance, optimizing separation processes, and enhancing energy efficiency. Smart sensors and AI-powered control systems can analyze vibration, flow rates, and torque in real-time to prevent breakdowns. This minimizes downtime and reduces operational costs. Machine learning algorithms also help operate and adjust variables for maximum throughput and quality. With AI, plants can better handle fluctuating feed conditions and improve safety. As automation becomes a priority, AI integration is no longer a luxury; it is becoming the industry standard.

Europe Decanter Centrifuge Market Size and Growth 2025 to 2034

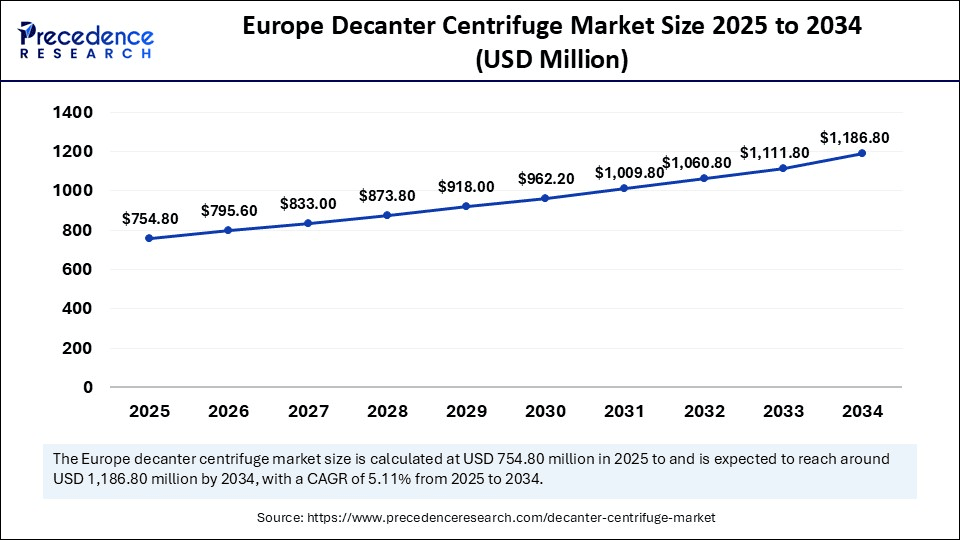

The Europe decanter centrifuge market size is exhibited at USD 754.80 million in 205 and is projected to be worth around USD 1,186.80 million by 2034, growing at a CAGR of 5.11% from 2025 to 2034.

What Made Europe the Dominant Force in the Global Decanter Centrifuge Market?

Europe dominated the market while holding a major revenue share of 34% in 2024, driven by its stringent environmental regulations and advanced industrial infrastructure. Countries like Germany, the UK, and the Netherlands are pioneers in wastewater treatment and resource recovery technologies. The region's strong focus on sustainability and circular economy practices fuels demand for high-efficiency centrifuges. Leading manufacturers headquartered in Europe continue to innovate with energy-efficient and AI-integrated models. Government incentives and regulations further accelerate the adoption across sectors like food processing, chemicals, and municipal utilities. Europe's mature market, coupled with a strong push for green technologies, keeps it firmly in the lead.

What Factors Contribute to Decanter Centrifuge Market Growth in Asia Pacific?

Asia Pacific is emerging as the fastest-growing area in the decanter centrifuge market. This is mainly due to rapid industrialization and urbanization. Countries like China, India, and Southeast Asia are investing heavily in wastewater treatment and industrial automation. The expanding oil & gas, mining, and food industries in the region demand robust and scalable separation solutions. Government initiatives aimed at pollution control and sustainable infrastructure are further boosting market adoption. Local and global players are also tapping into this region by offering cost-effective and customizable centrifuge solutions. With rising environmental concerns and economic growth, the market is spinning forward at full speed.

Market Overview

The decanter centrifuge market involves the design, manufacturing, and deployment of equipment used to separate solids from liquids in slurry mixtures through high-speed rotational force. These centrifuges are widely used in industries such as wastewater treatment, oil & gas, food & beverage, chemical processing, and pharmaceuticals. By utilizing the principles of sedimentation and centrifugal acceleration, decanter centrifuges enable continuous, efficient separation with minimal manual intervention.

The global decanter centrifuge market is gaining momentum, fueled by rapid industrialization and increasing environmental concerns. Growing demand for water reuse and sludge dewatering in municipal and industrial sectors is boosting the need for high-performance centrifuges. The oil and gas sector also relies heavily on these machines for drilling fluid recovery. Technological innovations are enhancing throughout, and reliability, making them indispensable in critical applications. Emerging economies are investing in infrastructure, further driving market expansion.

Key Market Trends

- Rise in automation: Industries are increasingly adopting AI and automation to enhance centrifuge efficiency, enabling predictive maintenance, real-time monitoring, and adaptive process control.

- Growing focus on sustainability: With stricter environmental regulations, there's rising demand for energy-efficient and eco-friendly centrifuges that support sludge minimization and water reuse.

- Expansion in wastewater treatment applications: Urbanization and industrial growth are driving demand for decanter centrifuges in municipal and industrial wastewater treatment plants worldwide.

- Technological advancements in design and materials: manufacturers are developing lighter, corrosion-resistant, and more durable materials, centrifuges using advanced materials and design improvements for better performance and lower maintenance.

- Boom in oil and gas mining sectors: The growing need for efficient separation and fluid recovery is driving centrifuge adoption in oil drilling, mining, and resource extraction processes.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.44 Billion |

| Market Size in 2025 | USD 2.22 Billion |

| Market Size in 2024 | USD 2.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.95% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Design Type, Bowl Design, Operation Type, Application, Capacity, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expanding the Scope of Applications in Various Industries

One of the primary factors driving the growth of the decanter centrifuge market is surging demand for efficient wastewater treatment solutions across industrial and municipal sectors. With tightening environmental regulations and growing awareness about water conservation, industries are investing in advanced separation technologies. Decanter centrifuges offer high throughput and continuous operation, making them ideal for large-scale operations. Additionally, their ability to handle a wide variety of feed compositions makes them highly versatile. The rising demand from oil & gas, chemicals, and food processing industries further fuels growth. As industries aim for cost-effective and eco-friendly processing, decanter centrifuges are becoming indispensable.

Restraint

High Costs and Technical Challenges

High initial capital investment remains a key restraint for the decanter centrifuge market. Small and mid-sized businesses often hesitate due to significant upfront costs and maintenance complexity. Operational noise and energy consumption also pose concerns in certain applications. Furthermore, the lack of skilled personnel to operate and maintain advanced systems limits adoption, especially in emerging economies. Regulatory hurdles and long approval cycles for industrial projects can delay centrifuge deployment. While technology is evolving, these barriers may slow down market growth if not addressed strategically.

Opportunity

Expansion into Emerging Markets

The global decanter centrifuge market is ripe with opportunities, particularly in developing regions where industrialization and infrastructure development are accelerating. Many countries across the world are investing in modern water treatment and resource recovery systems. There is also a rising trend of decentralizing waste treatment, creating demand for compact and mobile centrifuge units. Moreover, advancements in automation and AI integration open new doors for smart, self-optimizing centrifuge systems. The growing circular economy movement is pushing industries to recover more solids, oils, and water, boosting the use of decanter centrifuges.

Design Type Insights

How Did the 2-Phase Decanter Centrifuges Segment Dominate the Decanter Centrifuge Market in 2024?

The 2-phase decanter centrifuges segment dominated the market with a major revenue share of 62% in 2024. This is mainly due to their simplicity and efficiency in separating solid and liquid phases. They are widely used in municipal wastewater treatment, food processing, and industrial applications where oil removal is not necessary. Their lower operational cost and compact design make them attractive for both large-scale and decentralized setups. Additionally, their robust design ensures longer operational life and minimal maintenance. With strong demand from various industries, these centrifuges remain the preferred option. Their reliability and cost-effectiveness keep them spinning at the top.

The 3-phase decanter centrifuges segment is expected to grow at the fastest rate in the upcoming period due to the rising demand for the separation of solids, water, and oil in various industries. These centrifuges are crucial in applications like oil and gas, biodiesel production, and industrial wastewater, where multiple component separation is needed. Their ability to streamline complex processes into a single operation is a game-changer. The push for oil recovery and value extraction from waste is further boosting adoption. Advanced automation features are making these systems smarter and easier to operate. As resource recovery becomes a priority, 3-phase centrifuges are spinning toward greater relevance.

Bowl Design Insights

How Does the Cylindrical Conical Bowl Segment Dominate the Market in 2024?

The cylindrical-conical bowl segment remains dominant in the global decanter centrifuge market with a share of 68% due to its versatility and consistent performance across various separation needs. These centrifuges offer excellent clarity in liquid discharge and effective solid compilation. They are extensively used in sludge dewatering, food production, and pharmaceutical processes. The proven mechanics and ease of cleaning make them a top choice for continuous operations. Their adaptability to both 2-phase and 3-phase systems makes them the preferred choice in various industries. As a result, they continue to anchor the market with dependable efficiency.

Meanwhile, the peeler blow segment is witnessing rapid growth in the market, as demand for delicate and precise separation is increasing in the biotech, chemical, and specialty food sectors. These bowls allow for gentler handling of sensitive materials without compromising throughout. Their growing use in high-value and shear-sensitive applications is driving interest. The design facilitates easier cleaning and better hygiene, which is crucial for regulated industries. With customization and automation compatibility, they are becoming the go-to option for high-performance applications. Their excellent strength is quickly turning into mainstream demand.

Operational Type Insights

What Made Continuous Operation Centrifuges the Dominant Segment in the Market in 2024?

The continuous operation centrifuges segment dominated the decanter centrifuge market with the largest share of 73% in 2024 due to their ability to handle large volumes with minimal human intervention. Ideal for municipal and industrial wastewater treatment, these systems run around the clock with consistent efficiency. They offer higher productivity and are well-suited for automated facilities. Their lower long-term operational costs attract large-scale industries. The need for uninterrupted processing in sectors like oil & gas, and chemical reinforcement of their popularity. With smart control systems, continuous decanters remain the backbone of modern separation processes.

The batch-operated centrifuges segment is expected to grow at a rapid pace in the upcoming period. These centrifuges are gaining traction, especially in applications requiring high precision and controlled processing. They are increasingly used in pharmaceuticals, specialty chemicals, and food processing, where small, varied batches are common. These systems allow better control over the separation quality and are ideal for testing and R&D environments. The growing demand for flexible manufacturing is contributing to this rise. They also serve smaller facilities that don't require full-scale continuous systems. As customization becomes key, batch operations are carving out a fast-growing niche.

Application Insights

Why Did the Wastewater Treatment Segment Dominate the Market in 2024?

The wastewater treatment segment dominated the decanter centrifuge market with a share of 37% in 2024. This is mainly due to the increased demand for efficient separation solutions. As industries and communities prioritize eco-friendly practices, the demand for decanter centrifuges has increased in wastewater treatment. Increased urbanization and industrial discharge further bolstered the segment. Decanter centrifuges offer reliable sludge dewatering, volume reduction, and cost-effective processing.

Municipal and industrial plants prefer these centrifuges for their continuous operation and ease of maintenance. They also help reduce landfill impact and support water reuse strategies. As global water scarcity rises, their role becomes increasingly vital. Increasing environmental concerns and stricter regulations further ensure the long-term growth of the segment.

The oil & gas is the fastest-growing segment in the decanter centrifuge market due to the increasing need for drilling fluid recovery and sludge treatment. These centrifuges help reduce environmental impact while recovering valuable hydrocarbons. Offshore and onshore operations rely on them for their durability and continuous operations under harsh conditions. The demand for clean, efficient separation of oil, water, and solids is soaring. With the stricter environmental compliance, the sector is rapidly adopting advanced centrifuge systems. The expanding drilling operations is also propelling this segment's growth.

Capacity Insights

How Does the Medium Capacity Segment Dominate the Decanter Centrifuge Market in 2024?

The medium capacity (10–50 m³/h) segment led the market with a share of 48% in 2024 due to their balance of performance, cost, and flexibility. Decanter centrifuges with a capacity of 10–50 m³/h are well-suited for municipal treatment plants, medium-scale industries, and decentralized setups. These units provide strong throughput without the high operational complexity of large systems. Their footprint fits most facilities, making installation simpler. Industries value them for their versatility across multiple applications. Their practicality makes them the top pick for diverse users.

Meanwhile, the high capacity (>50 m³/h) segment is expected to grow at the fastest CAGR over the projection period due to the rising demand from mega industrial plants, oil refineries, and large municipal systems. These units are essential for processing huge volumes with minimal downtime. As industries scale up production, the need for robust and efficient equipment increases. High-capacity models offer greater solids handling and energy-efficient performance. They are also increasingly integrated with smart systems for real-time optimization.

End-User Insights

What Made Municipal Utilities the Dominant Segment in the Market in 2024?

The municipal utilities segment led the decanter centrifuge market with a share of 35% in 2024. This is mainly due to the increased demand for efficient wastewater treatment and sludge management solutions. Municipal utilities heavily rely on decanter centrifuges for reliable, low-maintenance, and high-throughput operations. Population growth and urban expansion are boosting the demand for potable water, encouraging municipal utilities to invest in efficient water treatment solutions, including decanter centrifuges. Public funding and international environmental guidelines also support large-scale installations. Their use in water recycling and sanitation infrastructure augmented the segment. As cities modernize, municipalities continue to invest heavily in these systems.

On the other hand, the oil & gas companies segment is expected to expand at the fastest CAGR in the coming years, driven by the need to recover drilling fluids, treat produced water, and manage oily sludge. With environmental scrutiny rising, these firms are turning to advanced centrifuge systems for compliance and efficiency. Decanter centrifuges reduce disposal costs and maximize fluid recovery, which is essential in cost-sensitive operations. Their rugged design suits harsh field environments, making them an operational asset. Global exploration and production activities are also rebounding, further spurring demand. As energy demands climb, so does centrifuge integration in oil & gas workflows.

Decanter Centrifuge Market Companies

- Centrisys (U.S.)

- Alfa Laval (Sweden)

- Andritz AG (Austria)

- Derrick Corporation (U.S.)

- Flottweg SE (Germany)

- FLSmidth A/S (Denmark)

- GEA Group Aktiengesellschaft (Germany)

- IHI Corporation (Japan)

- Mitsubishi Kakoki Kaisha Ltd (Japan)

- Pieralisi Maip SpA (Italy)

- TOMOE Engineering Co Ltd (Japan)

- Haus Centrifuge Technologies (Turkey)

- Noxon (U.S.)

- Elgin Separation Solutions (U.S.)

- Pennwalt (Sweden)

- Sanborn Technologies (U.S.)

- Ferrum AG (Switzerland)

Recent Development

- In July 2023, ANDRITZ announced the launch of decanter centrifuges tailored to challenging industrial oil recovery. ANDRITZ three phase decanter centrifuges are not only capable of separating liquid from solid but also liquids with different densities like oil and water.

(Source: https://www.andritz.com)

Segments covered in the report

By Design Type

- 2-Phase Decanter Centrifuges

- Solids-Liquid Separation

- 3-Phase Decanter Centrifuges

- Solids-Liquid-Liquid Separation

By Bowl Design

- Conical Bowl

- Cylindrical-Conical Bowl

- Peeler Bowl Design

By Operation Type

- Batch Operation Centrifuges

- Continuous Operation Centrifuges

By Application

- Wastewater Treatment

- Municipal Wastewater

- Industrial Effluent

- Oil & Gas

- Drilling Fluid Treatment

- Oil Sludge Dewatering

- Food & Beverage

- Juice & Beverage Clarification

- Dairy Product Separation

- Chemical & Pharmaceutical

- Catalyst Recovery

- Fine Chemical Separation

- Mining & Minerals

- Tailings Dewatering

- Ore Slurry Processing

- Pulp & Paper

- Fiber Recovery

- Sludge Dewatering

By Capacity

- Small Capacity (<10 m³/h)

- Medium Capacity (10–50 m³/h)

- High Capacity (>50 m³/h)

By End-User

- Municipalities & Utilities

- Oil & Gas Companies

- Food Processing Companies

- Chemical Manufacturers

- Mining & Metals Companies

- Pharmaceutical Manufacturers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting